Last week’s Jakota markets:

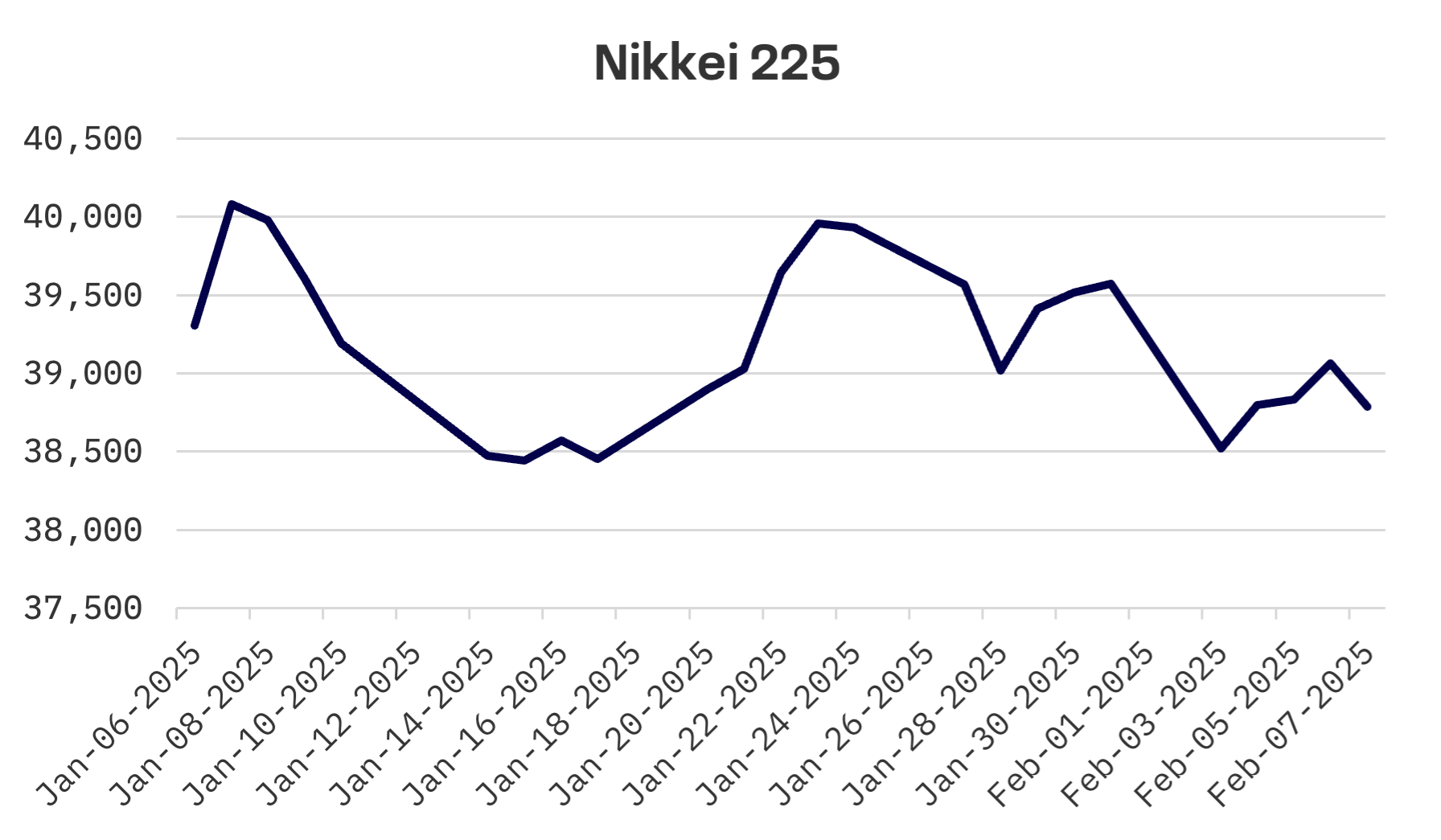

- Japan’s Nikkei 225 declined 2%, pressured by yen appreciation and BoJ’s hawkish stance on monetary policy

