Japan, an island nation, relies on maritime transport for over 99% of its import and export volume. The country currently ranks as the world’s third largest shipping nation, trailing only China and Greece.

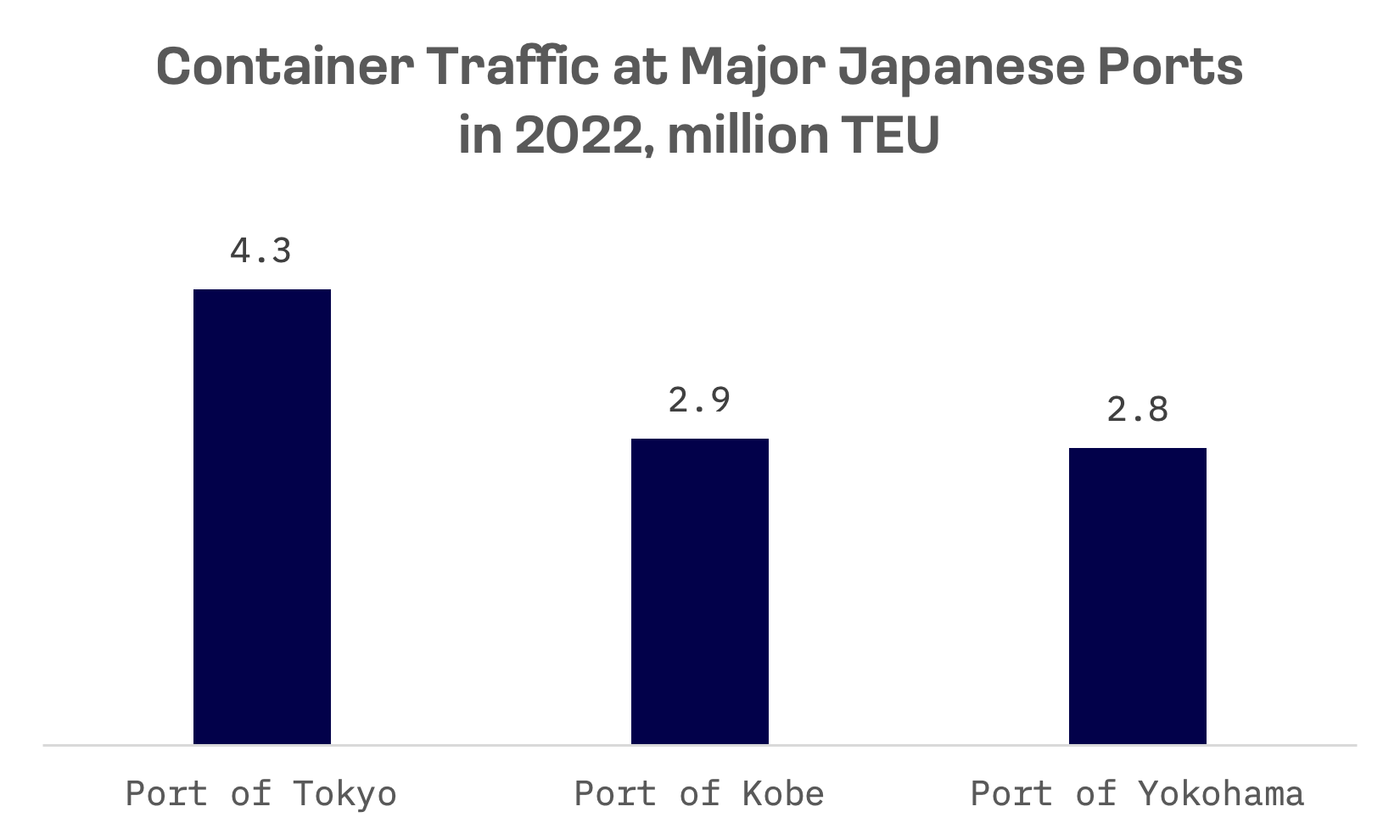

The country is home to 102 major ports, including five international strategic ports of global significance (Tokyo, Yokohama, Osaka, Nagoya and Kobe) and 18 international hub ports that offer quick access to airports, highways and railways.

