Last week’s Jakota markets:

- Japan’s Nikkei 225 Index fell 0.6% as yen weakness persisted and business activity stalled, despite rising inflation

- South Korea’s KOSPI climbed 0.94%, hitting a new annual high, buoyed by tech stocks and single-digit export growth

- Taiwan’s TAIEX surged 3.3%, outperforming regional peers and reaching a historic high on AI optimism

- The JAKOTA Blue Chip 150 Index edged down 0.8%, with AI-related stocks outperforming while battery stocks faltered

Japan

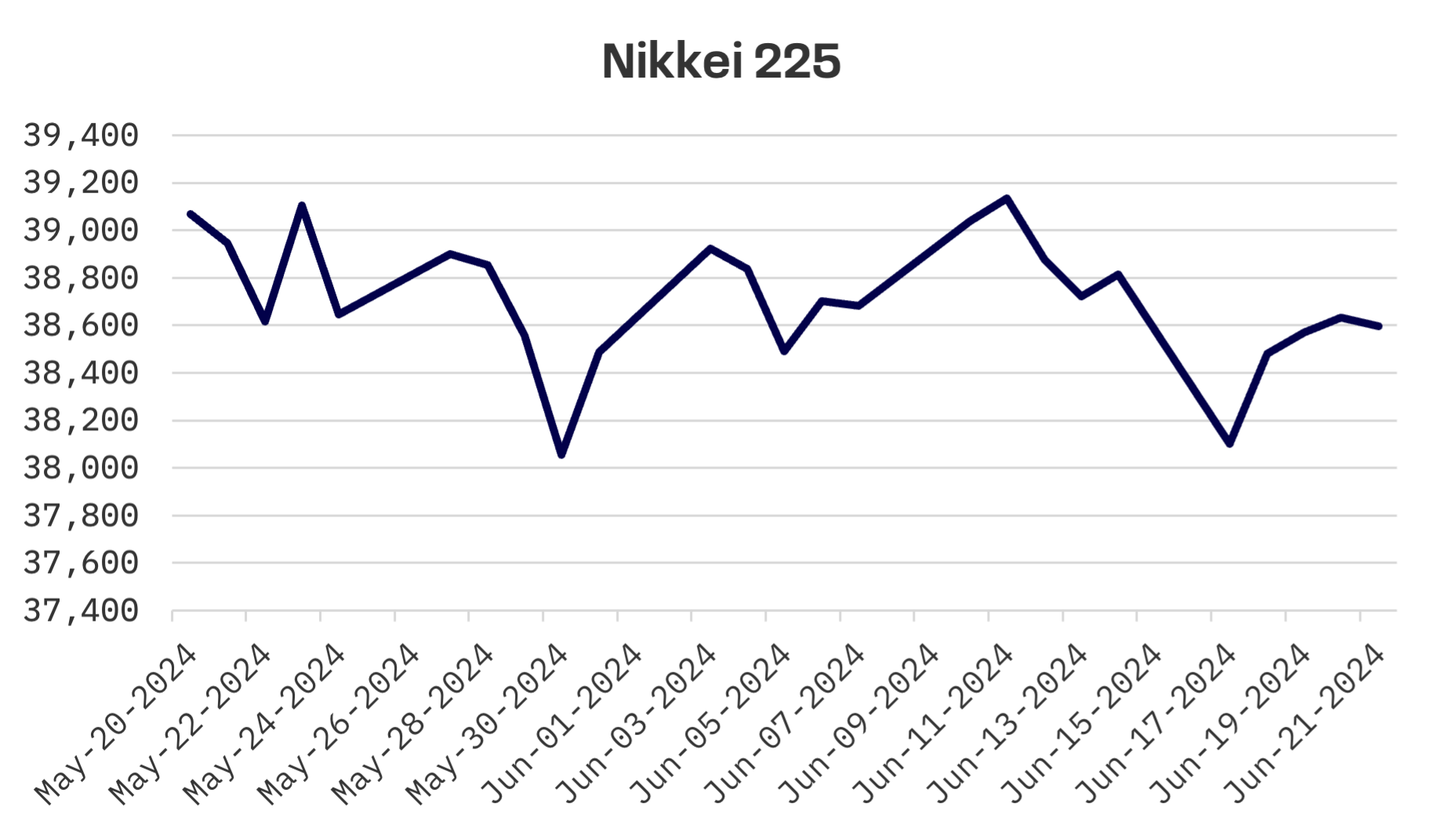

Japan’s stock market stumbled this week, with the Nikkei 225 Index falling 0.6%. The index plunged more than 2% on Monday, rattled by global political uncertainty, particularly the upcoming French lower house elections. Although it clawed back some losses in subsequent days, the Nikkei 225 remained below last week’s close as investors fretted over the Bank of Japan’s future monetary policy.

