Last week’s Jakota markets:

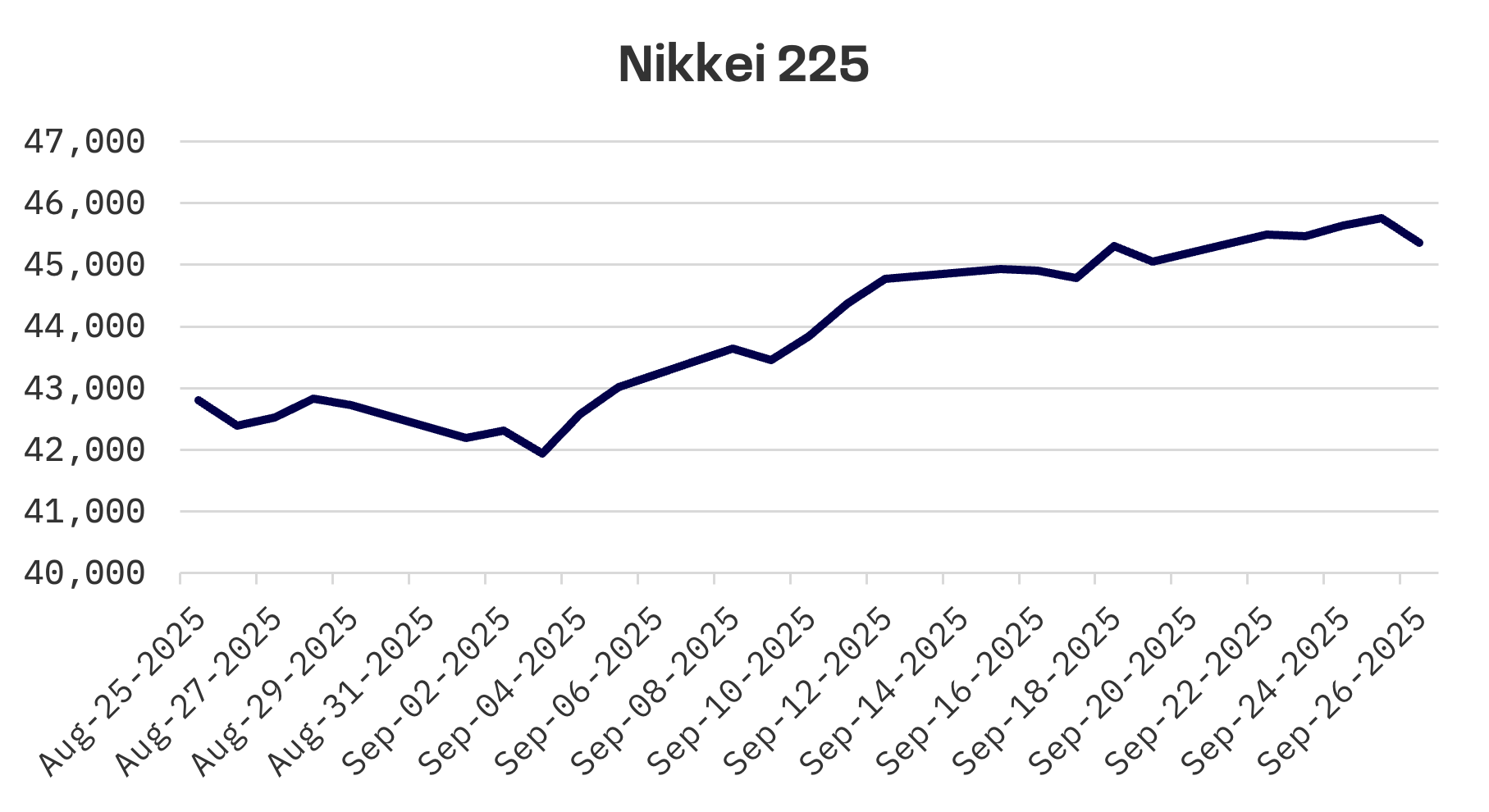

- Japan’s Nikkei 225 gained 0.7% as inflation data undershot forecasts, tempering expectations for imminent BoJ rate increases despite hawkish signals from two board members

