Last week’s Jakota markets:

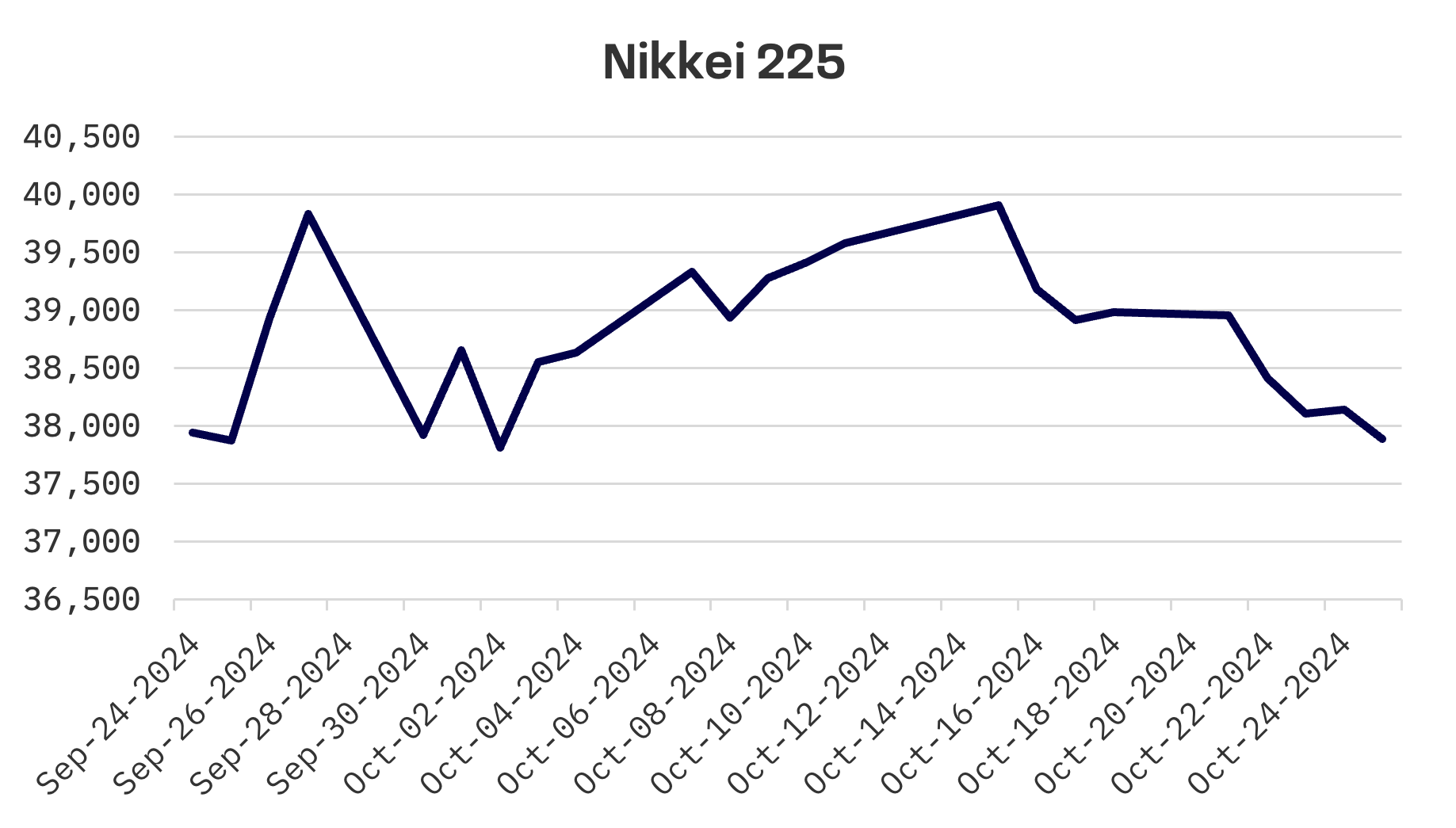

- Japanese stocks led regional declines with Nikkei 225 falling 2.7% ahead of Sunday’s general election, while the yen weakened past 151.5 against the dollar

