Last week’s Jakota markets:

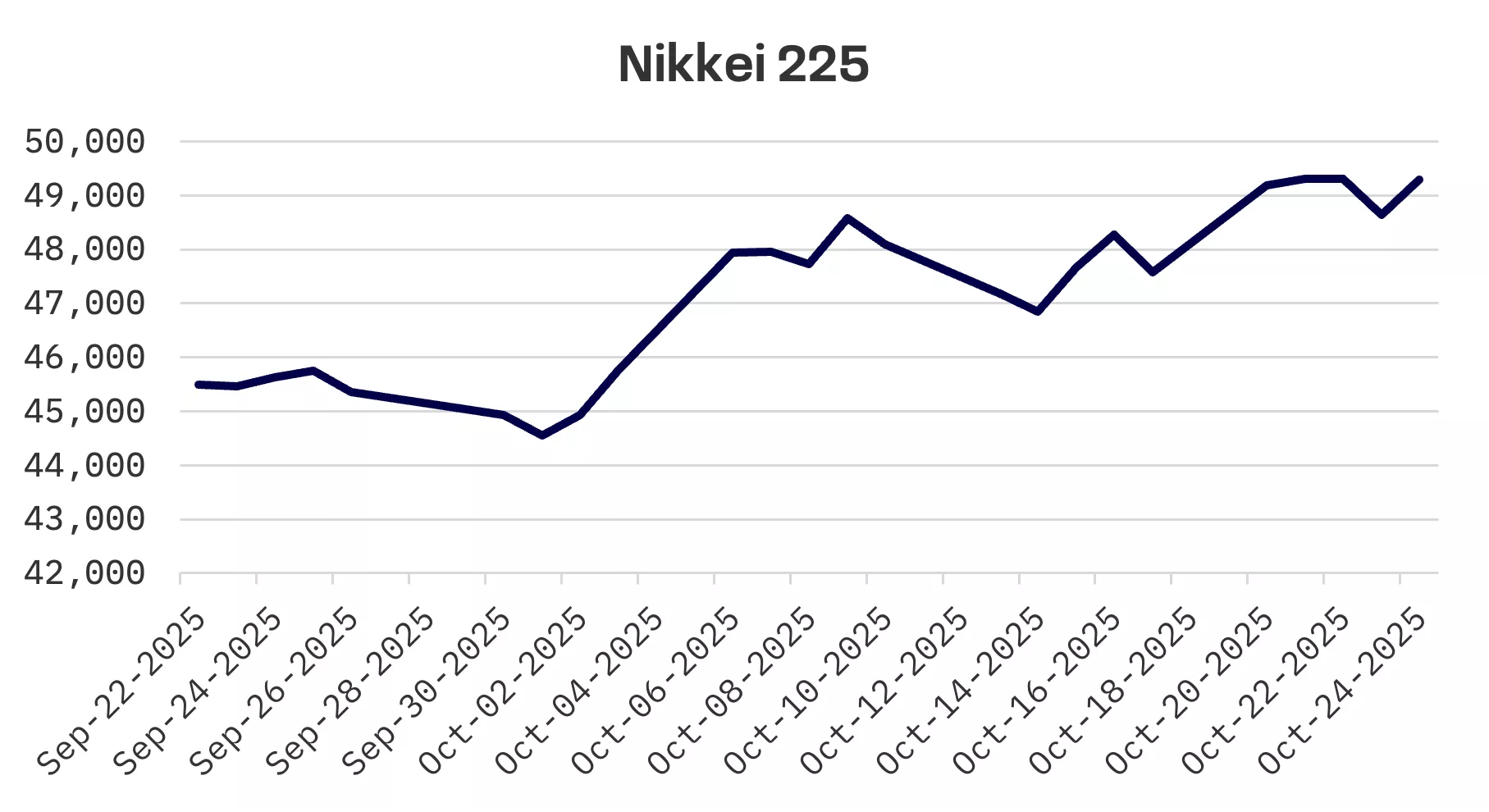

- Japan’s Nikkei 225 rallied 3.6% as new Prime Minister Sanae Takaichi’s stimulus plans and prospects for U.S.-China talks lifted sentiment, even as inflation held above the BoJ’s 2% target at 2.9%

