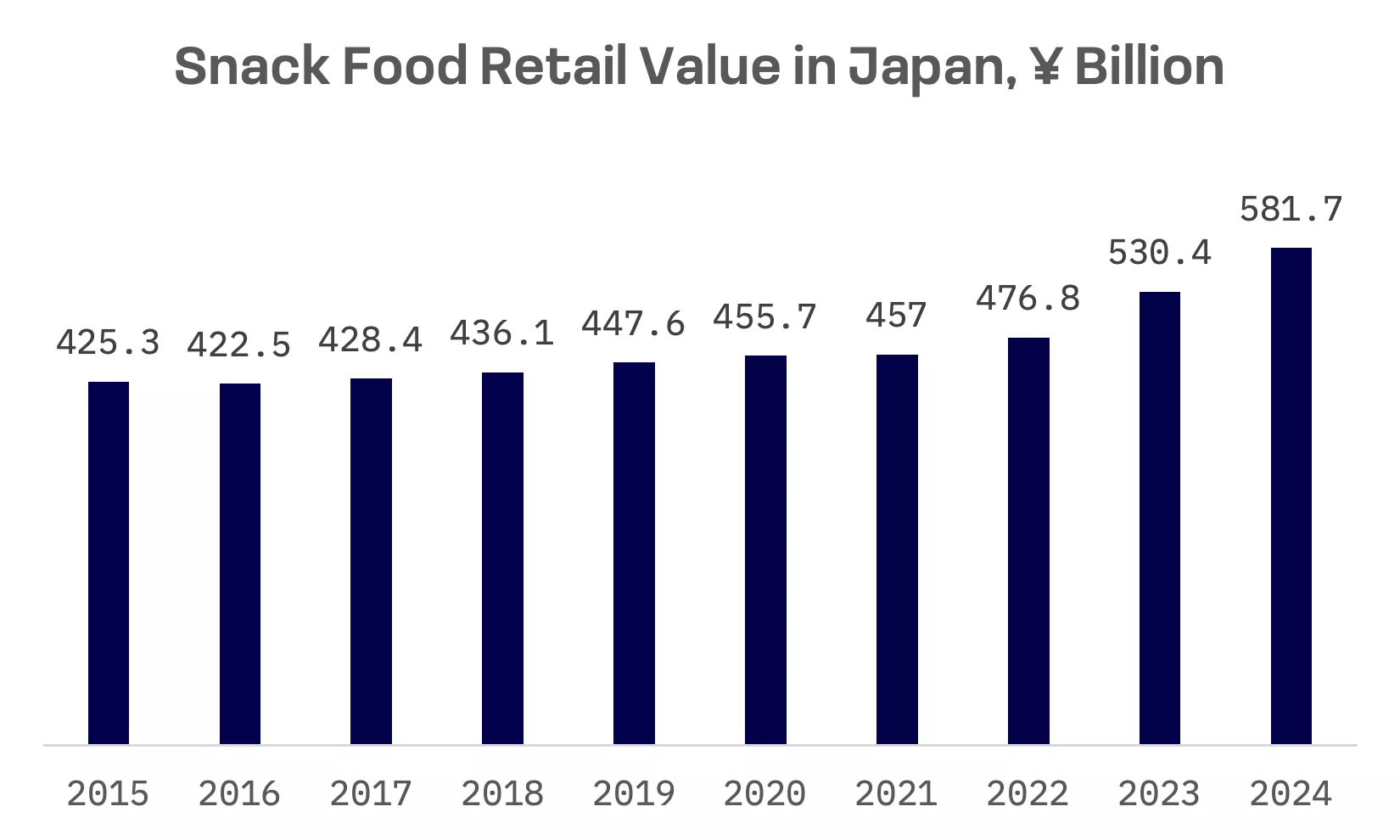

Japan is the world’s fourth largest snack food market, with 2024 revenues reaching about $26 billion. Trailing only the U.S., China and Russia in overall market size, the country’s ranking reflects both the industry’s maturity and consumers’ strong appetite for packaged foods. The market has expanded steadily over the past decade, buoyed by stable household consumption and a broad selection of domestic brands with deep retail penetration.

