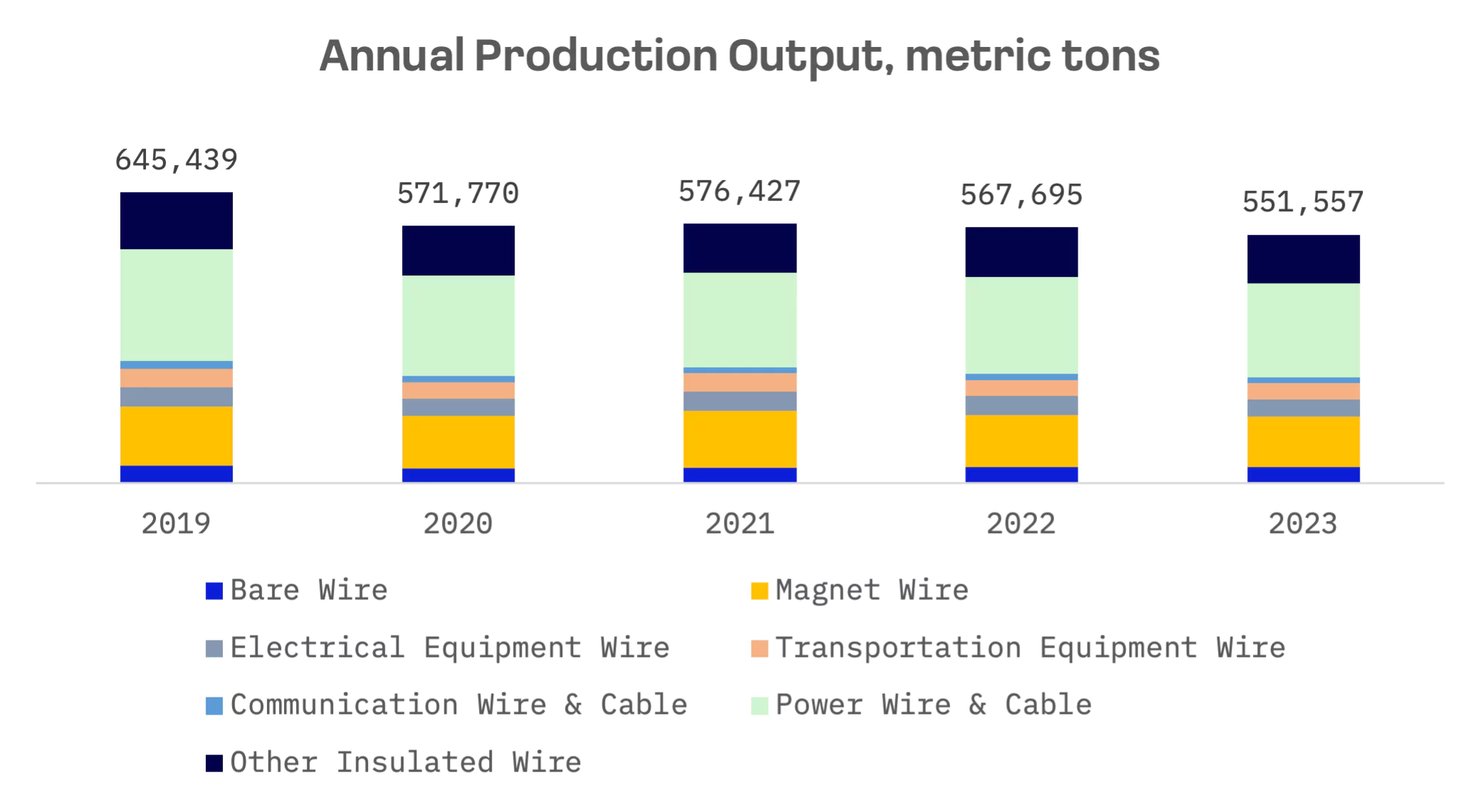

Japan’s wire and cable sector, a crucial component of the nation’s infrastructure, supports telecommunications, energy, automotive and construction industries. The sector has seen overall production decline over the past five years.

Yet a global surge in AI is providing fresh momentum as heightened demand for data centre cabling lifts the industry.

