Last week’s Jakota markets:

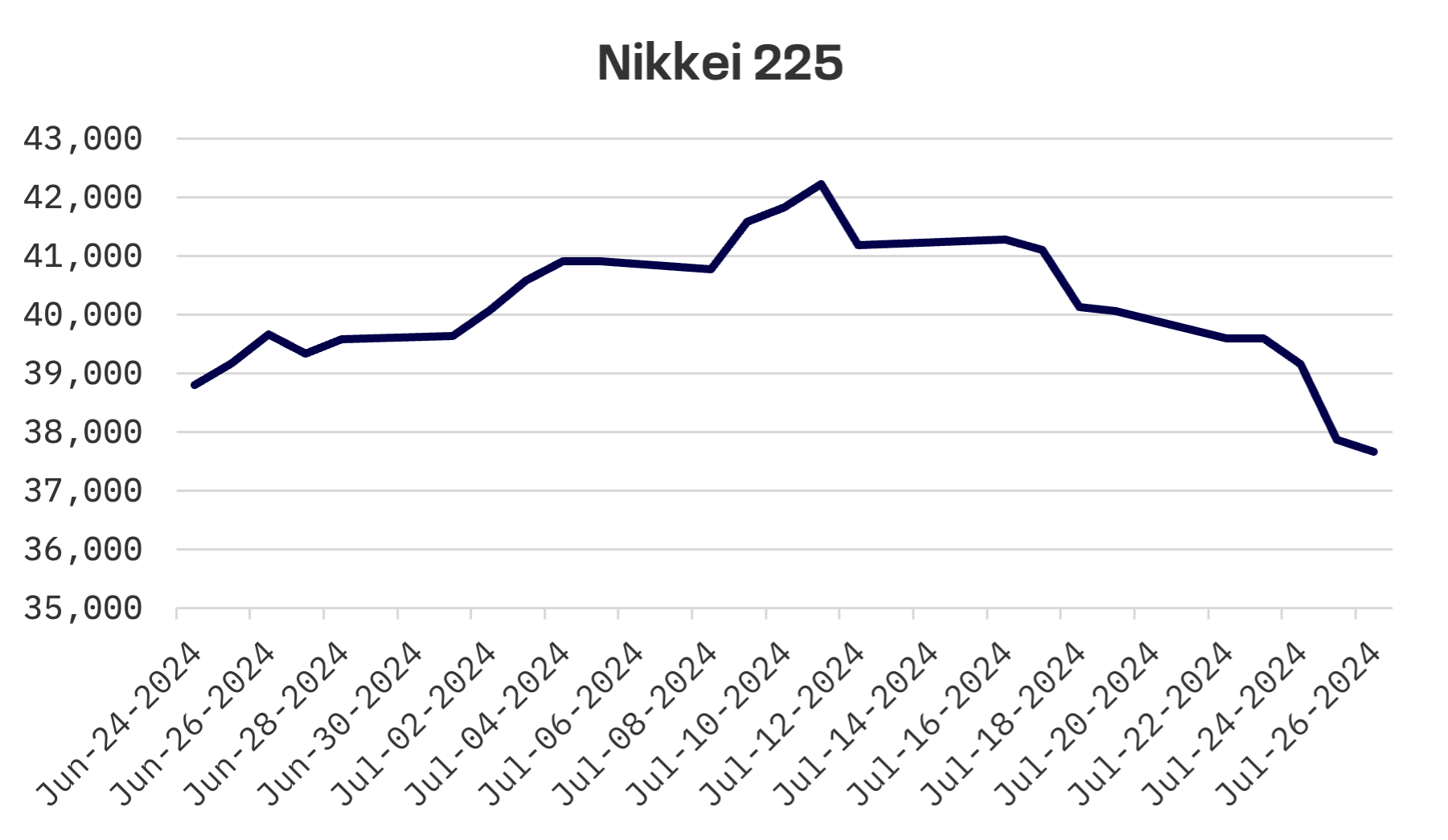

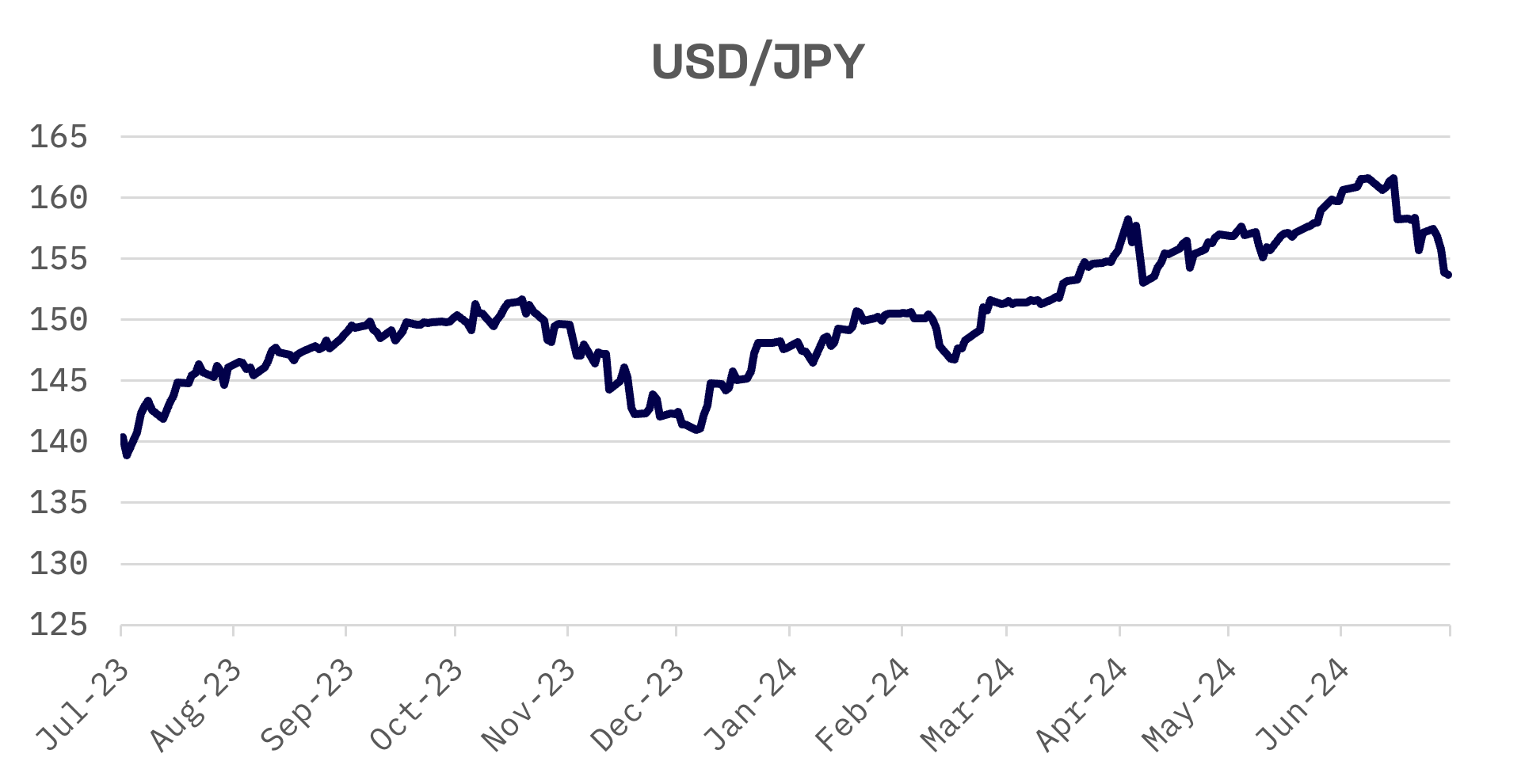

- Japan’s stock market tumbled, with the Nikkei 225 shedding 6.0% as technology shares mirrored U.S. tech sell offs and a stronger yen pressured exporters

