Renowned for its prowess in electronics and semiconductors, Taiwan also holds an impressive 13.3% stake in the global bicycle market. Its exports in this sector reached a notable $1.6 billion, positioning it second worldwide, behind only China.

In 2022, the global bicycle market, valued at $64.6 billion, is forecasted to grow at a compound annual rate of 9.7% from 2023 to 2030. The reasons? A rising interest in bicycling for recreation and its perceived health benefits, notably in preventing obesity-related illnesses.

For investors keen on tapping into this booming sector, the Taiwan stock market offers fertile ground. A majority of publicly listed bicycle enterprises are found there, with five companies listed on the Taiwan Stock Exchange and another three on the Taipei Exchange:

| Company Name | Exchange: Ticker | Market Cap as of Oct-6, 2023, USD million |

| Giant Manufacturing Co., Ltd. | TWSE:9921 | 2,183.7 |

| Merida Industry Co., Ltd. | TWSE:9914 | 1,651.9 |

| Yusin Holding Corp. | TWSE:4557 | 152.8 |

| Lee Chi Enterprises Company Ltd. | TWSE:1517 | 104.6 |

| Ideal Bike Corporation | TPEX:8933 | 96.7 |

| Axman Enterprise Co., Ltd. | TPEX:6804 | 67.3 |

| Sun Race Sturmey-Archer Corporation | TWSE:1526 | 64.8 |

| Joy Industrial Co., Ltd. | TPEX:4559 | 20.3 |

When diving deeper, Giant Manufacturing (TWSE:9921, JAKOTA Mid and Small Cap 2000 Index) and Merida Industry (TWSE:9914, JAKOTA Mid and Small Cap 2000 Index) emerge as key players for closer scrutiny. Additionally, Japan’s Shimano Inc. (TSE:7309, JAKOTA Blue Chip 150 Index, JAKOTA Consumer 250 Index), a leader in bicycle components, should be part of any comparative analysis.

| Giant Manufacturing | Merida Industry | Shimano | |

| Business Description | Giant Manufacturing Co., Ltd., together with its subsidiaries, manufactures and sells bicycles, electric bicycles, and related parts. The company offers on-road, x-road, off-road, youth, rider gear, bike gear, and service gear bicycles. Giant Manufacturing Co., Ltd. was incorporated in 1972 and is headquartered in Taichung City, Taiwan. | Merida Industry Co., Ltd. manufactures and sells bicycles and components in Taiwan, China, Hong Kong, Europe, and the United States. It offers mountain bicycles, road bikes, fitness bikes, e-bikes, gravel bikes and trekking and city bikes, as well as bikes for youth and kids. Merida Industry Co., Ltd. was incorporated in 1972 and is headquartered in Changhua, Taiwan. | Shimano Inc. develops, produces, and distributes bicycle components, fishing tackles, and rowing equipment. It has operations in Japan, Asia, Europe, North America, Latin America, and Oceania. Shimano Inc. was founded in 1921 and is headquartered in Sakai, Japan. |

| Operational indicators: | |||

| LTM Total Revenue, $mn | 2,788.7 | 1,116.6 | 3,946.0 |

| LTM EBITDA, $mn | 265.2 | 134.3 | 1,102.7 |

| LTM EBITDA margin, % | 9.5% | 12.0% | 27.9% |

| LTM EBIT, $mn | 207 | 125.9 | 953.2 |

| Trading multiples: | |||

| TEV/Total Revenues | 1.0 | 1.6 | 2.3 |

| TEV/EBITDA | 9.6 | 15.3 | 8.3 |

| TEV/EBIT | 12.9 | 16.8 | 9.7 |

| P/Diluted EPS | 16.8 | 21.7 | 17.0 |

Operational indicators reveal that Shimano, with an EBITDA exceeding $1.1 billion, leads in operational metrics. Yet, when looking at TEV/Total Revenues ratios, Shimano surpasses the two Taiwanese firms only marginally. Interestingly, Merida Industry commands the highest TEV/EBITDA and P/EPS multiples within this trio, reflecting its premium valuation owing to consistent sales growth and a healthier balance sheet.

Merida Industry: Key financial indicators, TWD million

| For the Fiscal Period Ending | 12 months Dec-31-2019A | 12 months Dec-31-2020A | 12 months Dec-31-2021A | 12 months Dec-31-2022A | 12 months Dec-31-2023E |

| Total Revenue | 28,243.2 | 27,072.3 | 29,391.2 | 37,003.1 | 30,600.2 |

| Growth Over Prior Year | 9.2% | (4.1%) | 8.6% | 25.9% | (17.3%) |

| Gross Profit | 3,819.7 | 3,787.2 | 4,087.0 | 6,391.3 | – |

| Margin | 13.5% | 14.0% | 13.9% | 17.3% | 18.9% |

| EBITDA | 1,929.2 | 2,103.4 | 1,820.3 | 3,703.1 | 3,842.6 |

| Margin | 6.8% | 7.8% | 6.2% | 10.0% | 12.6% |

| EBIT | 1,710.8 | 1,884.2 | 1,589.4 | 3,437.5 | 3,508.3 |

| Margin | 6.1% | 7.0% | 5.4% | 9.3% | 11.5% |

| Earnings from Cont. Ops. | 2,501.0 | 4,112.1 | 4,788.2 | 3,454.4 | – |

| Margin | 8.9% | 15.2% | 16.3% | 9.3% | – |

| Net Income | 2,502.4 | 3,993.3 | 4,649.5 | 3,389.1 | 2,632.6 |

| Margin | 8.9% | 14.8% | 15.8% | 9.2% | 8.6% |

| Diluted EPS Excl. Extra Items | 8.33 | 13.45 | 15.49 | 10.93 | – |

| Growth Over Prior Year | 46.4% | 59.3% | 16.7% | (27.3%) | (20.1%) |

Giant Manufacturing: Key financial indicators, TWD million

| For the Fiscal Period Ending | 12 months Dec-31-2019A | 12 months Dec-31-2020A | 12 months Dec-31-2021A | 12 months Dec-31-2022A | 12 months Dec-31-2023E |