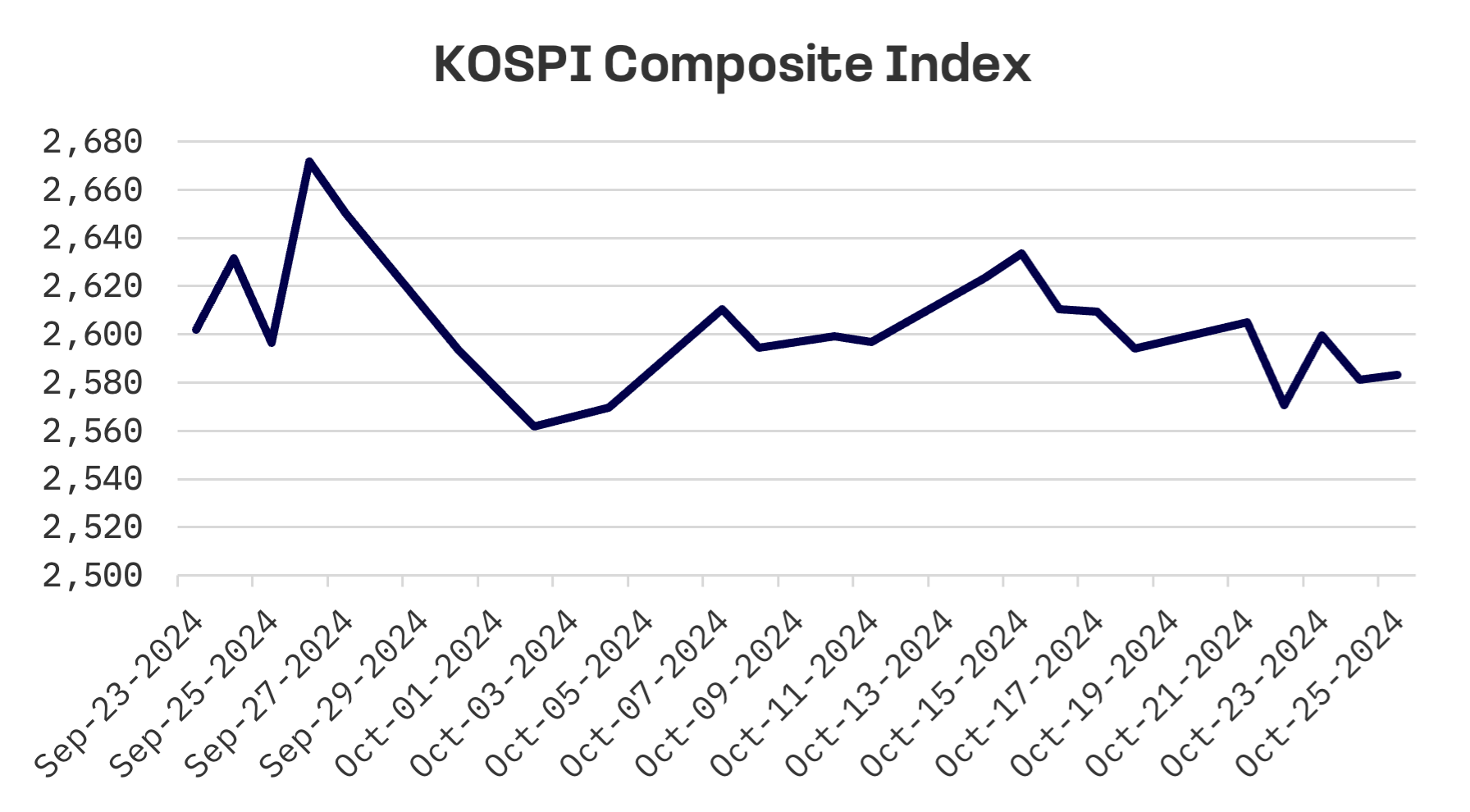

- South Korea’s KOSPI dropped 0.4% as Q3 GDP growth of 0.1% missed expectations, stoking speculation about earlier rate cuts

