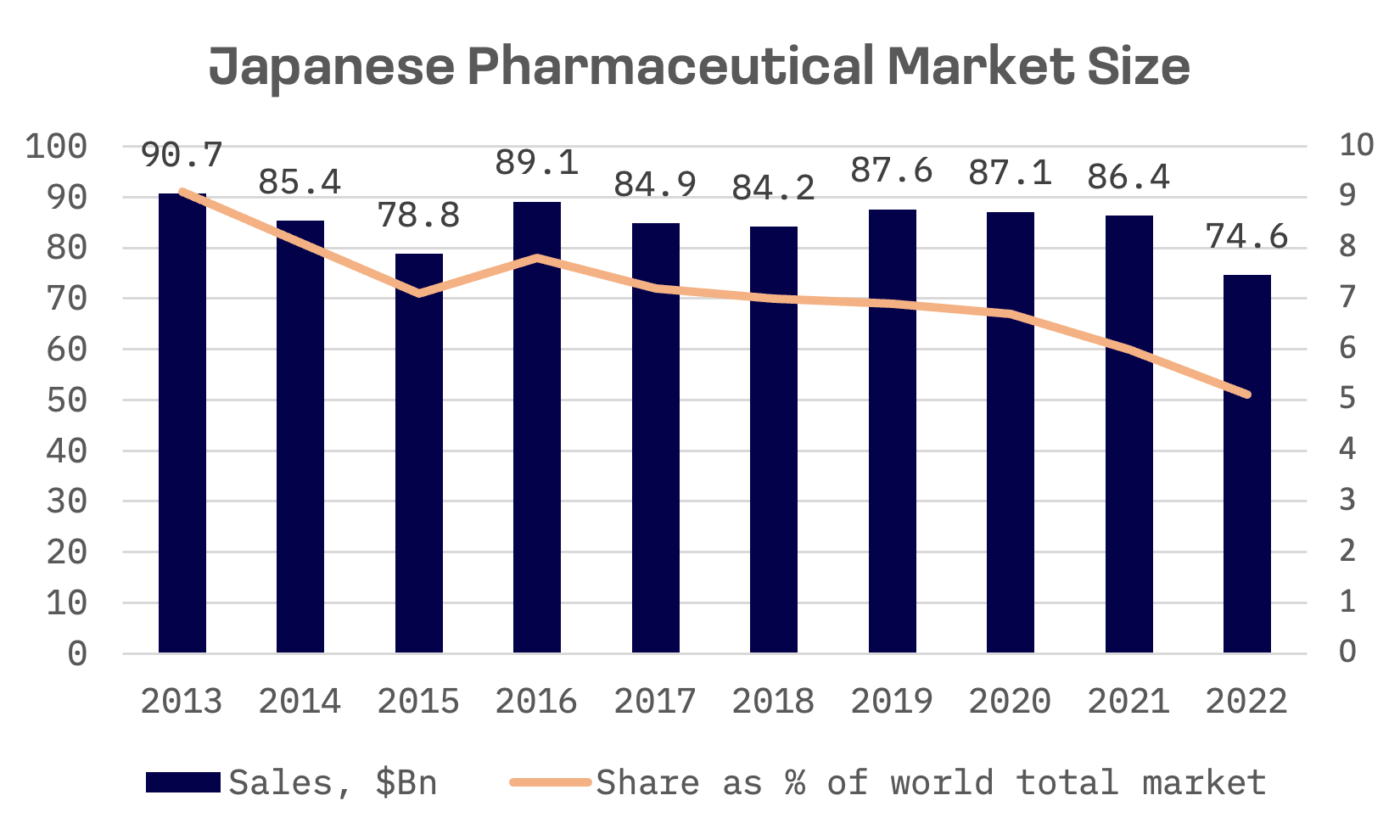

Japan stands as the third-largest pharmaceutical market globally. Since 2013, the Japanese government has actively promoted the healthcare sector as a pivotal catalyst for economic revitalisation within the nation’s overarching growth strategy. Despite these efforts, Japan’s share of the global pharmaceutical market has continued to decline.

