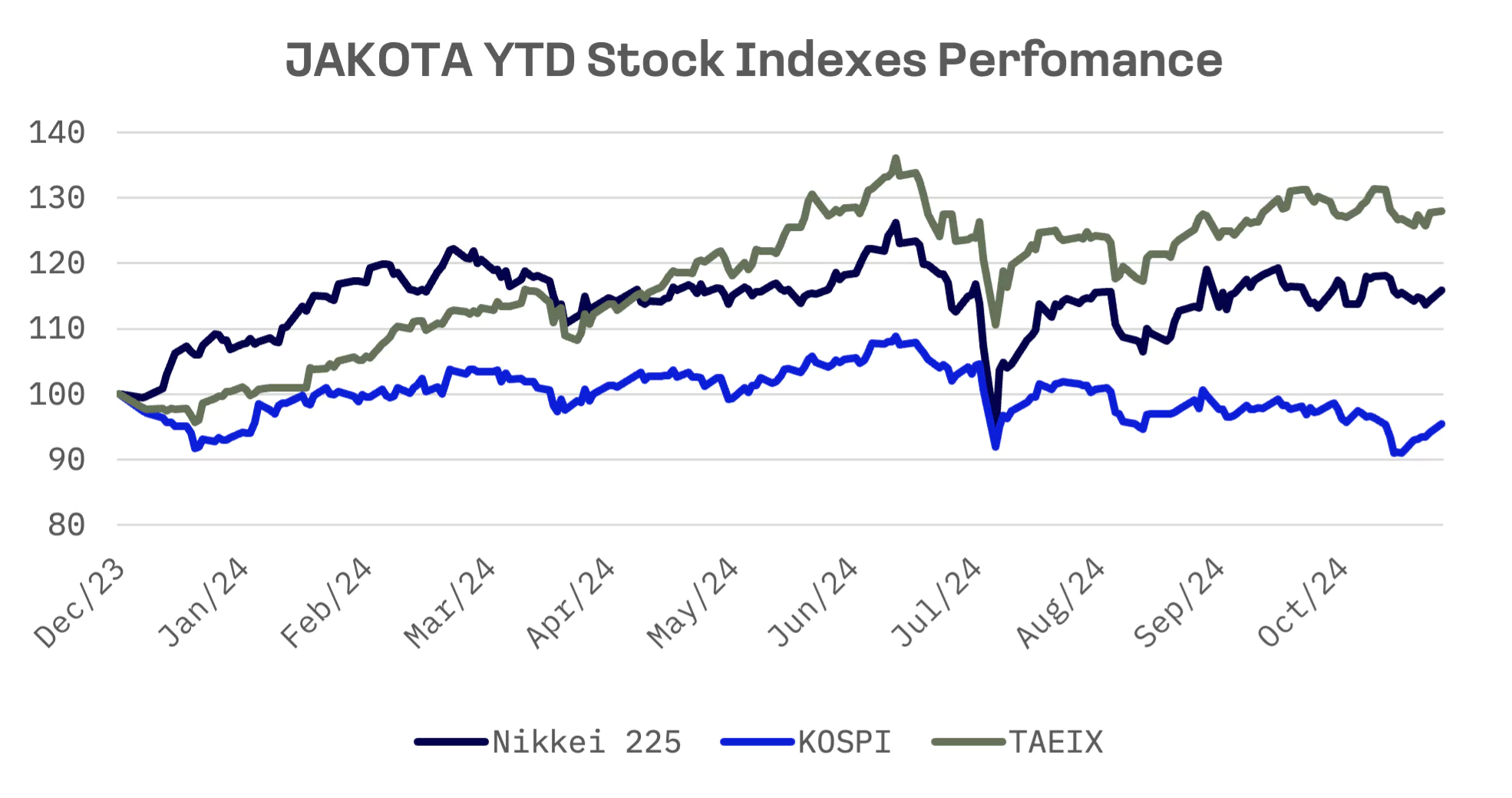

The Korea Composite Stock Price Index, or KOSPI, has recorded the weakest performance among the Jakota markets since the beginning of this year.

South Korean financial authorities on November 18 called the recent market downturn “excessive” given economic fundamentals, and promised heightened market monitoring alongside swift deployment of a policy fund to boost local company valuations.

The statement emerged from an interagency meeting in Seoul that brought together the heads of the Financial Services Commission (FSC), Financial Supervisory Service (FSS) and the Korea Exchange (KRX), along with market experts and institutional representatives, responding to significant losses in the domestic market.

“Uncertainties remain high both domestically and internationally. We will remain on high alert and closely monitor market conditions,” FSC Chairman Kim Byoung-hwan said. “It is crucial to implement corporate value-up funds without delay. The government is prepared to take a range of market stabilisation measures, if necessary,” he added.

The Korea Exchange announced on November 20 that it had completed the setup of the sub-fund for the Corporate Value-Up Fund, with investments set to begin the following day. The fund targets Value-Up Index Exchange Traded Funds (ETFs) and companies disclosed under the Value-Up program, regardless of their inclusion in the index.

