Last week’s Jakota markets:

- Japan’s Nikkei 225 eked out a 0.5% gain amid mixed trading and currency headwinds, buoyed by upbeat economic data

- South Korea’s KOSPI found strong footing, climbing 3.3%, as traders reacted to easing inflation and anticipated shifts in U.S. monetary policy

- Taiwan’s TAIEX hit a new high, up 1.8%, propelled by excitement over TSMC’s AI business prospects

- The JAKOTA Blue Chip 150 Index advanced 2.3%, with gains concentrated in the secondary battery and electric vehicle sectors, indicating a market turnaround

Japan

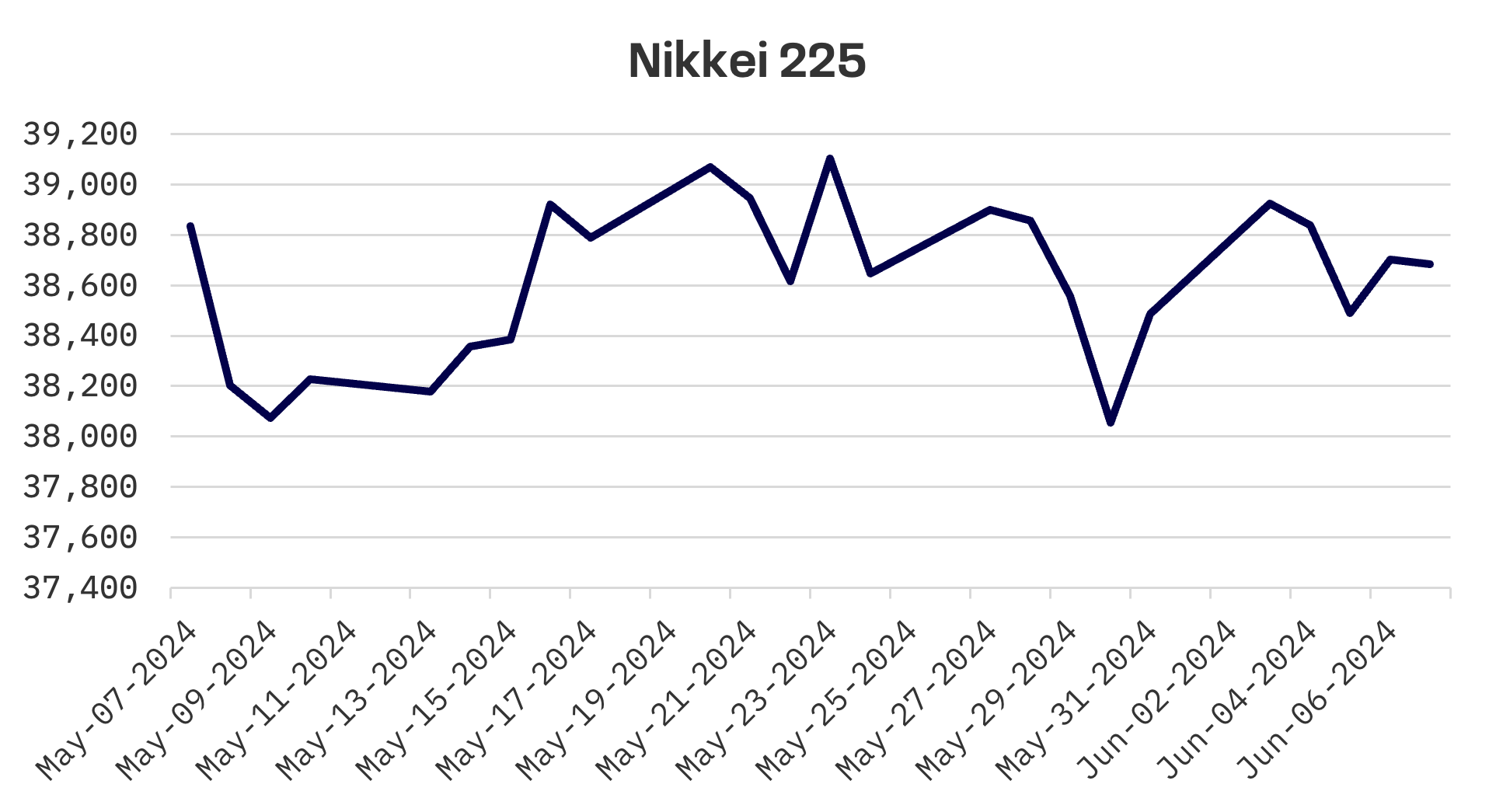

The Nikkei 225 Index in Japan experienced a mixed week but ultimately closed up by 0.5%. It rose on Monday, fell on Tuesday and Wednesday, rallied on Thursday, and then slipped again on Friday. The yen strengthened slightly to JPY 155 from JPY 157 the previous week, which posed challenges for exporters due to the increased cost of Japanese goods overseas.