- Taiwan’s TAIEX declined 0.6% amid concerns over TSMC chips found in Huawei products, despite unemployment hitting a 24 year low in September

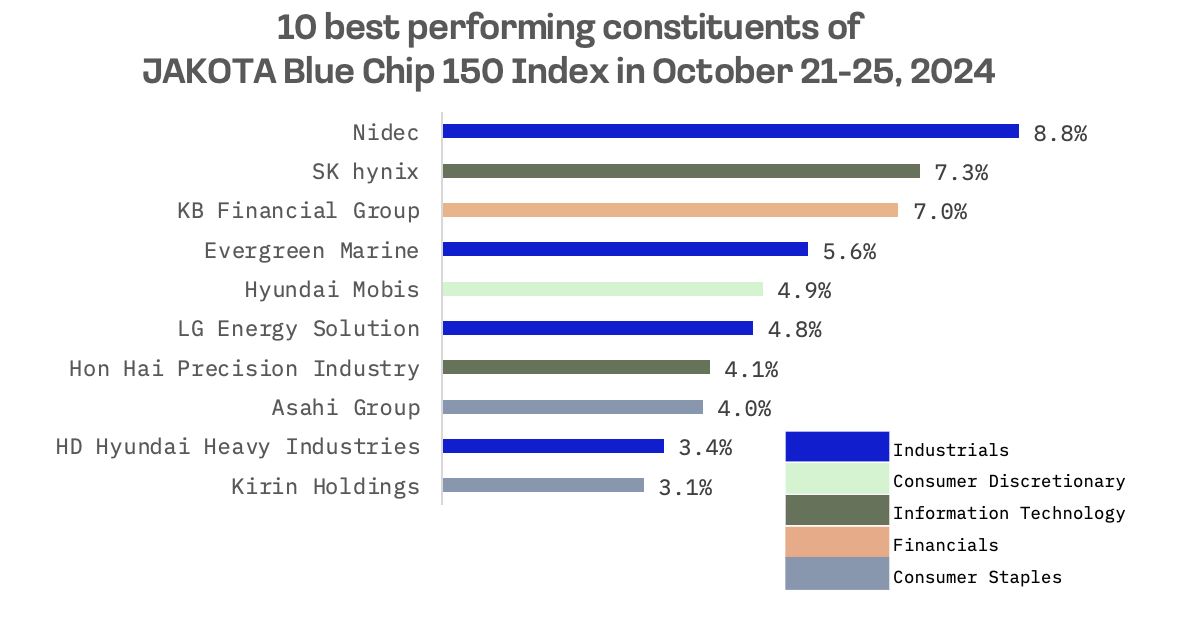

- JAKOTA Blue Chip 150 Index lost 3%, though Nidec shares jumped 8.8% on strong quarterly profits and AI related demand

Japan

Japanese stocks fell this week, with the Nikkei 225 Index dropping 2.7% as investors grew cautious ahead of the country’s general election on Sunday October 27.

The yen weakened to the upper JPY 151.5 range against the dollar, declining from about JPY 150 at last week’s close. The currency’s slide coincided with growing market expectations that the Federal Reserve would maintain higher rates longer than previously anticipated.

