Last week’s JAKOTA markets:

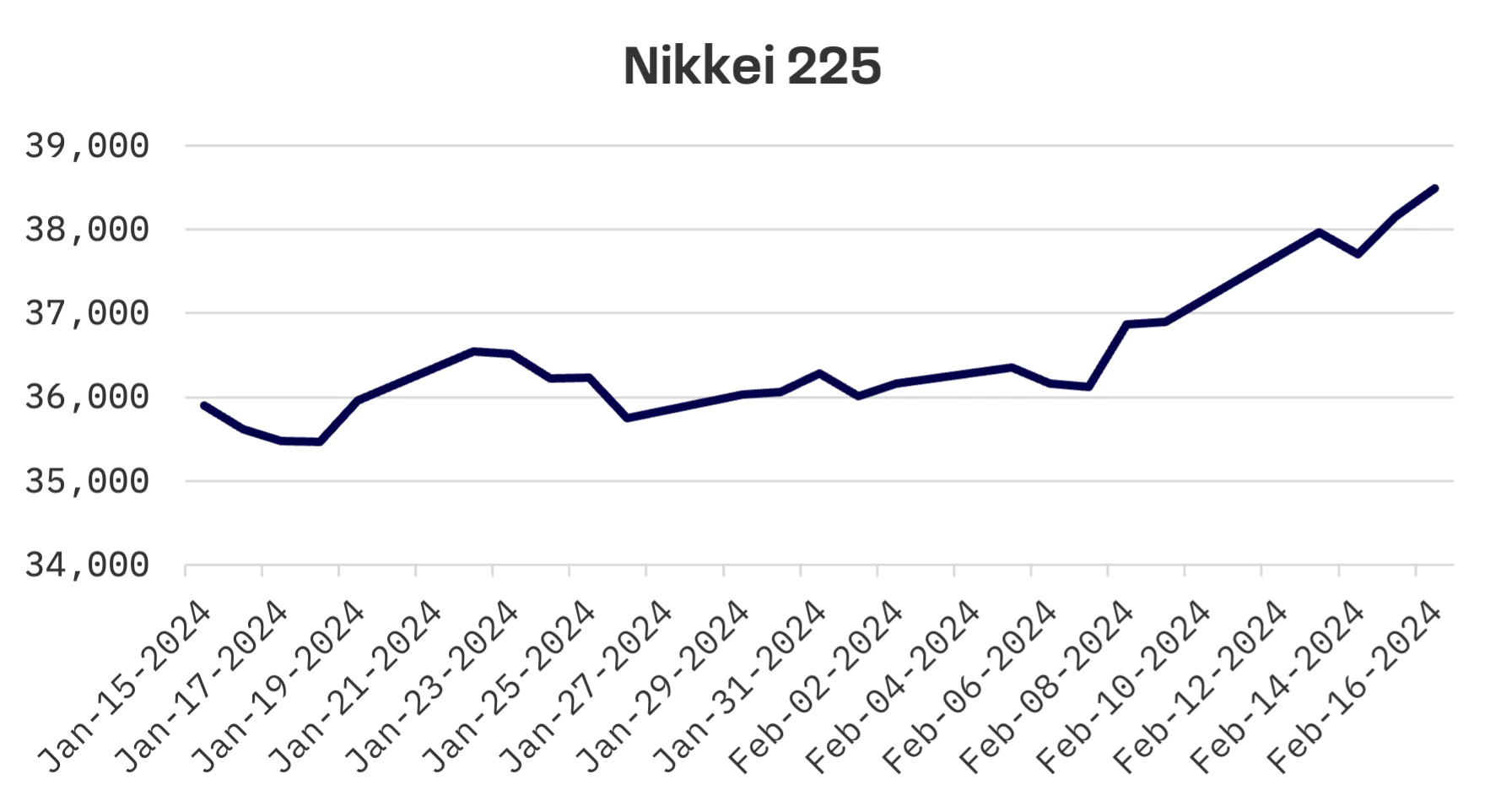

- Japan’s Nikkei 225 Index soared by 4.3%, reaching a 34-year high: driven by a depreciating yen and robust corporate earnings, and in spite of the emergence of technical recession

