Japan

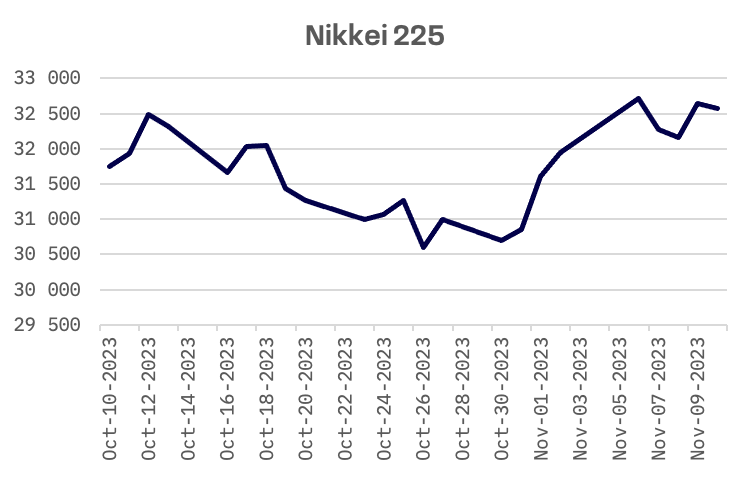

This week, Japan’s stock market witnessed a significant upswing, with the Nikkei 225 Index climbing by 1.9%. This growth was fueled by strong performances in key corporate sectors and reinforced by the government’s unwavering dedication to economic stimulus. However, the market’s buoyancy was later tempered by Federal Reserve Chair Jerome Powell’s hawkish remarks, which raised expectations of enduring high-interest rates to combat inflation.

Bank of Japan (BoJ) Governor Kazuo Ueda emphasized the complexities of normalizing short-term interest rates. He highlighted the potential impacts on financial institutions, borrowers, and overall demand, cautioning that precise policy adjustments are yet to be determined.

The yield on the 10-year Japanese government bond (JGB) declined to 0.85%, down from 0.91% at the end of the previous week. This decrease occurs against the backdrop of the BoJ’s October modification of its yield curve control policy, which introduced more flexibility in managing yields. Previously, 10-year JGB yields were rigidly capped at 1.0%, but now this figure serves more as a reference point than a strict limit. Despite this policy shift, Governor Kazuo Ueda has maintained that a substantial increase in the 10-year JGB yield beyond the 1.0% threshold remains unlikely.

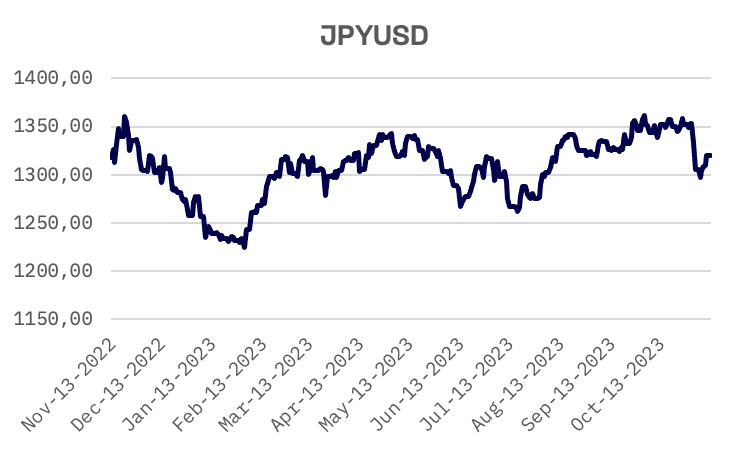

The Japanese yen weakened significantly, falling below the 151 level against the U.S. dollar, a low not seen in approximately 33 years.

Japan’s cabinet has greenlit a supplementary budget exceeding USD 110 billion, aimed at bolstering Prime Minister Fumio Kishida’s economic stimulus initiative. This comprehensive package includes specific reductions in income and residential taxes, as well as direct cash disbursements to low-income earners. These measures are designed to alleviate the inflation-induced strain on households and to promote wage growth. This fiscal response comes at a time when Japan has experienced a contraction in inflation-adjusted real wages and a decline in consumer spending, highlighting significant challenges to individual purchasing power and contributing to increased voter dissatisfaction.