Retail snack sales continue climbing to new highs. In 2024, Japan’s snack food sales hit a record ¥581.7 billion, capping a decade of steady growth. The category’s resilience underscores its status as an everyday staple and points to continued momentum as producers reshape their portfolios to match evolving health and lifestyle trends.

Japan’s snack market divides broadly into savoury and sweet categories. Savoury products include rice crackers, wheat based crackers and deep fried snacks, while sweet offerings span chocolates and cookies to candies, chewing gum, wagashi (traditional Japanese confectionery) and Western style confections.

The confectionery sector faces a crisis driven by unprecedented volatility in raw material costs, most notably cocoa. But the savoury snack market, dominated by potato chips and rice crackers, is enjoying a renaissance fuelled by texture innovation, regionalism and the “alcohol accompaniment,” or Otsumami, trend.

Meanwhile, healthy snacks are emerging as a distinct and fast growing segment. The category represented about 11% of total snack sales in 2023, with its share expected to climb to 13% by 2027. Demand is driven by aging demographics and rising interest in functional foods.

The country’s rapidly aging population has reshaped demand, shrinking the traditional core market of children and young adults. Rather than reducing overall consumption, the shift has redirected it: older consumers are gravitating towards health focused products. That has elevated “clear label” priorities across the industry, with senior shoppers scrutinising ingredients and favouring products that tout functional benefits.

Manufacturers are adjusting their strategies in response. But the Japanese snack food market remains dominated by a handful of players:

| Company Name | Segment | Products | Market Position |

| Lotte | Confectionery, Ice cream, Others | Ghana, Choco Pie, Xylitol gum, various ice creams | #1 in Japan for ice cream & chewing gum; major confectionery leader |

| Morinaga | Confectionery, Foods, Frozen desserts, Jelly drinks; Wholesale; Real estate/services | Hi-Chew, DARS chocolate, Choco Ball, caramel, cocoa, chilled desserts | Major Japanese confectioner; Hi-Chew is #1 soft candy brand in Japan |

| Calbee | Snacks (potato, corn, flour, bean), Cereals | Calbee Potato Chips, Jagariko, pea/corn snacks, Frugra cereal | 50%+ of Japan snack market, 70%+ of potato chips; Frugra is top cereal brand |

| Meiji | Food (dairy, beverages, confectionery, nutrition) | Meiji Milk Chocolate, Almond Chocolate, Galbo, Kinoko no Yama, dairy, yogurt, ice cream, sports nutrition | Largest player in Japan’s chocolate industry; leading food & confectionery manufacturer |

| Ezaki Glico | Confectionery & Food; Frozen confectionery; Dairy; Food ingredients | Pocky, Pretz, chocolate, biscuits, gum, ice cream, dairy desserts | Top tier Japanese confectioner; strong in chocolate & biscuits; Pocky is iconic national brand |

| Bourbon | Cookies, crackers, rice biscuits, snacks, candy, chocolate, gum, desserts, beverages, staple foods | Wide range of biscuits/cookies, rice snacks, candies, chocolates, gum, cocoa drinks, RTD beverages | Major diversified domestic confectionery maker; strong presence in biscuits/cookies though not category leading |

| Kameda Seika | Rice crackers & rice-based snacks | Kameda brand rice crackers, mixed senbei snacks | Japan’s #1 rice cracker maker; ~30% market share |