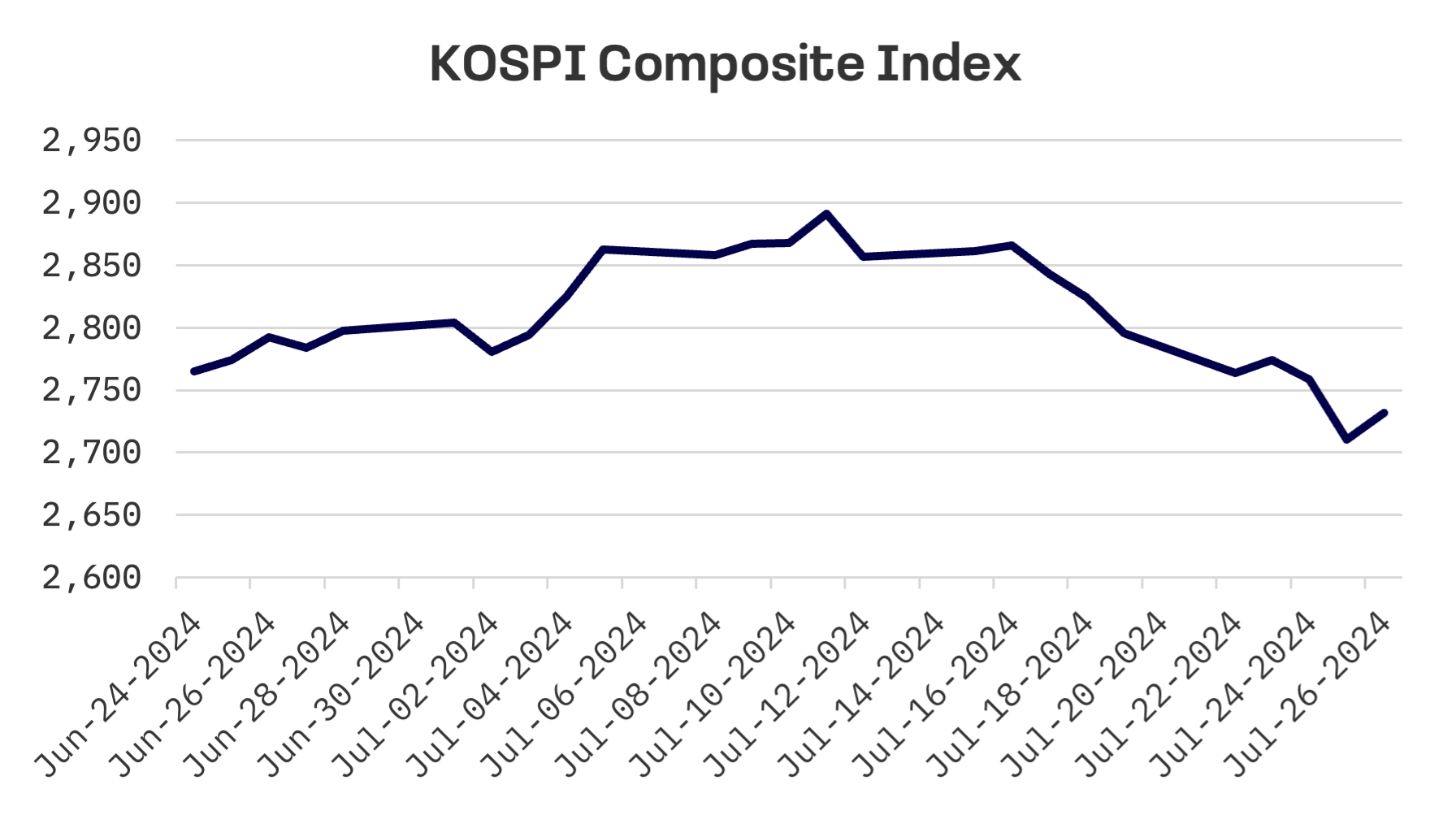

- South Korea’s KOSPI declined 2.3%, with a late week rebound in financials and shipbuilders partially offsetting earlier losses in tech and auto sectors

- Taiwan’s TAIEX slumped 3.3% amid extreme volatility, with TSMC’s 5.6% drop on Friday contributing to the index’s second largest point decline in history