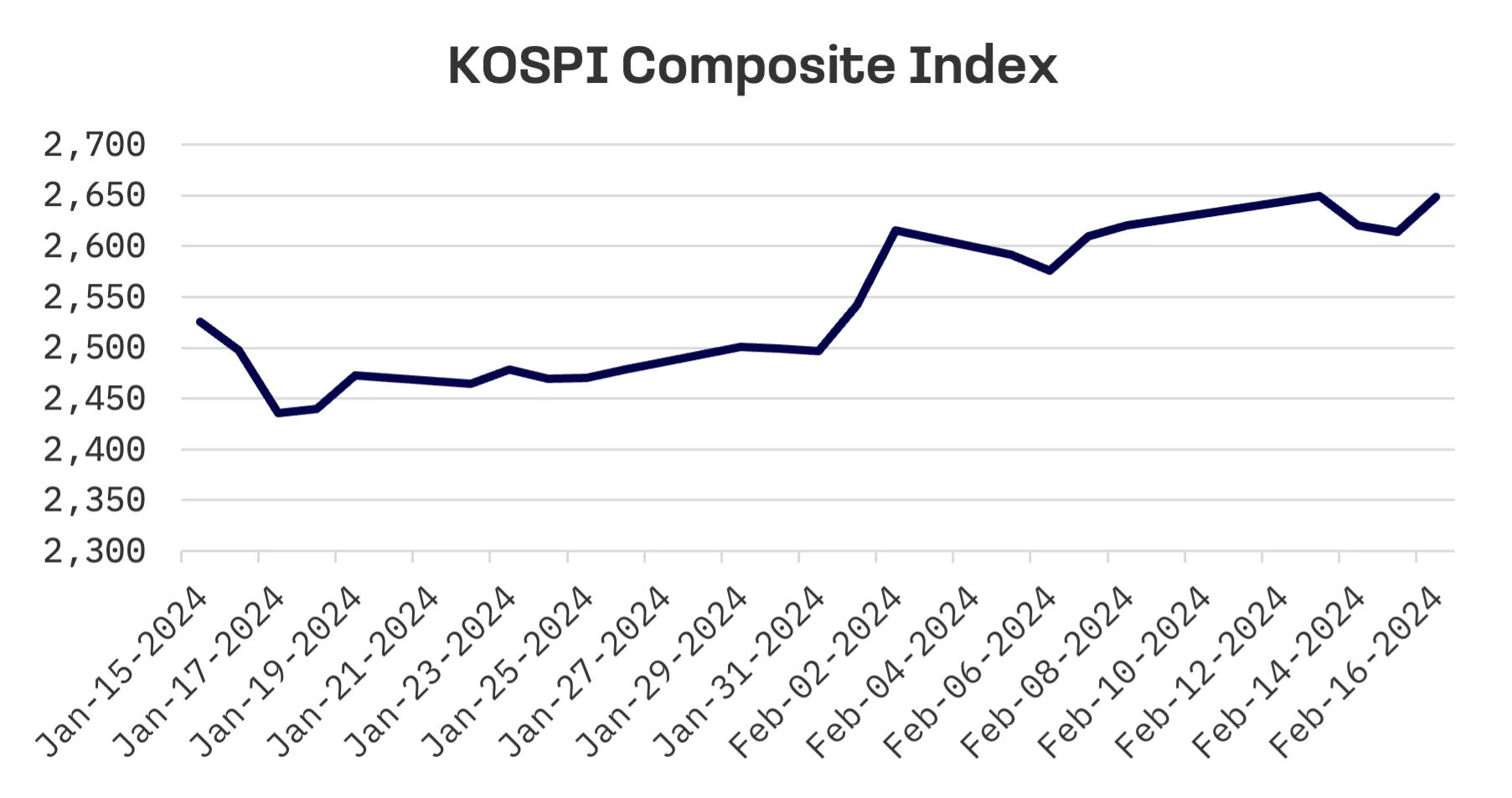

- South Korea’s KOSPI index continued its ascent, increasing by 1.1% on the back of strong semiconductor demand and optimistic corporate earnings, marking its fourth consecutive week of gains

