The quarterly rebalancing of the JAKOTA Blue Chip 150 Index added 14 companies while removing an equivalent number, with changes taking effect July 1, 2025.

| Entrants | Leavers | ||

| Doosan Enerbility | Kubota | ||

| HD Korea Shipbuilding & Offshore Engineering (KSOE) | Unicharm | ||

| SK Square | The Kansai Electric Power Company (KEPCO) | ||

| Korea Electric Power Corp. (KEPCO) | Subaru | ||

| Samsung Life Insurance | Mitsui O.S.K. Lines | ||

| IHI | Shimano | ||

| Hyundai Rotem | Rakuten Group | ||

| Nexon | Tokyo Gas | ||

| Wiwynn | Sysmex | ||

| Fujikura | LG Chem | ||

| Accton Technology | Hua Nan Financial Holdings | ||

| Capcom | Hikari Tsushin | ||

| First Financial Holding | T&D Holdings | ||

| HD Hyundai Electric | Kirin Holdings |

Of the 14 new entrants, six companies had previously departed the index in the prior quarterly rebalancing:

- Samsung Life Insurance (032830.KO), South Korea’s largest insurance company and a Samsung Group subsidiary.

- Nexon (3659.TSE), a video game developer and publisher founded in South Korea in 1994 and now headquartered in Tokyo.

- Wiwynn (6669.TW), a Taiwanese company specialising in cloud infrastructure product design, manufacturing and delivery.

- Fujikura (5803.TSE), a Japanese electrical and optical cable manufacturer.

- Accton Technology (2345.TW), a Taiwanese company specialising in advanced electronic components and systems design, manufacturing and distribution, including semiconductors, consumer electronics, telecommunications infrastructure and industrial automation.

- First Financial Holding (2892.TW), a Taiwan based holding company providing banking, bancassurance, securities, asset management, venture capital and financial consulting services.

Eight new companies joined the index:

- Doosan Enerbility (034020.KO), a South Korean heavy industrial company offering energy solutions for thermal power, nuclear power and renewable energy.

- HD Korea Shipbuilding & Offshore Engineering (KSOE) (009540.KO), a South Korean subholding company controlling HD Hyundai Group’s shipbuilding companies, including HD Hyundai Heavy Industries and HD Hyundai Samho.

- SK Square (402340.KO), a South Korean investment holding company focused on semiconductors and information and communications technology (ICT).

- Korea Electric Power (KEPCO) (015760.KO), South Korea’s largest electric utility company.

- IHI (7013.TSE), a Japanese engineering company providing aerospace, energy systems, industrial machinery and infrastructure solutions.

- Hyundai Rotem (064350.KO), a South Korean company specialising in railway systems, defence products and plant equipment.

- Capcom (9697.TSE), a Japanese video game developer.

- HD Hyundai Electric (267260.KO), a South Korean company specialising in electrical equipment and solutions.

