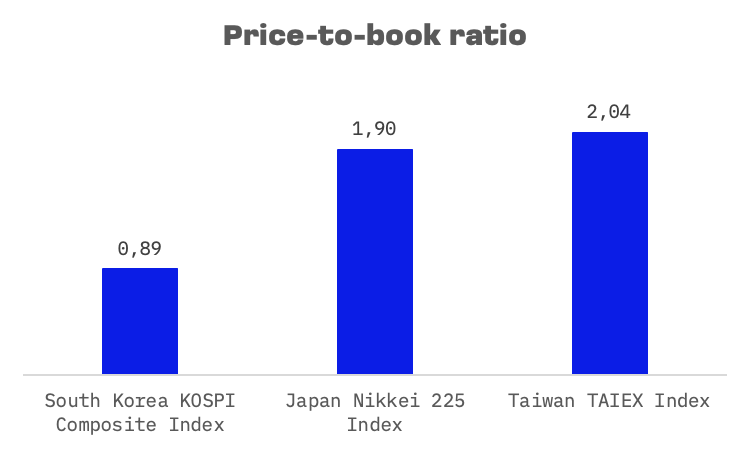

The “Korea Discount” describes the consistent undervaluation of South Korean stocks compared to their global counterparts. This phenomenon is often highlighted by the price-to-book ratio—a metric revealing how closely market valuation aligns with a company’s book value.

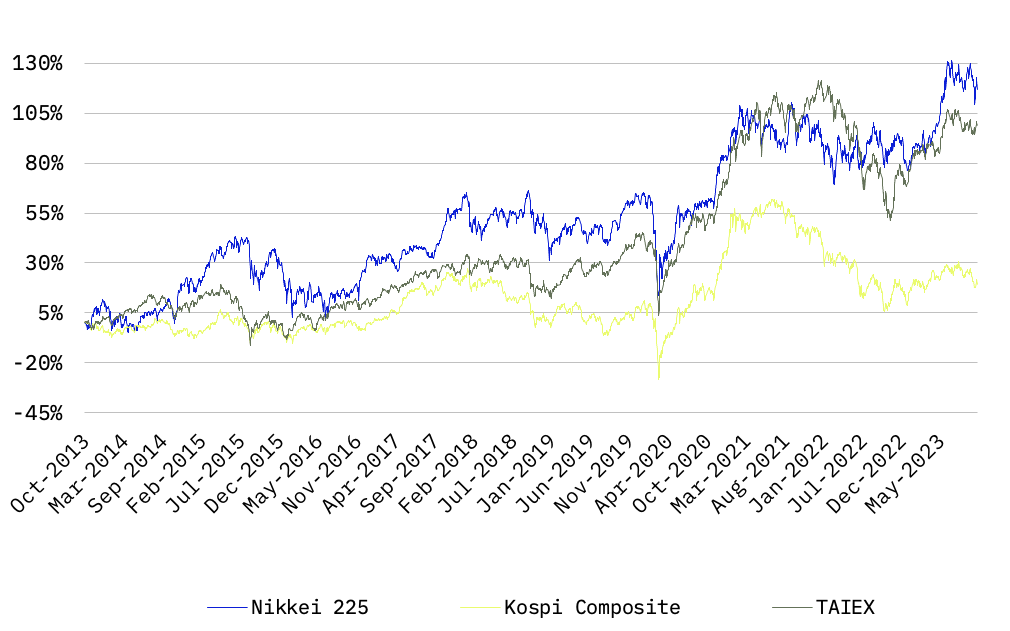

Over time, the KOSPI index has consistently lagged, especially when stacked against the other two JAKOTA markets.

The persistence of the “Korea Discount” can be traced back to multiple factors:

- Low dividend payouts: South Korea’s dividend payout ratio ranks at the bottom in Asia, excluding Japan. The Korea Capital Market Institute identifies this as a significant contributor to the discount.

- Geopolitical tensions: Historical issues, particularly involving North Korea, have deterred investors, leading to decreased valuations.

- Chaebol influence: South Korea’s family-run conglomerates, or chaebols, have raised concerns about transparency and governance, leading to investor hesitation.

- Barriers for foreign investors: Since 1992, registration requirements and sector-specific ownership caps have deterred foreign interest, curbing the influx of overseas investments.

In response to these concerns and the persistent discount, Rhee Yun-su, director general at the Financial Services Commission’s (FSC) capital market bureau, stressed the need for reforms, saying, “We have been looking into a few policies – especially those related to the inconveniences that foreign investors have been facing – that need to be reviewed as part of financial regulatory reforms under the new government.”

By January 2023, the FSC rolled out several transformative measures, including:

- Abolishing the foreign investor registration requirement.

- Facilitating the use of omnibus account for foreign investors.

- Enabling more convenient OTC transactions by foreign investors.

- Expanding English disclosures.

These changes, set to be implemented by December 14, will replace an investor registration system that’s been a mainstay since 1992.

Additionally, the FSC has focused on vertical spin-offs. In 2022, they introduced strategies to bolster shareholder rights linked to these listings. These measures included more rigorous disclosure requirements, appraisal rights for dissenting shareholders, and enhanced scrutiny of spin-off subsidiary listings.

This renewed approach, coupled with a rise in activist investor campaigns – which spiked from nine in 2020 to 56 in 2022, as reported by Insightia – might serve as a catalyst for South Korean equities.

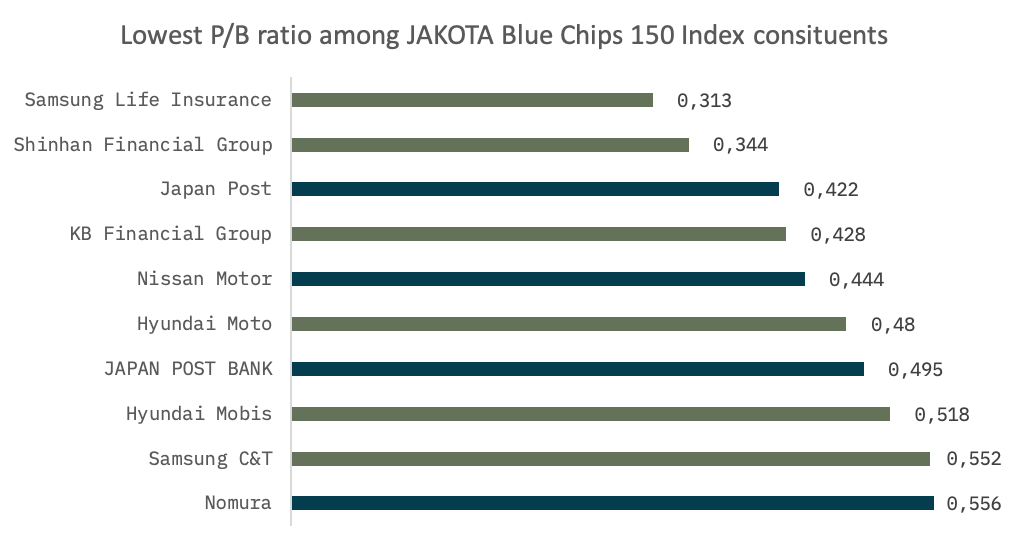

Interestingly, an analysis of the JAKOTA Blue Chip 150 Index reveals a telling trend: out of the ten companies with the most depressed price-to-book ratios, six are South Korean. Remarkably, Samsung Life Insurance and Shinhan Financial Group stand out with ratios under 0.4.