Last week’s Jakota markets:

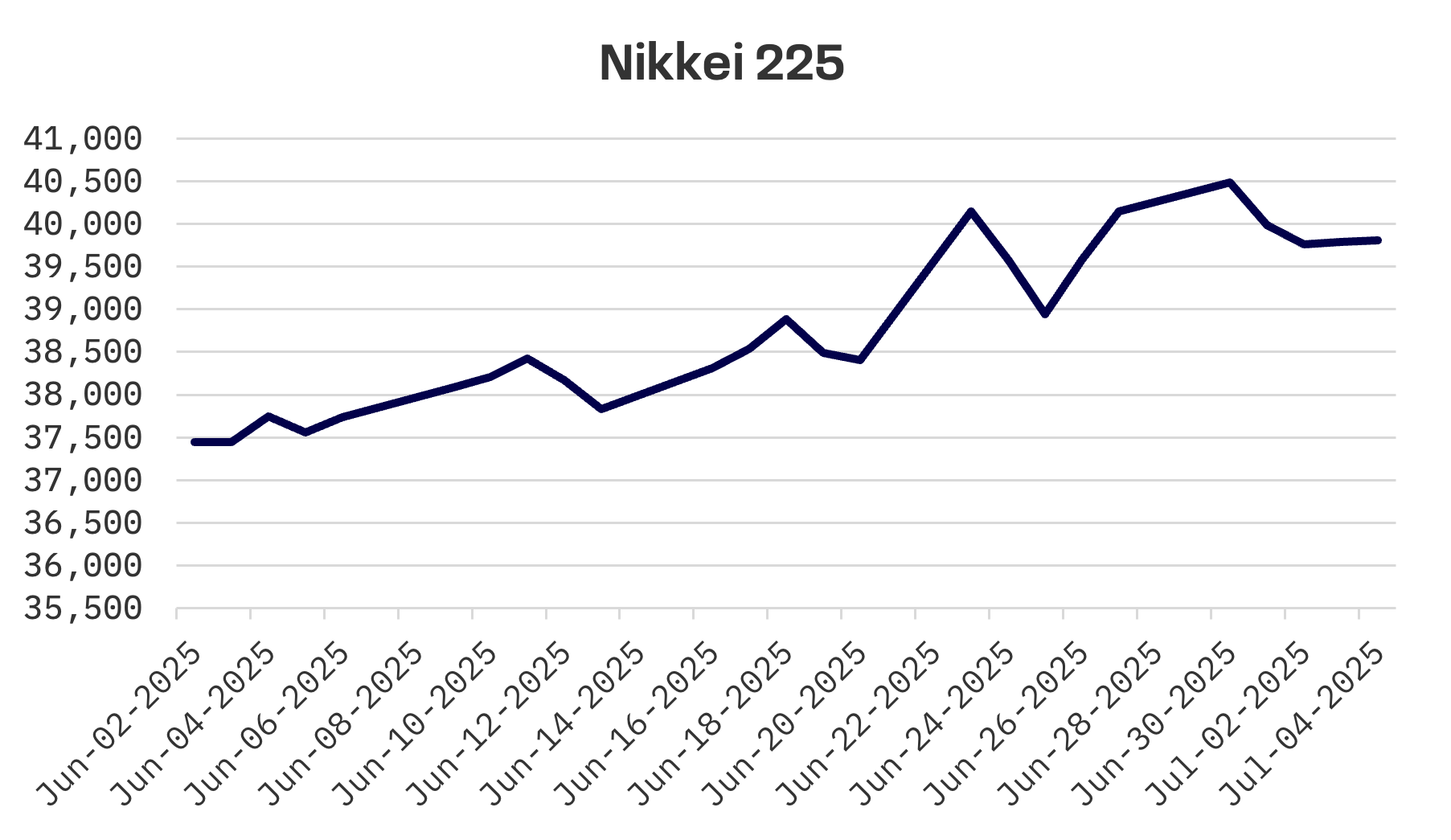

- Japan’s Nikkei 225 Index fell 0.91% as stalled U.S.-Japan trade negotiations dampened sentiment ahead of the July 9 tariff deadline