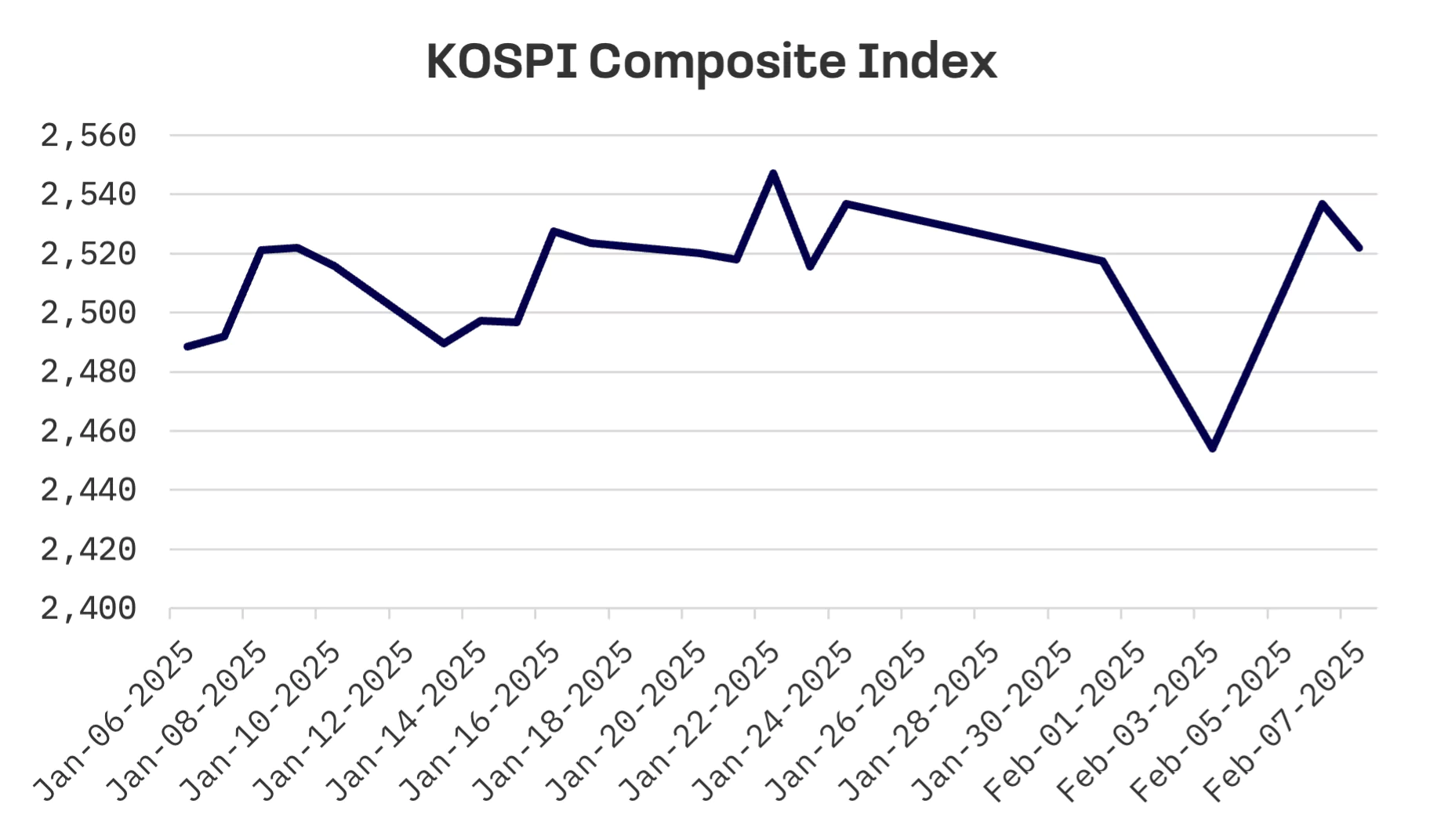

- South Korea’s KOSPI gained 0.2% in volatile trading, weathering U.S. tariff concerns and backed by tech sector resilience

