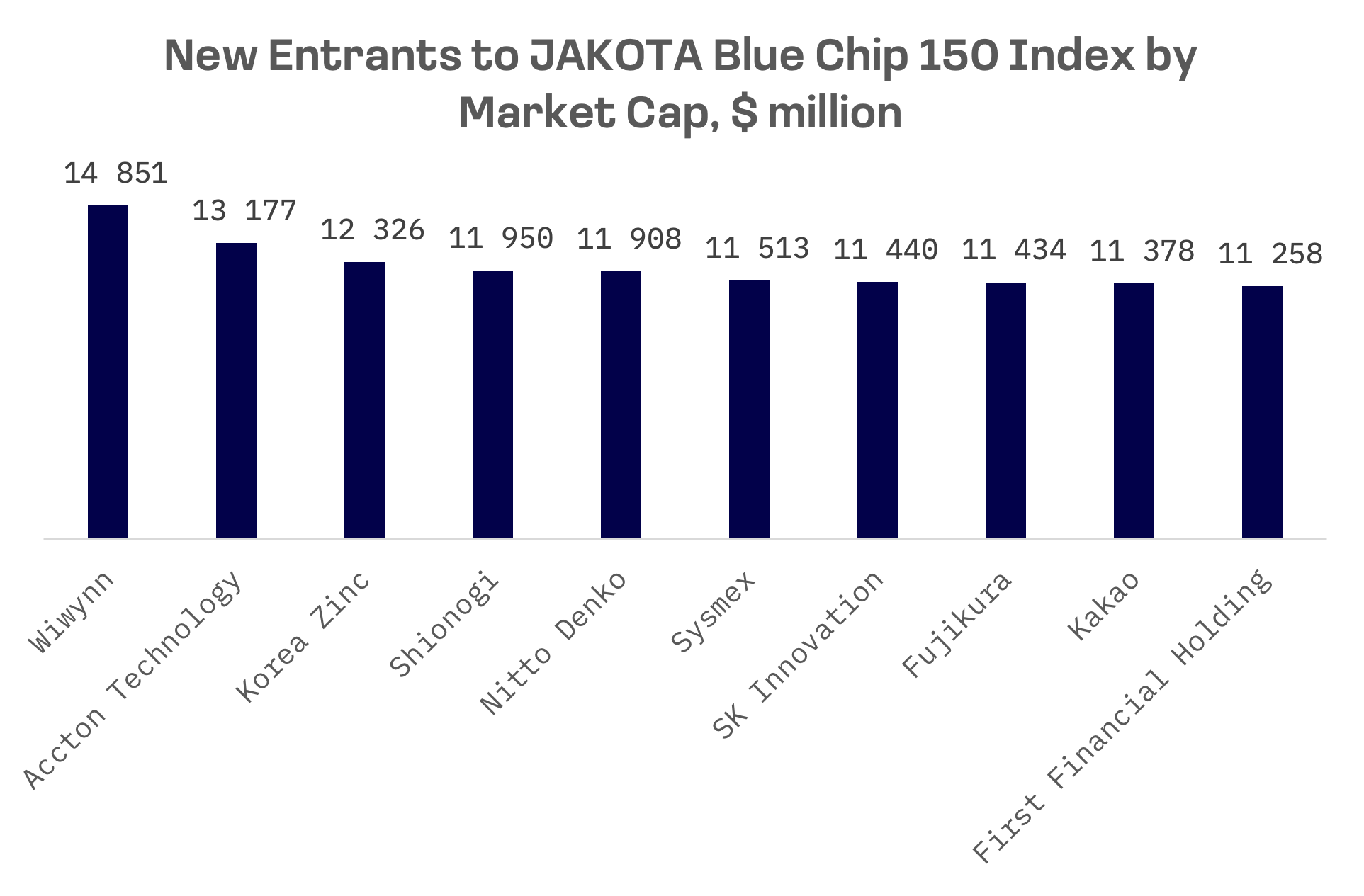

In the quarterly rebalancing of the JAKOTA Blue Chip 150 Index, 10 companies entered as 10 others departed, with the changes taking effect at the start of January 2025:

| Entrants | Leavers | ||

| Wiwynn | Samsung SDI | ||

| Accton Technology | Formosa Petrochemical | ||

| Korea Zinc | Lasertec | ||

| Shionogi | KEPCO | ||

| Nitto Denko | POSCO Future M | ||

| Sysmex | Ecopro BM | ||

| SK Innovation | LG Electronics | ||

| Fujikura | Hana Financial Group | ||

| Kakao | Hotai Motor | ||

| First Financial Holding | Kirin Holdings |

Among the newcomers, three companies are making a return after their previous departure from the index:

- Wiwynn (6669.TW), a Taiwanese company specialising in the design, manufacturing and delivery of cloud infrastructure products.

- Kakao (035720.KO), a South Korean Internet conglomerate known for its diverse portfolio of services spanning messaging, mobility, e-commerce, entertainment and fintech.

- First Financial Holding (2892.TW), a Taiwan based holding company that provides a range of services including banking, insurance, securities, asset management, venture capital and financial consulting.

Seven companies joined the index for the first time:

- Accton Technology (2345.TW), a Taiwanese firm specialising in the design, manufacture and distribution of advanced electronic components and systems such as semiconductors, consumer electronics, telecommunications infrastructure and industrial automation.

- Korea Zinc (010130.KO), South Korean company primarily engaged in the smelting and refining of non ferrous metals, including zinc, lead, silver and gold.

- Shionogi (4507.TSE), a Japanese pharmaceutical firm focused on infectious diseases, central nervous system disorders and cancer treatments.

- Nitto Denko (6988.TSE), a leading Japanese maker of functional materials and adhesive technologies.

- Sysmex (6869.TSE), a Japanese company that specialises in in vitro diagnostics (IVD), primarily focusing on medical devices, laboratory testing equipment and healthcare related technologies.

- SK Innovation (096770.KO), a South Korean firm engaged in petroleum, alternative energy and oil exploration.

- Fujikura (5803.TSE), a Japanese electrical and optical cable manufacturer.

The fourth quarter additions show geographic diversity, with Japan contributing four companies, while South Korea and Taiwan each added three. The sector distribution remains balanced, highlighted by the addition of two Japanese pharmaceutical firms: Shionogi and Sysmex.

At the same time, three Korean battery related companies — Samsung SDI, Posco Future M and Ecopro BM — were among the companies removed from the index in this quarterly rebalancing. The removal followed pressure on their shares amid growing concerns that the incoming Trump administration could roll back tax credits for the EV industry.

