South Korea’s National Assembly approved revisions to the Commercial Act on August 25 aimed at strengthening minority shareholders’ influence in proxy battles and enhancing the independence of outside directors, marking the latest push in a series of corporate governance reforms that have drawn pushback from the business community.

The legislation requires publicly listed companies with assets exceeding ₩2 trillion ($1.4 billion) to adopt a cumulative voting system, allowing minority shareholders to concentrate their votes on individual board candidates during proxy battles. The bill also mandates that listed companies increase the number of audit committee members elected independently from the board from one to at least two.

Both provisions were part of an initial corporate reform package but were excluded from the first amendment to the Commercial Act under the current administration. The National Assembly passed the first amendment in July to strengthen individual shareholder protections by broadening the board’s fiduciary duties to serve not only the company’s interests, but also those of its shareholders.

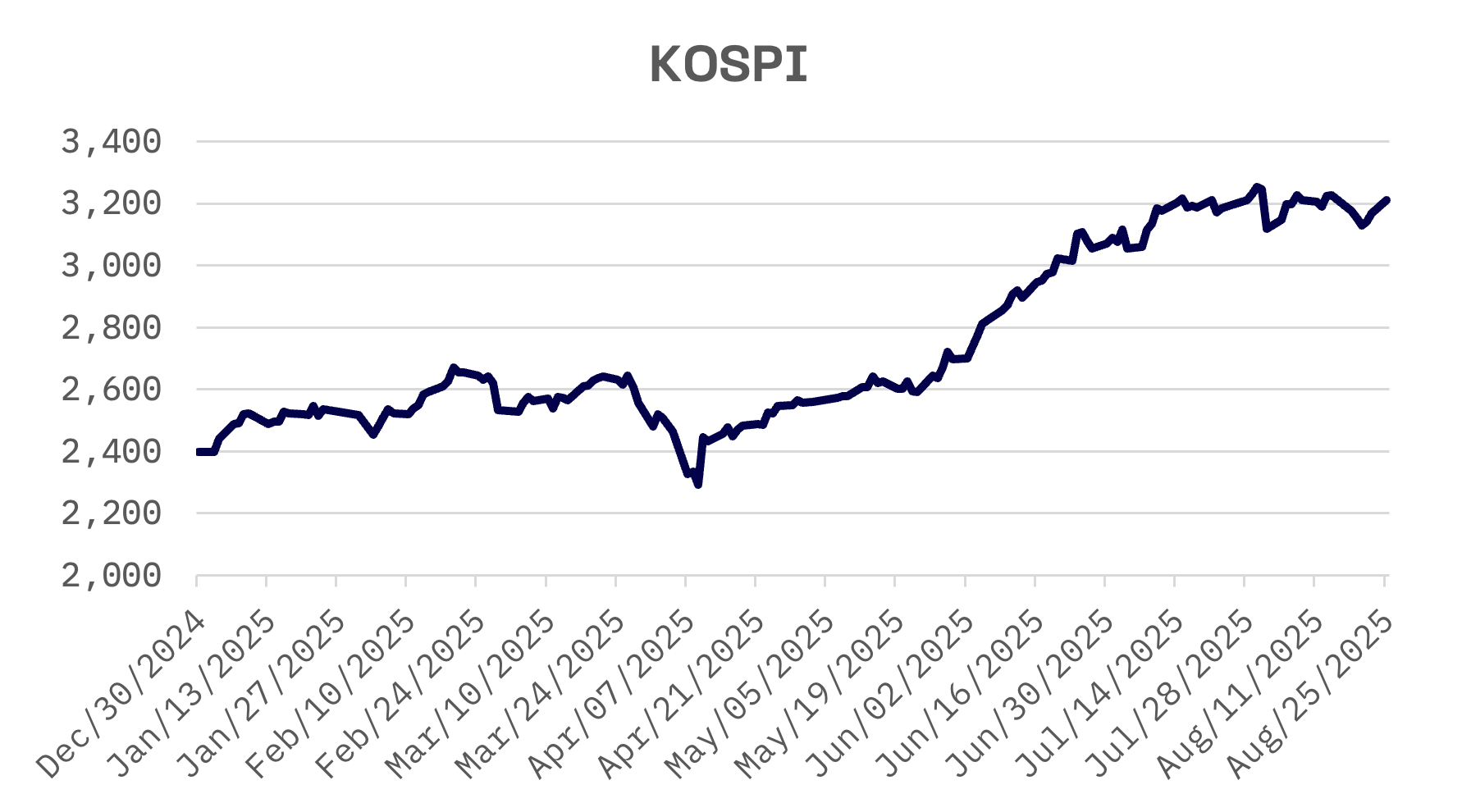

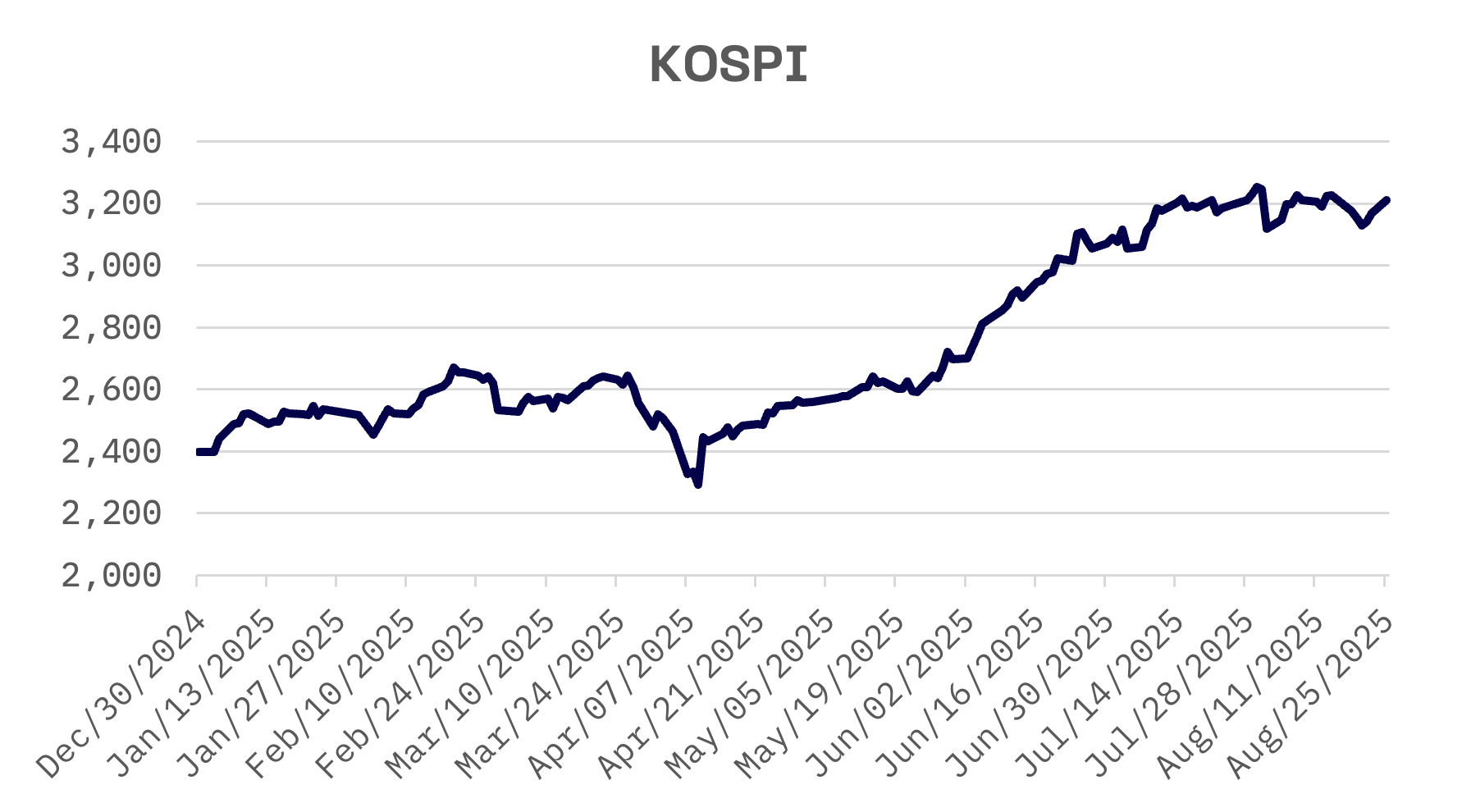

The ruling party promoted the legislation as a milestone that could lift the KOSPI index to 5,000 points, a target President Lee pledged during his campaign as part of a broader push to eliminate the so called “Korea Discount.” The opposition People Power Party, which supported the first Commercial Act amendment, opposed the second.

With passage of the new corporate reform bill, South Korean companies now face a triple challenge: tighter governance rules, a higher top corporate tax rate and labour friendly legislation under the so called “Yellow Envelope Act.”

The day before, the ruling party passed a sweeping labour reform package amending the Labour Union Act. The bill primarily aims to secure bargaining rights for indirectly employed subcontract workers.

