South Korea’s cosmetics industry has emerged as a global powerhouse, propelled by innovation, affordability and aggressive digital marketing. With the domestic market maturing, Korean brands are pushing aggressively into international markets, riding a wave of consumer interest in high quality but accessible skincare and beauty products. The outward push is generating strong export growth as shoppers worldwide embrace the efficacy, design and trendsetting appeal of K-beauty.

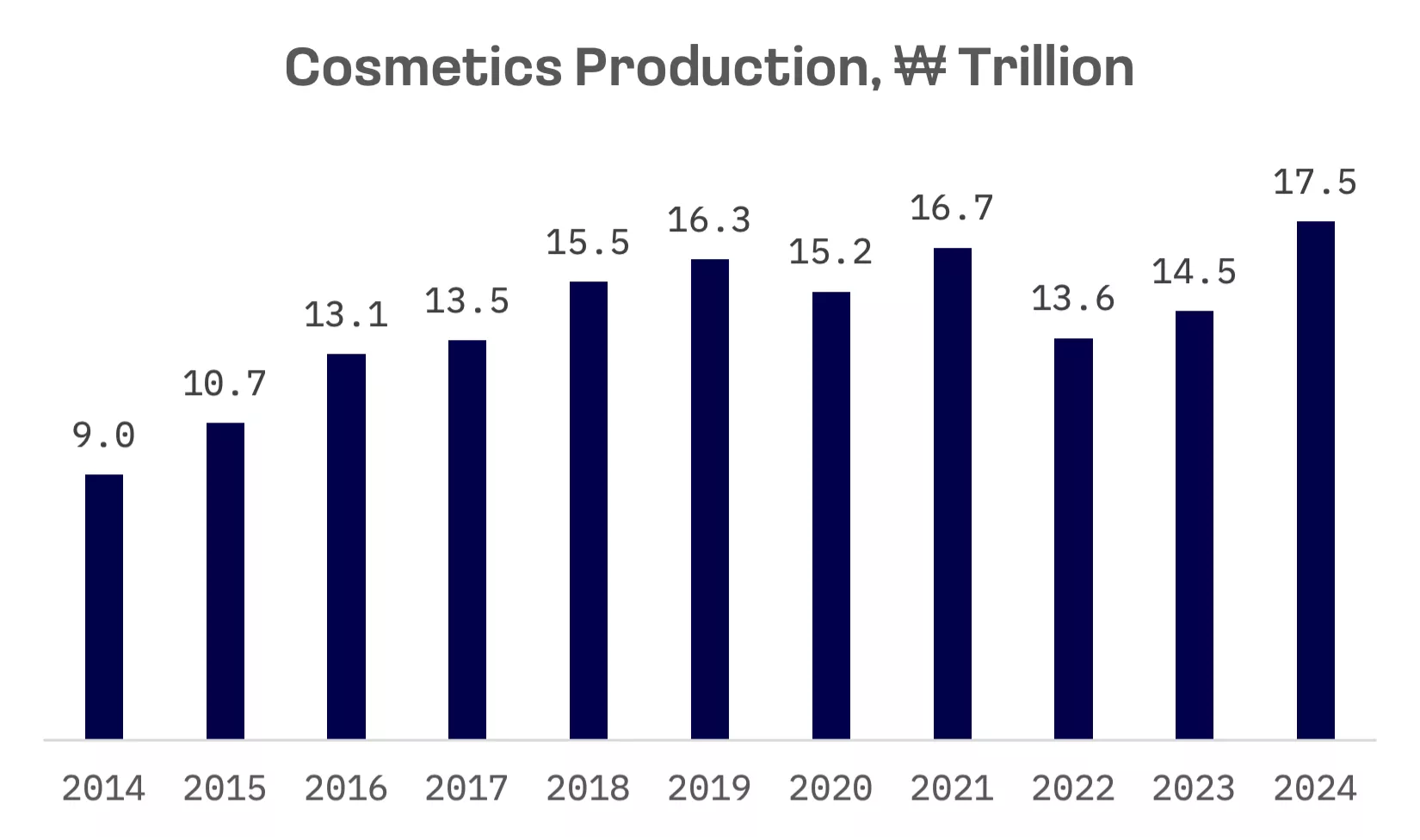

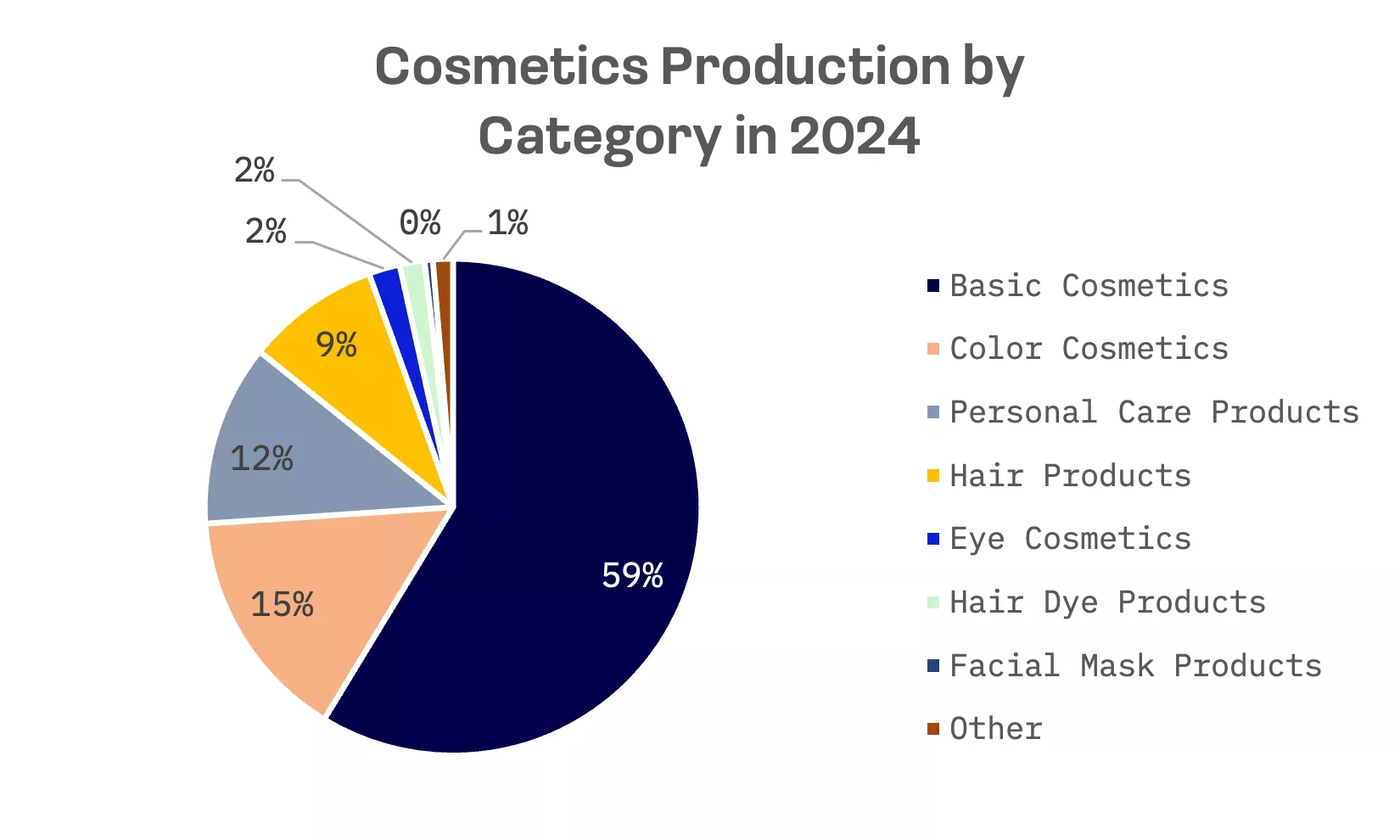

The numbers tell the story: South Korean cosmetics production hit a record ₩17.5 trillion in 2024, a 20.9% jump from the year prior. Basic products alone topped ₩10 trillion, with lotions and creams, essences and oils, and packs and masks leading the way.