| Total Revenue | 63,449.5 | 70,010.8 | 81,839.9 | 92,043.7 | 81,705.2 |

| Growth Over Prior Year | 5.3% | 10.3% | 16.9% | 12.5% | (11.2%) |

| Gross Profit | 13,656.9 | 16,168.7 | 19,764.1 | 20,824.0 | – |

| Margin | 21.5% | 23.1% | 24.1% | 22.6% | 21.0% |

| EBITDA | 6,051.3 | 8,311.0 | 10,300.0 | 9,668.3 | 7,998.9 |

| Margin | 9.5% | 11.9% | 12.6% | 10.5% | 9.8% |

| EBIT | 4,732.3 | 6,858.3 | 8,709.3 | 7,914.4 | 5,854.4 |

| Margin | 7.5% | 9.8% | 10.6% | 8.6% | 7.2% |

| Earnings from Cont. Ops. | 3,594.7 | 5,175.9 | 6,307.5 | 6,176.5 | – |

| Margin | 5.7% | 7.4% | 7.7% | 6.7% | – |

| Net Income | 3,374.6 | 4,949.0 | 5,930.1 | 5,843.9 | 3,923.6 |

| Margin | 5.3% | 7.1% | 7.2% | 6.3% | 4.8% |

| Diluted EPS Excl. Extra Items | 8.95 | 13.12 | 15.73 | 15.14 | 9.95 |

| Growth Over Prior Year | 17.9% | 46.6% | 19.9% | (3.8%) | (35.9%) |

The years 2021 and 2022 witnessed a seismic shift in transportation preferences, largely influenced by the COVID-19 pandemic, propelling both Giant Manufacturing and Merida Industry to greater heights.

However, 2023 paints a different picture. Both companies are likely to face a double-digit drop in full-year sales. For instance, Merida’s sales in the first half of 2023 are already down by 6.6% compared to the same period in 2022. The overoptimistic ordering in 2022, in anticipation of continued high demand, led to an oversupply. Consequently, bicycle prices in 2023 have dropped.

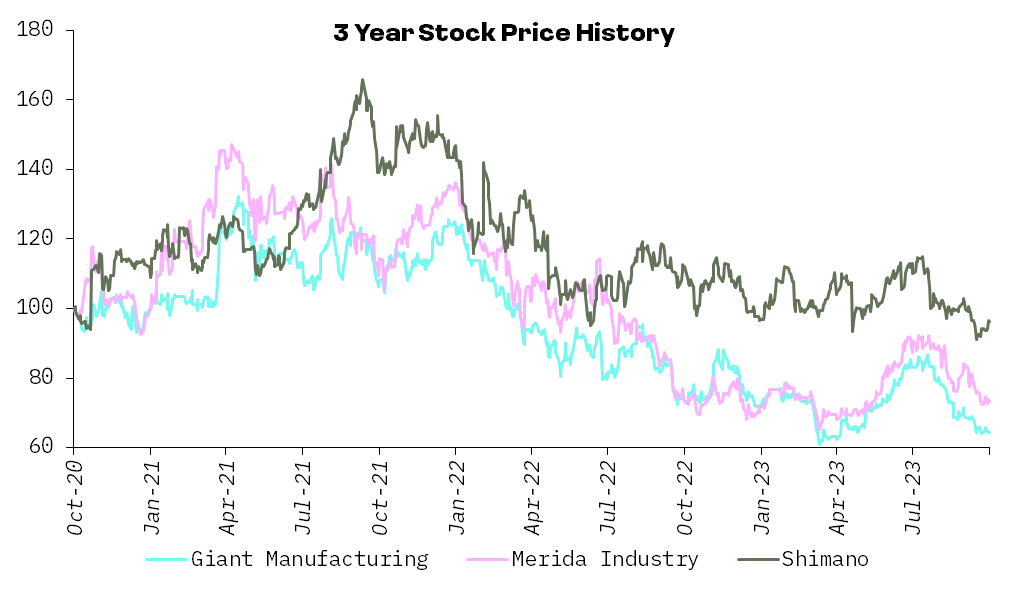

The stock narratives for these firms reflect industry trends. A 2021 zenith in demand set the stage for current valuations, which, given the bicycle price downturn, have now slid to a three-year low.

However, the future remains promising. The embracing of bicycling as regular exercise, the growth of the e-bike segment, and the rising trend of dockless bike-sharing systems, especially in Asian markets, suggest a brighter horizon. Looking ahead to 2024, projections indicate a resurgent sales growth trajectory for industry leaders like Giant Manufacturing, Merida Industry, and Shimano.