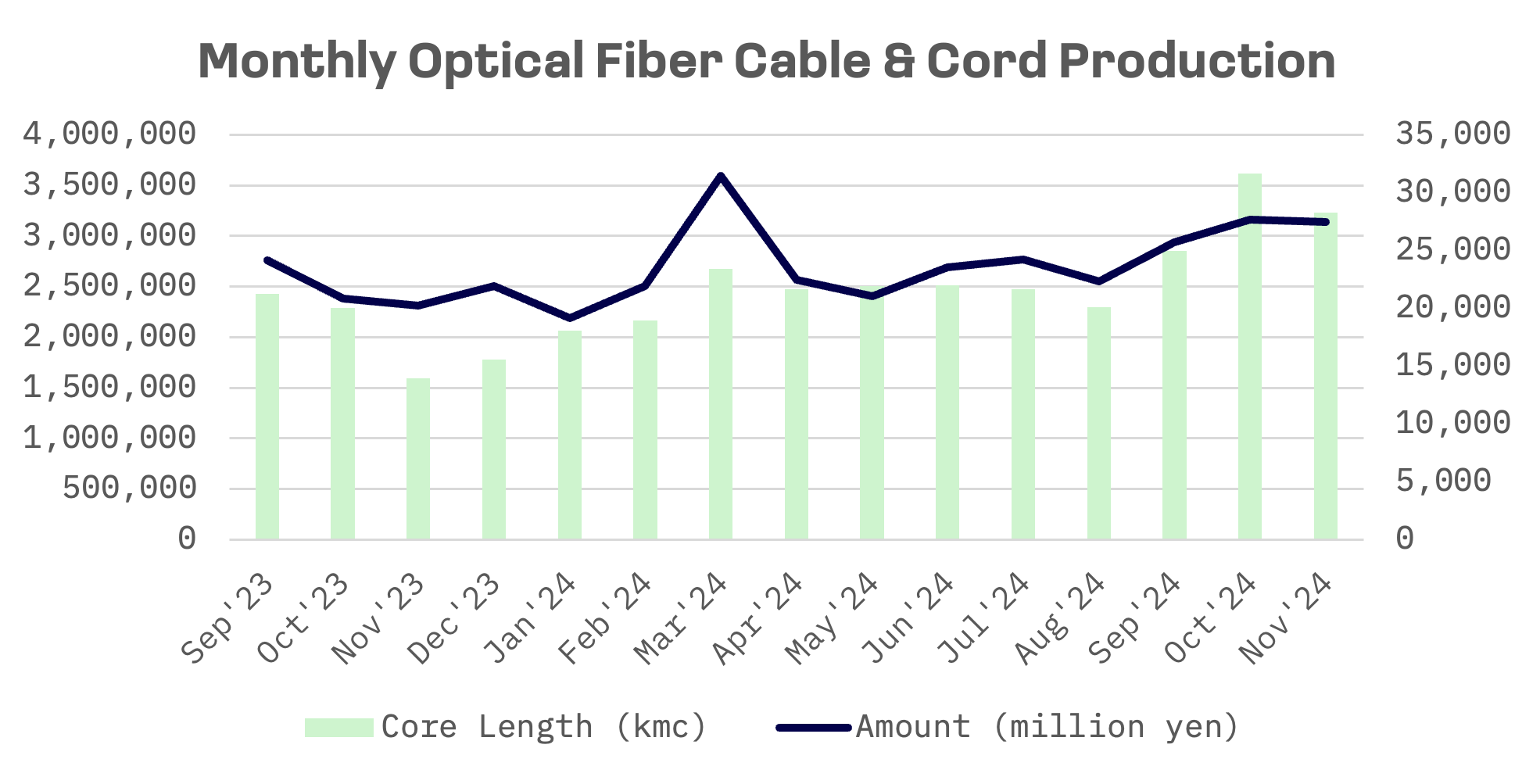

kmc = kilometre coils

Fibre optic cables are becoming increasingly vital in data centres, offering high bandwidth, low latency and superior transmission capabilities. The shift from 400G to 800G networks is driving demand for advanced fibre optic solutions.

Japan’s wire and cable industry faces key challenges, including raw material price volatility and intensifying competition:

- Fluctuating copper and aluminum prices squeeze margins, prompting firms to adopt hedging strategies and long term supply contracts.

- Domestic and global rivals are expanding their presence, pushing companies to emphasise innovation, quality and customer service to maintain their edge.