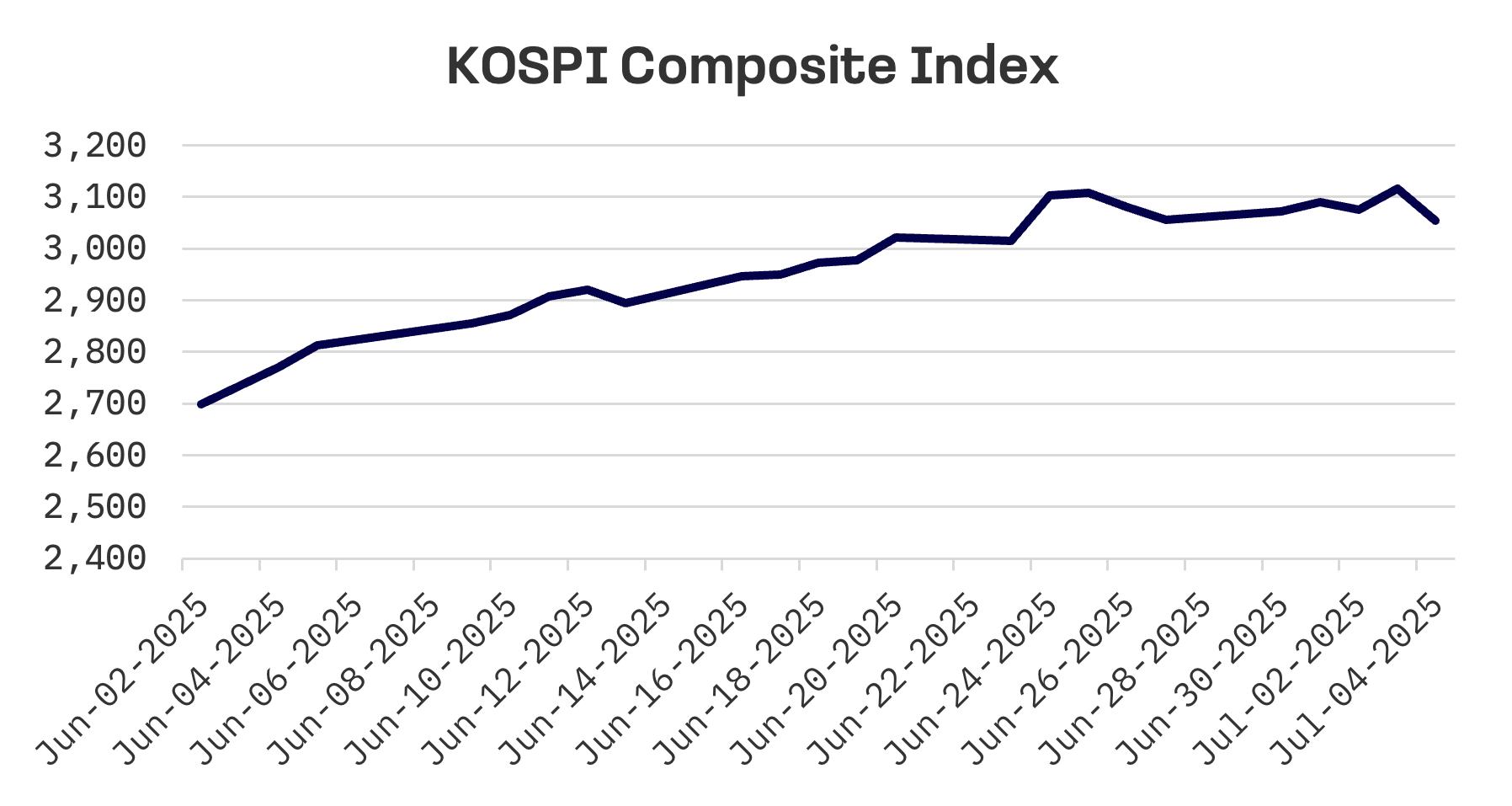

- South Korea’s KOSPI ended five weeks of gains with a 0.1% decline, pressured by profit taking following the index’s climb to four year highs

- Taiwan’s TAIEX declined 0.1% as a stronger Taiwan dollar squeezed manufacturing margins and policy uncertainties persisted

