Japan’s electric power industry, a cornerstone of the nation’s economy, is undergoing significant transformation. Driven by a mix of traditional and renewable energy sources, the sector is segmented into three primary areas: generation, transmission and distribution, and retailing. As of mid-2022, these segments boasted 1,038 (April 15), 35 (February 4) and 738 (July 1) operators, respectively.

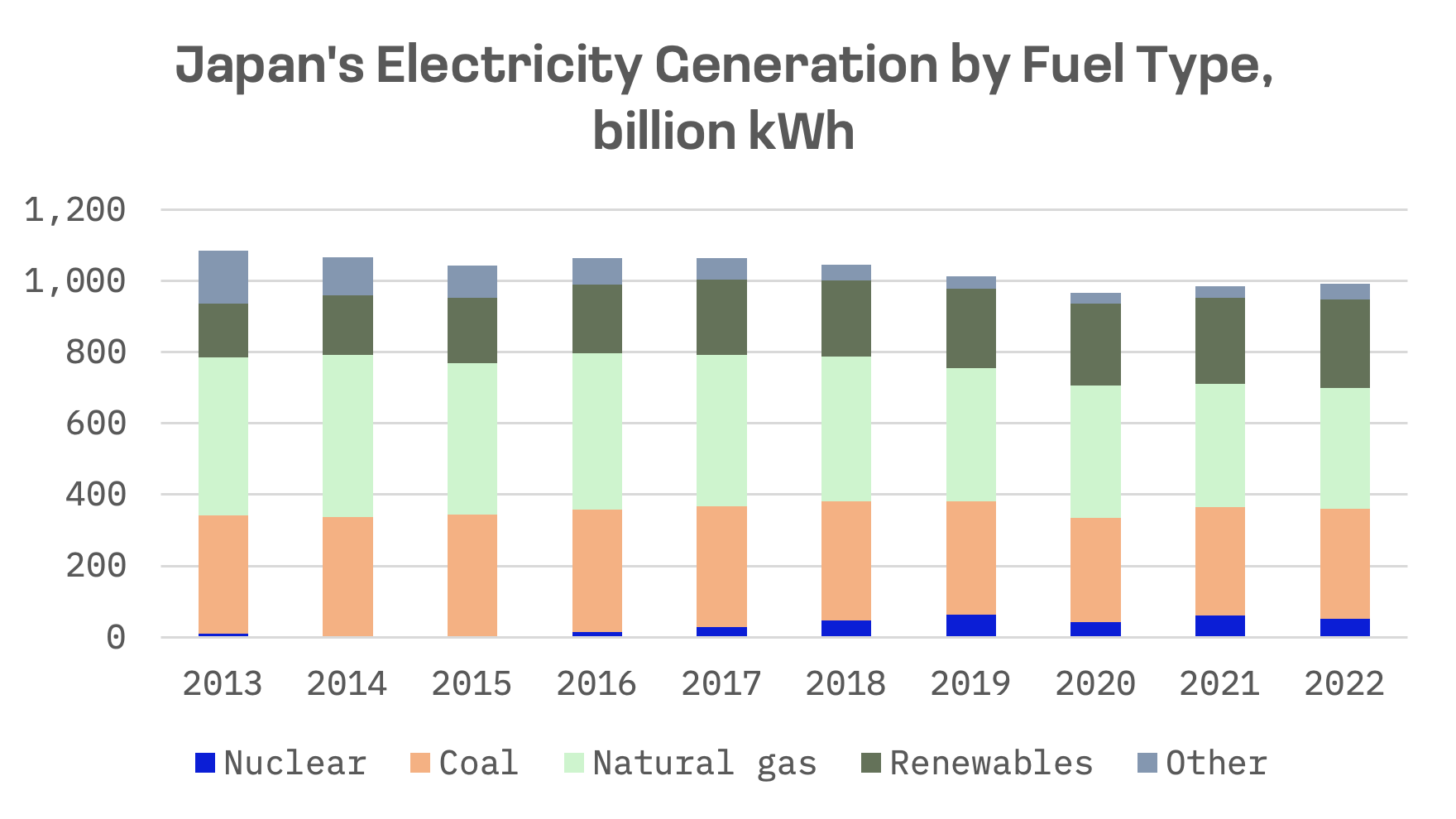

Over the past several years, electricity generation has remained below 1,000 billion kWh. Demand dropped in 2020 due to the COVID-19 pandemic but began to rise again in December 2020, though it has yet to reach pre-pandemic levels.