- Taiwan’s stock market, with only two days of trading, saw a 2.8% jump, predominantly driven by TSMC’s impressive performance relating to AI developments

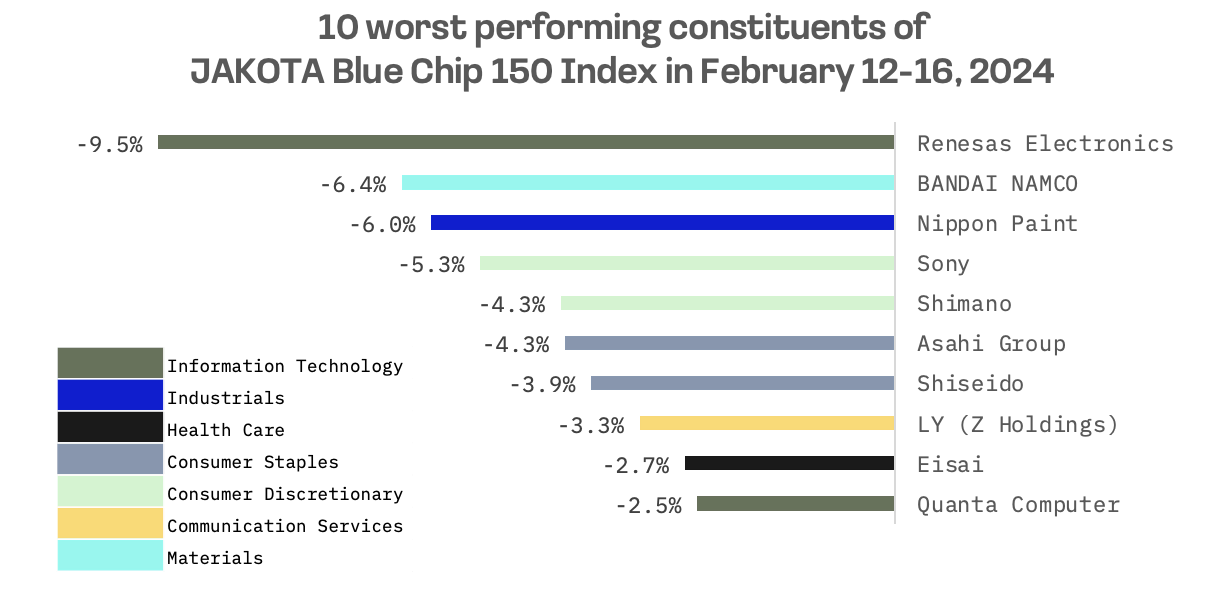

- The JAKOTA Blue Chip 150 Index rose by 2.3%, with Japanese insurers leading the charge following regulatory directives, while Renesas Electronics faced a downturn after announcing a major acquisition