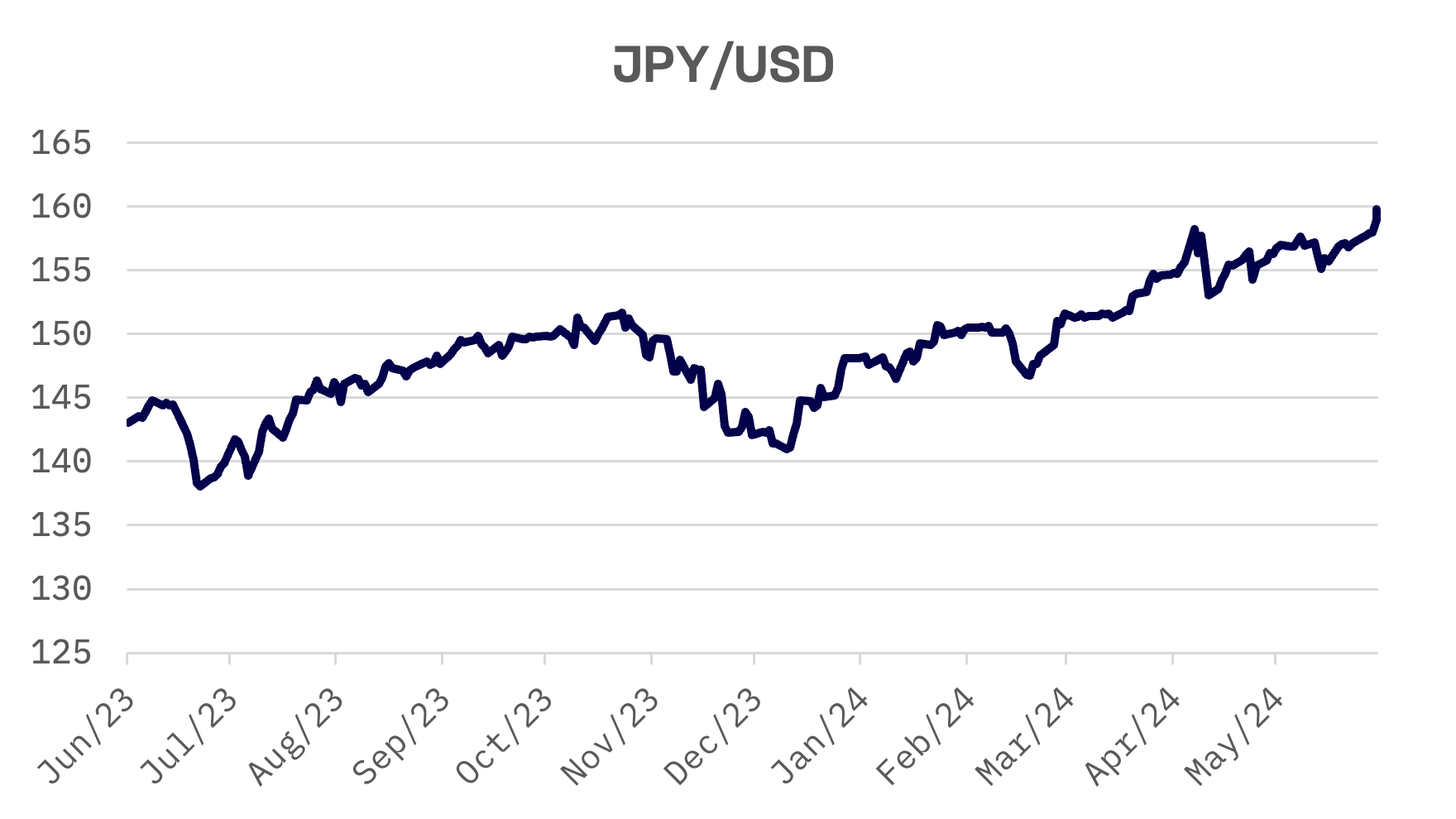

In currency markets, the yen weakened to around ¥159 against the dollar from ¥157.4 the previous week, hovering near fresh 34-year lows due to U.S.-Japan interest rate differentials. Japanese authorities reiterated their readiness to intervene against “speculative, excessive volatility” in foreign exchange markets. This stance follows their interventions in April and May 2024 to buy yen and sell dollars, which have had limited success in reversing the yen’s downtrend.

