Last week’s Jakota markets:

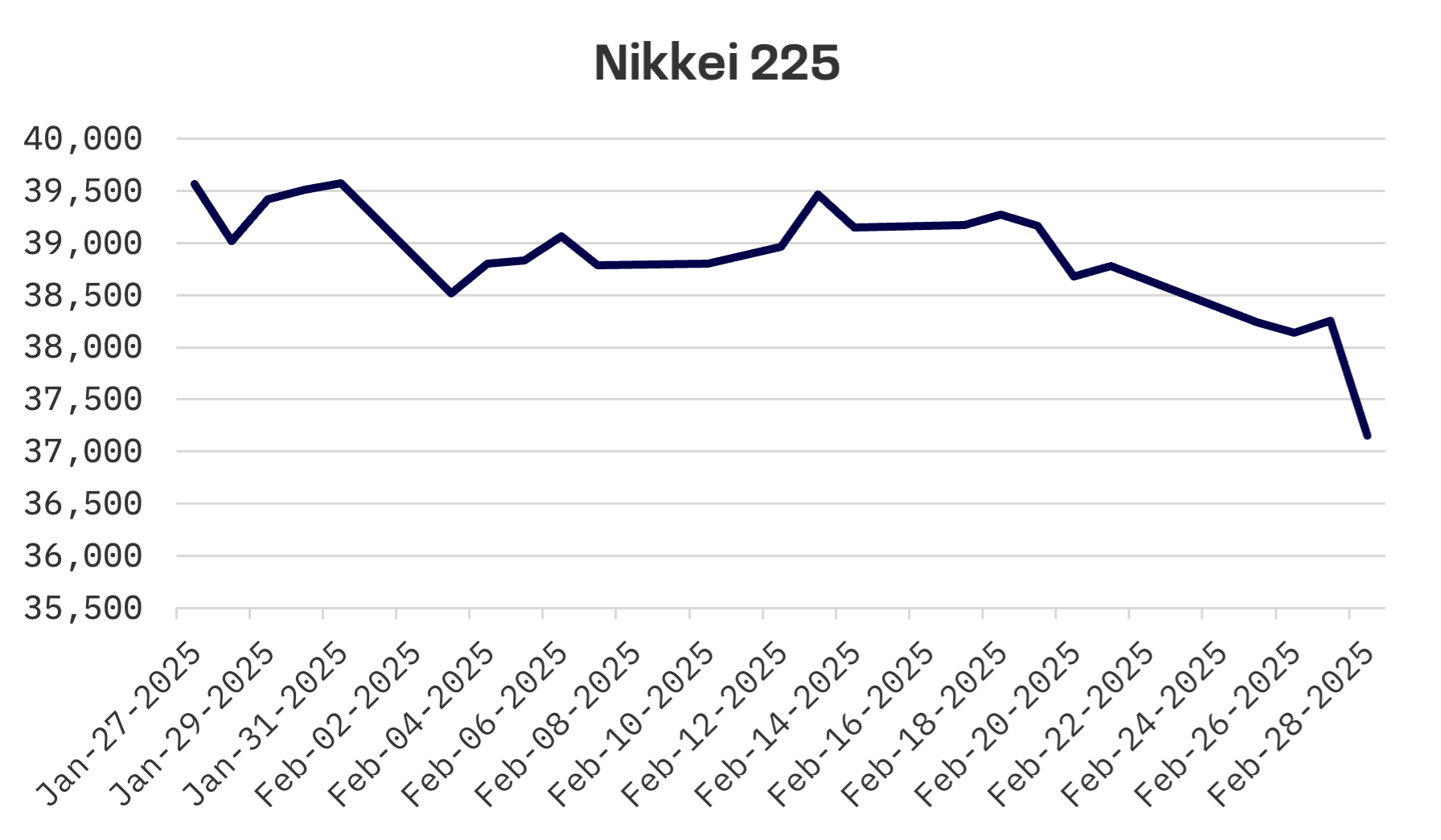

- Japan’s Nikkei 225 Index plunged 4.2% as AI related stocks tumbled amid U.S. tech selloff and concerns over Washington’s planned 10% tariff on Chinese imports

