While Japan is globally renowned for its sake, beer reigns as the country’s most produced alcoholic beverage, underscoring its importance in social gatherings. The nation’s beer industry, established in the 1870s with guidance from foreign brewers, has evolved into the world’s seventh largest beer market. Four major players — Asahi Breweries, Kirin Brewery, Sapporo Brewery and Suntory Beer — dominate the landscape.

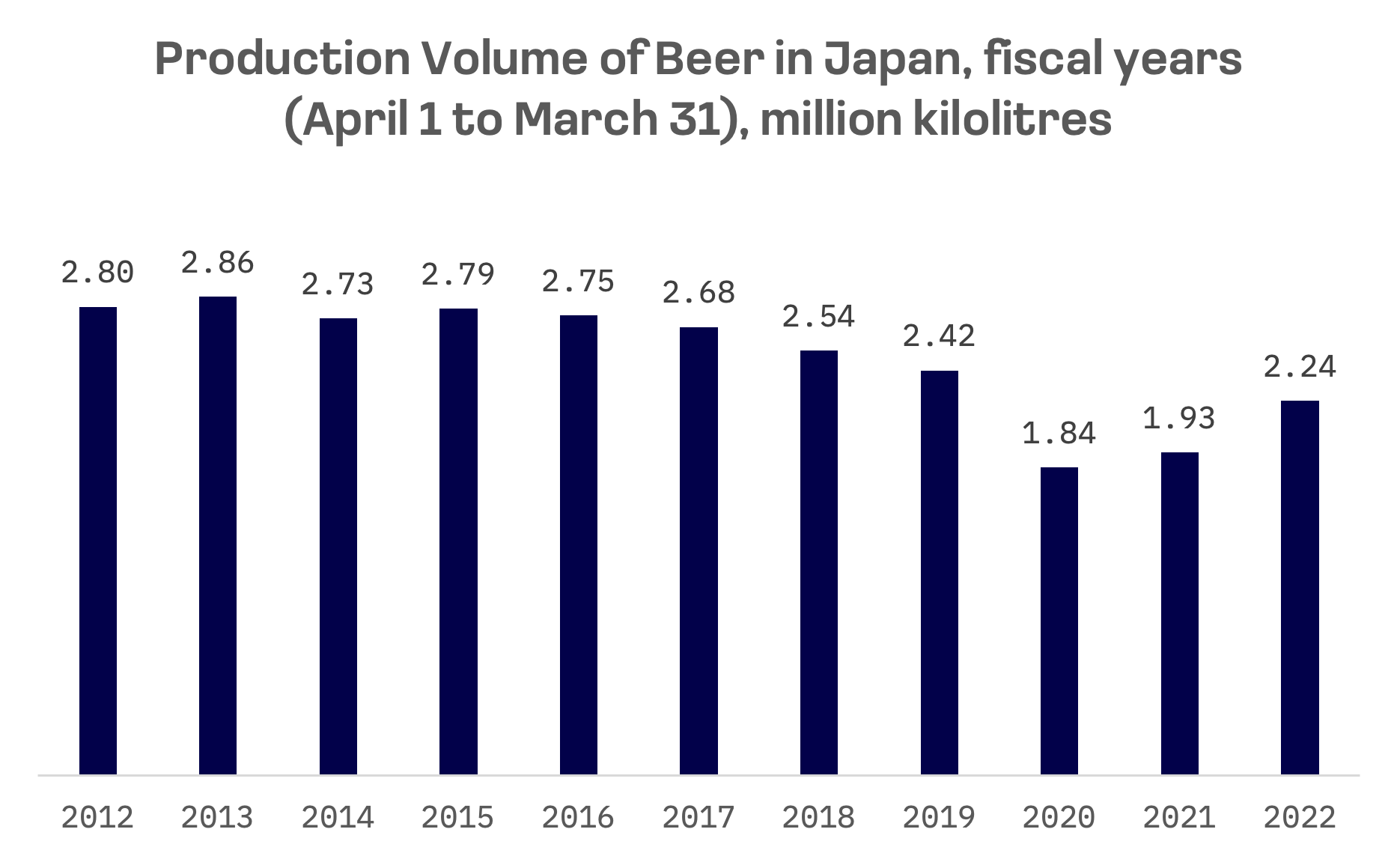

The industry has weathered challenges in recent years. Production volumes declined steadily from 2013 to 2019, followed by a sharp downturn in 2020 amid pandemic disruptions. Despite a recovery in 2021 and 2022, output remains below the peaks of the early 2010s. However, the big four breweries reported strong sales and profit growth in 2023, bolstered by price adjustments, international expansion and the weaker yen’s boost to exports.