All of these companies trade on the Tokyo Stock Exchange and are part of the JAKOTA Mid and Small Cap 2000 Index, except for privately held Lotte Holdings. Four have market capitalisations exceeding $1 billion:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Meiji | 2269.TSE | Mid and Small Cap 2000 | 5.5B |

| Calbee | 2229.TSE | Mid and Small Cap 2000 | 2.4B |

| Ezaki Glico | 2206.TSE | Mid and Small Cap 2000 | 2.2B |

| Morinaga | 2201.TSE | Mid and Small Cap 2000 | 1.4B |

| Kameda Seika | 2220.TSE | Mid and Small Cap 2000 | 0.5B |

| Bourbon | 2208.TSE | Mid and Small Cap 2000 | 0.4B |

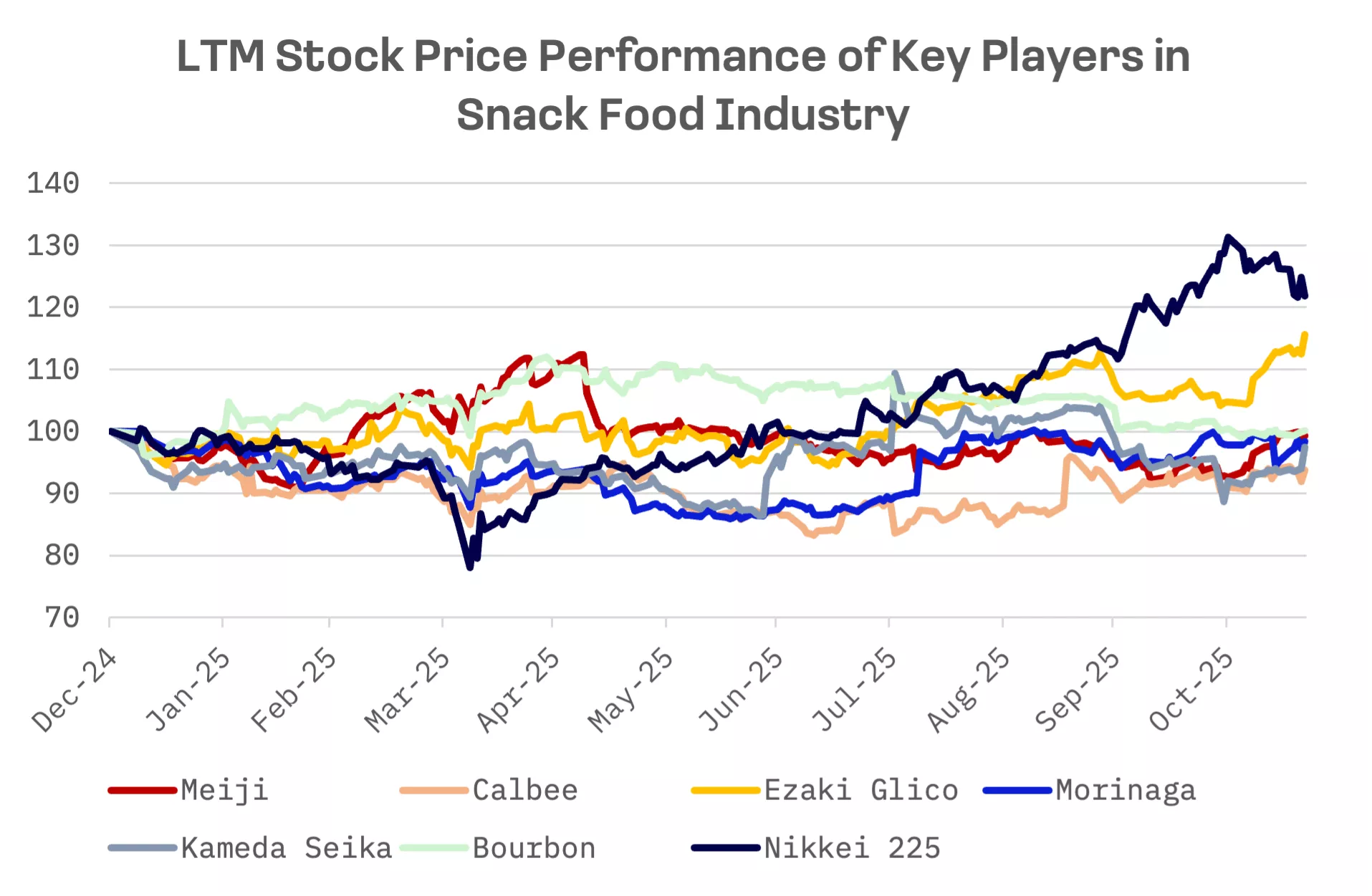

With one exception, all major players in Japan’s snack food industry have posted negative or flat share price performance so far this year. Ezaki Glico has outpaced its peers in 2025, lifted by investor activism and strong sales growth last quarter. Still, despite gaining about 15.7% this year, the stock has lagged the Nikkei 225.

Unsurprisingly, Ezaki Glico trades at a significant premium on both EBITDA and P/E multiples, reflecting stronger growth expectations:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Meiji | 0.77x | 6.71x | 18.97x |

| Calbee | 1.07x | 8.60x | 21.64x |

| Ezaki Glico | 0.86x | 9.50x | 41.09x |

| Morinaga | 0.93x | 6.23x | 12.84x |

| Kameda Seika | 0.94x | 3.15x | 3.07x |

| Bourbon | 0.43x | 4.06x | 11.69x |

| AVERAGE | 0.83x | 6.38x | 18.22x |

| MEDIAN | 0.90x | 6.47x | 15.91x |

Meiji – leader by Market Cap

Meiji ranks among Japan’s leading food manufacturers, best known for its dominant position in confectionery. Founded in 1916 and headquartered in Tokyo, the company operates across food, nutrition and pharmaceuticals – a diversified portfolio that serves as both its strategic strength and the source of a persistent “conglomerate discount.”

Within its food segment, Meiji is particularly known for its extensive chocolate and candy lineup, anchored by flagship brands such as Meiji Milk Chocolate, Almond Chocolate and Kinoko no Yama.

