Last week’s Jakota markets:

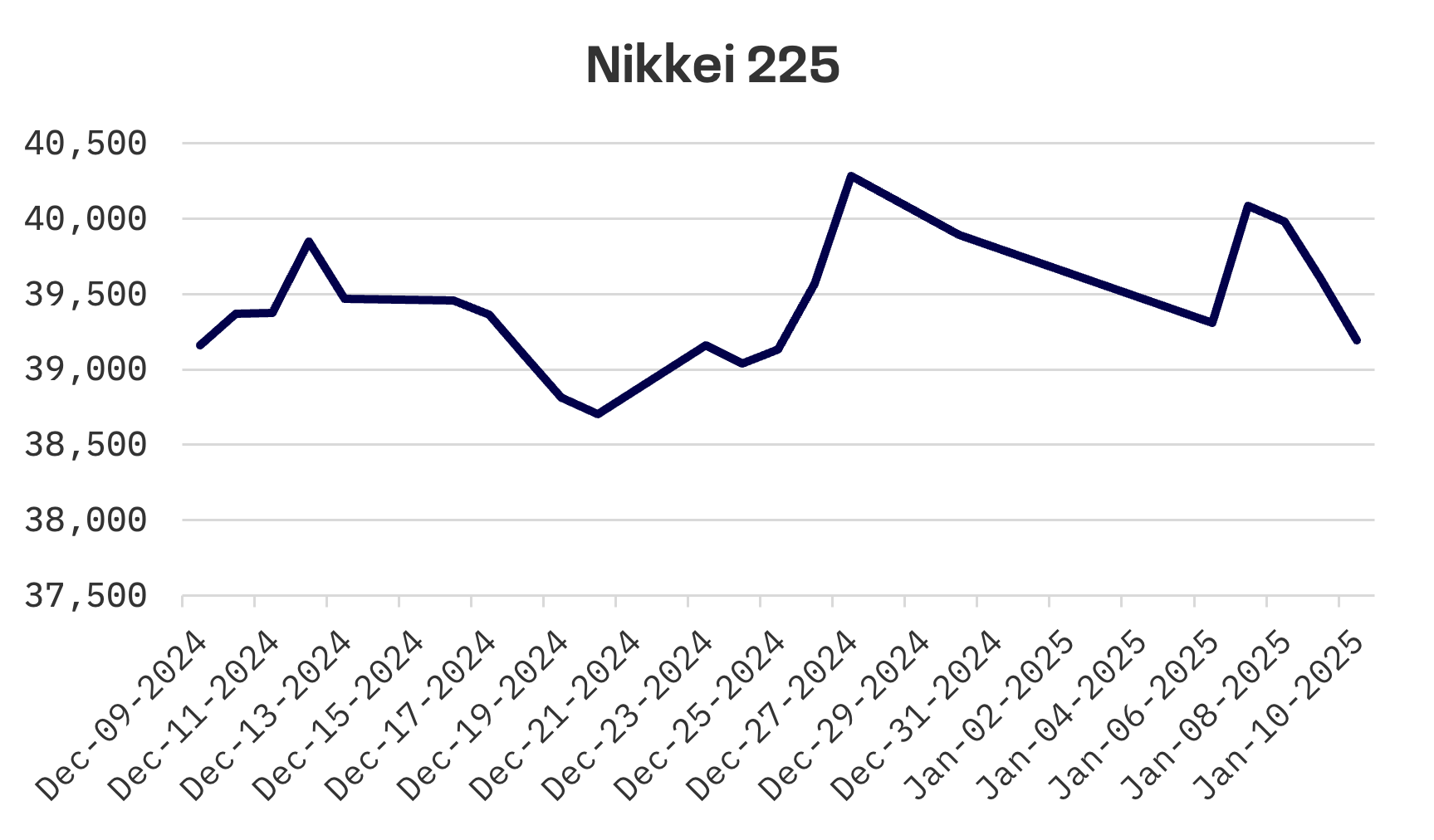

- Japan’s Nikkei 225 fell 1.8% as the yen weakened to 158 against the dollar, with investors watching for BoJ’s next rate move amid declining real wages