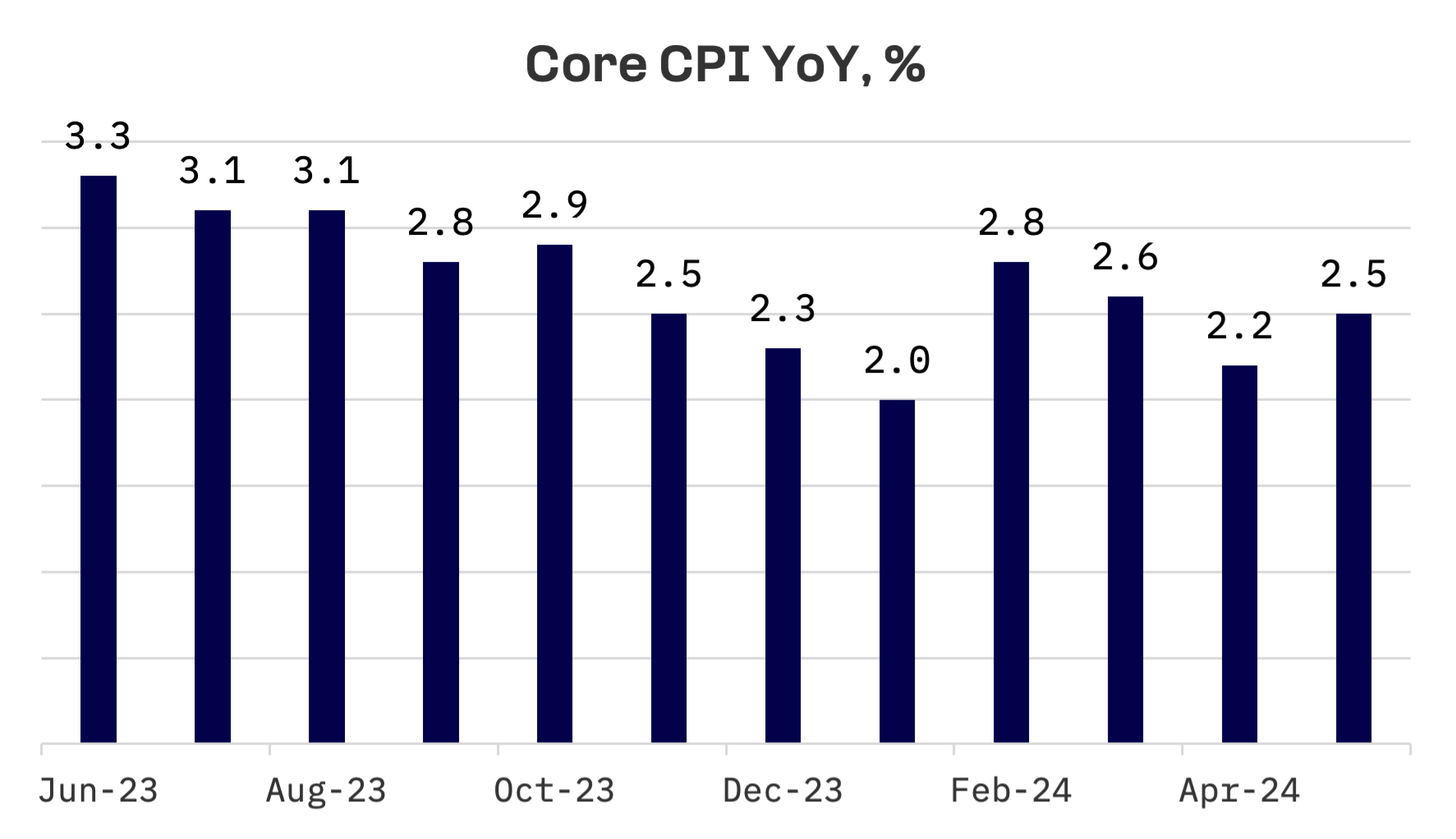

Inflation data showed the nationwide core consumer price index (CPI) rose 2.5% year-over-year in May, up from April’s 2.2% increase but slightly below the 2.6% consensus forecast. Bank of Japan Governor Kazuo Ueda maintained that a July rate hike remains possible, depending on economic data. He noted that this decision is separate from the central bank’s plans to detail its tapering of Japanese government bond purchases next month.

Business activity across Japan’s private sector stalled in June. The flash composite purchasing managers’ index (PMI), compiled by au Jibun Bank, fell to 50.0 from May’s 52.6, driven by a decline in services activity partially attributed to labor constraints. Manufacturing conditions improved marginally for the second consecutive month. Separately, Japan’s exports surged 13.5% year-over-year in May, bolstered by yen weakness and strong shipments to the U.S. and China.