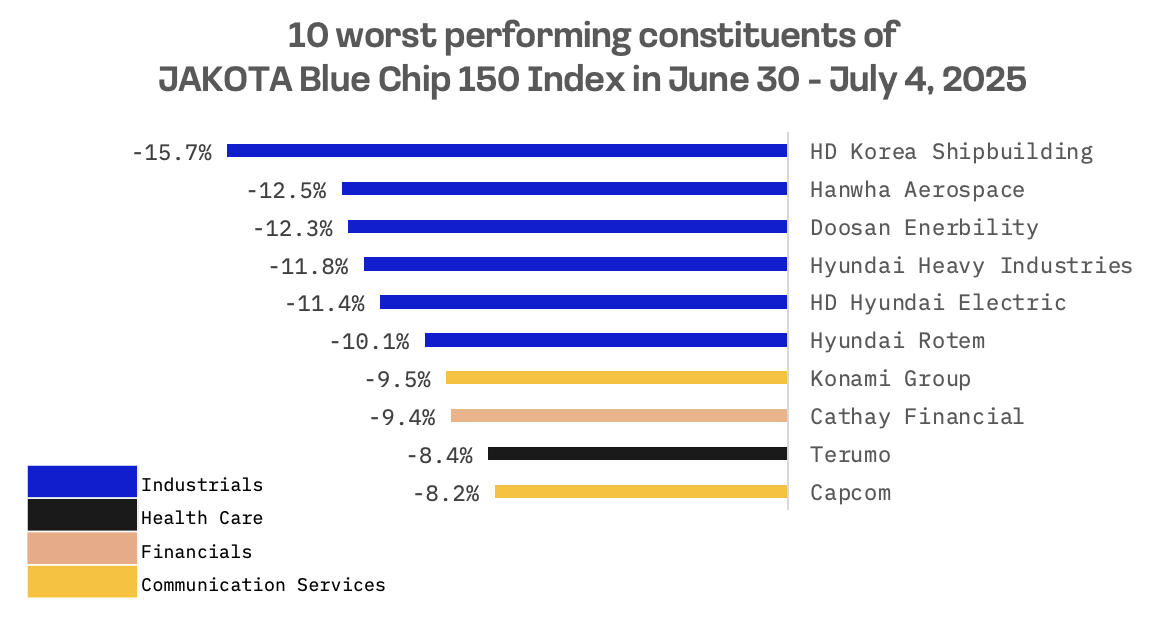

- The JAKOTA Blue Chip 150 Index dropped 0.3%, with POSCO Holdings leading gains on U.S. lithium production plans and HD Korea Shipbuilding plunging 15.7%

Japan

Japan’s stock market retreated for the week, with the Nikkei 225 falling 0.91% as stalled U.S.-Japan trade negotiations weighed on investor sentiment. The market also faced uncertainty ahead of Japan’s Upper House election scheduled for July 20.

A looming deadline threatens to trigger the reinstatement of a 24% reciprocal tariff on Japanese imports starting July 9. President Trump has warned that tariffs could surge to between 30-35% if the two nations fail to reach an agreement by that date – a deadline his administration appears unwilling to extend. Tokyo has reportedly maintained its demand for the elimination of all tariffs, particularly on automobiles and auto parts, while Washington is pressing Japan to increase imports of U.S. agricultural goods.

