Last week’s Jakota markets:

- Japan’s Nikkei 225 Index surged 3.8%, as investors cheered U.S. election results and Fed rate cut, despite corporate earnings concerns

- South Korea’s KOSPI edged up 0.7%, boosted by the withdrawal of planned capital gains tax, though gains were limited by Trump victory concerns

- Taiwan’s TAIEX climbed 3.4%, lifted by strong electronics sector performance and record October exports driven by AI demand

- The JAKOTA Blue Chip 150 Index added 3.4%, highlighting biotech sector strength while Trump victory pressured battery related stocks

Japan

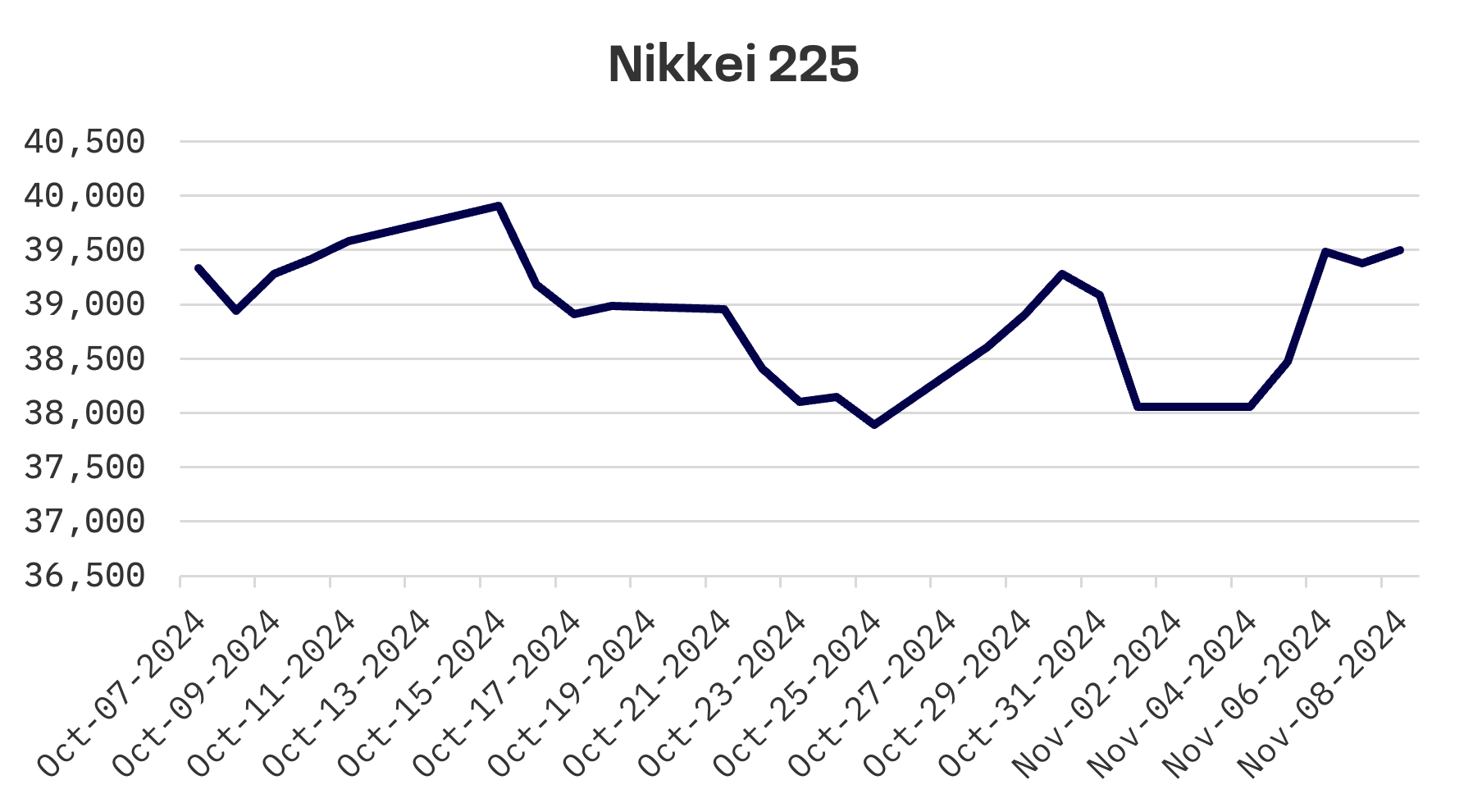

Japanese stocks advanced 3.8% last week, with the Nikkei 225 Index gaining ground as investors welcomed the U.S. presidential election results and Federal Reserve rate cut. These external factors overshadowed the domestic corporate earnings season, where several companies lowered their guidance.