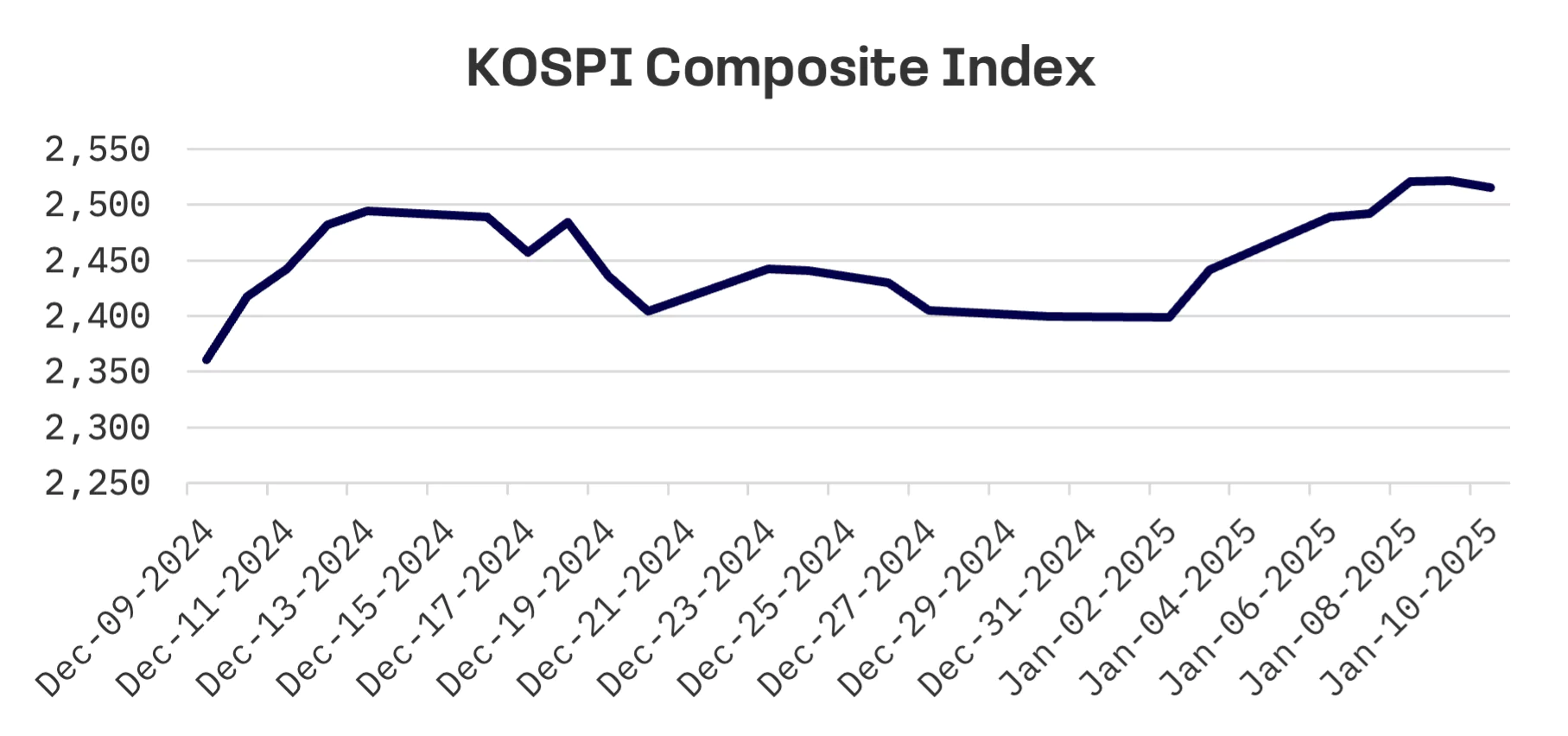

- South Korea’s KOSPI surged 3% on tech rally and foreign buying, though political turmoil raised concerns about sovereign credit rating

- Taiwan’s TAIEX gained 0.5%, supported by TSMC’s record quarterly sales and strong export data, marking 14 straight months of growth

