Japan has emerged as a key player in the global space industry, combining decades of scientific achievements with a renewed focus on strategic and commercial applications. The country’s space program stands at a critical turning point as policymakers and industry leaders pivot towards commercialisation, national security and deep space exploration.

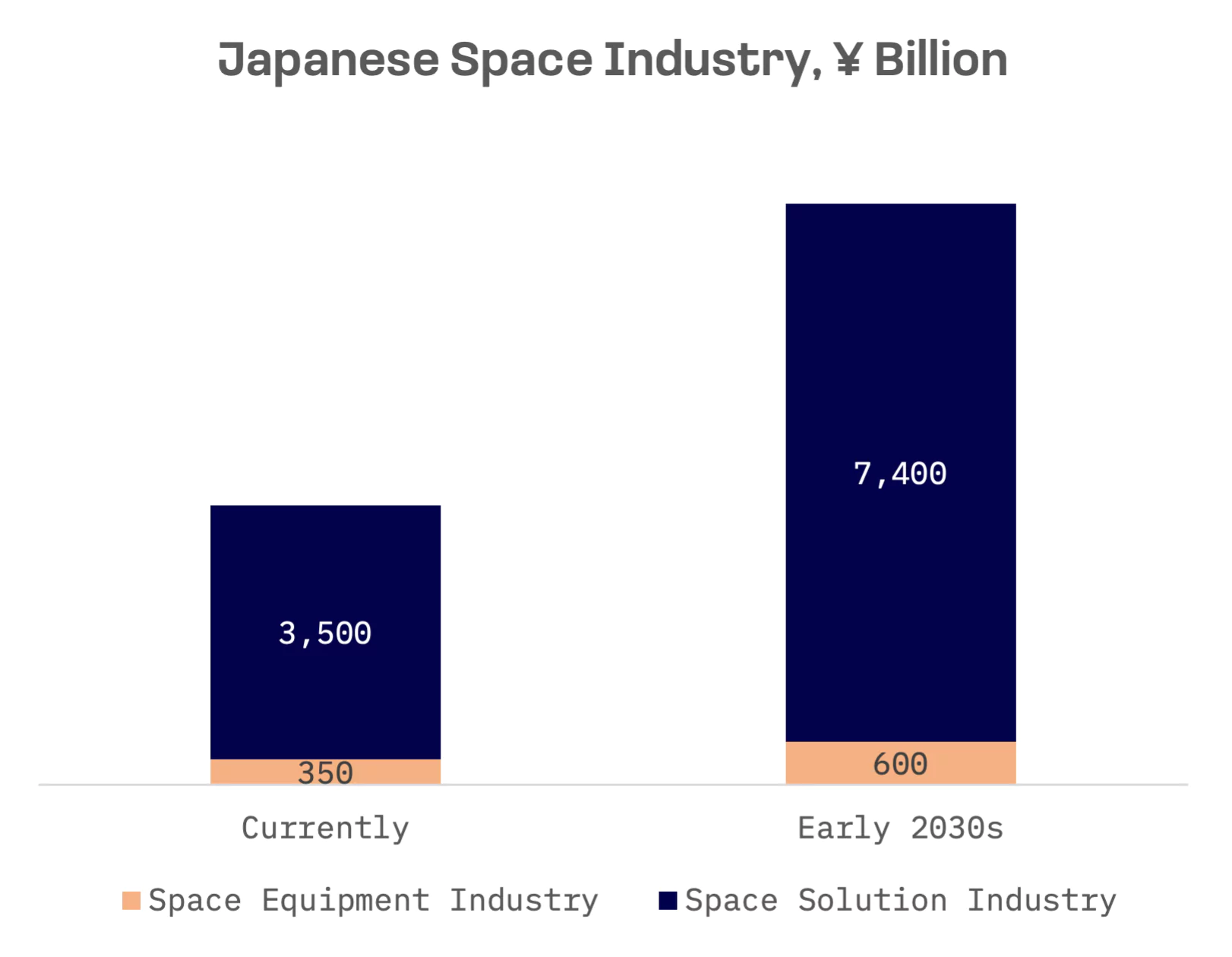

Japan’s space industry, currently valued at ¥4 trillion (approximately $28 billion), is positioned for rapid expansion, with government plans targeting ¥8 trillion ($56 billion) by the early 2030s.

The Japan Aerospace Exploration Agency (JAXA) remains central to these ambitions, driving core research and leading flagship missions. In 2024, Japan achieved a series of milestone breakthroughs, most notably becoming the fifth country to successfully land a spacecraft on the moon through JAXA’s Smart Lander for Investigating Moon (SLIM).

Japan is actively fostering a private space sector. Government initiatives such as the Space Industry Vision 2030 and the ¥1 trillion ($7 billion) Space Strategy Fund launched in 2024 and managed by JAXA are designed to bolster space startups and accelerate commercialisation of the nation’s space ecosystem.