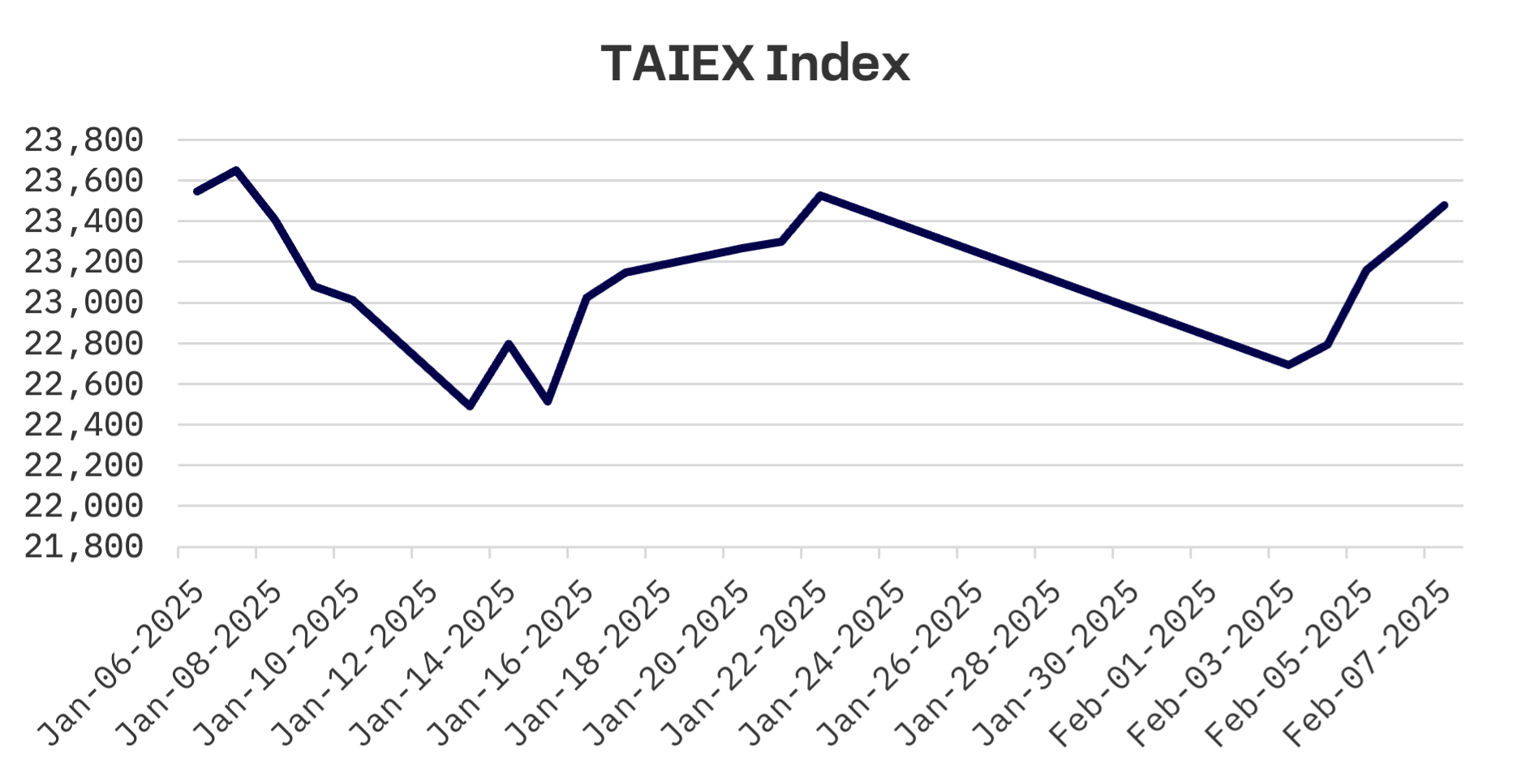

- Taiwan’s TAEX lost 0.2%, dragged down by electronics sector reaction to U.S. tariffs and Chinese AI competition