Market participants anticipate the Bank of Japan could implement a rate increase as early as January 2025. Minutes from the central bank’s September policy meeting, released last week, revealed board members’ agreement that additional rate increases would be appropriate if economic and inflation forecasts meet expectations. The board emphasised monitoring overseas economic developments, particularly in the U.S., given their potential impact on Japan’s recovery trajectory.

The yen strengthened to around ¥152 against the dollar from ¥153 the previous week, following an initial decline after U.S. election results. The currency’s appreciation pressured the nation’s export sector. Atsushi Mimura, Japan’s senior currency official, noted sharp, one sided exchange rate movements, stating that authorities are monitoring markets with increased vigilance and remain ready to counter excessive volatility. Finance Minister Katsunobu Kato reinforced this position, indicating officials are closely tracking potential economic and financial impacts from Donald Trump’s election victory, given the U.S. and Japan’s interconnected economic relationship.

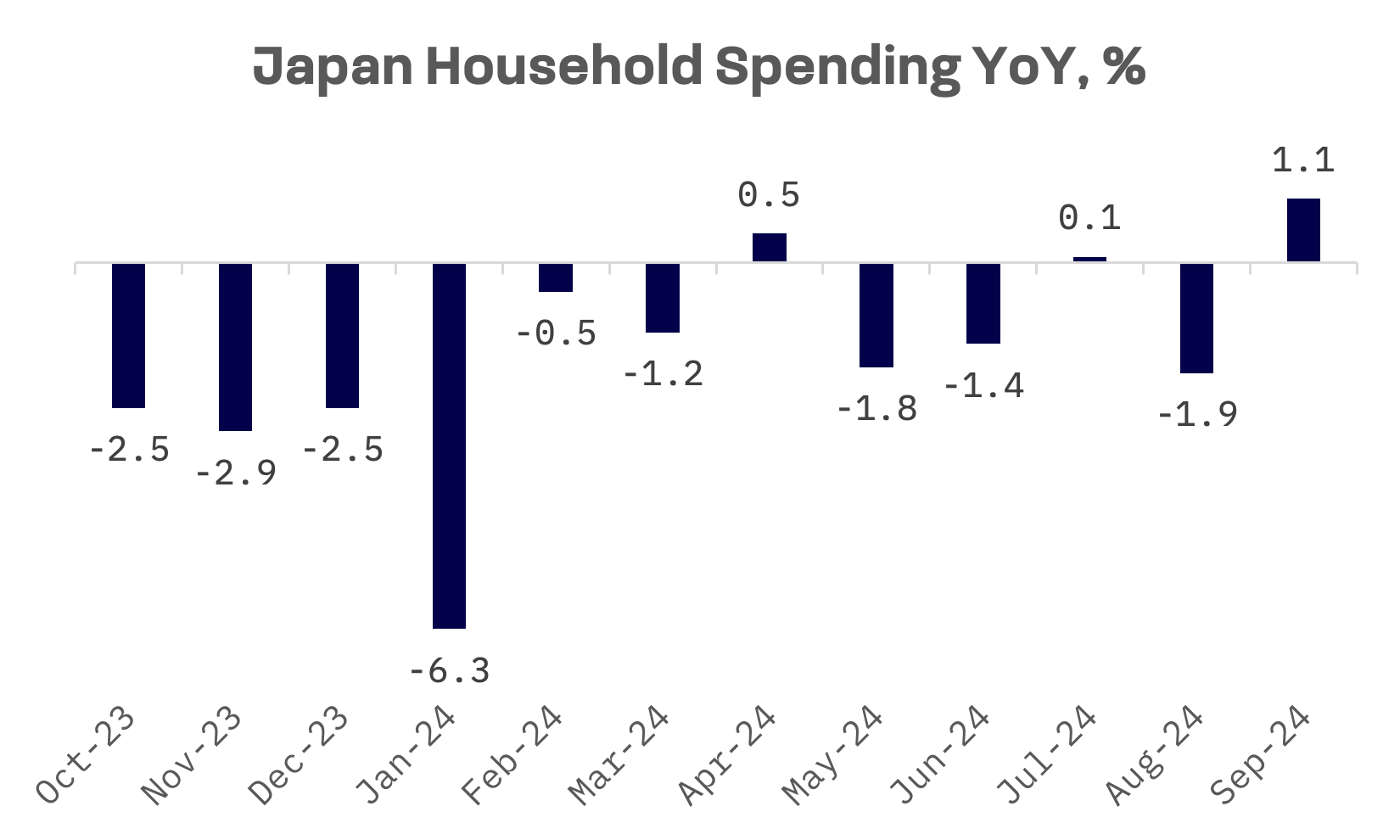

Japanese household spending showed unexpected resilience, falling 1.1% in September from a year earlier, less than economists’ projected 2.1% decline, suggesting sustained consumer spending despite inflation pressures.

Inflation adjusted wages declined 0.1% in September, following August’s revised 0.8% drop. While nominal wages increased 2.8%, meeting forecasts, they failed to keep pace with September’s 2.9% consumer inflation rate.