Despite these headwinds, Japan’s wire and cable industry is set to extend its growth trajectory, driven by rising data centre demand, renewable energy expansion and smart city development. Government initiatives in digital transformation and infrastructure investment are expected to bolster industry momentum.

The global data centre cabling market, valued at $7.1 billion in 2024, is projected to grow at an 8.9% compound annual growth rate (CAGR) through 2034. Based on global and regional trends, Japan’s data centre cabling segment represents a significant share of the Asia Pacific market, potentially exceeding $1 billion in 2024. Growth stems from increasing requirements for scalable, flexible networks and a shift towards energy efficient, sustainable infrastructure.

The industry is dominated by three key players:

| Company Name | Products | Market Position |

| Fujikura | HTS superconducting wires, optical fibres & cables, power cables, automotive components | Leader in HTS wires for energy and medical sectors, key player in fibre optics |

| Sumitomo Electric Industries | Superconducting wires, electric wires & cables, automotive components, industrial materials | Broad superconducting portfolio, dominant in power cables and automotive parts, strong global footprint |

| Furukawa Electric | Superconducting wires & materials, electric wires & cables, metal products, healthcare solutions | Specialised in superconducting materials, strong in power and communication cables, expanding into healthcare |

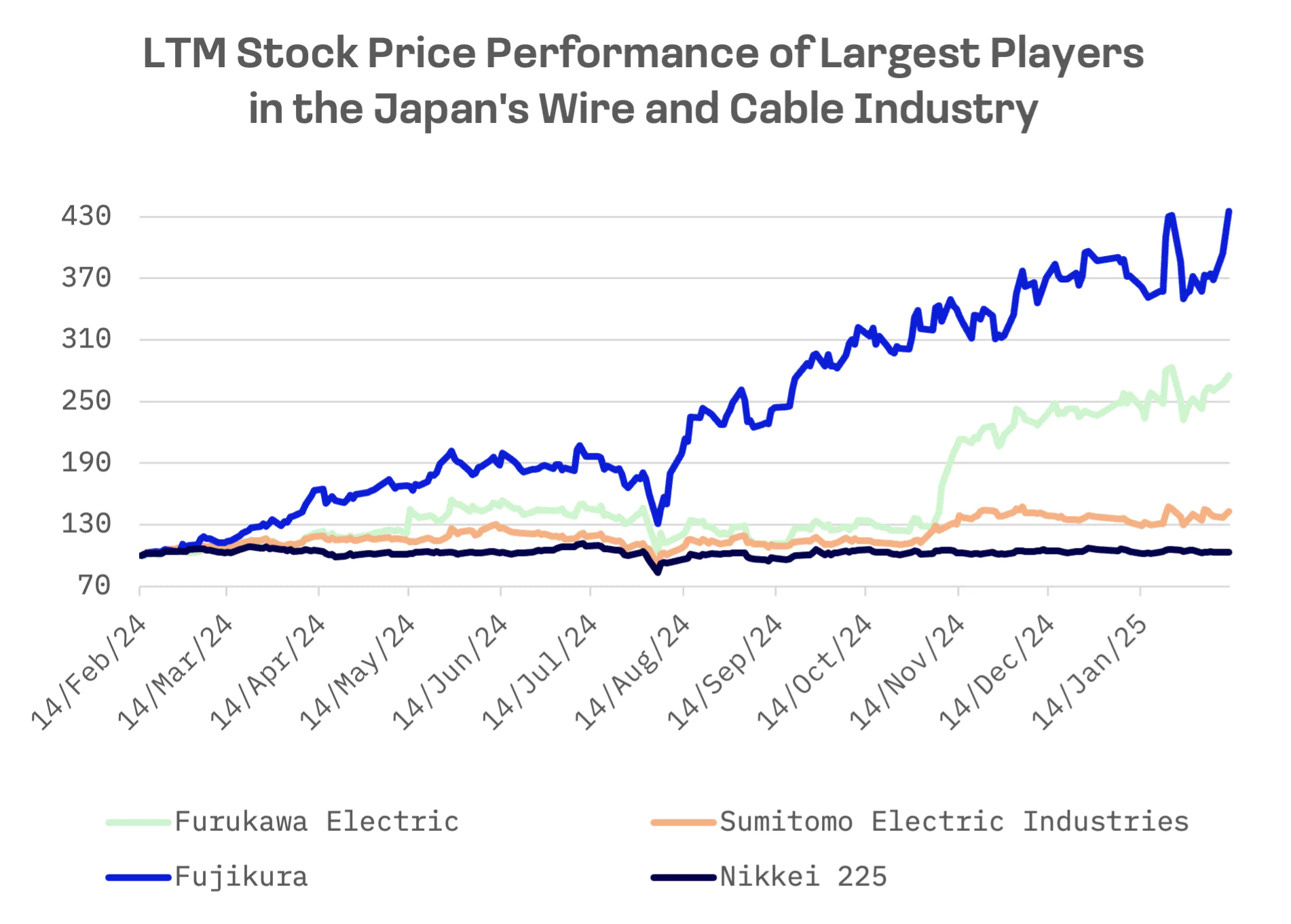

All three companies are publicly traded, with their shares listed on the Tokyo Stock Exchange:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Fujikura | 5803.TSE | Blue Chip 150 | 13.2B |

| Sumitomo Electric Industries | 5802.TSE | Blue Chip 150 | 15.1B |

| Furukawa Electric | 5801.TSE | Mid and Small Cap 2000 | 3.6B |

