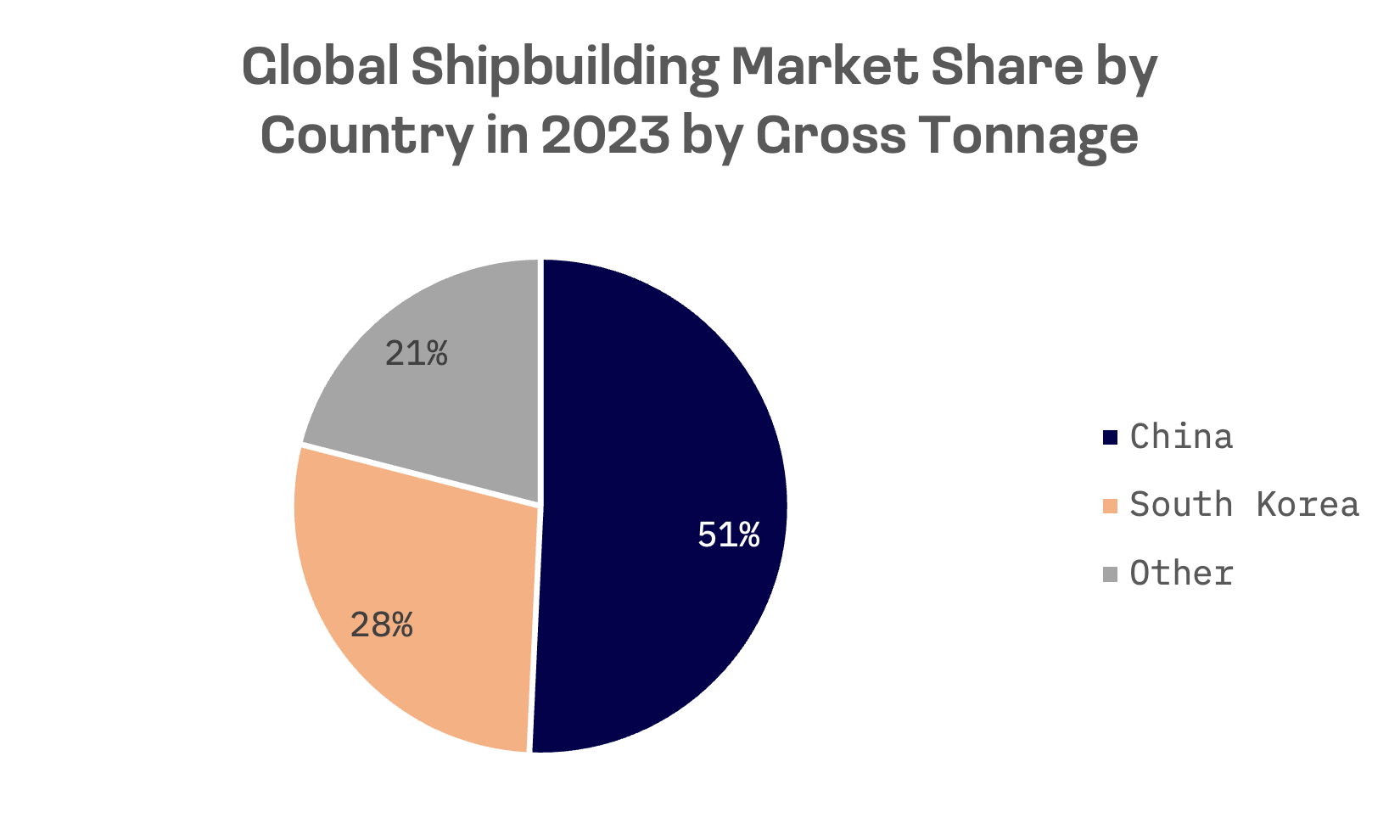

South Korea, the world’s second largest shipbuilding nation after China, is riding a wave of growth in the global shipbuilding market. Known for constructing large container ships, oil and LNG tankers, and specialised vessels, South Korean shipbuilders have carved out a pivotal role in the industry.