The exchange launched the fund in collaboration with major securities institutions, including the Korea Securities Finance Corporation, Korea Securities Depository, Korea Financial Investment Association and Koscom. The initial fund size of ₩200 billion draws from private pension pools, with half coming from the Korea Exchange and four securities institutions, matched by private investors.

The exchange and its partners have committed to raising an additional ₩300 billion by year end, which would expand the total fund size to ₩500 billion. Both institutional and private investors will contribute ₩150 billion each, a move intended to accelerate adoption of Value-Up investment practices.

“We anticipate that this fund expansion will help spread the Value-Up investment culture and invigorate the stock market,” a Korea Exchange representative said. “We will continue working with our partners to implement measures that will drive the momentum of the Value-Up program.”

FSS Governor Rhee Bok-hyun pledged “sufficient and immediate” action to address market volatility and stressed zero tolerance for illegal trading activities.

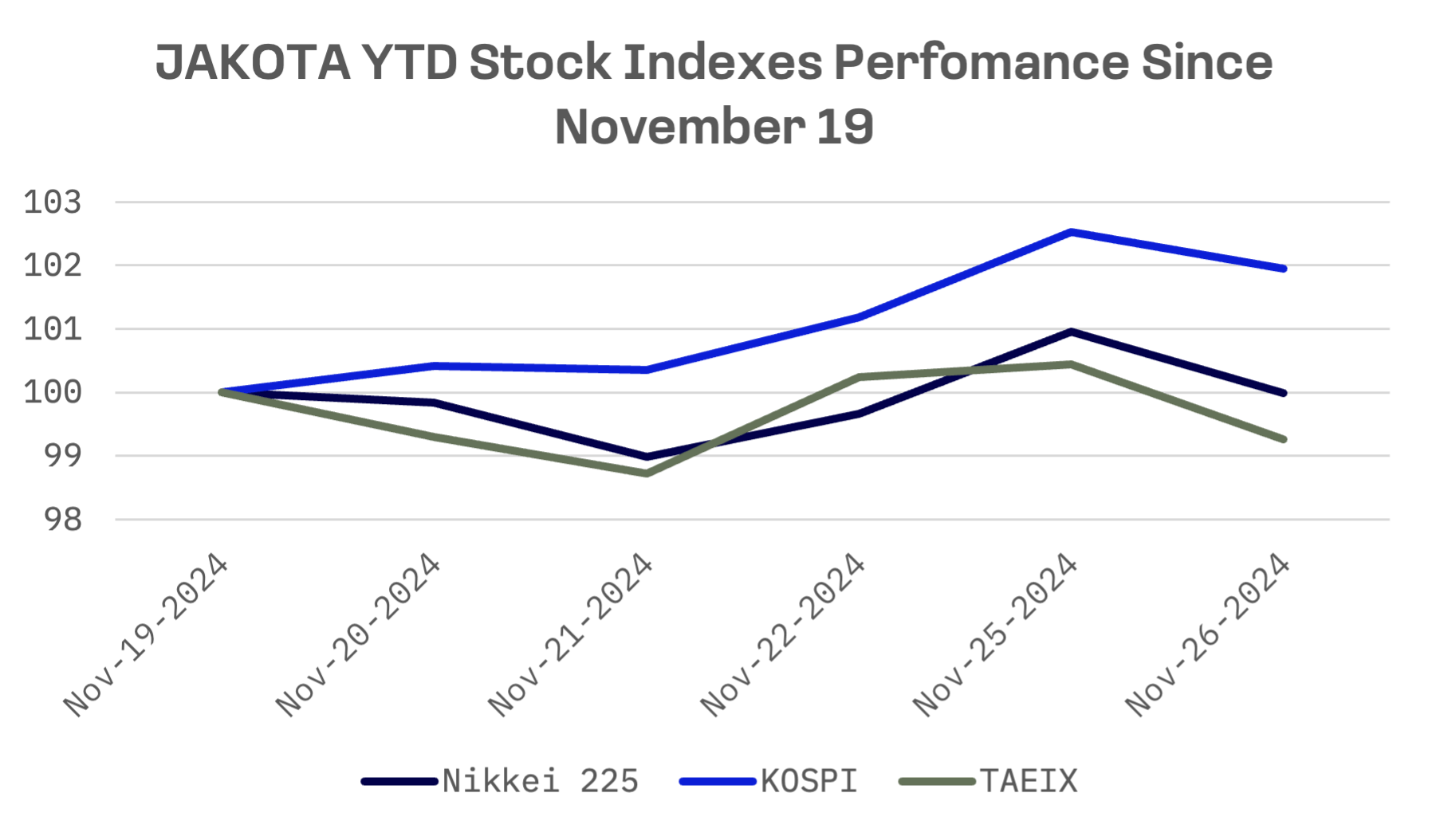

The KOSPI has rebounded since November 19, posting gains while Japan’s Nikkei 225 and Taiwan’s TAIEX declined during the same period.