South Korea

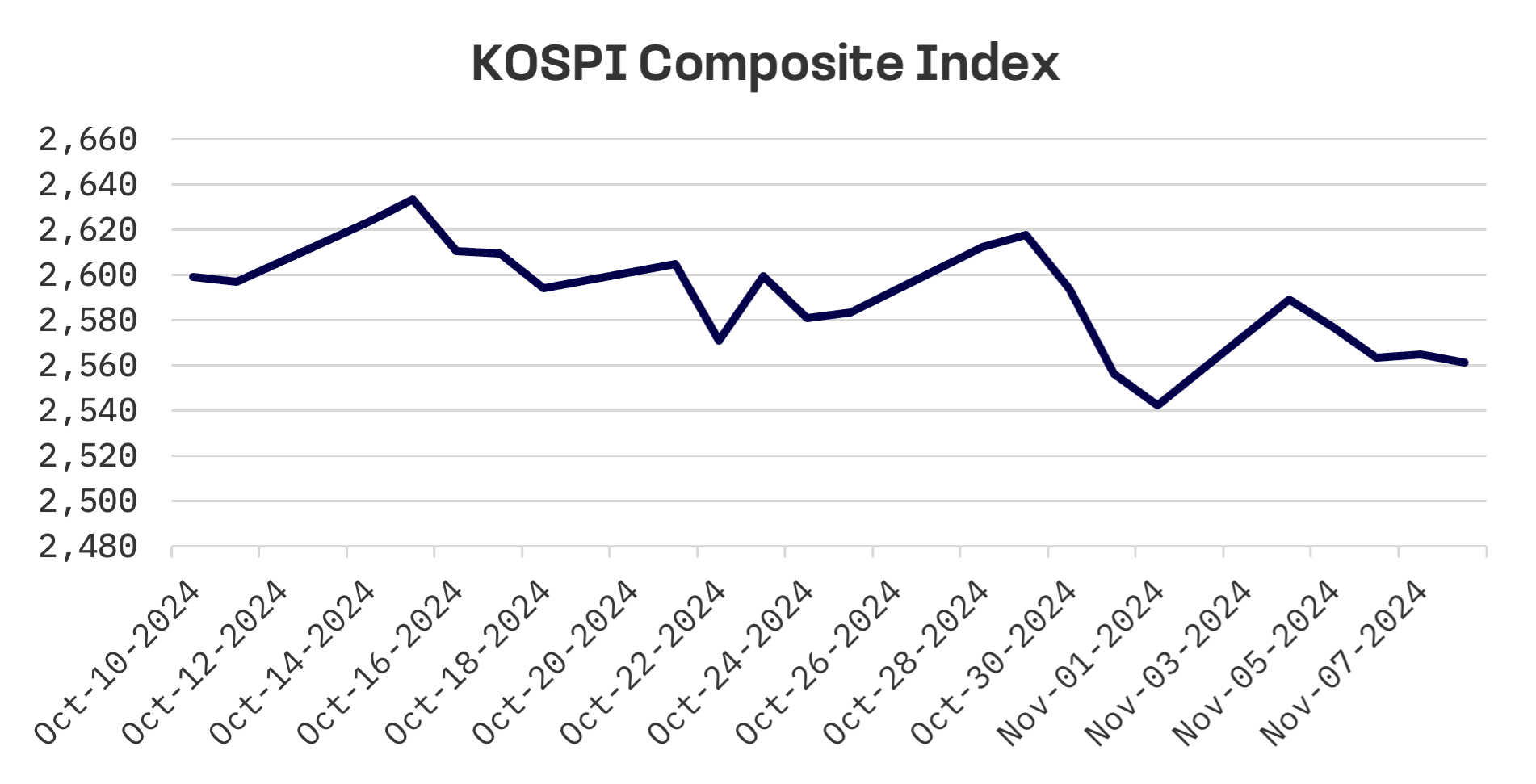

South Korean equities posted modest gains last week, with the KOSPI Index rising 0.7%. The advance was primarily driven by Monday’s rally after the Democratic Party of Korea withdrew plans for a capital gains tax on domestic stock investments scheduled for next year. Market sentiment weakened on Tuesday as investors grew cautious ahead of the U.S. presidential election and Federal Reserve meeting. The index extended losses on Wednesday as growing expectations of a Trump victory weighed on equities. A brief rebound followed on Thursday as investors evaluated potential sector impacts under a Trump administration, but stocks retreated on Friday on policy shift concerns, with limited support from the Fed’s rate cut.

