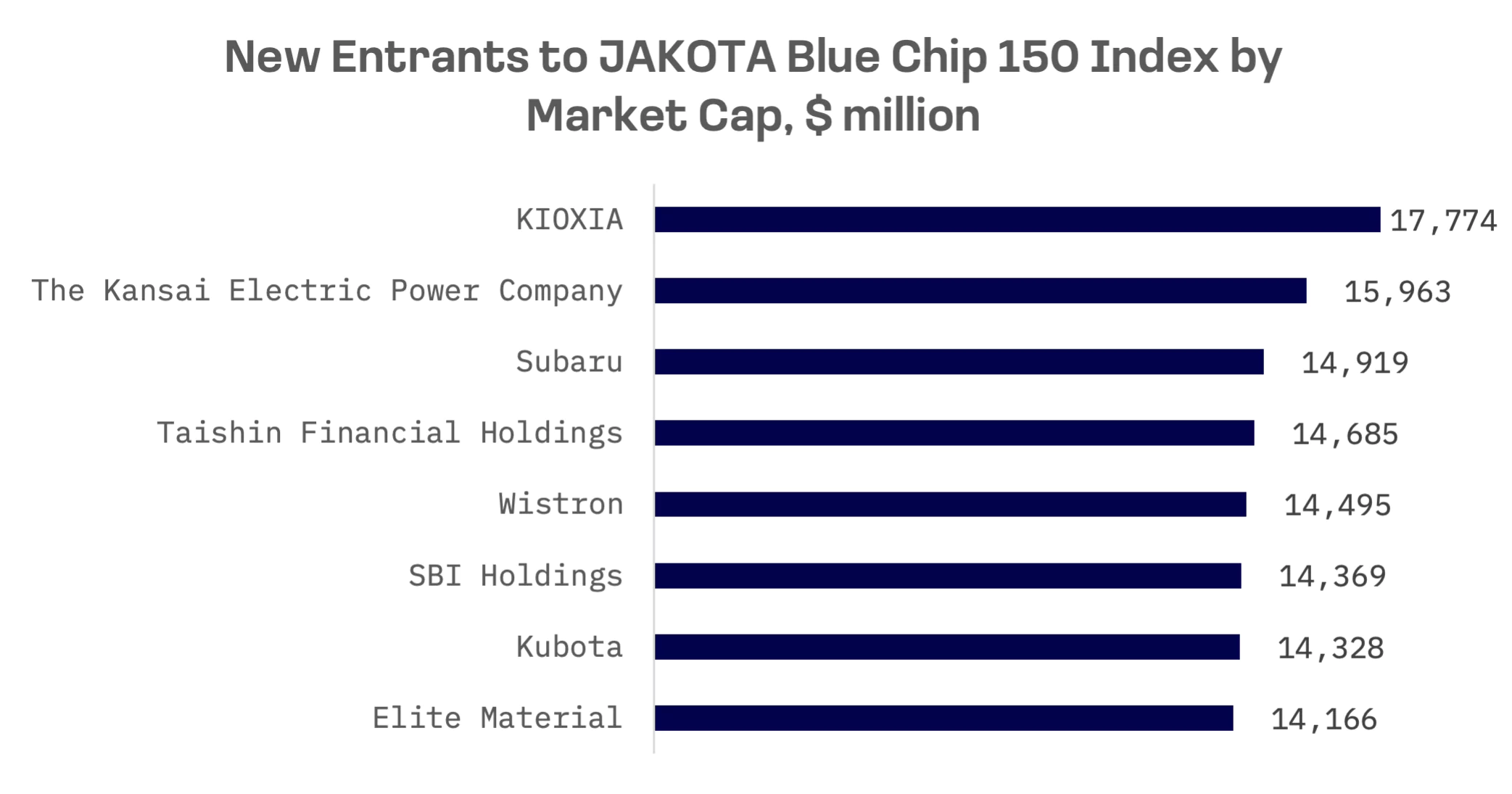

Eight companies joined the JAKOTA Blue Chip 150 Index in its quarterly rebalancing, while an equal number exited, with the changes taking effect October 1, 2025:

| Entrants | Leavers | ||

| KIOXIA | NTT Data | ||

| The Kansai Electric Power Company (KEPCO) | Pan Pacific | ||

| Subaru | Oracle Corp Japan | ||

| Taishin Financial Holdings | Evergreen Marine | ||

| Wistron | Capcom | ||

| SBI Holdings | First Financial Holding | ||

| Kubota | SK Innovation | ||

| Elite Material | Olympus |

Among the eight entrants, three companies had left the JAKOTA Blue Chip 150 Index in the previous quarterly rebalancing:

- The Kansai Electric Power Company (KEPCO) (9503.TSE) is an electric utility serving the Kansai region of Japan.

- Subaru (7270.TSE) is a Japanese corporation specialising in automobile manufacturing and the country’s sixth largest automaker by production.

- Kubota (6326.TSE) is a Japanese manufacturer specialising in tractors, agricultural machinery and heavy equipment.

Five new entrants also were included:

- KIOXIA (285A.TSE) is a Japanese computer memory manufacturer specialising in flash memory and solid state drives.

- Taishin Financial Holdings (2887.TW) is a Taiwan based financial holding company offering financial services through subsidiaries in banking, securities, investment management and insurance.

- Wistron (3231.TW) is a Taiwanese electronics manufacturer of laptops, servers and other electronic devices.

- SBI Holdings (8473.TSE) is a Japanese financial services company.