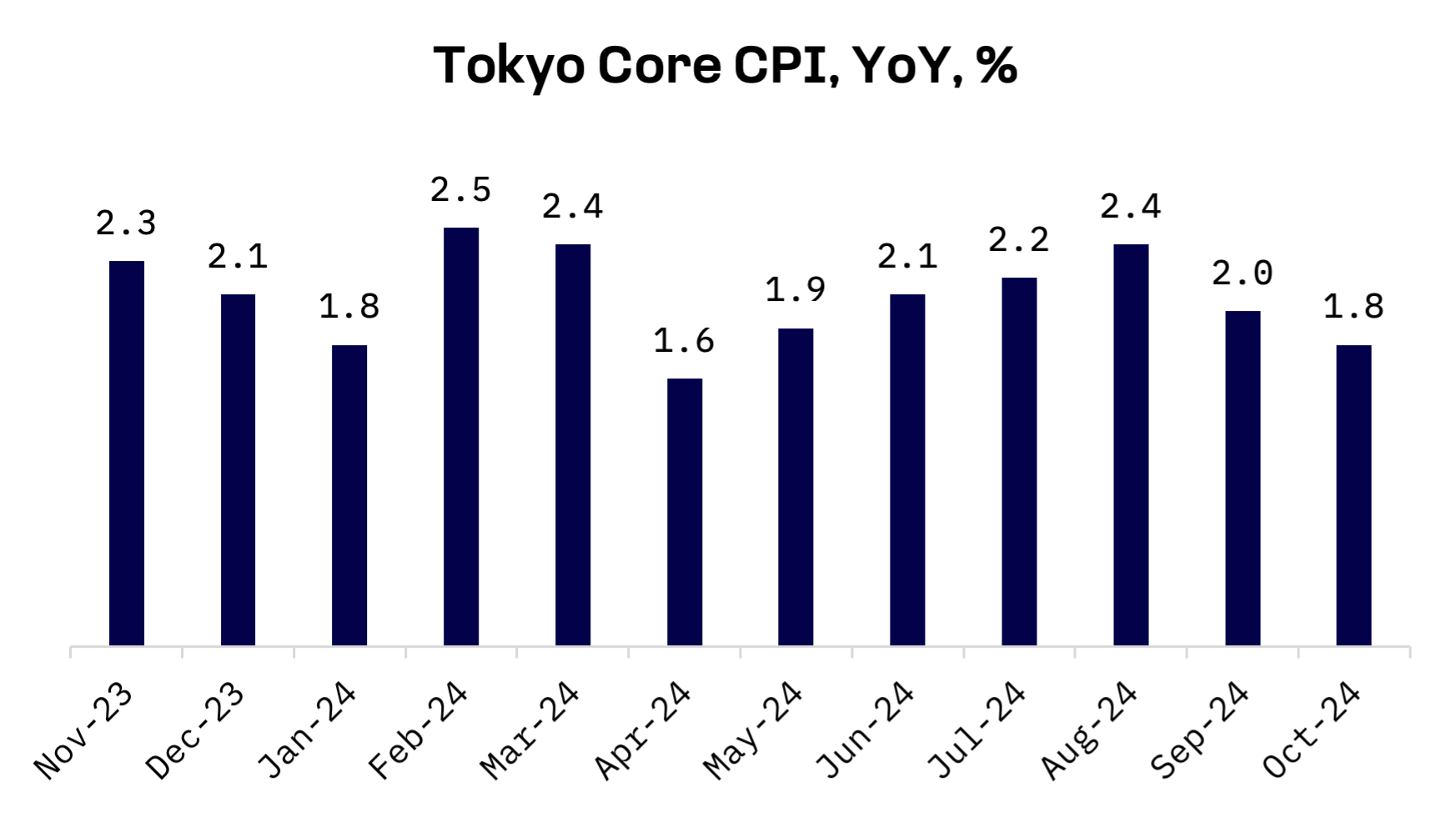

Tokyo’s core consumer price index (CPI), widely viewed as a harbinger of nationwide inflation trends, rose 1.8% in October from a year earlier. While slightly exceeding forecasts, the increase marked a slowdown from September’s 2% gain, largely due to reinstated government subsidies for electricity and gas.

Bank of Japan Governor Kazuo Ueda said the central bank’s 2% inflation target remains out of reach, highlighting the importance of a balanced approach. Ueda emphasised the need to move cautiously amid significant economic uncertainty while also avoiding signals that rates would stay low indefinitely, which could encourage excessive speculation.

South Korea

The South Korean stock market retreated, with the KOSPI Index falling 0.4% amid concerns about economic growth and fading hopes for Fed rate cuts.

South Korea’s economy grew more slowly than expected in the third quarter, hampered by weak exports, prompting speculation that the Bank of Korea might accelerate plans for interest rate cuts to bolster Asia’s fourth largest economy.

The country’s gross domestic product (GDP) increased 0.1% from the previous quarter during July-September, according to preliminary data from the central bank. That fell short of the Bank of Korea’s August forecast of 0.5% quarterly growth.