Fossil fuels, primarily natural gas and coal, dominate Japan’s electricity market. However, renewable energy’s share increased from 21% to 26% between 2018 and 2022. Nuclear power, which contributed about 30% pre-2011, has maintained a steady share of approximately 5% of total output since 2018. Prior to the 2011 Fukushima Daiichi accident, government plans aimed to increase nuclear’s share to over 40% by 2017. Following the disaster, the Japanese government suspended all nuclear reactor operations for mandatory inspections and safety upgrades. Since then, Japan has restarted 12 reactors and expects to restart two more units in 2024.

The 2016 full liberalization of Japan’s power market, a significant move influenced by the Fukushima Daiichi nuclear disaster, aimed to harness competition as a catalyst for change. This reform sought to manage consumer prices and diversify the generation mix, addressing vulnerabilities in Japan’s energy infrastructure highlighted by the catastrophic event.

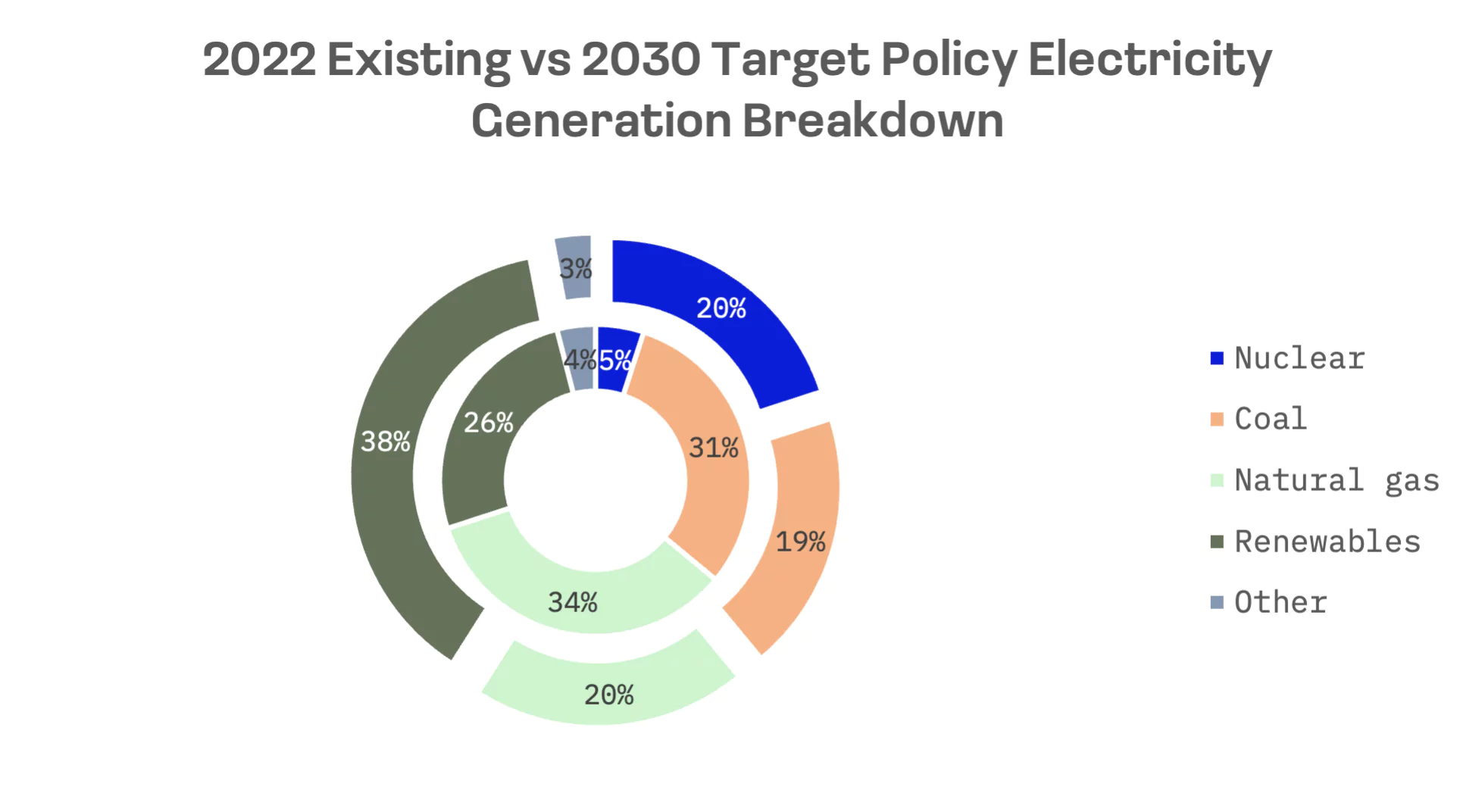

Recent energy policies, including Japan’s 6th Strategic Energy Plan (2021) and the GX Decarbonization Power Supply Bill (2023), target carbon neutrality, or net-zero greenhouse gas emissions, by 2050. These policies aim to reduce emissions across the electric power, industrial and transportation sectors, with ambitious 2030 goals emphasizing renewable energy and nuclear power.

The government aims to increase non-fossil fuel generation to 59% of the electricity mix by 2030, up from 31% in 2022.

This shift is supported by initiatives including:

- Establishing renewable energy promotion zones (zones that meet specific criteria for developing renewable energy projects and that provide investment and licensing benefits)

- Increasing investments in research and development focused on technology advancements, particularly in solar and wind

- Accelerating development of offshore wind projects

- Stimulating growth in the renewable capacity buildout through other initiatives