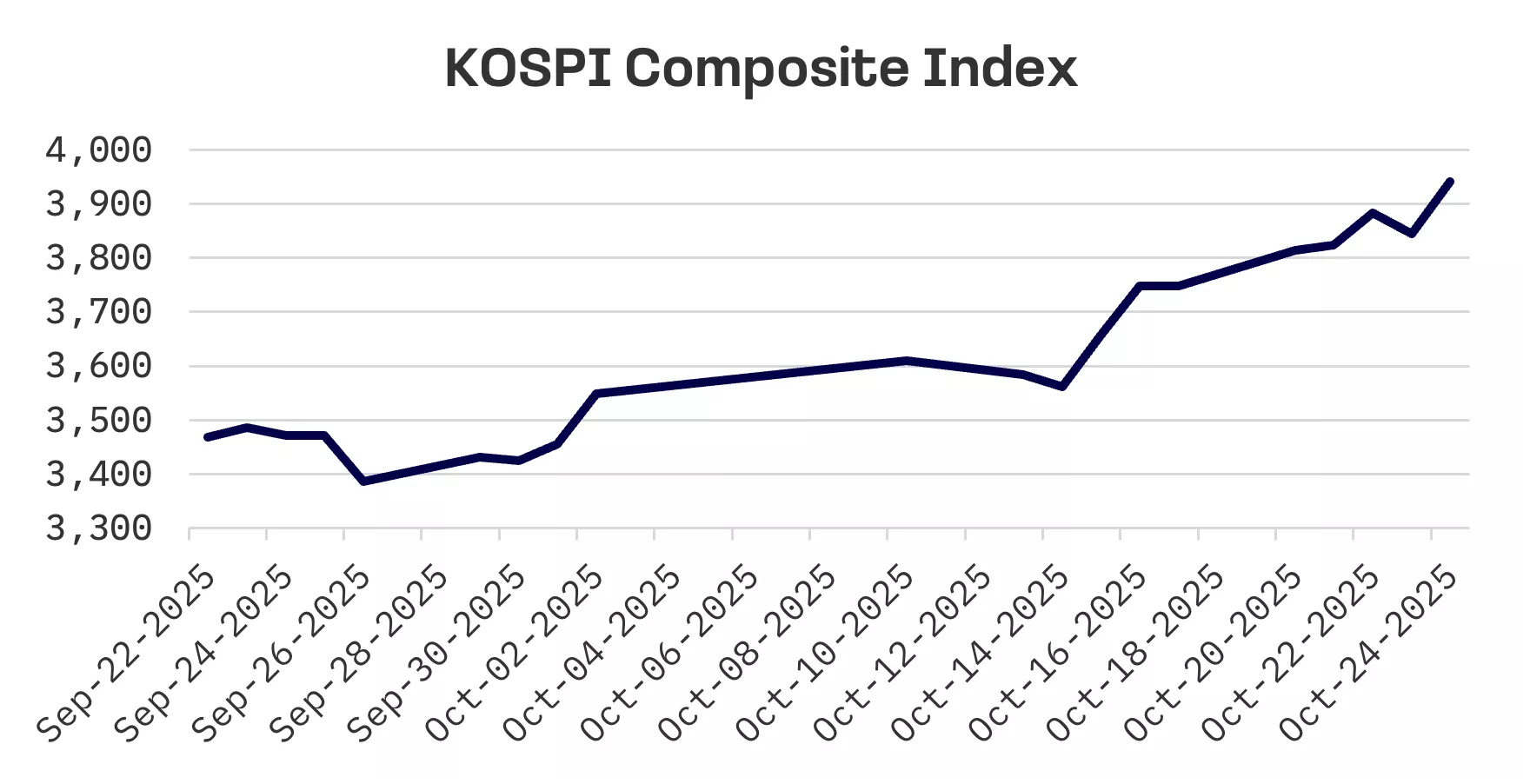

- South Korea’s KOSPI jumped 5.1% to approach 4,000 and set another record, with tech shares surging despite the central bank holding rates steady at 2.5%

