In the quarterly rebalancing of the JAKOTA Blue Chip 150 Index, 10 companies were added while an equivalent number departed, with the changes taking effect April 1, 2025:

| Entrants | Leavers | ||

| Hanwha Aerospace | Wiwynn | ||

| Hanwha Ocean | Nitori Holdings | ||

| The Kansai Electric Power Company (KEPCO) | Accton Technology | ||

| Tokyo Gas | Nexon | ||

| HMM | Korea Zinc | ||

| Hua Nan Financial Holdings | Japan Exchange Group | ||

| Hikari Tsushin | Samsung Life Insurance | ||

| T&D Holdings | Fujikura | ||

| Hana Financial Group | Taiwan Cooperative Financial | ||

| Kirin Holdings | First Financial Holding |

Three of the entrants are returning to the index after having left in the previous quarterly rebalancing:

- The Kansai Electric Power Company (KEPCO) (9503.TSE), an electric utility company operating in Japan’s Kansai region.

- Hana Financial Group (086790.KO), a South Korean financial group providing integrated services through subsidiaries including KEB Hana Bank, Hana Daetoo Securities, KEB Hana Card and Hana Life.

- Kirin Holdings (2503.TSE), a Japanese manufacturer of alcoholic and non alcoholic beverages and pharmaceutical products.

Seven companies joined the index for the first time:

- Hanwha Aerospace (012450.KO), a South Korean company specialising in aerospace and defence technologies.

- Hanwha Ocean (042660.KO), a South Korean shipbuilder, formerly Daewoo Shipbuilding & Marine Engineering, specialising in commercial and defence ships.

- Tokyo Gas (9531.TSE), a Japanese gas utility company.

- HMM (011200.KO), a South Korean container transportation and shipping company.

- Hua Nan Financial Holdings (2880.TW), a Taiwan based financial holding company engaged in investment business.

- Hikari Tsushin (9435.TSE), a Japanese company engaged in diverse businesses, including insurance, office automation equipment and corporate services.

- T&D Holdings (8795.TSE), a Japanese insurance company.