Japan’s private space industry has traditionally been dominated by heavy industry conglomerates such as Mitsubishi Heavy Industries, IHI Corp. and its subsidiary IHI Aerospace, as well as NEC Space Technologies. However, this landscape is beginning to shift, with more than 100 startups now active in Japan’s space sector. A select few have transitioned to the public market. These publicly listed companies include:

| Company Name | Ticker | Primary Segment | Brief Description | JAKOTA Index | Market Cap, USD |

| Synspective | 290A.TSE | Earth Observation | Provides high resolution Earth observation data using synthetic aperture radar (SAR) satellite technology | N/A | 1,243M |

| ispace | 9348.TSE | Lunar Transportation | Develops lunar landers and rovers to deliver customer payloads to the Moon | Mid and Small Cap 2000 Index | 978M |

| Astroscale | 186A.TSE | On Orbit Servicing & Debris Removal | Focuses on technologies for space debris removal and satellite servicing in orbit | N/A | 547M |

| iQPS | 5595.TSE | Earth Observation | Specialises in small SAR satellites to offer frequent, high resolution Earth imaging services | N/A | 473M |

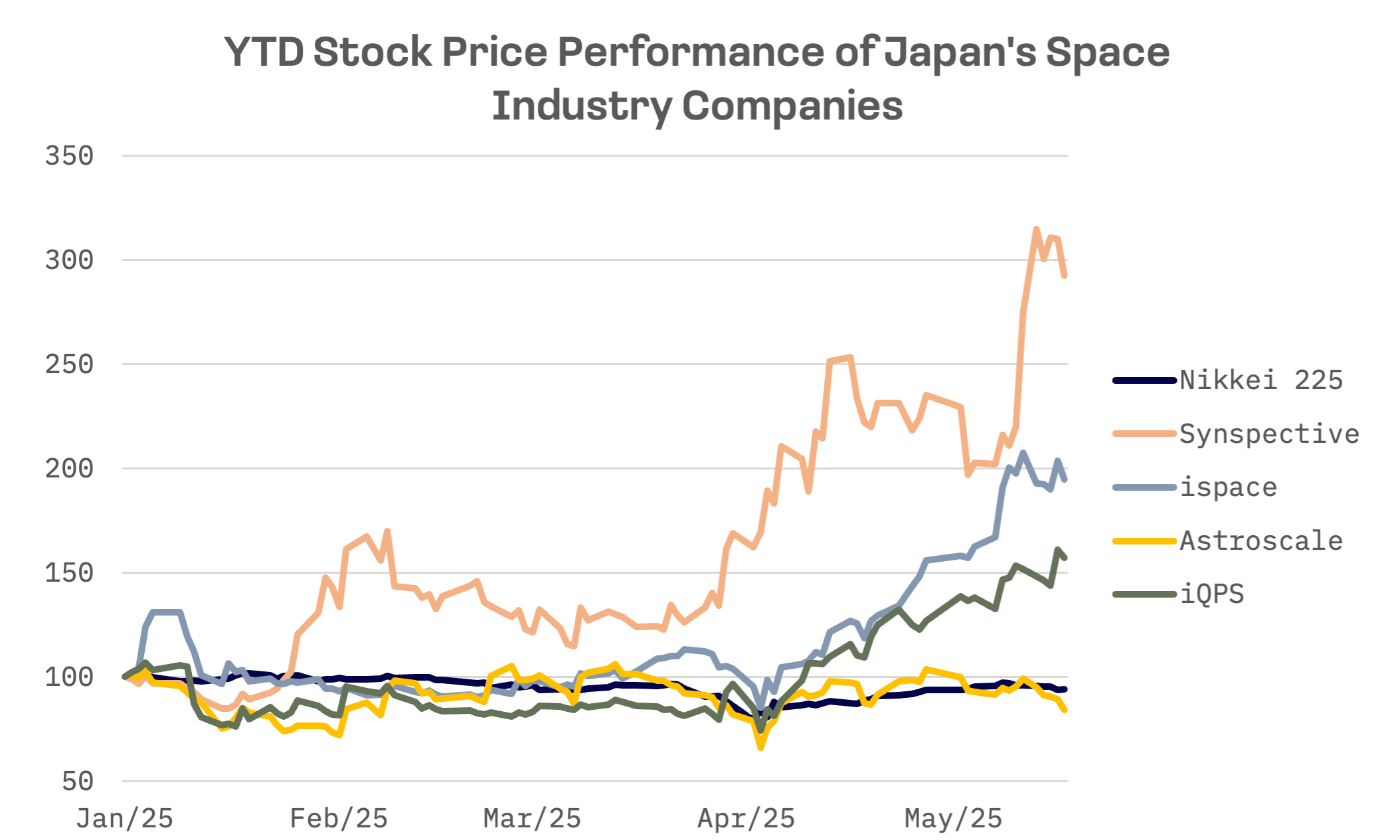

Two of the companies – Synspective and ispace – have market capitalisations approaching $1 billion. They have delivered the strongest year to date (YTD) stock performance within the peer group, significantly outperforming the Nikkei 225 Index. Astroscale is the only company that has posted a YTD decline in its stock price.