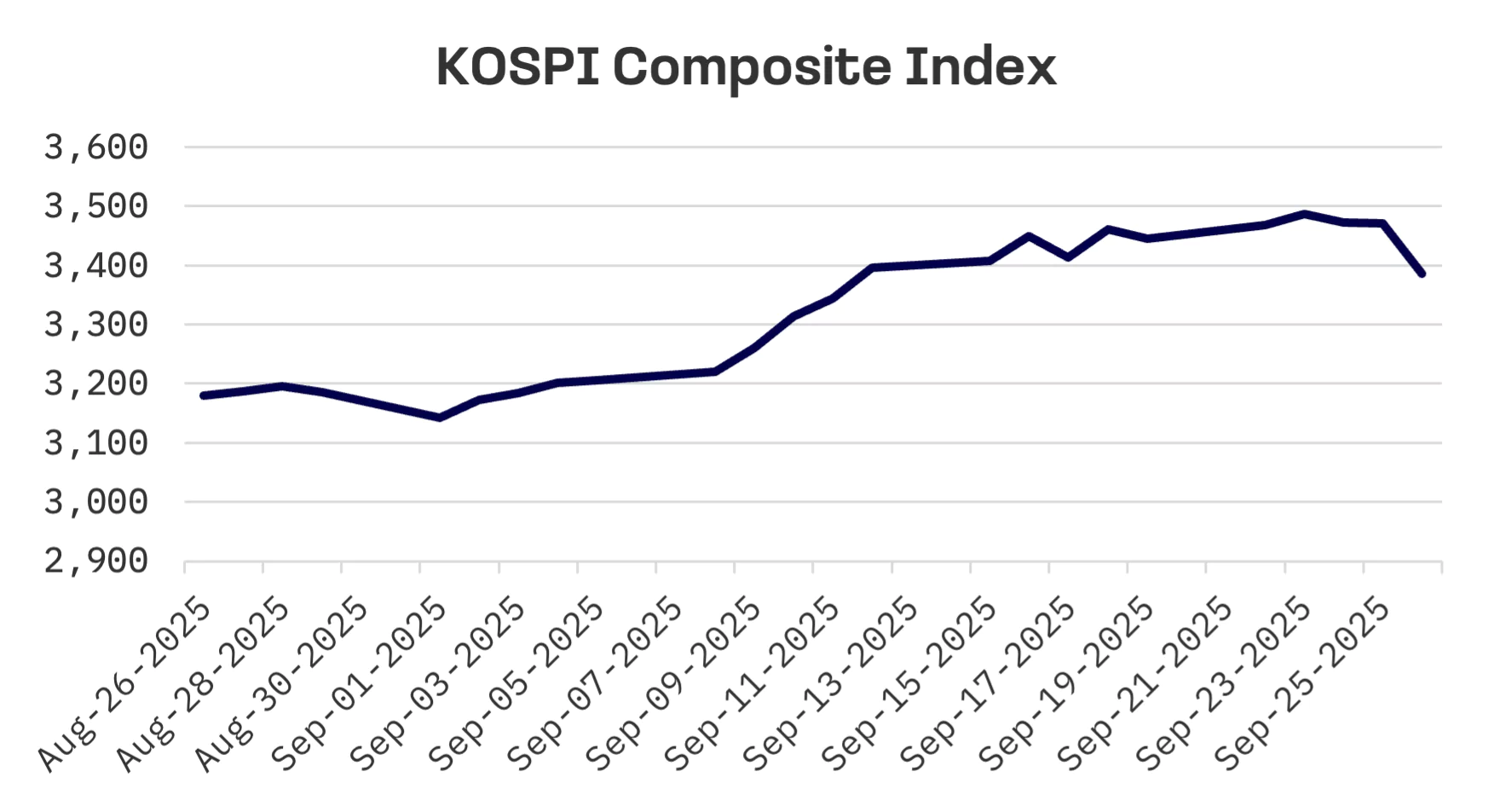

- South Korea’s KOSPI tumbled 1.7%, pressured by tariff worries after President Trump questioned Seoul’s $350 billion investment pledge and strong U.S. data dimmed Fed rate cut hopes