Japan

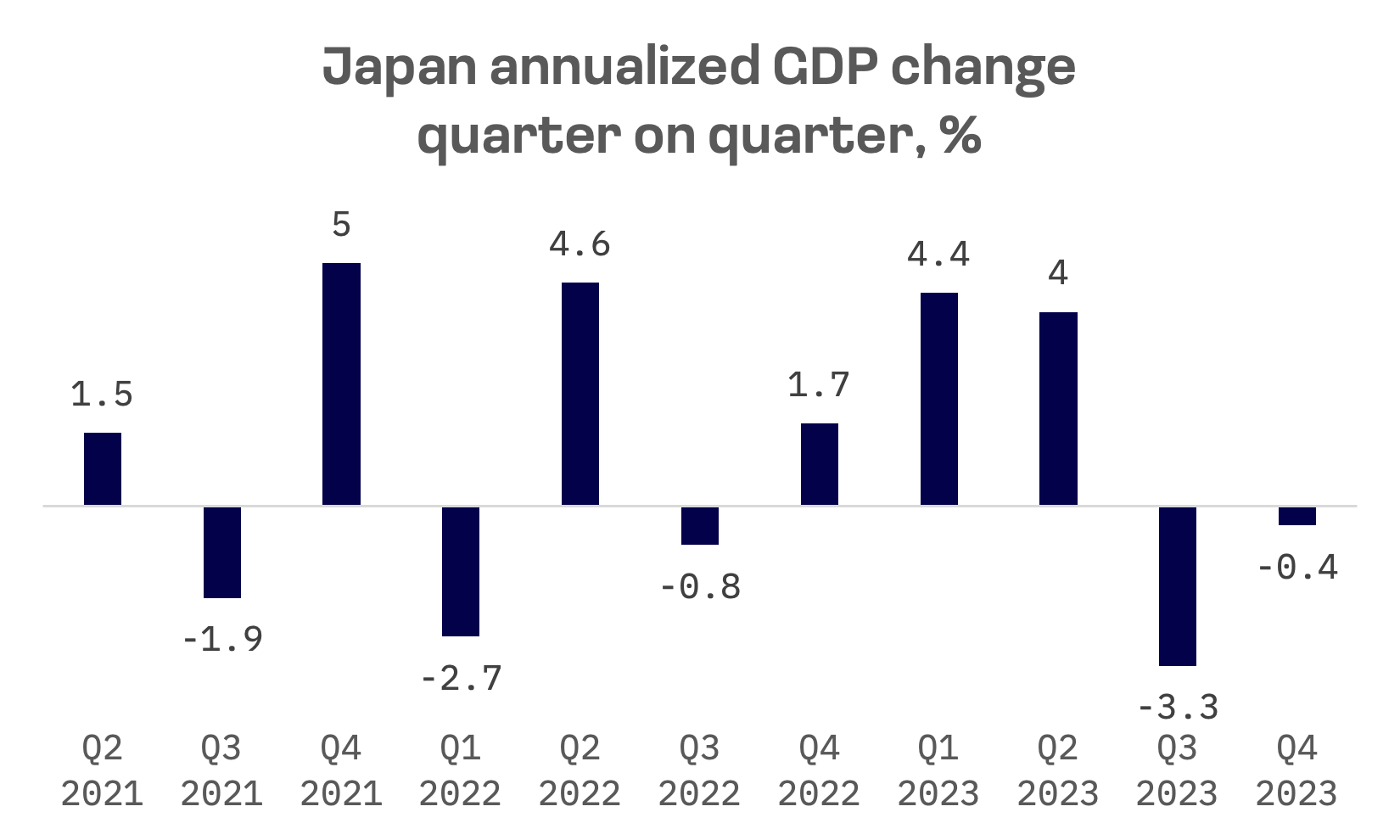

The Nikkei 225 Index in Japan surged by 4.3% this week, hovering around its highest level in 34 years, bolstered by a weaker yen and strong corporate earnings. Nevertheless, Japan’s economy saw a contraction of 0.4% last quarter, adding to the uncertainties around the Bank of Japan’s (BoJ) monetary policy direction, especially given the central bank’s emphasis on achieving its 2% inflation target.

The yen’s decline to the low-JPY 150 range against the dollar continued, prompting verbal interventions from Japan’s finance minister. No immediate market intervention was indicated by the minister, as was the case in September 2022, when the Ministry of Finance took action to support the yen. Despite currency stability concerns, the weaker yen has notably benefitted Japanese exporters by enhancing the value of their overseas earnings.

Japan’s slip into a technical recession, underscored by two consecutive quarters of negative growth, was driven by weak domestic demand despite a boost from returning tourists. This downturn has relegated Japan to the world’s fourth-largest economy, behind Germany, highlighting structural challenges and prompting capital outflows as investors seek opportunities abroad.

South Korea

The KOSPI index in South Korea continued its upward trajectory, gaining 1.1% and marking the fourth consecutive week of gains. The market’s optimism was fueled by the anticipation of potential U.S. Federal Reserve easing measures and optimistic corporate earnings, with Kakao Corp.‘s share price rising after reporting strong revenue growth for 2023, despite its first annual net loss in four years.

In January, South Korea witnessed a significant 25.1% increase in its exports of information and communication technology (ICT) products compared to the same month the previous year, primarily propelled by a resurgence in global demand for semiconductors. The Ministry of Science and ICT reported that outbound shipments of ICT products amounted to $16.4 billion, a substantial rise from $13.1 billion a year earlier. This achievement represents the third consecutive month of year-on-year growth and marks the sector’s first double-digit expansion since May 2022.