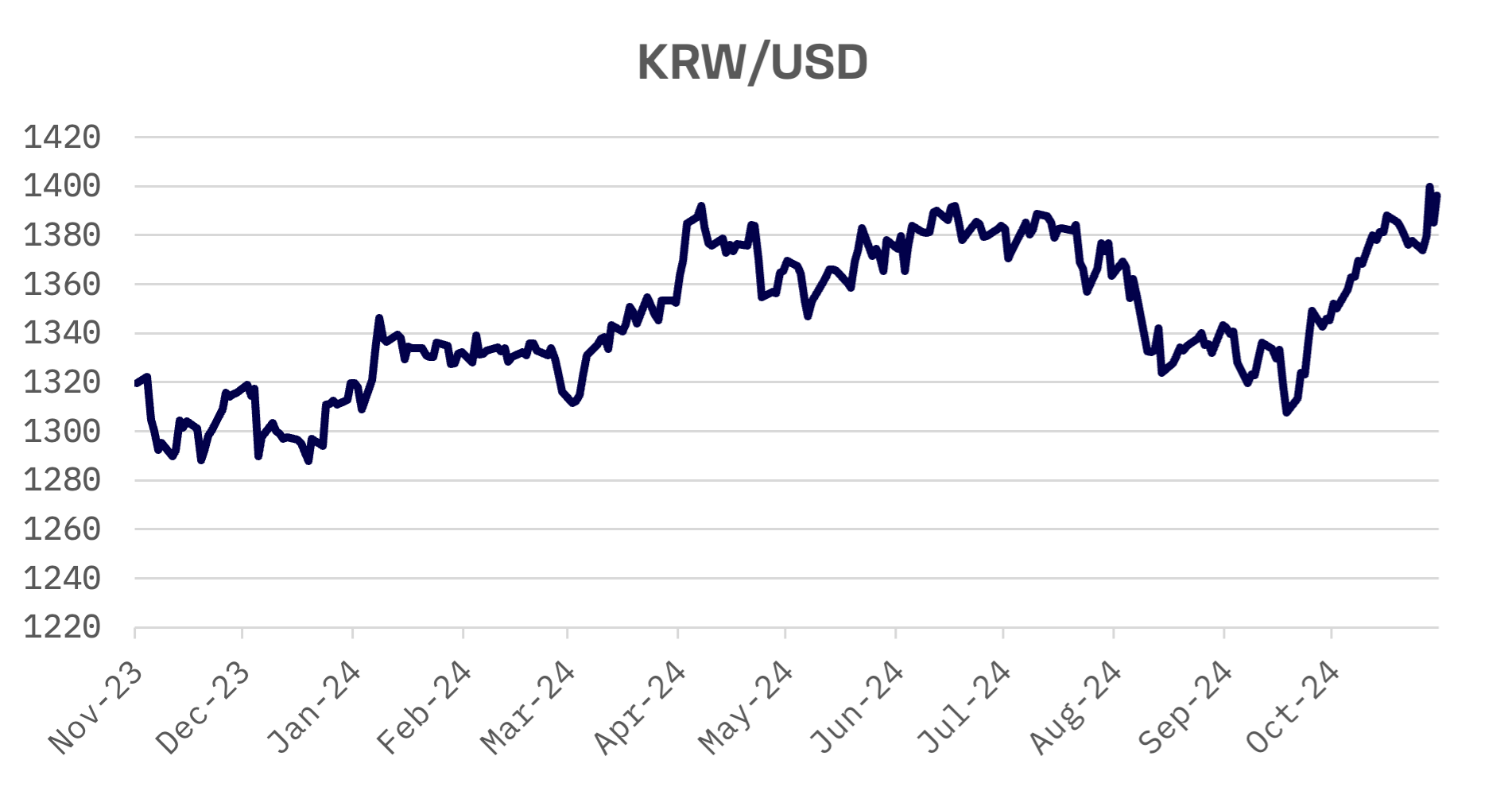

The South Korean won fell to a two year low against the dollar on Wednesday as investors bought the U.S. currency, anticipating increased fiscal spending and tax cuts under a Trump administration that could boost government debt issuance and market interest rates.

The Bank of Korea (BOK) warned on Friday of increased uncertainties in global growth, inflation and major economies’ monetary policies following Trump’s victory. The central bank committed to enhanced market monitoring and timely intervention as needed.

