The Taiwan Futures Exchange (TAIFEX) announced on July 31 that the U.S. Commodity Futures Trading Commission (CFTC) had notified it of the reclassification of the Taiwan Stock Exchange Capitalization Weighted Stock Index (TAIEX). This change affects futures contracts linked to the TAIEX, including TAIEX Futures (TX), Mini-TAIEX Futures (MTX) and Mini-TAIEX Flexible Futures (MXFFX).

As a result, these contracts will now fall under the joint oversight of both the CFTC and the Securities and Exchange Commission (SEC). U.S. investors looking to trade these contracts must adhere to the stipulations outlined in SEC Order (SEC Release No. 34-60194) and the 2010 CFTC Advisory. According to these regulations, U.S. persons are prohibited from trading these futures contracts.

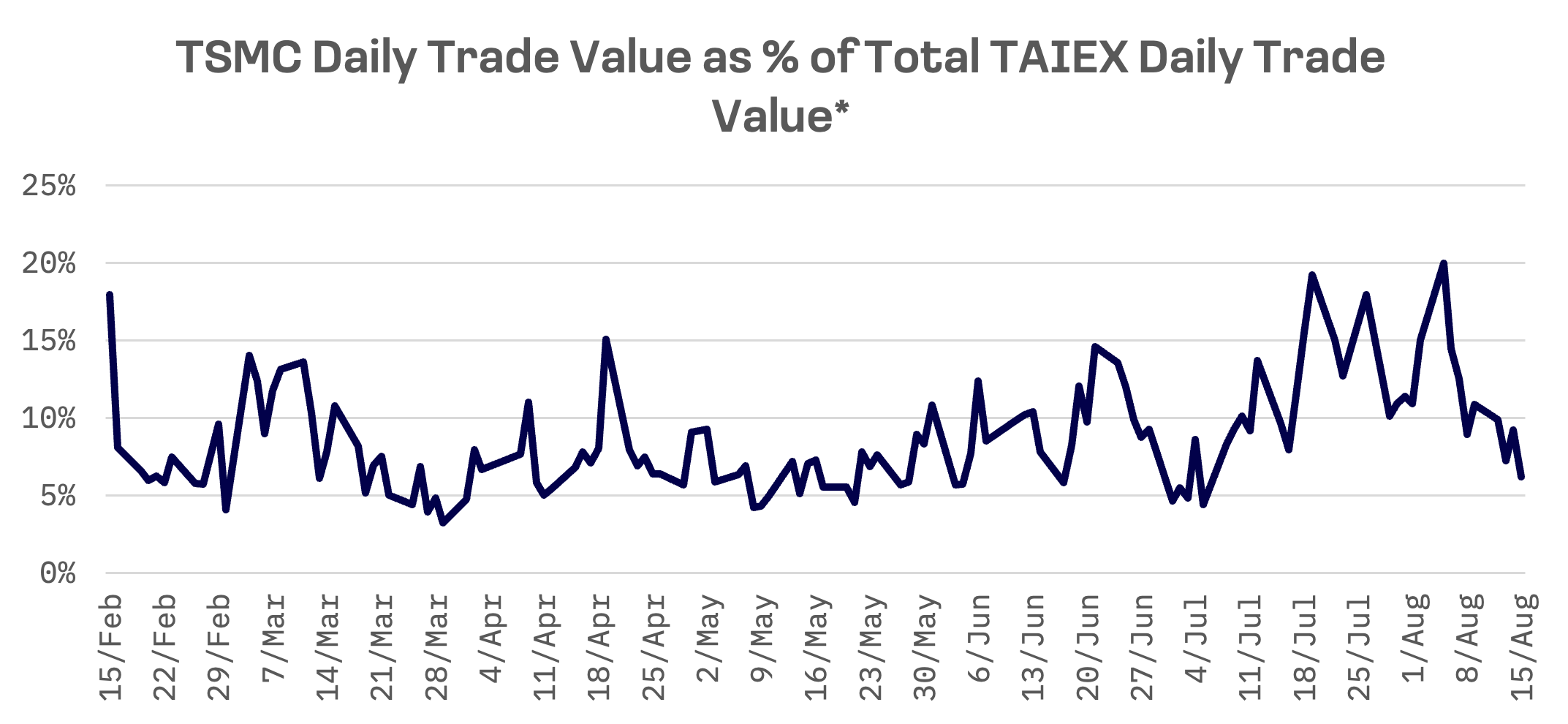

The reclassification stems from Taiwan Semiconductor Manufacturing Co.’s (TSMC) outsized influence on the TAIEX, meeting criteria set by the CFTC. From February 15 to April 29, the world’s leading contract chipmaker accounted for over 30% of the main board’s total turnover for 45 consecutive trading sessions. After a three-month grace period, the CFTC notified TAIFEX on July 30 that the TAIEX and related indexes — TX, MTX and MXFFX — had been reclassified as narrow-based security indexes. This change bars U.S. investors, including qualified institutional buyers, from trading these Taiwan futures indexes.

