Last week’s Jakota markets:

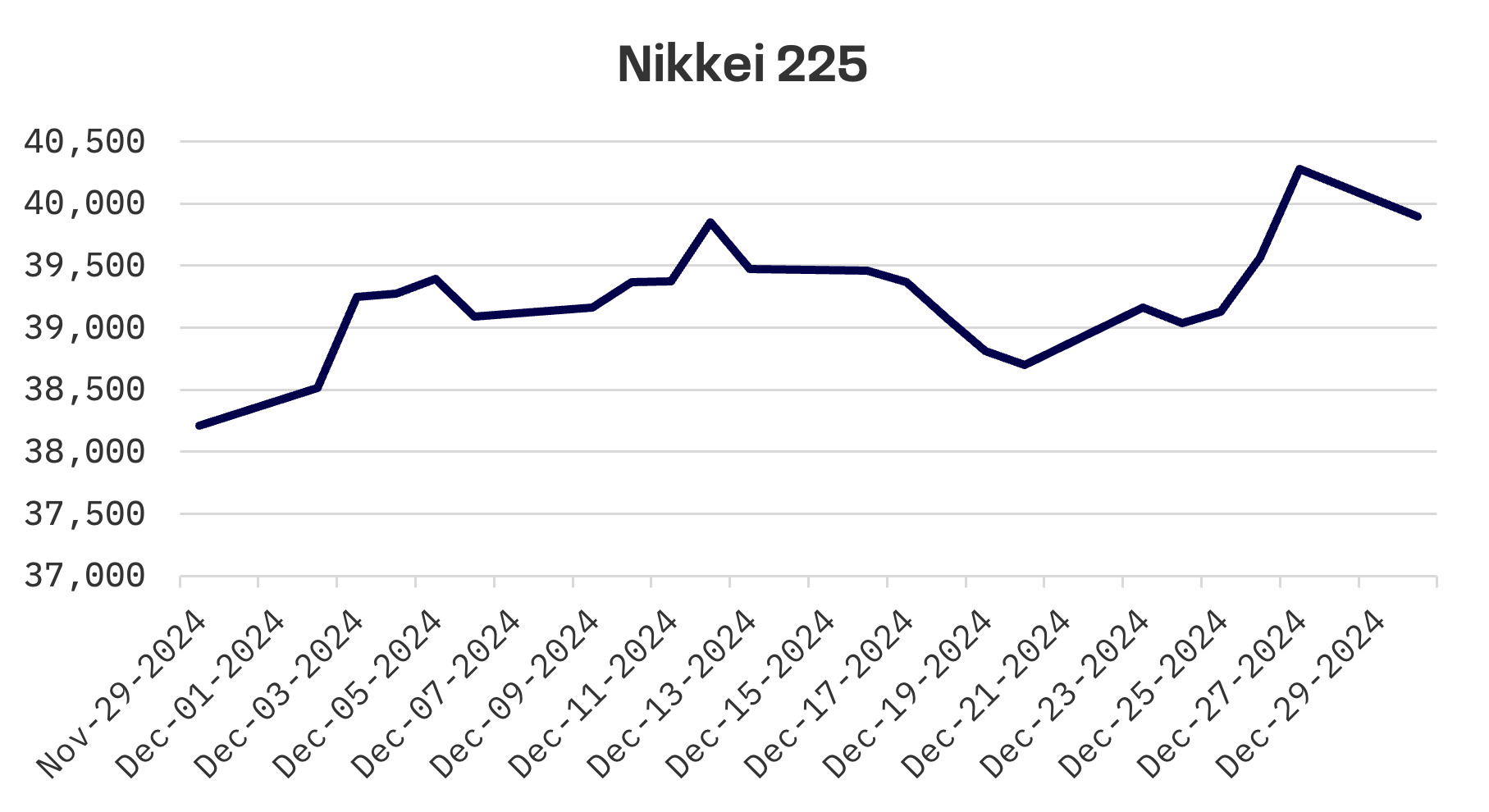

- Japan’s Nikkei 225 Index dipped 1% in holiday trading, ending 2024 with a 20% advance on improved corporate governance and currency tailwinds