The country faces stiff competition from major players in the global pharmaceutical industry, such as the United States and Europe. Concurrently, Japan’s healthcare system is undergoing reforms aimed at improving efficiency and cost-effectiveness. Moreover, Japan’s regulatory environment has historically posed challenges for pharmaceutical companies. A distinctive aspect of Japan’s Pharmaceutical and Medical Device (PMD) regulatory landscape is the dual licensing framework required to market PMD products. Companies must first undergo a review to establish a PMD sales system and secure a corresponding license, followed by separate evaluations for product efficacy and safety.

IQVIA, a prominent global research organisation, forecasts that Japan’s pharmaceutical market will experience modest annual growth of 0.5% to 1.5% until 2027. This projection is significantly below the anticipated global market growth during the same period. A contributing factor to this stagnation is the decline in Japan’s off-patent drug segment. However, there is optimism for Japan’s patented drug market, which is expected to maintain its growth trajectory.

The ageing population and the rise in chronic illnesses are poised to be key drivers of Japan’s pharmaceutical sector. According to the World Bank, approximately 30% of Japan’s population were aged 65 years and above in 2022. This demographic is particularly susceptible to cardiovascular diseases, thereby fuelling the demand for therapeutics within the nation.

Additionally, the prevalence of Alzheimer’s disease is increasing in Japan, presenting a substantial market opportunity. The Alzheimer’s disease drugs market in Japan is projected to grow at a compound annual growth rate (CAGR) of 8.9% from 2022 to 2030.

