Japan’s automotive industry, long a symbol of the country’s economic strength and technological innovation, contributes 3% of the nation’s GDP. As the world’s fourth largest automotive market, Japan houses global powerhouses Toyota, Honda, Nissan, Mazda, Suzuki, Subaru, Daihatsu and Mitsubishi.

Despite this strong domestic foundation, Japan’s auto industry faces mounting global challenges. Chinese manufacturers have made aggressive inroads, particularly in emerging markets, steadily eroding Japanese dominance in once secure territories like Southeast Asia. Compounding these pressures, the U.S. government’s looming 25% tariffs on imported vehicles — scheduled to hit in April 2025 — threaten to severely impact Japan’s export dependent auto sector. The U.S. was Japan’s largest market for car exports in 2023, valued at $41.07 billion.

Against this backdrop, the February 2025 collapse of merger negotiations between Honda and Nissan delivers a significant blow to Japan’s automotive sector. The proposed $60 billion merger aimed to create the world’s third largest automaker, enhancing competitiveness against global rivals, particularly in the rapidly growing electric vehicle (EV) market and against increasing competition from Chinese automakers. The companies had signed a memorandum of understanding on December 23, but in February 2025, they jointly announced they had “agreed to terminate” the agreement, abandoning their integration strategy.

The merger talks between Honda and Nissan were prompted by a combination of factors. Nissan, grappling with sagging sales and profitability, sought financial stabilisation and product line revitalisation. Honda, despite robust financial health, particularly in the U.S. market, where sales revenue climbed 8.9% in the first nine months of fiscal year ending March 2025, recognised its need to accelerate EV development to keep pace with industry leaders Tesla and BYD.

Nissan Motor and Honda Motor: Key financial indicators, ¥ billion

| Nissan Motor | Honda Motor | |||

| Fiscal Q3 2025 ended 12/31/2024 | Y/Y Change, % | Fiscal Q3 2025 ended 12/31/2024 | Y/Y Change, % | |

| Revenue | 3,514.31 | 1.64% | 5,531.11 | 2.62% |

| EBITDA | 209.24 | -10.11% | 578.48 | -5.08% |

| Net Income | -14.08 | -148.29% | 310.58 | 22.61% |

The merger promised substantial rewards. Combining resources and expertise could have led to significant cost savings, streamlined operations and accelerated innovation in key areas like EV technology and autonomous driving. However, negotiations ultimately foundered on several fundamental issues:

- Corporate Structure Disagreement: Honda, with a market value nearly five times that of Nissan, proposed making Nissan a subsidiary. This was unacceptable to Nissan, which sought an equal partnership.

- Restructuring Philosophy Divide: Honda was concerned about Nissan’s slow pace of restructuring and its reluctance to make deeper cuts, including potentially closing plants. Nissan, on the other hand, was hesitant to undertake drastic measures that could further erode its value and potentially lead to job losses.

- Decision Making Disparities: Honda executives found Nissan’s decision making process to be slow, further fuelling their desire for greater control.

The collapsed deal creates distinct challenges for both automakers. Nissan confronts an uncertain path forward, with pressing needs to address substantial debt loads and develop a credible EV strategy. Honda, though financially stronger, must reconsider its approach to EV development and explore alternative partnerships to maintain competitive momentum.