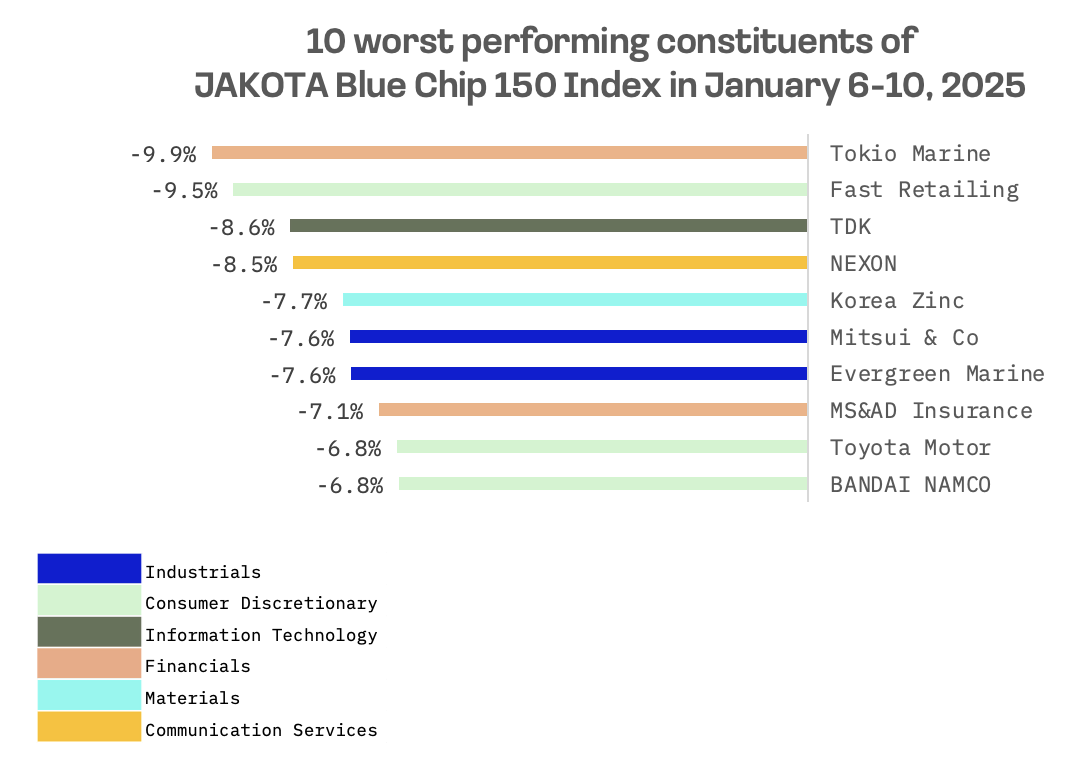

- The JAKOTA Blue Chip 150 Index retreated 1%, with Advantest leading gains while Tokyo Marine and Fast Retailing fell over 9%

Japan

The Japanese stock market declined this week, with the Nikkei 225 falling 1.8% as investors assessed the timing of the Bank of Japan (BoJ)’s next interest rate increase.

The yen slipped to about 158 against the U.S. dollar, down from 157 at the previous week’s close. The currency’s weakness reflected ongoing uncertainty about the BoJ’s monetary policy normalisation pace and the widening interest rate gap between the U.S. and Japan.

Finance Minister Katsunobu Kato warned against speculative, one sided currency moves, indicating the government’s readiness to intervene. Japanese authorities last entered currency markets in July 2024 to prop up the yen.