All four brewers maintain diversified portfolios of beer and other beverages catering to various tastes worldwide.

| Company Name | Brands |

| Asahi Group | Asahi Super Dry, Clear Asahi, Asahi Beery, Mitsuya Cider, Wilkinson, Wonda, Grolsch, Ursus, Goodday, Victoria Bitter, Calpis, Mintia, Long white vodka, Dear-Natura, Peroni Nastro Azzurro, Pilsner Urquell, Pepsi, Dairy Champ, Balter, Schweppes, Cool ridge, Great Northern, Kozel, Cruiser vodka, EBIOS, Bireley’s, BLACK, Alpaca, Amano Foods |

| Kirin Holdings | Kirin Ichiban, Kirin Lager, Kirin Beer Harekaze, Heartland, Little Creatures, James Squire, White Rabbit, Lion, Spring Valley Brewery |

| Suntory | Suntory Tennensui, BOSS, Suntory Green Tea Iyemon, Suntory Green Tea Iyemon Tokucha (FOSHU), GREEN DAKARA, Pepsi Big, C.C.Lemon, Natchan, Orangina, Oasis, Lucozade, Ribena, Schweppes, MayTea, TEA+, MYTEA Oolong Tea, Sting, Okky, Goodmood, BRAND’S Essence of Chicken, V, Nature’s Twist |

| Sapporo | Black label, Yebisu, GOLD STAR, SAPPORO PREMIUM BEER, ANCHOR, Mugi to Ho |

Each of the “Big Four” breweries is publicly traded, with two companies featured in the JAKOTA Blue Chip 150 Index and the other two in the JAKOTA Mid and Small Cap 2000 Index:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Asahi Group | 2502.TSE | Blue Chip 150 | 16.2B |