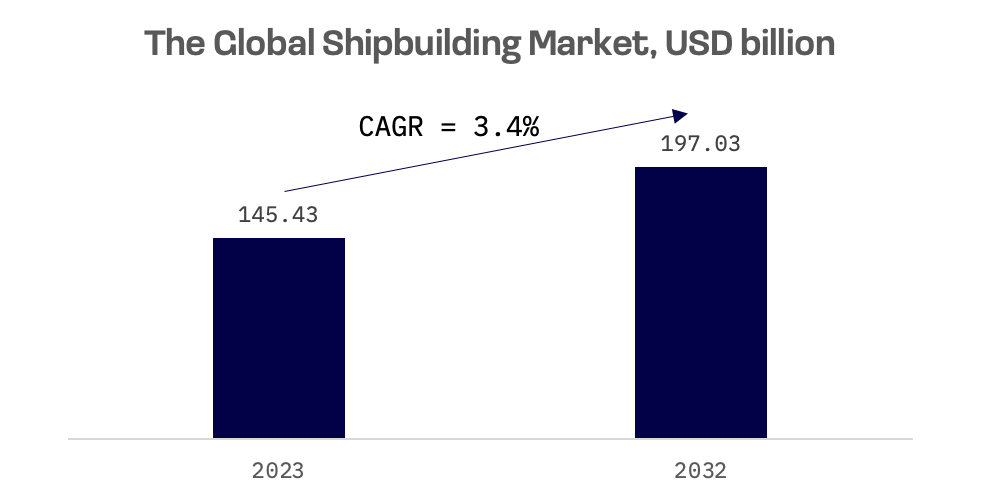

The global shipbuilding market, currently valued at approximately $145 billion, is projected to expand by 3.4% in the coming years.

This growth is fuelled by increasing demand for energy efficient vessels, supply chain expansion and a surge in orders for eco friendly ships as companies adapt to stricter environmental regulations. Decarbonising the world’s fleet by 2050 could cost between $8 billion and $28 billion annually, with an additional $28 billion to $90 billion needed yearly to build a fully carbon neutral fuel infrastructure.

South Korea’s shipbuilders, recognised for their advanced technology and high quality production, are well positioned to capitalise on this trend. Of the 42 LNG floating storage and regasification units (LNG-FSRU) built worldwide, 32 were constructed by South Korean companies.

South Korea’s shipbuilding industry is heavily dominated by the “Big Three” companies: HD Hyundai Heavy Industries (one of the new entrants to the JAKOTA Blue Chip 150 Index during recent quarterly rebalancing), Hanwha Ocean and Samsung Heavy Industries.

HD Hyundai Heavy Industries, the world’s largest shipbuilding company, specialises in naval and industrial shipbuilding, including crude oil tankers, bulk carriers and container carriers. The company’s portfolio extends beyond shipbuilding, encompassing offshore engineering and services for engines, machinery and marine plants.

Hanwha Ocean, formerly known as Daewoo Shipbuilding & Marine Engineering (DSME), is the world’s second largest shipbuilder. It holds the distinction of being the largest builder of warships and submarines globally, and boasts advanced technologies for constructing specialised vessels.

Samsung Heavy Industries, Korea’s third largest shipbuilder, is renowned for its expertise in commercial vessels. The company’s focus spans container ships, offshore units, specialised vessels and LNG carriers.

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| HD Hyundai Heavy Industries | 329180.KO | Blue Chip 150 | 11.8B |

