Last week’s Jakota markets:

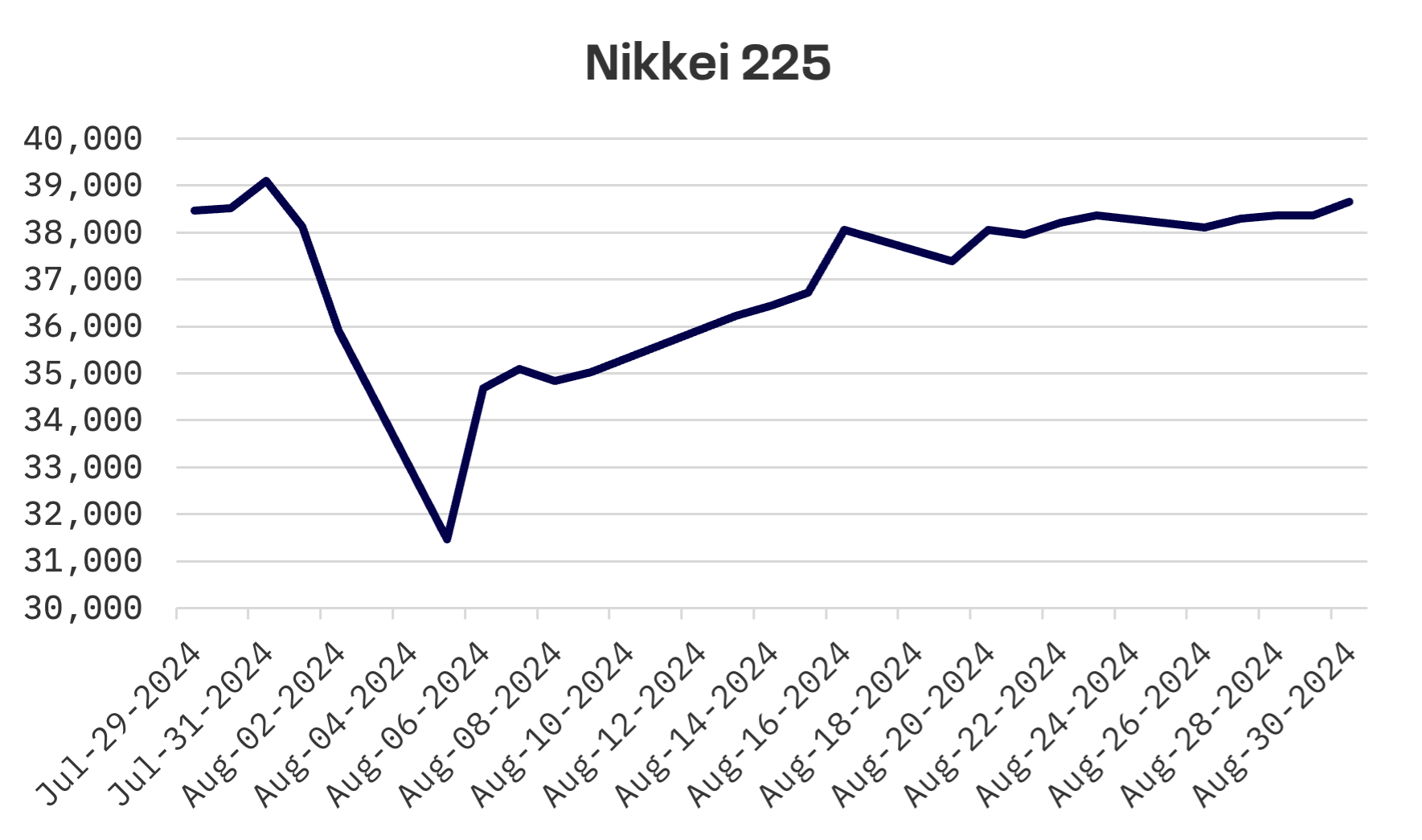

- Japan’s Nikkei 225 rose 0.7%, shaking off earlier losses as the Bank of Japan signals readiness for further rate hikes amid persistent inflation