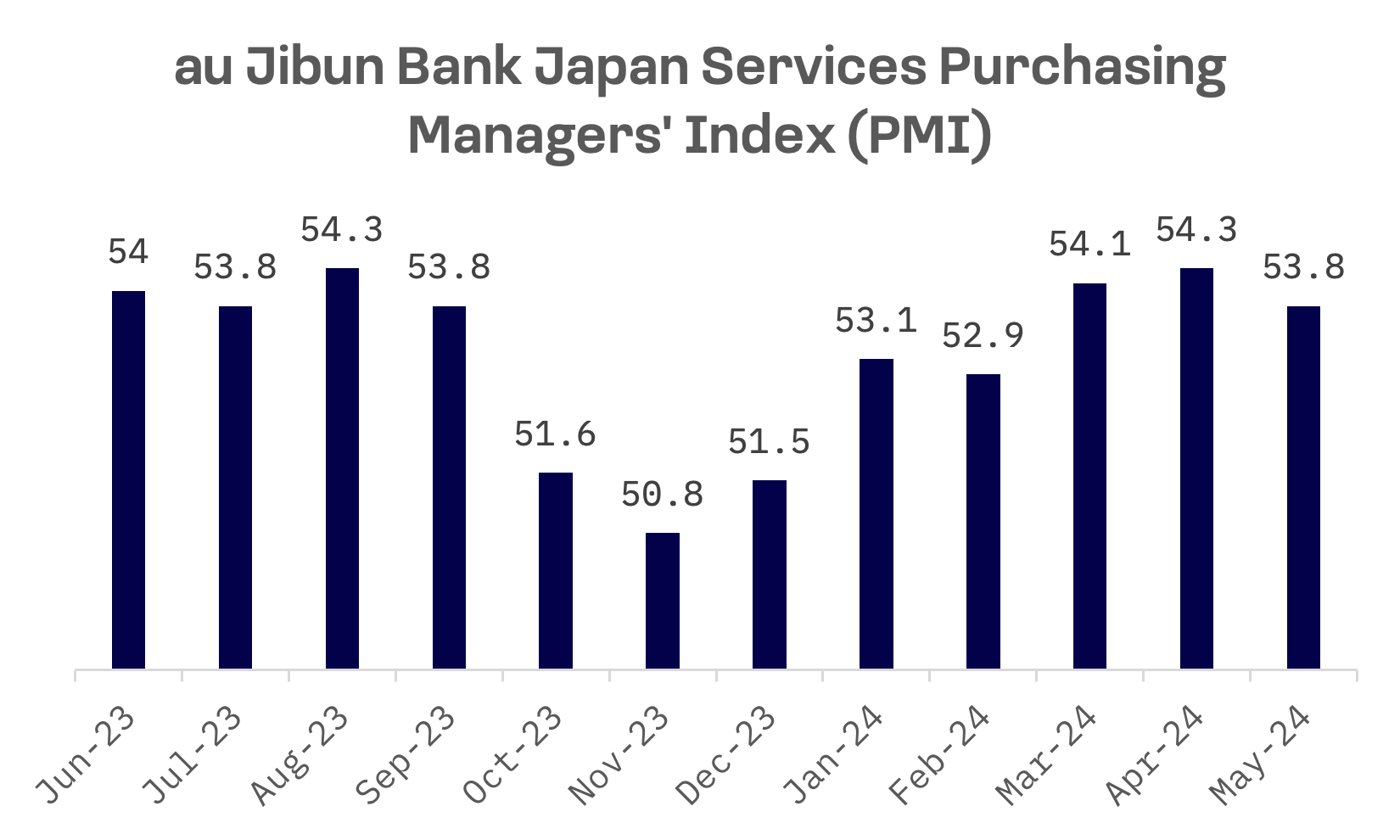

Positive economic indicators, however, bolstered market sentiment. Despite inflationary pressures heightening expectations for another rate increase this year, the final au Jibun Bank Service Purchasing Managers’ Index (PMI) for May recorded a slight decrease to 53.8 from 54.3 in April but remained firmly above the 50-mark that separates contraction from expansion since September 2022. Private consumption also showed signs of improvement, with household spending increasing year-over-year in April for the first time in 14 months.

