Last week’s Jakota markets:

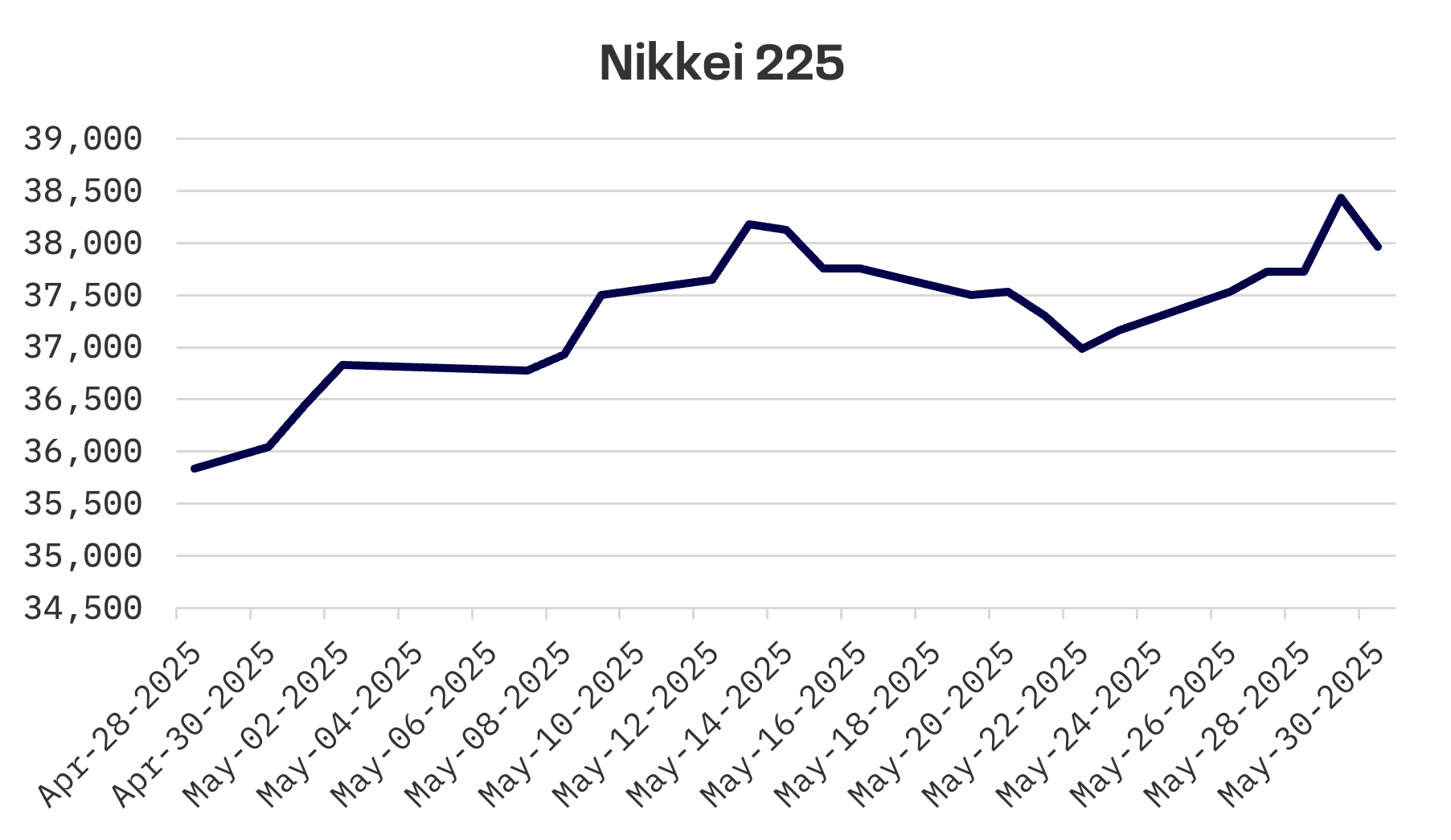

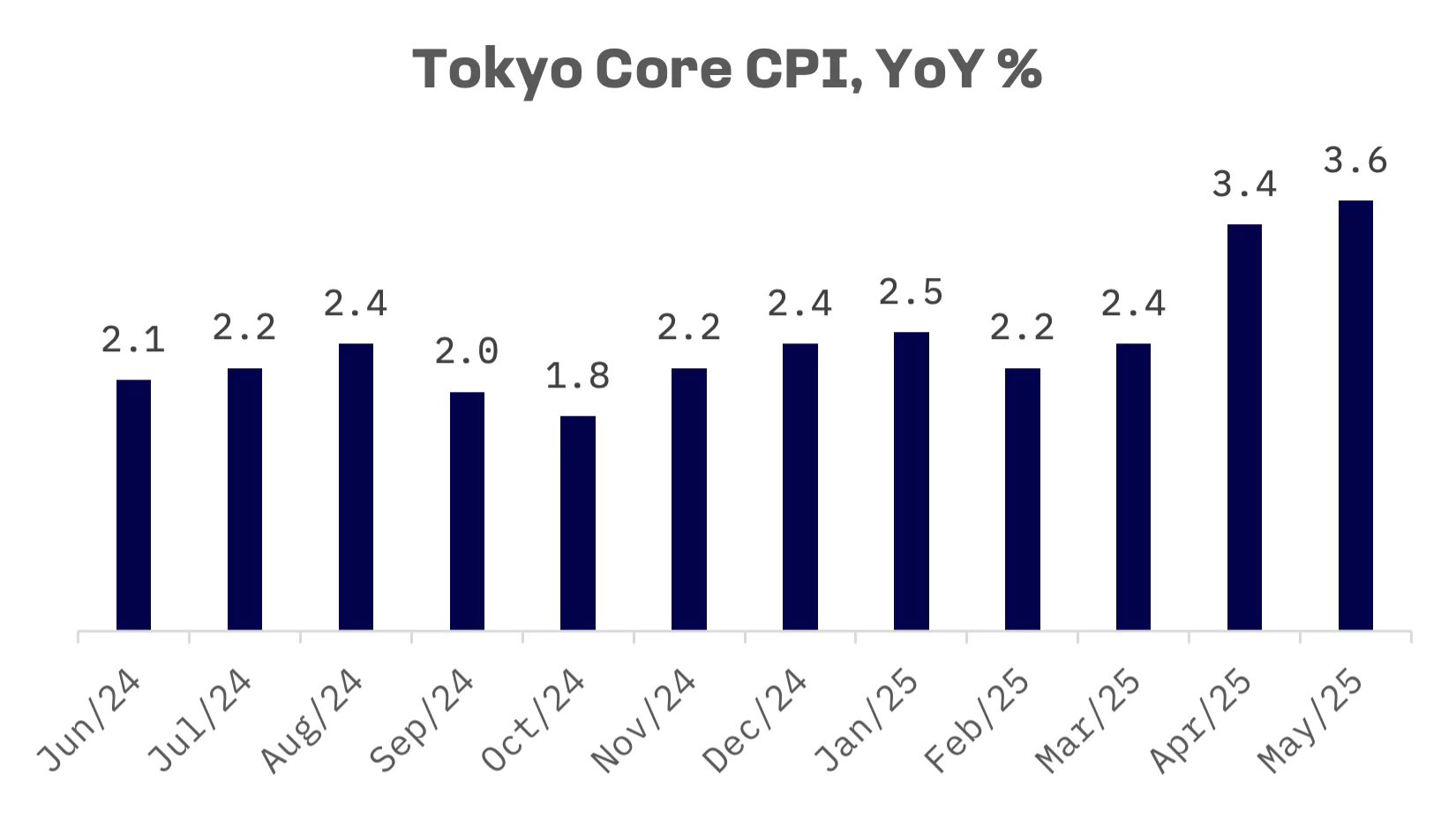

- Japan’s Nikkei 225 surged 2.17% as U.S.-Japan trade deal optimism intensified following Trump’s endorsement of Nippon Steel’s U.S. Steel bid, while Tokyo inflation hit a two year high of 3.6%

