South Korea’s finance ministry on July 31 unveiled a finalised tax reform plan that raises the top corporate tax rate by one percentage point to 25% and increases taxes on stock trades and capital gains from share sales, rolling back cuts enacted by the previous administration.

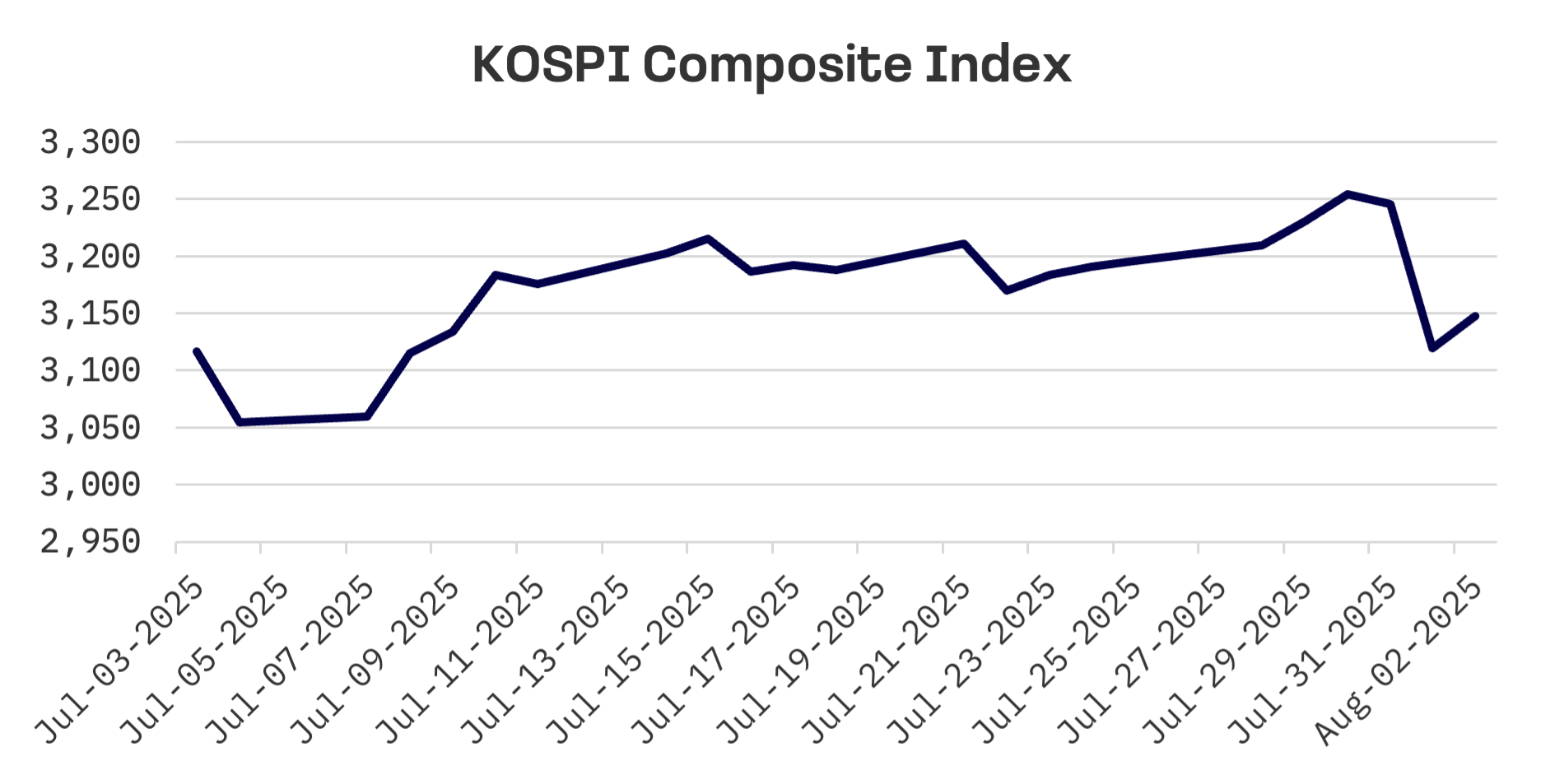

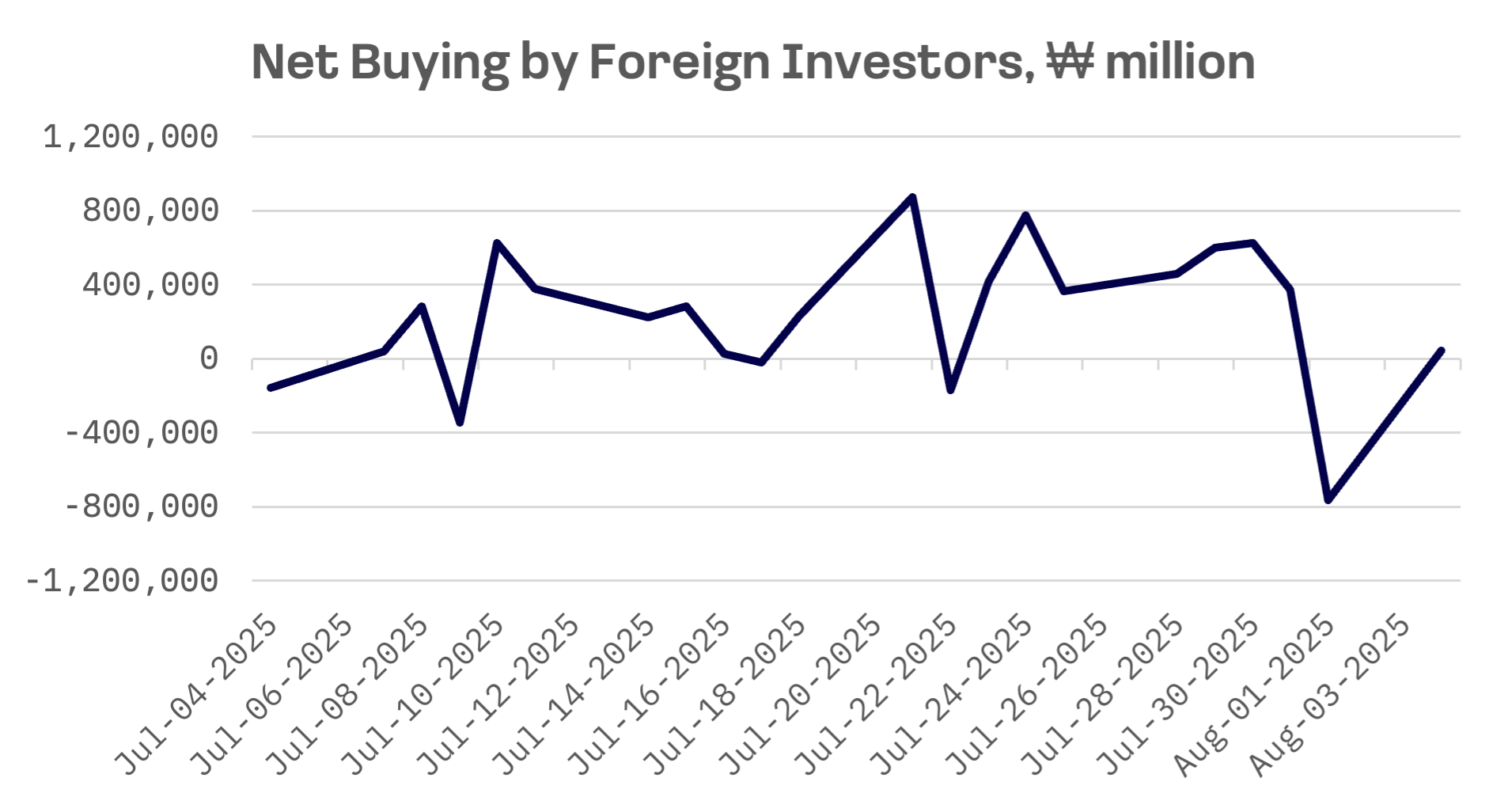

Markets reacted sharply to the announcement. The benchmark KOSPI index tumbled 3.9% the following day, marking its steepest single day drop in months, while foreign investors sold ₩763 billion ($544 million) worth of shares.