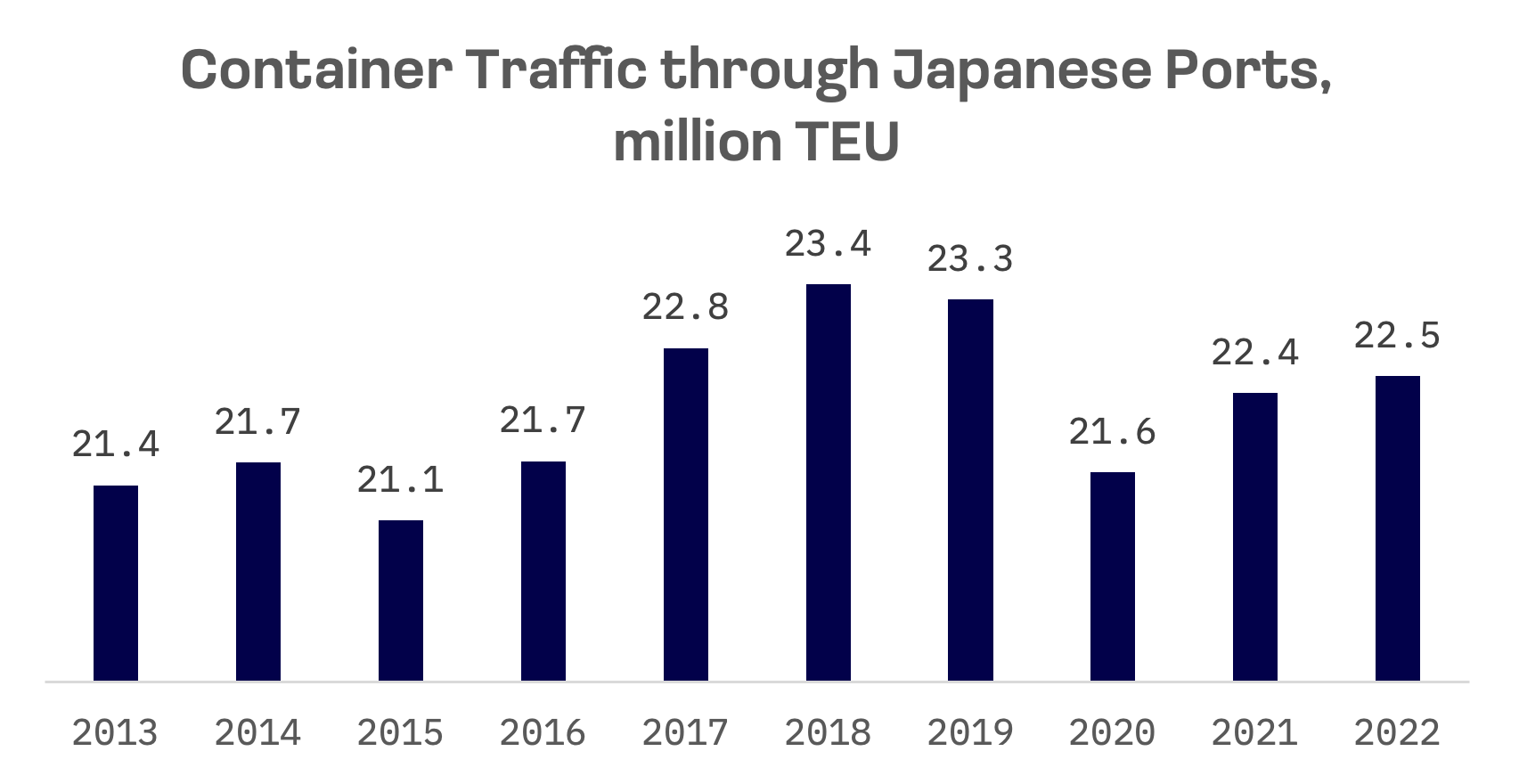

Container traffic through Japanese ports reached its zenith in 2018 before experiencing a sharp decline during the pandemic in 2020. The volume has struggled to return to pre-pandemic levels in 2021 and 2022.