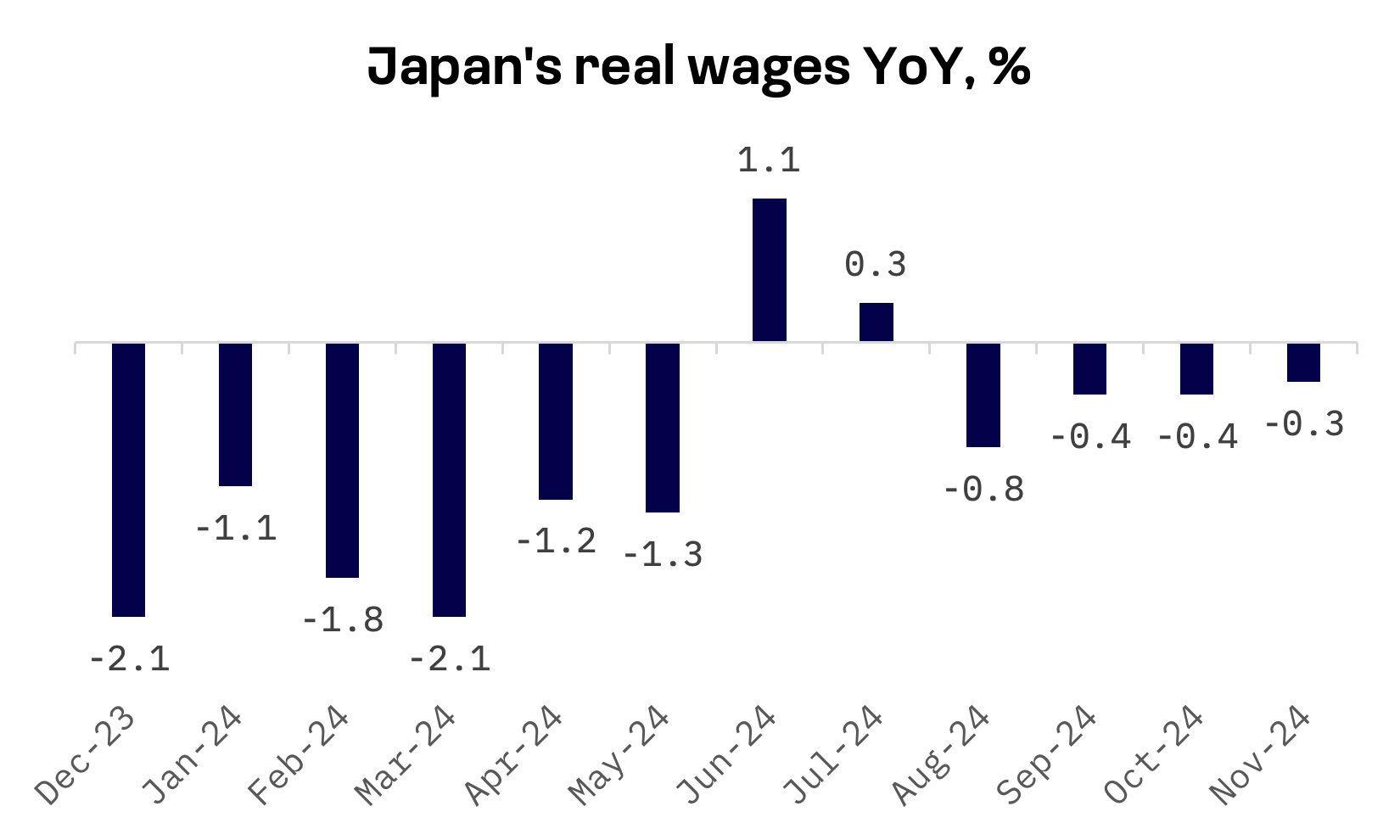

Japan’s inflation adjusted wages fell 0.3% in November from a year earlier, marking the fourth straight monthly decline in real wages.

The BoJ kept its tightening stance, confirming that rates will increase if economic and price conditions improve. However, BoJ Governor Kazuo Ueda’s recent comments highlighted concerns about U.S. economic policies, including tariffs and fiscal measures, suggesting limited likelihood of a rate increase at January’s monetary policy meeting. Market participants now largely expect the BoJ to wait until March or April to raise rates.

South Korea

South Korea’s stock market advanced this week, with the KOSPI index rising 3%, lifted by strong gains in large cap technology stocks and foreign investor buying.

Microsoft’s announcement of an $80 billion investment plan for data centre expansion to support AI models and cloud applications boosted market sentiment, while investors also drew confidence from rallying U.S. chip stocks.

Meanwhile, global credit rating agencies warned of potential pressure on South Korea’s sovereign credit rating amid political turbulence in Asia’s fourth largest economy. The instability follows President Yoon Suk Yeol’s controversial six hour martial law decree, which led to his impeachment by the National Assembly.