Recent trading data underscore this trend. TSMC’s trade value as a percentage of total TAIEX trade value has continued to climb, peaking in late July.

* Total TAIEX daily trade value encompasses more than main board activity. It includes regular trading, Odd lot, After hours Fixed Price and Block trading, but excludes Auction and Tender offers. Foreign currency ETF values are converted to New Taiwan dollars at the 3:30 p.m. exchange rate on the day of trading.

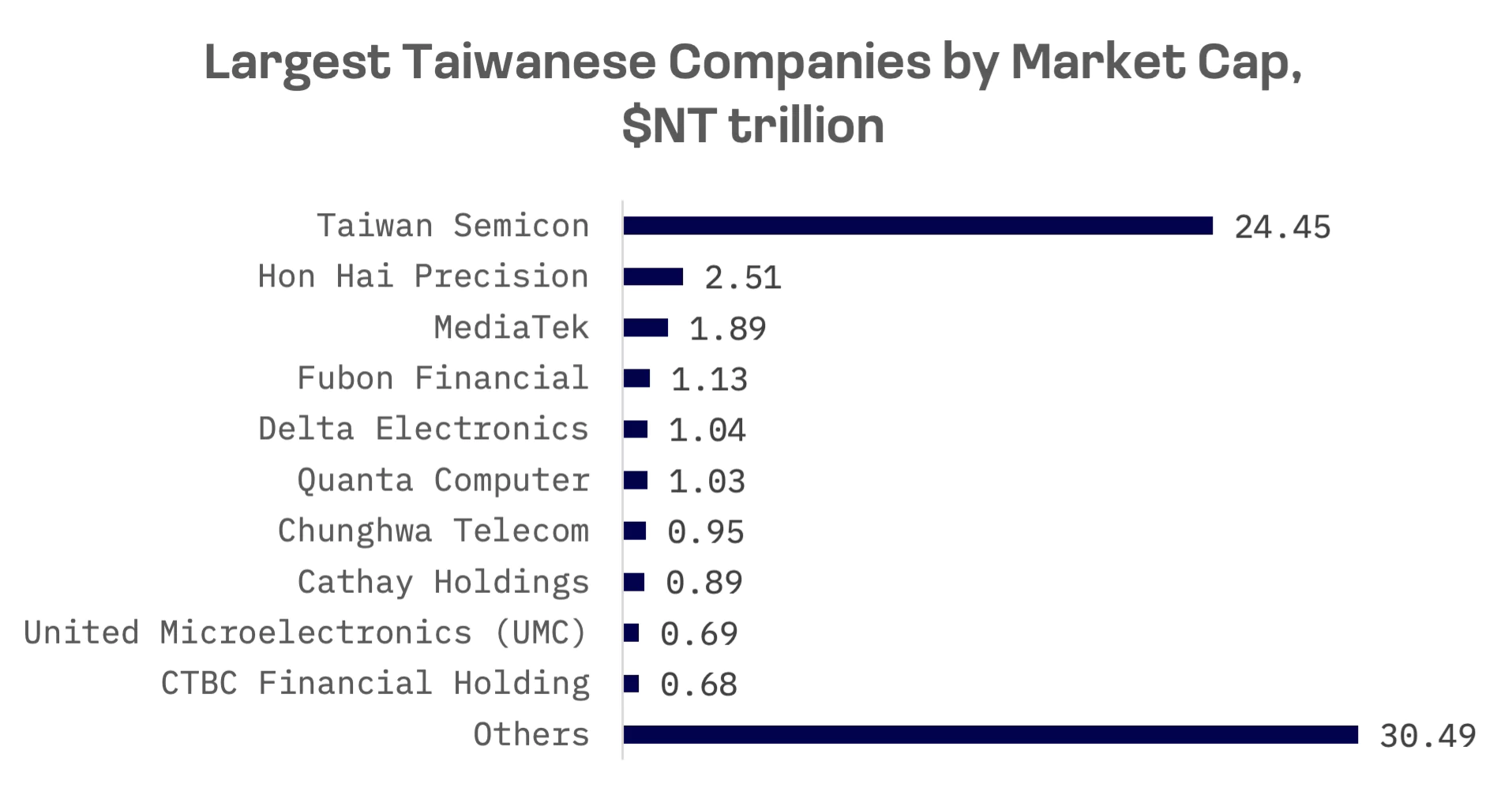

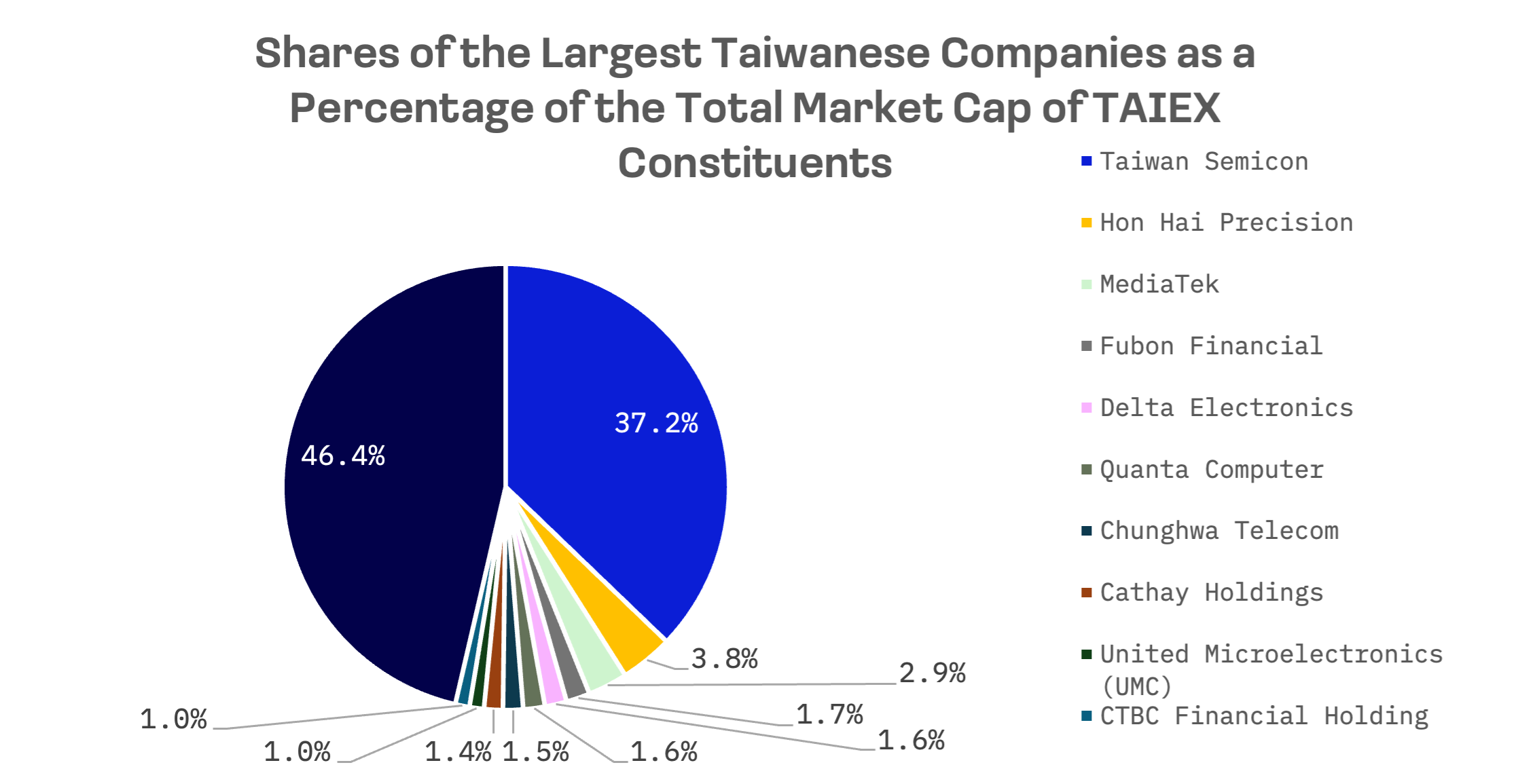

As of August 14, TSMC’s market capitalization of NT$24.45 trillion ($770 billion) represented 37% of the total market value of TAIEX constituents.

The narrow-based security index classification is expected to persist until TSMC’s market capitalization drops below 30% of the TAIEX. Taiwan’s Financial Supervisory Commission, the country’s top financial regulator, says this won’t affect trading of individual TSMC shares in spot and futures markets.

However, market analysts warn of potential negative impacts on the local stock market. Hsu Chi-ching, chairman and vice president of Capital Futures, notes that a previous reclassification in April 2021 led to increased market volatility and a weaker Taiwan dollar. During that 18-month period, foreign institutional investors sold a net 876 million TSMC shares, with the stock falling 33.5%, though this decline was partly due to the Covid-19 pandemic.

Hsu warns that this reclassification could once again dampen foreign institutional investors’ willingness to trade in the local equity market, potentially impacting trading volumes and reducing market turnover.