| Kirin Holdings | 2503.TSE | Blue Chip 150 | 11.1B |

| Suntory | 2587.TSE | Mid and Small Cap 2000 Index | 10.1B |

| Sapporo | 2501.TSE | Mid and Small Cap 2000 Index | 4.5B |

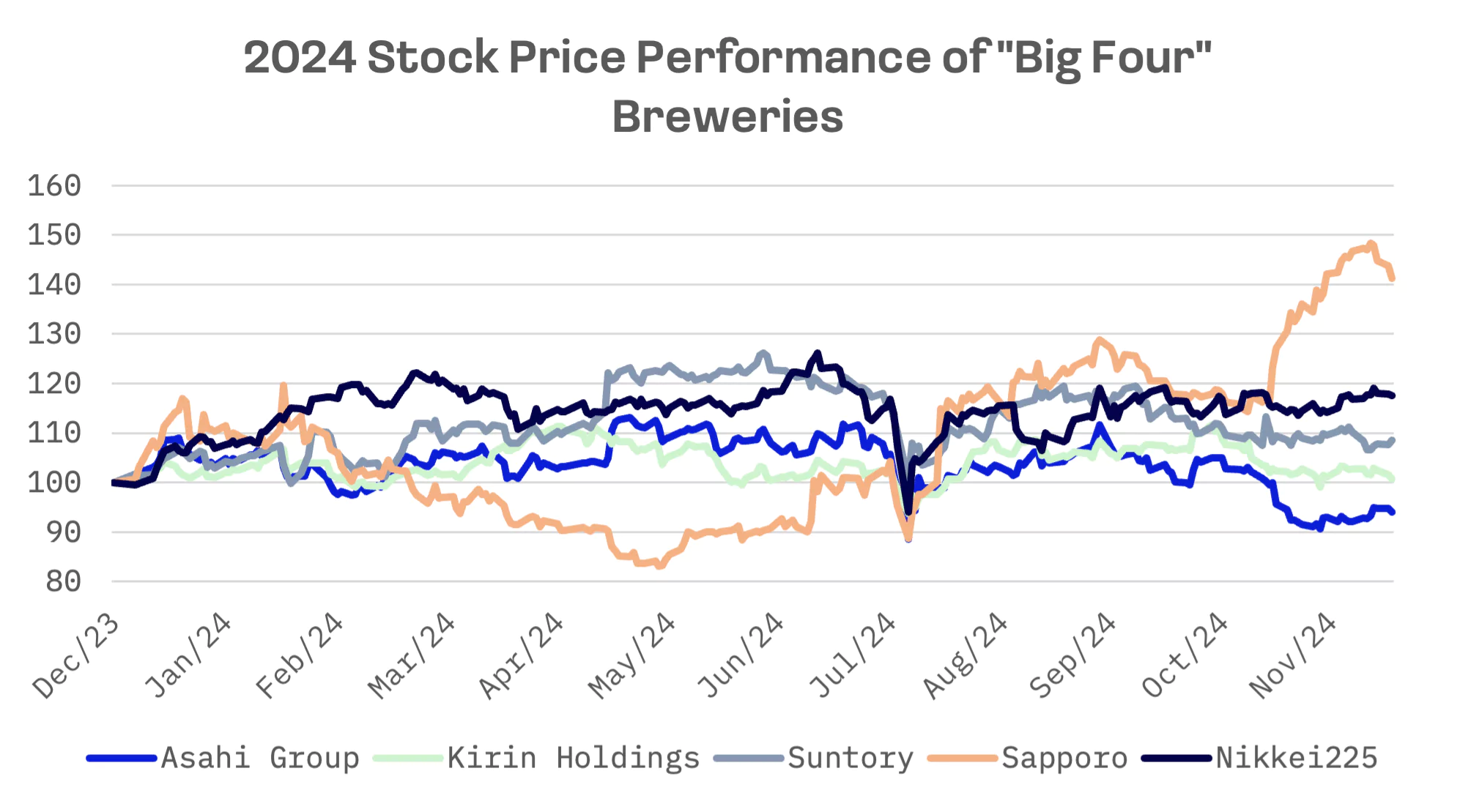

Since the beginning of 2024, Sapporo has been the sole outperformer against the Nikkei 225, while Suntory advanced about 10%. Kirin Holdings remained flat, with Asahi Group slipping into negative territory.

Despite its weak share performance, Asahi Group, the sector’s largest company, commands premium valuations in terms of EV/Sales and EV/EBITDA compared with Kirin Holdings and Suntory. Sapporo, following a recent share price surge, now carries the highest such multiples among peers.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Asahi Group | 1.30x | 8.98x | 14.76x |

| Kirin Holdings | 0.99x | 7.16x | 15.66x |

| Suntory | 0.87x | 5.98x | 15.91x |

| Sapporo | 1.74x | 19.70x | N/A |

| MEAN | 1.23x | 10.46x | 15.44x |

| MEDIAN | 1.15x | 8.07x | 15.66x |

Asahi Group

Asahi Group overhauled its governance in 2022, establishing a six member Executive Committee and regional headquarters with CEOs overseeing key markets in Japan, Europe, Oceania and Southeast Asia. The company entered 2024 pursuing global expansion to enhance corporate value and strengthen international brands through strategic partnerships.