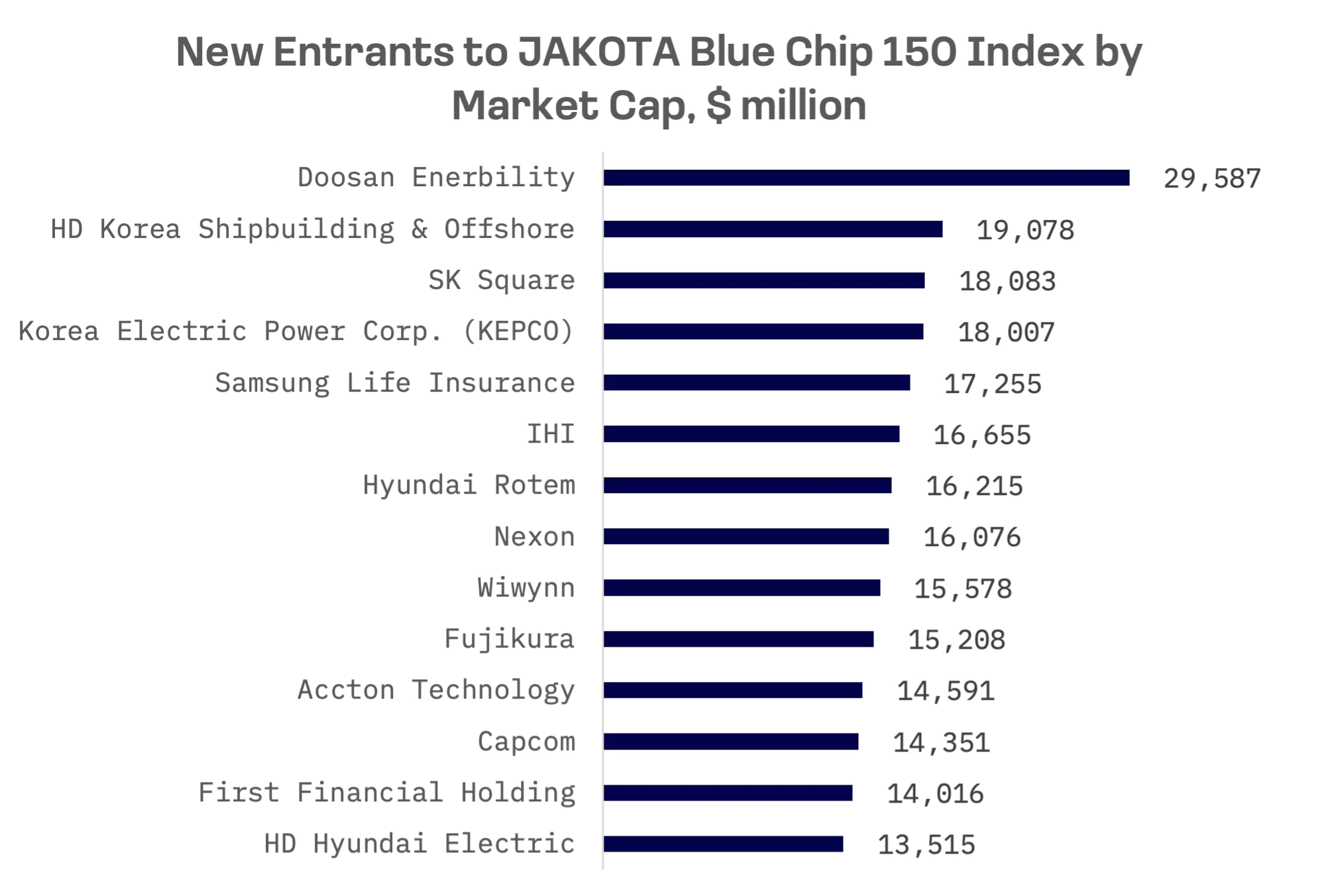

South Korea contributed seven companies to the index, while Japan added four and Taiwan contributed three. The top five new entrants by market capitalisation are all South Korean, reflecting the strong rally in South Korean stocks during June 2025 following Lee Jae-myung’s presidential election victory. Investor optimism was fuelled by his ambitious “KOSPI 5,000” initiative and capital market reforms aimed at addressing the longstanding “Korea Discount.”

Heavy industry and engineering sectors – including power generation and shipbuilding subsectors – attracted strong investor interest, driving market capitalisation surges for Doosan Enerbility and HD Korea Shipbuilding & Offshore Engineering (KSOE). Two game developers, Nexon and Capcom, also made it into the list, demonstrating robust investor appetite for gaming industry stocks.

