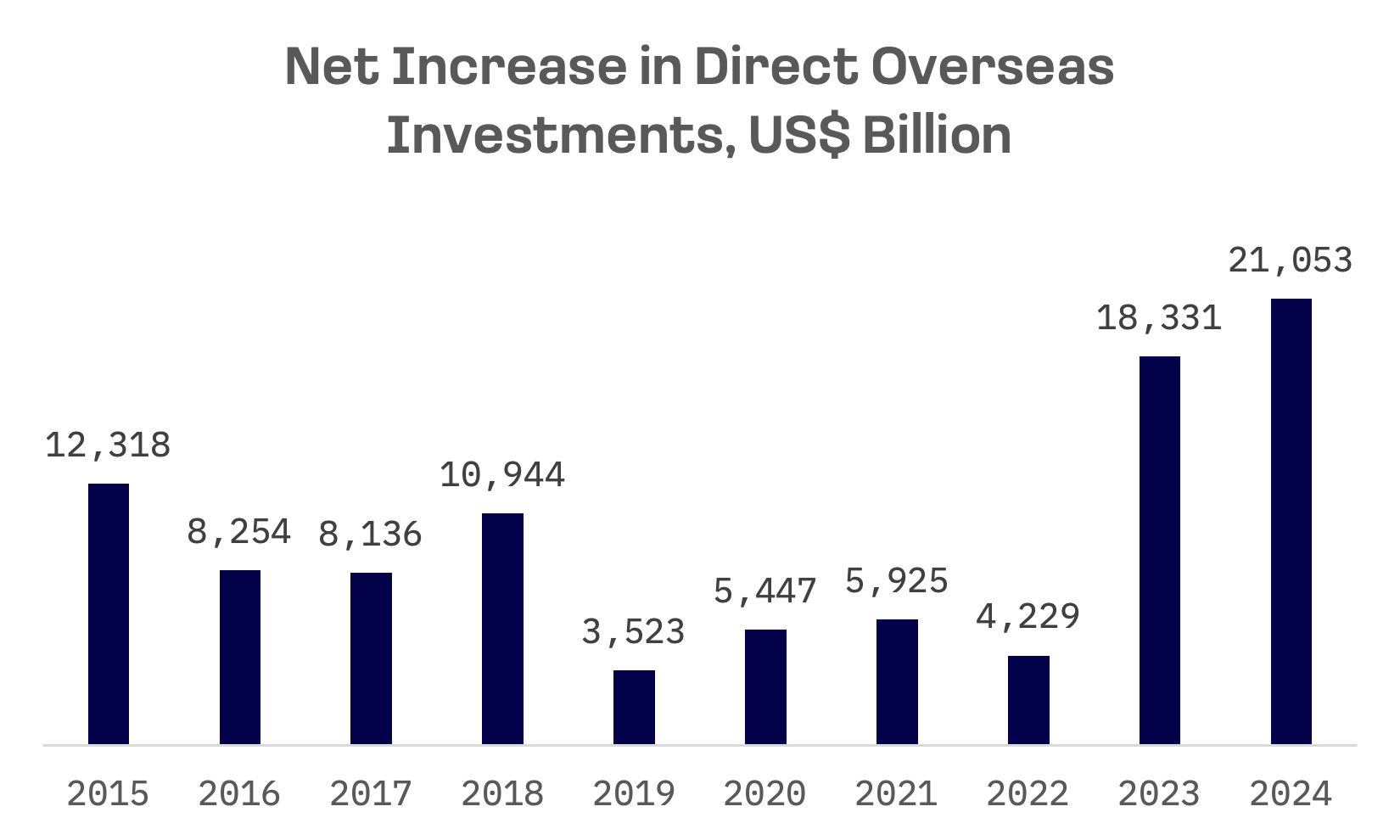

Taiwan’s direct overseas investments reached a record $21.05 billion in 2024, driven largely by Taiwan Semiconductor Manufacturing Co. (TSMC)’s expansion of production facilities in the U.S. and Japan, alongside overseas growth by other major manufacturers. Vanguard International Semiconductor, WT Microelectronics and Hon Hai Precision Industry also contributed to the record surge.