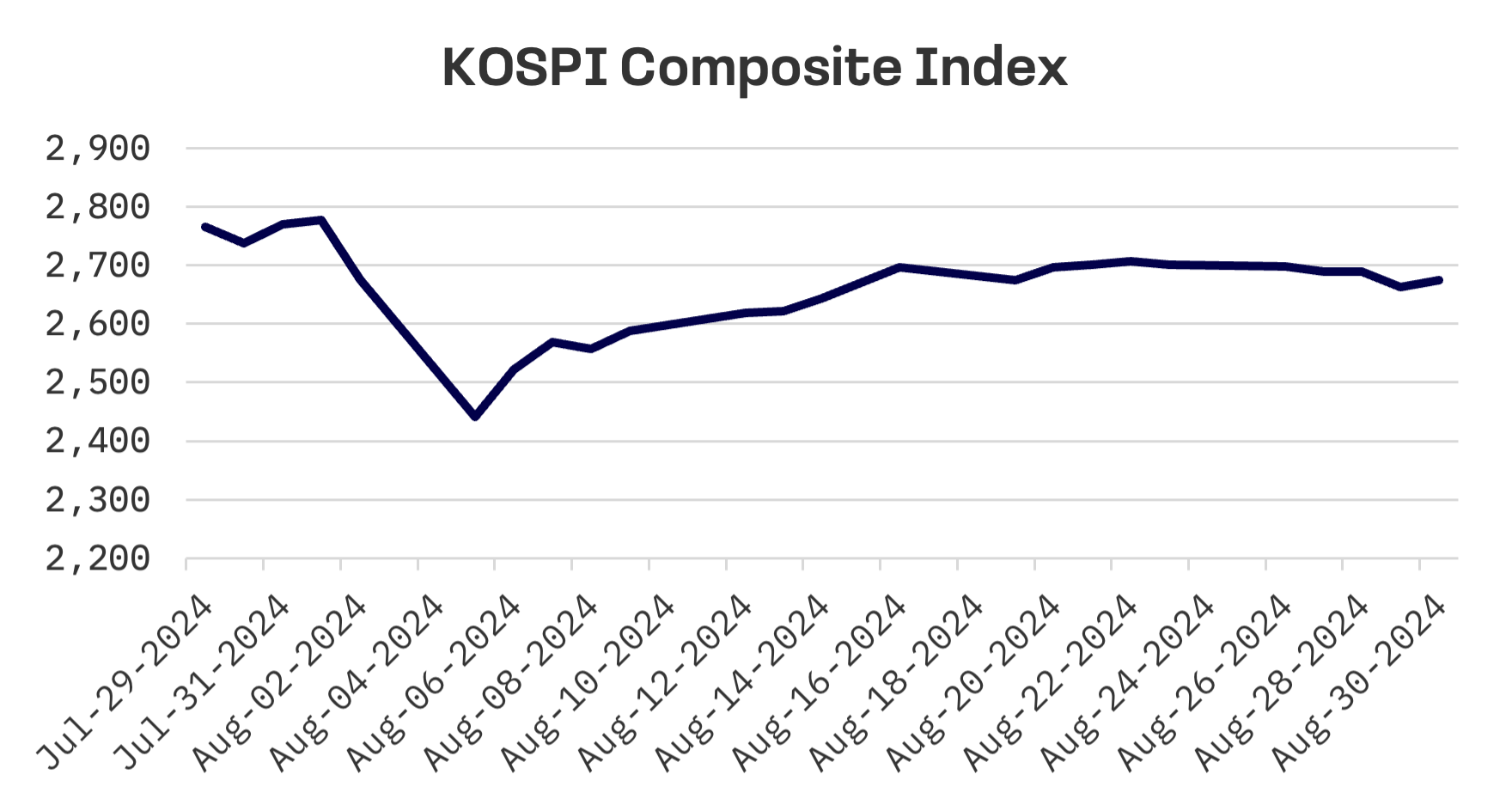

- South Korea’s stock market dropped 1.0%, reacting to mixed signals from global markets and tech earnings, despite an 11-month export growth streak

- Taiwan’s TAIEX slipped 0.5%, navigating technical resistances and global tech sentiment, while grappling with reduced representation in key global indices