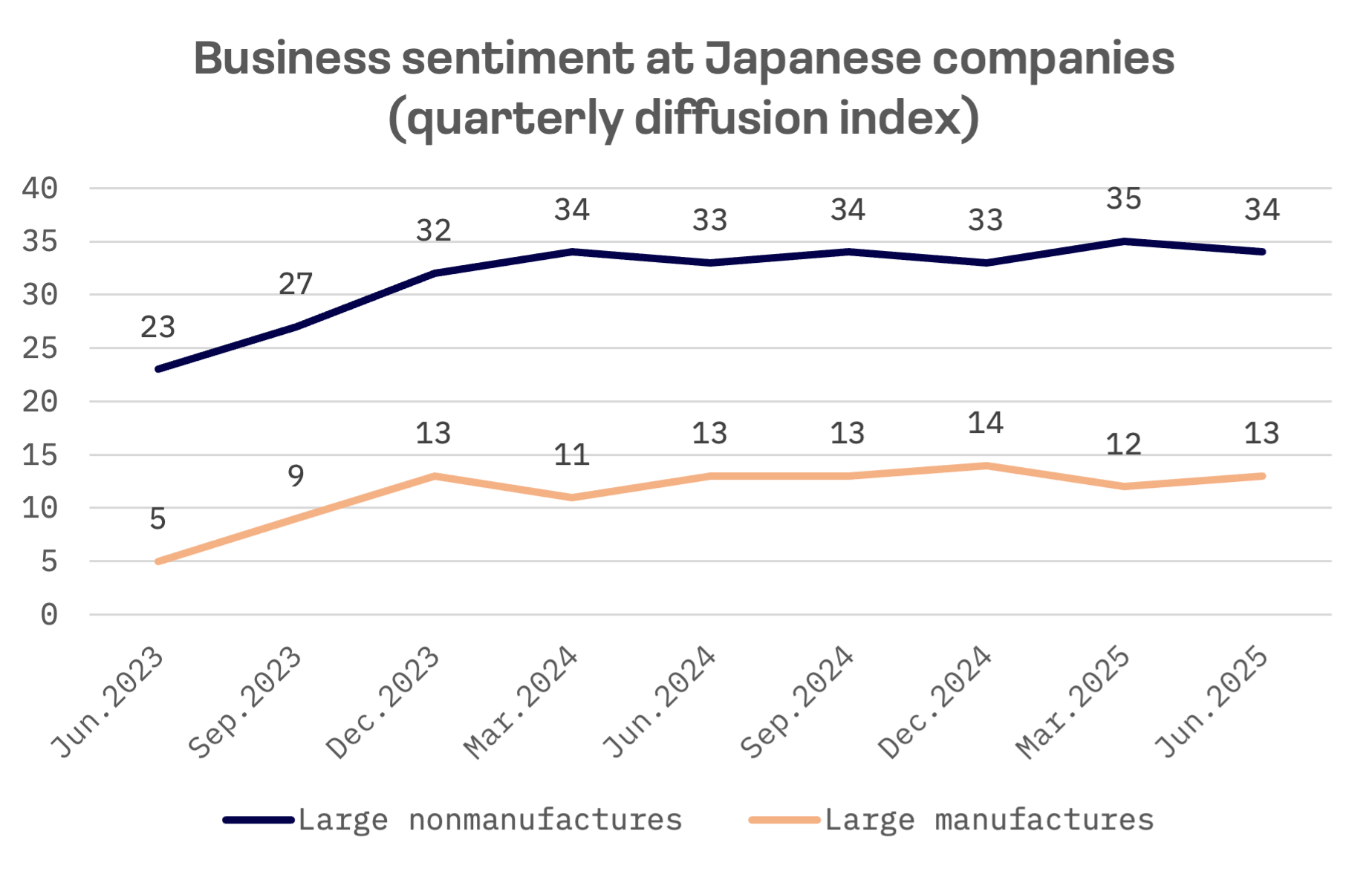

Business sentiment among Japan’s large manufacturers posted a modest and unexpected improvement in the three months through June, according to the Bank of Japan’s (BoJ) closely watched quarterly tankan survey. The index rose to +13 from +12 in March, beating market forecasts of +10. A positive reading indicates more firms view current business conditions favourably than unfavourably. However, big manufacturers expect confidence to decline over the next three months.

South Korea

South Korean stocks slipped into negative territory after five consecutive weeks of gains, with the KOSPI Index edging down 0.1%. The market dropped nearly 2% on Friday as investors took profits following a strong rally and monitored ongoing tariff negotiations with the United States. The pullback followed Thursday’s surge, when the index climbed to its highest level in nearly four years, lifted by the National Assembly’s passage of shareholder friendly revisions to the Commercial Act and signs of progress in U.S.-Vietnam tariff negotiations.

Investors remained focused on Seoul’s ongoing tariff negotiations with Washington, with just one week remaining before the July 9 deadline set by President Trump. Trade Minister Yeo Han-koo is expected to travel to the U.S. this week for last minute talks. According to media reports, President Trump indicated his administration will begin issuing letters to trading partners on Friday outlining unilateral tariff rates ranging from 10% to 70%, set to take effect in August.