Finance Minister Shunichi Suzuki confirmed that his ministry intervened in the foreign exchange market between April 29 and May 29 to counter excessive currency moves. He stated that the yen-buying intervention had some effect. However, the efficacy of such measures is limited by the significant U.S.-Japan interest-rate differential expected to continue weighing on the yen.

South Korea

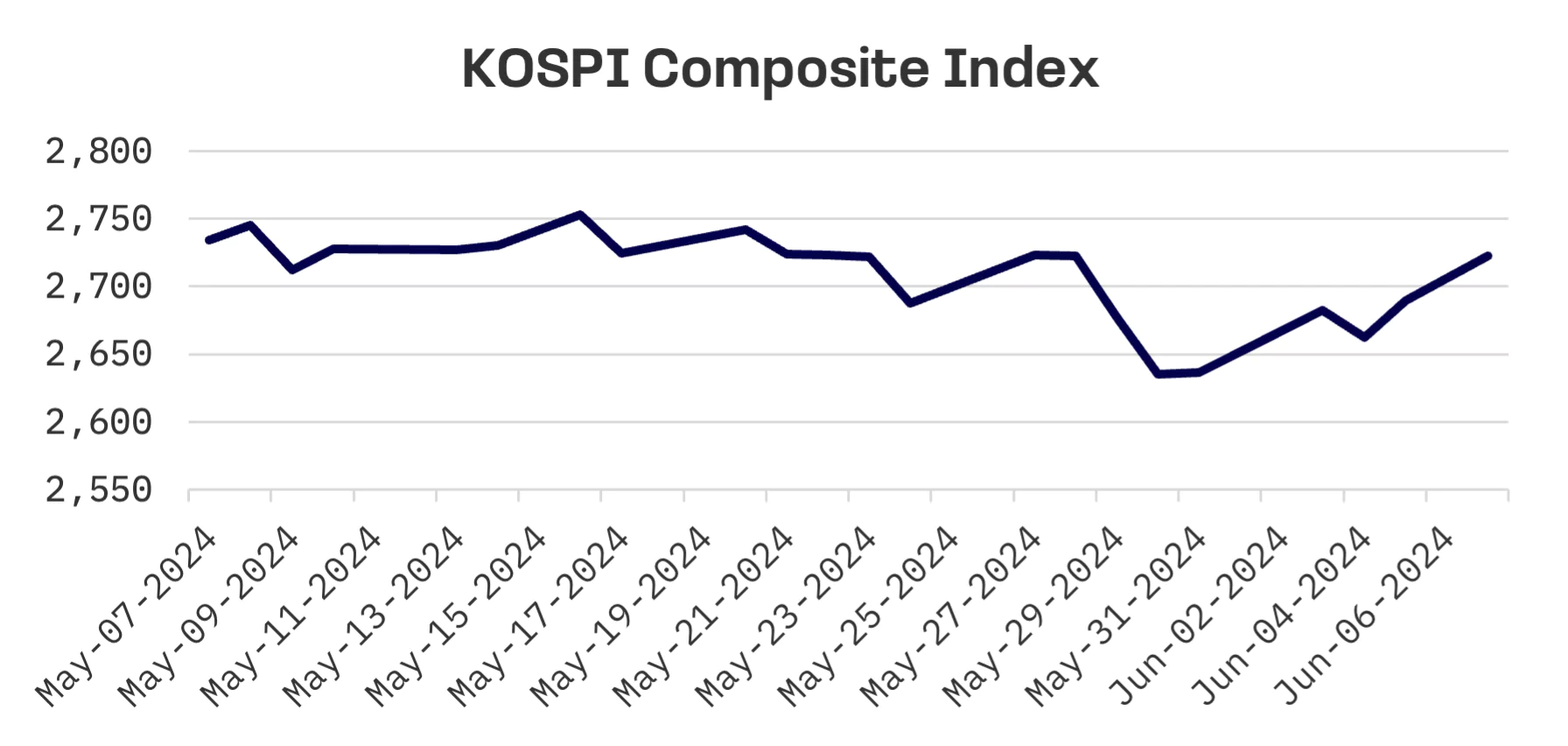

After three down weeks, the South Korean stock market rebounded strongly this week, with the KOSPI jumping 3.3%. Investor sentiment was lifted by favourable economic data and heightened expectations for a U.S. rate cut following the European Central Bank’s decision to lower interest rates for the first time in nearly five years, sparking a significant rally in chip and battery shares.

Inflation in South Korea slowed to a 10-month low in May, as per government data released on Tuesday. Consumer prices increased by 2.7% year-on-year, the slowest increase since July 2023, suggesting that the Bank of Korea’s tight monetary policy is aligning with expectations for subdued price pressures in the latter half of the year.