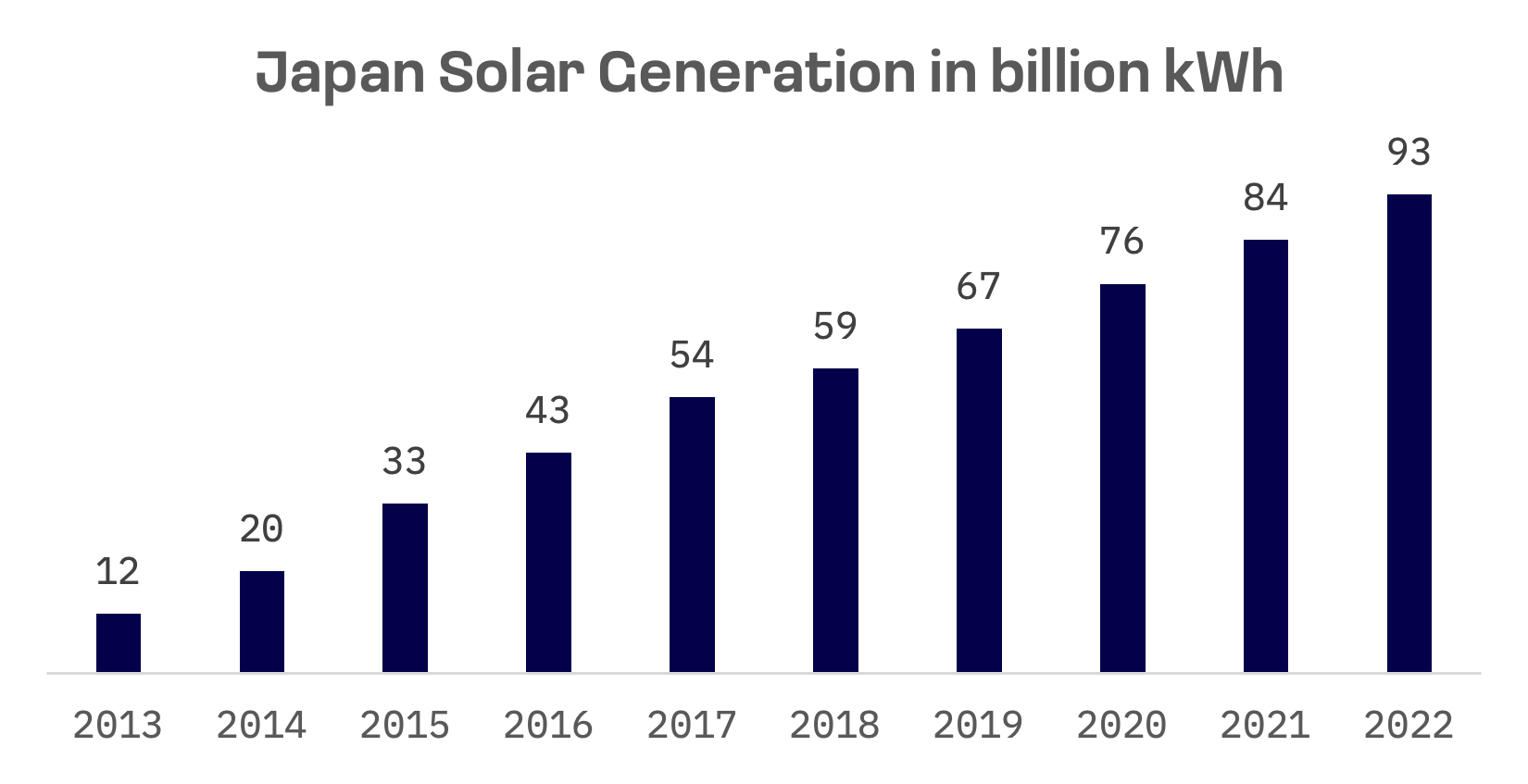

Solar power installations are outpacing wind, driven by faster environmental impact assessments and fewer grid capacity constraints. The government projects solar generation to account for 14-16% of the total electricity mix by 2030. A feed-in tariff (FIT) scheme introduced in 2012 boosted renewable capacity, particularly solar. In April 2022, the government introduced a feed-in premium scheme, adding premiums to the market prices of power sources like large-scale commercial solar and wind power.

However, fluctuating solar output poses grid operation challenges, particularly in balancing morning and evening demand. The decrease in net demand in the morning and increase in the evening have become more pronounced, creating grid operation issues in some regions. Resolving these challenges is critical for advancing further solar power deployment.

Another significant challenge for Japan’s electric power sector is the growing demand, projected to surge by 35% to 50% by 2050. This increase is driven by the expanding needs of semiconductor factories and data centers supporting AI.

A government forecast indicates that power production must rise from this decade’s estimate of 1 trillion kWh to nearly 1.35–1.5 trillion kWh by 2050 to meet this demand. This escalation is attributed to the expansion of data centers, chip factories and other energy-intensive infrastructure, bolstered by the shift towards remote or hybrid work, online learning and AI-powered e-commerce growth.