Fujikura emerged as the top performer on the Nikkei 225 in 2024, surging more than 400% for the year. The company joined the MSCI Global Standard Indexes on November 25 and was included in the JAKOTA Blue Chip 150 Index in the first quarter of 2025 during a quarterly rebalancing. Furukawa Electric and Sumitomo Electric also outperformed the Nikkei 225 Index significantly.

Fujikura commands the highest valuations across all metrics, reflecting strong market growth expectations. Furukawa Electric’s valuation profile more closely mirrors Fujikura in terms of P/E ratio, indicating a similarly high valuation:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Fujikura | 2.03x | 17.94x | 26.28x |

| Sumitomo Electric Industries | 0.59x | 8.24x | 12.40x |

| Furukawa Electric | 0.72x | 9.44x | 25.55x |

Fujikura

Fujikura is stepping up M&A activity to strengthen its market position. In September 2024, it announced an absorption type merger with subsidiary DDK and a company split between DDK and FES to streamline operations. In November 2023, it merged with Optoenergy to reinforce its optical communications business.

The company is also expanding aggressively. In November 2023, its subsidiary AFL acquired Canadian utility contractor ZN Services, bolstering its telecom infrastructure capabilities. AFL is investing $155 million to expand fibre optic manufacturing in South Carolina, adding more than 150 jobs.

Fujikura is also leveraging partnerships and R&D to drive growth. A licensing deal with US Conec expands its fibre optic connector portfolio, while an investment in Kyoto Fusioneering signals interest in alternative energy. After being caught off guard by the AI boom, Fujikura is betting on the next big opportunity – nuclear fusion. The promise of limitless clean energy has attracted investment from billionaires like Sam Altman, Jeff Bezos and Bill Gates. While large scale viability remains unproven, success would drive demand for advanced cables and wiring – an area where Fujikura sees future growth.