| Hanwha Ocean | 042660.KO | Mid and Small Cap 2000 | 7.0B |

| Samsung Heavy Industries | 010140.KO | Mid and Small Cap 2000 | 6.3B |

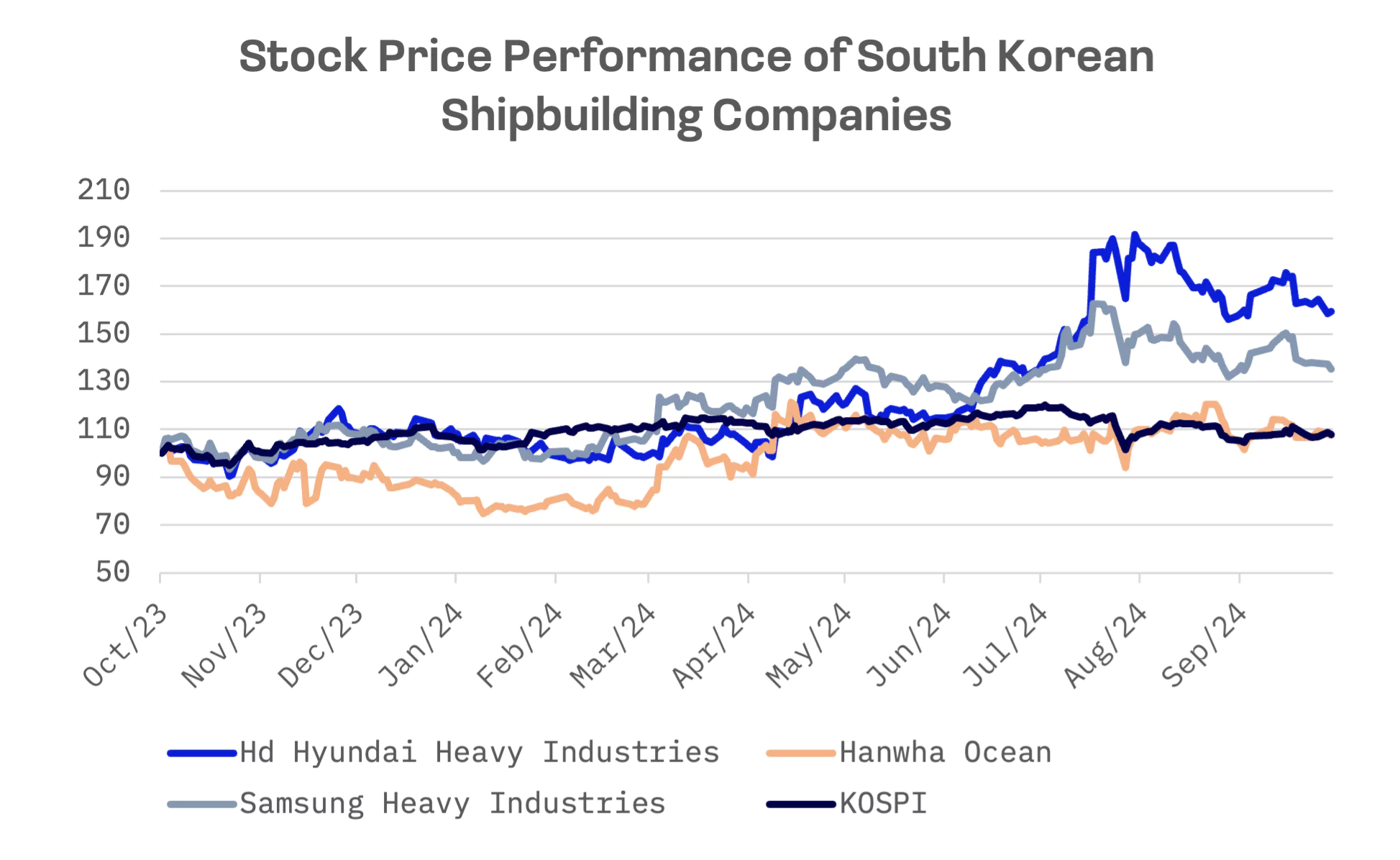

Over the past year, these companies have seen their stock prices rise, with Hanwha Ocean’s performance closely aligning with the KOSPI index. In contrast, Samsung Heavy Industries, and especially HD Hyundai Heavy Industries, significantly outperformed the index.

The shipbuilding industry is experiencing a renaissance driven by technological advancements, particularly in LNG-FSRUs and ultra-large container ships (ULECs). These vessels are in high demand due to their efficiency and environmental friendliness.

On October 2, 2024, South Korea’s Big Three shipbuilders secured over ₩2 trillion ($1.4 billion) in shipbuilding orders in a single day, a milestone not reached since 2008, signalling a significant industry rebound.

However, Hanwha Ocean’s share performance has lagged behind its competitors, despite the industry’s overall resurgence and several positive developments for the company.