TSMC has accelerated direct investments in key markets, propelled by geopolitical shifts, rising demand for advanced chips and efforts to diversify its manufacturing base. The semiconductor giant’s expansion into the U.S. and Japan aligns with global initiatives to strengthen supply chain resilience and reduce dependence on a single region for chip production.

In February 2025, TSMC’s board approved capital appropriations of approximately $17.14 billion to support long term capacity expansion aligned with market demand forecasts and the company’s technology roadmap. The investment will fund the installation and upgrade of advanced technology capacity, enhancements in advanced packaging and specialty technologies, as well as fab construction and facility system installations. Although the meeting resolutions don’t disclose the exact allocation for overseas investments, a substantial portion of the capital is likely destined for TSMC’s expansion in the U.S. and Japan.

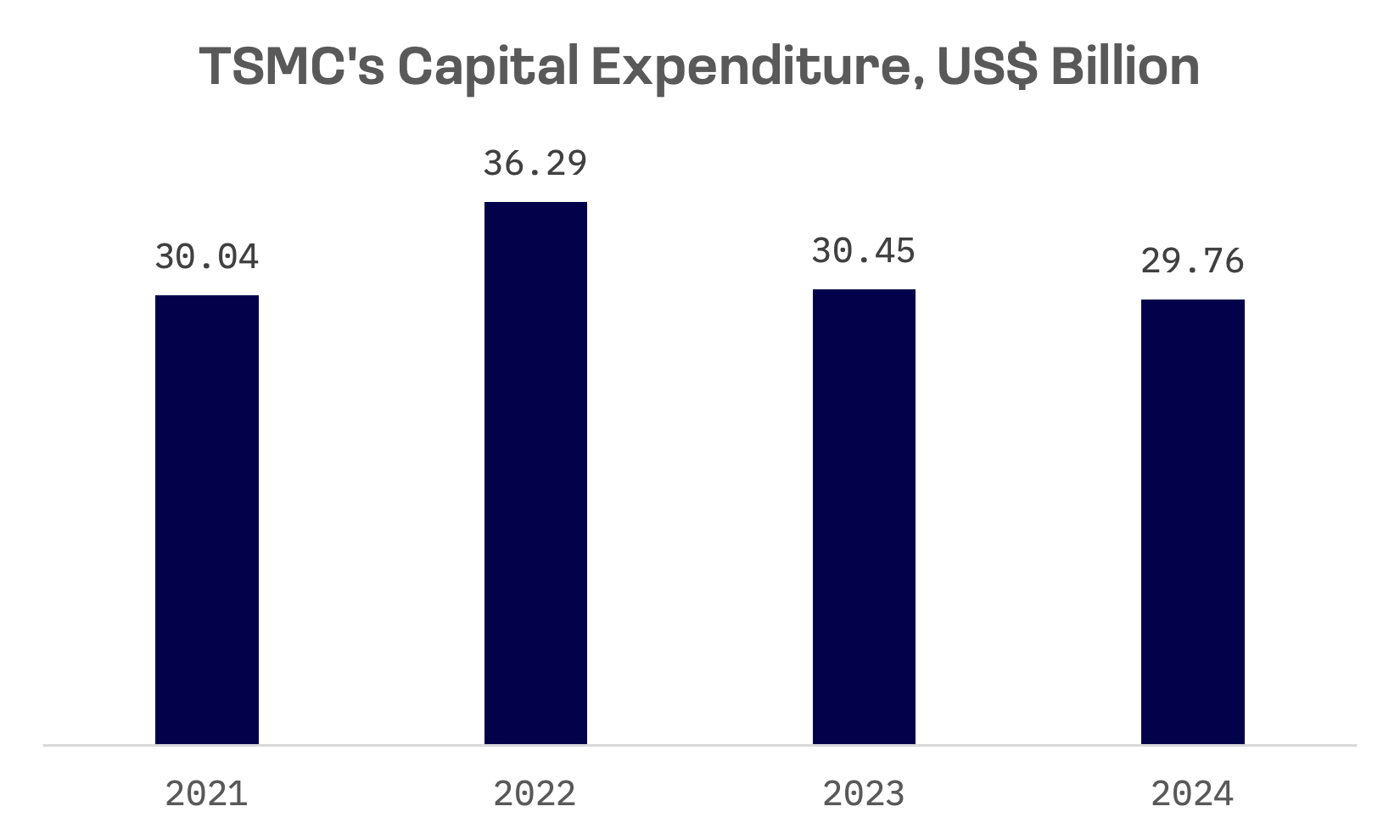

TSMC’s annual capital expenditure has hovered around $30 billion each year over the past four years, with the exception of 2022, when CAPEX surged to $36 billion.