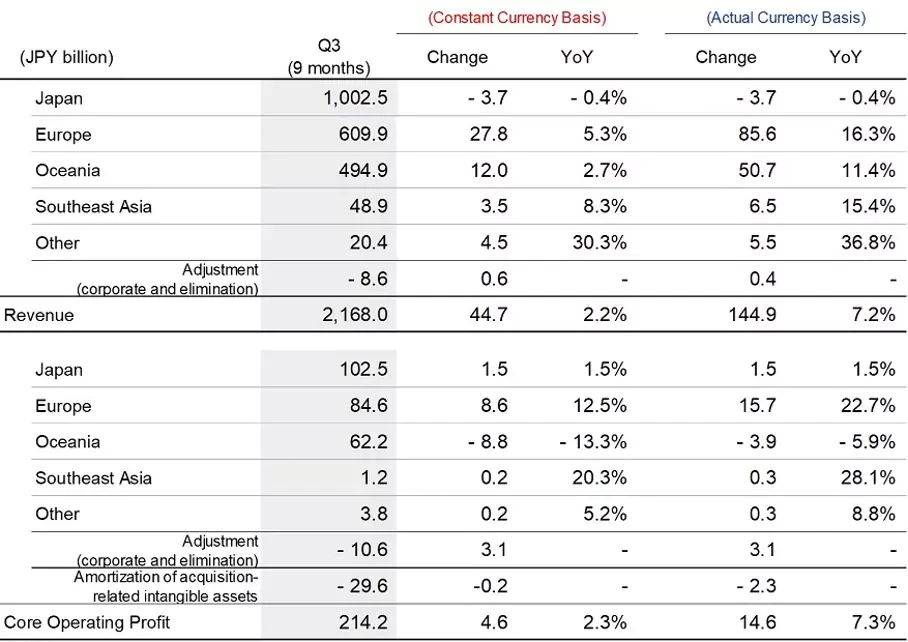

From January through September 2024, Asahi’s regional operations delivered robust revenue and core profit growth, driven by higher unit prices through disciplined pricing strategies and premiumisation.

Revenue and core profit performance in 2024:

In Japan, shifting consumer preferences towards beer, following liquor tax changes, lifted earnings. Ready to drink (RTD) alcohol and non alcoholic beer categories also contributed significantly. In Europe, premium segments, including non alcoholic beer, powered growth as the company focused on maintaining and strengthening market position.