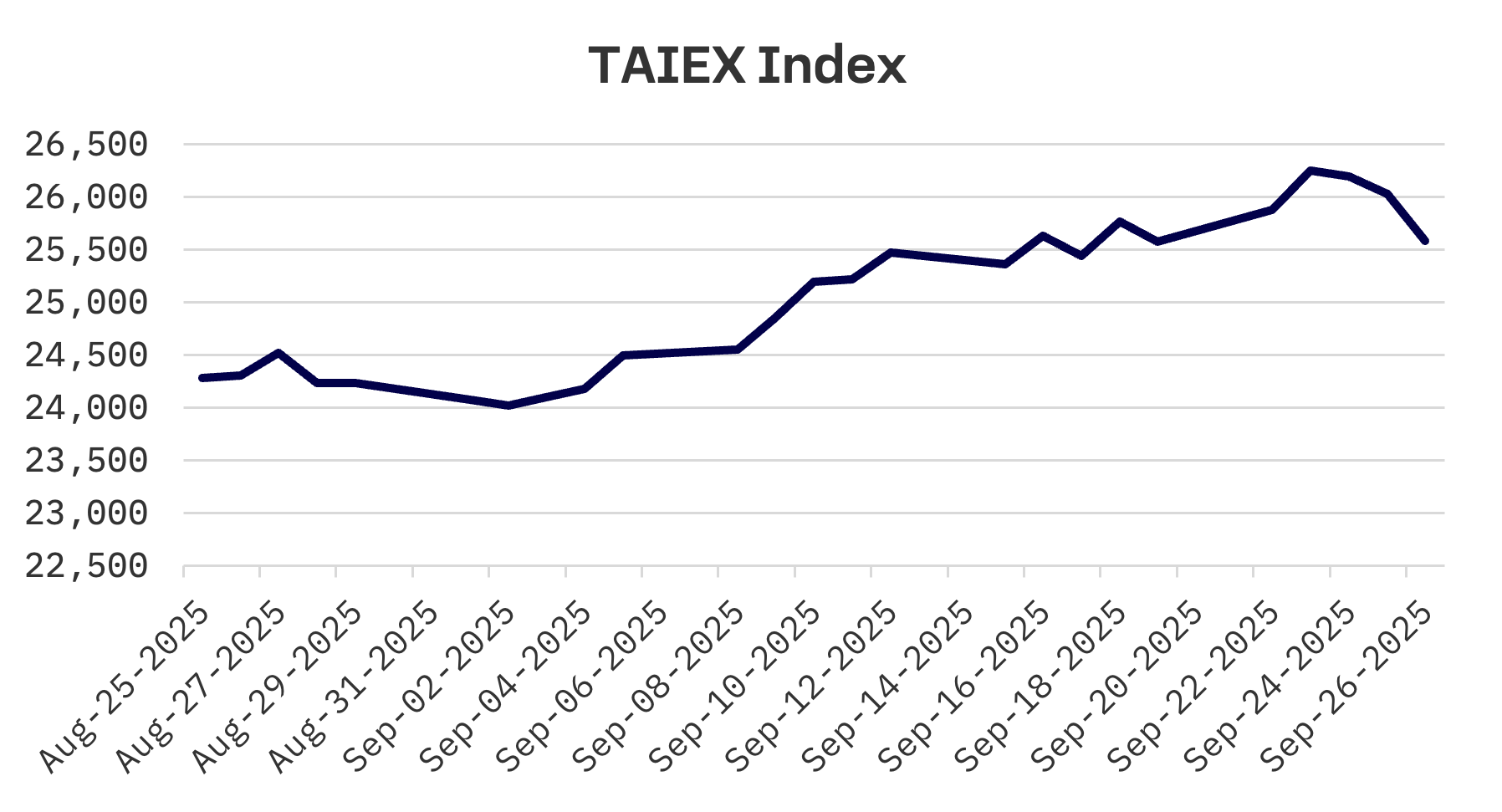

- Taiwan’s TAIEX finished essentially flat with a 0.01% gain, as TSMC hit fresh records on AI optimism before profit taking and tariff threats sparked a Friday retreat