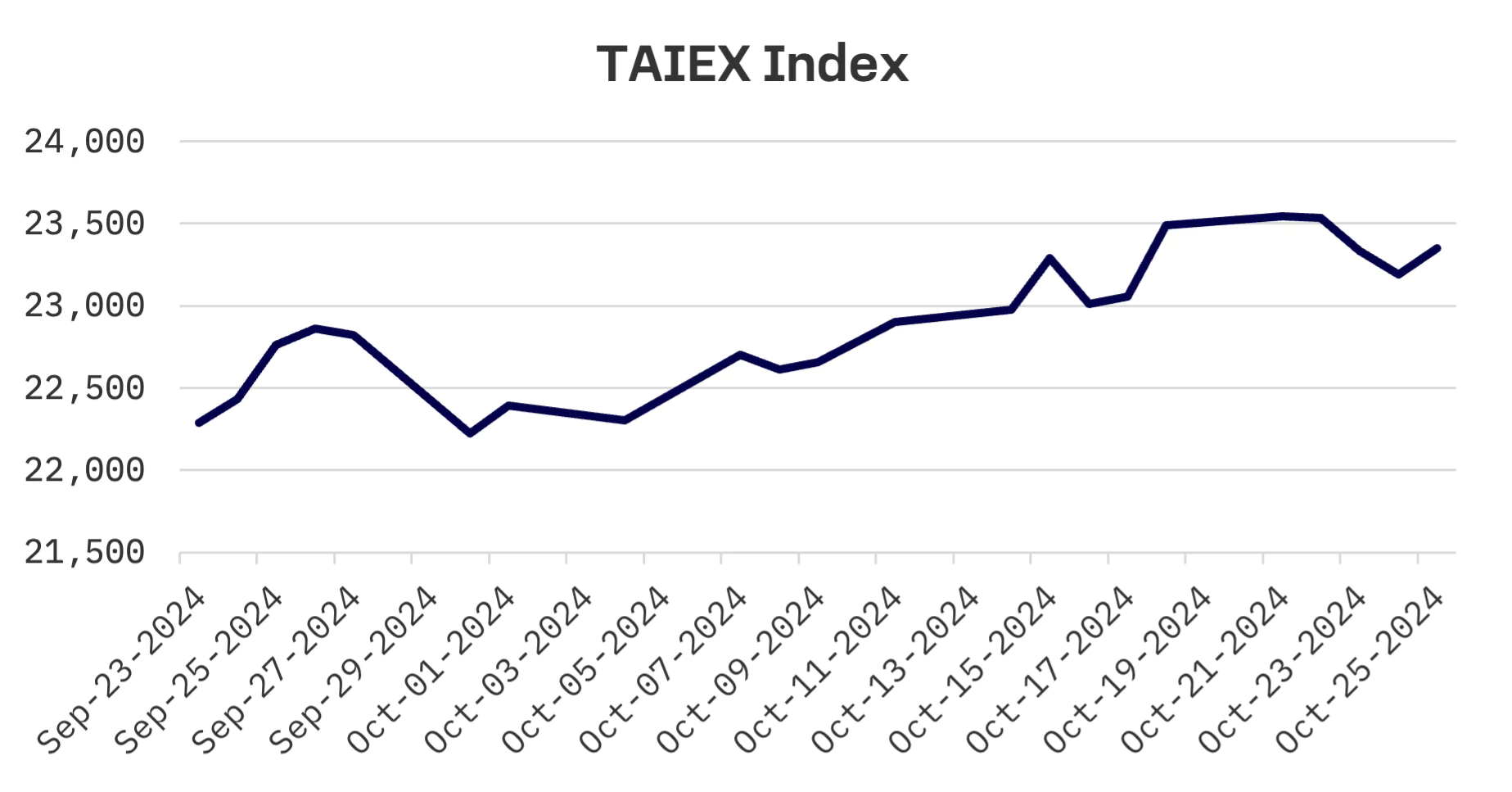

Taiwan

Taiwan’s stock market joined the regional slide, with the TAEIX slipping 0.6% after reports that Taiwan Semiconductor (TSMC) chips were discovered in a product of a Chinese tech giant, Huawei Technologies, potentially violating U.S. export restrictions.