Further bolstering the positive outlook for South Korea’s stock market, the Bank of Korea (BOK) revealed that foreign investors continued their buying streak in January, marking the third consecutive month of net purchases of Korean stocks. Driven by anticipations of a recovery in the semiconductor industry, offshore investors acquired a net total of $2.51 billion worth of local stocks last month. This followed closely on the heels of $2.52 billion in purchases in December and $2.64 billion in November 2023.

Taiwan

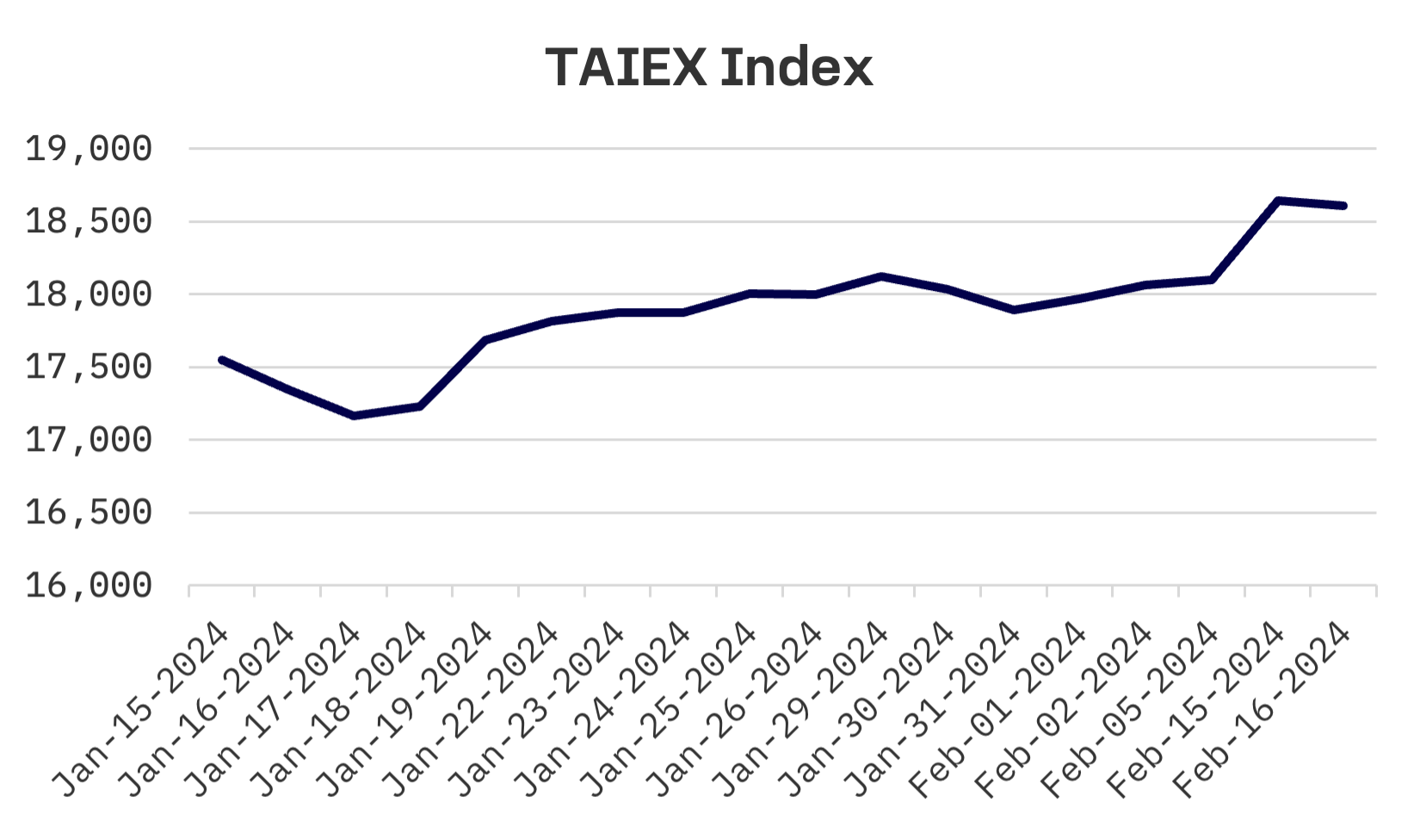

After the Lunar New Year break, Taiwan’s stock market had a shortened trading week, with the TAIEX index rising by 2.8%. The market saw a remarkable 3% surge on the first trading day, led by strong buying in the electronics sector, particularly TSMC, which saw its ADRs jump by more than 11% during the holiday closure. This rally was fueled by excitement over artificial intelligence advancements, though the market slightly retracted by 0.2% the following day.

