The election of Lee Jae-myung as South Korea’s president marks a turning point for the country’s economy and financial markets. Following a snap election on June 3, the Democratic Party of Korea leader assumed office the next day, bypassing the customary transition period and moving swiftly to implement his policy agenda. His administration has prioritised capital market reform, targeting the long standing “Korea Discount” – a term describing the chronic undervaluation of South Korean stocks relative to their global peers.

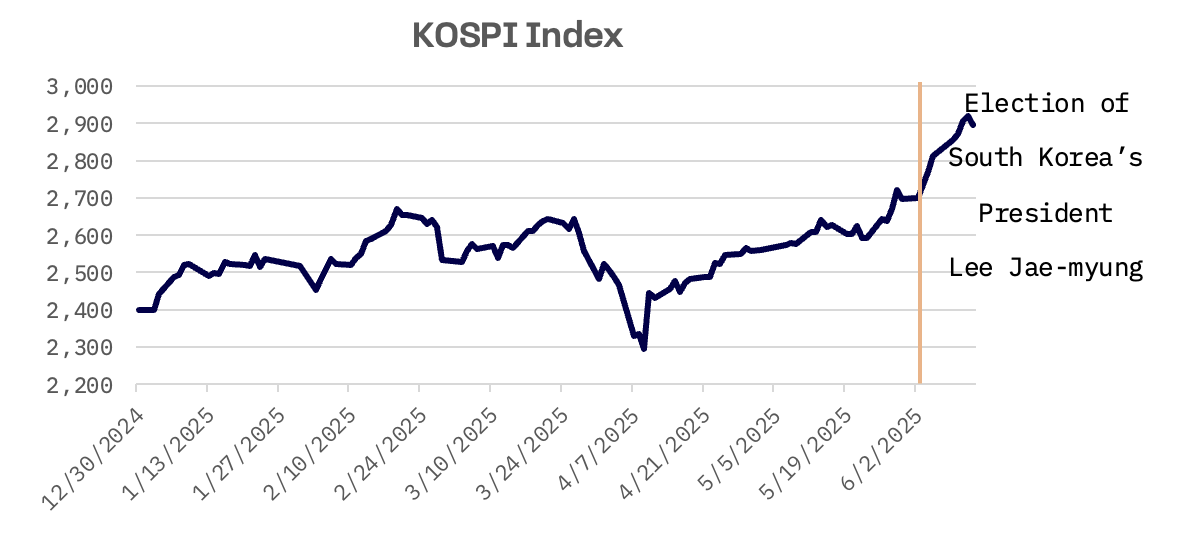

Markets have responded favourably to President Lee’s rapid policy implementation. The benchmark KOSPI index jumped to a three year high in the days after his inauguration, driven by investor optimism surrounding his ambitious “KOSPI 5,000” initiative.

President Lee’s key policy initiatives include strengthening corporate governance, enhancing minority shareholder protections, overhauling dividend taxation and enforcing stricter controls on market manipulation.

| Policy Area | Specific Initiative | Description | Stated Objective |

| Corporate Governance | Expanded Fiduciary Duty | Directors must balance corporate interests with proportional benefits for all shareholders, not just majority stakeholders. | Address the “Korea Discount,” enhance minority shareholder protection, attract foreign investment. |

| Corporate Governance | Mandatory Cancellation of Treasury Shares | Companies will be required to cancel excess treasury shares, redirecting capital to shareholders. | Improve shareholder returns, prevent value dilution for minority shareholders. |

| Corporate Governance | Electronic Shareholder Meetings & Shareholder Voting Rules Overhaul | Electronic meetings will be mandatory, with lower cumulative voting thresholds to enhance minority investor participation and board accountability. | Democratise corporate decision making, curb short term profiteering. |

| Dividend Tax Reform | New Tax Regime Favouring Dividend Increases | Various incentives and tax code reforms will be introduced to encourage listed companies to pay higher dividends. | Boost dividend payouts, make equities an attractive alternative to real estate, stimulate domestic consumption. |

| Dividend Tax Reform | Abolition of Financial Investment Income Tax (FIIT) | The planned capital gains tax on financial investments exceeding ₩50 million will be eliminated. | Boost the domestic capital market, encourage foreign portfolio investments. |

| Anti Manipulation Measures | “One-Strike-Out” Rule | Stricter penalties for stock manipulation will include repayment of multiples of illicit gains. | Deter unfair trading, restore investor trust, enhance market transparency. |

| Anti Manipulation Measures | Enhanced Market Surveillance & Enforcement | Detection systems for illicit trading will be improved, personnel for investigations expanded and substantial fines imposed. | Strengthen market integrity, reduce repeat offences, recover illicit gains. |

A significant strategic objective for President Lee’s administration is securing South Korea’s inclusion in the MSCI Developed Markets Index. Lee has explicitly pledged to achieve this status as a top policy priority, which depends on improvements in market accessibility, liquidity and regulatory transparency – areas in which Seoul has been advancing reforms. Initiatives such as the “Value-Up Program,” designed to strengthen corporate governance and boost shareholder returns, support this effort. Should South Korea achieve developed market status from MSCI, the country’s stock market is expected to attract net foreign capital inflows ranging from $5 billion to $36 billion.

South Korea’s KOSPI surged 7.7% in the first week of President Lee’s term. The post election rally reflects preliminary confidence in the administration’s reformist approach and its potential for rapid execution. However, transforming ambition into lasting change will require political resilience and careful implementation. Key initiatives such as the “one-strike-out” rule for market manipulation will test the government’s enforcement capabilities, particularly amid growing concerns over cross border trading abuses and evolving technological threats.