Senior analysts at S&P Global Ratings and Moody’s Ratings expressed concern about increased economic uncertainty stemming from the crisis, highlighting risks to the country’s financial and political stability.

Taiwan

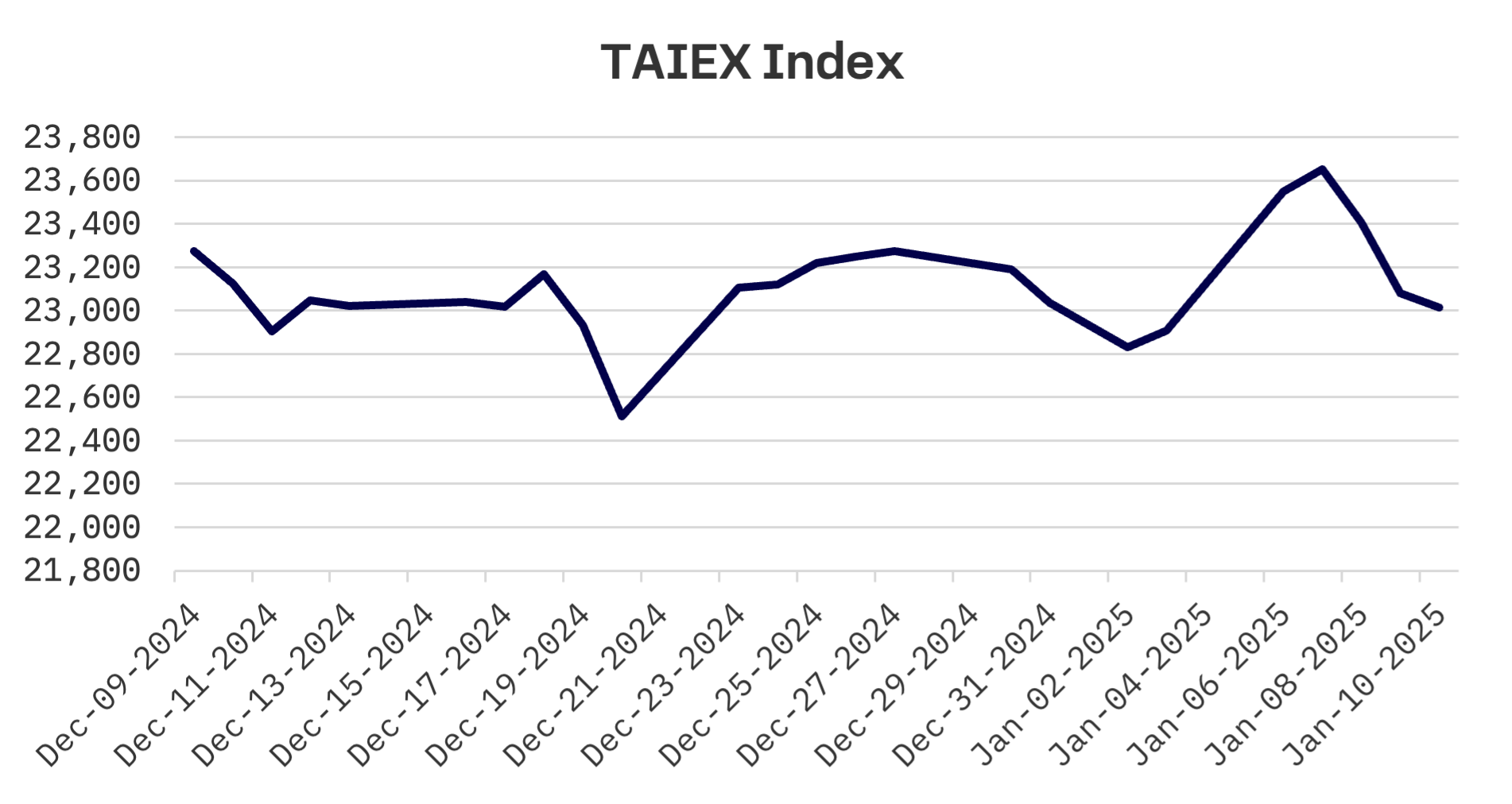

Taiwan’s stock market edged up this week, with the TAIEX Index gaining 0.5%. Early week momentum in chip stocks gave way to a three day decline in the electronics sector, despite Taiwan Semiconductor Manufacturing Co. (TSMC) reporting record fourth quarter sales on Friday. Largan Precision, a key supplier of smartphone camera lenses to Apple Inc., posted on Thursday a more than 74% year-over-year increase in fourth quarter 2024 net profit.