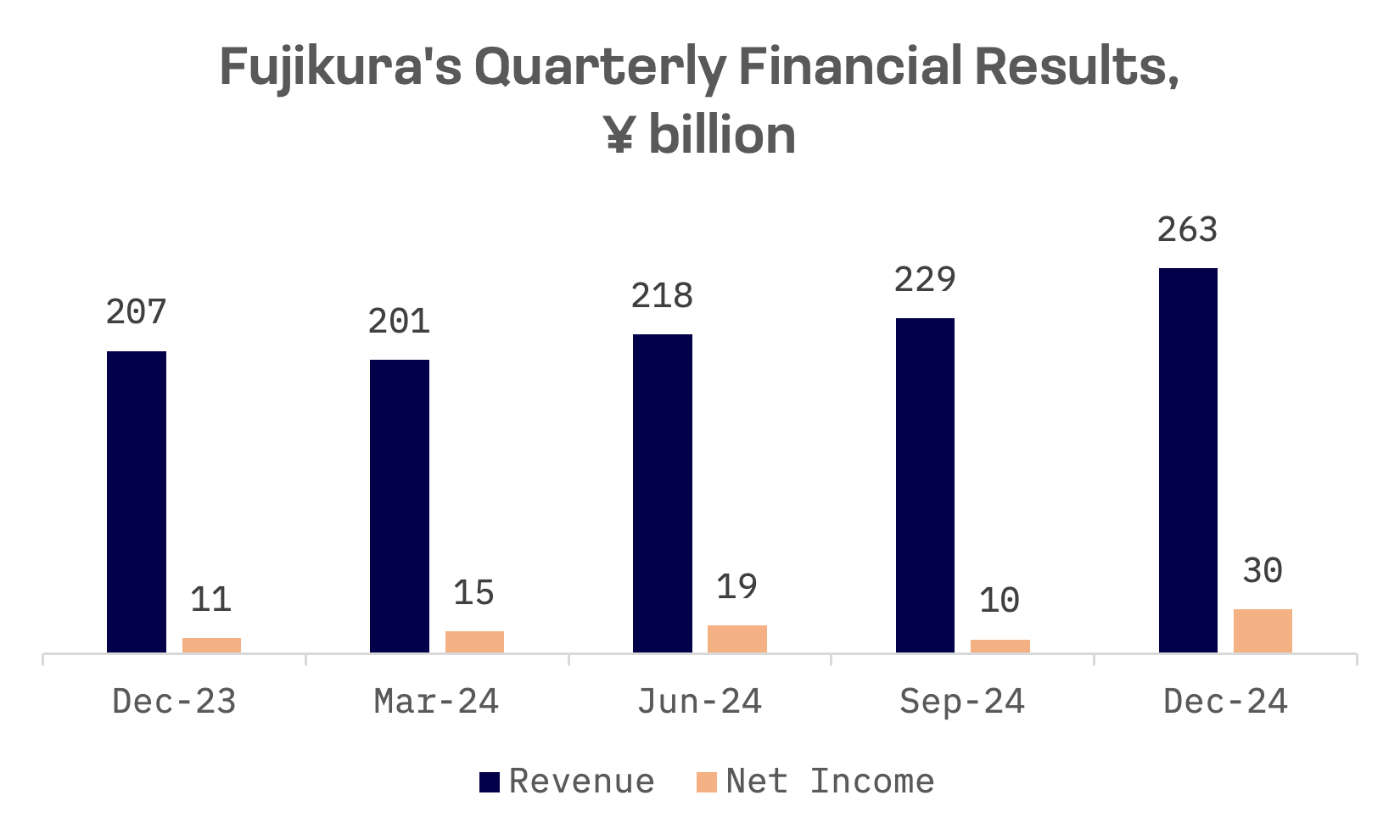

Fujikura reported earnings after the afternoon session on February 10, with consolidated ordinary profit for the April-December period jumping 85.8% year-over-year to ¥95.7 billion. The company raised its full year ordinary profit forecast by 18.4% to ¥122 billion, up from a prior projection of ¥103 billion (previous year: ¥69.7 billion). Profit growth is now expected to accelerate to 75.0% from 47.7%, extending its streak of record earnings to a third straight year.

Fujikura: Key financial indicators, ¥ billion

| Fiscal Q3 2025 ended 12/31/24 | Y/Y change, % | |

| Revenue | 263.45 | 27.23% |

| EBITDA | 47.17 | -32.68% |

| Net income | 30.35 | 186.0% |

Sumitomo Electric Industries

Sumitomo Electric Industries is accelerating innovation across its business segments. In November 2024, the company developed the world’s fastest 0.07 millisecond converter for high resolution DisplayPort-to-Ethernet transmission, enabling immersive 3D visual spaces for applications in gaming, entertainment and industrial design. In September, it introduced a 5 metre range road crossing detection sensor to enhance pedestrian and cyclist safety, supporting advanced driver assistance systems.

The company continues to strengthen its manufacturing, cost efficiency and supply chain resilience to bolster its management foundation.