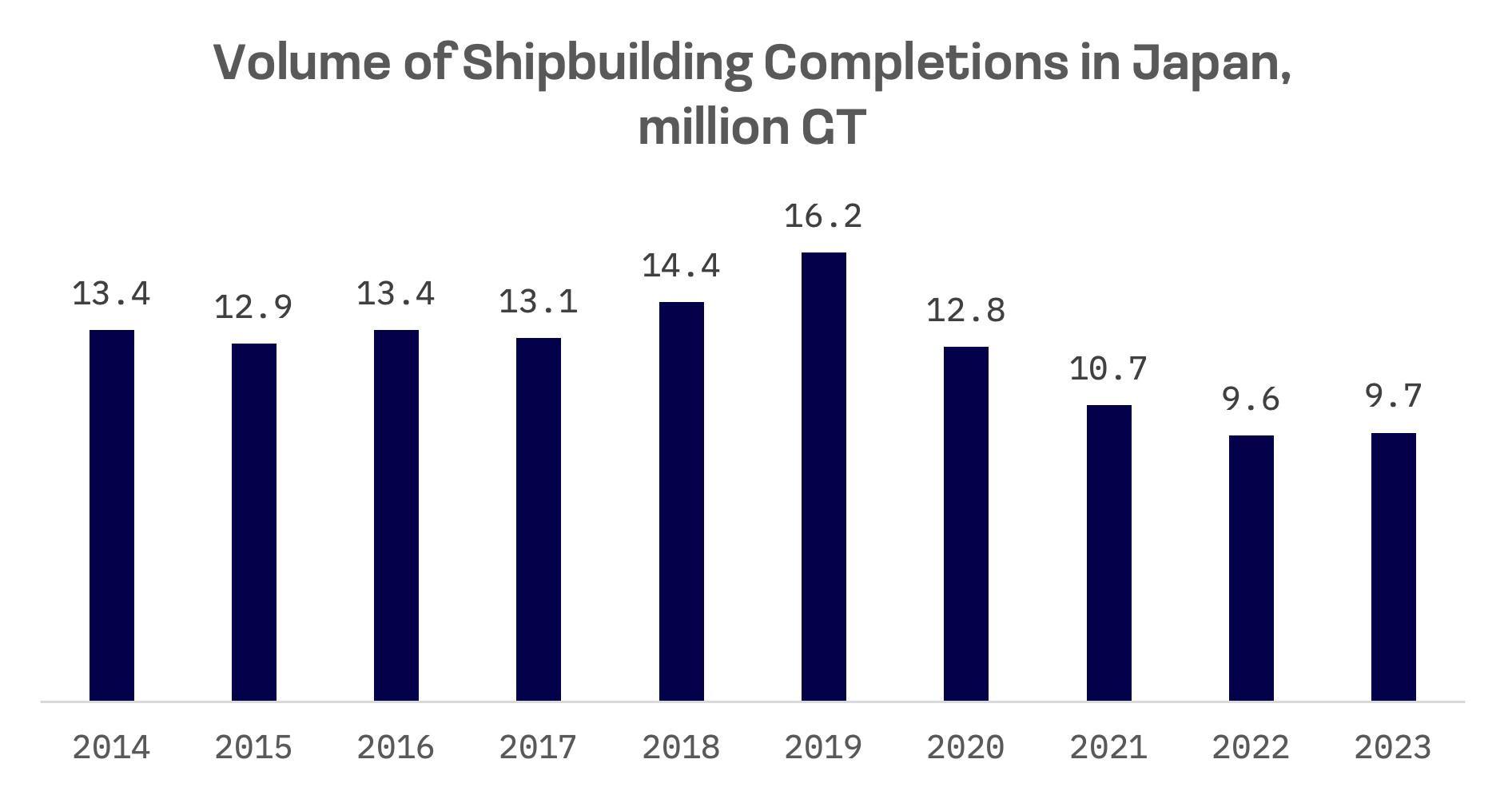

In the shipbuilding sector, Japan holds the third position globally, behind China and South Korea. These three nations represented 94% of the global shipbuilding market in 2022. However, in recent years, while shipbuilding output has increased in both China and South Korea, Japan has seen a decline.

The Japanese maritime industry encompasses several key categories, including a mix of both public and private companies in each:

Marine Transportation

Major public shipping companies such as Nippon Yusen Kabushiki Kaisha and Mitsui O.S.K. Lines manage significant fleets for transporting bulk commodities, containers and liquefied natural gas (LNG).