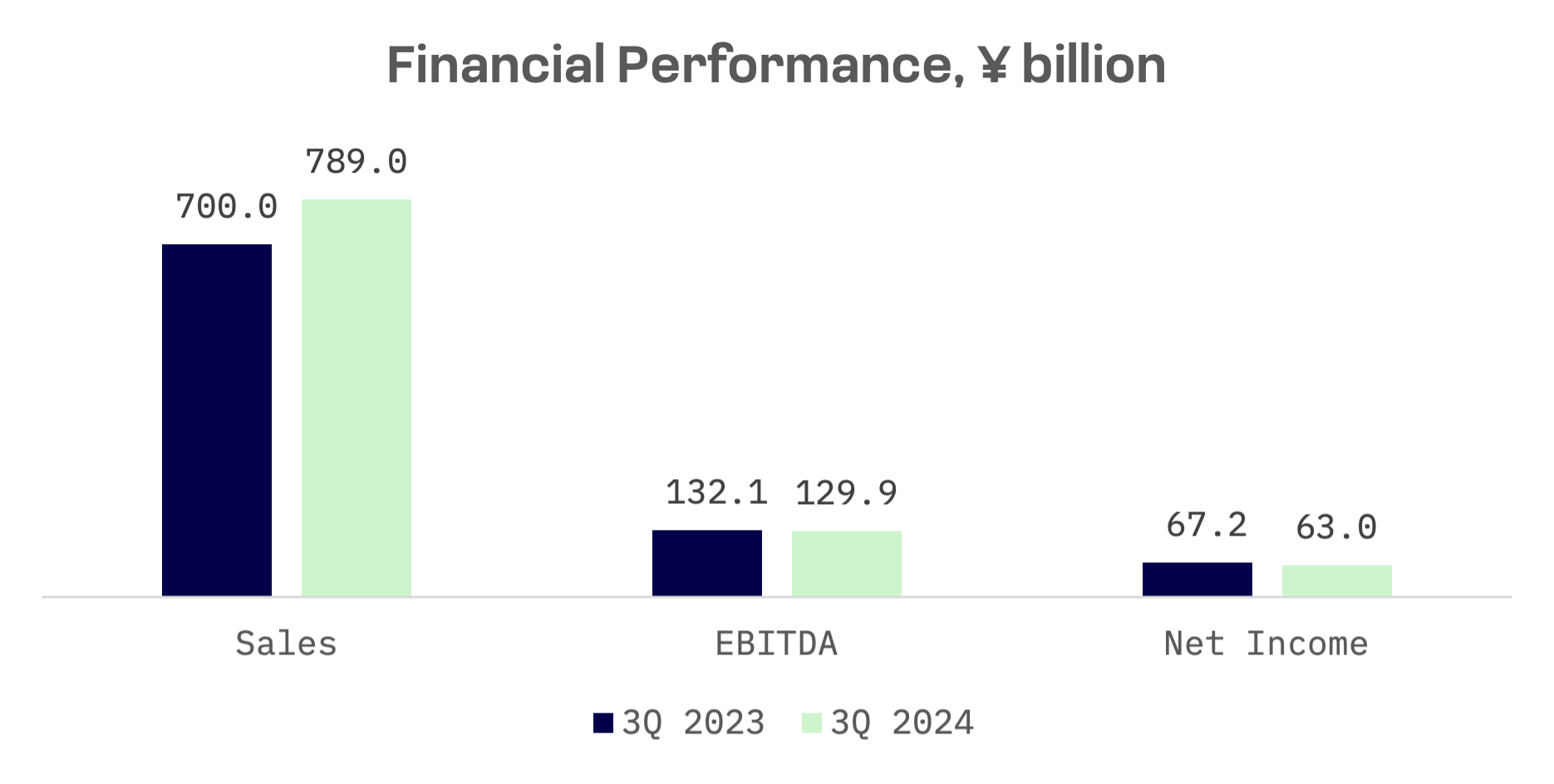

However, despite these achievements, Asahi Group’s EBITDA and net profit edged lower in the third quarter of 2024. The earnings decline stemmed primarily from Oceania, where lower beer volumes and higher variable costs pressured profits.

Sapporo Holdings

Sapporo Holdings faced pressure from activist investors to sell its property assets. Singapore based 3D Investment Partners has built a 16% stake, becoming the largest single shareholder, while criticising the company’s emphasis on real estate over core brewing operations.

In February, President Masaki Oga acknowledged concerns raised by 3D Investment Partners but declined to detail transformation plans or timelines. He conceded the need to refocus on beer operations to boost corporate value.

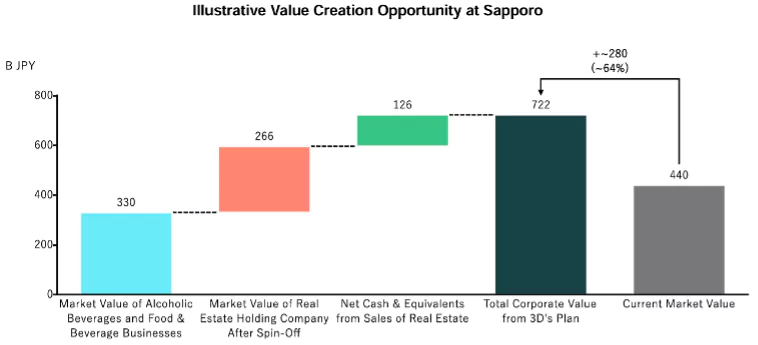

3D Investment Partners issued an open letter and presentation materials in July regarding real estate value maximisation. The fund estimated that divesting property assets could increase Sapporo’s market capitalisation by approximately ¥280 billion, a 64% gain from current levels.

As a result of these initiatives, Sapporo Holdings announced in September that it was exploring the sale of its real estate portfolio, including its flagship mixed use complex in Tokyo’s Shibuya ward, to raise funds for revitalising its struggling drinks business.

The company disclosed in a stock filing that it began soliciting and evaluating proposals from potential strategic partners for real estate capital injection.

Despite activist pressure, Sapporo Holdings reported strong financial results for the first nine months of 2024. Operating profit jumped 84.6% year-over-year to ¥17.67 billion, while revenue rose 2.1% to ¥386 billion compared with the same period in 2023.