The Federation of Electric Power Companies of Japan comprises the following member firms:

- Hokkaido Electric Power

- Tohoku Electric Power

- Tokyo Electric Power

- Chubu Electric Power

- Hokuriku Electric Power

- The Kansai Electric Power

- The Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- The Okinawa Electric Power

Distribution Areas and Frequency of General Electricity T&D Utilities:

This report focuses on the five largest companies in the sector by market capitalization:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| The Kansai Electric Power | 9503.TSE | Blue Chip 150 | 15.4B |

| Chubu Electric Power | 9502.TSE | Mid and Small Cap 2000 | 9.0B |

| Tokyo Electric Power | 9501.TSE | Mid and Small Cap 2000 | 8.8B |

| Kyushu Electric Power | 9508.TSE | Mid and Small Cap 2000 | 5.0B |

| Tohoku Electric Power | 9506.TSE | Mid and Small Cap 2000 | 4.5B |

Four out of five companies, each with a market cap below $10 billion, are part of the JAKOTA Mid and Small Cap 2000 Index. The Kansai Electric Power, however, stands out as the only constituent of the JAKOTA Blue Chip 150 Index. Serving the Kansai region, including Osaka, Kansai Electric Power is noted for substantial investments in nuclear and renewable energy and is pivotal in balancing energy supply and demand in one of Japan’s most populous and industrialized regions.