- Elite Material (2383.TW) is a Taiwanese manufacturing company specialising in materials for printed circuit boards (PCBs).

Unlike the previous quarter’s rebalancing when South Korean entrants dominated, no Korean companies were included this time. Japan added five companies and Taiwan contributed three, even though all three markets had reached record highs at the end of September.

By sector, electronics, automobiles and financial companies attracted strong investor interest, based on the breakdown of new entrants. The electronics sector was supported by robust AI demand, while Japanese automakers received relief after months of diplomacy culminated in Trump signing an order in early September to cut U.S. tariffs on imported Japanese autos from 27.5% to 15%.

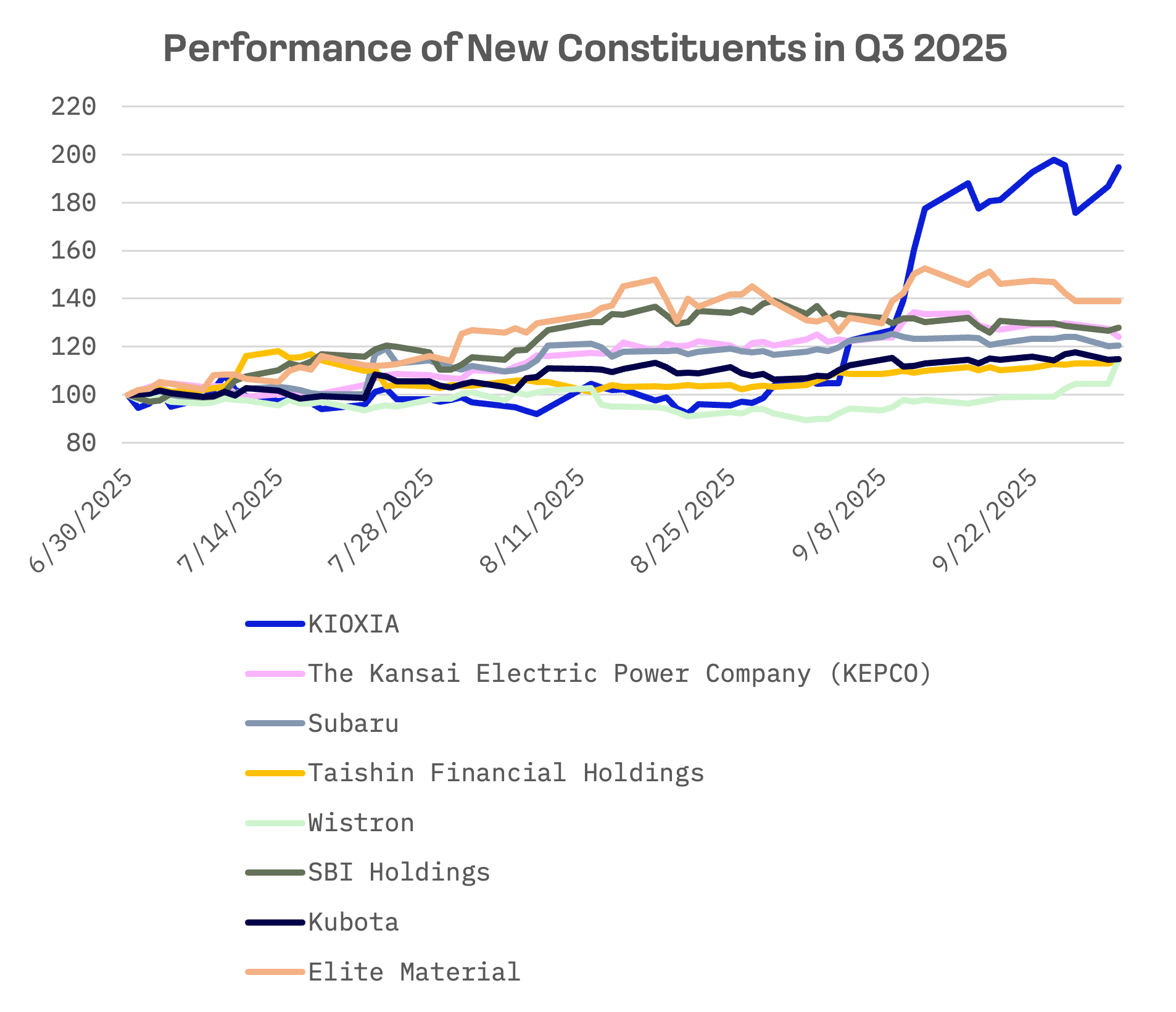

KIOXIA demonstrated standout performance in the third quarter of 2025, with shares nearly tripling as investors revalued the flash memory maker’s prospects. The company went public on the TSE Prime in December 2024.

The rally was fuelled by a combination of internal and external factors:

Corporations are ramping up investment in AI infrastructure, driving sustained demand for high performance storage. Leading chipmakers have redirected production from lower margin, high volume products to premium segments, such as enterprise SSD controllers, curbing wafer output for commodity flash. As a result, the NAND flash memory market entered the third quarter of 2025 on a clear upward price trajectory.

KIOXIA raised $2.2 billion in its debut bond sale in July, using the proceeds to repurchase preferred stock. The move cut the company’s priority debt ratio to below 20% from as high as 60%, easing financial risk and bolstering investor confidence.

A strong first quarter fiscal 2026 earnings report was released on August 8, with profit beating expectations by 112%. Momentum continued with the rollout of ninth generation BiCS Flash samples and the opening of the advanced Kitakami Fab2 plant in September, aimed at next generation 3D NAND for AI applications.