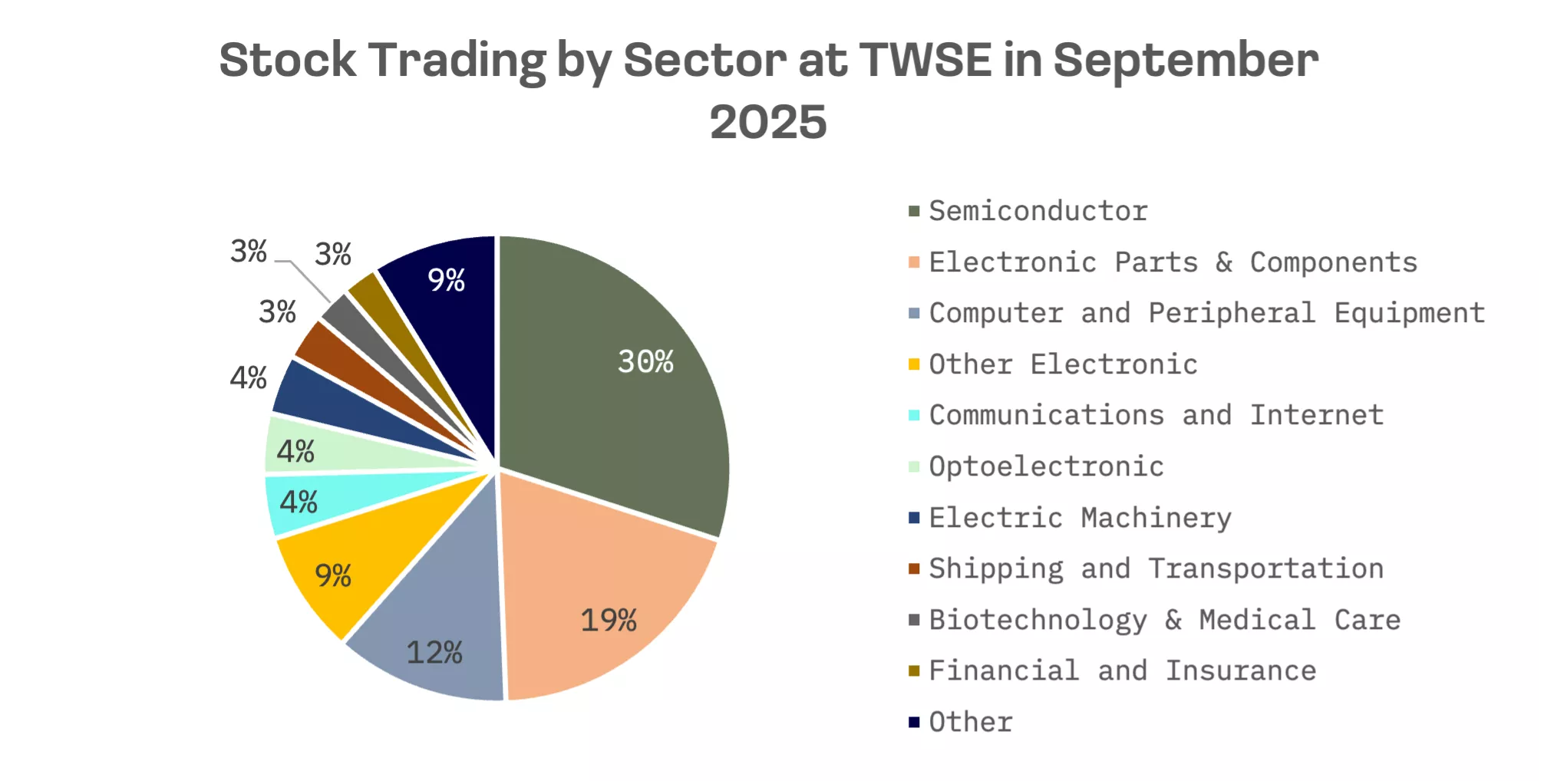

Taiwan’s stock market remains heavily concentrated in the chip industry. The combined market value of the main board and over-the-counter (OTC) market reached NT$90 trillion ($2.93 trillion) at the end of September, making it the world’s eighth largest bourse. The semiconductor sector alone accounted for roughly 48% of total market capitalisation. On the main board, semiconductor stocks represented about 30% of total trading value in September.

That heavy concentration in semiconductors cuts both ways. It creates a robust ecosystem and provides valuation benchmarks for new technology entrants. Yet the current market structure also reflects an overwhelming domestic focus: as of September 2025, the Taiwan Stock Exchange (TWSE) listed just 90 foreign companies, compared with 964 domestic firms.

Now Taiwan aims to leverage its technological strengths to boost the global competitiveness of its capital markets. Central to this strategy is the government’s plan to transform the Taiwan Stock Exchange into an “Asia Nasdaq,” an initiative backed by President Lai Ching-te and Premier Cho Jung-tai. The Financial Supervisory Commission (FSC) is spearheading the effort to position Taiwan as a major fundraising hub in the region.

The exchange is zeroing in on high growth startups from Southeast Asian (ASEAN) markets and Silicon Valley as part of its broader push to become the region’s preferred fundraising platform.

To advance that goal, the TWSE and the Taipei Exchange, which oversees the OTC market, are pooling resources to assist companies in semiconductors, AI, the AI Internet of Things (AIoT), green energy, robotics, biotechnology, cybersecurity and next generation communications.

By targeting these high value sectors, Taiwan is positioning itself as a source of “smart capital”, providing not only financial backing but also access to its advanced industrial ecosystem, including the world leading semiconductor supply chain anchored by Taiwan Semiconductor (TSMC).

At the heart of the “Asia Nasdaq” strategy is the liberalisation of the Taiwan Innovation Board (TIB), designed specifically for companies with core technologies or innovative business models. The board serves as a fundraising platform for emerging companies with smaller capital bases or continuing losses but strong growth potential. As part of the strategy, qualified investor restrictions for the board were eliminated starting January 6, 2025.

On October 20, 2025, the TWSE unveiled plans to ease listing rules to attract more foreign startups. Among the key changes, foreign listed firms whose major shareholders hold more than a 30% stake will be exempt from the requirement that over half their board members be Taiwanese nationals. Such companies must still appoint at least two Taiwan nationals as independent directors, however. The exemption applies only to companies with no capital originating from China, Hong Kong or Macau.

The exchange also said mutual funds will be allowed to apply the same investment criteria when purchasing stocks listed on the TIB as they use for main board shares. Investors will also be permitted to trade multi asset ETFs that track stocks listed on the board.

Companies that meet main board profit requirements but opt to list on the TIB will see their share depository and clearing period shortened from two years to one, the exchange said, with underwriting and accounting rules also relaxed. Firms listed on the main board, OTC market or TIB will be allowed to switch between boards after at least one year, provided they meet the listing standards of their target market.

The exchange didn’t specify when the new rules will take effect but said it will coordinate with the Taipei Exchange to streamline resources and support companies seeking listings.

The TWSE has been working to attract high growth tech firms, particularly from Southeast Asia. The liberalisation of the TIB and main board has made Taiwan’s listing standards among the most flexible in the region. Combined with the island’s structural advantages – including high tech valuation multiples and deep integration into global supply chains – the TWSE offers both funding opportunities and operational synergies.