On Friday, South Korea’s National Assembly approved a supplementary budget totaling ₩31.8 trillion ($23.3 billion), roughly two weeks after the government unveiled the plan. The package, initially proposed in mid June by President Lee Jae-myung’s administration following his June 3 victory, included ₩20.2 trillion in new spending aimed at spurring economic growth and ₩10.3 trillion to address an expected shortfall in tax revenue. The approved package came in ₩1.3 trillion higher than the original proposal after lawmakers increased funding for a universal cash handout program, which will distribute vouchers to nearly every citizen in Korea, to ₩12.2 trillion won.

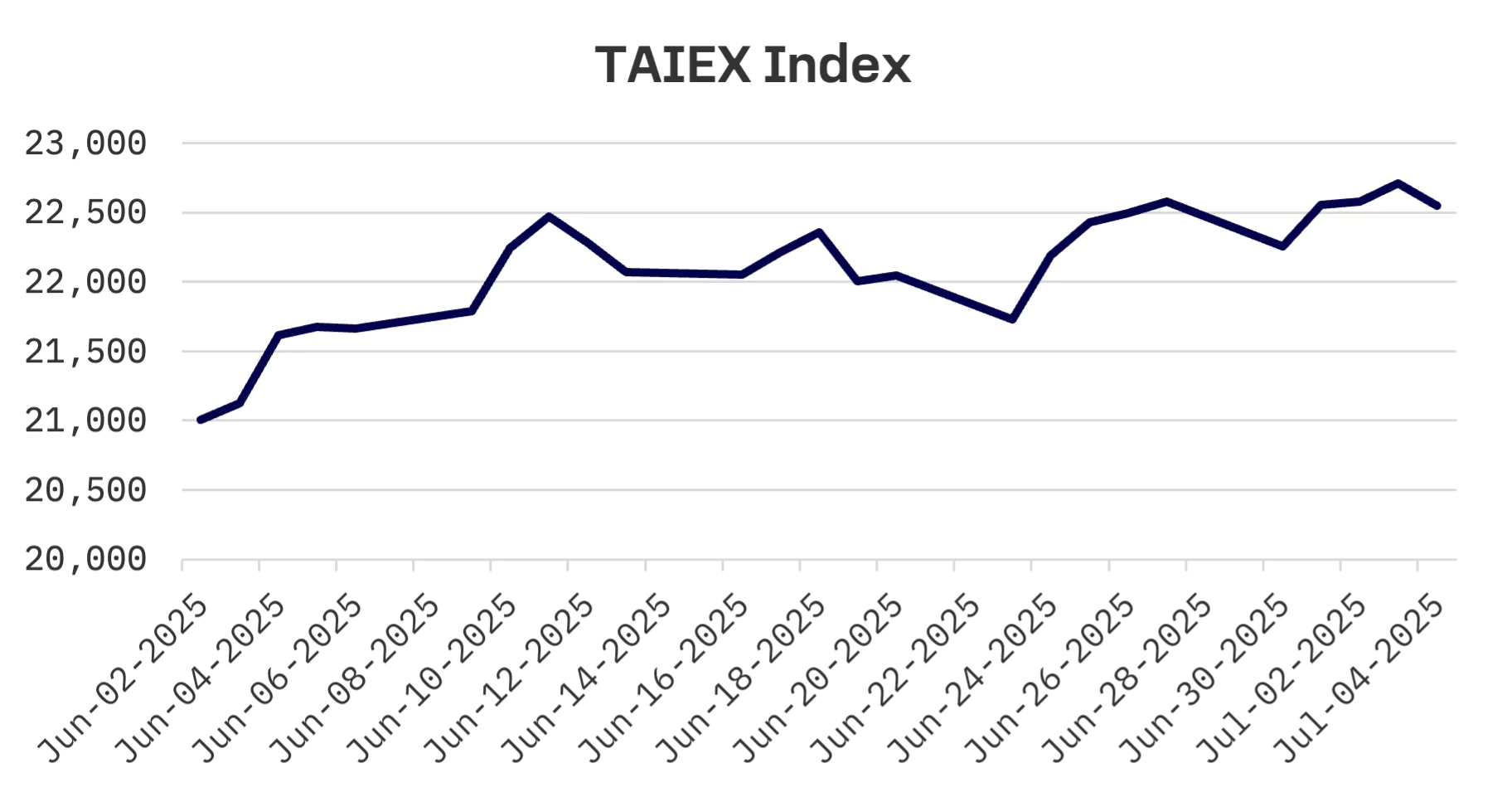

Taiwan

Taiwan’s stock market edged slightly lower this week, with the TAIEX declining 0.1% as uncertainties surrounding Trump administration policies continued to weigh on investor sentiment.