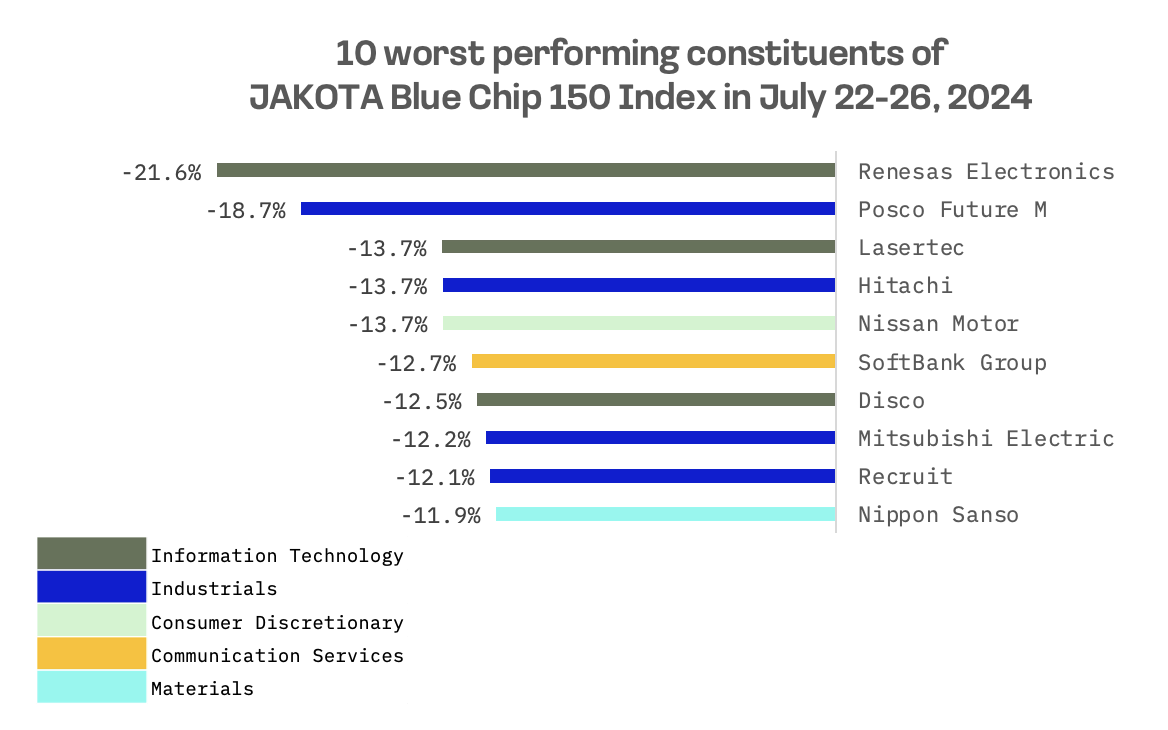

- The JAKOTA Blue Chip 150 Index suffered a 3.9% loss, featuring Samsung Biologics’ strong performance contrasted with Renesas Electronics’ steep decline amid AI spending concerns

Japan

Japan’s stock markets posted significant declines last week, with the Nikkei 225 Index plunging 6.0%. Over the past two weeks, the index has tumbled 8.55%, marking its largest two week percentage drop since March 2020. Japanese technology stocks remained under pressure, mirroring the persistent sell off in U.S. mega cap tech shares.

The yen strengthened for the third consecutive week, reaching about ¥154 against the dollar, further impacting Japanese exporters’ profit outlook. This appreciation follows signals of government intervention in foreign exchange markets earlier in July. The yen’s gains were also driven by unwinding of short positions and growing expectations of narrowing U.S.-Japan interest rate differentials.

Recent inflation figures have kept the possibility of a rate hike open. The Tokyo core consumer price index rose 2.2% year-over-year in July, matching expectations and up from 2.1% in June. However, weak private consumption remains a constraint on raising rates.

South Korea

The KOSPI Composite Index fell 2.3% last week, marking its third consecutive weekly decline. South Korean shares dropped nearly 2% on Thursday as tech and auto stocks tumbled, following Wall Street’s downturn. However, shares rebounded sharply on Friday, ending a two day losing streak. Large cap gains led by financial firms and shipbuilding companies helped partially offset the KOSPI’s weak performance earlier in the week.