TSMC plans to build multiple new facilities, including advanced process wafer factories and advanced packaging plants. Abroad, the company will coordinate construction in Japan, the U.S. and Europe. The following table summarises TSMC’s planned overseas factory expansions:

| Location | Type of Factory | Expected Investments | Planned Start of Production |

| Arizona, United States | Two fabs | $65 Billion | First phase in 2025, second in 2027 |

| Arizona, United States | Three fabs, two packaging facilities, R&D team centre | $100 Billion | Construction will take at least 4 years |

| Kumamoto, Japan | Two fabs | $20 Billion | First phase in 2024, second in 2027 |

| Dresden, Germany | Special processes | $10.9 Billion | End of 2027 |

United States

TSMC announced its commitment to U.S. expansion in May 2020, selecting Arizona as the site for a cutting edge semiconductor fabrication plant (fab). Initially outlining a $12 billion investment, the company planned to establish an N5 process fab with a monthly capacity of 20,000 wafers, breaking ground in 2021 and targeting mass production by late 2024 — creating roughly 1,600 jobs.

In 2022, TSMC expanded its vision, unveiling plans to introduce N4 process technology at the Arizona site to address growing market demand. By December of that year, the company launched a second phase of construction, aimed at deploying N3 process technology by 2026.

This decision follows the enactment of the CHIPS and Science Act of 2022, which aims to incentivise semiconductor companies to establish and expand their manufacturing presence in the United States. TSMC has already benefitted from this act, receiving $6.6 billion in direct funding and $5 billion in low cost loans to support its initial Arizona fab.

The total investment across both phases surged to $65 billion, positioning the initiative among the largest foreign direct investments in U.S. history, while boosting TSMC’s U.S. workforce to 4,500. Upon completion, the Arizona fabs are projected to exceed an annual capacity of 600,000 wafers. However, production delays have pushed the first phase’s timeline from late 2024 to the first half of 2025, consequently deferring the second phase’s production start beyond 2027.

In March 2025, TSMC unveiled its plan to invest an additional $100 billion in its Arizona operations, raising its total investment in the U.S. to an unprecedented $165 billion. This expansion includes the construction of three new fabs, two advanced packaging facilities and a major R&D centre.

Japan

In October 2021, TSMC, in partnership with Sony Group’s wholly owned subsidiary, Sony Semiconductor Solutions, established Japan Advanced Semiconductor Manufacturing (JASM) in Kumamoto, Japan. Sony Semiconductor Solutions committed approximately $500 million to acquire up to a 20% stake in JASM.

Japanese automotive components giant Denso later joined as an investor. The facility is set to achieve a monthly production capacity of 55,000 wafers and has secured commitments from the Japanese government, including a subsidy of approximately ¥476 billion ($3.34 billion).

TSMC recently announced a second JASM fab in collaboration with Sony Semiconductor, Denso and Toyota Motor Corporation. Construction is expected to begin by late 2024, with operations to commence by the end of 2027. The expansion aims to enhance production capacity, optimise cost structures and improve supply chain efficiency.

Upon completion, the two JASM fabs will offer a combined monthly output exceeding 100,000 12 inch wafers. Capacity planning will be adjusted based on market demand, while the Kumamoto site is expected to generate over 3,400 high tech jobs. The overall investment in JASM will exceed $20 billion.

Following the investment, TSMC holds approximately 86.5% of JASM shares, with Sony Semiconductor, Denso and Toyota owning 6%, 5.5% and 2%, respectively.

Europe

TSMC’s global expansion strategy also includes Europe. In August 2023, TSMC together with Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors N.V. unveiled plans to invest in the European Semiconductor Manufacturing Company (ESMC) in Dresden, Germany, bolstering the region’s chipmaking capacity. The move underscores efforts to meet surging demand for automotive and industrial semiconductors.