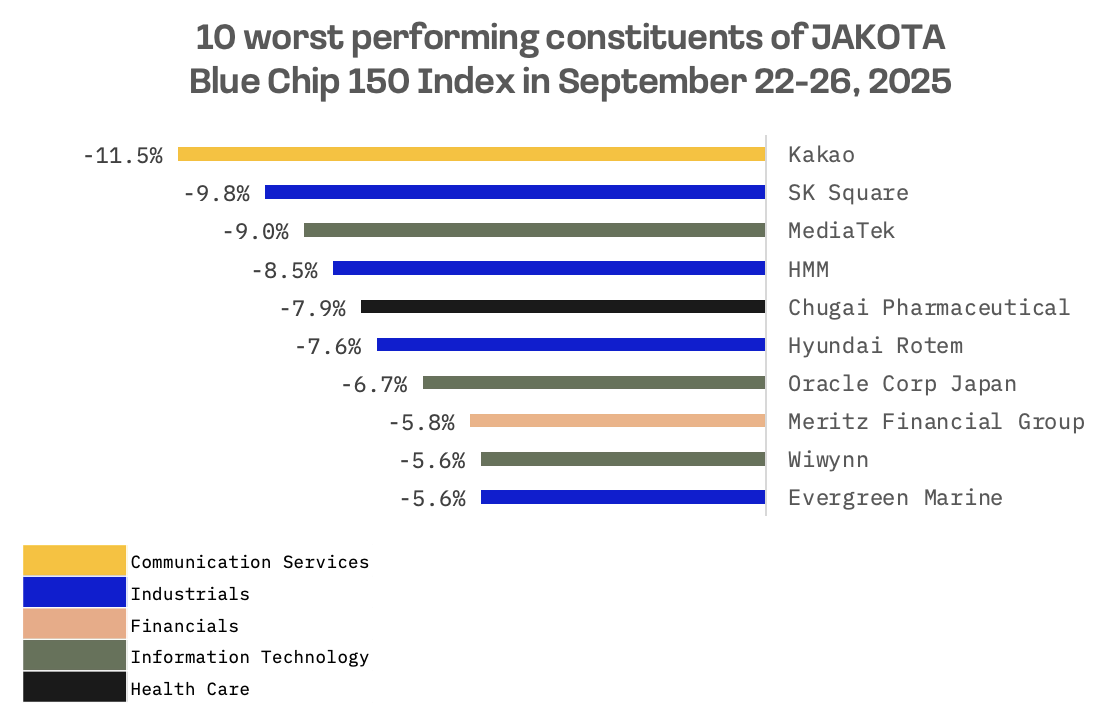

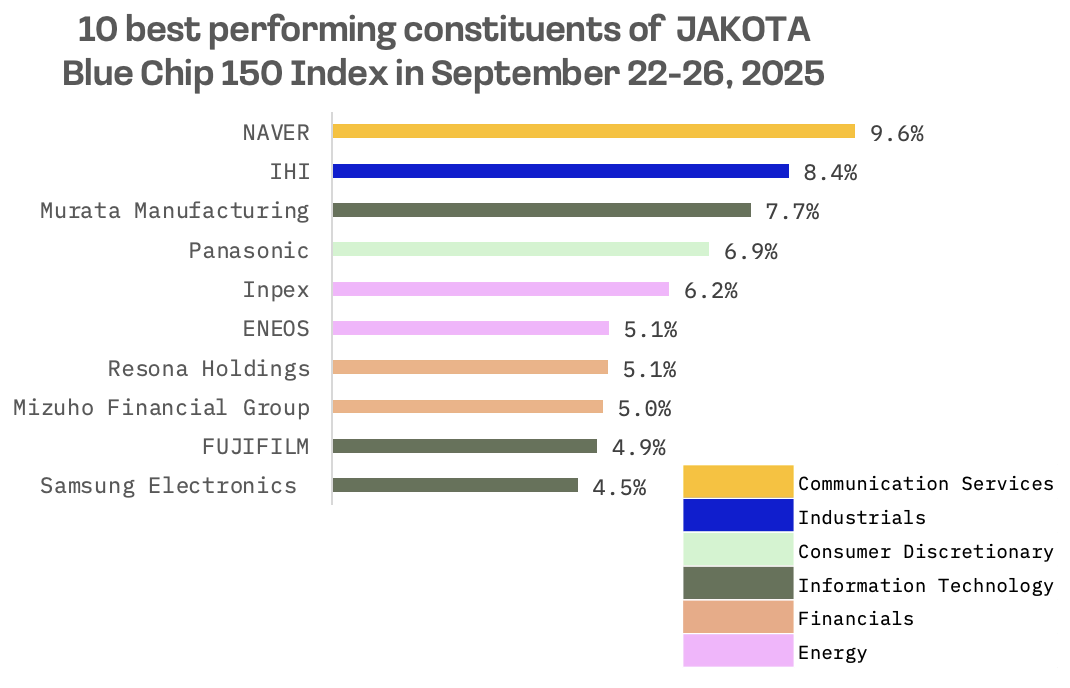

- The JAKOTA Blue Chip 150 Index slipped 0.5%, with Naver surging 9.6% on its Dunamu acquisition and Kakao tumbling on user backlash against its KakaoTalk redesign

Japan

Japan’s stock market edged higher this week, with the Nikkei 225 climbing 0.7%, as expectations receded for an imminent Bank of Japan (BoJ) interest rate increase after Tokyo consumer inflation data fell short of forecasts. Pharmaceutical shares lagged following new U.S. tariff measures aimed at the sector.