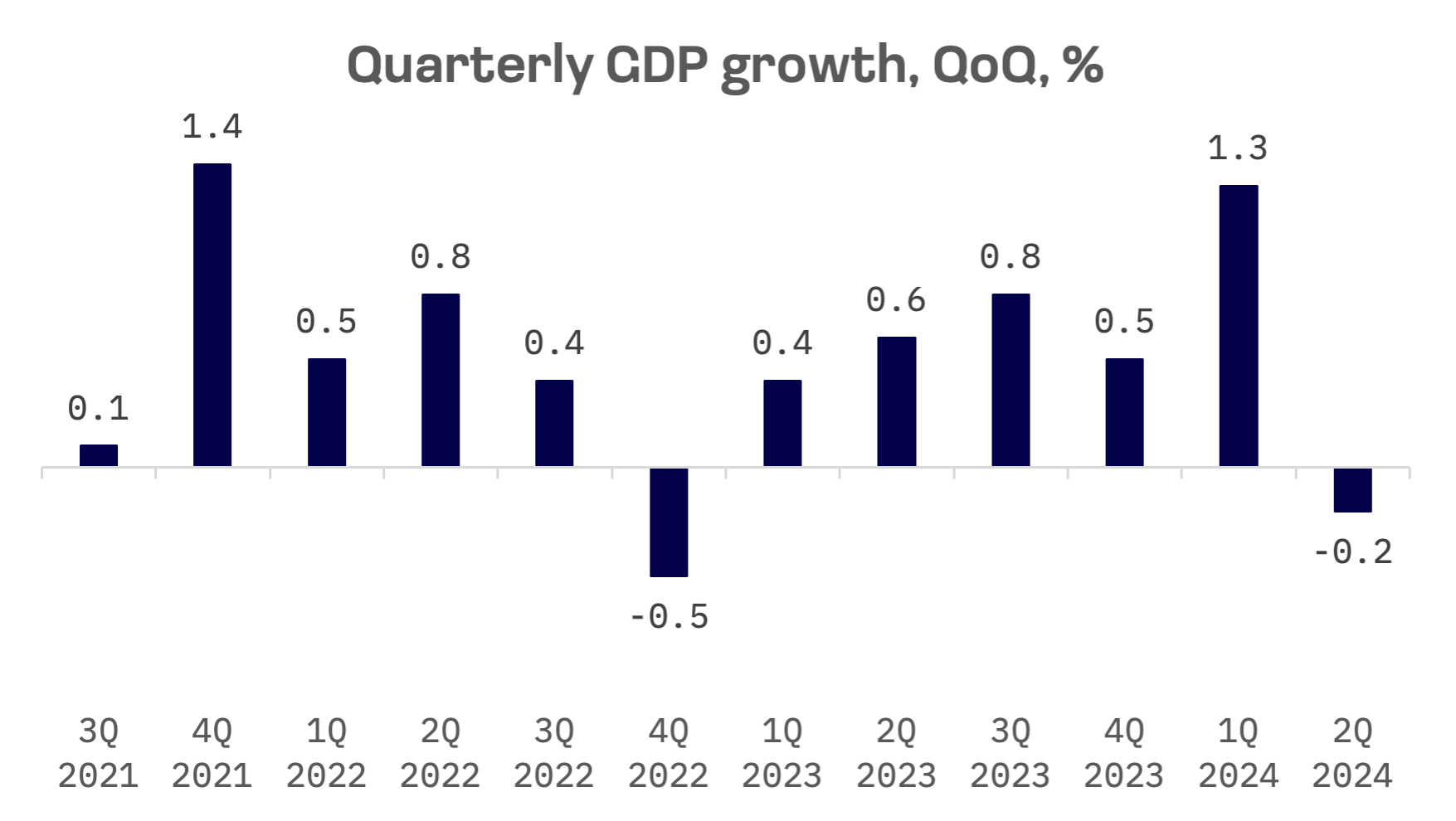

South Korea’s economy contracted in the second quarter, as weaker domestic demand overshadowed robust exports. Preliminary data from the Bank of Korea showed the country’s real gross domestic product declined by 0.2% quarter-on-quarter in the April-June period.