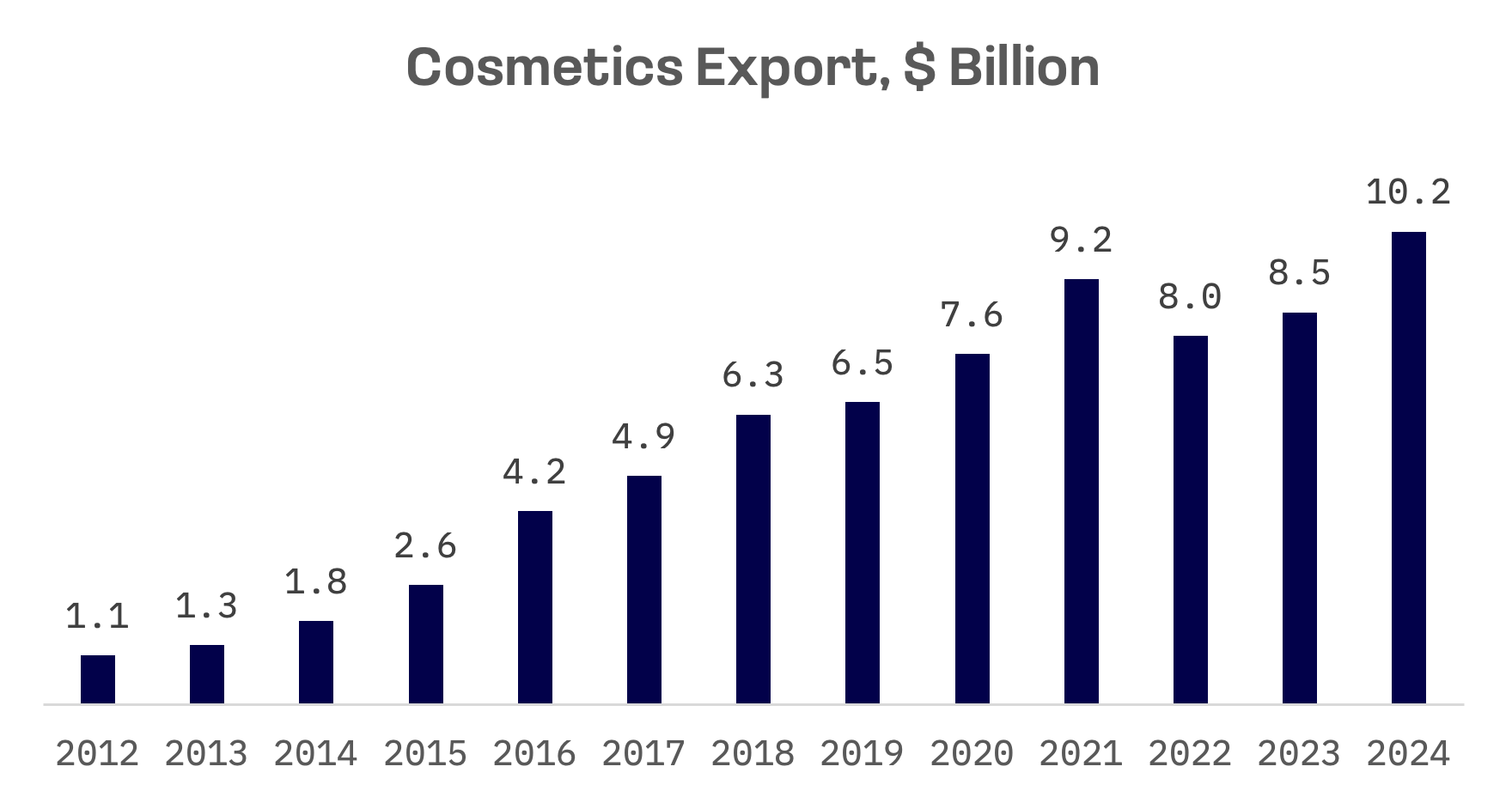

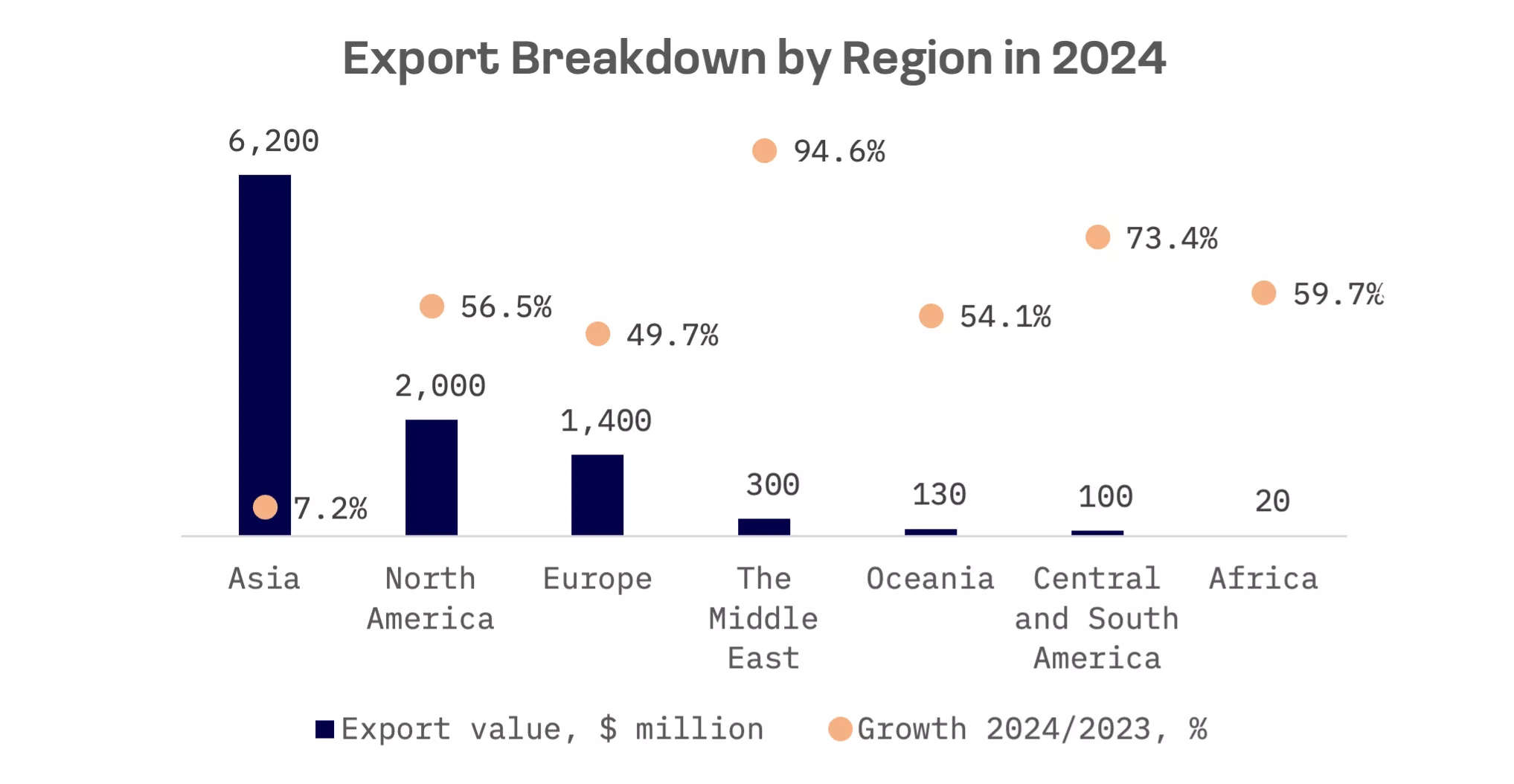

Korean cosmetics exports surged to $10.2 billion in 2024, continuing a multiyear boom. Despite falling shipments to China, K-beauty claimed the top spot among imported cosmetics in both the U.S. and Japan.

The gains propelled Korea to third place in global cosmetics exports in 2024, leapfrogging Germany while trailing only France and the U.S.. In the first four months of 2025, South Korea shipped $3.61 billion in cosmetics – outpacing American beauty exports for the first time.

Export growth is accelerating across Asia (excluding China), North America and Europe. Last year, Korea’s three largest export markets were China ($2.49 billion, down 10.3%), the U.S. ($1.9 billion, up 56.4%) and Japan ($1.04 billion, up 29.1%).

The boom is lifting all boats. The number of companies generating more than ₩100 billion in production jumped to 21 in 2024 from 12 the year before. Five major players each posted trailing 12 month (TTM) revenue exceeding ₩1 trillion.

| Company Name | Segment | Products | Market Position |

| Amorepacific | Cosmetics, Daily Beauty | Skincare, makeup, perfume, medical beauty, beauty devices, inner beauty supplements | Leading South Korean beauty company with a global presence |

| LG H&H | Beauty, Health, Refreshment | Skincare, cosmetics, household goods, beverages | A major South Korean producer of cosmetic, household and personal care products. Diversified business model across beauty, household and beverage sectors. The beauty segment accounted for 42% of total sales in 2024 |

| APR | Beauty, Fashion, Entertainment | Skincare, makeup, medical cosmetics, diet products, fashion items | A high growth company with a focus on D2C (Direct-to-Consumer) for its beauty and skincare products, notably through brands like MediCube and Aprilskin |

| Cosmax | Cosmetics (ODM/OEM), Personal Products | Skincare, makeup, Korean herbal cosmetics, fragrances, mask sheets, nail polish | A leading global Cosmetics ODM/OEM (Original Design/Equipment Manufacturer) |

| Kolmar | Cosmetics (ODM/OEM), Pharmaceutical, Food | Pharmaceuticals (ointments, creams, oral solutions), health functional foods | A significant player in the ODM/OEM space for cosmetics, similar to Cosmax, but also operates in the pharmaceutical and health functional food sectors |

Behind the scenes, a substantial ODM/OEM sector, led by Cosmax and Kolmar, manufactures products for major global beauty brands, leveraging specialised R&D and manufacturing capabilities.