Six major industry associations, including the Korea Enterprises Federation, the Federation of Korean Industries (KFI) and the Korea Chamber of Commerce and Industry (KCCI), issued a rare joint statement condemning the legislation. They urged the government to collaborate closely with the business community during the six month grace period to mitigate potential negative impacts on employers.

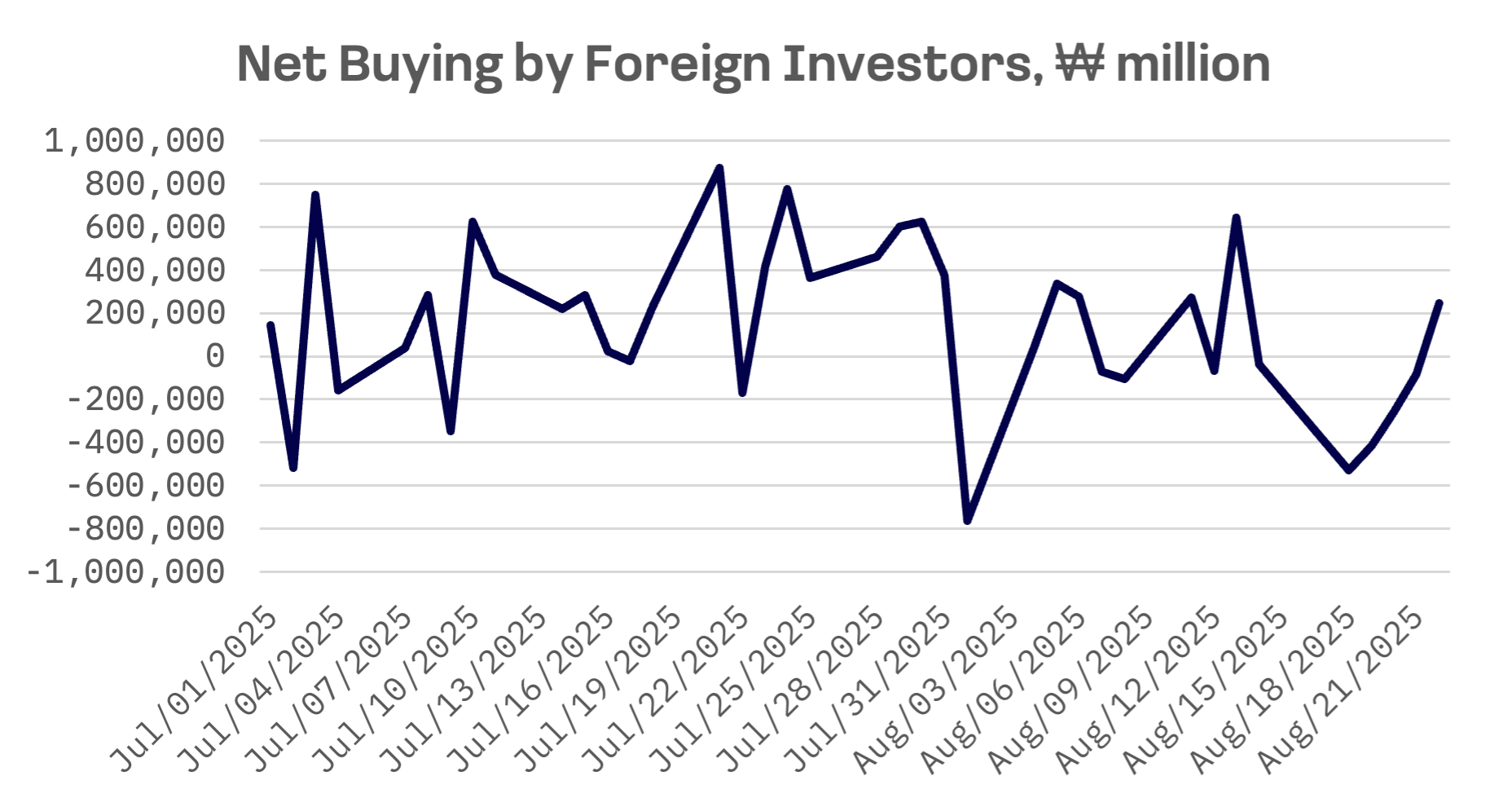

Meanwhile, representatives of foreign companies operating in South Korea voiced concerns that the new law could undermine foreign investor confidence. The latest data show foreign investors substantially trimmed net purchases in August compared with July.

The KOSPI Index demonstrated a strong rally in June and the first half of July but has since hovered around the 3,200 level. Investors are watching how the latest wave of corporate governance reforms can sustain momentum in the stock market over the medium and long term.