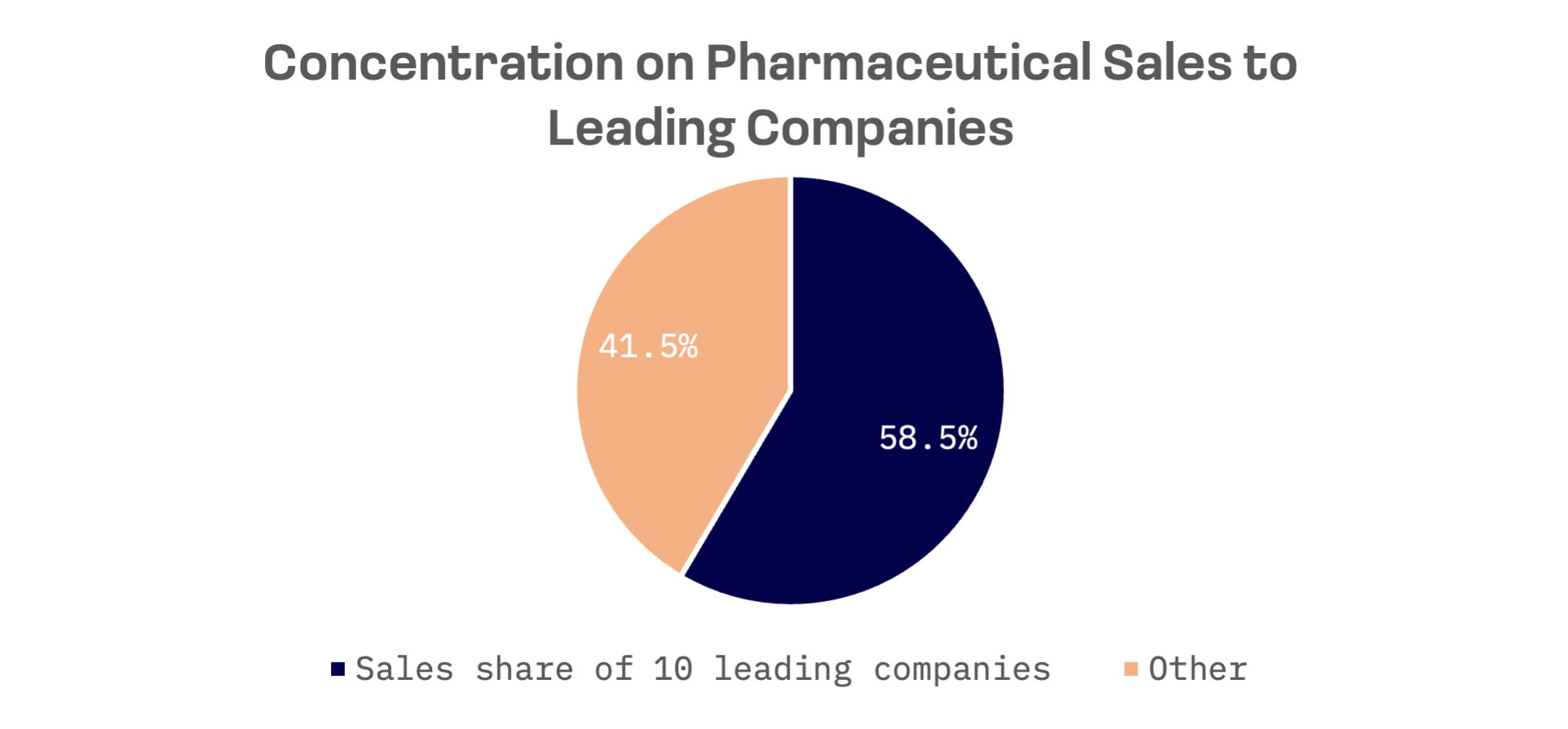

Despite the presence of several hundred pharmaceutical companies, including domestic firms and Japanese subsidiaries of leading global pharmaceutical companies, the concentration of pharmaceutical sales remains notably high among leading companies. The sales share of the top five companies amounts to 45.2%, and the top ten companies constitute 58.5%.

Seven domestic public companies boast market capitalisations surpassing $10 billion, six of which are constituents of the JAKOTA Blue Chip 150.

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Daiichi Sankyo | 4568.TSE | Blue Chip 150 | 58.5B |