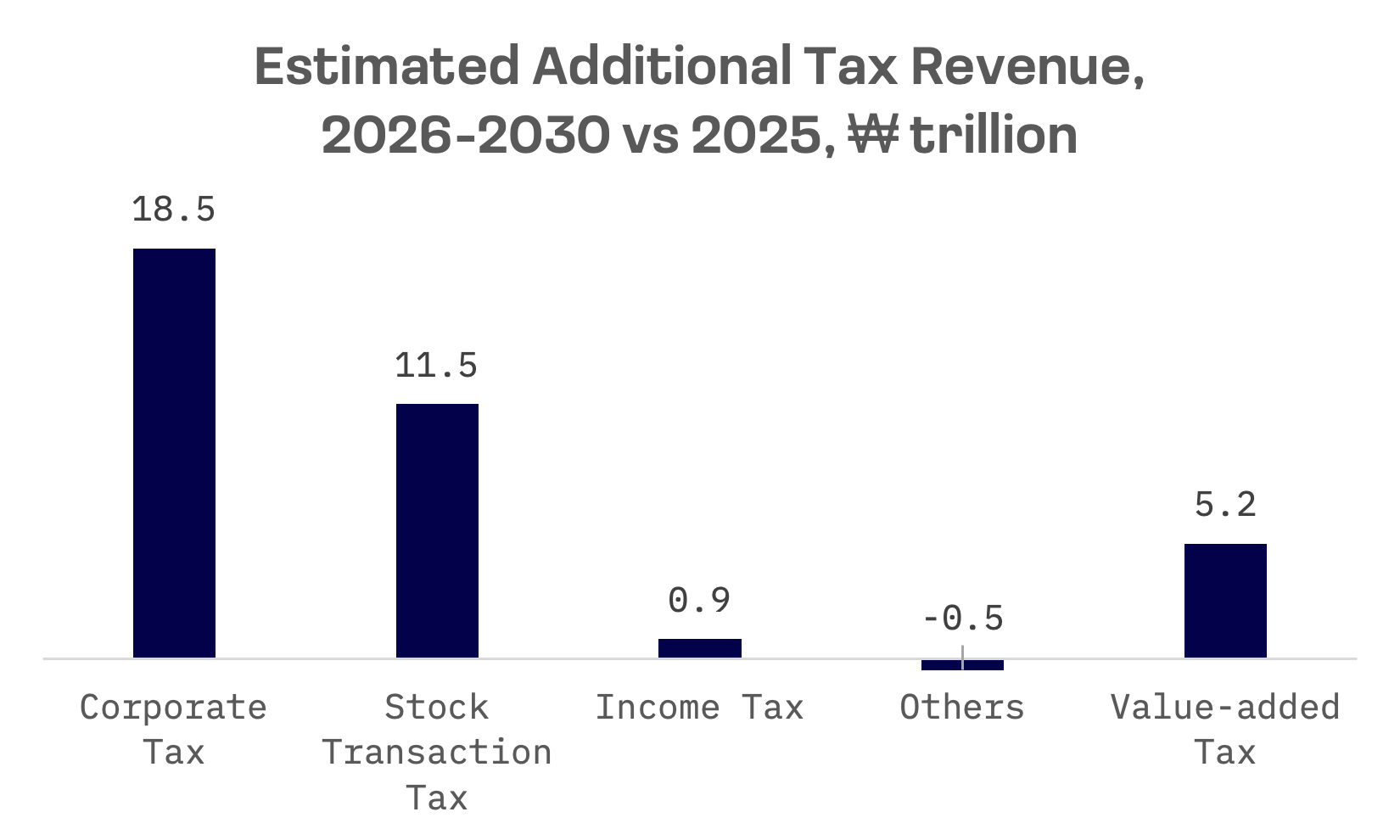

As President Lee Jae-myung shifts towards expansionary fiscal policy to boost domestic consumption and deliver on campaign pledges, the finance ministry projects the tax overhaul will raise an additional ₩35.6 trillion ($25.4 billion) in revenue through 2030, helping offset recent shortfalls in tax receipts.

Under the tax overhaul, corporate tax rates will rise by one percentage point across all four income brackets starting next year. The top rate will increase from 24% to 25% for companies with taxable income exceeding ₩300 billion, with lower brackets also facing higher rates:

| Taxable income, ₩ | Current (%) | Revised (%) |

| 0 – 200,000,000 | 9 | 10 |

| 200,000,000 – 20 billion | 19 | 20 |

| 20 billion – 300 billion | 21 | 22 |

| Over 300 billion | 24 | 25 |

The stock transaction tax will increase from the current 0.15% to 0.2%. The threshold for capital gains tax liability on large shareholders will be lowered significantly, from ₩5 billion to ₩1 billion per stock in listed companies, broadening the scope of taxation. Large business groups are expected to shoulder the largest share of the tax increase, with their burden projected at ₩16.8 trillion.

The government will ease dividend tax rates for shareholders of listed companies that maintain robust shareholder return policies. Dividend income from these companies will be taxed separately at rates between 14% and 35%, rather than under the comprehensive financial income tax, which can reach as high as 45%. However, the complex eligibility criteria and relatively modest tax benefits may limit the policy’s overall impact.

Stricter capital gains tax rules could prompt a year end wave of share sales, as investors move to avoid being labelled as major shareholders. The policy shift may undercut President Lee’s push to drive the KOSPI index to 5,000.