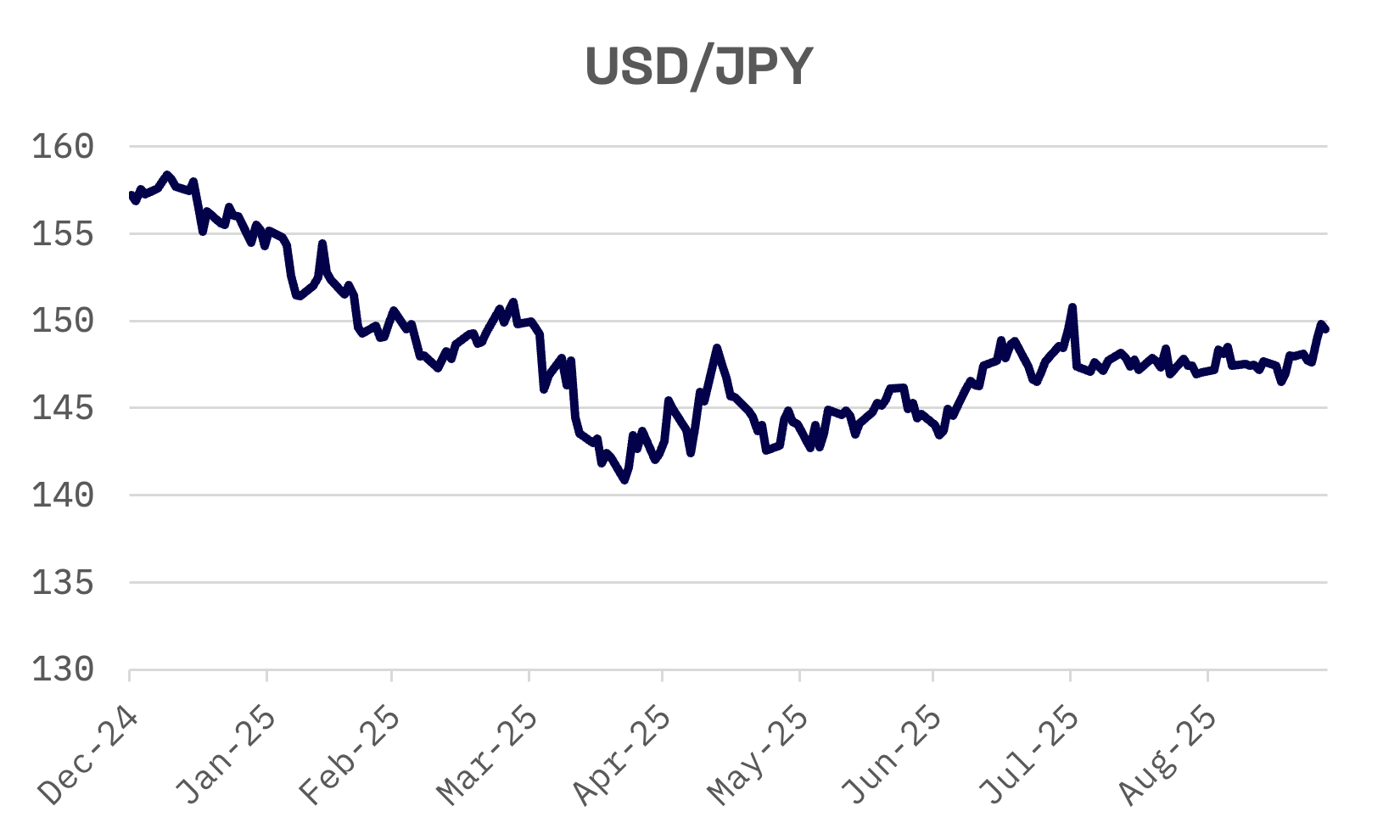

The yen weakened to around ¥150 against the dollar from roughly ¥148 a week earlier, weighed down by political uncertainty surrounding the Liberal Democratic Party’s presidential vote. The dollar drew broader support from strong U.S. economic data that investors said reduces the odds of aggressive Federal Reserve rate cuts.