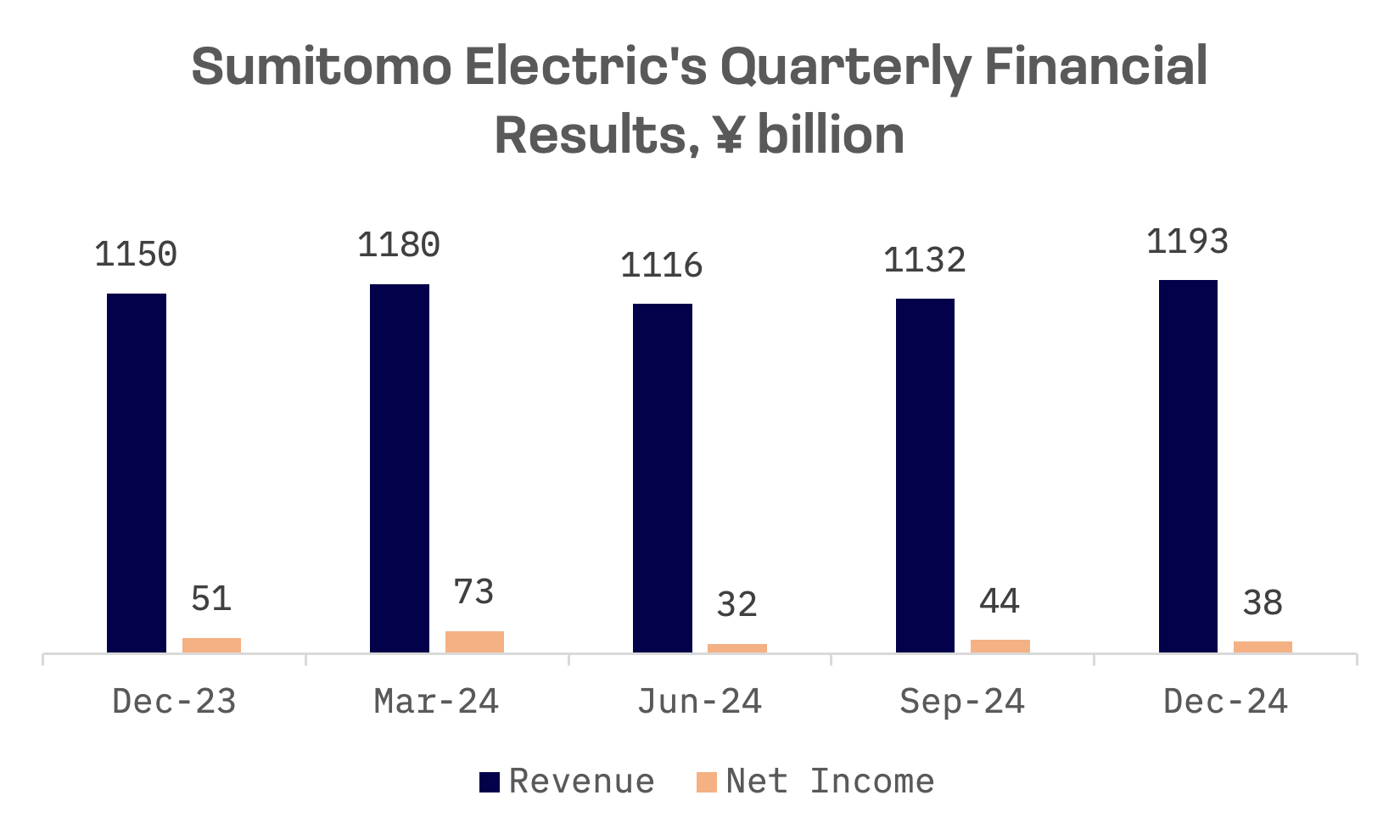

Sumitomo Electric reported earnings on February 4, with revenue rising 3.8% year-over-year to ¥1.19 trillion, exceeding analyst expectations. However, earnings per share (EPS) fell short, missing estimates by 16%.

Sumitomo Electric Industries: Key financial indicators, ¥ billion

| Fiscal Q3 2025 ended 12/31/24 | Y/Y change, % | |

| Revenue | 1,193 | 3.8% |

| EBITDA | 139.11 | 6.99% |

| Net income | 37.93 | -24.89% |

Furukawa Electric

Furukawa Electric remained active in M&A, acquiring a 67% stake in Hakusan Inc. in November 2024 to expand its hyperscale data centre connector business amid rising AI driven demand. In October, it converted MFOPTEX Co., Ltd. into a subsidiary, while in May, it exited the Essex Furukawa joint venture, selling its remaining stake to Superior Essex to refocus on core priorities.

Furukawa Electric is scaling operations with new laser processing labs – one in Kariya City, Japan (November 2024) to accelerate production technology, and another in Budapest, Hungary (October 2024) to support eMobility development in Europe.

