The global musical instrument market includes a broad range of products – guitars, electric guitars and digital instruments – designed to meet the diverse needs of amateur enthusiasts, professional musicians and educational institutions. This broad product offering is driving significant market expansion, with projections showing growth to $31.97 billion by 2032 from $19.82 billion in 2024, according to Fortune Business Insights. The industry is expected to grow at a compound annual rate of 6.23% between 2024 and 2032.

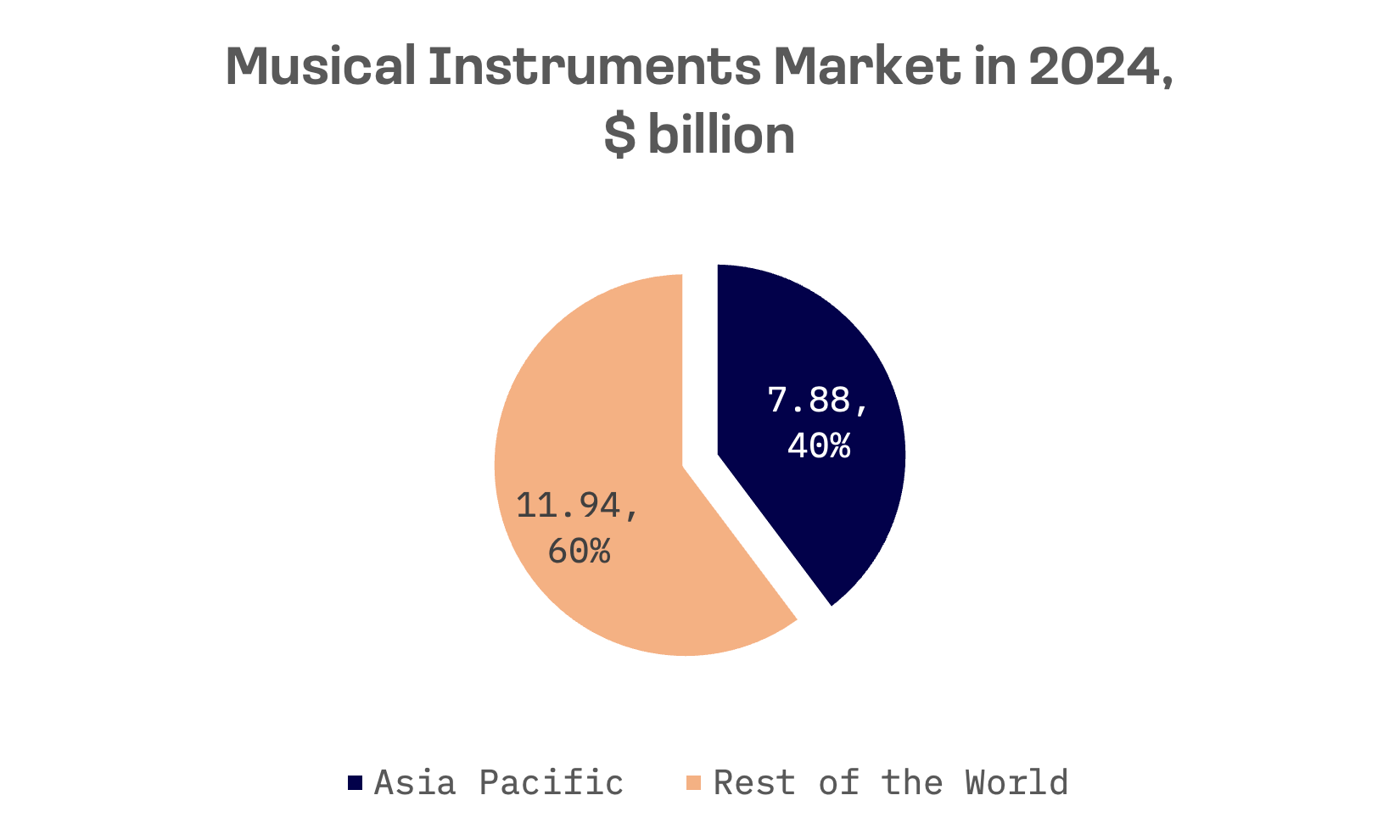

The Asia Pacific region dominated the global musical instrument market in 2024, accounting for a 40% share. Within this dynamic regional market, Japan holds a pivotal position. The country’s domestic musical instrument sales are estimated at approximately $1.5 billion. Beyond strong local demand, Japan has earned global recognition for its innovation – particularly in high end electronic instruments – making it the world’s top exporter of musical instruments.