Taiwan achieved its second highest annual exports in 2024 at $475.07 billion, according to the Ministry of Finance. December exports reached $43.59 billion, marking 14 consecutive months of year-over-year growth, supported by steady global demand for high performance computing and AI products.

JAKOTA Blue Chip 150 Index

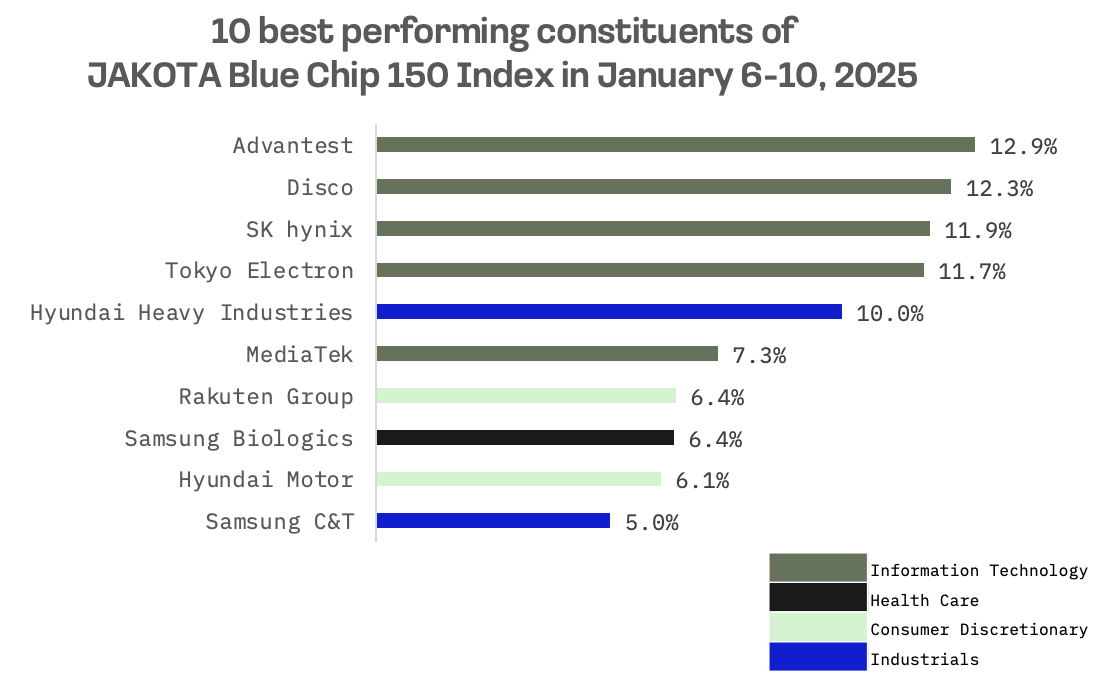

The JAKOTA Blue Chip 150 Index fell 1% this week, with only 41 of 150 constituents advancing.

Chip related stocks from Japan and South Korea — including Advantest, Disco, SK Hynix and Tokyo Electron — led gains, with Advantest emerging as the top performer, as expectations for generative AI remain strong.

Tokio Marine, Japan’s oldest insurance company, and Fast Retailing, the Japanese apparel designer and retailer owning the Uniqlo brand, were among the worst performers, each dropping more than 9%.

Investors remained cautious, weighing concerns over Fast Retailing’s slow sales from Uniqlo’s Mainland China operations, despite the company posting first quarter profits.

The company reported that group sales for the quarter and December were slightly below expectations, though it anticipates making up the shortfall in the second quarter. Excluding Mainland China, Uniqlo saw strong sales in Japan, with the brand experiencing favourable growth in Southeast Asia, India, Australia, North America and Europe.