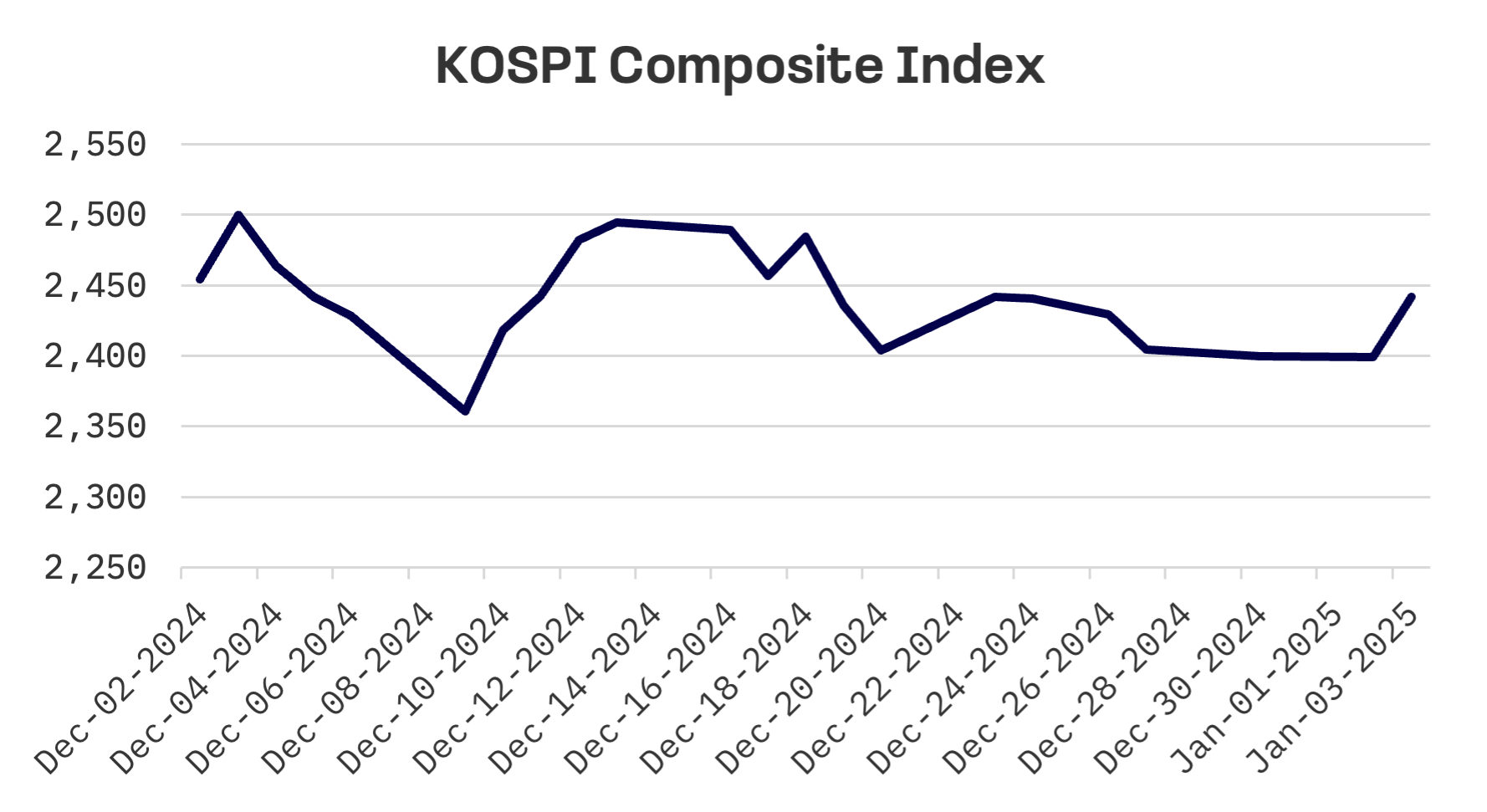

- South Korea’s KOSPI advanced 1.5% despite political turmoil, breaking a five day losing streak as battery makers and tech stocks rallied amid presidential impeachment developments