On the economic front, Taiwan’s manufacturing sector slipped into contraction in May as a stronger Taiwan dollar squeezed profit margins for the island’s export driven manufacturers.

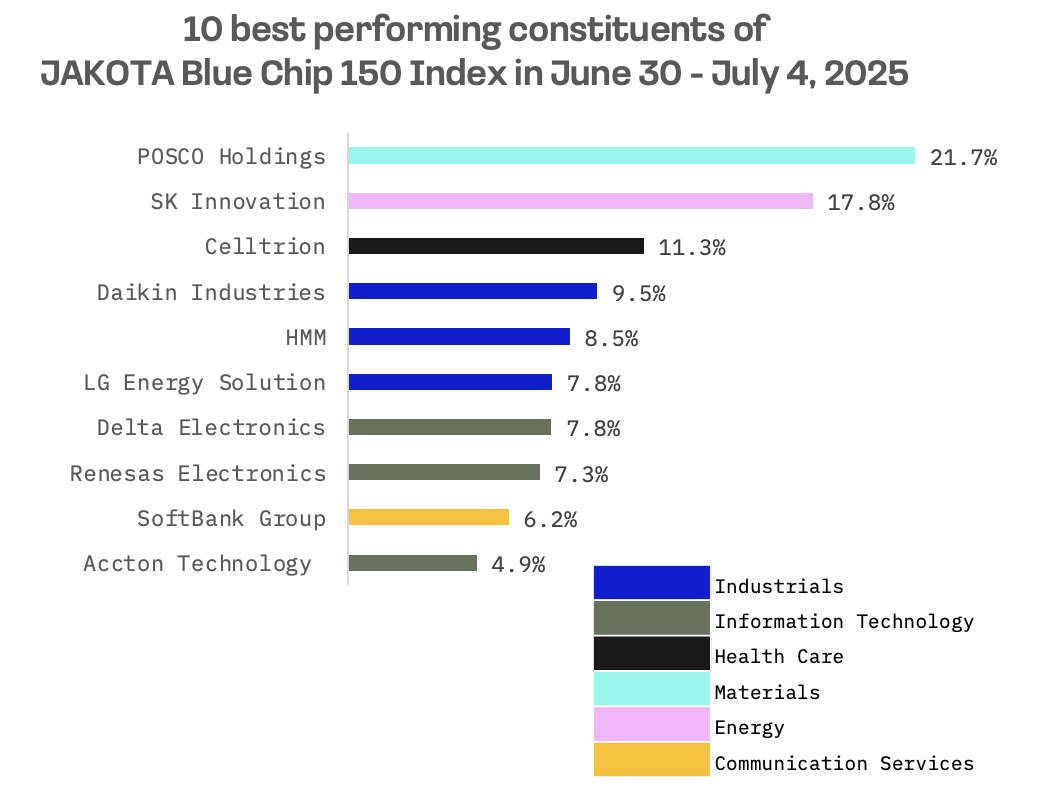

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index declined 0.3% for the week. Among 150 constituents, 65 stocks posted gains.

POSCO Holdings, a South Korean multinational conglomerate involved in steel production and battery materials, emerged as the top performer on the JAKOTA Blue Chip 150 Index this week. The stock rallied after the company announced plans to pursue lithium production in the U.S.

POSCO Holdings said it will partner with Australia’s Anson Resources to build a direct lithium extraction (DLE) demonstration plant in the United States, the first such facility by a Korean company. The move represents a strategic step for the South Korean steel to battery materials conglomerate as it seeks to strengthen its position in the North American battery materials supply chain.

Several South Korean industrial stocks suffered double digit declines, with HD Korea Shipbuilding & Offshore Engineering (KSOE) plunging 15.7%. The selloff was driven by profit taking following a sharp rally in June. KSOE has a high proportion of individual investors, who hold approximately 42% of the company’s shares – the largest ownership group. These investors tend to sell quickly during market pullbacks, contributing to increased volatility.