All the companies mentioned are listed on the Korea Stock Exchange with market capitalisations above $1 billion:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Amorepacific | 090430.KO | Mid and Small Cap 2000, Beauty 40 | 4.8B |

| LG H&H | 051900.KO | Mid and Small Cap 2000 | 2.9B |

| Cosmax | 192820.KO | Mid and Small Cap 2000, Beauty 40 | 1.6B |

| APR | 278470.KO | Mid and Small Cap 2000 | 1.3B |

| Kolmar | 161890.KO | Mid and Small Cap 2000, Beauty 40 | 1.2B |

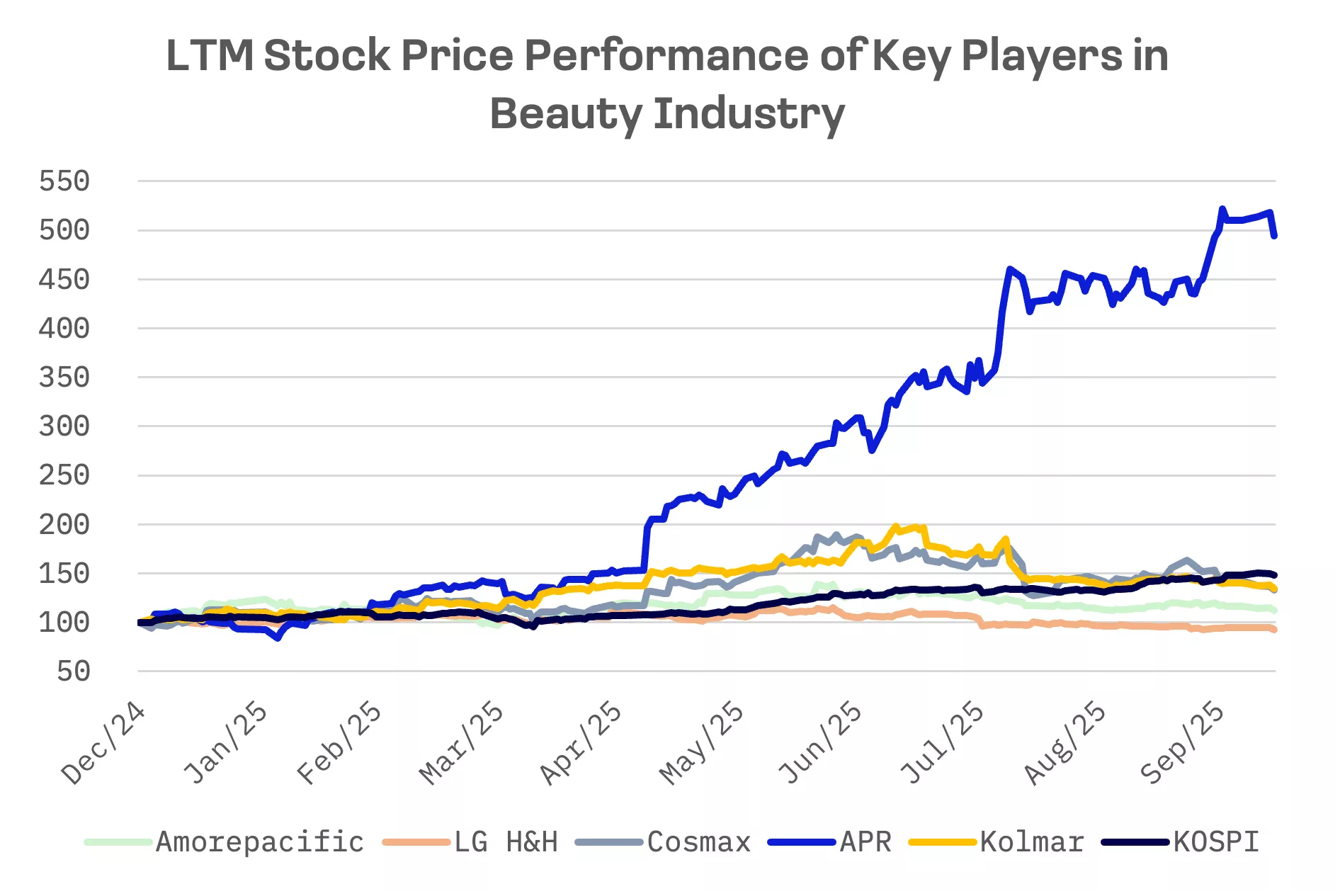

Except for LG H&H – whose cosmetics division is the largest revenue generator, though the company remains diversified – every major player in South Korea’s beauty sector has posted positive stock performance year-to-date (YTD). But while the KOSPI index has been Asia’s star performer in 2025, soaring roughly 48% YTD, only one beauty company has beaten it: APR, whose share price is now nearly five times higher than its closing level at the end of 2024.