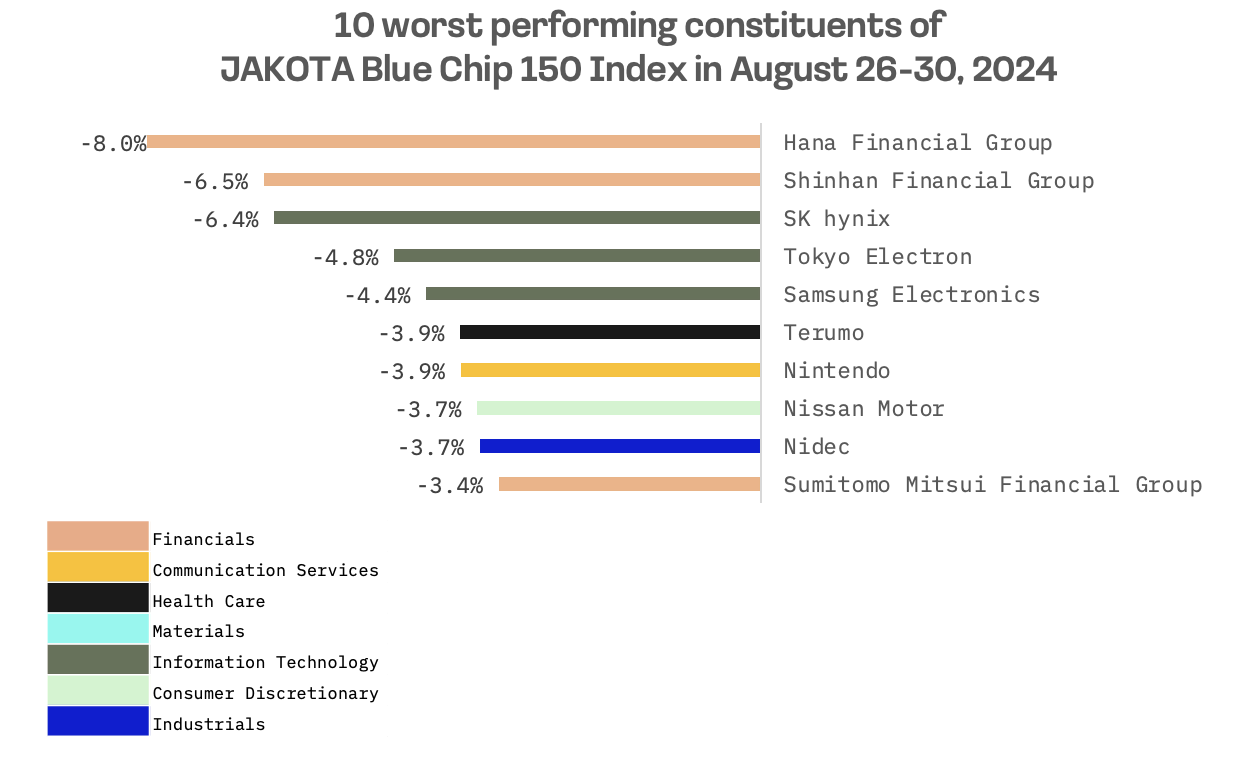

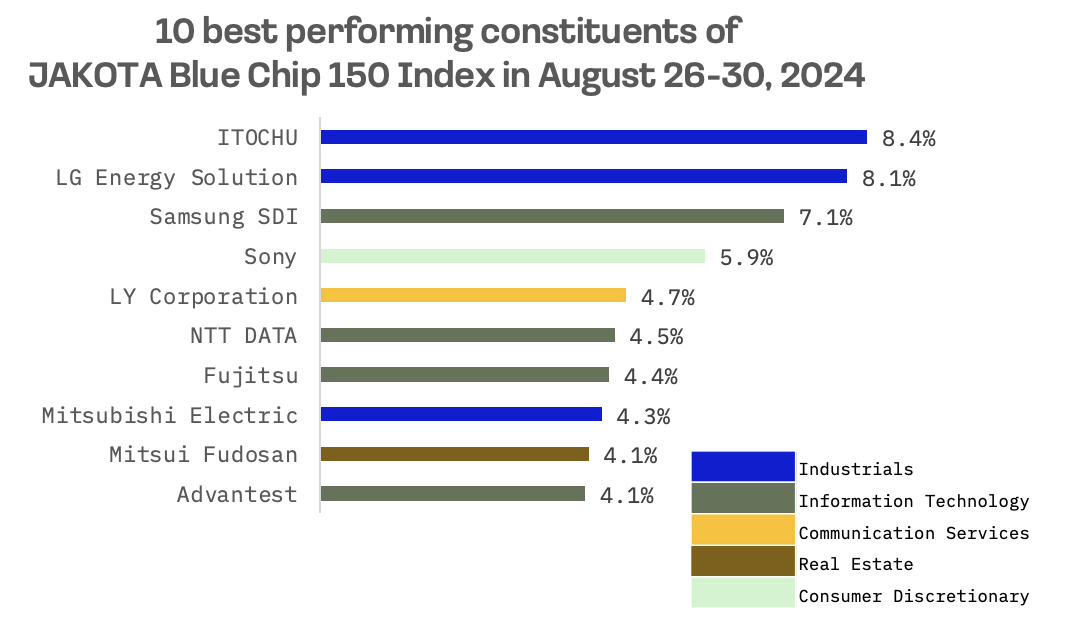

- The JAKOTA Blue Chip 150 Index inched up 0.1%, with ITOCHU Corporation surging over 8% on acquisition news, while Korean financial firms struggled

Japan

Japan’s stock market rallied this week, with the Nikkei 225 Index climbing 0.7%. By August’s end, the index had recouped most losses from the sharp sell off earlier in the month, which was triggered by the Bank of Japan’s late July interest rate hike and compounded by renewed U.S. economic growth concerns and a rapid unwinding of the yen carry trade.

The yen weakened slightly but still strengthened for the second consecutive month in August, driven by divergent monetary policy outlooks between Japan and the U.S. This trend has added pressure on the earnings prospects of Japan’s export oriented firms.