South Korea

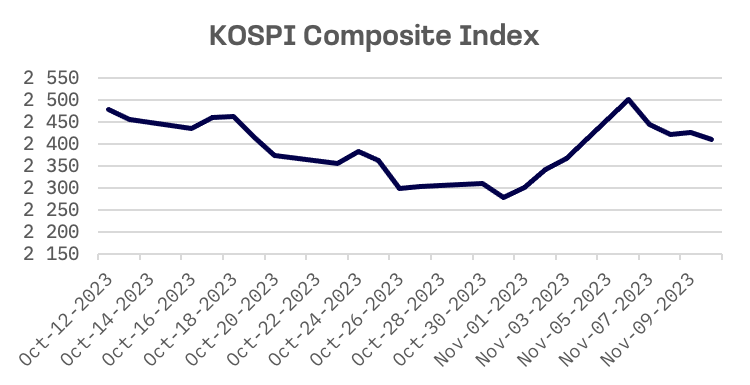

The KOSPI Composite Index in South Korea surged by 1.74% this week, marking its most substantial two-week gain in both points and percentage terms since the week ending January 13, 2023.

This rise was initially fueled by over a 5.66% increase on Monday, following the country’s financial regulators reinstating a ban on stock short selling, effective through June 2024. This decision, made to curb escalating market volatility and counter the perceived threat of illegal short selling practices, notably boosted stocks in the electric vehicle batteries and information technology sectors. However, the market experienced a correction with a decline of over 2.3% on Tuesday as investors took profits from the previous day’s significant gains. The market’s momentum flattened in the second half of the week as investors weighed the hawkish remarks from Federal Reserve Chair Jerome Powell.

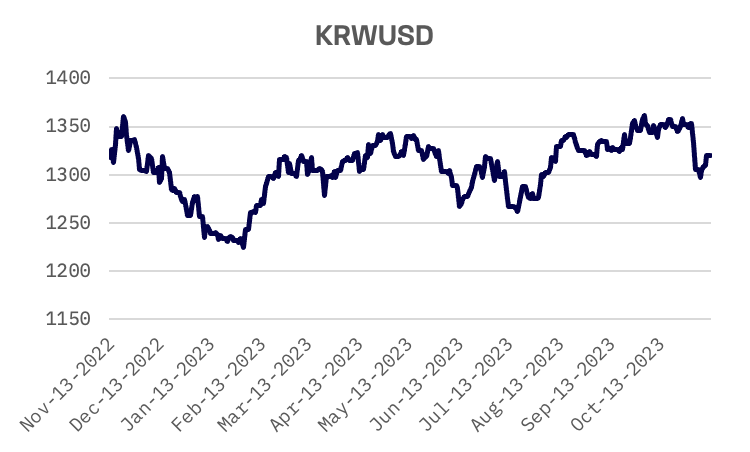

The reintroduction of the short-selling ban positively impacted the local currency, strengthening it against the U.S. dollar.

Additionally, the Korea Development Institute (KDI) announced a revision in its economic forecasts on Thursday. The 2024 growth forecast has been adjusted downwards to 2.2%, a 0.1 percentage point reduction.

Furthermore, the institute revised its 2023 growth projection down to 1.4%, from the previous estimate of 1.5% released in August. This adjustment reflects an anticipated slower expansion of 1.8% in the second half of the year, compared to the earlier forecast of 2.1% growth.

In its release, the KDI stated, ‘Inflation has been decelerating in response to elevated interest rates, although it remains substantially above the central bank’s target of 2%.’ The institute emphasized the continued necessity of maintaining a tight monetary policy in the current economic climate.

Taiwan

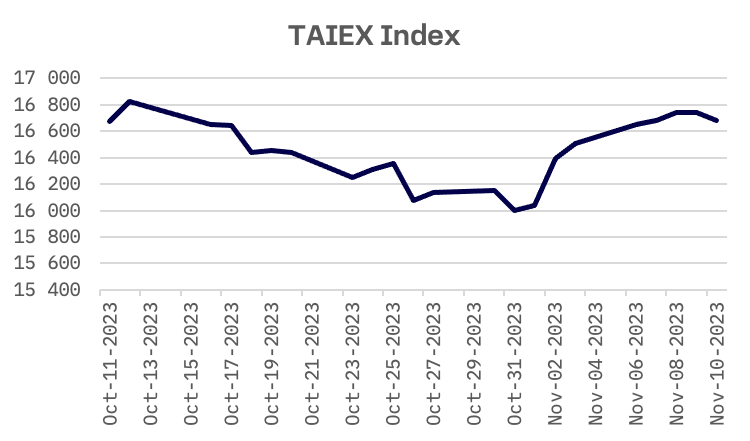

The TAIEX index in Taiwan registered a 1.1% gain over the last week, concluding a seven-session upward streak on Friday. Notably, the market faced downward pressure, particularly in the bellwether electronics sector, following losses in U.S. tech stocks the previous night. This sentiment was further influenced by Federal Reserve Chair Jerome Powell’s hawkish comments on U.S. monetary policy, leading to an increase in U.S. treasury yields and dampening both domestic and international investor interest in tech stocks.