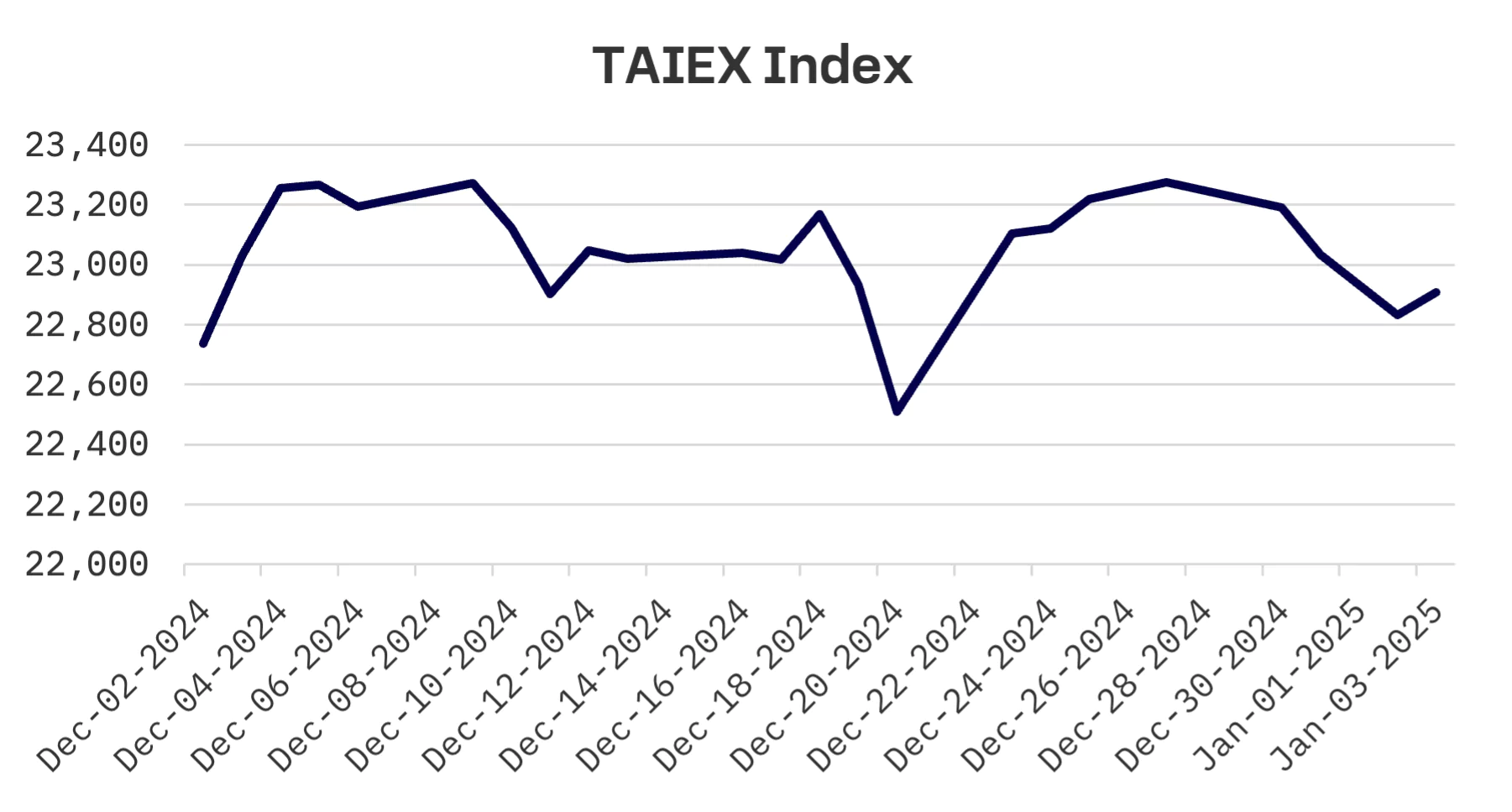

- Taiwan’s TAIEX dropped 1.6%, though closed 2024 with an impressive 28% annual gain driven by TSMC’s strong performance in AI related developments