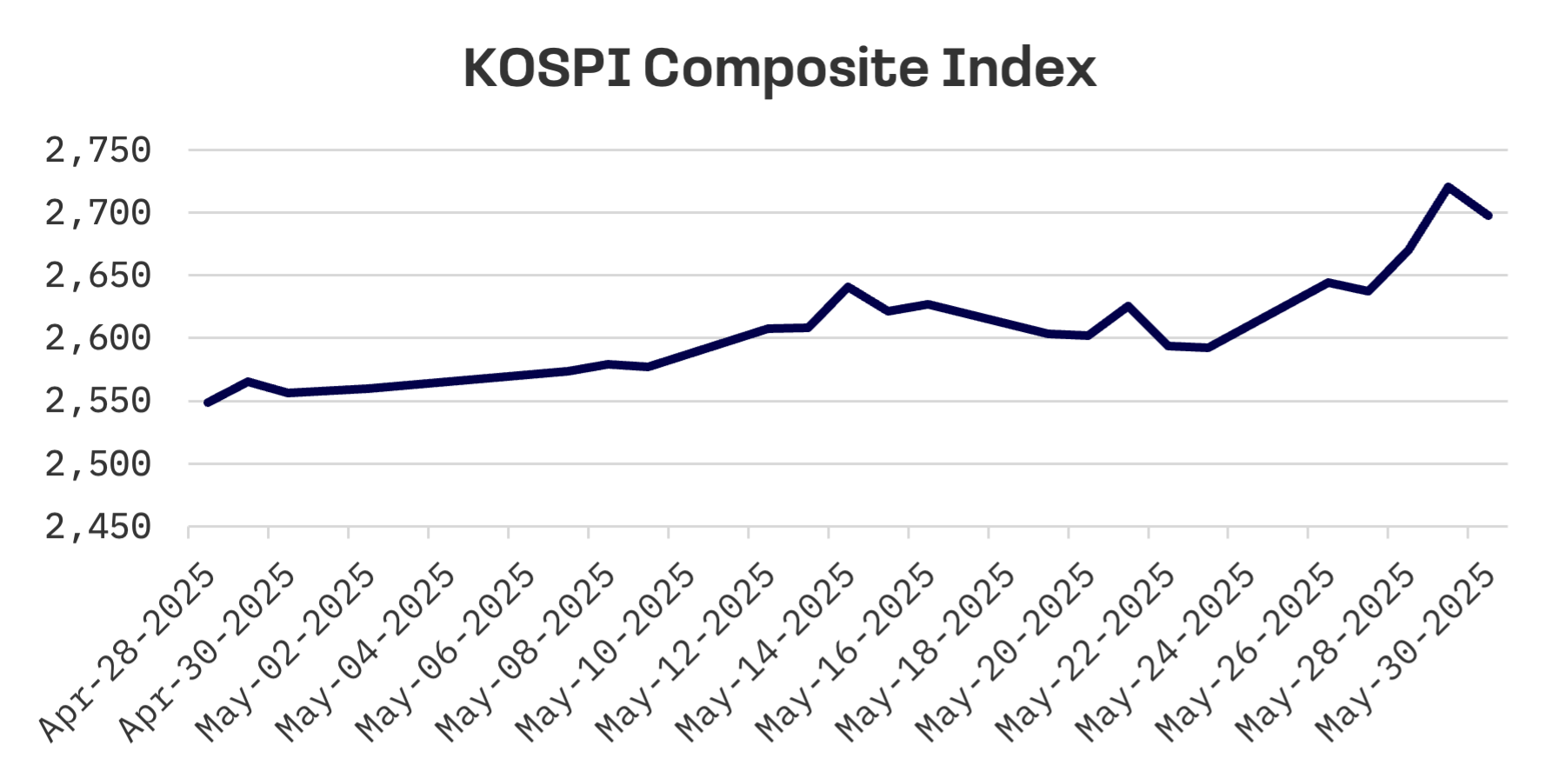

- South Korea’s KOSPI soared 4.1% to 10 month highs, buoyed by tech rally and rate cut expectations as the central bank delivered its first easing since 2021