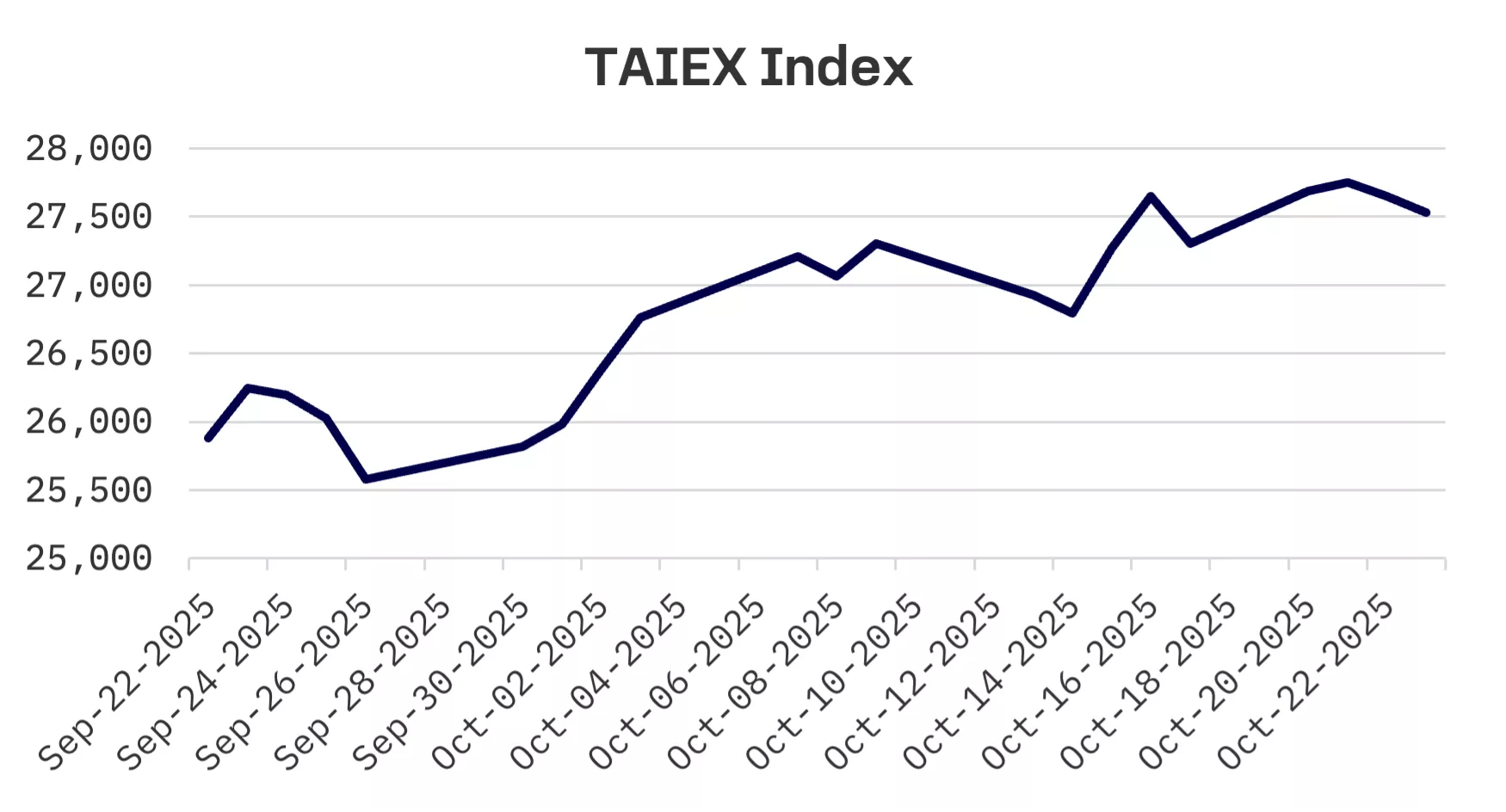

- Taiwan’s TAIEX rose 0.8%, buoyed by electronics shares and AI enthusiasm

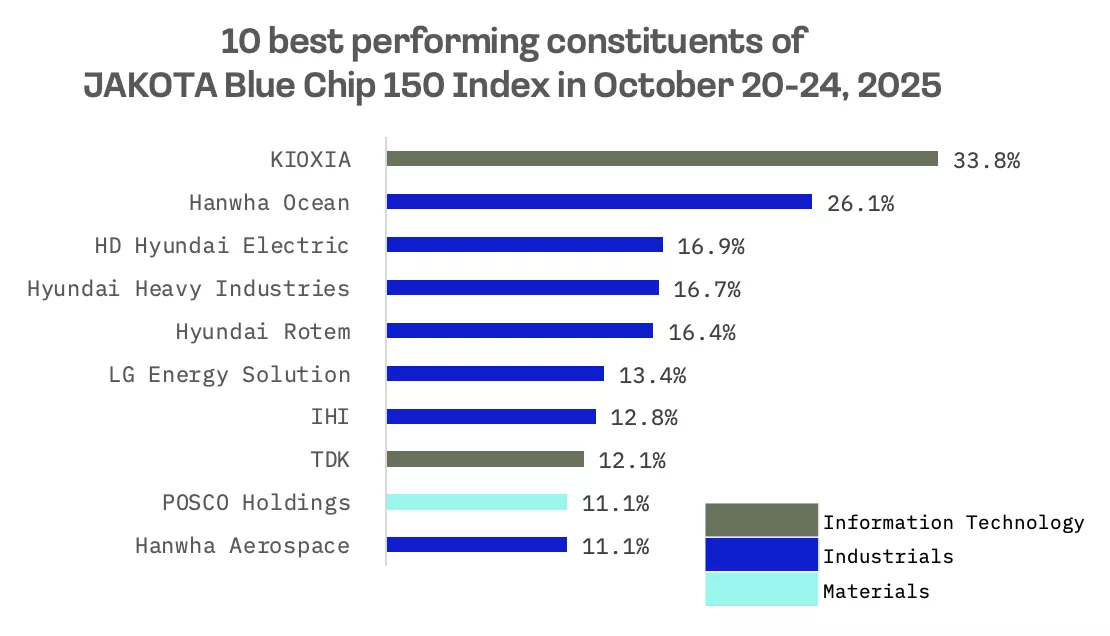

- The JAKOTA Blue Chip 150 Index gained 1.4%, with memory chip maker KIOXIA leading winners with a 34% surge and Renesas Electronics topping decliners on semiconductor sector concerns

Japan

Japan’s stock market rallied this week, with the Nikkei 225 climbing 3.6% following the election of Liberal Democratic Party (LDP) leader Sanae Takaichi as the nation’s new prime minister. Markets viewed Takaichi’s focus on economic growth and plans for proactive fiscal stimulus as a positive signal for equities. The LDP’s coalition with the Japan Innovation Party (JIP) is expected to deliver a relatively stable administration, even though the alliance falls just short of a majority in both chambers of parliament.

Optimism strengthened ahead of next week’s closely watched meeting between Presidents Donald Trump and Xi Jinping. The White House confirmed the two leaders will meet on the sidelines of the APEC summit, raising hopes for an easing of trade tensions. Trump suggested he could extend the pause on new tariffs if China resumes large scale soybean purchases and takes steps to restrict fentanyl exports.

Rising speculation that Takaichi may unveil a large scale stimulus package in the near term pressured the yen, sending the currency lower to about ¥153 per U.S. dollar from ¥150.6 yen a week earlier. The improved risk appetite also reduced demand for safe haven assets.

