Taiwan’s electronics industry is best known for its semiconductors, but its footprint extends well beyond chips. The sector spans passive and discrete components, networking and telecom equipment, consumer electronics and, most notably, optoelectronics.

Taiwan has secured a global niche in the optoelectronics industry, including high brightness LEDs, laser diodes, photodetectors and advanced display panels. Taiwanese companies also provide critical components for fibre optic networks and imaging systems.

Taiwan’s photonics industry, including its optoelectronics subsegment, experienced explosive growth in 2023, with industry output surging 44% to NT$2.05 trillion ($65 billion) from NT$1.42 trillion the previous year, according to the Photonics Industry and Technology Development Association. Demand from AI applications, high speed data transmission and other emerging technologies drove the expansion. Taiwan’s optoelectronics output alone is projected to reach NT$1.56 trillion ($48.3 billion) in 2024, representing 10% annual growth.

Display panels remain a cornerstone of Taiwan’s optoelectronics industry, with AU Optronics and Innolux standing out as major global suppliers. The sector is increasingly focused on advanced Mini LED and Micro LED technologies, which deliver brighter displays, sharper contrast and improved energy efficiency compared with traditional LCD panels.

Taiwan continues to hold a leading position in LED manufacturing, supplying chips for general lighting, automotive applications and consumer device backlighting. The segment is experiencing a significant shift towards higher value applications and next generation technologies. Everlight Electronics has established itself as a leading global LED manufacturer with an extensive product portfolio.

Optical lenses and image sensors represent another high growth segment, propelled by the proliferation of smartphones with sophisticated camera systems and the rising adoption of Advanced Driver Assistance Systems (ADAS) in vehicles. Largan Precision, a world renowned manufacturer of smartphone camera lenses, dominates this segment.

Several Taiwanese optoelectronics companies have carved out strong positions in industrial and specialty markets. Coretronic has built a reputation in Digital Light Processing (DLP) projectors, optical modules and medical imaging displays, while Lite-On Technology offers a broad portfolio of optoelectronic components, LEDs and automotive lighting solutions.

All of the above companies are publicly traded on the Taiwan Stock Exchange. Together with other players valued at more than $1 billion, they form the peer group of Taiwanese optoelectronics companies included in the JAKOTA Mid and Small Cap 2000 Index:

| Company Name | Ticker | Segment | Primary Business Focus | Market Cap, USD |

| AU Optronics (AUO) | 2409.TW | Display & Panel | TFT-LCD, OLED and Mini/Micro-LED panels | 3.2B |

| Innolux | 3481.TW | Display & Panel | LCD panels for TVs, monitors, notebooks and automotive displays | 3.7B |

| Radiant Opto-Electronics | 6176.TW | Display & Panel | Backlight modules (BLUs) for LCD panels | 2.2B |

| Everlight Electronics | 2393.TW | LED Lighting | LCD panels for TVs, monitors, notebooks and automotive displays | 1.0B |

| Largan Precision | 3008.TW | Optical Lenses & Image Sensors | Smartphone camera lenses | 10.5B |

| Genius Electronic Optical | 3406.TW | Optical Lenses & Image Sensors | Lenses for cameras, projectors and AR/VR applications | 1.7B |

| Asia Optical | 3019.TW | Optical Lenses & Image Sensors | Manufactures optical instruments, camera modules and laser rangefinders | 1.5B |

| Coretronic | 5371.TW | Industrial & Specialty Applications | DLP projectors, optical modules and medical imaging displays | 1.6B |

| Lite-On Technology | 2301.TW | Industrial & Specialty Applications | Optoelectronic components, LEDs and automotive lighting | 9.7B |