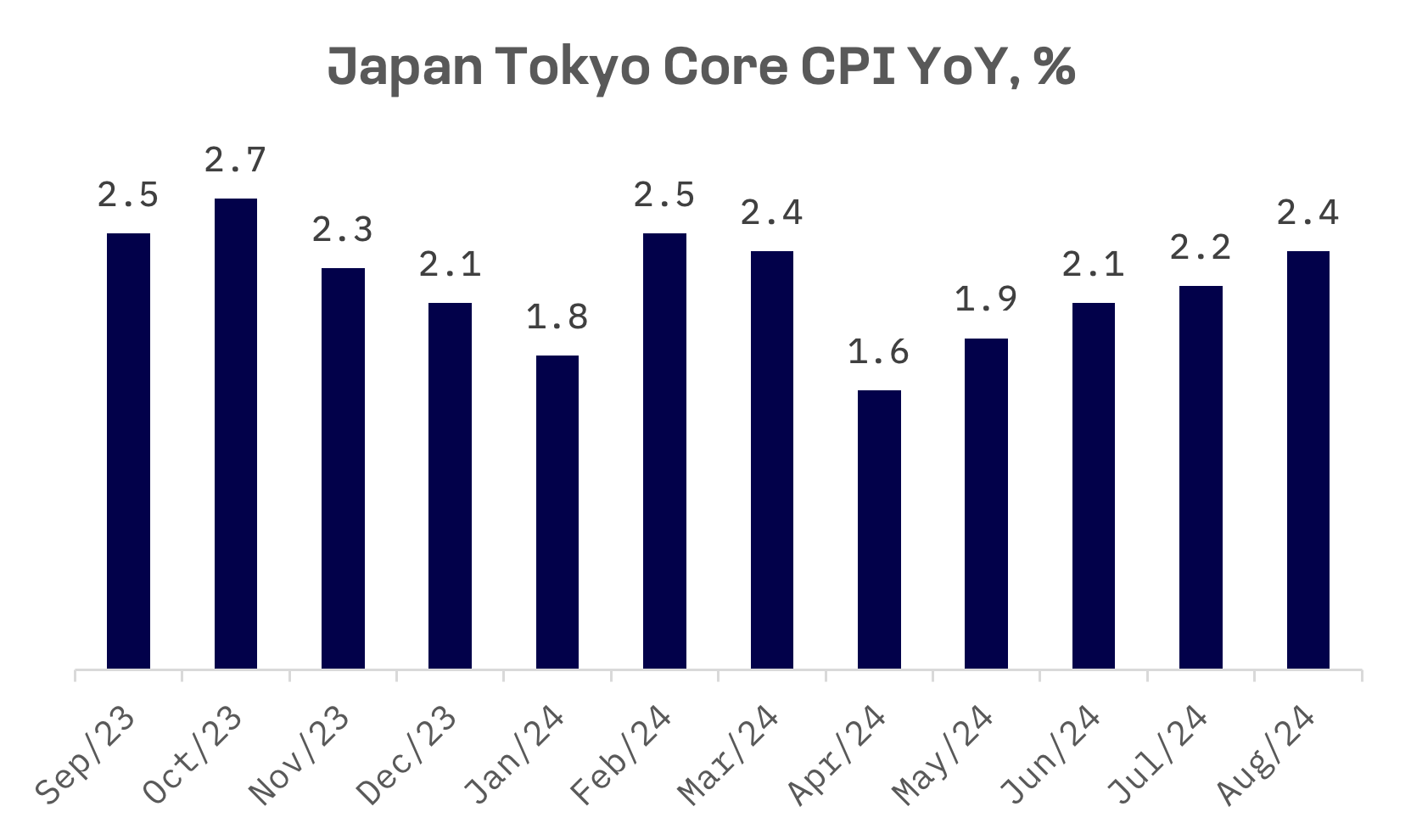

Inflation data reinforced a hawkish outlook on the Bank of Japan’s (BOJ) monetary policy. The Tokyo area core consumer price index (CPI), a key indicator of nationwide trends, rose 2.4% year-over-year in August, surpassing the consensus estimate of 2.2% and hitting its highest level since March.

BOJ Governor Kazuo Ueda recently reaffirmed the central bank’s commitment to normalizing monetary policy as it gains confidence in achieving stable 2% inflation, signalling readiness to raise rates again if economic and price projections align.

Deputy Governor Ryozo Himino echoed Mr. Ueda’s remarks, emphasizing that the BOJ’s baseline scenario anticipates growth and inflation will develop as expected. However, Mr. Himino noted that volatile financial markets, both domestically and internationally, could influence this outlook and must be monitored “with an extremely high sense of urgency.”

South Korea

South Korea’s stock market retreated this week, with the KOSPI Index shedding 1.0%. The decline began Monday and Tuesday as investors took profits following hints from Federal Reserve Chair Jerome Powell about a potential rate cut. The losing streak continued Wednesday, with the market ending nearly flat as investors awaited earnings from U.S. tech giant Nvidia.

On Thursday, shares fell over 1%, led by chipmakers reacting to Nvidia’s underwhelming earnings results. The market rebounded Friday, with investors snapping up bargains in tech, energy and blue chip stocks, despite the local currency’s decline.

On the economic front, South Korea’s exports continued their upward trajectory in August, marking the 11th consecutive month of year-over-year gains. The robust performance was fuelled by strong demand for semiconductors, which the Ministry of Trade, Industry and Energy attributed to new smartphone launches and increased investment in the AI sector by major technology firms. Outbound shipments rose 11.4% from a year earlier, reaching $57.9 billion.