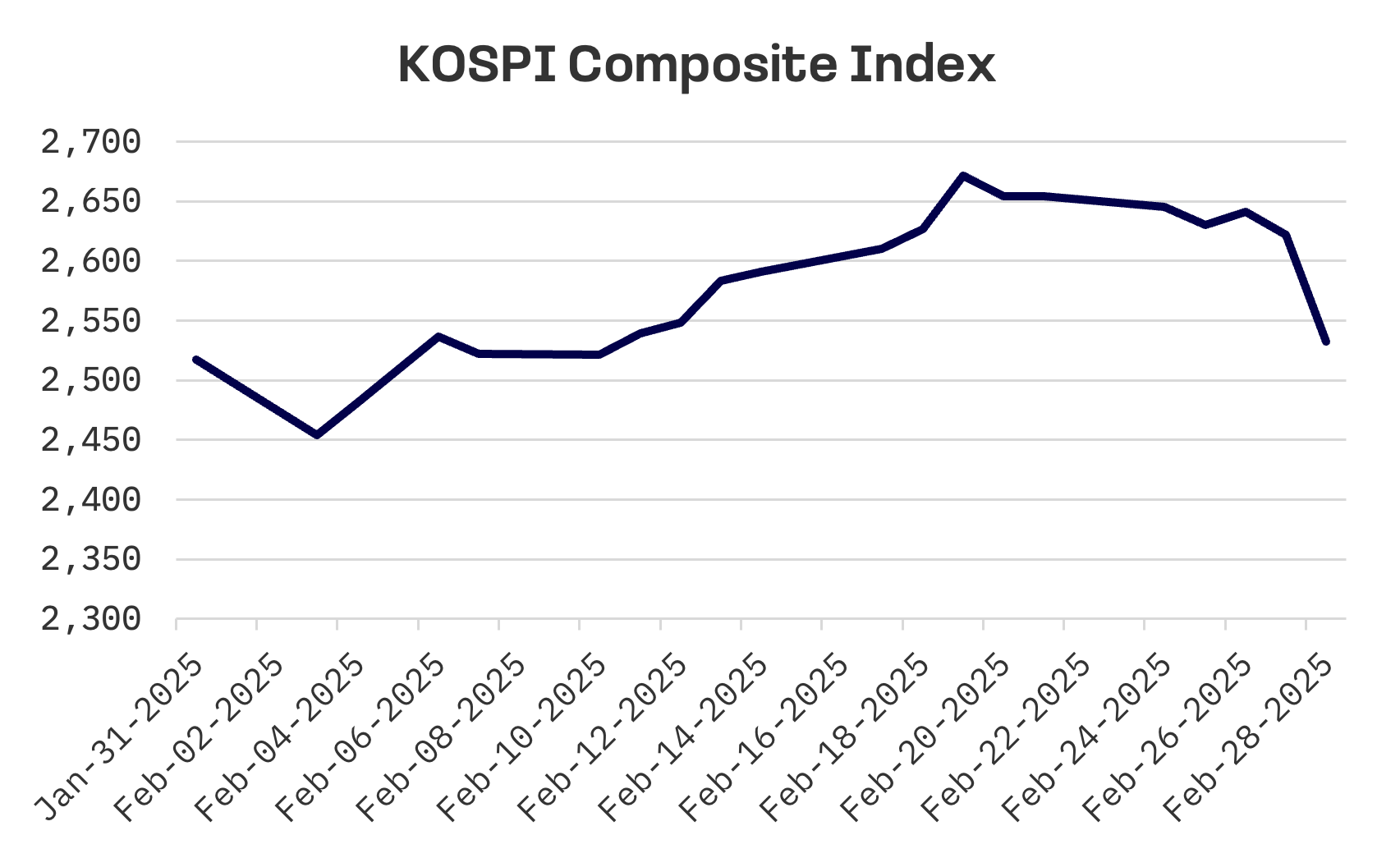

- South Korea’s KOSPI dropped sharply by 4.3%, pressured by tariff war concerns and Nvidia’s growth deceleration, while the central bank cut rates to 2.75% and slashed growth forecasts