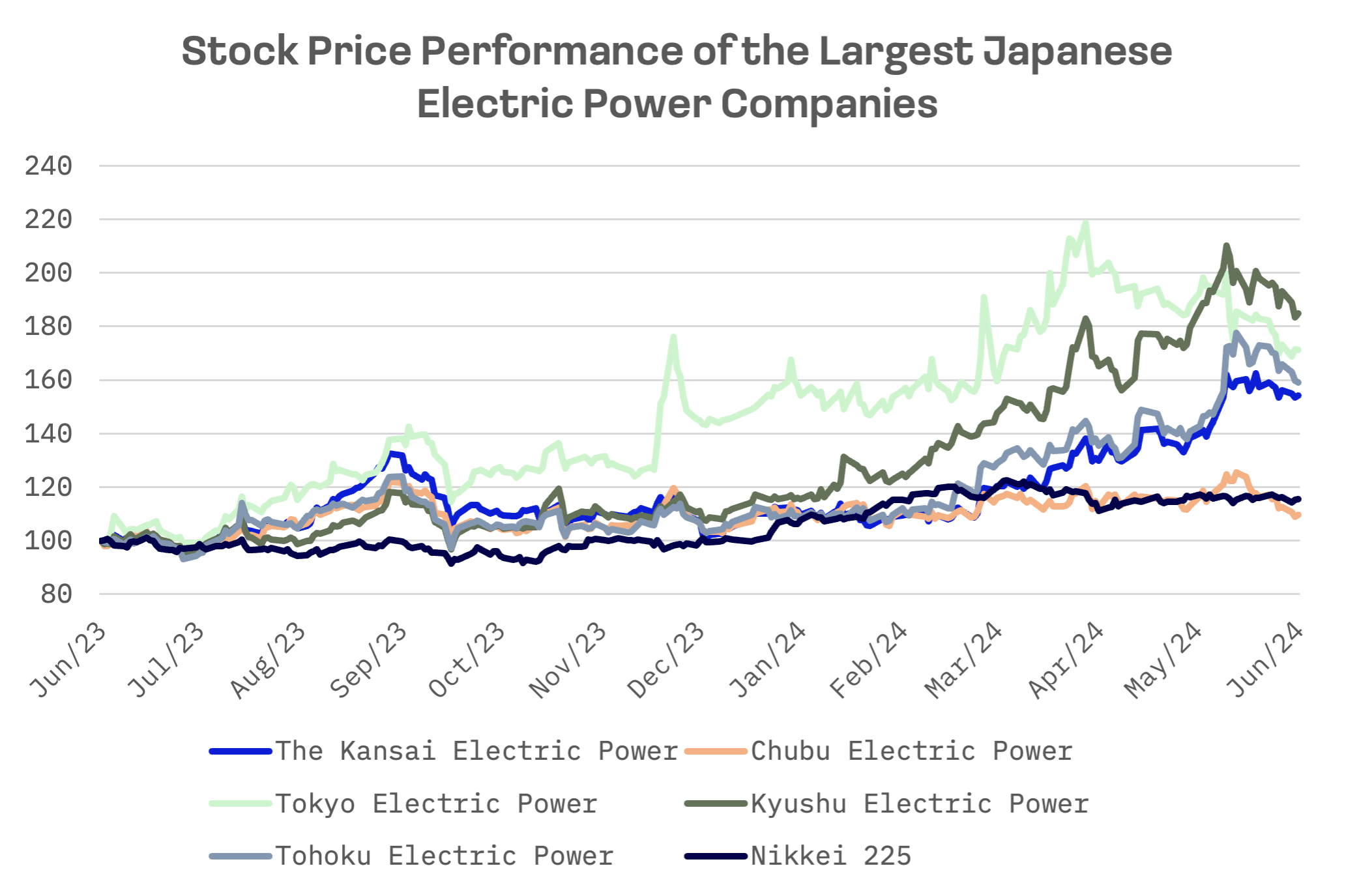

Over the past 12 months, shares of these five companies have shown positive price performance, with four substantially outperforming the Nikkei 225 index. This surge is attributed to expanding profit margins, courtesy of favorable gas and coal prices, coupled with a steady increase in electricity demand propelled by the rapid growth of AI, cryptocurrency mining and cloud computing. These technological advancements are driving data center electricity consumption to unprecedented levels. Notably, except for Chubu Electric Power, these companies have exhibited particularly robust performance since the start of 2024.

Based on multiples, Kyushu Electric Power is valued higher than the other companies in the peer group. This aligns with the strongest stock price performance Kyushu Electric Power has demonstrated recently.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| The Kansai Electric Power | 1.37 | 7.97 | 5.49 |