Marine Ports and Services

Companies in this sector play a crucial role in managing logistics related facilities at Japan’s major ports. Notable public firms include Kamigumi, which operates at Kobe Port, and The Sumitomo Warehouse, a leading container terminal operator. However, since less than 20% of The Sumitomo Warehouse’s sales come from its harbour transportation segment, it should not be classified solely as a marine ports and services company.

Shipbuilding

Leading private firms include Imabari Shipbuilding, Japan Marine United Corporation (JMU), Tsuneishi Shipbuilding and Oshima Shipbuilding. Public companies with a substantial presence in the industry include Mitsubishi Heavy Industries, IHI Corporation and Kawasaki Heavy Industries, though industry analysts note their shipbuilding sales alone don’t classify them as dedicated shipbuilding companies.

The sector also includes smaller, specialised firms. Mitsui Engineering & Shipbuilding focuses on high value ship equipment like engines and automated gantry cranes, while Namura Shipbuilding manufactures ships, machinery and steel structures. Both have market capitalisations under $1 billion.

| Company Name | Ticker | Subsector | JAKOTA Index | Market Cap, USD |

| Nippon Yusen | 9101.TSE | Marine Transportation | Blue Chip 150 | 16.6B |

| Mitsui O.S.K. Lines | 9104.TSE | Marine Transportation | Mid and Small Cap 2000 | 12.8B |

| Kamigumi | 9364.TSE | Marine Ports and Services | Mid and Small Cap 2000 | 2.5B |

| Mitsui E&S | 7003.TSE | Shipbuilding | Mid and Small Cap 2000 | 0.8B |

| Namura Shipbuilding | 7014.TSE | Shipbuilding | Mid and Small Cap 2000 | 0.7B |