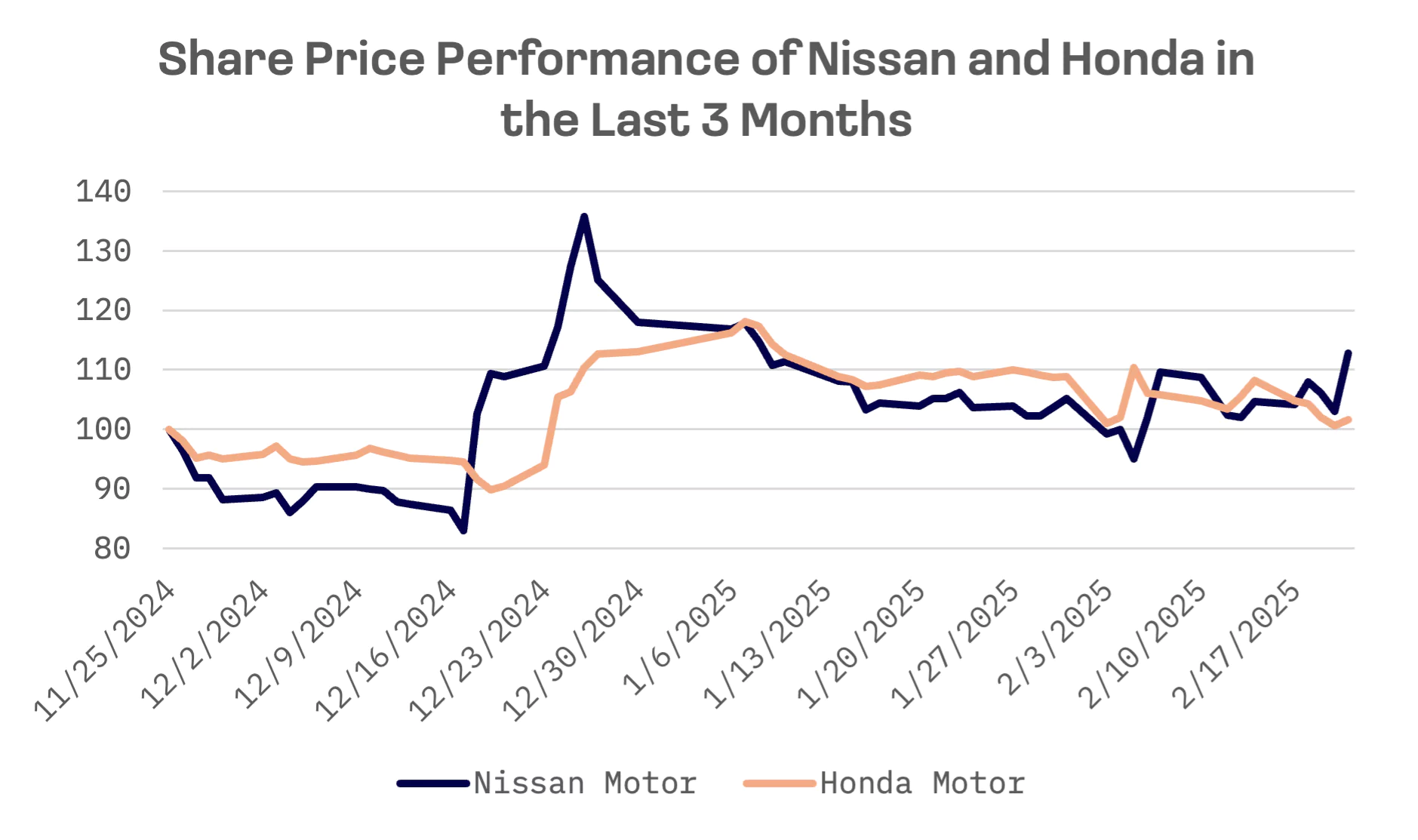

The failed negotiations sparked significant stock market volatility, particularly for Nissan shares, which experienced pronounced price swings over the past three months.

The merger’s collapse raises broader questions about Japan’s automotive industry maintaining its global position. Both Honda and Nissan have lagged behind in the EV market, particularly compared to Chinese automakers. Furthermore, the potential sale of Renault’s stake in Nissan adds another layer of complexity to the situation. This could have significant implications for the Japanese auto industry, potentially opening the door for greater foreign influence and further reshaping the competitive landscape.

In the aftermath, both companies have expressed intentions to continue collaborating on electric and intelligent vehicle technologies. Meanwhile, according to the Financial Times, Honda may be willing to restart talks if Nissan CEO Makoto Uchida leaves the company.

While the merger’s potential benefits appeared clear, insurmountable differences in corporate culture, strategic vision and leadership ultimately doomed the initiative. Both companies now face the daunting task of navigating rapid industry transformation independently.

Multiple scenarios remain possible. Nissan may pursue alternative strategic partnerships or implement more aggressive restructuring. Honda likely needs to reassess its EV strategy and consider new collaborative approaches to accelerate development.

A high level Japanese group, which includes former Prime Minister Yoshihide Suga, has drafted a proposal for Tesla to invest in Nissan, the Financial Times reported on February 21. The group believes Elon Musk’s company might have interest in acquiring Nissan’s U.S. manufacturing facilities and becoming a strategic investor, the paper reported. Hiromichi Mizuno, a former Tesla board member, leads this initiative with support from Suga and his former aide Hiroto Izumi.

Separately, Nikkei reported that Taiwan’s Foxconn has proposed a potential tie-up with Honda, with the long term goal of forming a broader four way alliance that would also bring in Nissan and Mitsubishi Motors.