The island’s unemployment rate improved to 3.43% in September, reaching a 24 year low for the month as seasonal graduation effects subsided and labour markets stabilised, according to the Directorate General of Budget, Accounting and Statistics (DGBAS).

JAKOTA Blue Chip 150 Index

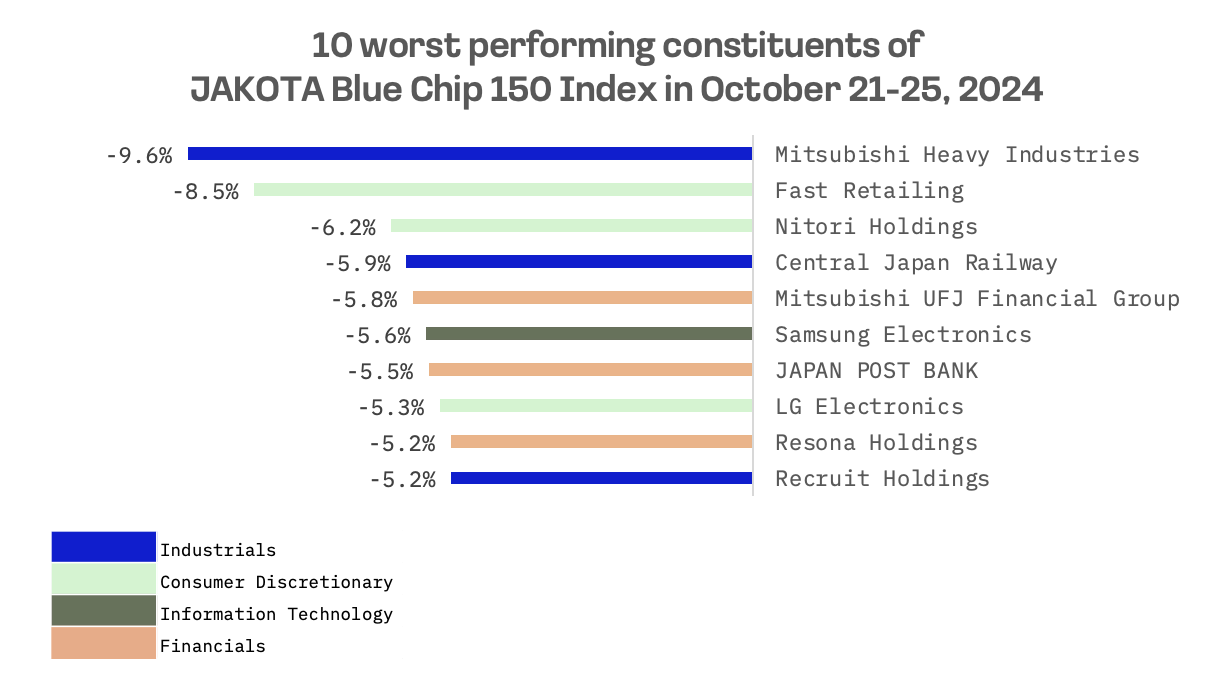

The JAKOTA Blue Chip 150 Index declined 3% this week, with only 28 of its 150 constituents posting gains.

Nidec, a Japanese manufacturer and distributor of electric motors, led the gainers, rising 8.8%. The company reported on Wednesday that its quarterly operating profit increased 10%, helped by cost cutting measures. Nidec maintained its full year outlook, citing expected growth in sales of cooling systems for AI data centers.

Mitsubishi Heavy Industries, a Japanese heavy machinery manufacturer, posted the index’s steepest decline. The company’s shares weakened ahead of Saturday’s House of Representatives election, where defence sector companies figure prominently in Prime Minister Ishiba Shigeru’s policy agenda. Market participants worry the ruling Liberal Democratic Party (LDP) could lose enough seats to threaten its governing coalition’s majority.