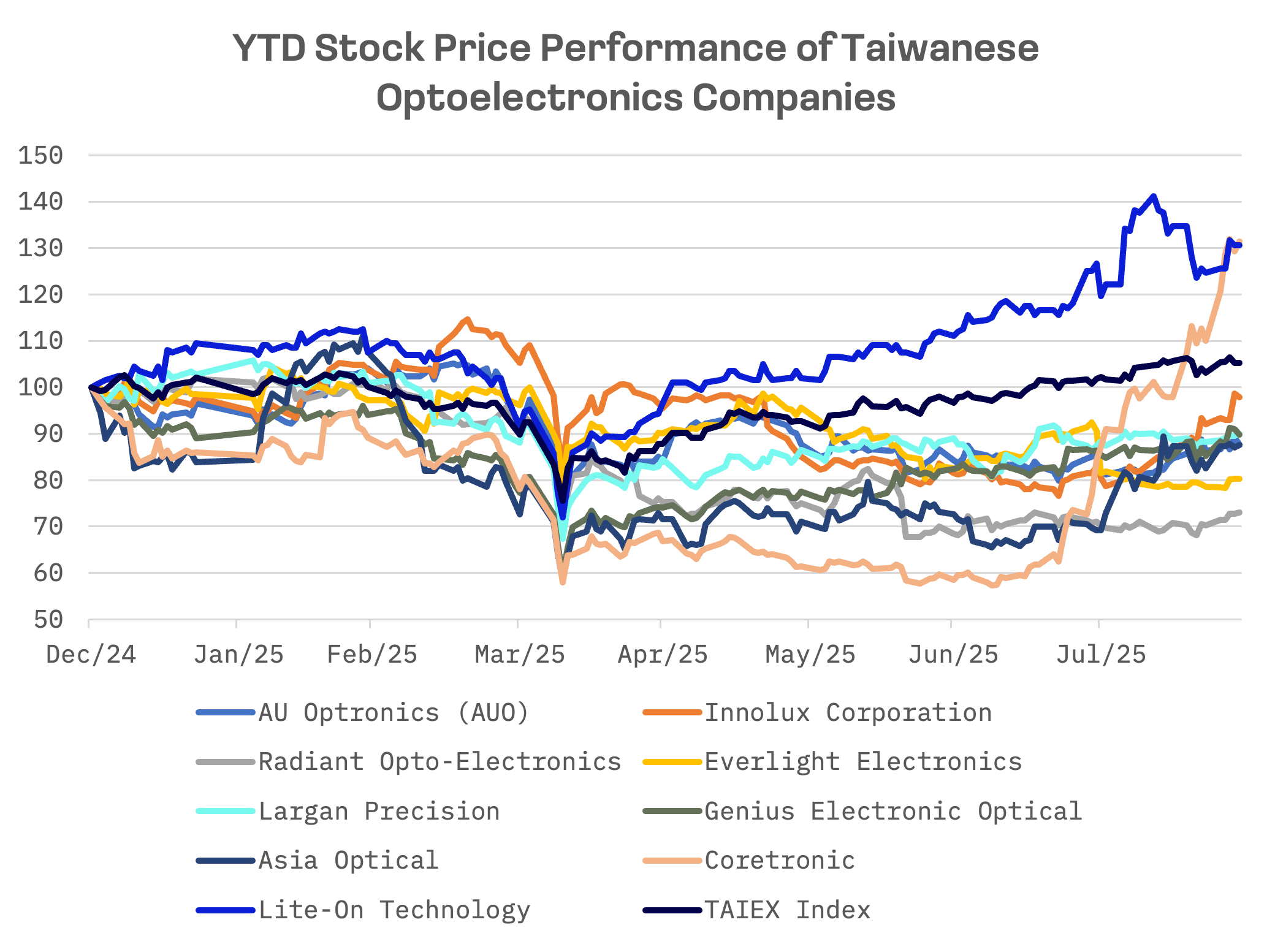

Year-to-date, only Coretronic and Lite-On Technology have outperformed the TAIEX index, delivering positive returns.

Coretronic and Lite-On Technology, which represent the Industrial & Specialty Applications segment, and Largan Precision – the peer group’s largest company by market capitalisation – trade at premiums on key valuation metrics including EV/Sales, EV/EBITDA and P/E:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| AU Optronics (AUO) | 0.56x | 3.67x | 16.47x |

| Innolux | 0.35x | 1.80x | 12.77x |

| Radiant Opto-Electronics | 0.75x | 4.39x | 12.40x |

| Everlight Electronics | 0.89x | 4.39x | 13.42x |

| Largan Precision | 5.55x | 9.30x | 14.25x |

| Genius Electronic Optical | 1.98x | 5.20x | 15.58x |

| Asia Optical | 1.35x | 8.72x | 22.21x |

| Coretronic | 1.27x | 19.37x | 101.65x |

| Lite-On Technology | 1.60x | 10.74x | 23.01x |

| MEDIAN | 1.27x | 5.20x | 15.58x |

| MEAN | 1.59x | 7.51x | 25.75x |

Largan Precision

Largan Precision dominates the global high end optical lens market, supplying smartphone camera lenses to top brands including Apple. While smartphones remain its core business, the company has expanded into camera modules, automotive lenses, Voice Coil Motors (VCM) and ventures such as sleep health monitoring and colour contact lenses.

Largan trades at a consistent premium, reflecting its market position and exceptionally high profitability. Its EBITDA margin reached 57.7% in the second quarter of 2025.

Largan Precision: Key Financial Indicators, $NT billion

| Fiscal Q2 2025 ending 06/30/25 | Y/Y change, % | |

| Revenue | 11.67 | 6.26% |

| EBITDA | 6.73 | 26.41% |

| Net income | 1.03 | -77.05% |

Lite-On Technology

Founded in 1975, Lite-On Technology is a diversified and established player in Taiwan’s electronics industry.

Lite-On Technology: Key Financial Indicators, $NT billion

| Fiscal Q2 2025 ending 06/30/25 | Y/Y change, % | |

| Revenue | 40.42 | 21.44% |

| EBITDA | 4.45 | 7.79% |

| Net income | 3.16 | 1.29% |

The company is focusing on growth and profitability across its core businesses, including optoelectronics, cloud computing, Artificial Intelligence of Things (AIoT), automotive electronics and smart life solutions. A major strength lies in power supply solutions for AI servers and data centres, where demand for next generation products is robust.

Coretronic

Coretronic operates as a diversified technology company, concentrating on backlight and panel modules as well as projectors and optical systems. The company is also expanding into augmented reality (AR) and mixed reality (MR) applications, embedded systems and intelligent robotics.

Coretronic: Key Financial Indicators, $NT billion

| Fiscal Q2 2025 ending 06/30/25 | Y/Y change, % | |

| Revenue | 9.86 | -1.11% |

| EBITDA | 0.53 | -29.03% |

| Net income | 0.06 | -79.62% |

Since mid July, Coretronic’s share price has more than doubled following a report of a 16% rise in consolidated revenue for the second quarter of 2025 compared with the previous quarter. The improvement was supported by recovering key product shipments and revenue growth from subsidiaries. Gross margin improved slightly due to a favourable product mix, while operating and net income posted strong quarter-on-quarter gains, despite year-over-year declines.

Taiwan’s optoelectronics industry lacks a single growth template, with each company pursuing strategies aligned with its specific competitive advantages. However, the sector’s most significant long term risk remains persistent price competition from mainland China, particularly in next generation technologies such as MicroLED displays.

Companies without strong competitive advantages, defensible market niches or meaningful cost advantages may struggle to maintain profitability as Chinese competitors continue to invest heavily in manufacturing capacity and technological capabilities.