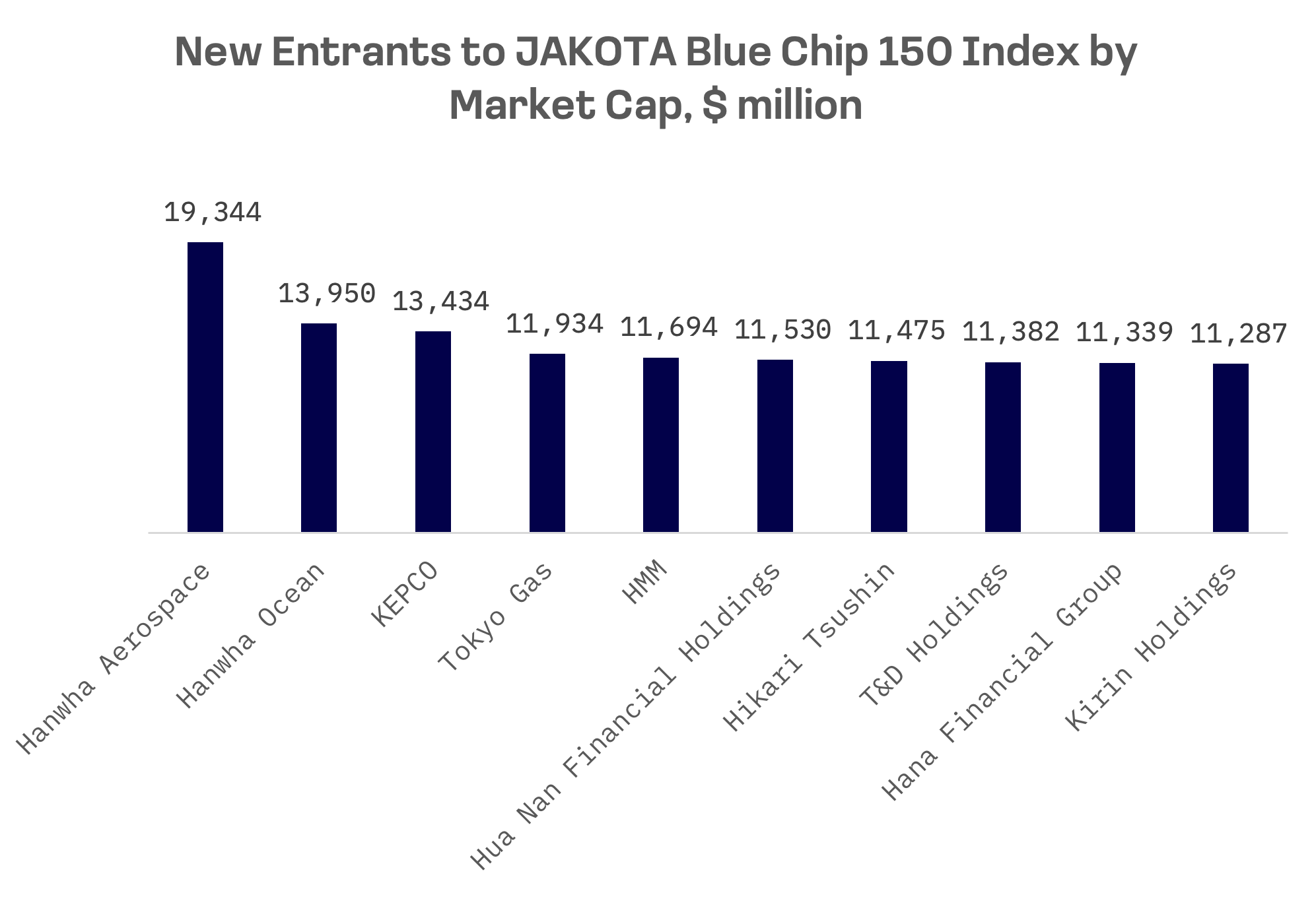

Japan and South Korea contributed five and four companies, respectively, to the index, while Taiwan added just one. Utilities and financial sectors gained appeal, while defenсe stocks also drew strong interest, as reflected in the market cap surge of Hanwha Aerospace and Hanwha Ocean.