Taiwan

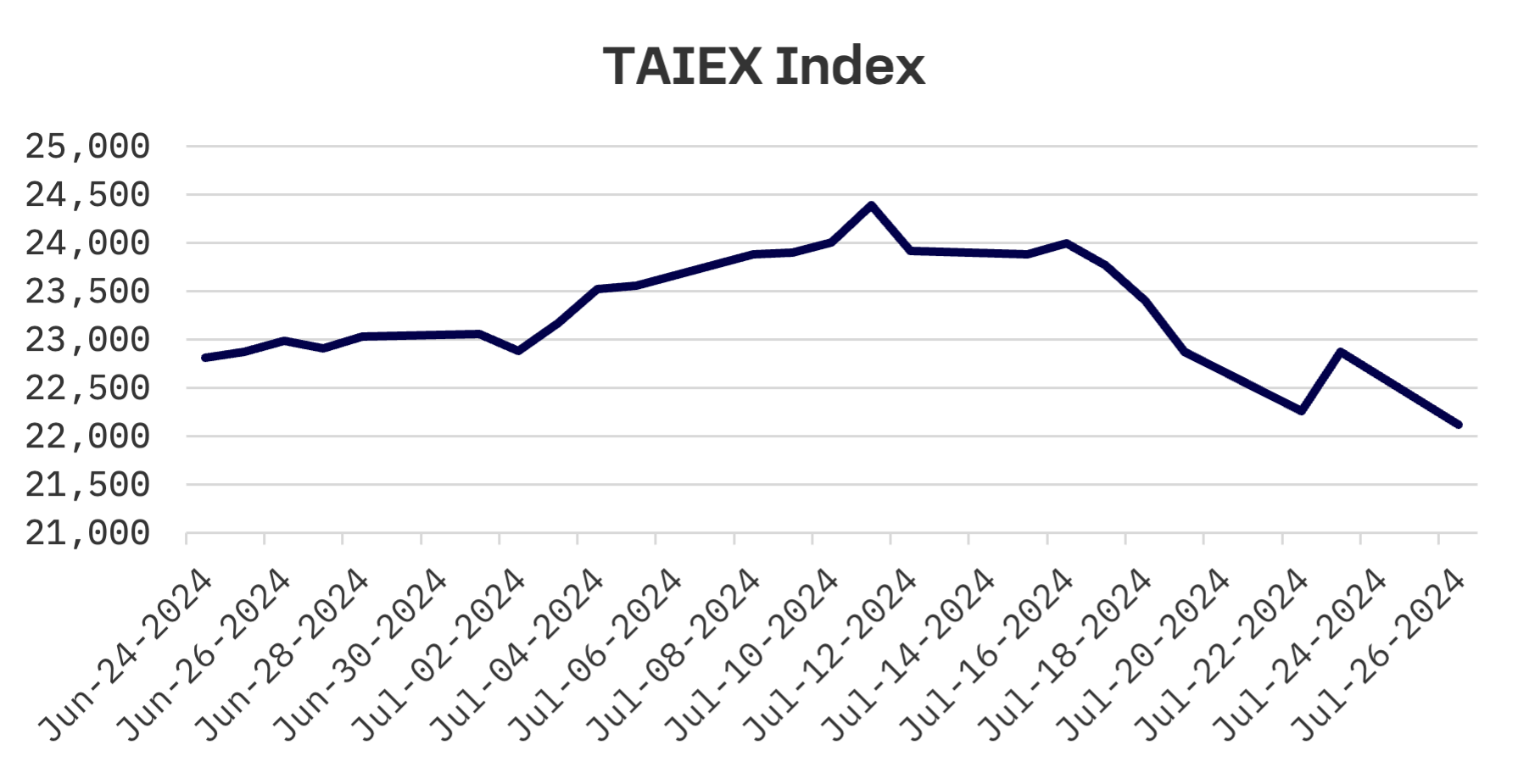

Taiwan’s stock market continued its downward trajectory, with the TAIEX index slumping 3.3% last week. Over the past two weeks, the TAIEX has declined by 7.5%. Trading was shortened as markets closed Wednesday and Thursday due to a typhoon, contributing to extreme volatility.

On Monday, the TAIEX dropped 2.7%, with significant selling pressure on large cap stocks. This followed news of U.S. President Biden’s withdrawal from the presidential race, prompting foreign institutional investors to offload Taiwanese stocks and repatriate funds amid increased chances of former President Donald Trump winning the upcoming November election, raising fears of heightened geopolitical tensions.

Tuesday saw a major technical rebound, driven by a surge in Taiwan Semiconductor Manufacturing Co. (TSMC) following an overnight rally in U.S. tech stocks. However, on Friday, Taiwanese shares experienced their second largest point drop in history as TSMC plummeted over 5.6%. Volatility in U.S. tech stocks sparked concerns about returns on substantial investments in AI development, leading to a significant decline in the local electronics sector.

Economic data brought positive news for Taiwan’s economy. The Directorate General of Budget, Accounting and Statistics (DGBAS) reported unemployment falling to a 24-year low for the month, driven by a resurgence in the manufacturing sector and solid demand in the service sector. The Ministry of Economic Affairs (MOEA) announced record high retail sales for June, supported by robust domestic spending.