APR commands a steep premium on both sales and EBITDA multiples, a reflection of investors’ bullish growth expectations:

| Company Name | EV/Sales | EV/EBITDA | Forward P/E |

| Amorepacific | 1.69x | 6.74x | 19.38x |

| LG H&H | 0.54x | 7.43x | 28.57x |

| Cosmax | 1.34x | 13.90x | 18.25x |

| APR | 9.33x | 38.76x | 26.67x |

| Kolmar | 1.07x | 9.56x | 26.46x |

| AVERAGE | 2.79x | 15.28x | 23.87x |

| MEDIAN | 1.34x | 9.56x | 26.46x |

Amorepacific

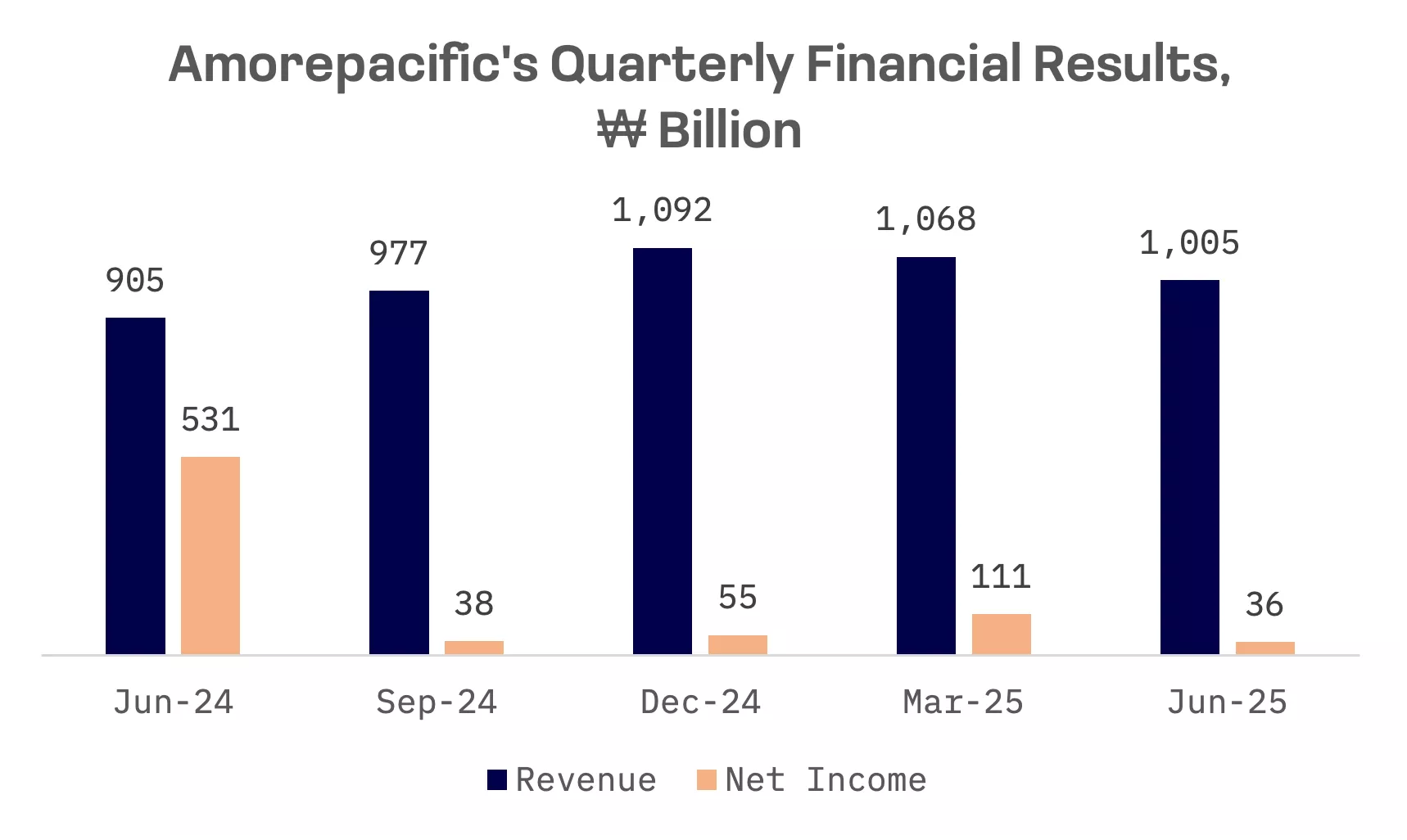

Amorepacific operates as a vertically integrated conglomerate, managing the entire value chain from R&D and manufacturing to distribution, with a diversified portfolio of luxury and mass market brands.

The linchpin of the company’s strategy is “Pentagon Five,” a global expansion plan targeting North America, Europe, India and the Middle East, and key Asian markets. The goal: international sales accounting for 70% of the total by 2035. The initiative is gaining traction overseas and reducing Amorepacific’s longtime dependence on China.