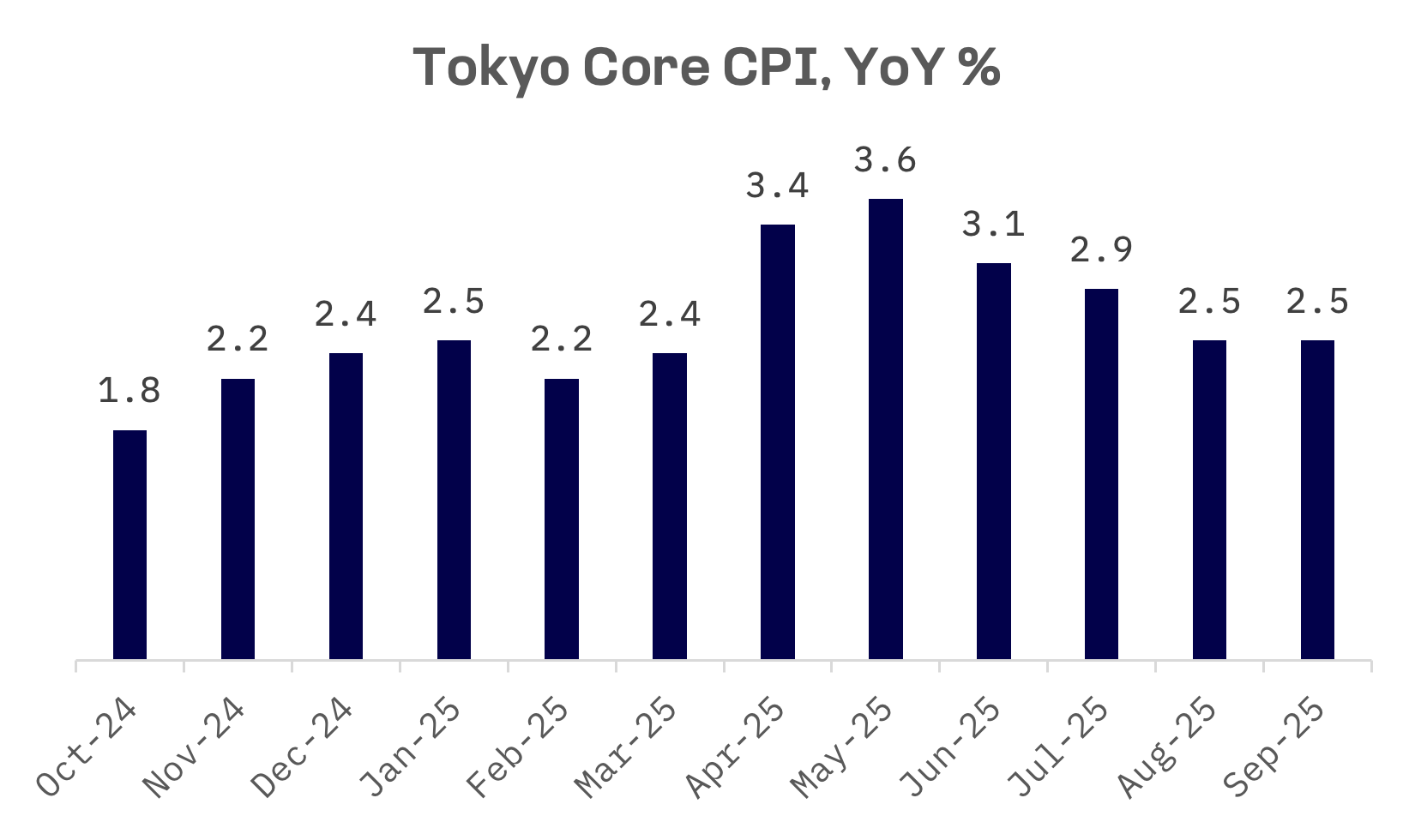

Tokyo’s core consumer price index (CPI), often viewed as a bellwether for nationwide inflation trends, rose 2.5% year-on-year in September, matching the previous month’s pace but trailing the 2.8% gain economists had forecast.

The weaker than anticipated reading, stemming partly from temporary government subsidies, undercut expectations that the BoJ would raise rates in the near term. Yet two BoJ board members dissented at the September policy meeting, favouring a rate increase over standing pat – a hawkish signal that left the door ajar for a potential move at the October or December gatherings.

South Korea

South Korean stocks retreated this week, with the KOSPI sliding 1.7% as a Friday selloff pushed the benchmark below 3,400 for the first time in 10 sessions. Mounting tariff concerns weighed on the market after President Trump suggested South Korea’s planned $350 billion investment commitment amounted to little more than an “up front” pledge. Robust U.S. economic growth further dimmed prospects for near term Fed rate cuts.

At the Korea Investment Summit at the New York Stock Exchange on Thursday, South Korean President Lee Jae-myung pledged sweeping structural reforms to strengthen corporate governance and bolster protections for investors.

Seoul has already passed two amendments to the Commercial Act that expand directors’ fiduciary duties to encompass all shareholders and fortify safeguards for minority stakeholders. A third wave of changes will overhaul what officials call “irrational decision making structures” at Korean conglomerates.

South Korea is also moving to extend foreign exchange trading to round-the-clock operations and create an offshore won settlement system, measures designed to improve international access to its capital markets. The steps form part of a wider strategy to win inclusion in the MSCI developed market index, with additional details due later this year, the Ministry of Economy and Finance said.