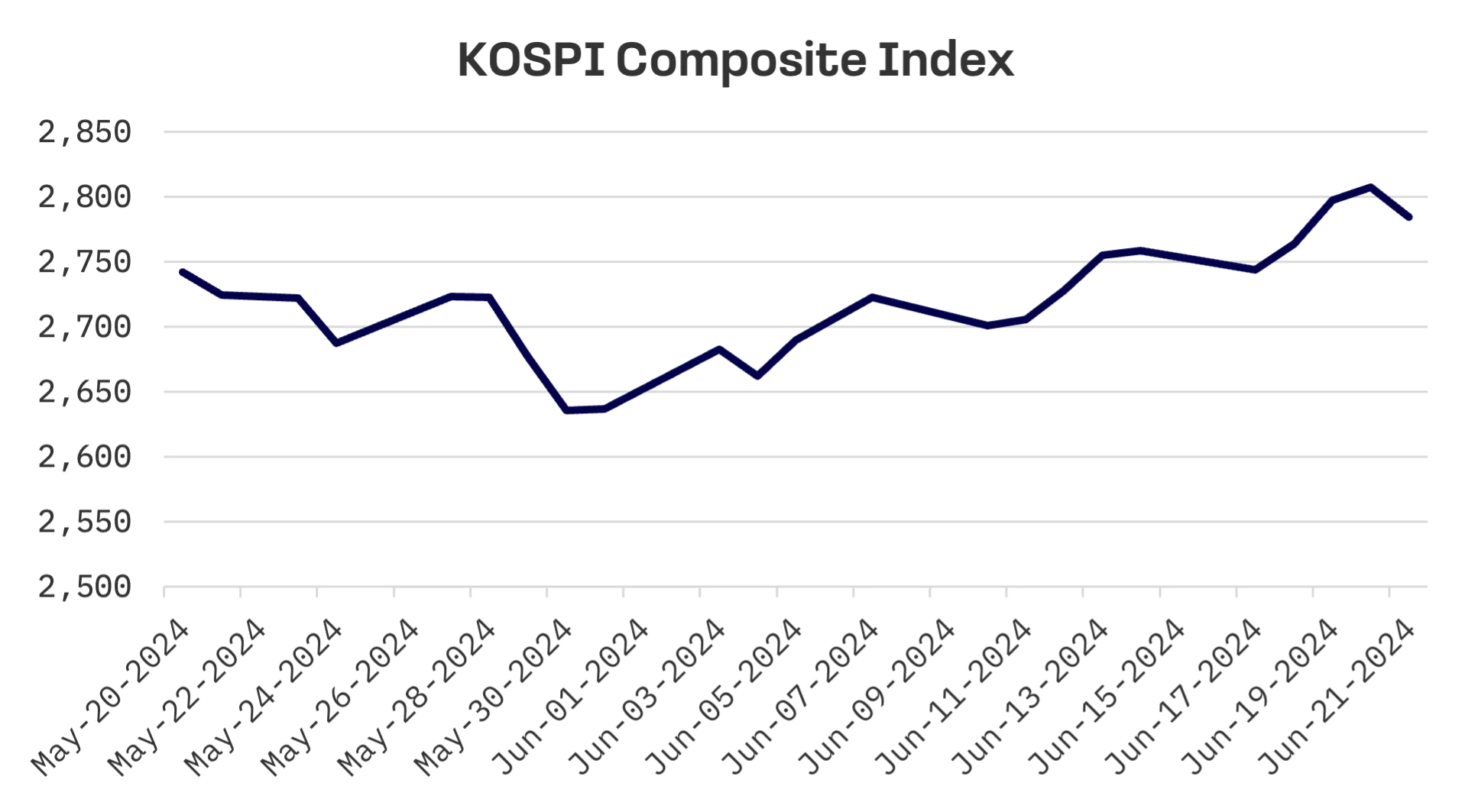

South Korea

The KOSPI Composite Index rose 0.94%, marking its third consecutive week of gains. The index hit a new annual high, buoyed by tech stocks following Wall Street’s rally. Nvidia Corp.’s ascent to become the world’s most valuable company provided additional momentum.

Meanwhile, South Korea’s exports showed single-digit growth in the first 20 days of June, driven by robust demand for domestically produced semiconductors.

A central bank report released Tuesday suggested inflation in South Korea may drop below 2.5% in the second half of the year, though geopolitical risks and weather conditions remain significant factors.

MSCI Inc. kept South Korean stocks on its emerging market list as the government maintained its short-selling ban. The index provider will continue monitoring reform measures aimed at enhancing market accessibility.