Taiwan

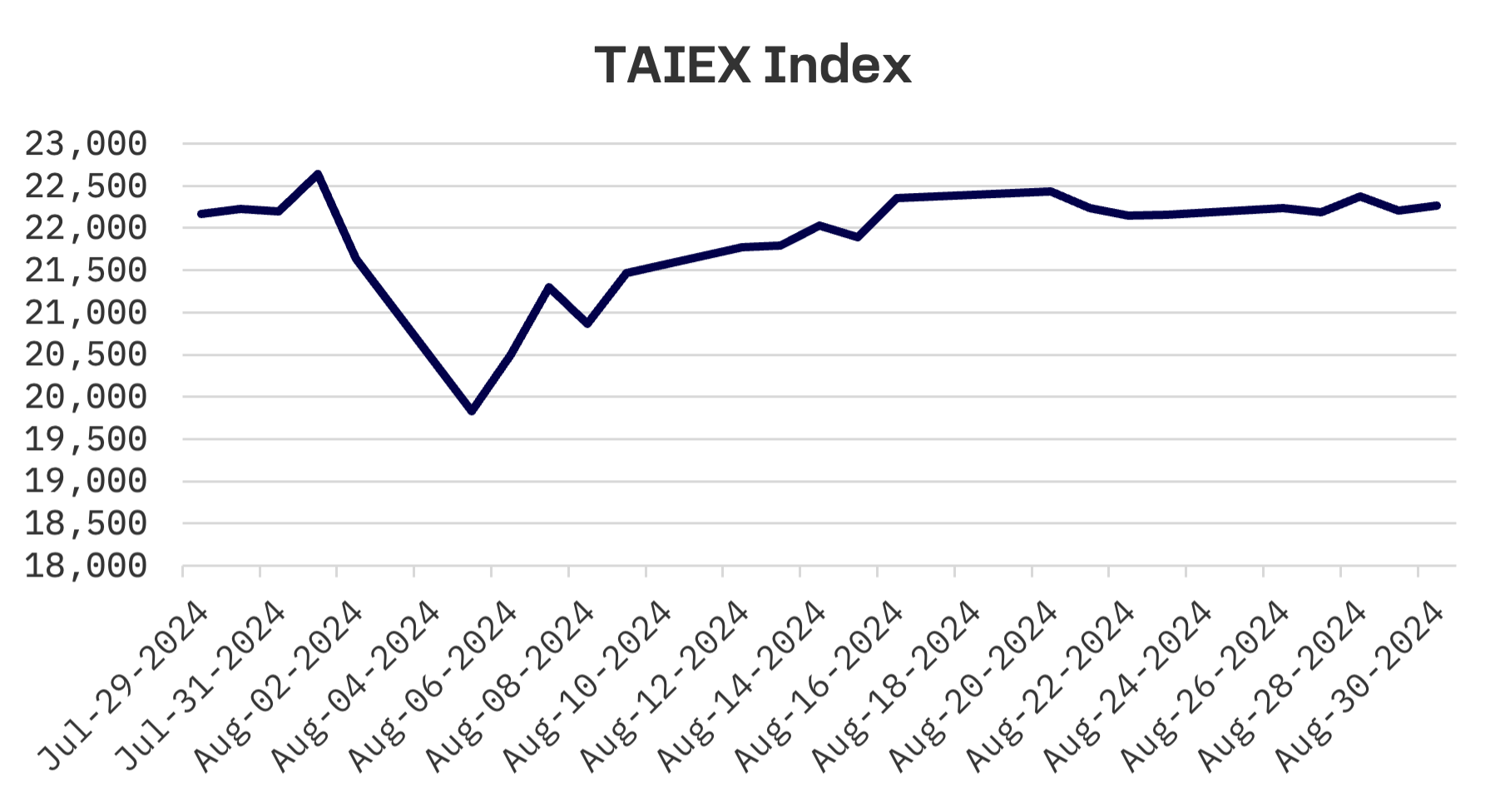

Taiwan’s shares experienced a modest decline this week, with the TAIEX index falling 0.5%. The market saw daily fluctuations, starting with moderate gains on Monday that were trimmed as the index approached technical resistance around its 60-day moving average. While the electronics sector faltered, strong performance in non-tech stocks, particularly financials, provided some offset. Tuesday brought a slight dip on thin trading, mirroring significant losses in U.S. tech stocks. Investors’ optimism about upcoming announcements from U.S. AI chip designer Nvidia sparked a rebound on Wednesday, but Thursday saw another decline. The week closed on a positive note Friday, though gains were constrained by news of Taiwan’s reduced weighting in two of MSCI Inc.’s major indices, a development closely monitored by foreign investors.

JAKOTA Blue Chip 150 Index

The JAKOTA Blue Chip 150 Index edged up 0.1% this week, with 83 out of 150 constituents posting gains.

ITOCHU Corporation, a leading sogo shosha (general trading company), emerged as the top performer, surging over 8%. The company, which engages in domestic and international trade of diverse products ranging from textiles to machinery, rallied on news of its planned takeover of Tokyodo’s business operations. The deal, to be executed through ITOCHU’s subsidiary, ITOCHU Retail Link, will use an absorption type company split.

Tokyodo, established in 1917, has built a robust commercial logistics network linking retailers and manufacturers. It distributes daily necessities and cosmetics to various retail outlets, including drugstores, convenience stores and supermarkets. ITOCHU’s interest in Tokyodo dates back to 2005 when it acquired an initial stake, aiming to capitalize on the company’s extensive logistics capabilities.

Korean financial firms Hana Financial Group and Shinhan Financial Group were the worst performers on the index. Their shares came under pressure due to increasing regulatory scrutiny from financial authorities and escalating geopolitical uncertainties.