Taiwan

Taiwan’s stock market finished the week nearly unchanged, with the TAIEX inching up 0.01% despite sharp intraday swings. The benchmark hit a fresh record on Tuesday as Taiwan Semiconductor (TSMC) extended its run of all time highs, buoyed by AI euphoria following Nvidia’s commitment to invest as much as $100 billion in OpenAI. The rally lost steam in the week’s second half, with stocks tumbling on Friday as investors locked in profits on large cap names amid worries about lofty valuations. Pressure intensified after the Trump administration slapped a 100% tariff on pharmaceutical imports and opened a similar probe into semiconductors.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index fell 0.5% for the week, with 80 of its 150 constituents posting gains.

Naver, a South Korean internet conglomerate, led the index higher with shares surging 9.6% after the company said it would acquire Dunamu, which operates Upbit, South Korea’s largest virtual asset exchange.

Another South Korean internet giant – Kakao – logged the index’s steepest decline as users revolted against a sweeping redesign of its dominant KakaoTalk messaging app.

The overhaul, launched on September 23, added Instagram style profile feeds, short form video content in open chat and an altered friends list – changes that many subscribers panned as a departure from the app’s core messaging purpose. The backlash dashed hopes that the makeover would drive user engagement and soured investor sentiment instead.

Compounding Kakao’s troubles, founder Kim Beom-soo, who leads the company’s Management Reform Committee, is standing trial on allegations he manipulated shares of SM Entertainment. His initial sentencing hearing is set for October 21.