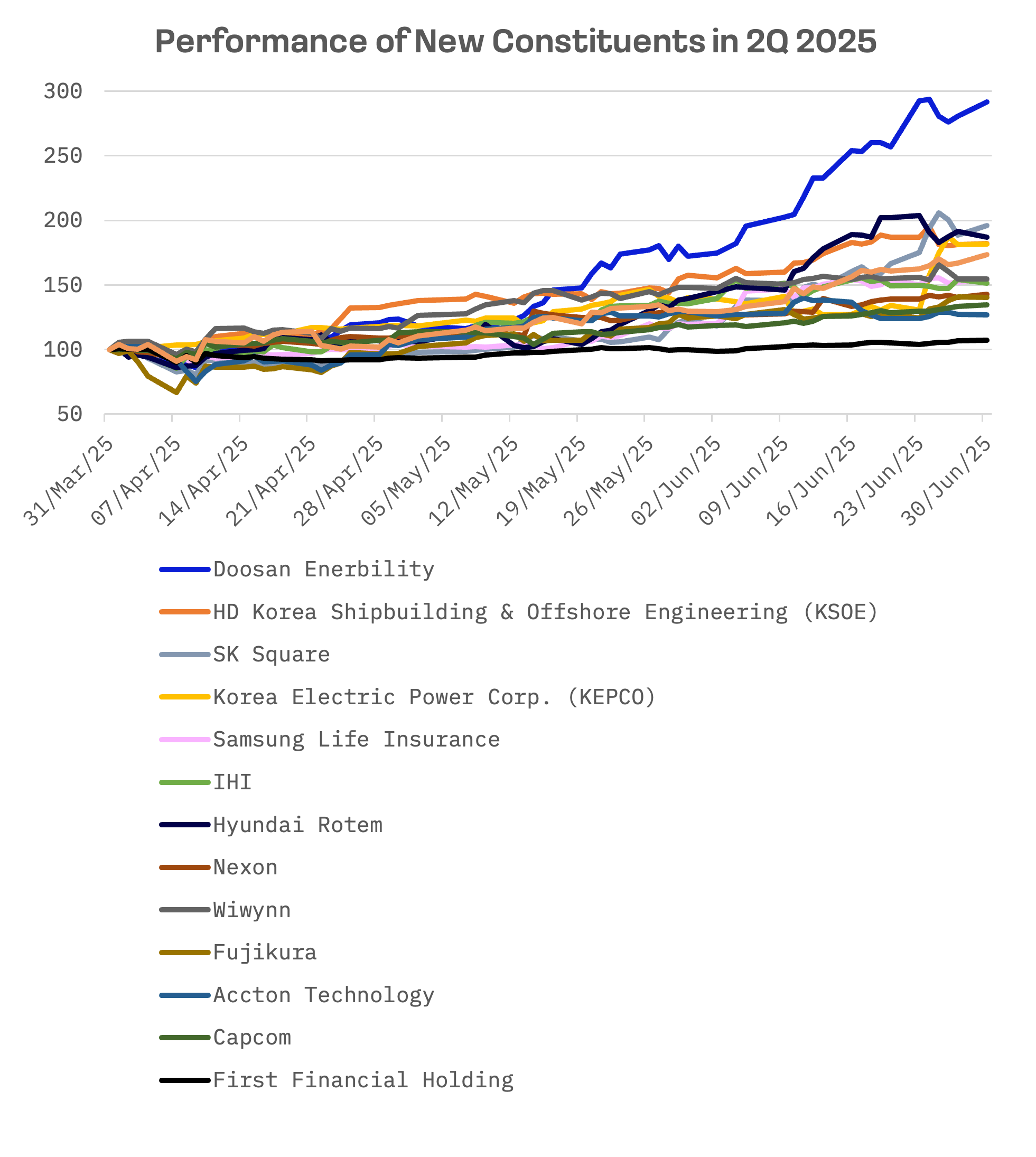

Doosan Enerbility delivered a standout second quarter 2025 performance, with shares nearly tripling amid rising global demand for nuclear energy, particularly in the U.S. and Europe. President Donald Trump’s executive orders in late May and early June 2025, designed to reassert America’s nuclear power leadership, established ambitious targets for expanding capacity and building new large reactors, creating favourable conditions for Doosan Enerbility’s growth prospects.

In June 2025, Doosan Enerbility secured several major contracts totalling more than $1 billion:

- Vietnam Gas Fired Power Plant: On June 9, Doosan announced a ₩900 billion deal to build the O Mon 4 gas fired power plant, marking its fifth major overseas gas power project this year and underscoring growth in the global combined cycle gas market.

- Saudi Arabia Power Projects: The company won a ₩340 billion contract to supply steam turbines and generators for two combined cycle gas turbine expansions at Ghazlan 2 and Hajjar.

- Yeongdong Pumped Storage Hydropower Plant: On June 20, Doosan signed a ₩330 billion agreement with Korea Hydro and Nuclear Power to supply key components for Korea’s first variable speed pumped storage hydropower units.