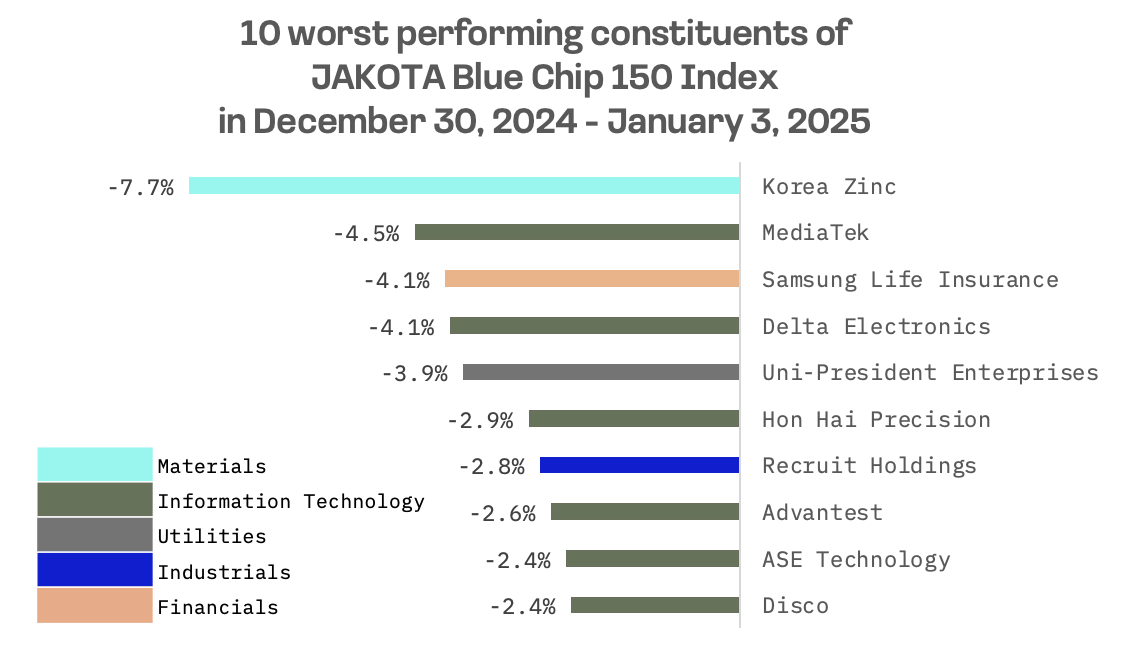

- The JAKOTA Blue Chip 150 Index shed 0.7%, with SK Innovation leading gains while Korea Zinc fell 7.7% amid hostile takeover concerns

Japan

Japan’s stock market closed lower in a holiday shortened trading week amid profit taking pressure. The Nikkei 225 Index declined nearly 1% on Monday, though the benchmark still recorded an annual gain of about 20% for 2024, supported by share buybacks, corporate governance improvements and a weaker yen that boosted exporters.

South Korea

South Korean markets ended the week higher, with the KOSPI index advancing 1.5%, despite significant political turbulence.

The market started on a weak note on Monday, extending losses to a fourth consecutive session. The final trading day of 2024 saw investors grappling with a brief martial law attempt and concerns over the country’s credibility, overshadowing positive sentiment around the president’s impeachment motion. Adding to market pressure were high tariffs and policy shifts from the incoming Trump administration. The KOSPI closed 2024 with an annual decline of nearly 10%.

The market slipped further on Thursday, the first trading session of 2025, marking a five day losing streak amid uncertainty surrounding President Yoon Suk Yeol’s impeachment trial and investigation. However, a sharp rebound followed on Friday, with the benchmark index climbing nearly 1.8%, led by chipmakers, battery producers and biotech firms.

The recovery coincided with an unsuccessful attempt by the anti corruption agency to detain the impeached president over his alleged martial law bid, which ended in a standoff with presidential security officials.

Bank of Korea (BOK) Governor Rhee Chang-yong, speaking at a New Year’s meeting with financial institution leaders on Friday, emphasised the need for monetary policy flexibility amid unprecedented political and economic uncertainty. Mr. Rhee indicated the central bank would carefully pace rate cuts while monitoring domestic and global risks.