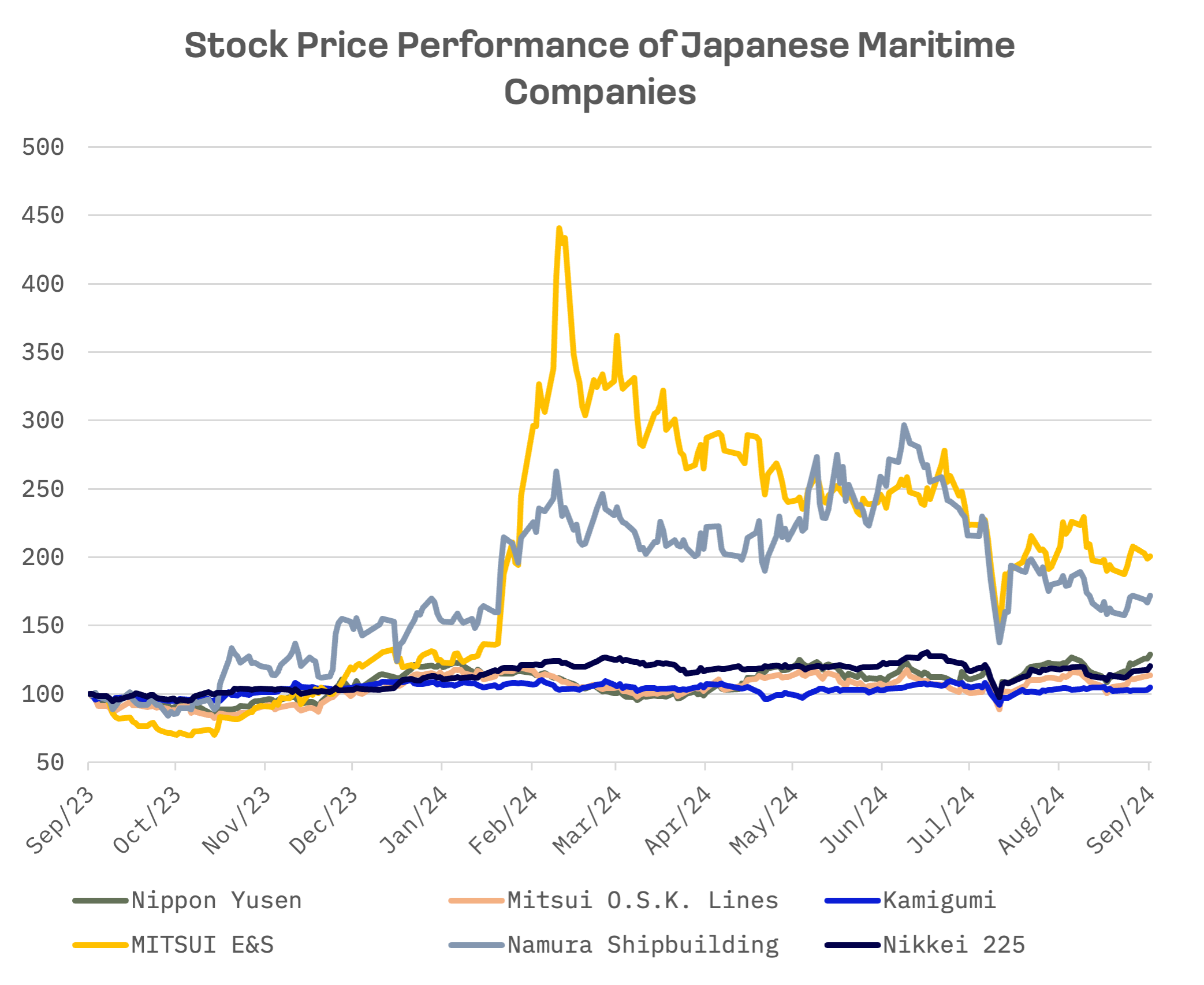

Over the past year, all shipbuilding stocks in the peer group delivered positive returns, significantly outperforming the Nikkei 225 Index. Mitsui E&S and Namura Shipbuilding, the smaller cap stocks, showed the most volatility.

Mitsui E&S shares surged in February 2024 after reporting strong third quarter (April to December 2023) results for the fiscal year ending March 2024. The company revised its full year forecast upward, citing strong performance across all major businesses, including increased orders for container cranes in Southeast Asia.

Namura Shipbuilding, despite its stock being off its 12 month high reached in July, has seen positive developments. Recent months brought new orders from Taiwan Navigation for two 80,000 DWT bulk carriers and from Seacon for a pair of bulkers.

Mitsui O.S.K. Lines, one of the world’s largest shipping companies, stands out as the most expensive among its peers based on EV-to-Sales and EV-to-EBITDA multiples:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Nippon Yusen | 1.3x | 8.3x | 9.3x |