In 2022, Hanwha Group, South Korea’s leading defence manufacturer, acquired a controlling stake in Daewoo Shipbuilding and Marine Engineering (DSME) for ₩2 trillion. This strategic move aimed to create synergies with Hanwha’s existing operations, particularly its ammunition and arms division, Hanwha Defense. The acquisition marked a significant extension of Hanwha’s capabilities into the warship and submarine markets. DSME rebranded as Hanwha Ocean on May 23 2023.

In August 2023, Hanwha Ocean announced plans to raise about ₩2 trillion through new share issuance to bolster its maritime defence business and enhance overseas operations. Following the announcement, Hanwha Ocean’s stock price experienced a continued decline, driven by investor concerns about potential dilution of their holdings resulting from the new share issuance. Hanwha Ocean’s stock price was also influenced by broader market dynamics including a significant KOSPI downturn in early 2024 that positioned it as one of the worst performing stock markets worldwide.

Although Hanwha Ocean’s stock price has since improved, it continues to lag behind its two main competitors. This is notable despite positive news around the industry and specifically surrounding Hanwha Ocean::

October 2024: An order for one LNG-FSRU from an Asian shipowner, valued at ₩545.4 billion ($400 million). The vessel is slated for delivery around October 2027.

September 2024: A deal with A.P. Møller – Mærsk A/S, the world’s second largest shipping company, for six LNG dual fuel container ships, each with a capacity of 16,000 twenty foot equivalent units (TEUs). The deal is valued at up to $2.2 billion, with each ship priced at $220 million. Maersk has an option to order four additional vessels.

July 2024: Hanwha Ocean became the second South Korean shipbuilder, after HD Hyundai Heavy Industries, to secure a Master Ship Repair Agreement (MSRA) with Naval Supply Systems Command (NAVSUP), qualifying for participation in the U.S. Navy’s maintenance, repair and overhaul (MRO) business.

July 2024: Contracts worth ₩2.16 trillion (approximately $1.57 billion) to construct four LNG carriers and four very large crude carriers (VLCCs) for Middle Eastern clients.

In contrast to share price performance, all three companies exhibit similar EV-to-Sales multiples, however Samsung Heavy Industries stands out as the most expensive based on its EV-to-EBITDA multiple:

| Company Name | EV/Sales | EV/EBITDA | Forward P/E |

| HD Hyundai Heavy Industries | 1.29x | 24.28x | 34.60x |

| Hanwha Ocean | 1.34x | 20.10x | 19.69x |

| Samsung Heavy Industries | 1.27x | 50.29x | N/A |

| AVERAGE | 1.30x | 31.56x | 27.15x |

| MEDIAN | 1.29x | 24.28x | 27.15x |

HD Hyundai Heavy Industries has emerged as the strongest performer among the Big Three, with a nearly 27% year-over-year surge in sales and a 357% increase in net profit.

HD Hyundai Heavy Industries: Key financial indicators, ₩ billion

| As of 6/30/2023 | As of 6/30/2024 | Y/Y Change, % | |

| Total Revenue | 3,064.4B | 3,884.0B | 26.7% |

| EBITDA | 142.5B | 440.9B | 209.4% |

| Net Income | 33.7B | 154.1B | 357.3% |

HD Hyundai Heavy Industries has recently bolstered its order book with contracts worth ₩881.4 billion. The deals include the construction of two ultra large ethane carriers (ULECs) for an Asian shipping company, two liquefied petroleum gas (LPG) carriers for an Oceania based client and one LNG bunkering vessel.

In a strategic move to strengthen its supply chain, HD Hyundai Heavy Industries announced plans in September to acquire Leeyoung Industrial Machinery, a Korean manufacturer of shipbuilding equipment. This acquisition is timely, positioning the company to meet rising demand in a booming shipbuilding market.