- Taiwan’s TAIEX fell 1.4% during a holiday shortened week, trailing regional peers as tariff worries persisted and economic growth projections were trimmed to 3.1% for 2025

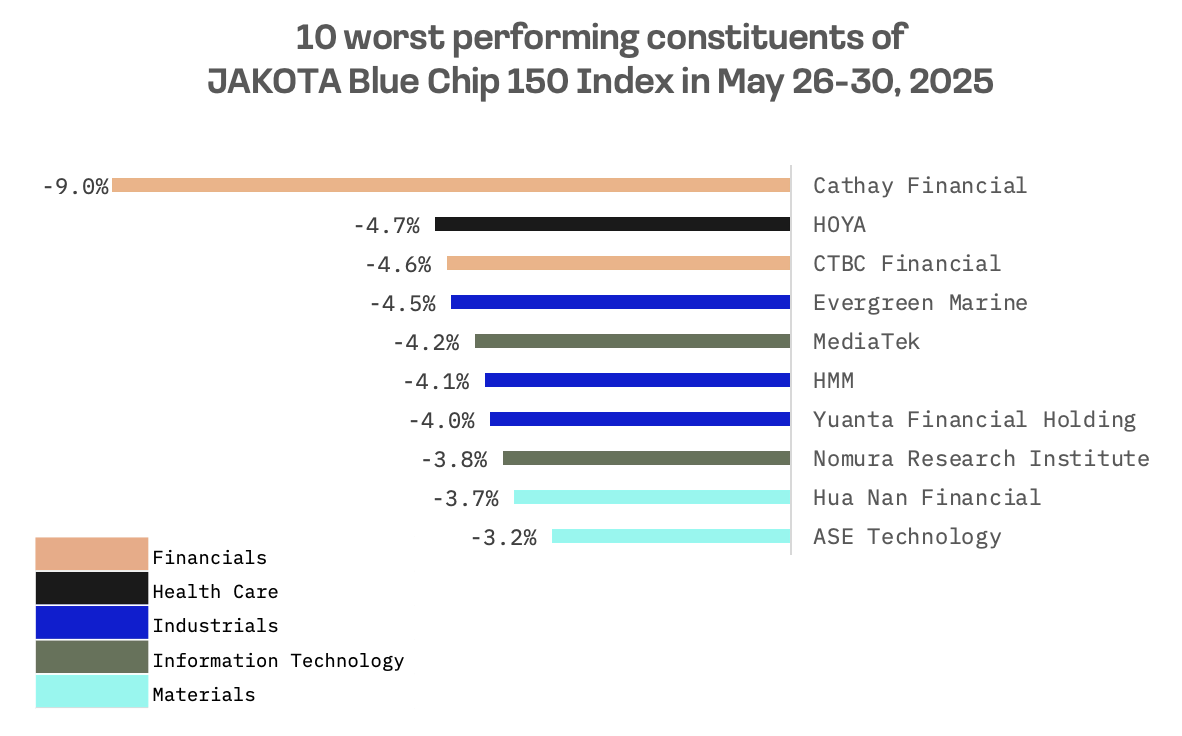

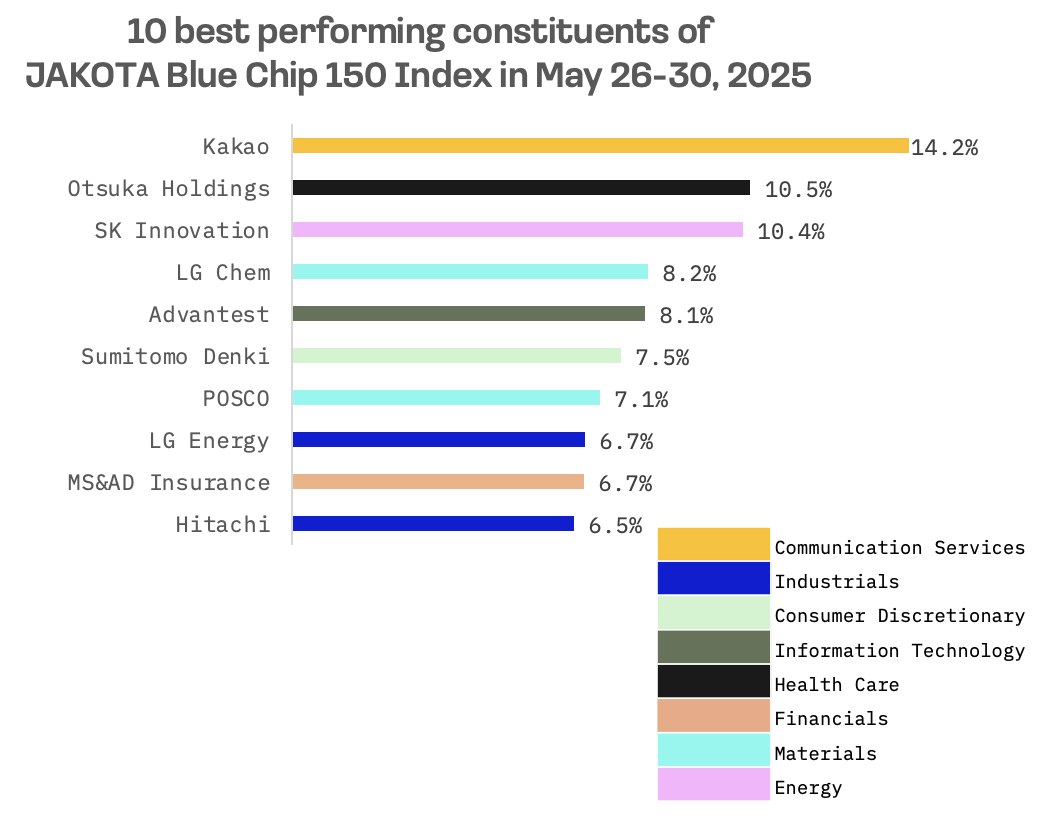

- The JAKOTA Blue Chip 150 Index posted 1.6% gains with 77% of constituents rising, highlighted by Kakao’s AI driven 14.2% surge contrasting with Cathay Financial’s downgrade led decline

Japan

Japan’s stock market advanced over the week, with the Nikkei 225 climbing 2.17% as investors grew increasingly optimistic about a potential U.S.-Japan trade agreement. Prime Minister Shigeru Ishiba and U.S. President Donald Trump held what officials described as a “constructive” phone call on Thursday, setting the stage for the next round of trade negotiations in Washington.

Speculation about a possible deal gained momentum after Trump publicly endorsed Nippon Steel’s proposed acquisition of U.S. Steel, raising hopes that negotiators could reach a breakthrough before the G7 summit in mid June, where the two leaders are scheduled to meet.

Tokyo’s core consumer prices accelerated to 3.6% year-over-year in May, up from April’s 3.4% increase and marking the fastest pace in more than two years. The reading exceeded market expectations of 3.5%, reinforcing views that inflationary pressures remain persistent.

The stronger than expected inflation data sparked speculation about a potential interest rate increase, though Bank of Japan (BoJ) Governor Kazuo Ueda maintained the central bank’s cautious policy stance. Ueda attributed the recent downward revision to the inflation outlook to mounting global growth risks tied to trade uncertainty, easing cost push pressures and declining oil prices. He emphasised that the BoJ remains committed to its 2% inflation target and would adjust policy as needed, though not imminently.

The robust inflation data, combined with the reversal of an illegal tariff ruling, helped drive the yen beyond ¥144 per dollar.

South Korea

South Korean equities rallied this week, with the KOSPI index surging 4.1% to a 10 month high on Thursday, powered by a technology led advance. Investor sentiment received a boost from strong earnings at U.S. chip giant Nvidia and a temporary suspension of U.S. tariffs on the European Union, which fuelled demand for riskier assets.