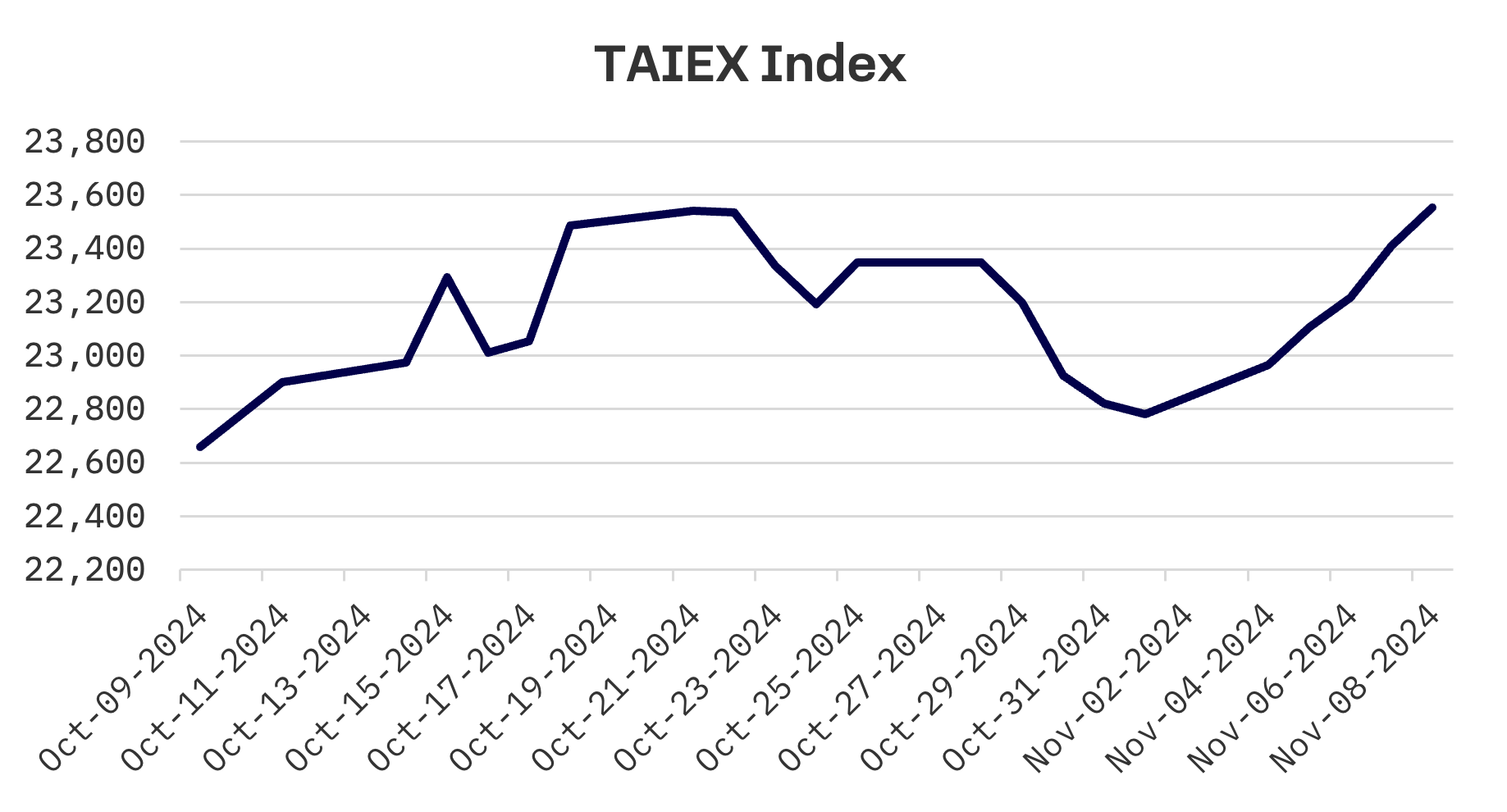

Taiwan

Taiwanese stocks rose 3.4% last week, with the TAIEX Index benefitting from gains in large cap electronics shares. The rally followed reduced uncertainty after the U.S. presidential election and Federal Reserve rate cut, which sparked a rally in U.S. technology stocks and helped lift Taiwan’s tech heavy index.

Taiwan’s exports hit a record October high, rising 8.4% from a year earlier to $41.3 billion, marking the twelfth consecutive monthly increase. The Ministry of Finance attributed the gains to strong demand for AI related products.