But its heavy dependence on chocolate makes the company highly vulnerable to swings in global cocoa prices. The rise in cocoa prices over the best part of the last two years has sharply squeezed margins across the industry, with Meiji facing outsize profitability pressure. Despite strong brand equity and a steady demand base, the company currently lacks a near term catalyst to offset the headwinds battering its confectionery business.

Ezaki Glico – leader on on EBITDA and P/E multiples

Ezaki Glico is another major Japanese food company with a strong foothold in the confectionery market, known for brands such as Pocky, Pretz, Bisco and Giant Cone. Founded in 1922 and headquartered in Osaka, the company also operates in ice cream, dairy, chilled products and a growing portfolio of health focused and overseas businesses.

In April 2024, Glico suffered a major system migration failure that halted shipments of chilled products for an extended period, triggering a drop in operating income. The disruption exposed weaknesses in the company’s supply chain and inventory management systems and caught the eye of activist investors.

In February 2025, Dalton Investments submitted shareholder proposals calling for amendments to Glico’s articles of incorporation, stronger disclosure around cost of capital and shareholder returns, and a share buyback program. Dalton pegged the company’s five year average ROE at roughly 4-5%, well below Meiji and Morinaga.

Glico’s board has pushed back against many of the activist proposals, arguing that measures such as buybacks must be weighed against growth investment. Even so, Glico unveiled its fiscal 2025-27 plan, which allocates approximately ¥30 billion to ordinary investment, ¥45-50 billion for growth investment over three years and ¥25 billion for shareholder returns.

Investors are wagering that shareholder pressure will push Glico’s management towards more disciplined capital allocation, higher shareholder returns and improved governance transparency.