| Chugai Pharmaceutical | 4519.TSE | Blue Chip 150 | 54.7B |

| Takeda Pharmaceutical | 4502.TSE | Blue Chip 150 | 41.9B |

| Otsuka Holdings | 4578.TSE | Blue Chip 150 | 22.3B |

| Astellas Pharma | 4503.TSE | Blue Chip 150 | 17.0B |

| Shionogi | 4507.TSE | Blue Chip 150 | 13.6B |

| Eisai | 4523.TSE | Mid and Small Cap 2000 | 11.3B |

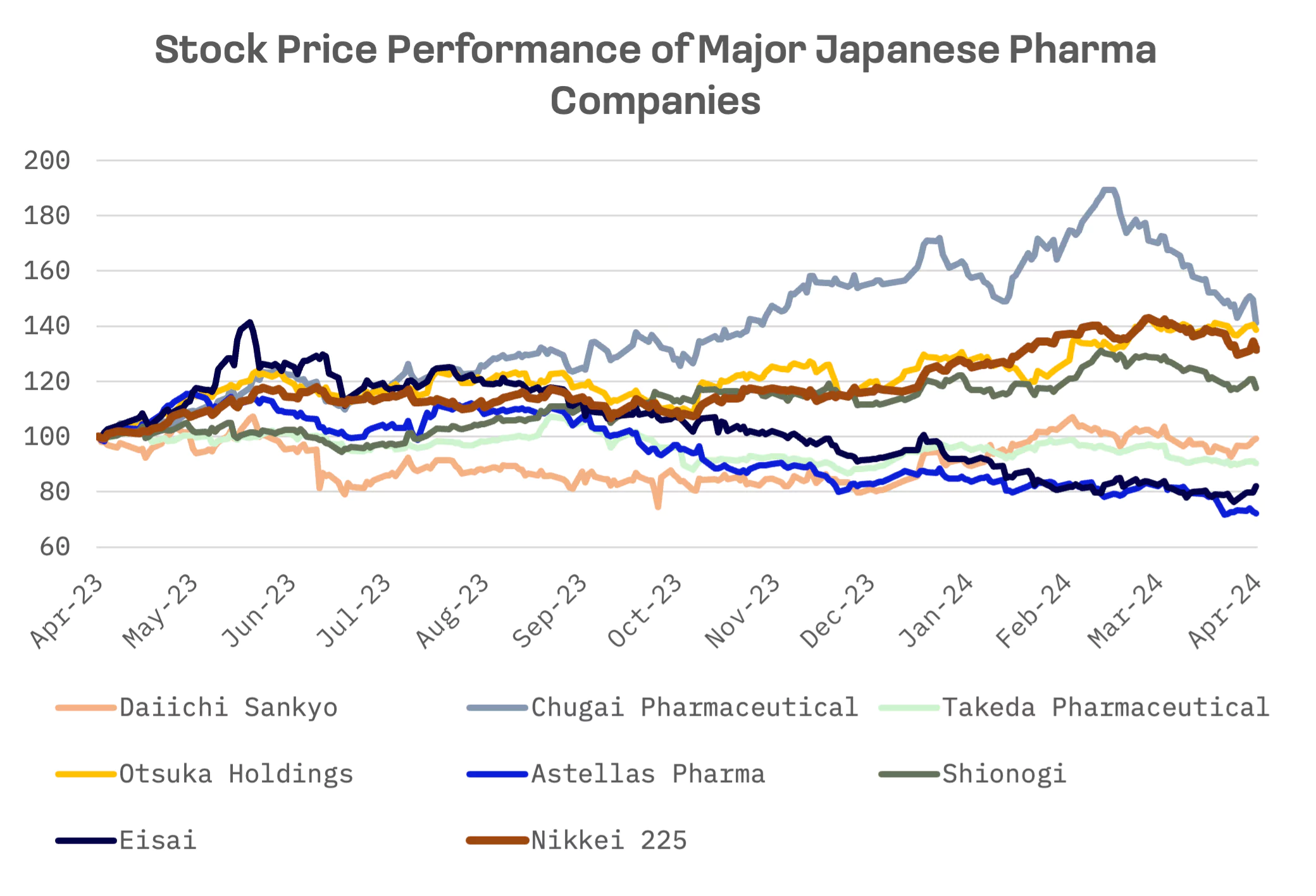

Over the past 12 months, the share price performance of Japanese big pharma stocks has been multidirectional. Notable declines were observed in Astellas and Eisai, which experienced losses of 28% and 18%, respectively. Most stocks from the peer group underperformed the Nikkei 225 index, with exceptions such as Chugai Pharmaceutical and Otsuka Holdings, which managed to slightly outperform the index. Chugai Pharmaceutical exhibited the most volatility in performance. In mid-March 2024, its share price nearly doubled compared to April 2023. However, in recent weeks, significant losses have been recorded.

Chugai Pharmaceutical, a subsidiary controlled by Hoffmann-La Roche, witnessed the highest share price growth despite a decline in sales. The company recently announced that crovalimab, a humanized complement inhibitor C5 monoclonal antibody, has received approval from the Chinese National Medical Products Administration (NMPA) for the treatment of patients diagnosed with Paroxysmal Nocturnal Hemoglobinuria (PNH) who have not undergone previous treatment with complement inhibitors. Additionally, there are positive developments regarding robust demand from Roche for Hemlibra, a drug utilised in the treatment of haemophilia A.

In contrast, Astellas Pharma witnessed a substantial decline in its shares, likely attributable to the slower than anticipated progress in the launch of the menopausal drug Veozah. The company has adjusted its fiscal-year sales projection to ¥7.1 billion and indicated a review of its peak sales projection, originally estimated to be between ¥300 to ¥500 billion. Astellas’ Chief Financial Officer, Atsashi Kitamura, attributed the slower progress to the effect of direct to consumer marketing efforts being “lower than expected,” alongside limited demand due to physician hesitance in prescribing the drug.