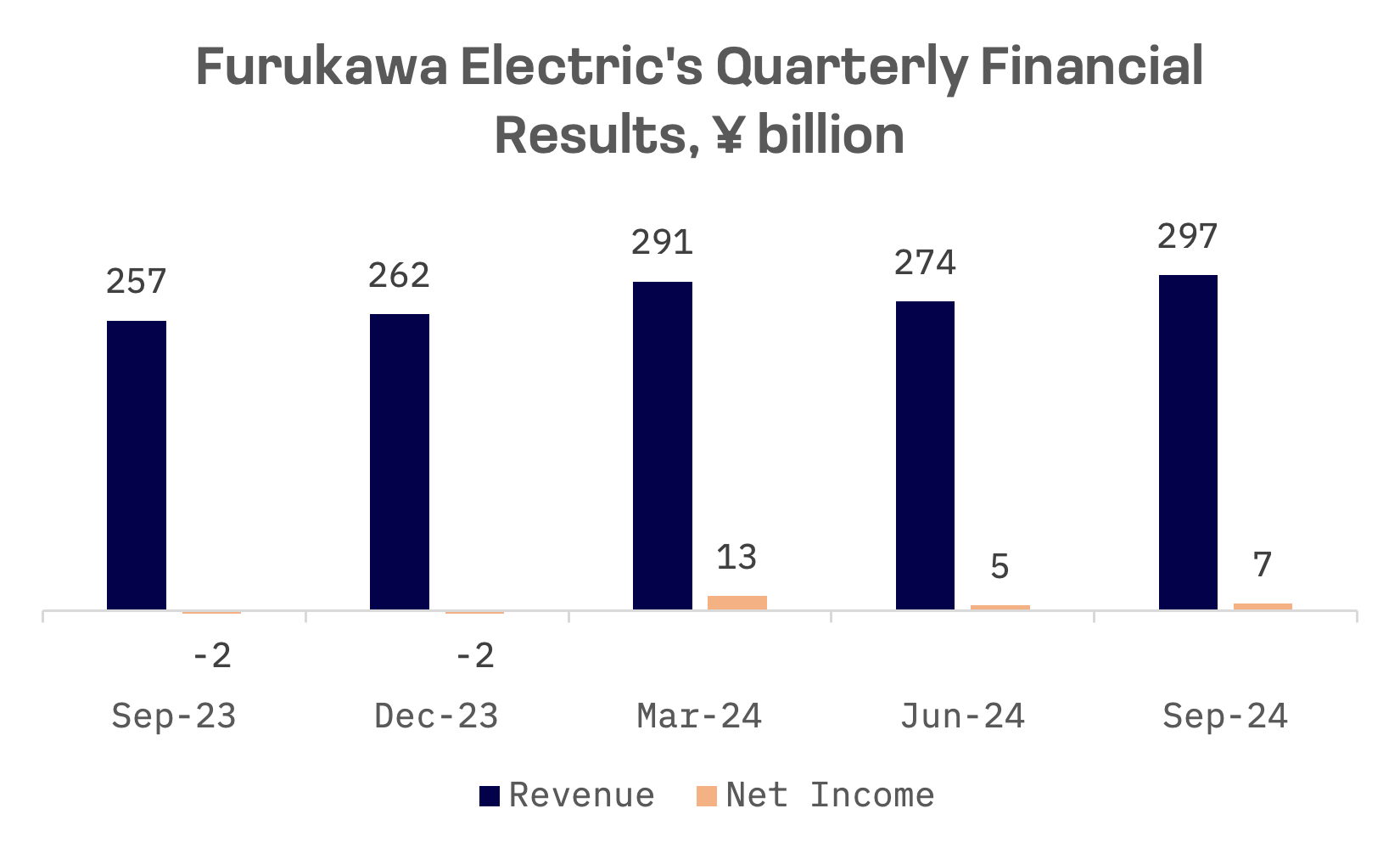

Furukawa Electric: Key financial indicators, ¥ billion

| Fiscal Q2 2025 ended 09/30/24 | Y/Y change, % | |

| Revenue | 296.81 | 15.63% |

| EBITDA | 24.21 | 211.32% |

| Net income | 6.52 | 367.35% |

Despite operating in overlapping sectors, Fujikura, Sumitomo Electric and Furukawa Electric maintain distinct strengths. Fujikura leads in fibre optics and data centre solutions, Sumitomo Electric dominates in automotive and energy, while Furukawa Electric excels in optical connectors and laser technology.

The three companies have leveraged innovation and expansion to capture emerging market opportunities, reinforcing their competitive positions and driving sustained growth.