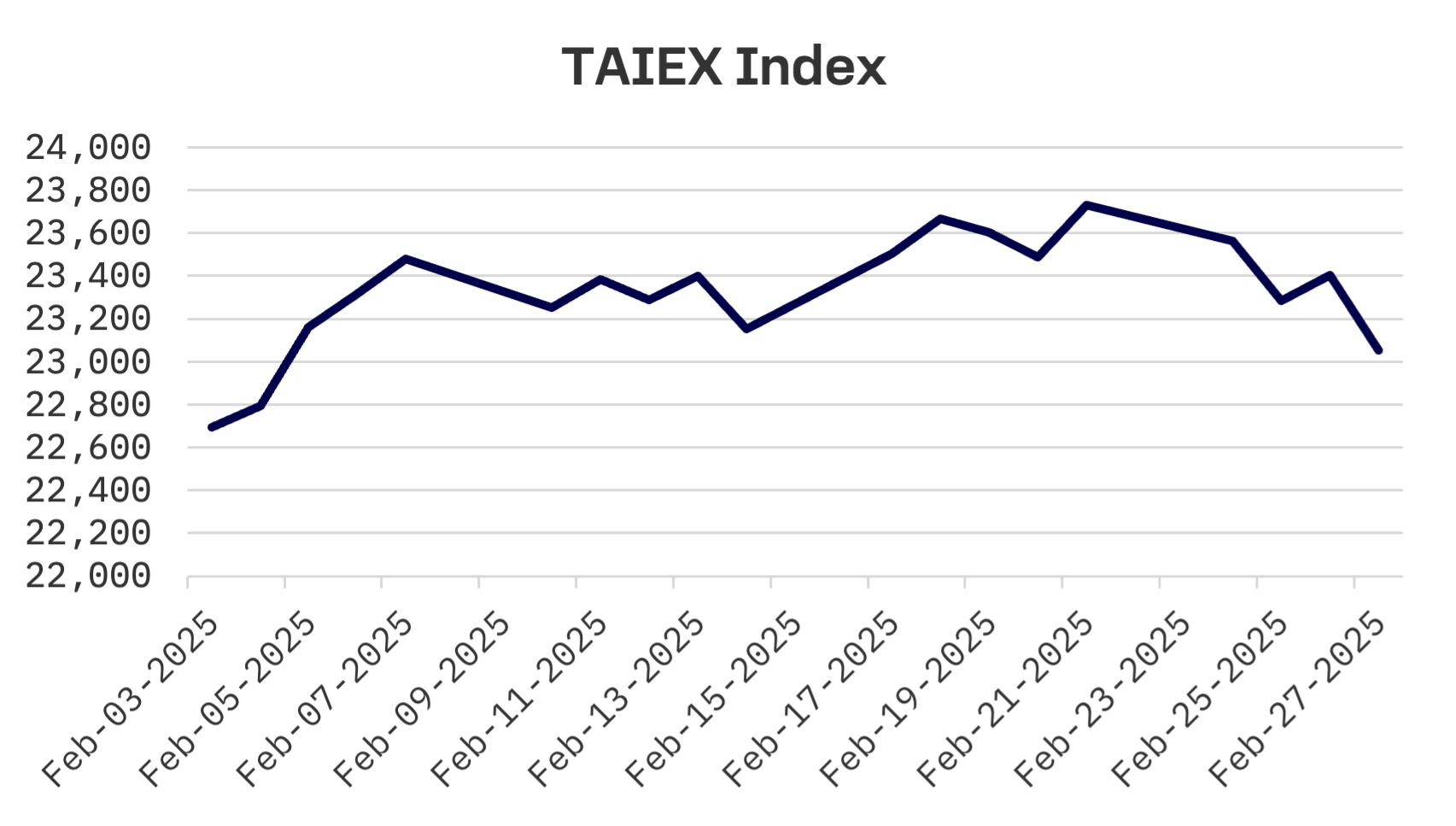

- Taiwan’s TAIEX fell 2.9% in a holiday shortened week, driven by concerns over future AI investments and Microsoft’s data centre lease cancellations

- The JAKOTA Blue Chip 150 Index lost 2.9%, though ITOCHU surged 8.6% after Buffett signalled increased investment in Japanese trading companies

Japan

Japan’s stock market retreated over the week, with the Nikkei 225 falling 4.2% as chipmakers and AI related stocks declined amid a broader selloff in U.S. tech shares. Investors grew concerned about potential fallout from escalating trade tensions, with Washington planning to impose an additional 10% tariff on Chinese imports. The move has created additional uncertainty regarding Japan’s economic outlook and the Bank of Japan (BoJ)’s approach to monetary policy normalisation.

BoJ Governor Kazuo Ueda emphasised significant uncertainties over how U.S. tariffs could influence the global economic outlook. He said the central bank would assess the potential effects of U.S. trade policies on Japan’s economy as it formulates its monetary policy stance. Ueda also reaffirmed the BoJ’s readiness to increase Japanese government bond purchases if yields rise abnormally.

The yield on the 10 year Japanese government bond (JGB) declined to 1.37%, down from 1.43% the previous week, as softer domestic inflation data weighed on rates.