JAKOTA Blue Chip 150 Index

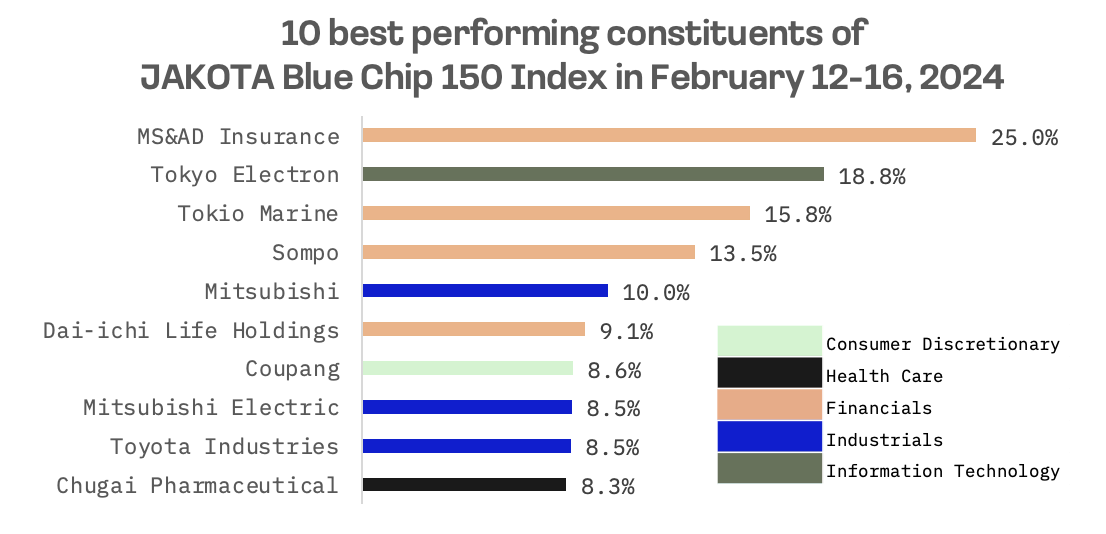

The JAKOTA Blue Chip 150 Index climbed 2.3%, with the majority of its constituents boasting gains.

This week, shares of Japanese insurers saw a remarkable upward turn following a directive from the Financial Services Agency (FSA) that called for an accelerated unwinding of their cross-shareholdings. As a consequence, Dai-ichi Life Holdings, Sompo, Tokio Marine and MS&AD Insurance stood out as top performers within the constituents of the JAKOTA Blue Chip 150 Index.

MS&AD Insurance Group, in particular, distinguished itself as the index’s top performer with an impressive 25% gain. This growth was fueled by a significant increase in profit attributable to the parent company’s owners, which soared by 102.6% to ¥281.6 billion for the fiscal nine months ending in December. This robust performance played a pivotal role in propelling the overall positive momentum in the Japanese insurance sector throughout the week.

On the other end of the spectrum, Renesas Electronics was identified as the JAKOTA Blue Chip 150 Index’s least successful stock this week. This downturn was a direct consequence of the company’s announcement to acquire the Australia-listed electronics design firm Altium for AU$9.1 billion ($5.9 billion) in an all-cash deal.

Renesas proposed to buy Altium at AU$68.50 per share, a substantial 34% premium over Altium’s closing price the Wednesday before the announcement. This acquisition, intended to be financed through a mix of bank loans and existing cash reserves, marks the largest acquisition of an Australian-listed company by a Japanese buyer to date. Altium’s expertise in circuit board design tools is expected to significantly enhance and streamline Renesas’s electronics design process for its customers.