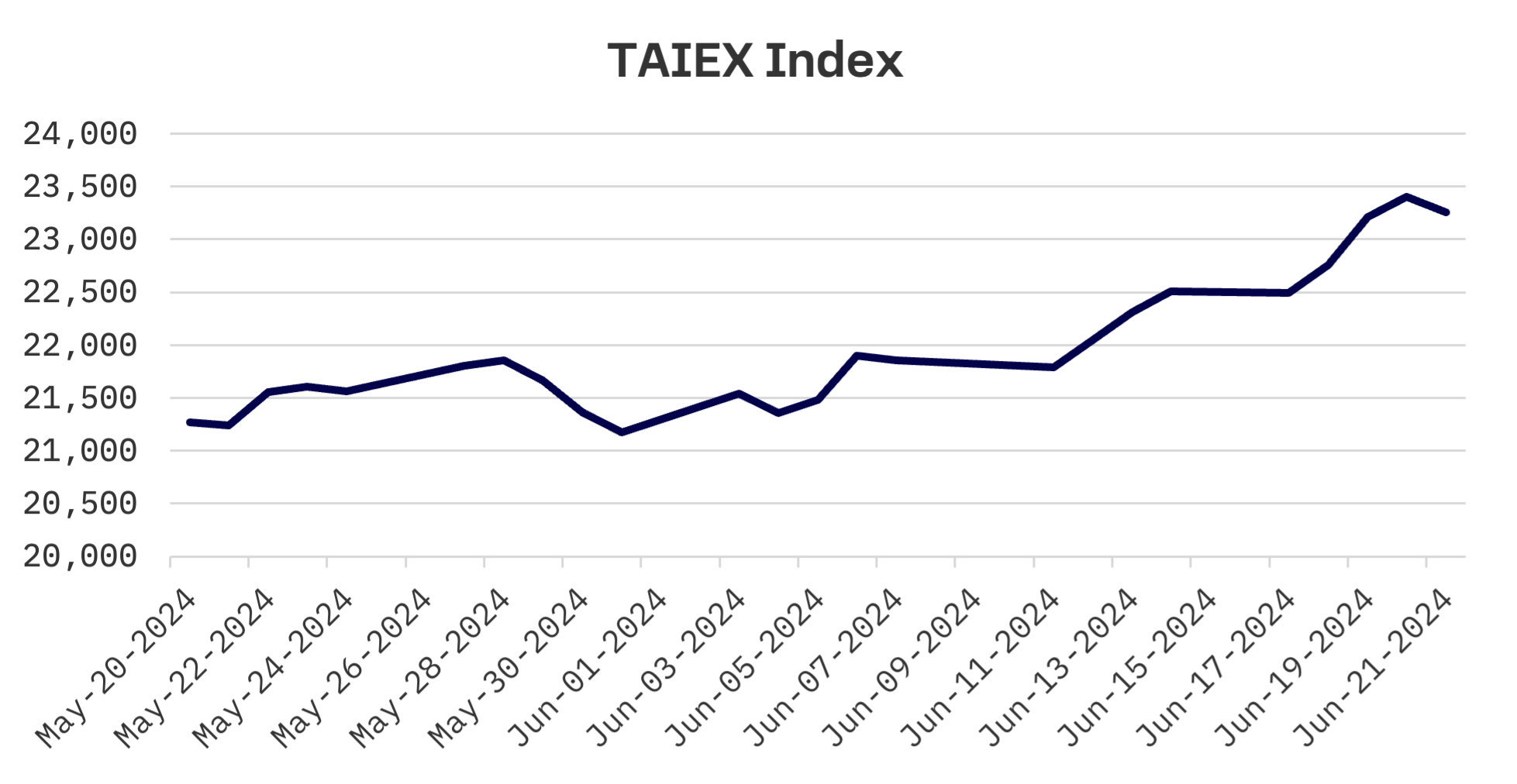

Taiwan

Taiwan’s stock market outperformed its regional peers, with the TAIEX index climbing 3.3%. On Thursday, it surpassed the 23,400-point mark, reaching a new historic high amid optimism over global AI developments.

Taiwan Semiconductor (TSMC), the most heavily weighted stock on the local market, also hit a closing high on Wednesday, driving the main board upward. This surge followed a strong performance by U.S.-based AI chip designer Nvidia Corp. on U.S. markets.