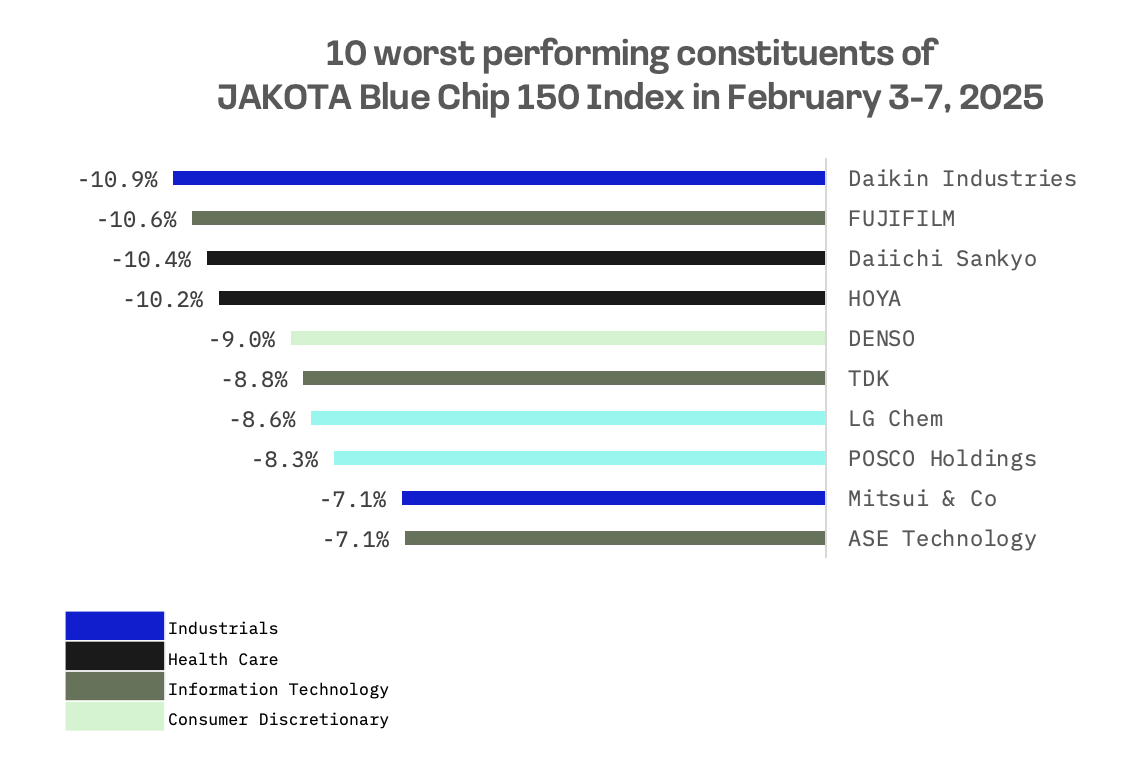

- The JAKOTA Blue Chip 150 Index slipped 0.1%, with Konami Group surging on strong earnings while Daikin Industries tumbled 10.9%

Japan

Japan’s stock markets retreated last week, with the Nikkei 225 dropping 2%. The latest hawkish comments from the Bank of Japan (BoJ) led the yen to strengthen to the high end of ¥151 against the dollar from ¥155.2 at the end of the previous week, pressuring export heavy industries’ profit outlooks.

The BoJ signalled its readiness to tighten policy if growth in the economy, prices and wages align with expectations. December data showed rising nominal wages and a second straight month of positive real wage growth, driven by substantial winter bonuses. Household spending also rebounded beyond forecasts. The BoJ has consistently emphasised the necessity of real wage increases to sustain an upward trend in private consumption.

Minutes from the BoJ’s January meeting, which marked its third rate increase within a year, revealed policymakers’ scrutiny of the monetary policy divergence with the U.S. Federal Reserve. With the Fed likely to pause rate cuts temporarily, the BoJ sees greater flexibility in its policy approach.

South Korea

South Korea’s KOSPI edged up 0.2% in a volatile week. Markets initially slumped on Monday due to U.S. tariff concerns regarding Canadian and Mexican imports before rebounding on news of tariff postponements. Thereafter, gains were led again through Thursday by tech giants.

The Bank of Korea (BOK) warned on Wednesday that global oil and farm produce prices, currency fluctuations and domestic demand could affect inflation.

Separately, the Ministry of Economy and Finance unveiled plans for a high tech fund exceeding ₩34 trillion ($23 billion) to support battery, biotech and other advanced technology sectors, addressing worries over U.S. nationalist policies and competition from DeepSeek, China’s new generative AI.

Taiwan

Taiwan’s TAEX shed 0.2% after dropping 3.53% on Monday following the Lunar New Year break. The selloff reflected trade war concerns and market reaction to DeepSeek’s – a Chinese AI startup – low cost model. The electronics sector led the downturn as investors reacted to U.S. tariffs on Canada, Mexico and China.

