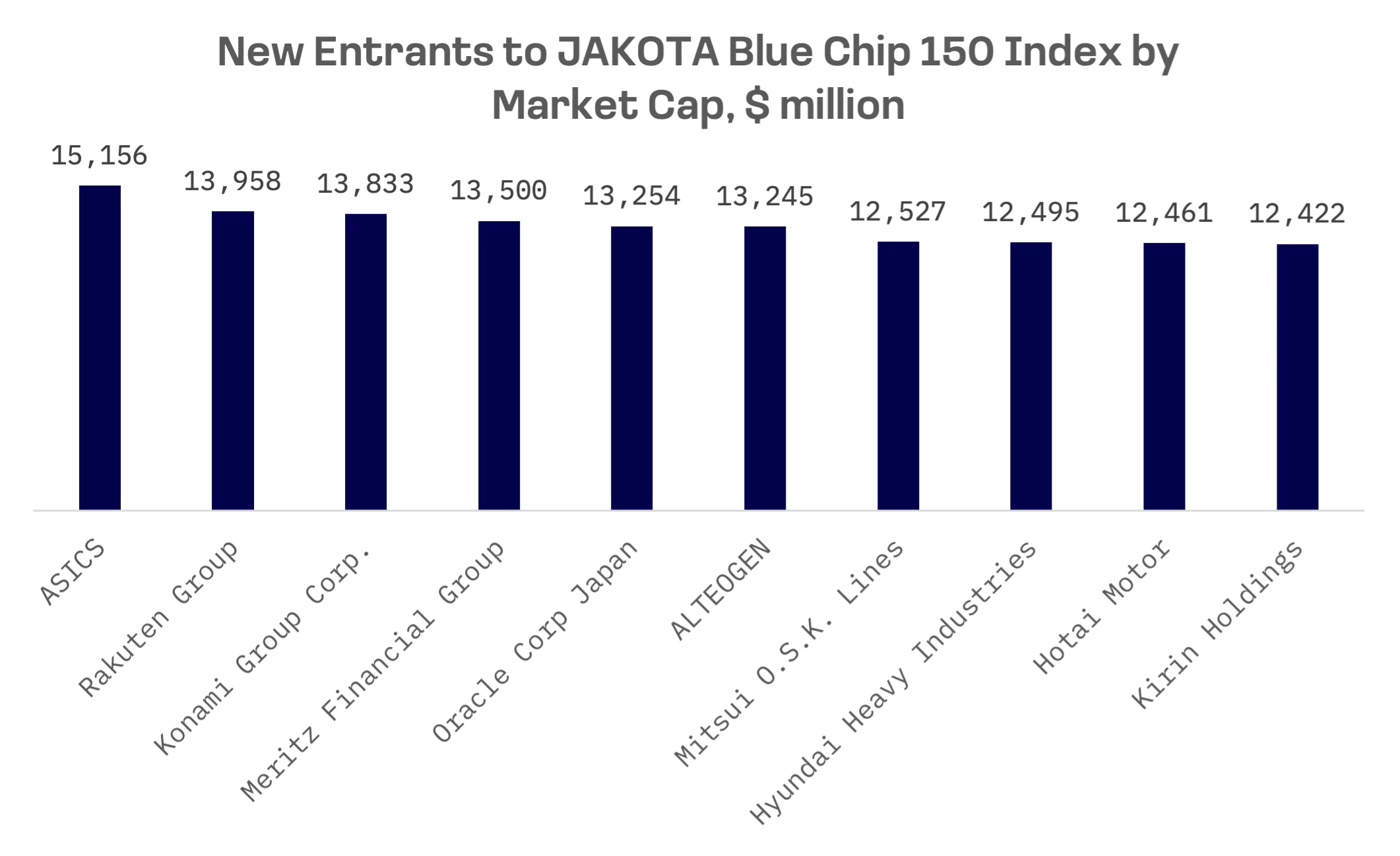

The JAKOTA Blue Chip 150 Index‘s quarterly rebalancing, effective October 1, 2024, saw 10 companies added and an equal number removed.