Three of the five leading musical instrument companies are Japanese, with Yamaha Corporation emerging as the clear market leader, capturing more than 20% of the global electronic instrument market:

- Yamaha Corporation (Japan)

- Roland Corporation (Japan)

- Fender Musical Instruments (U.S.)

- Kawai Musical Instruments (Japan)

- Steinway & Sons (U.S.)

All three Japanese companies trade publicly on the Tokyo Stock Exchange, with Yamaha and Roland included in the JAKOTA Mid and Small Cap 2000 Index:

| Company Name | Ticker | Primary Business Focus | JAKOTA Index | Market Cap, USD |

| Yamaha | 7951.TSE | Pianos, Keyboards, Guitars, Brass & Woodwind, Drums, Music Production | Mid and Small Cap 2000 | 3.37B |

| Roland | 7944.TSE | Electronic Musical Instruments, Synthesisers, Digital Pianos, Electronic Drums, Guitar Effects | Mid and Small Cap 2000 | 0.58B |

| Kawai Musical Instruments | 7952.TSE | Grand Pianos, Upright Pianos, Digital Pianos, Electronic Keyboards | – | 0.16B |

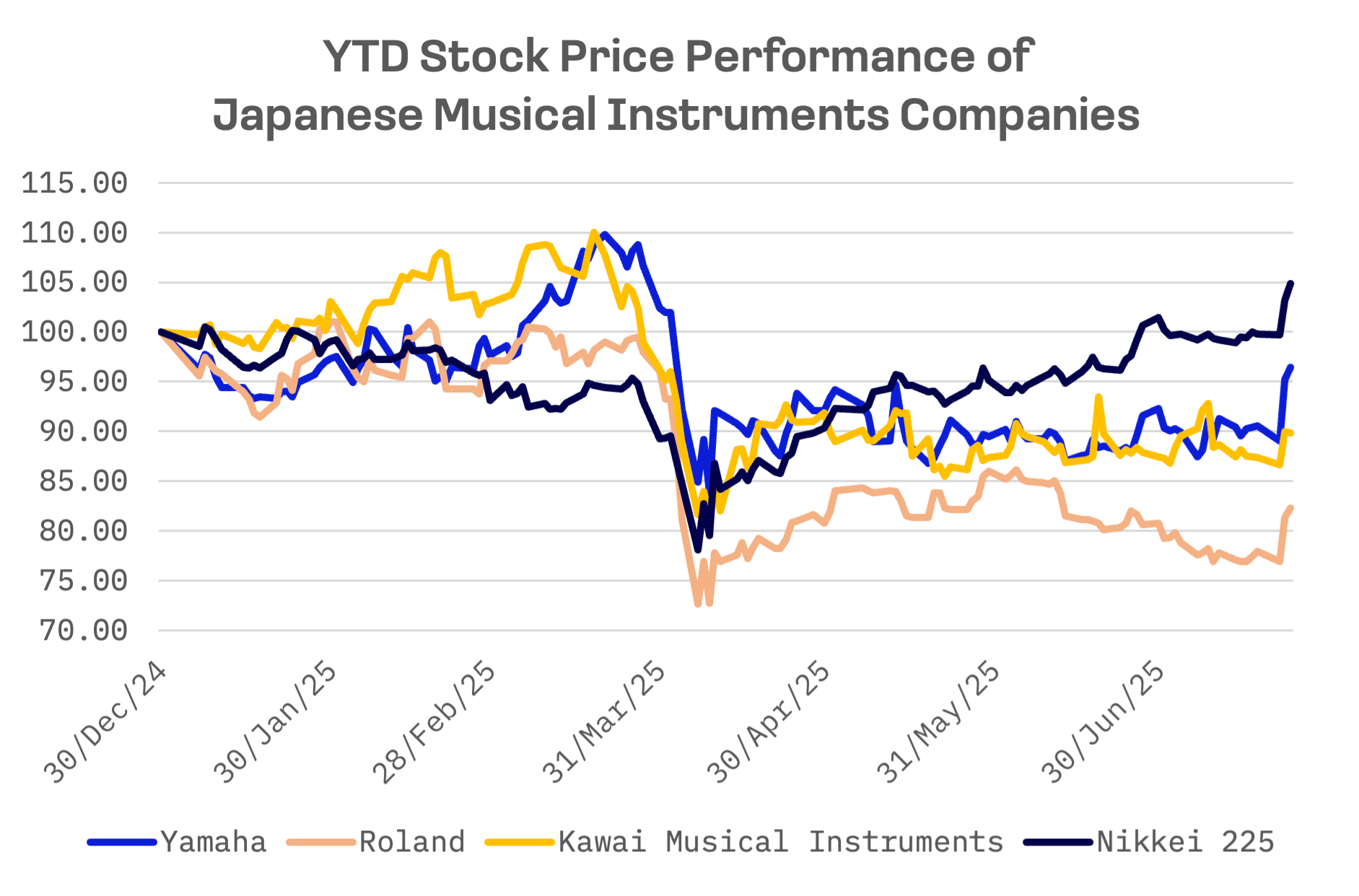

Year to date, all three companies have underperformed the Nikkei 225, with shares posting negative returns ranging from a 3.6% decline for Yamaha to a 17.7% drop for Roland. The underperformance of Yamaha, Roland and Kawai Musical Instruments relative to the Nikkei 225 reflects sector specific headwinds, including shifting demand patterns and the impact of China’s market slowdown on traditional instruments.

Yamaha stands out as the market leader, trading at above average multiples and delivering significantly stronger performance than peers on an EV/EBITDA basis:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Yamaha | 0.87x | 15.89x | 39.5x |

| Roland | 0.93x | 7.80x | 13.1x |

| Kawai Musical Instruments | 0.25x | 7.98x | 56.59x |

| AVERAGE | 0.68x | 10.56x | 36.40x |

| MEDIAN | 0.87x | 7.98x | 39.50x |

Yamaha

Yamaha, established in 1887, has evolved into a global market leader in musical instruments and audio technology. The company’s expansive portfolio spans nearly every major category: acoustic and digital pianos, keyboards, guitars, basses, amplifiers, brass, woodwind, marching instruments, drums, percussion and music production equipment.

Under its recently unveiled medium term plan, Rebuild & Evolve, Yamaha is accelerating digital transformation and innovation. Its U.S. division, Yamaha Music Innovations, has forged strategic partnerships with AI and data analytics firms to enhance operational efficiency. The company is also prioritising development of next generation digital instruments that integrate AI and the Internet of Things (IoT) technology.

In the fiscal year ending March 31, 2025, revenue from acoustic pianos declined amid persistently weak market conditions in China. Digital musical instrument sales held steady year-over-year, supported by a rebound in digital piano sales. Wind, string and percussion instrument revenue fell, reflecting the expiration of financial support programs in the U.S., while guitar revenue remained broadly in line with the previous fiscal year.