The Bank of Korea (BOK) cut its benchmark interest rate by 25 basis points to 2.5% on Thursday, as policymakers cited weakening economic growth and stable inflation. The widely anticipated decision marked the central bank’s first rate reduction since it began tightening monetary policy in 2021.

In a statement following its policy meeting, the Monetary Policy Board pointed to a “considerable” decline in South Korea’s growth outlook while noting that inflation remains broadly stable.

The central bank described the economy as maintaining a “sluggish pace” into the second quarter after contracting in the first quarter. Domestic demand is expected to recover only “modestly,” while exports face additional headwinds from U.S. trade actions.

BOK Governor Rhee Chang-yong signalled the door remains open for additional easing, with four of six board members supporting the option of rate cuts within the next three months.

While the central bank reiterated its commitment to stabilising inflation, it also emphasised a balanced approach that considers economic growth and financial stability. The board reaffirmed its dovish stance, citing the need to cushion downside risks to the economy, but flagged concerns over a potential increase in household debt and heightened foreign exchange market volatility under prolonged accommodative conditions.

Taiwan

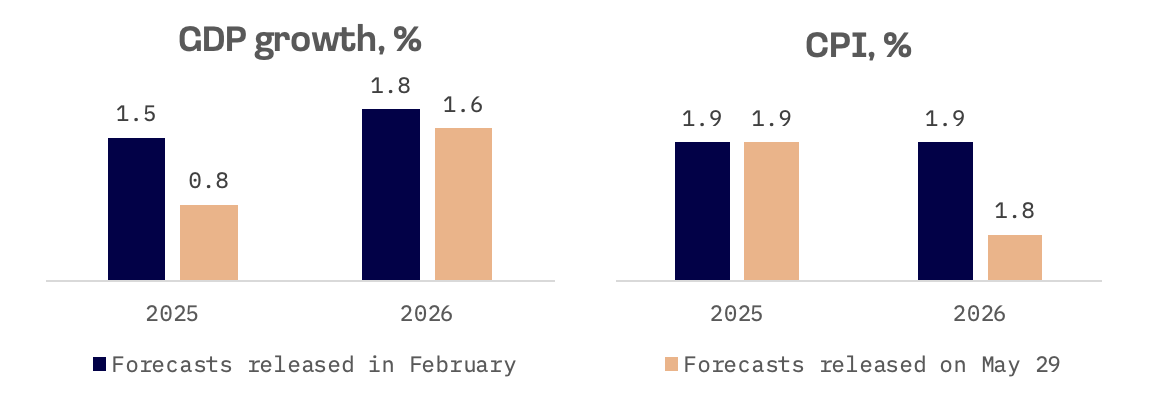

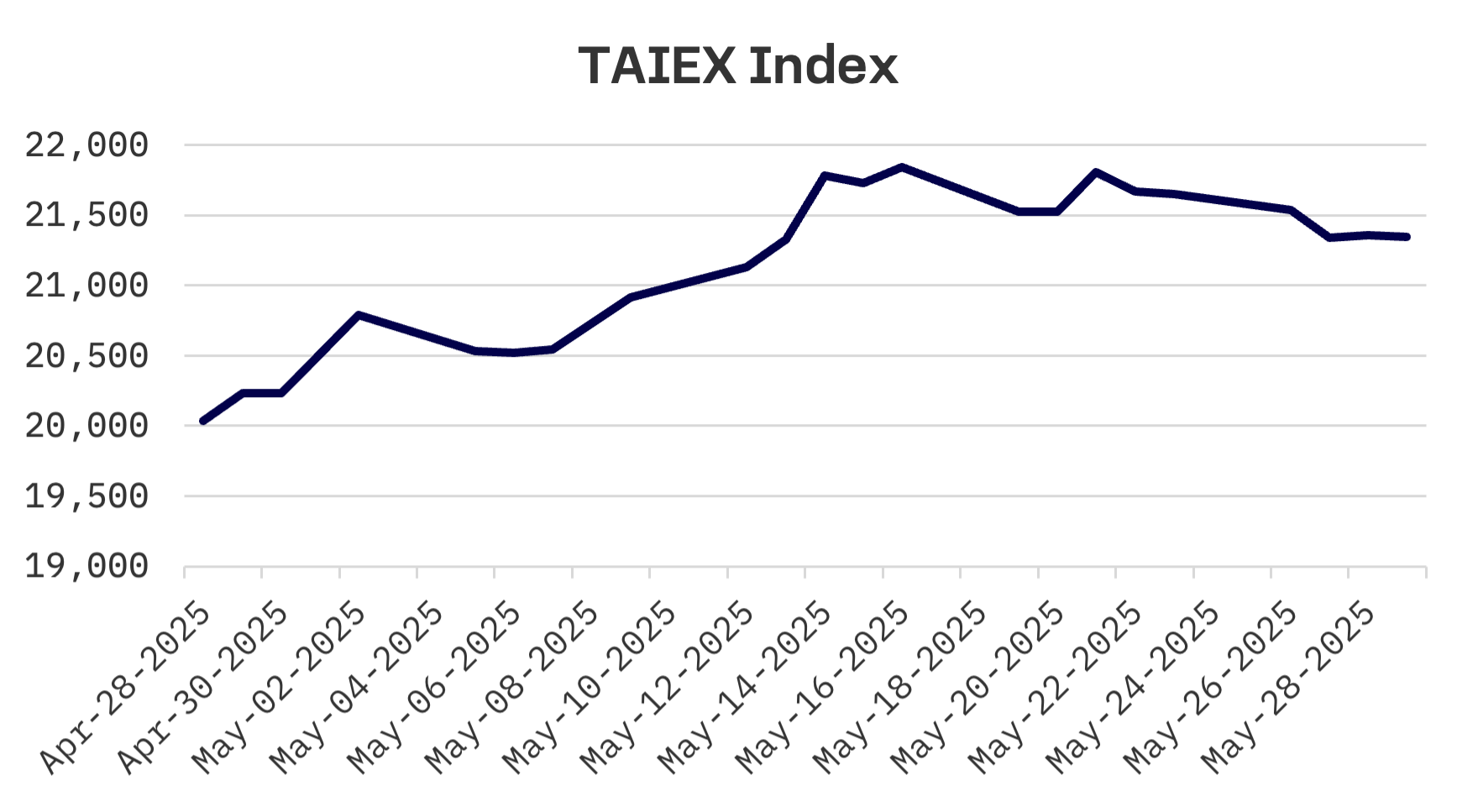

Taiwan’s stock market lagged behind its Jakota peers this week, with the TAIEX slipping 1.4% during a holiday shortened trading period. Markets were closed on Friday for the Dragon Boat Festival. The decline reflected profit taking by investors who remained cautious amid persistent concerns over potential U.S. tariff actions.

Taiwan’s statistics agency trimmed its 2025 GDP growth forecast to 3.1%, citing global economic headwinds that may dampen consumer sentiment and investment appetite. The National Development Council noted signs of recovery in April, supported by robust demand for AI related applications that lifted manufacturing activity, but cautioned that external uncertainties continue to pose risks to the outlook.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index added 1.6% this week, with 116 of its 150 constituent stocks posting gains.

Kakao, a South Korean internet conglomerate, surged 14.2% to become the top performing stock on the JAKOTA Blue Chip 150 Index this week after OpenAI announced plans to develop AI products in South Korea in partnership with the chat app operator.

Cathay Financial, a leading Taiwanese financial institution, was the worst performer on the JAKOTA Blue Chip 150 Index this week, weighed down by a Goldman Sachs downgrade. The investment bank cut its rating on the financial services company to Neutral from Buy on May 27 and reduced its price target.

The downgrade cited “potential uncertainties regarding FY25 profit,” with Goldman highlighting downside risks from an expected 5% appreciation of the New Taiwan dollar against the U.S. dollar over the next year. While Cathay has demonstrated some resilience to currency fluctuations, a stronger New Taiwan dollar could pressure earnings and potentially affect dividend expectations.