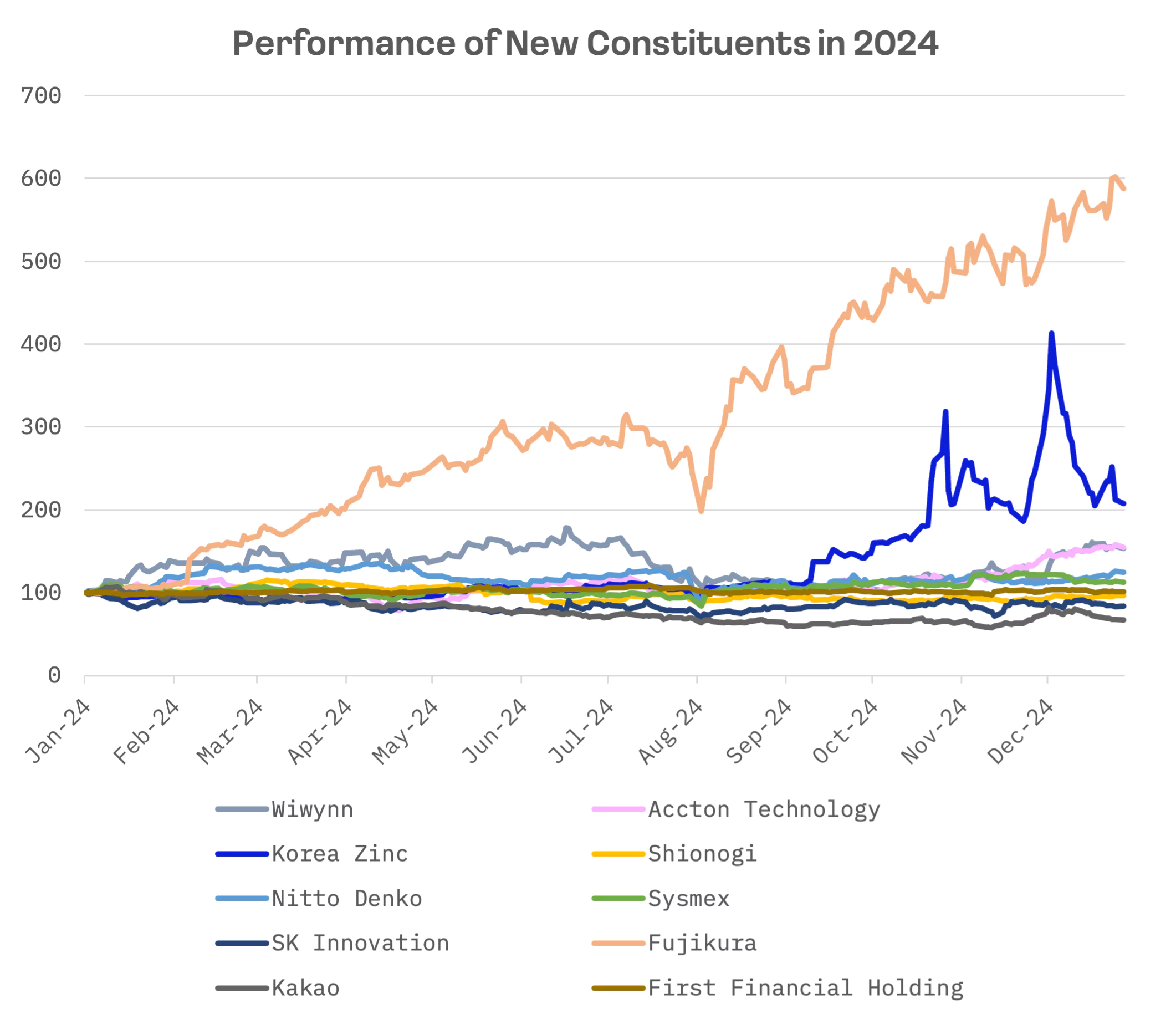

Fujikura, a 139 year old Japanese company, has emerged as an unexpected market leader, buoyed by the global surge in AI. The data centre cable manufacturer’s shares skyrocketed nearly 500% in 2024, leading the Nikkei 225 index. Fujikura’s rise underscores its role as a “picks and shovels” player in the AI driven infrastructure buildout, which Bloomberg estimates will require more than $1 trillion in investment. The company’s expertise in ultra thin fibre optic cables, coupled with clients like Apple, has positioned it at the forefront of a rapidly expanding market, with global data centre capacity projected to grow 33% annually through 2030, according to McKinsey.

In November, Fujikura raised its operating income forecast by 17% to ¥104 billion ($674 million) for the current fiscal year. The company generates over 70% of its revenue internationally, with approximately 38% coming from the U.S.

Despite its newfound success, Fujikura is wary of geopolitical and economic risks. The company has proactively established U.S. based production facilities to comply with domestic manufacturing requirements under the Build America, Buy America Act, mitigating tariff concerns.

Korea Zinc, the world’s leading non ferrous metal producer, became embroiled in a corporate control struggle in 2024, leading to significant share price fluctuations in the fourth quarter. MBK Partners, working with Young Poong, initiated a tender offer for Korea Zinc, which some analysts view as a hostile takeover despite MBK’s statements to the contrary. The dispute has exposed weaknesses in the governance structures of South Korea’s chaebols, traditionally dominated by family ownership with relatively low share stakes.

The outcome of Korea Zinc’s March 23 extraordinary shareholders meeting will likely determine the company’s future leadership. Regardless of the result, the case has transformed South Korea’s hostile takeover landscape. Once confined to activist hedge funds, such bids have now gone mainstream, with well capitalised private equity firms increasingly challenging the entrenched dominance of chaebol leadership.