Among the newcomers, two companies made a comeback after being dropped in the previous quarter:

- Kirin Holdings (2503.TSE), a Japanese manufacturer of alcoholic and non-alcoholic beverages, as well as pharmaceuticals.

- Rakuten Group (4755.TSE), Japan’s largest ecommerce company and the third largest ecommerce marketplace globally.

Eight companies joined the index for the first time:

- ASICS (7936.TSE): Japanese manufacturer and distributor of sports products, such as sports shoes, sportswear and sports equipment.

- Konami Group Corp. (9766.TSE): Japanese multinational entertainment company and video game developer and publisher.

- Meritz Financial Group (138040.KO): South Korean financial holding company which provides a range of financial services, including insurance, asset management and investment banking.

- Oracle Corp Japan (4716.TSE): Software vendor specialising in database management system software, application development tools, decision making support tools and business related applications.

- ALTEOGEN (196170.KQ): South Korean biopharmaceutical firm focused on on the development and commercialisation of novel biologics.

- Mitsui O.S.K. Lines (9104.TSE): Japanese maritime company which provides marine transportation, warehousing and cargo handling services.

- Hyundai Heavy Industries (329180.KO): South Korean company, the world’s largest shipbuilding company and a major heavy equipment manufacturer.

- Hotai Motor (2207.TW): Taiwanese distributor of automobiles, commercial trucks and industrial equipment.

The departing companies include:

- Kakao

- Nissan Motor

- HANMI Semiconductor

- Nan Ya Plastics

- First Financial Holding

- Eisai

- Shiseido

- Novatek Microelectronics

- Largan Precision

- Wiwynn

This quarter’s rebalancing marks a geographic shift towards Japan, contrasting with the previous quarter’s focus on Taiwan. The sector distribution has broadened, with notable activity in Consumer Discretionary and Industrials. The exodus of several Taiwanese semiconductor firms suggests waning investor interest in the AI sector.