In economic data, Taiwan’s exports saw a 4.5% year-over-year decline in October, reversing a brief rebound from September. This was reported by the Ministry of Finance (MOF) on Tuesday, with the electronics component industry, crucial to Taiwan’s exports, recording a 7.4% year-on-year decrease.

On Wednesday, the Taiwan Institute of Economics Research (TIER) announced its GDP growth projection for 2024 at 3.15%. The institute cited factors including stable domestic demand, a resurgence in exports, and the global trade recovery as drivers of this growth.

Additionally, Taiwan Semiconductor Manufacturing Co. (TSMC) reported a significant nearly 35% surge in October sales compared to September, reaching a new monthly record. This robust growth is attributed to strong demand for the company’s advanced chip process technology.

JAKOTA Blue Chip 150 Index

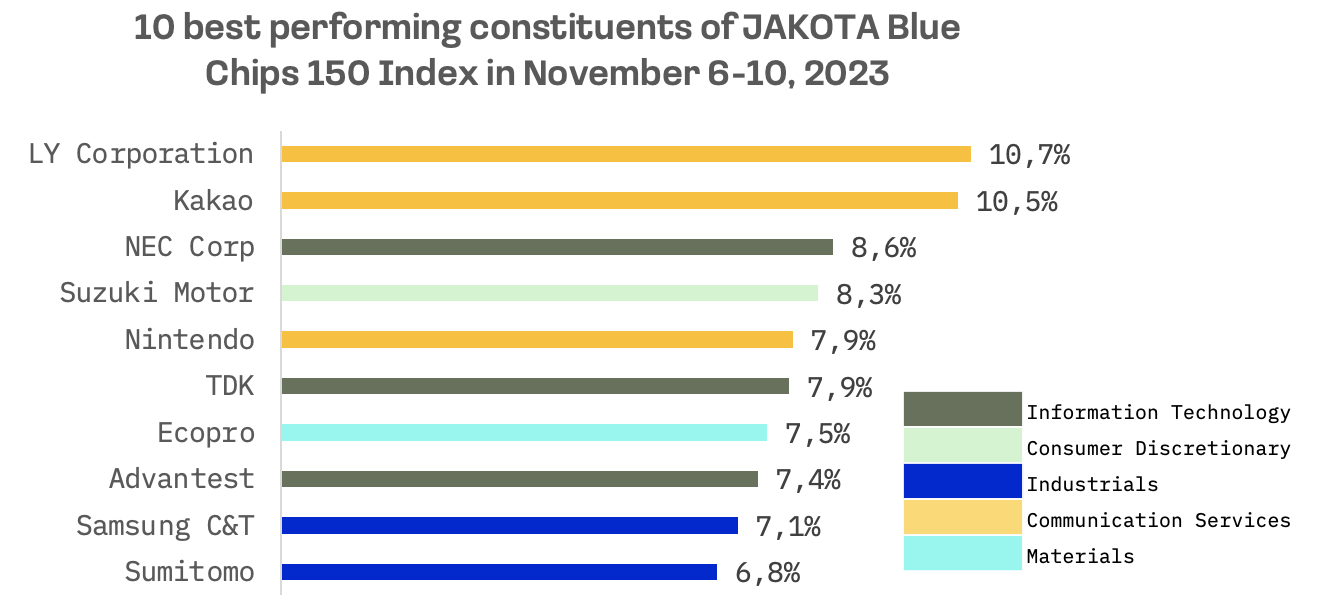

Out of a pool of 150 constituents in the JAKOTA Blue Chip 150 Index, 99 shares demonstrated positive price trends this week. The top performers included LY Corporation and Kakao.

Japanese LY Corporation reported robust quarterly results, with Q2 revenue reaching JPY 441.2 billion, marking a significant year-over-year increase of 11.9%. Additionally, its adjusted EBITDA reached JPY 103.3 billion, reflecting a substantial year-over-year growth of 28.1%, establishing new records for the company’s highest Q2 revenue and income.