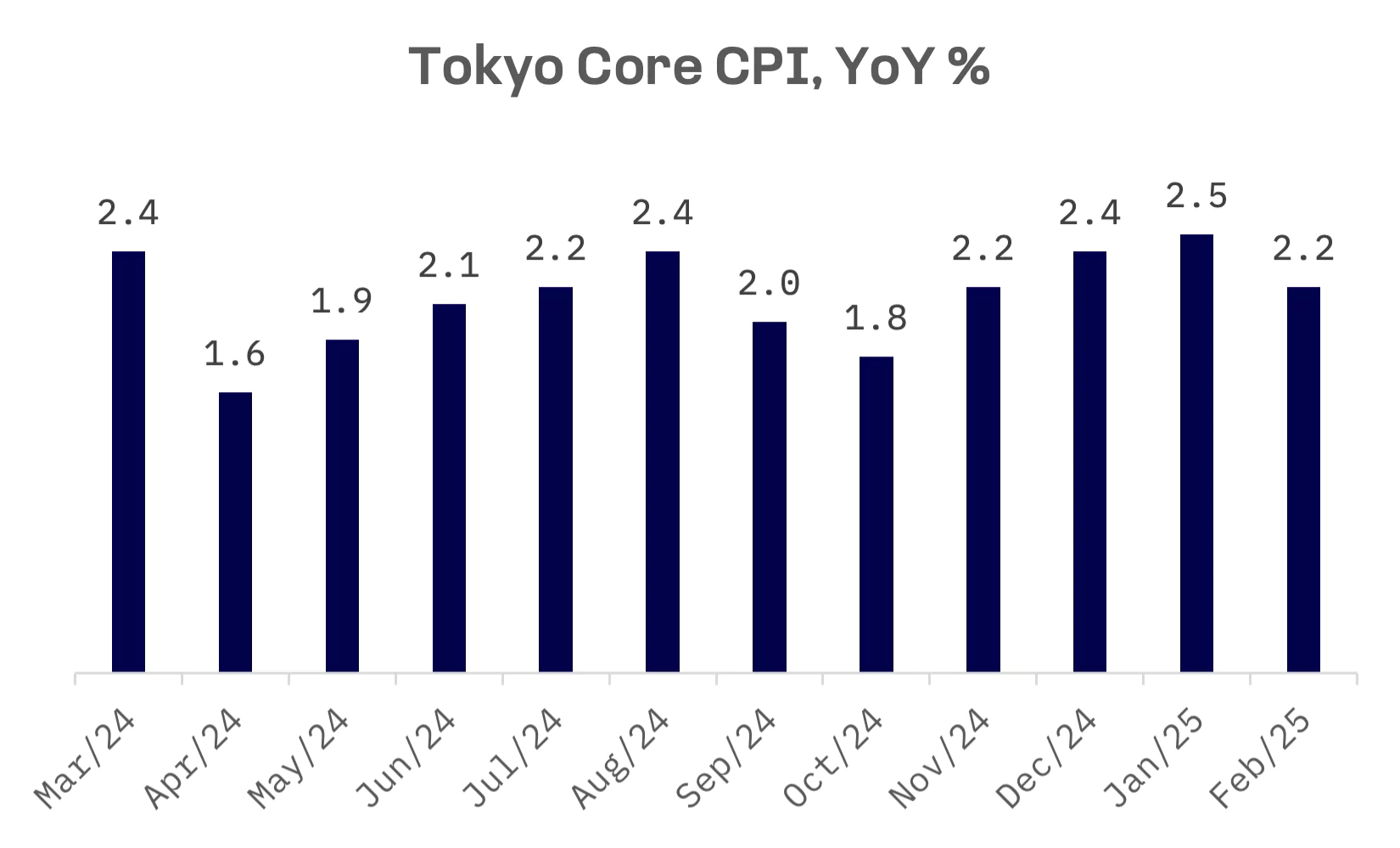

On the economic data front, the Tokyo area core consumer price index (CPI), a key indicator of nationwide inflation trends, rose 2.2% year-over-year in February, missing forecasts of 2.3% and slowing from 2.5% in January. The deceleration largely reflected the renewed impact of government subsidies aimed at lowering energy costs.

South Korea

South Korea’s stock market tumbled this week, with the KOSPI plummeting 4.3% as investor concerns mounted over the threat of a potential tariff war initiated by U.S. President Donald Trump and a sharp downturn in shares of AI chipmaker Nvidia.

Nvidia is widely regarded as a barometer of AI investment trends, and Wall Street responded negatively to the chipmaker’s quarterly forecast on Thursday, sending shares down more than 8%. Though Nvidia’s first quarter revenue outlook exceeded market expectations, with CEO Jensen Huang highlighting “amazing” demand for the company’s next generation Blackwell chips, growth is decelerating. Nvidia expects revenue to rise approximately 65% – a significant slowdown from the triple digit increases investors have grown accustomed to over the past year.

In a widely anticipated move, South Korea’s central bank on Tuesday reduced its benchmark interest rate to 2.75% – the lowest level since August 2022 – and lowered its economic growth forecast, citing political uncertainty following December’s martial law decree and the potential impact of U.S. tariffs on Asia’s fourth largest economy.

The central bank also revised its economic growth outlook for the year to 1.5%, down from its previous 1.9% forecast in November. The latest projection falls below last month’s estimate of 1.6% to 1.7%. South Korea’s economy grew 2% in 2024.

Taiwan

In a holiday shortened week, Taiwan’s stock market slumped, with the TAIEX index dropping 2.9%, as Friday’s Peace Memorial Day closure prevented investors from reacting to Nvidia’s quarterly results. This week’s selloff was driven by concerns over future AI investments following reports that Microsoft cancelled some data centre leases, as well as broader worries about the U.S. economy.

Taiwan’s unemployment rate edged down 0.02% in January from the previous month to 3.3%, the lowest for that month in 25 years, indicating a stable job market. However, the rate is expected to rise next month as job changes typically increase after the Lunar New Year holiday.