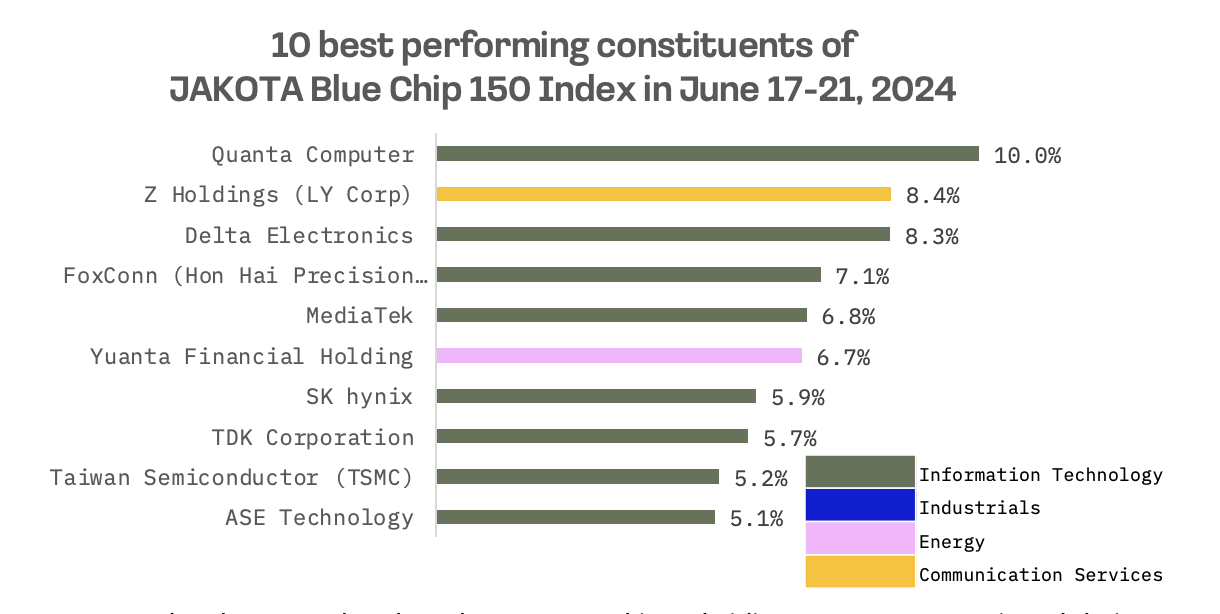

JAKOTA Blue Chip 150 Index

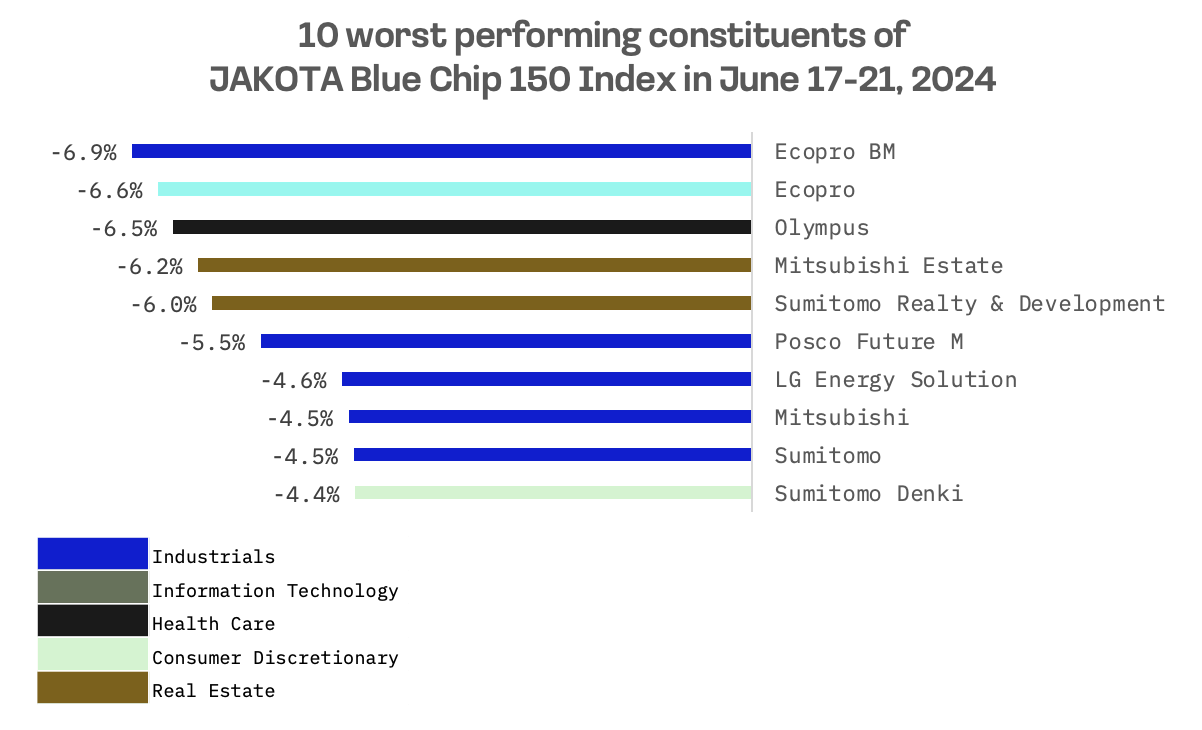

The JAKOTA Blue Chip 150 Index fell 0.8% this week, with 67 of its 150 constituents showing positive price trends.

AI-related stocks dominated the top performers. Quanta Computer, a Taiwan-based manufacturer of computers, servers and other electronic hardware, led gains with an 11.5% increase, benefitting from the surge in AI server business opportunities.

Korean secondary battery stocks Ecopro and its subsidiary Ecopro BM continued their decline for the second consecutive week, maintaining their reputation as the most volatile stocks within the JAKOTA Blue Chip 150 Index. Just two weeks ago, these stocks topped the list as the best-performing constituents. The battery industry is grappling with stagnant growth due to sluggish demand. Samsung Securities issued a new report on Ecopro BM, lowering the stock’s target price.