In the second quarter of 2025, the company’s overseas operations posted a 14.4% year-over-year sales increase and a stunning 611% jump in operating profit. U.S. sales climbed 10%, fuelled by successful launches of brands including AESTURA and HANYUL and continued momentum from flagship lines Laneige and Innisfree. In Europe, the Middle East and Africa, sales rose 18%, powered by strong demand for Laneige and Innisfree across European markets.

Cosmax

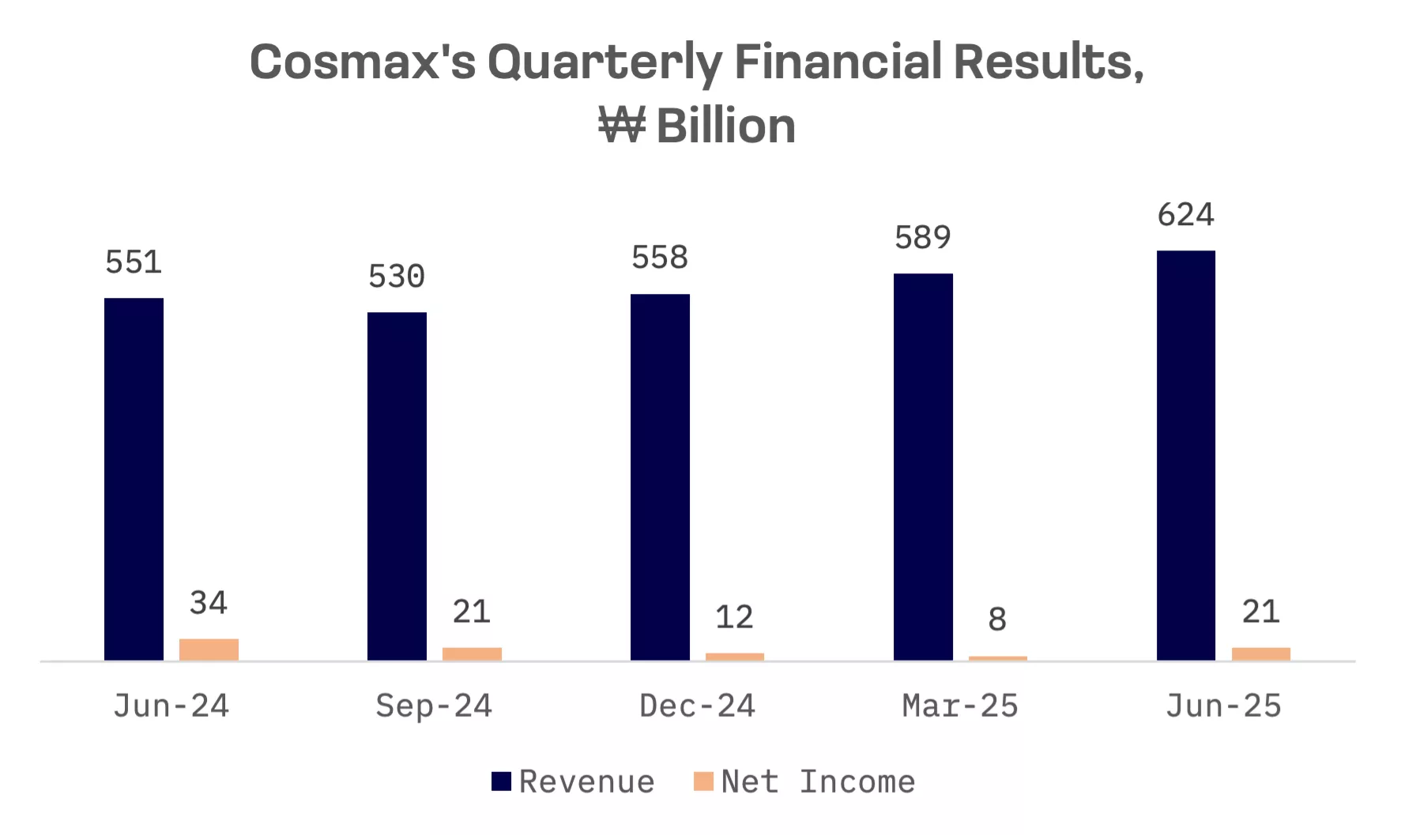

Cosmax is a leading Original Design Manufacturing (ODM) company in South Korea’s beauty sector. The company actively conducts research, develops proprietary formulations, secures patents and then proposes finished product concepts to brand owning companies. That positions Cosmax as an integrated R&D and manufacturing partner, not a mere contract manufacturer.

Heavy investment in R&D and innovation has cemented Cosmax’s global standing. The company develops and manufactures products for 18 of the world’s 20 largest cosmetics brands, including luxury names such as Yves Saint Laurent (YSL) and Christian Dior.