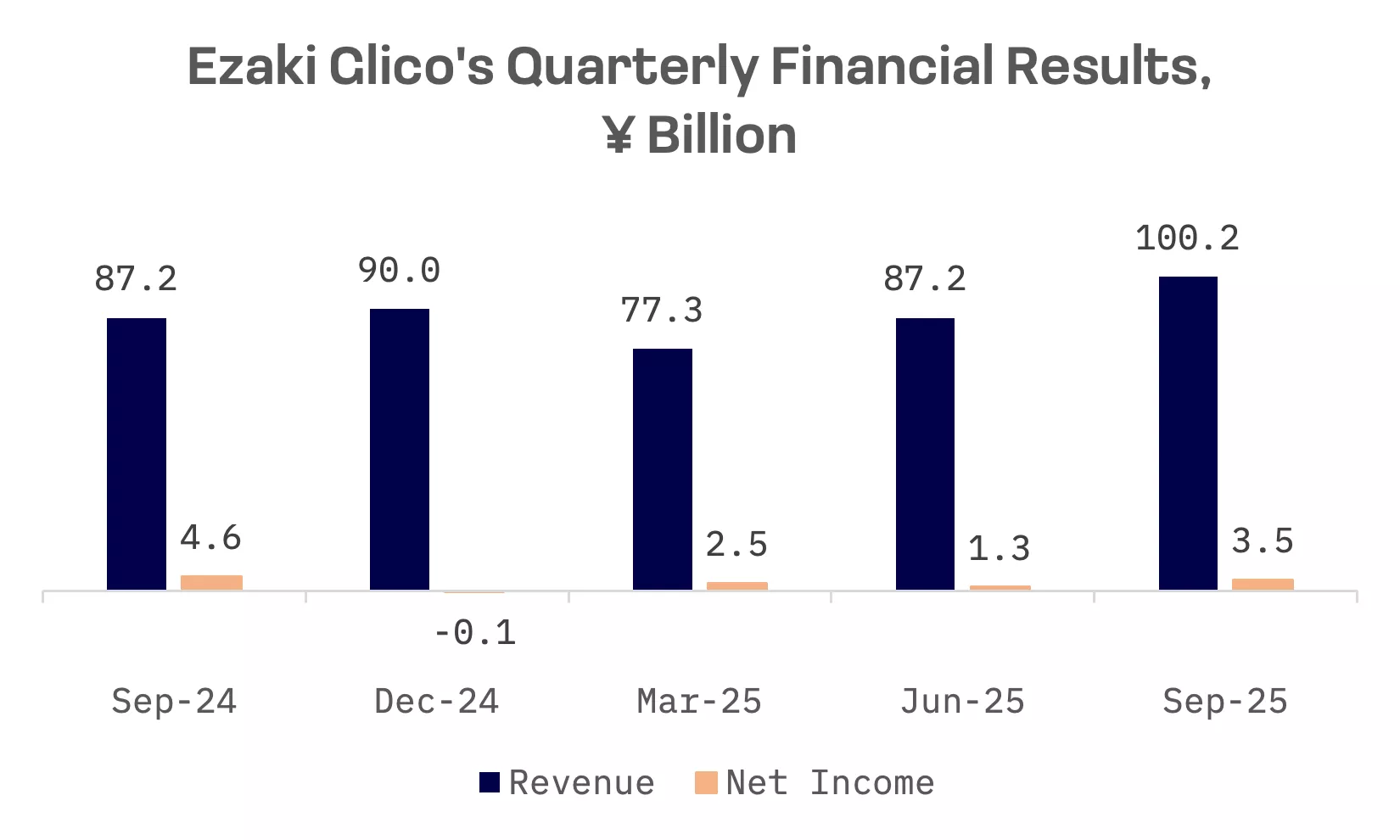

Ezaki Glico’s third quarter fiscal 2025 results showed roughly 15% year-over-year sales growth, driven largely by strong performance in its Health and Yoghurt categories. But net income fell compared with the same period in 2024, reflecting continued margin pressure.