Synspective trades at the highest EV/Sales multiple within the peer group, in which all companies remain in the pre-profitability phase. Sustained access to capital – equity or debt – remains critical to support operations and scale. Synspective is comparatively well positioned on this front, boasting the lowest debt to equity ratio among peers.

| Company Name | EPS (TTM), ¥ | EV/Sales | Debt/Equity, % |

| Synspective | -42.76 | 78.3x | 39.3% |

| ispace | -113.02 | 31.5x | 229.7% |

| Astroscale | -164.45 | 29.5x | 147.0% |

| iQPS | -61.51 | 26.4x | 57.1% |

| AVERAGE | -95.44 | 41.4x | 118.3% |

| MEDIAN | -87.27 | 30.5x | 102.1% |

Synspective

Tokyo based Synspective, founded in 2018, develops and operates the “StriX” series of small SAR satellites. The company went public on the Tokyo Stock Exchange Growth Market in December 2024. Synspective delivers high frequency, high resolution Earth observation data and analytics, with applications spanning disaster response, defence, maritime monitoring and environmental intelligence.

The company differentiates itself with compact 100 kilogram class satellites – roughly one-tenth the mass of traditional SAR systems – targeting lower cost launches and agile deployment. Synspective has built proprietary data processing and integration capabilities to support global clients, including governments, corporations and analytics providers.

As part of its long term vision to build a “Learning World” ecosystem, Synspective aims to launch a 30 satellite constellation by the late 2020s to enable near real time global SAR coverage.

Synspective reached a key operational milestone with the launch of its sixth satellite, StriX-3, on December 22, 2024, with the first imagery from this satellite released on February 12, 2025. To accelerate deployment, Synspective signed a multi launch deal with Rocket Lab for 10 Electron missions on June 18, 2024, and secured a rideshare agreement with SpaceX for two additional satellites slated for 2027.

Among recent key strategic and corporate developments, the company was selected for the Ministry of Economy, Trade and Industry’s Global South Co-Creation Subsidy in February 2025 and expanded its global footprint by establishing a U.S. subsidiary in March 2025.

Still in a high growth, pre-profitability phase, Synspective is betting on scale and strategic alliances to solidify its position in the global Earth observation market.

Synspective: Key Financial Indicators, ¥ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 1.14 | 119.60% |

| EBITDA | -0.63 | N/A |

| Net income | -1.19 | -87.81% |

ispace

ispace is a Tokyo based lunar exploration startup founded in 2010. Listed on the Tokyo Stock Exchange’s Growth Market in April 2023, the company develops small robotic lunar landers and rovers aimed at enabling high frequency, low cost payload transport and lunar data services. The company targets government and commercial customers with services spanning lunar imaging, environmental telemetry and resource mapping.

Mission Milestones:

- Mission 1, launched in December 2022, was aimed at a lunar landing in April 2023 but failed due to a software error.

- Mission 2 reached two key mission milestones: deep space maneuvering (April 24) and lunar orbit insertion (May 7). Landing is expected no earlier than June 5.

- Mission 3 development is ongoing. The launch has been postponed and a new propulsion system has been unveiled.

Since March 2025, the company has raised approximately ¥17.55 billion in funding. This includes a ¥10 billion loan from Sumitomo Mitsui Banking Corp. secured on May 22, 2025, ¥5 billion from Mizuho Bank on May 14, and an additional ¥1.4 billion from Sumitomo Mitsui Trust Bank on March 26. On March 10, the company also received $7.7 million (approximately ¥1.15 billion) from Draper to support work under NASA’s Commercial Lunar Payload Services (CLPS) program.

The company has formed several new strategic partnerships and signed agreements to advance its lunar mission capabilities:

- Memorandums of understanding and agreements with Redwire, Zeno Power and Takasago Thermal.

- Partnering with KDDI, Kurita, Space Data and Chuo University for lunar technology initiatives.

- Participating in government backed and international projects, including with Japan’s Space Strategy Fund, entX (Australia) and UNESCO.

ispace remains in a capital intensive development phase, with revenue largely generated from payload services and government and commercial contracts tied to its lunar missions. The company has yet to reach profitability and continues to depend on external funding sources.

ispace: Key Financial Indicators, ¥ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 2.75 | 418.64% |

| EBITDA | -3.32 | -91.69% |

| Net income | -4.58 | -199.33% |

Satellite company Axelspace soon to go public

Japan’s space industry is entering a pivotal phase, marked by accelerating innovation and deepening collaboration between the public and private sectors. The upcoming June IPO of Tokyo based satellite company Axelspace demonstrates growing confidence in the commercial potential of space startups.

Axelspace is targeting a public listing by June, according to people familiar with the matter. The company is expected to fetch a valuation comparable to peers in the radar satellite segment. Its IPO plans had been pushed back due to technical issues and delays in securing government subsidies.

The government’s active role – through contracts, funding and validation – has been instrumental in reducing risk and attracting private capital. As Japan positions itself as a serious contender in the global space economy, this public-private partnership model will be key to unlocking long term growth and strategic advantage in this capital intensive arena.