APR

APR embodies a new business model in K-beauty, blending technology with streamlined distribution. Its competitive edge rests on pairing proprietary high tech beauty devices with complementary cosmetic products, all marketed and sold through a highly efficient D2C channel.

Cutting out intermediaries boosts gross margins and enables APR to expand globally with speed and capital efficiency – no need for the sprawling store networks that Amorepacific requires.

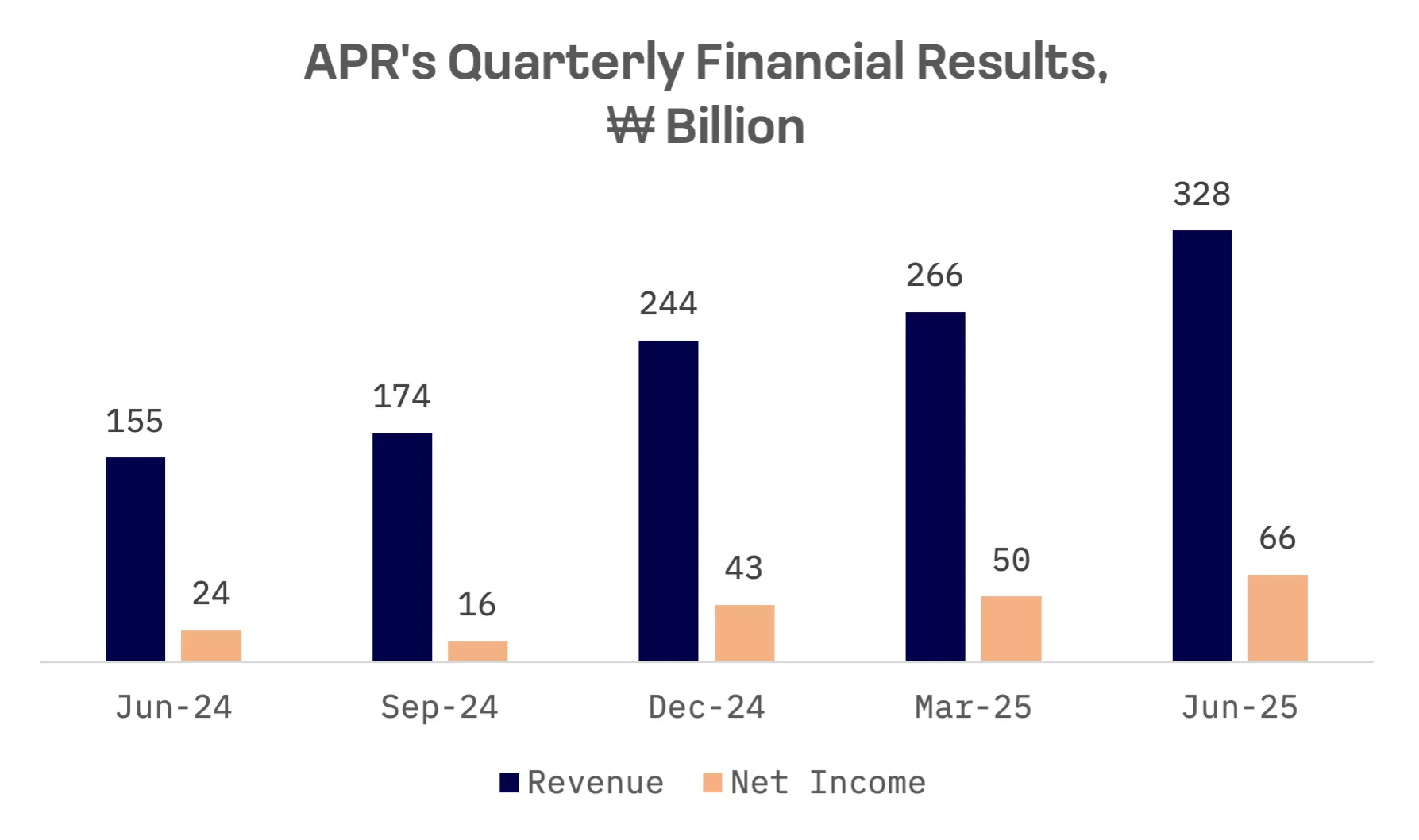

The model is delivering results. Second quarter 2025 sales jumped 111%, while net income surged 175%.

APR: Key Financial Indicators, ₩ billion

| Fiscal Q2 2025 ending 06/30/25 | Y/Y change, % | |

| Revenue | 327.7 | 110.8% |

| EBITDA | 91.9 | 175.6% |

| Net income | 66.3 | 175.2% |

Sustaining that trajectory hinges on continued innovation in high margin beauty devices and maintaining the scalability of the D2C channel, especially in North America and other international markets where overseas sales already exceed domestic revenue.