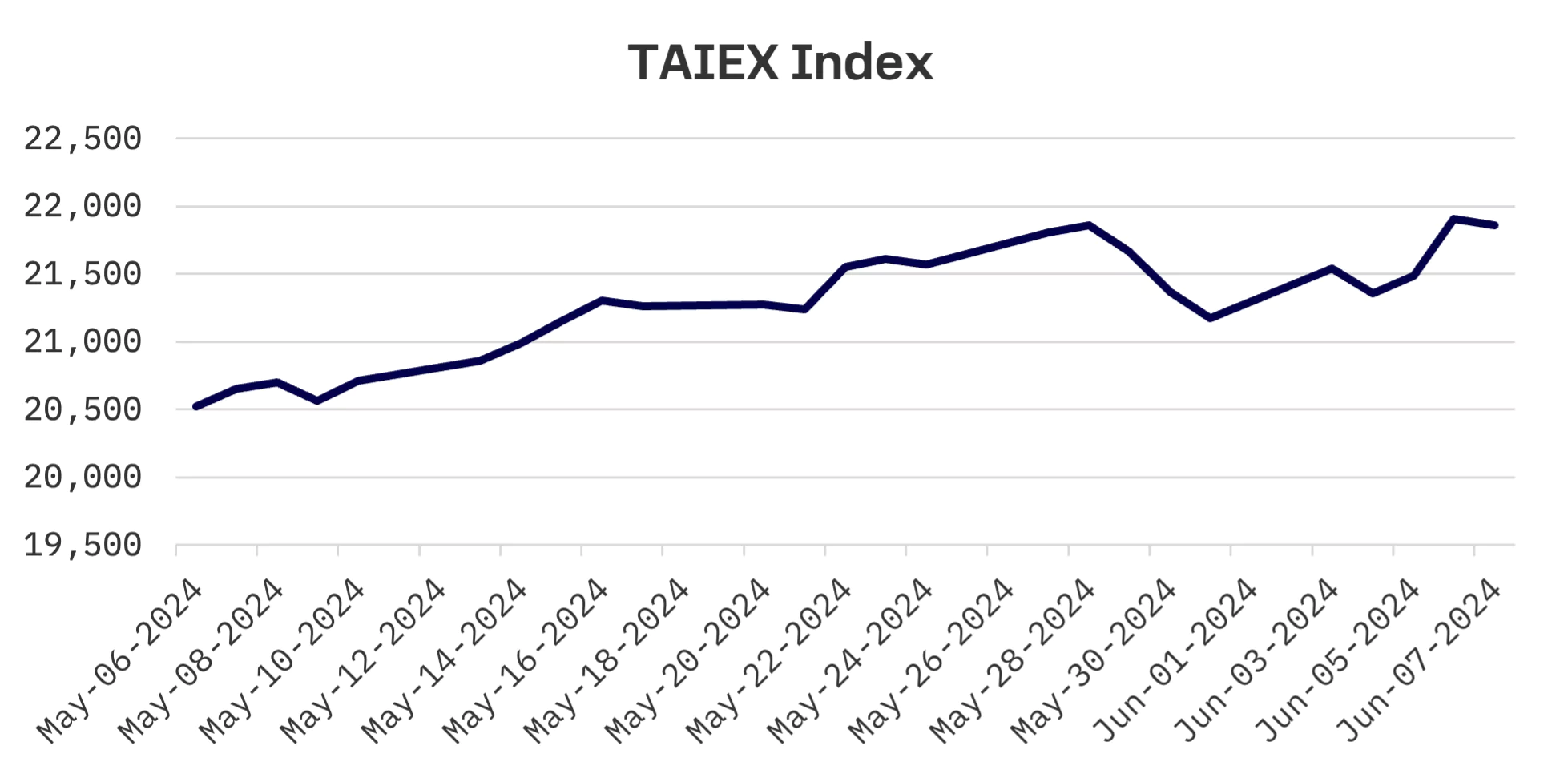

Taiwan

Taiwan’s TAIEX index surged by 3.2% this week, reaching a new historic high by surpassing the 21,900-point mark on Thursday.

The rally was driven by enthusiasm surrounding developments in AI, particularly following a speech in Taipei by Nvidia CEO Jensen Huang, which fuelled speculation about new business for Taiwan Semiconductor (TSMC) to supply advanced chips for Nvidia’s graphics processing units.

TSMC reported that its net revenue for May was NT$229.62 billion ($7.1 billion), marking a 30.1% increase from the same period last year and the third-highest monthly revenue in the company’s history.

As reported by the Ministry of Finance (MOF), Taiwan’s exports rose by 3.5% in May year-on-year, the seventh consecutive monthly increase. Backed by the booming AI market, shipments of information, communication and audio-visual products soared in May, growing by 62.4% to $9.42 billion compared to the same month last year.