With a planned monthly capacity of 40,000 wafers, the project is set to fortify Europe’s semiconductor supply chain and create around 2,000 high tech jobs. This €10 billion ($10.9 billion) facility aims to break ground in the second half of 2024, targeting production by late 2027.

This expansion into Europe is part of TSMC’s global strategy to diversify its production locations and mitigate risks associated with geopolitical tensions. It also positions the company to capitalise on the growing demand for AI chips and other advanced semiconductors in the European market.

Strategic Drivers and Challenges

Taiwan Semiconductor’s global expansion is driven by multiple factors. Diversifying its manufacturing footprint beyond Taiwan helps mitigate risk from geopolitical tensions and natural disasters, ensuring a stable chip supply even in the face of regional disruptions. Establishing fabs closer to key customers allows TSMC to provide faster, more efficient support, particularly crucial in fast evolving industries like AI and high performance computing.

Additionally, governments worldwide are offering substantial financial incentives to attract TSMC’s investments, easing the cost burden of new facilities and making overseas expansion more appealing.

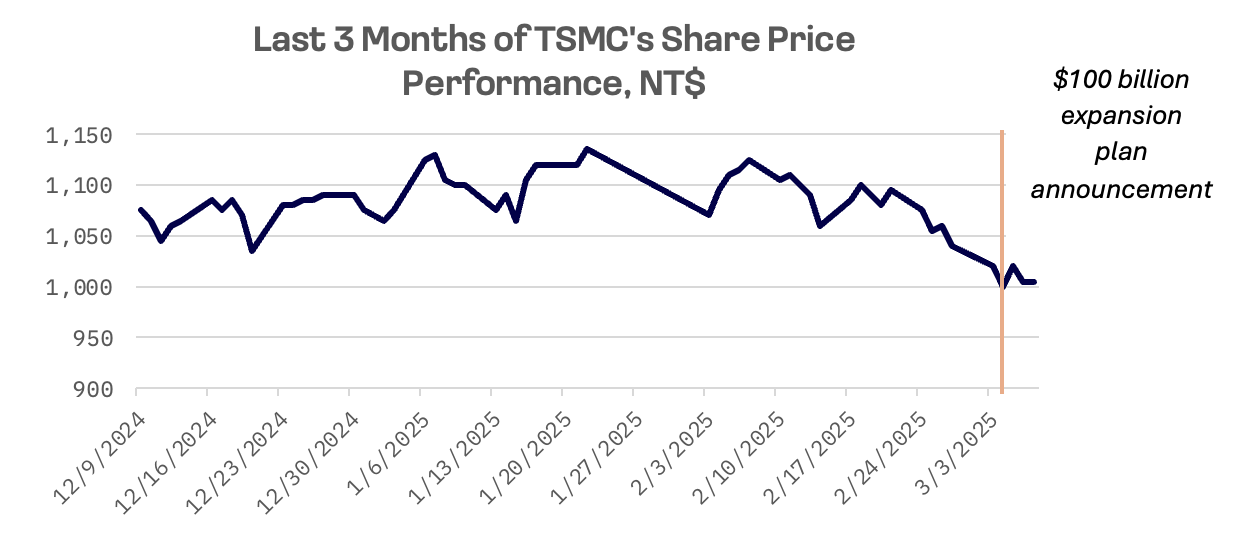

TSMC’s share price has experienced volatility over the past three months as investors weigh the impact of potential U.S. tariffs, uncertainty surrounding the CHIPS Act and the company’s massive U.S. investment plans.

President Donald Trump is considering tariffs of up to 100% on Taiwanese made semiconductors, a move that could drive up prices, weaken demand and pressure TSMC’s financials. His opposition to the CHIPS Act, which offers tax breaks for U.S. chipmakers, adds another layer of uncertainty. A repeal could hurt domestic players like Intel while inadvertently bolstering TSMC — though at the cost of heightened market volatility.

Meanwhile, TSMC’s ambitious $100 billion plan to establish new fabs and a major R&D hub in the U.S. presents a strategic opportunity to meet surging AI chip demand. However, the move also raises concerns over strategic dilution and the company’s role in Taiwan’s geopolitical landscape, especially amid growing military tensions with China.

Beyond geopolitical risks, TSMC faces challenges including higher operating costs, cultural and operational complexities and potential concerns over technology transfer.