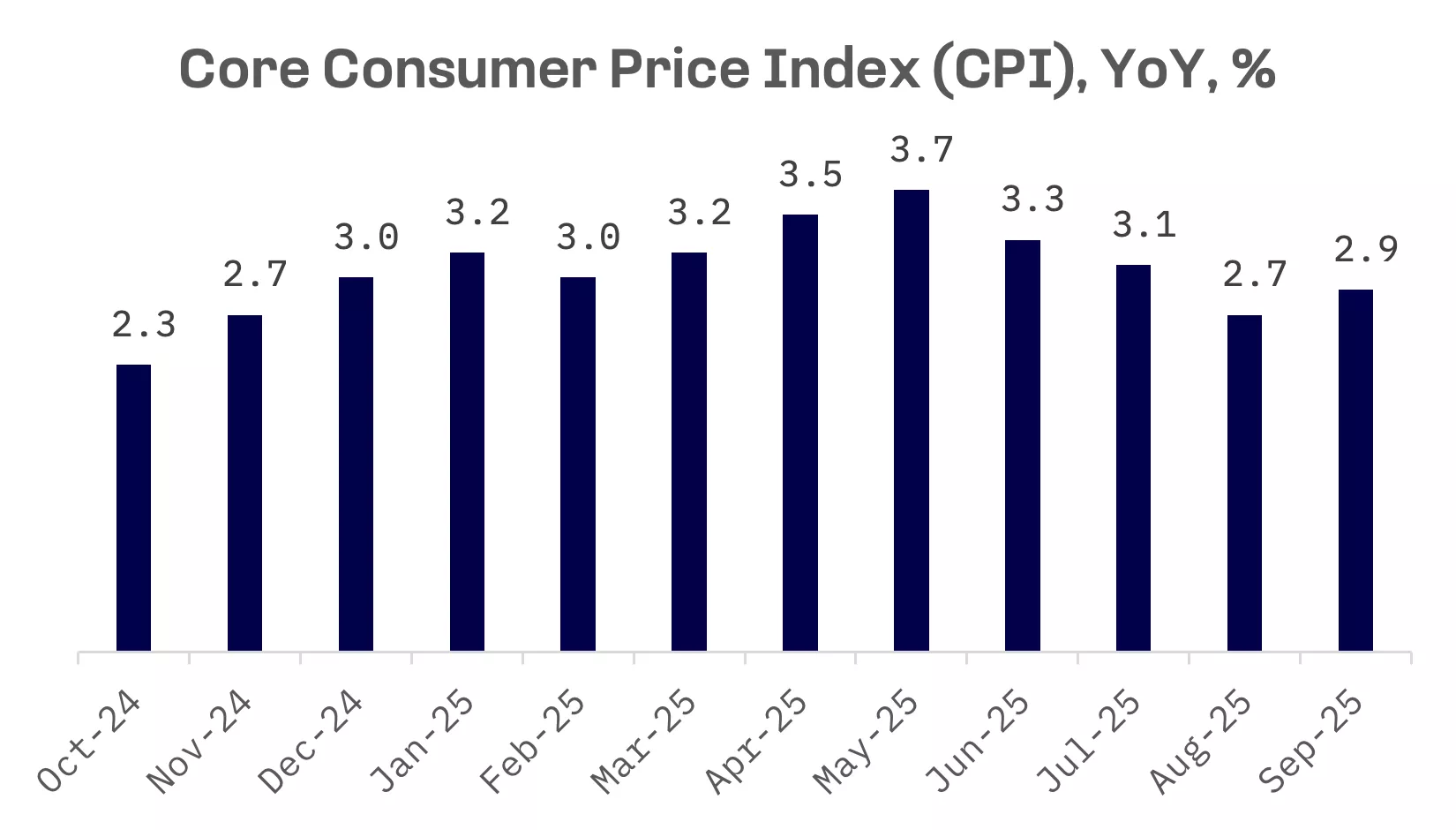

On the economic data front, inflation stayed above the Bank of Japan’s (BoJ) 2% target, with the nationwide core consumer price index (CPI) rising 2.9% year-over-year in September matching forecasts and accelerating from August’s 2.7%. The pickup was driven largely by higher energy and food costs.

BoJ Governor Kazuo Ueda emphasised that underlying inflation remains uncertain, adding that the central bank will assess incoming data with an open mind before making any decisions on interest rates.