Yamaha projects a decline in overall revenue for the next fiscal year but expects profit to rise due to improved margins in its Musical Instruments segment. Yamaha’s strategic overhaul involves phasing out underperforming operations, including certain acoustic piano businesses in China, while shifting resources towards higher growth segments such as professional audio and AI/IoT integrated digital instruments. Although restructuring costs are expected to weigh on short term results, the company views these measures as necessary steps towards improving operational efficiency and long term profitability.

Yamaha: Key Financial Indicators, ¥ billion

| Fiscal Q4 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 111.39 | -8.0% |

| EBITDA | 10.94 | -10.6% |

| Net income | -0.94 | -110.5% |

Roland

Founded in Japan in 1972, Roland is a global manufacturer focused on electronic musical instruments and related audio equipment. Its product portfolio spans synthesisers, digital pianos, electronic drums, guitar amplifiers and synthesisers, effects units, mixing consoles and DJ controllers. The company’s brand lineup includes Boss, known for guitar gear, and Drum Workshop, a specialist in drums, pedals and hardware.

For the quarter ending March 31, 2025, Roland reported modest revenue growth of 2.08% year-over-year, reaching ¥22.54 billion. Net income, however, surged 87.24% year-over-year to ¥1.84 billion, primarily driven by a temporary increase in income related to timing differences in tax expenses. The company said the tax related boost has no impact on full year earnings.

Like Yamaha, Roland is also prioritising AI and technology innovation as a key part of its growth strategy. Roland established the “Roland Future Design Lab” in August 2024 to drive music technology innovation, introducing AI powered Tone Explorer technology previews in November 2024. The company launched BOSS Effects Pedals Plug Ins and updated its SP-404MKII with Serato integration, leveraging software for music production. This proactive approach to integrating AI and digital technologies positions Roland favourably in the evolving digital music production landscape.

Roland: Key Financial Indicators, ¥ billion

| Fiscal Q1 2025 ending 03/31/25 | Y/Y change, % | |

| Revenue | 22.54 | 2.1% |

| EBITDA | 2.02 | -3.1% |

| Net income | 1.84 | 87.2% |

Although the global musical instruments market is expected to grow, the outlook for Japanese musical instrument companies will largely depend on their ability to adapt to the shifting digital landscape, respond strategically to regional market dynamics and manage ongoing market adjustments effectively.