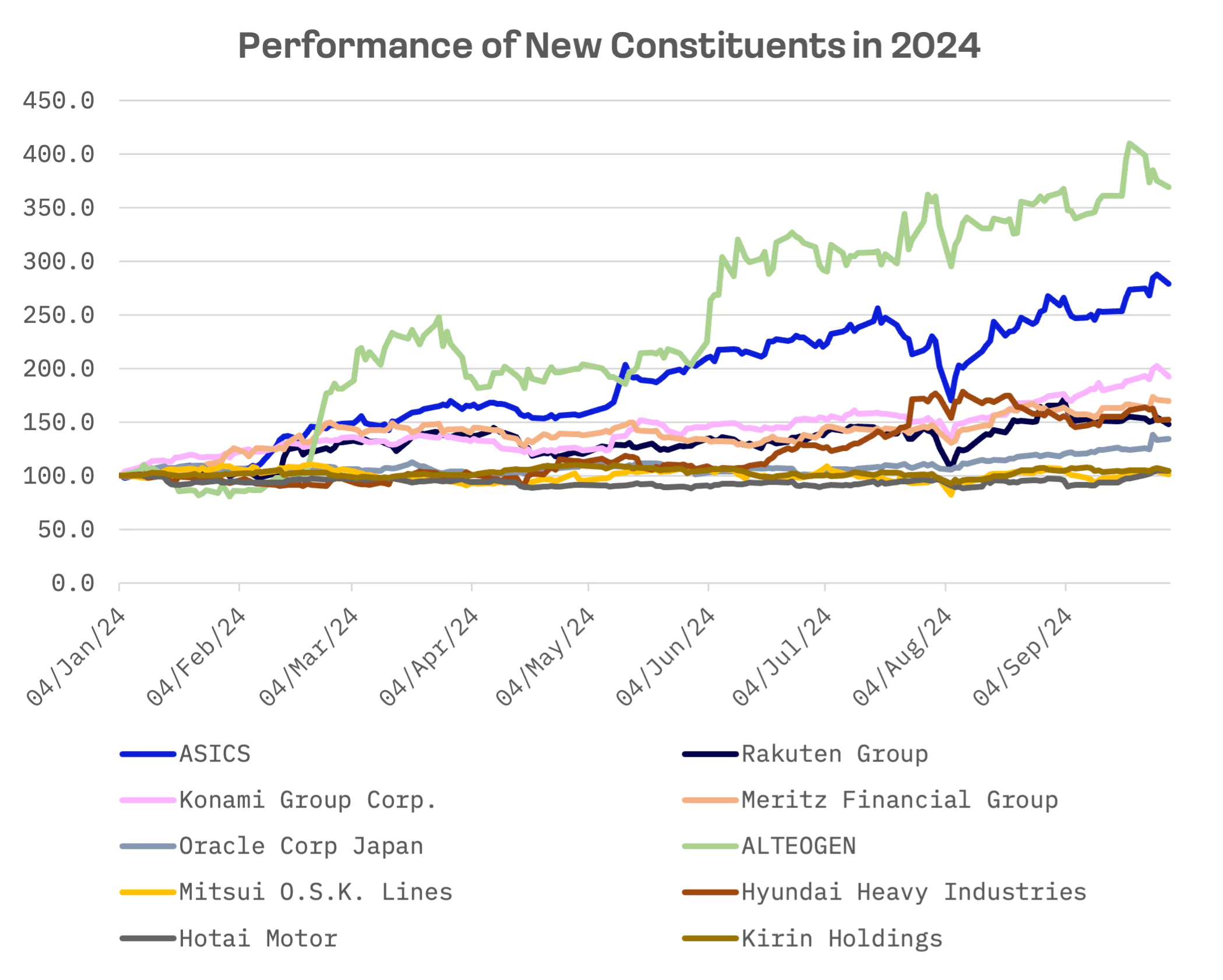

ALTEOGEN and ASICS have emerged as the top performers among the new entrants in 2024, significantly outpacing their peer group:

- ALTEOGEN’s stock has surged 370% year-to-date, with an additional 17% gain in the third quarter. The company has overtaken EcoPro BM, a producer of cathode materials, to become the largest corporation on the KOSDAQ exchange.

- ASICS has seen a 279% increase since the start of the year, with a further 22% rise in the third quarter.

ALTEOGEN specialises in biosimilars — affordable versions of biologic drugs — and biobetters, which are enhanced versions of existing treatments offering greater safety or effectiveness. The company’s success is largely attributed to its ALT-B4 technology, which enables subcutaneous drug administration rather than intravenous, providing a more convenient and less invasive option for patients. This innovation has proven lucrative, particularly after ALTEOGEN secured a licensing deal with U.S. pharmaceutical giant Merck earlier this year.

ASICS’s strong performance is backed by robust earnings and improved investor sentiment. The company reported a more than 70% jump in attributable profit during the first half of the year. Additionally, ASICS completed a significant share repurchase program, further boosting investor confidence.

ASICS now ranks among the most expensive stocks of the new entrants based on various valuation multiples. ALTEOGEN stands out as the most expensive in terms of EV/Total Revenues, primarily due to its limited revenue base and current lack of profitability, making traditional P/E ratios inapplicable. This high valuation reflects investor optimism about ALTEOGEN’s future prospects, despite its current unprofitability.

| Company | EV/Total Revenues | EV/EBITDA | P/E |

| ASICS | 3.55x | 22.35x | 40.94x |

| Rakuten Group | 0.68x | 5.58x | N/A |

| Konami Group Corp. | 4.65x | 15.20x | 29.61x |

| Meritz Financial Group | 7.75x | N/A | N/A |

| Oracle Corp Japan | 7.37x | 22.20x | 33.47x |

| ALTEOGEN | 189.67x | N/A | N/A |

| Mitsui O.S.K. Lines | 1.77x | 9.41x | 6.58x |

| Hyundai Heavy Industries | 1.33x | 25.00x | N/A |

| Hotai Motor | 2.57x | 13.48x | 17.21x |

| Kirin Holdings | 1.04x | 6.69x | 12.77x |

| MEAN | 22.04x | 14.99x | 23.43x |

| MEDIAN | 3.06x | 14.34x | 23.41x |