South Korea’s exports, the country’s main growth driver, hit a record in 2024, climbing 8.2% year-over-year to $683.8 billion, driven by strong semiconductor sales and recovering shipments to China, according to data from the Ministry of Trade, Industry and Energy. Despite the record, exports fell short of the government’s $700 billion target. South Korea, Asia’s fourth largest economy, also remained behind its neighbour Japan, which faced its own challenges amid global economic uncertainty.

The Ministry of Economy and Finance cut its 2025 economic growth forecast to 1.8% from its July 2024 projection of 2.2%, citing political upheaval following President Yoon’s martial law decree. The economy is estimated to have grown 2.1% in 2024, slightly below earlier estimates.

“Downside risks have intensified due to heightened uncertainties both domestically and globally,” the ministry stated in its 2025 Economic Policy Directions report, indicating potential additional economic support measures after first quarter assessments.

Taiwan

Taiwan’s stock market declined 1.6% this week, though the TAIEX Index posted a robust 28% gain for 2024, largely driven by Taiwan Semiconductor (TSMC). The market heavyweight benefitted from optimism surrounding AI applications and strong financial results.

JAKOTA Blue Chip 150 Index

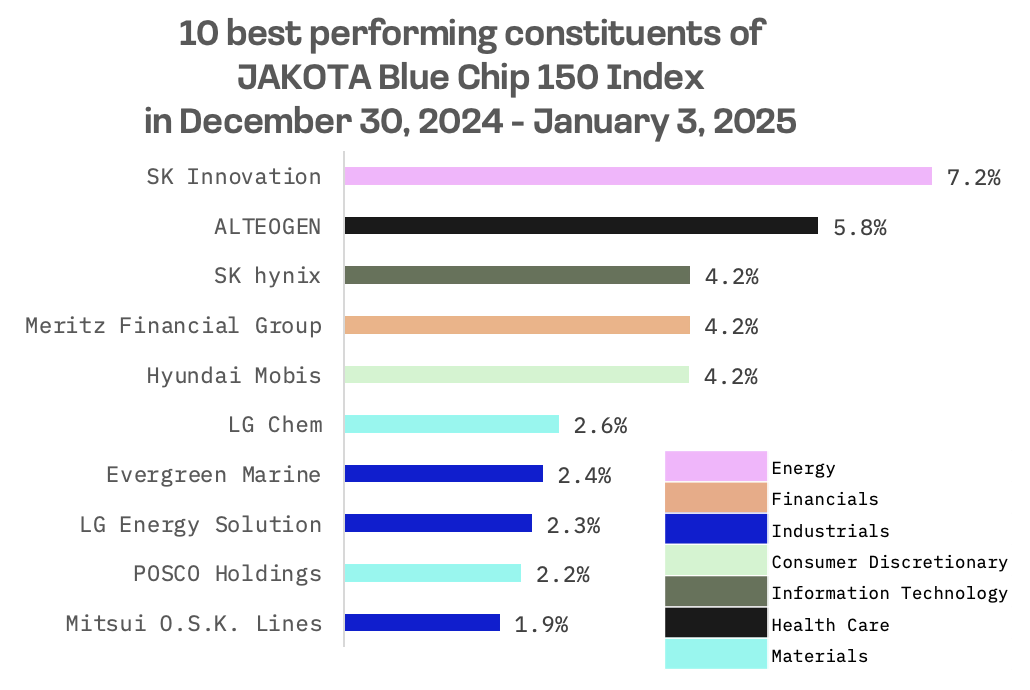

The JAKOTA Blue Chip 150 Index fell 0.7% this week, with only 36 of 150 constituents advancing.

SK Innovation, an energy and chemical company pursuing both battery and oil exploration and production (E&P) businesses, led gainers as investors sought bargains in battery stocks on Friday.

Korea Zinc, a global leader in non ferrous metal smelting and a recent addition to the JAKOTA Blue Chip 150 Index, reaffirmed its reputation for volatility with a 7.7% decline this week. The drop led the company to top the list of the worst weekly performers in the index.

Korea Zinc’s management expressed concern on 2024’s final trading day about MBK Partners and Young Poong’s hostile takeover tactics, particularly questioning the timing of injunction filings that coincided with events including Young Poong’s 58 day smelting operations suspension for environmental violations. Critics suggest these actions might mislead markets and harm minority shareholder interests.