| Mitsui O.S.K. Lines | 1.8x | 9.6x | 6.7x |

| Kamigumi | 1.1x | 8.0x | 13.7x |

| Mitsui E&S | 0.8x | 4.6x | 2.3x |

| Namura Shipbuilding | 0.4x | 2.4x | 4.1x |

| AVERAGE | 1.1x | 6.6x | 7.2x |

| MEDIAN | 1.1x | 8.0x | 6.7x |

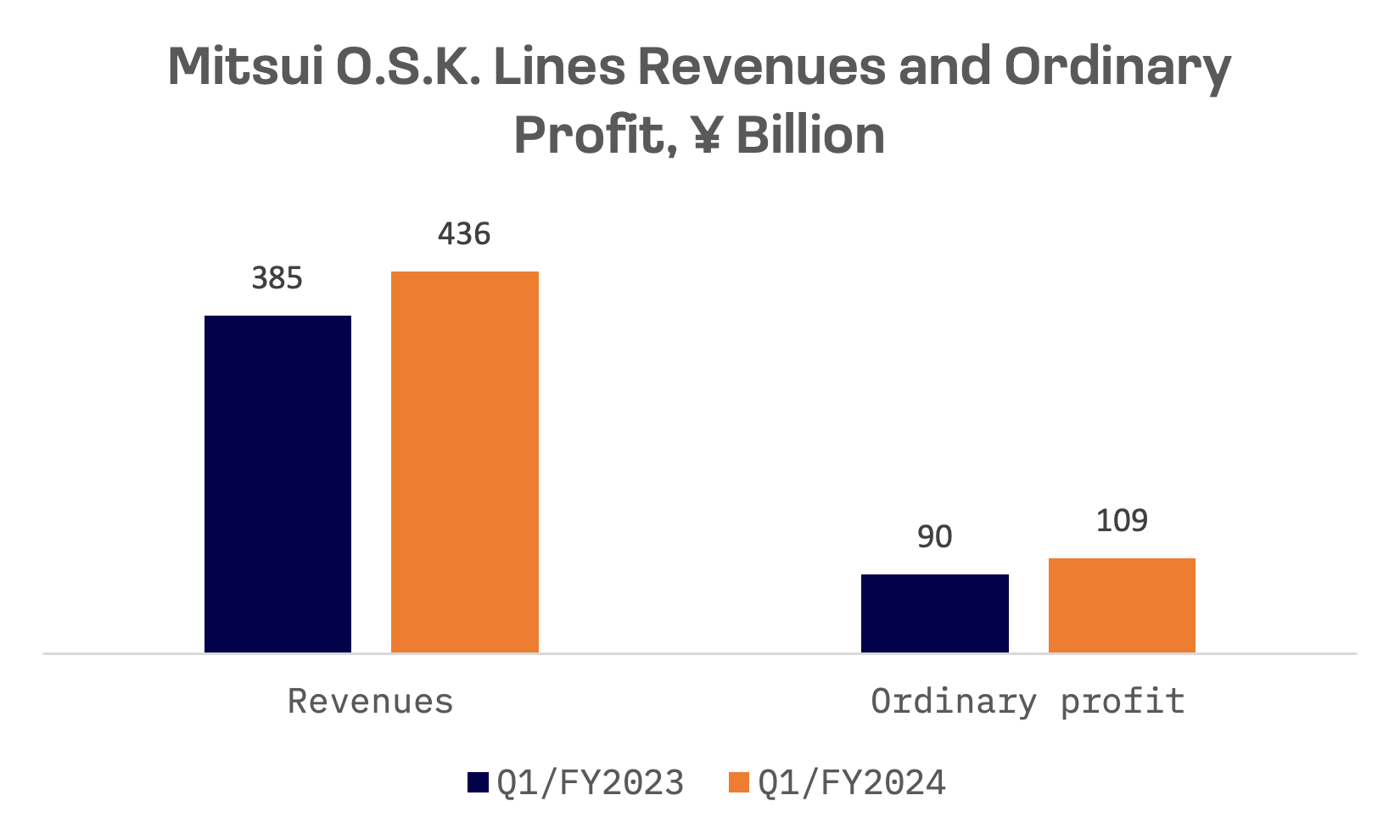

The company operates a diverse fleet that includes bulk carriers, LNG carriers, Ro-Ro car carriers, oil tankers and container ships, along with container terminal operations. For the quarter ended June 30, 2024, Mitsui O.S.K. Lines delivered strong financial results, driven by robust shipping demand and elevated freight rates. The company reported a 13% year-over-year increase in sales and a 20% jump in ordinary profit.

The containership segment saw particularly robust profit growth, driven by tight vessel supply and demand as ongoing Red Sea tensions forced continued transit via the Cape of Good Hope. This, coupled with a rebound in personal consumption in Europe and the U.S., pushed spot freight rates sharply higher.

A key challenge and opportunity for the global maritime industry is the growing emphasis on decarbonisation and Green Shipping Initiatives. The International Maritime Organization (IMO) is pushing for stricter carbon emission targets, seeking a 40% reduction by 2030 relative to 2008 levels and net zero emissions by 2050.

Mitsui O.S.K. Lines is poised to take a leadership role in adopting eco friendly vessels. Investments are expected to increase in initiatives such as wind powered ships and electric or hydrogen fuelled vessels. Japan’s maritime industry is well positioned to leverage this shift, aiming to become a leader in sustainable shipping solutions.

Mitsui O.S.K. Lines recently announced an investment in HIF Global, a U.S. based company specialising in e-Fuels, as part of its strategy to support the decarbonisation of the mobility industry through synthetic fuels. This move underscores MOL’s commitment to advancing sustainable energy solutions and reducing carbon emissions in the shipping sector.

Additionally, Mitsui O.S.K. Lines and Chevron Shipping Company LLC have unveiled plans to install the Wind Challenger, a hard sail wind assisted propulsion system, on a new LNG carrier. This innovative technology aims to enhance fuel efficiency and reduce carbon emissions.

Kamigumi, primarily operating at Kobe Port, offers a range of services including cargo handling, warehousing and distribution. The company’s shares have shown the weakest performance among the peer group over the last 12 months.