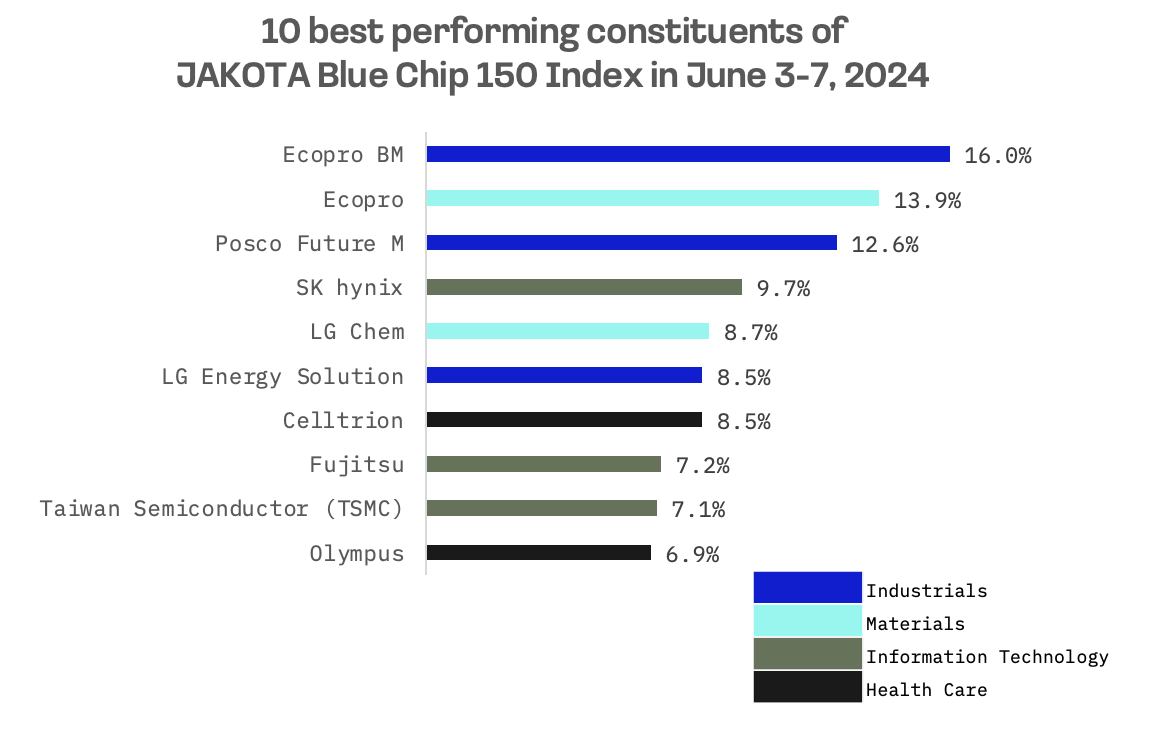

JAKOTA Blue Chip 150 Index

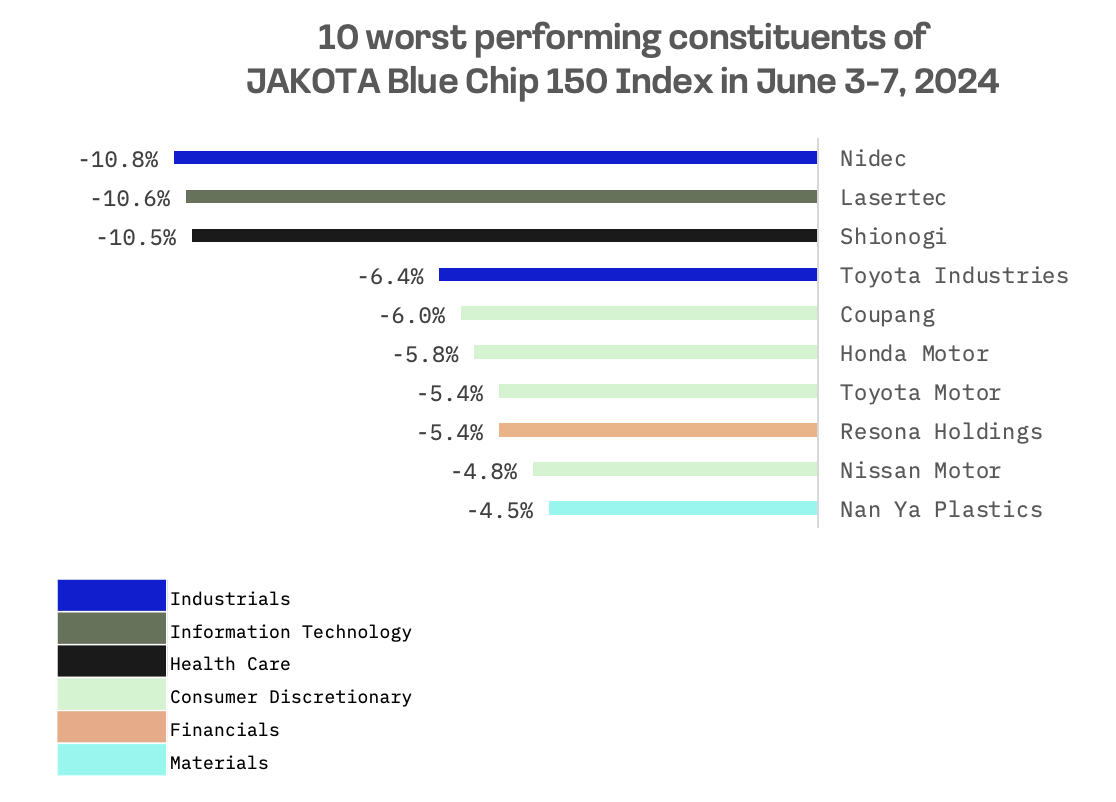

The JAKOTA Blue Chip 150 Index jumped 2.3%, with 82 of 150 constituent stocks rising.

Leading the gains were Korean secondary battery stocks such as Ecopro and its subsidiary Ecopro BM, along with Posco Future M.

These stocks, which had been experiencing weakness since last year, have recently shown signs of a turnaround, attracting attention to the underlying factors driving this shift. Supply and demand dynamics have improved, evidenced by foreigners purchasing stocks in the secondary battery industry for four consecutive trading days. This activity stems from the perception that stock prices have reached a bottom, with expectations of performance improvement anticipated to commence earnestly. This optimism is fueled by the projected recovery of the electric vehicle industry in the second half of the year and the implementation of eco-friendly policies in the European Union.

Conversely, Nidec, a Japanese manufacturer and distributor of electric motors, faced another week of stock declines, exacerbated by the company’s announcement that its subsidiary, Nidec Drive Technology, had misidentified the adjustment target for some consolidated adjustments. This has led to necessary revisions in the company’s past financial statements, securities reports and internal control reports.

Additionally, Nidec announced limits on its forthcoming share buyback program, setting a cap at 5 million shares and ¥35 billion.