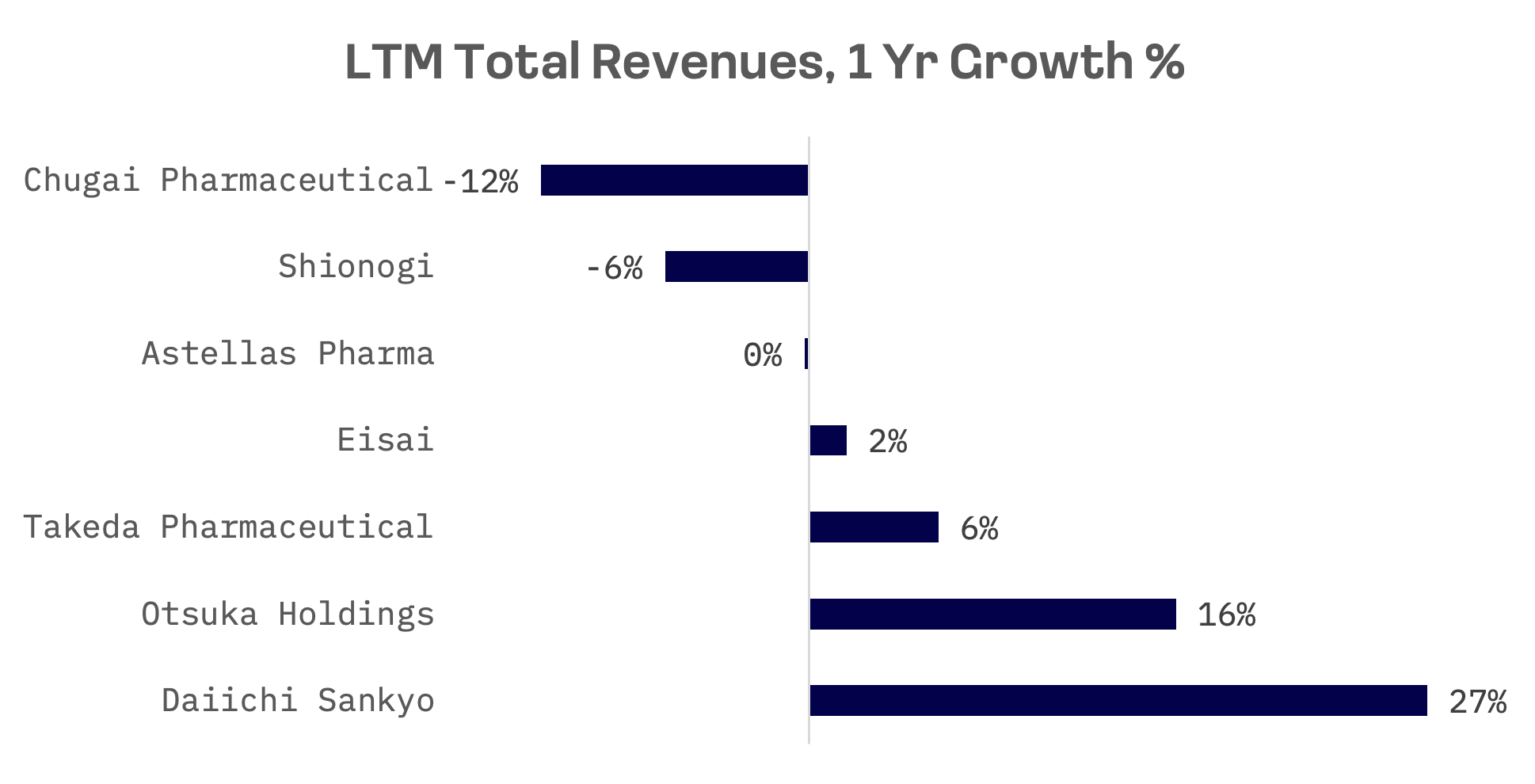

Daiichi Sankyo, the largest Japanese pharmaceutical company by market capitalization, experienced a sales increase of 27%, driven primarily by Enhertu, a drug designed for women with incurable HER2-low secondary breast cancer. Based on the EV/Sales and P/E ratios, Daiichi Sankyo emerges as the absolute leader within the peer group.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Daiichi Sankyo | 5.0x | 26.4x | 48.8x |