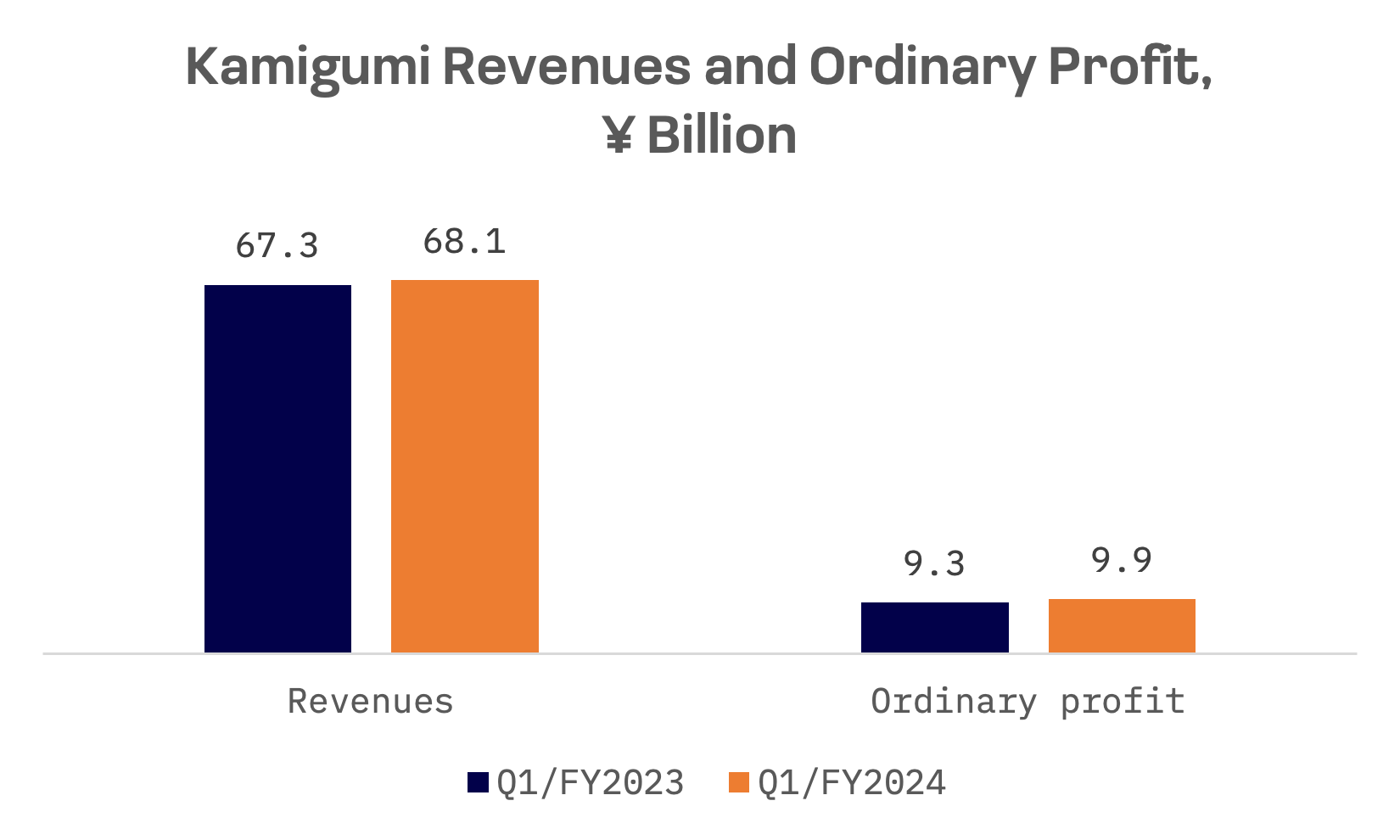

For the quarter ending June 30, 2024, Kamigumi reported only modest growth in revenues and operating profit, with revenue growth particularly subdued. The company has grappled with challenges stemming from reduced cargo movement, attributed to lower imports linked to yen depreciation and an economic slowdown in China.

The Japanese maritime industry faces fierce competition from firms in countries such as China and South Korea. Coupled with stringent domestic and international environmental regulations, this competitive landscape demands significant investment in cleaner technologies and practices, from emissions reduction to more effective waste management. As a result, the Japanese maritime sector is under increasing pressure.

To effectively address these challenges and strengthen Japan’s position as a global leader in maritime affairs, a collaborative approach between government and the private sector is crucial.