Kakao, the South Korean internet giant, also reported strong performance, benefiting from the impact of the short-selling ban. Its cumulative net profit for the third quarter of this year was approximately 279.3 billion won, a 37.9% increase compared to the previous year. This figure stands as the largest ever for the company’s third-quarter cumulative net profit, surpassing market expectations by 16.6%.

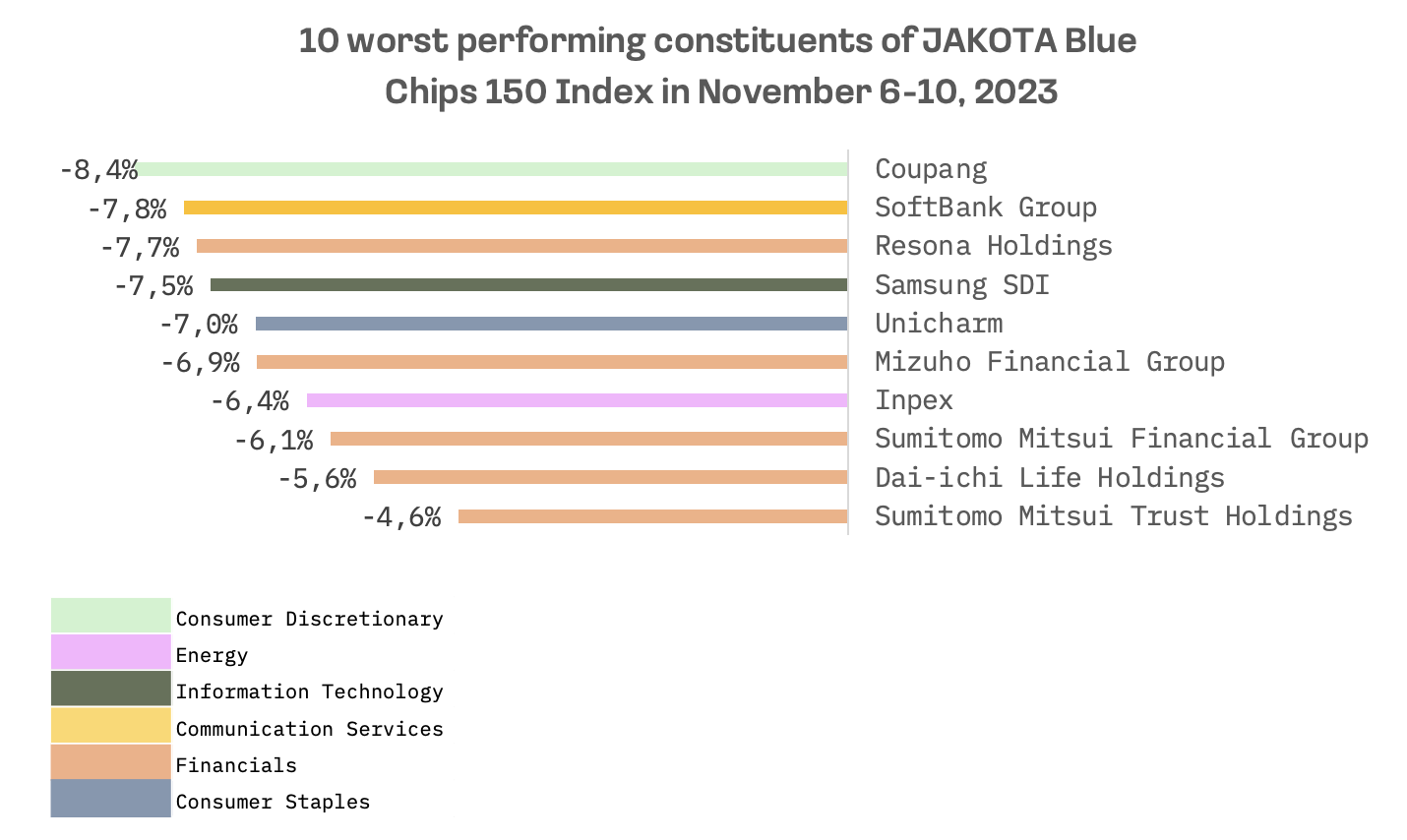

Conversely, Coupang was the worst-performing constituent of the JAKOTA Blue Chip 150 Index. Reporting financial results on November 7, the company announced a revenue of $6.2 billion, exceeding expectations by $260 million. However, it failed to garner a positive investor response, as its earnings per share of $0.05 missed estimates by $0.02. Additionally, being listed on the NYSE, Coupang did not benefit from the short-selling ban that applied to other Korean stocks.