JAKOTA Blue Chip 150 Index

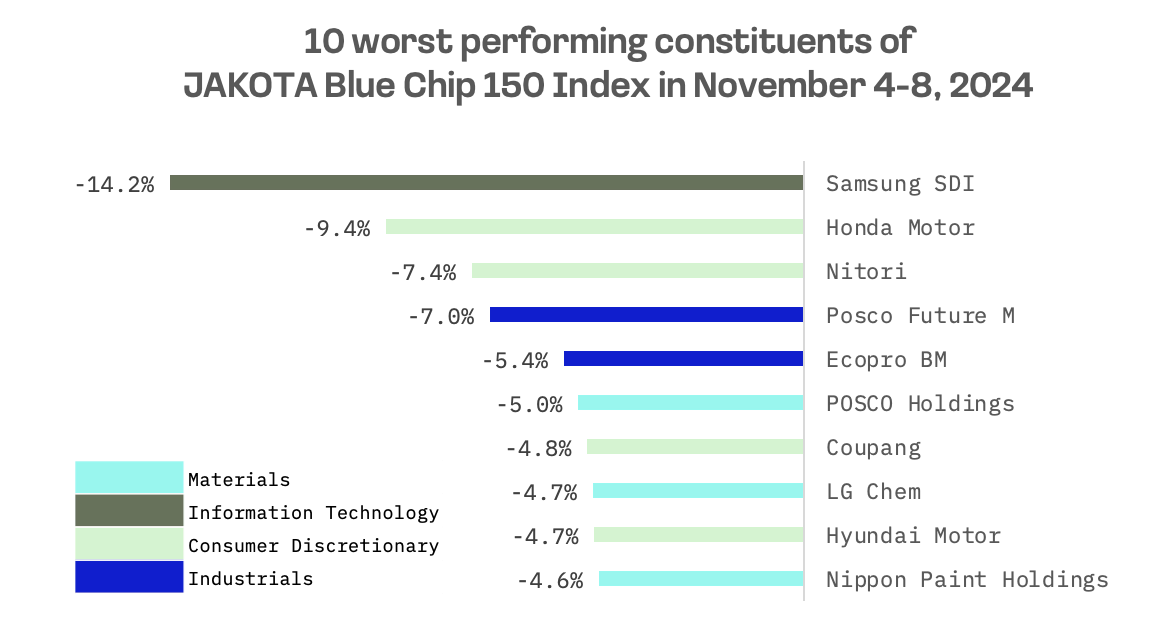

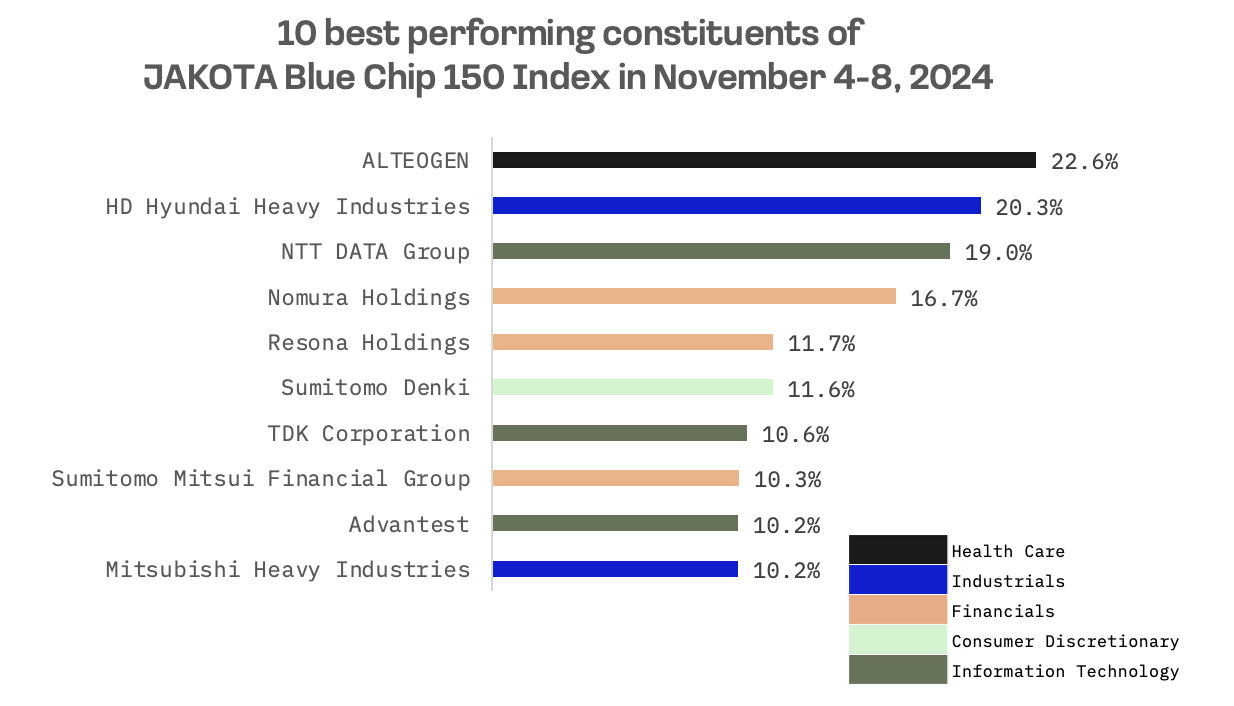

The JAKOTA Blue Chip 150 Index advanced 3.4% last week, with 110 of 150 constituents posting gains.

ALTEOGEN, a Korean biotech company specialising in long acting biobetters, proprietary antibody drug conjugates and antibody biosimilars, led advances with a 22.4% surge after signing a deal worth up to $300 million with Daiichi Sankyo to develop a subcutaneous version of Enhertu, a cancer drug partnered with AstraZeneca.

ALTEOGEN will receive an upfront payment of $20 million, with an additional $280 million available from Daiichi Sankyo if the new subcutaneous formulation of Enhertu (trastuzumab deruxtecan) successfully reaches the market and meets sales targets.

Battery sector stocks, including Samsung SDI, Posco Future M, Ecopro BM and LG Chem, experienced a selloff following Trump’s November 5 election victory. Investors grew concerned about the sector’s outlook under Trump, who has opposed green initiatives and criticised electric vehicle tax credits as “outrageous.”