South Korea

South Korean stocks surged this week, with the KOSPI jumping 5.1% to approach the 4,000 mark and set another record high, driven by strong gains in technology shares. Sentiment was boosted by growing hopes for easing global trade tensions following news of an upcoming summit between American and Chinese leaders, alongside renewed enthusiasm for AI shares.

In a widely expected move, South Korea’s central bank left its benchmark interest rate unchanged at 2.5% on Thursday, seeking to maintain financial stability amid a heated housing market and a weakening won. The Bank of Korea’s (BOK) Monetary Policy Board signalled it remains committed to supporting the economic recovery through an accommodative policy stance.

Taiwan

Taiwan’s stock market advanced this week, with the TAIEX gaining 0.8%, supported by strength in electronics shares amid persistent optimism over AI development.

JAKOTA Blue Chip 150 Index

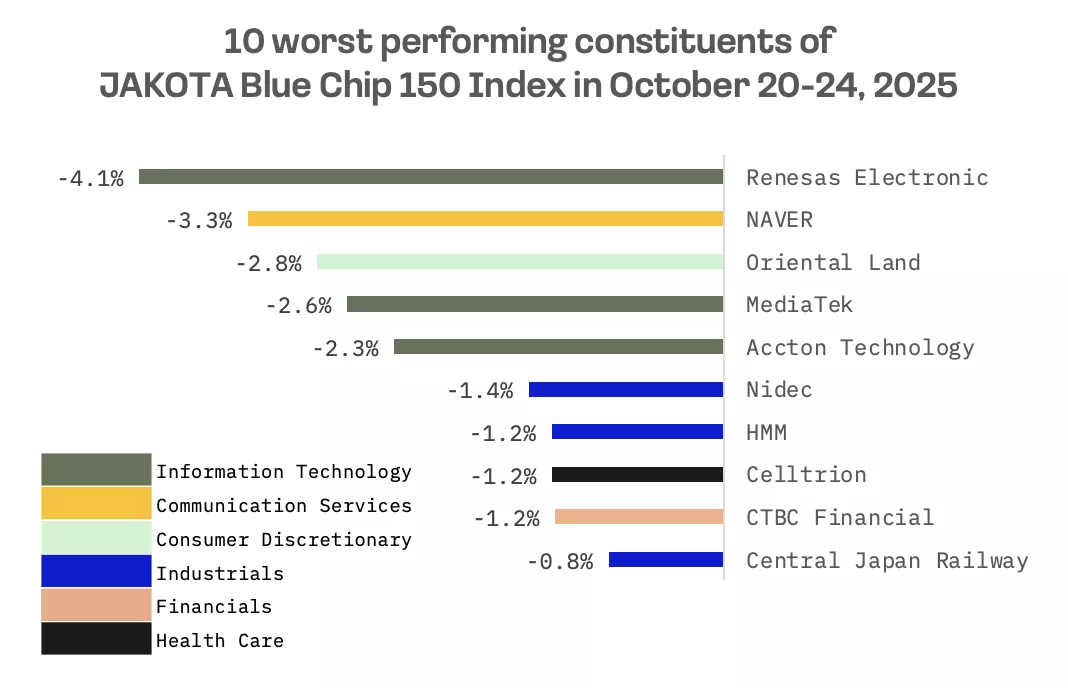

The JAKOTA Blue Chip 150 Index rose 1.4% this week. Out of a pool of 150 constituents, 129 stocks posted gains.

KIOXIA, a Japanese memory chip manufacturer, emerged as the top performer on the JAKOTA Blue Chip 150 Index this week, with shares surging around 34% and extending their 2025 rally to roughly 435%. The company’s gains were fuelled by an improving outlook for NAND and flash storage demand, supported by growth in AI and data centres.

Renesas Electronics, a Japanese semiconductor manufacturer, led the losses on the JAKOTA Blue Chip 150 Index this week. The stock fell after weak results from Texas Instruments, which issued a downbeat fourth quarter outlook and cautioned that the semiconductor industry’s recovery is losing momentum.