Taiwan’s consumer prices rose 2.66% in January year-over-year, marking an 11 month high, according to data from the Directorate General of Budget, Accounting and Statistics (DGBAS). The increase was driven by higher service costs, particularly for taxis and babysitting during the Lunar New Year holiday, well exceeding the central bank’s 2% alert threshold.

The National Development Council (NDC) reported strong December growth in Taiwan’s economy, citing demand for AI applications and high performance computing (HPC) devices. The NDC’s composite index of economic indicators rose four points to 38, signalling a “red light” for the first time in four months, up from the “yellow-red” warning in November.

JAKOTA Blue Chip 150 Index

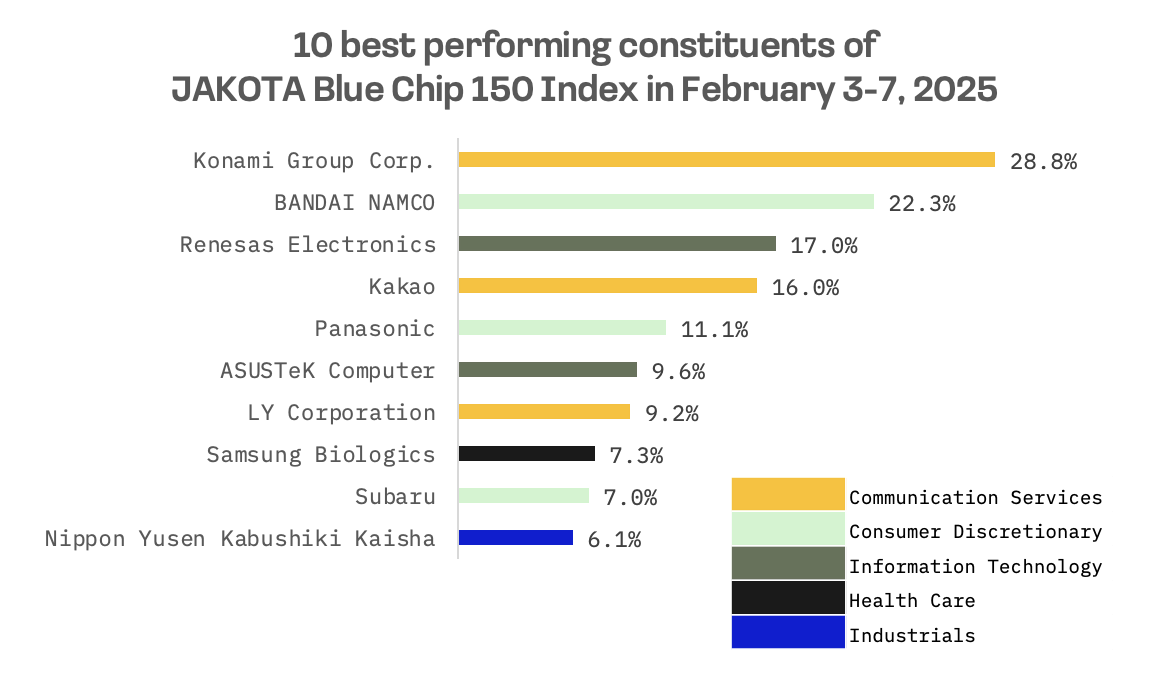

The JAKOTA Blue Chip 150 Index dipped 0.1%, with gains in 51 of 150 stocks.

Konami Group, Japanese entertainment company and video game developer, led advances after reporting October-December operating profit of ¥36.9 billion, up 52.5% year-over-year and exceeding ¥30 billion estimates. The company raised its full year profit forecast to ¥100 billion – below the ¥105 billion consensus, but viewed as conservative by investors – leaving room for potential upside.

Samsung Biologics, the world’s largest contract drugmaker, rose to become South Korea’s third most valuable stock on the main bourse, benefitting from sales growth and potential gains from U.S. biotech initiatives targeting China.

Daikin Industries, a Japanese conglomerate, the global leader in the HVAC&R (heating, ventilating, air conditioning and refrigerating) industry, was the worst performer on the JAKOTA Blue Chip 150 Index this week, falling 10.9% after reporting earnings per share of ¥120, missing ¥208 estimates. Although Daikin’s quarterly revenue of ¥1.1 trillion met analysts’ forecasts, the significant earnings shortfall weighed on investor sentiment.