| Chugai Pharmaceutical | 7.5x | 17.4x | 26.0x |

| Takeda Pharmaceutical | 2.6x | 10.7x | 36.8x |

| Otsuka Holdings | 1.6x | 12.7x | 14.0x |

| Astellas Pharma | 2.1x | 19.2x | – |

| Shionogi | 3.8x | 7.6x | 13.9x |

| Eisai | 2.2x | 14.4x | 38.5x |

| MEAN | 3.5x | 15.5x | 29.6x |

| MEDIAN | 2.6x | 14.4x | 31.4x |

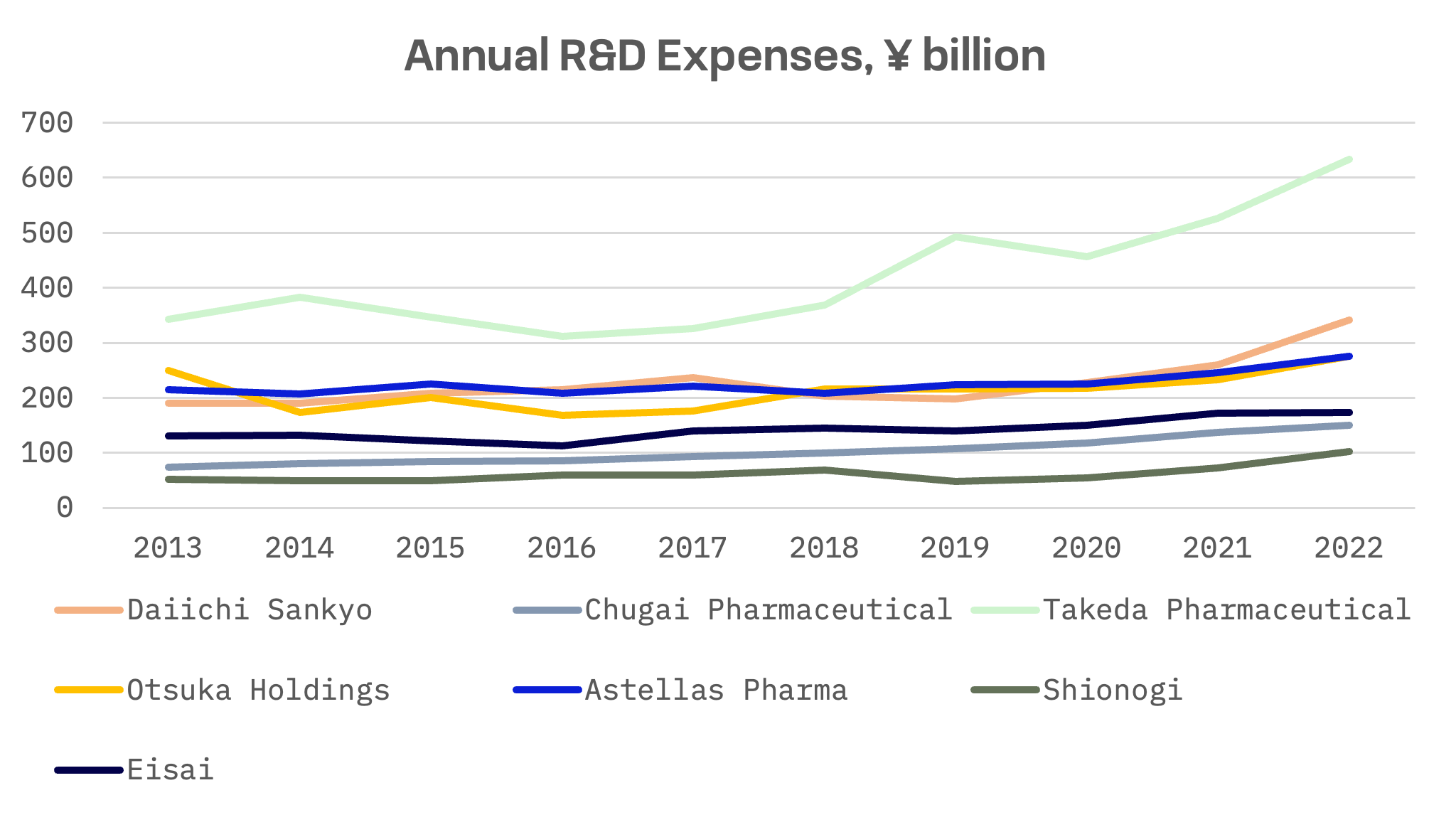

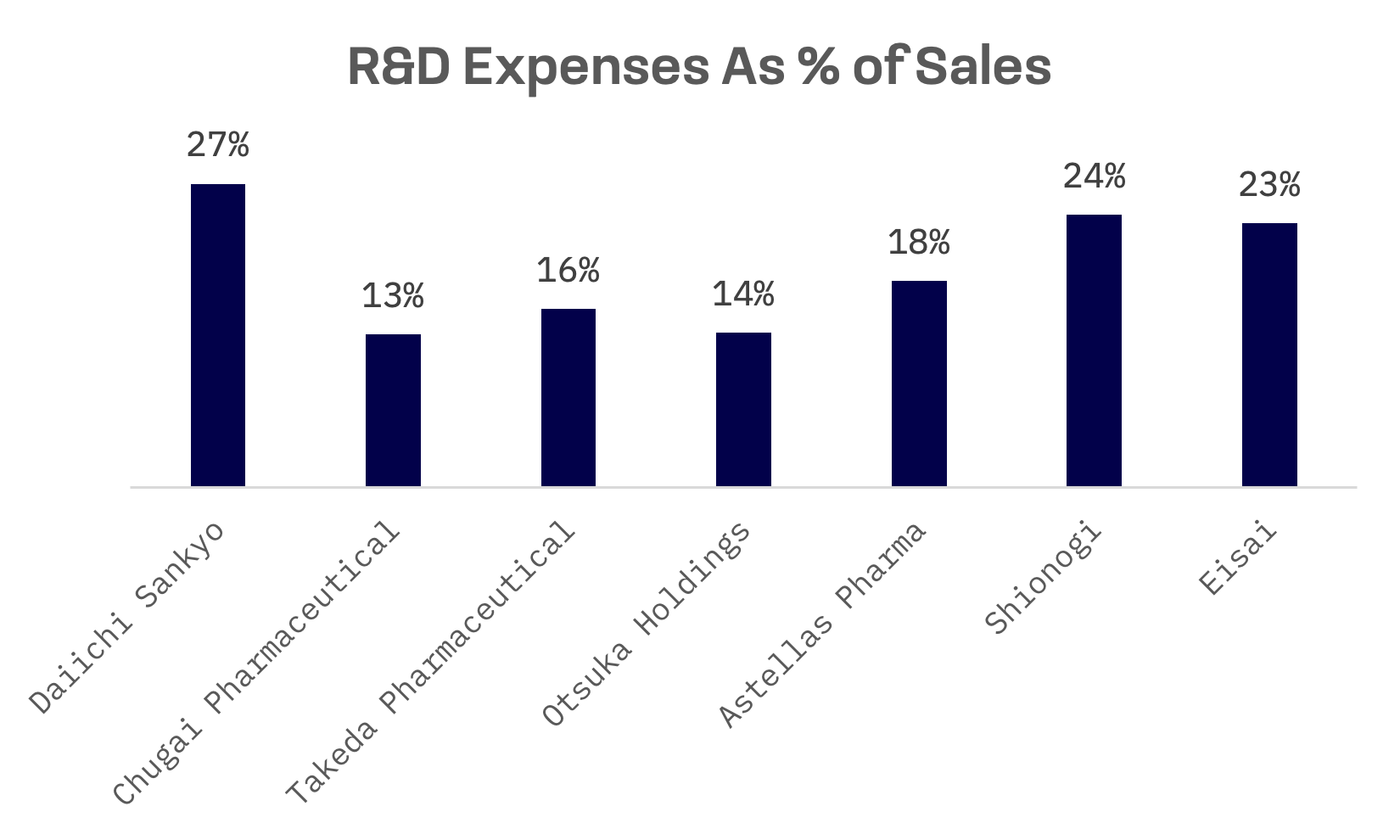

R&D (research and development) expenses serve as a key metric for evaluating the long-term growth prospects and competitiveness of pharmaceutical companies. Over the past decade, all companies have increased their R&D expenditures. In absolute terms, Takeda Pharmaceutical emerges as the leader. However, when considering R&D expenses as a percentage of sales, Daiichi Sankyo takes the lead among its peer group.