| Chubu Electric Power | 1.04 | 7.19 | 3.55 |

| Tokyo Electric Power | 0.86 | 6.07 | 5.14 |

| Kyushu Electric Power | 1.69 | 11.51 | 4.95 |

| Tohoku Electric Power | 1.10 | 9.87 | 3.19 |

| AVERAGE | 1.21 | 8.52 | 4.46 |

| MEDIAN | 1.10 | 7.97 | 4.95 |

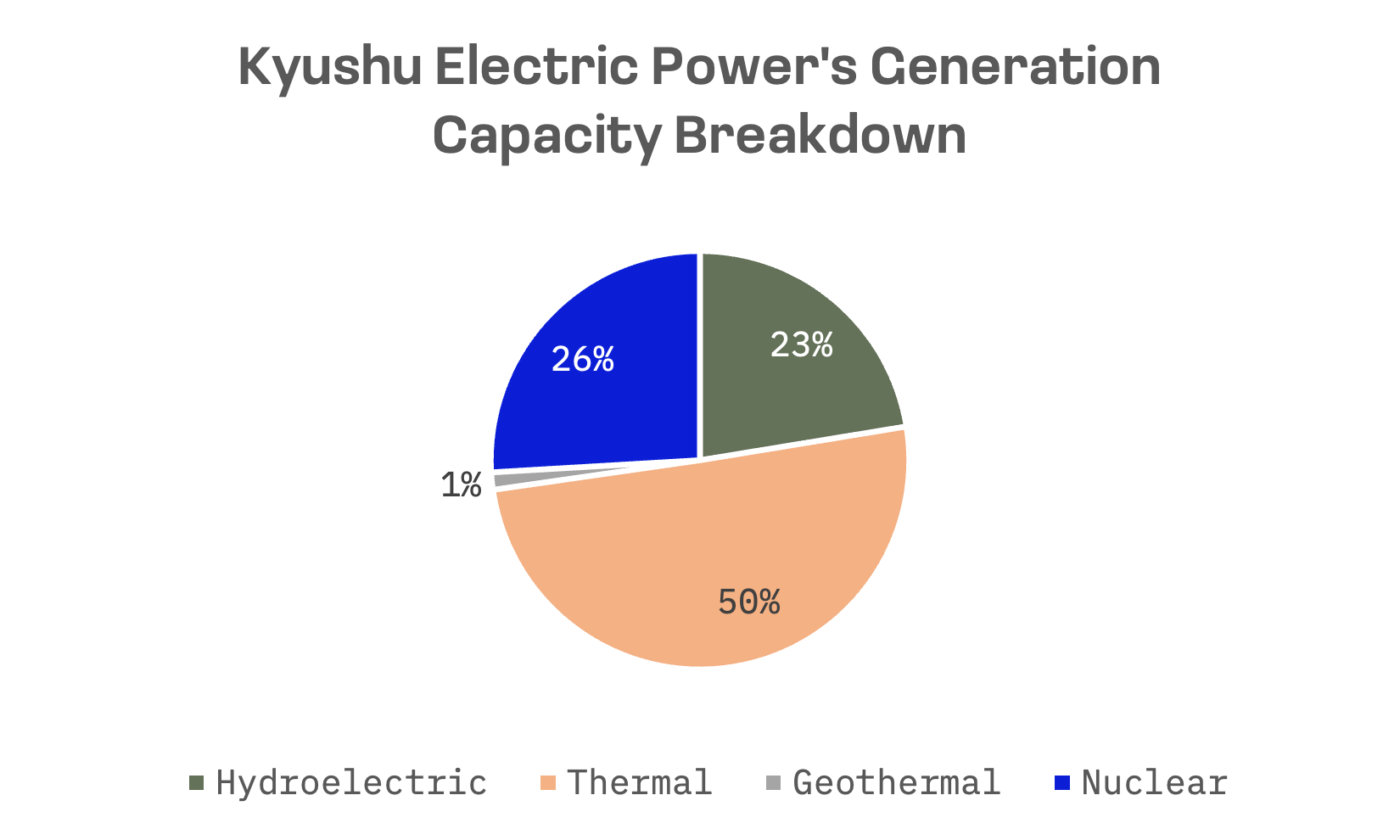

In the Kyushu Electric Power’s capacity, nuclear and hydroelectric generation account for 26% and 23%, respectively. Moreover, Kyushu Electric Power is a key player in Japan’s transition to a greener energy future. For instance, in 2024, the company announced plans to build a 5-MW geothermal power plant in Kirishima, Kagoshima Prefecture.

In 2024, several key developments have driven the share prices of Kyushu Electric Power upwards. The company successfully issued Japan’s first nuclear-focused environmental bond, raising ¥30 billion. This bond, aimed at financing nuclear-related projects, marked a significant milestone in Japan’s push towards carbon neutrality by 2050.

Additionally, Kyushu Electric is exploring strategic investments to secure energy supplies. The company is considering a substantial investment in the Lake Charles LNG project in the U.S., which would involve buying a stake and securing a 20-year contract to import liquefied natural gas.

The increase in demand, the first in 20 years, coupled with ambitious plans to increase the share of non-fossil fuel generation sources, requires large-scale investments in power sources. While challenging, these investments could enhance the resilience and reliability of Japan’s power infrastructure, potentially reducing dependency on imported fossil fuels and mitigating risks associated with energy price volatility.