JAKOTA Blue Chip 150 Index

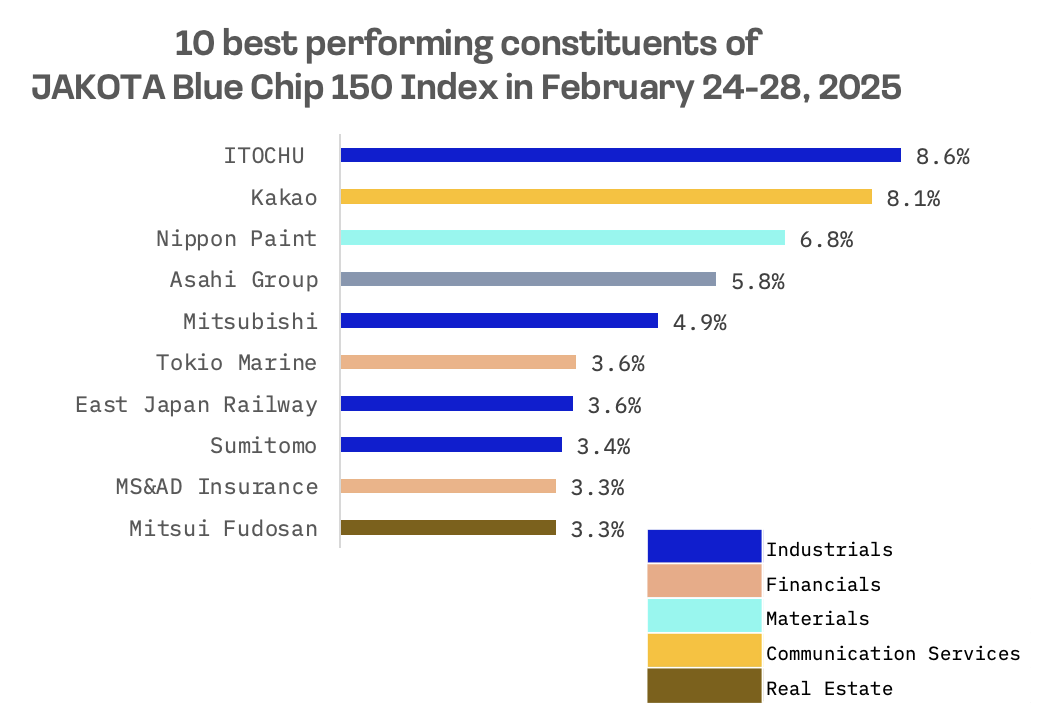

The JAKOTA Blue Chip 150 Index lost 2.9% this week. Out of a pool of 150 constituents, 51 stocks posted gains.

ITOCHU, one of the largest Japanese sogo shosha (general trading and investment companies), emerged as the top performer on the JAKOTA Blue Chip 150 Index, rising 8.6% this week after Warren Buffett wrote in Berkshire Hathaway’s annual shareholder letter that it would increase its investment in Japan’s largest sogo shosha firms – ITOCHU, Marubeni, Mitsubishi, Mitsui and Sumitomo – which invest across a range of industries both domestically and overseas.

Berkshire Hathaway remains committed to its Japanese investments for the long term and has secured agreements allowing it to exceed the initial 10% ownership cap, Warren Buffett said in his annual letter to shareholders on Saturday.

“From the start, we also agreed to keep Berkshire’s holdings below 10% of each company’s shares. But, as we approached this limit, the five companies agreed to moderately relax the ceiling,” Buffett wrote. “Over time, you will likely see Berkshire’s ownership of all five increase somewhat.”

Japanese chipmakers and AI related stocks including Disco, Advantest and Tokyo Electron declined this week, leading the losses in the JAKOTA Blue Chip 150 Index amid a selloff in U.S. technology shares.