Additionally, the Taiwan Institute of Economic Research (TIER) raised its 2024 GDP growth forecast to 3.85%, up 0.56 percentage points from April, citing improved economic conditions domestically and internationally.

JAKOTA Blue Chip 150 Index

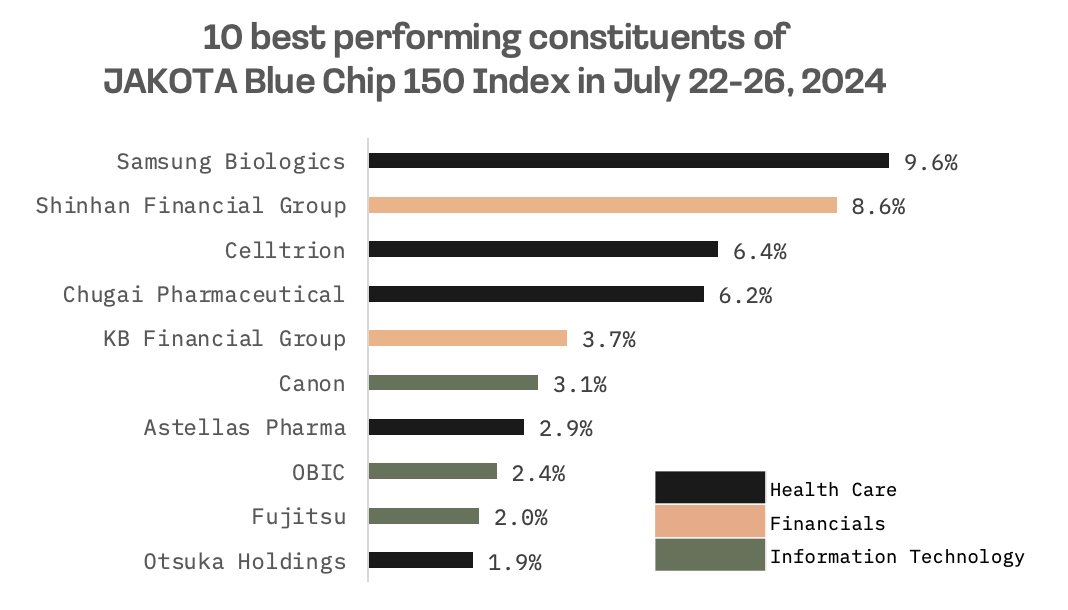

The JAKOTA Blue Chip 150 Index nosedived 3.9% last week. Out of 150 constituents, only 26 stocks exhibited positive price trends, a historically low number.

Samsung Biologics, a South Korean contract development and manufacturing organization, emerged as the top performing stock amid news that it surpassed ₩2 trillion in first half sales for the first time. The company’s consolidated sales for the first half surged 32.56% year-over-year to ₩2.1 trillion won, while operating profit jumped 47.31% to ₩655.8 billion. Samsung Biologics attributed its robust performance to large scale orders, increased operational rates at Plant 4 and milestone payments for Samsung Bioepis’ biosimilar product approval.

Renesas Electronics, a Japanese semiconductor manufacturer, saw its shares plummet by 21.6%, making it the worst performing stock. The drop was driven by a broader tech selloff and investor disappointment over the company’s profit miss. Renesas reported underwhelming operating profit in its mainstay industrial segment, which includes chips for factories, the Internet of Things and infrastructure.

“We were too optimistic in our outlook in the first quarter,” Renesas Electronics CEO Hidetoshi Shibata told reporters. He noted that sales of industrial use chips are expected to decline this quarter due to inventory adjustments, but revenue is projected to recover in the following quarter. Mr. Shibata highlighted that demand for power semiconductors to run AI-training chips will gain momentum by the end of 2024.

“We have no intention to slow down our spending on R&D,” he added.

Renesas has been on an acquisition spree to diversify its customer base beyond automakers. Earlier this year, the company announced a deal to buy Australia listed software firm Altium Ltd., aiming to move upstream in product development and electronics design. Mr. Shibata indicated that this deal will likely be completed next week. Previously, Renesas acquired UK based Dialog Semiconductor Plc, San Jose based Integrated Device Technology Inc. and California based Intersil Corp.

Investors had initially cheered these acquisitions, pushing the company’s shares to a record high earlier this month. However, concerns about the longevity of AI related spending have since caused the company’s market value to plunge.