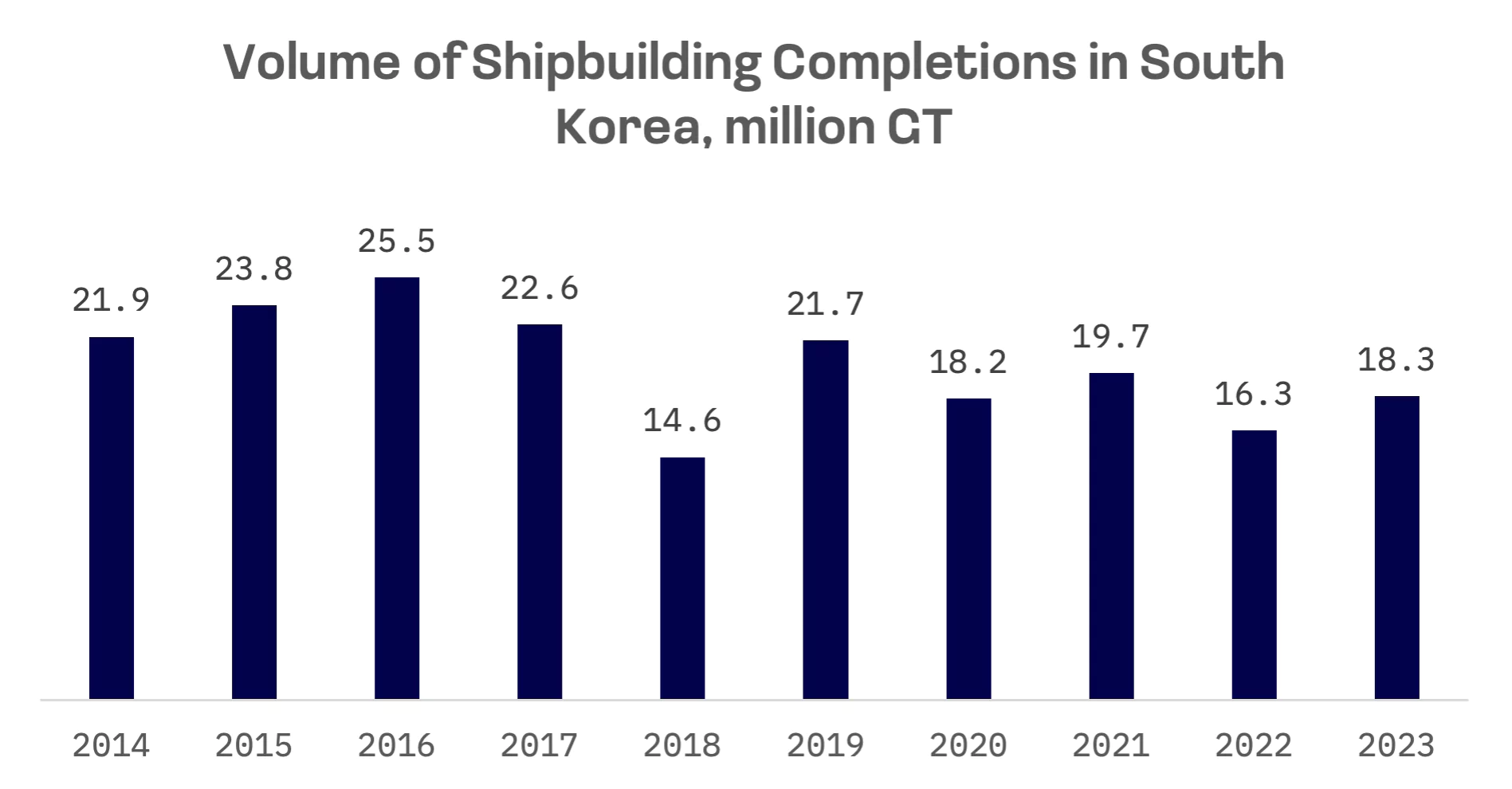

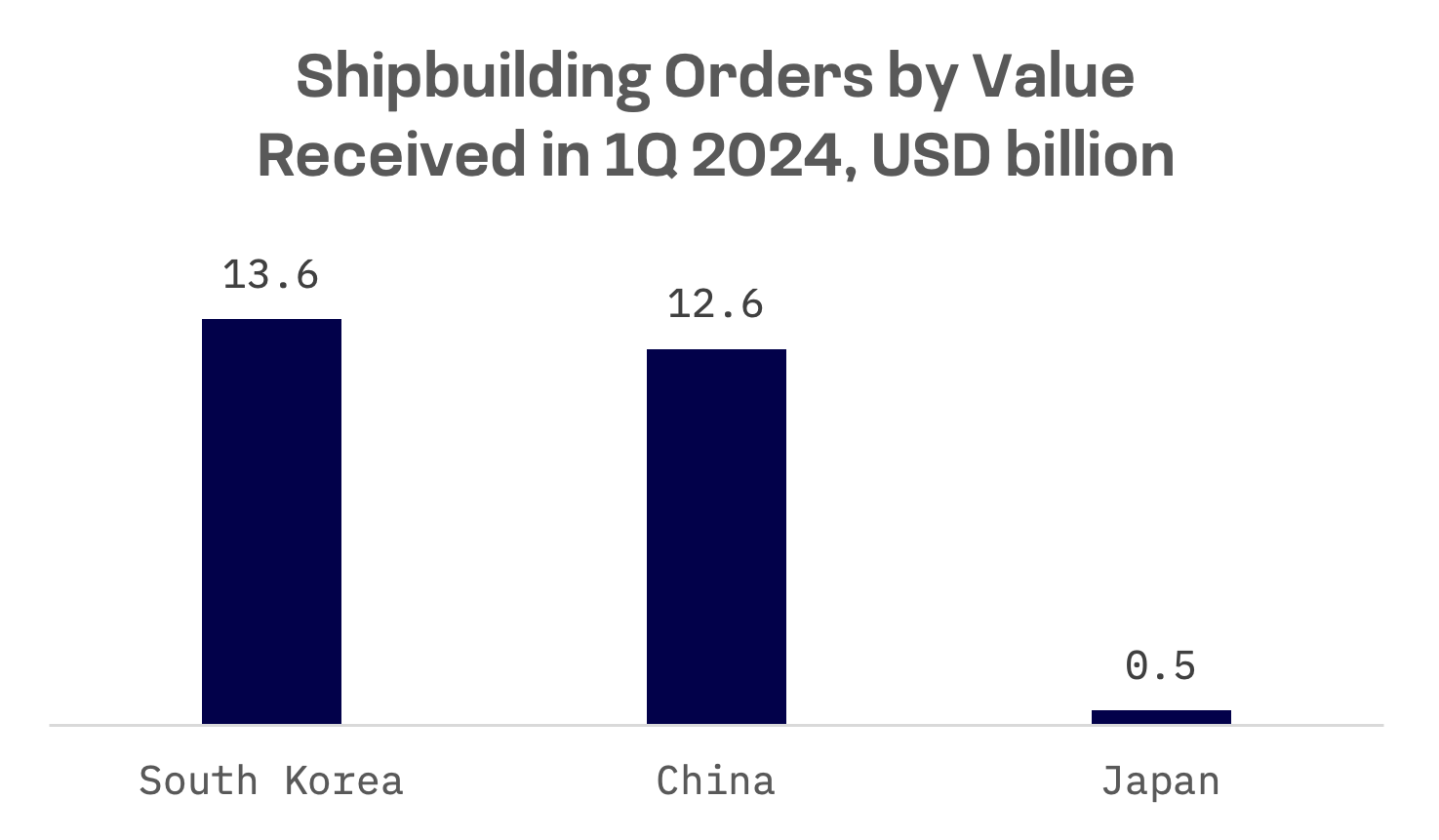

South Korea’s shipbuilding industry is experiencing a resurgence, marked by a strategic pivot towards environmentally conscious, technologically advanced vessels. The sector saw a surge in orders totaling $13.6 billion in the first quarter of 2024, a 41.4% increase from the same period last year. This growth is bolstered by substantial financial guarantees from South Korean banks and state run financial institutions.

The government is playing a crucial role in fostering this renaissance through key initiatives such as foreign direct investment incentives and the “Next Generation K-Shipbuilding Initiative.” These programs aim to drive technological innovation and talent development, positioning South Korea for sustained growth in the industry.

As the global shipbuilding landscape shifts towards decarbonisation, South Korean shipyards are capitalising on the growing demand for eco-friendly LNG and ammonia vessels. This strategic focus on high value, low carbon ships is expected to maintain South Korea’s competitive edge and leadership in the next phase of the industry’s evolution.