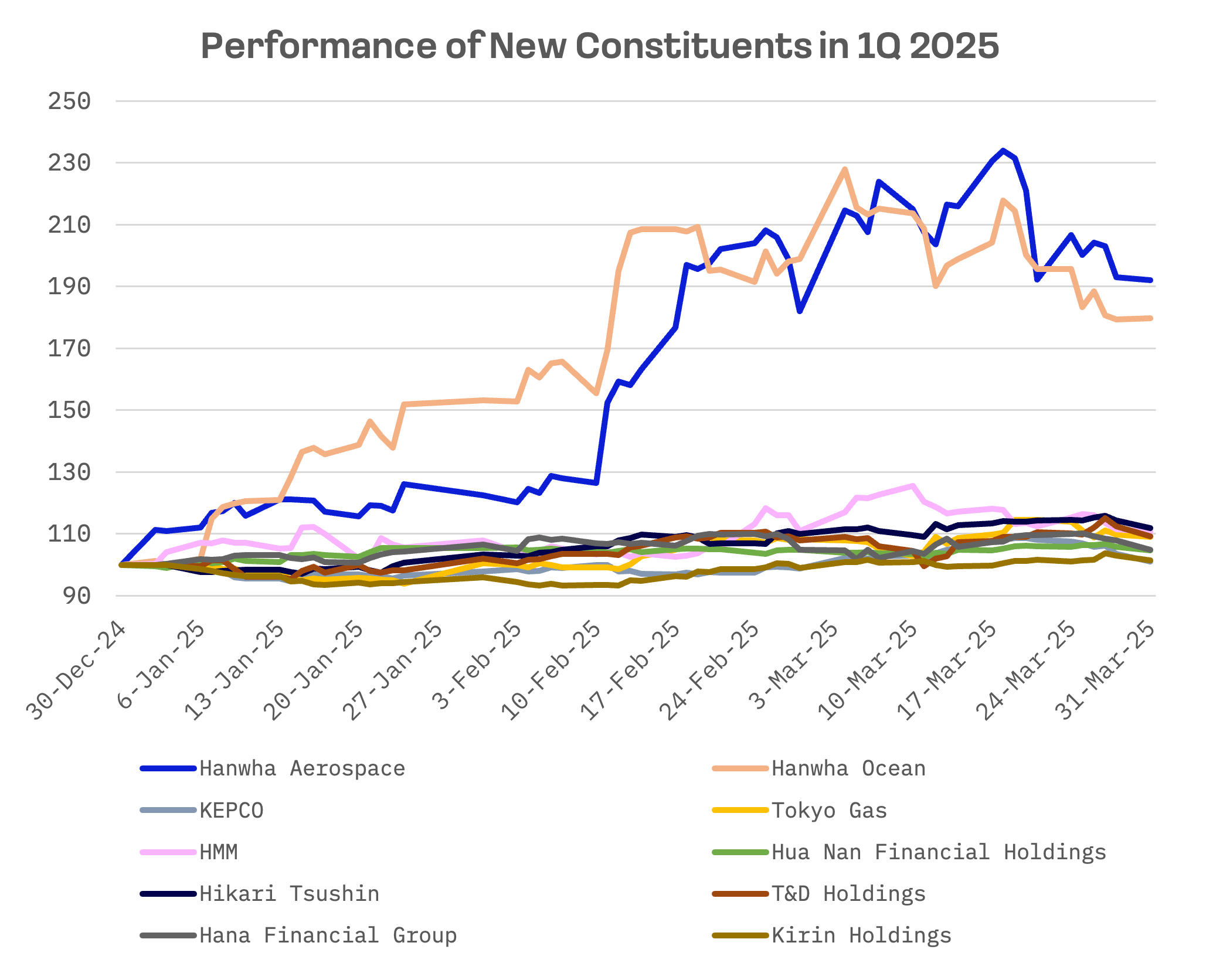

Korean Aerospace and Defence Sector Shares Double Over Last Three Months

South Korea’s aerospace and defenсe sector is riding a wave of bullish momentum, with Hanwha Aerospace and Hanwha Ocean emerging as standout performers among new entrants to the JAKOTA Blue Chip 150 Index. Shares of both companies have nearly doubled over the past three months, reflecting strong investor confidence.

The broader industry outlook remains robust, underpinned by escalating regional security concerns and rapid technological advancements. Globally, demand for defenсe products continues to rise, driven in part by heightened geopolitical tensions.

A key catalyst behind Hanwha Aerospace’s rally was its stronger than expected full year 2024 results, reported on February 10. The company posted a 43% year-on-year surge in revenue, while net profit soared 181%, far exceeding analyst expectations. Both revenue and earnings per share were above expectation, reinforcing optimism about the company’s growth trajectory.

Hanwha Aerospace: Key financial indicators, ₩

| 2024 | Y/Y change, % | |

| Revenue | 11.24T | 42.47% |

| Net income | 2.30T | 181.21% |

| Earnings per share | 46.72K | 161.18% |

| EBITDA | 1.93T | 106.84% |

Hanwha Ocean Co.’s stock rally was further fuelled by its success in securing and executing maintenance, repair and overhaul (MRO) contracts with the U.S. Navy. In March 2025, the company completed its first MRO project on the USNS Wally Schirra, marking a historic milestone as the first Korean firm to take on such a task. It also secured a contract for scheduled maintenance of the USNS Yukon, reinforcing its growing foothold in the sector. Hanwha Ocean has set an ambitious target of landing five to six U.S. Navy MRO contracts this year, signalling strong growth prospects.

Hanwha Ocean: Key financial indicators, ₩

| 2024 | Y/Y change, % | |

| Revenue | 10.78T | 45.46% |

| Net income | 528.12B | 230.31% |

| Earnings per share | 1.65K | 123.91% |

| EBITDA | 418.25B | 4363.86% |

Meanwhile, Hanwha Aerospace Co. deepened its investment in Hanwha Ocean, acquiring an additional ₩1.3 trillion (around $880 billion) worth of shares in March. The move raised its stake in the shipbuilder to 30.4%, further aligning the two companies’ strategic ambitions.