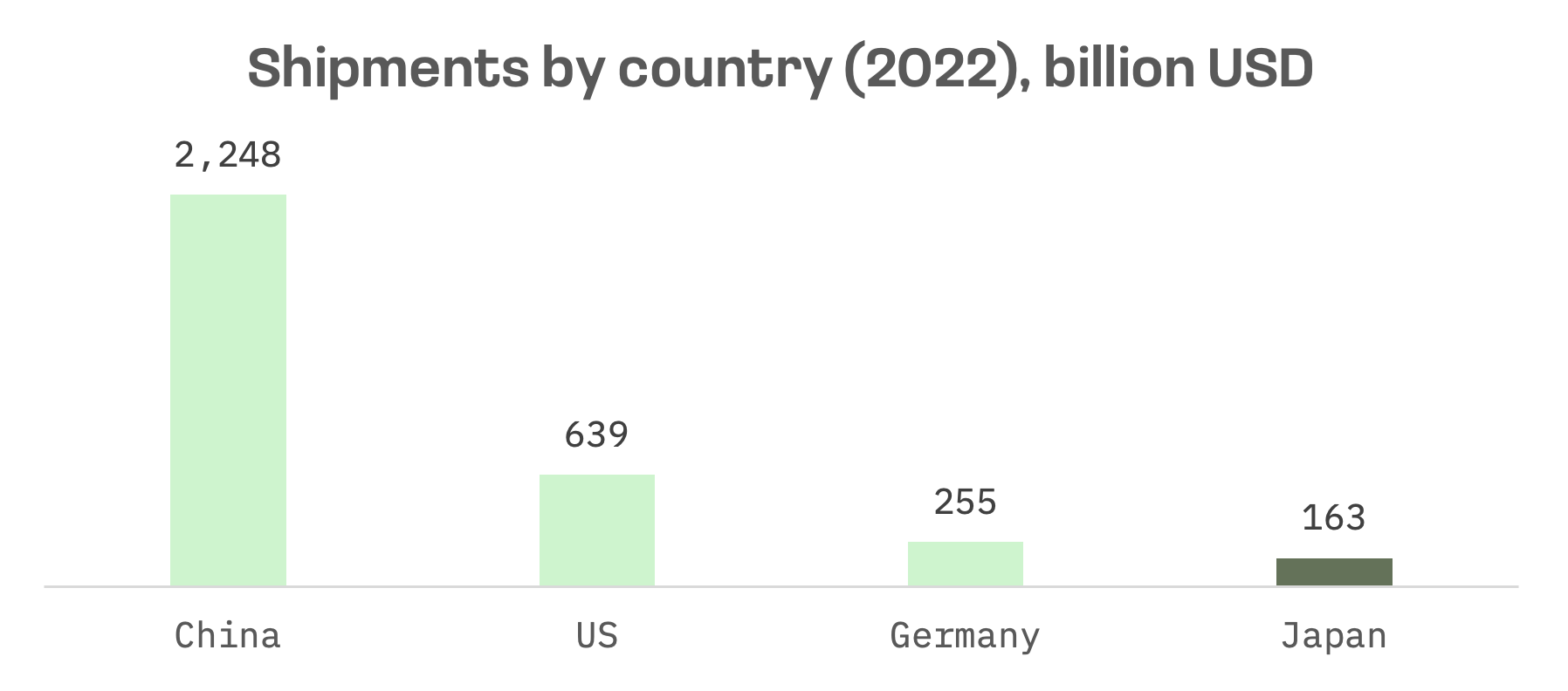

Japan’s chemical industry, ranking fourth globally (behind China, the United States and Germany), plays a critical role in supplying materials to essential sectors such as transportation machinery and automotive, marking it as a cornerstone of the country’s manufacturing landscape.

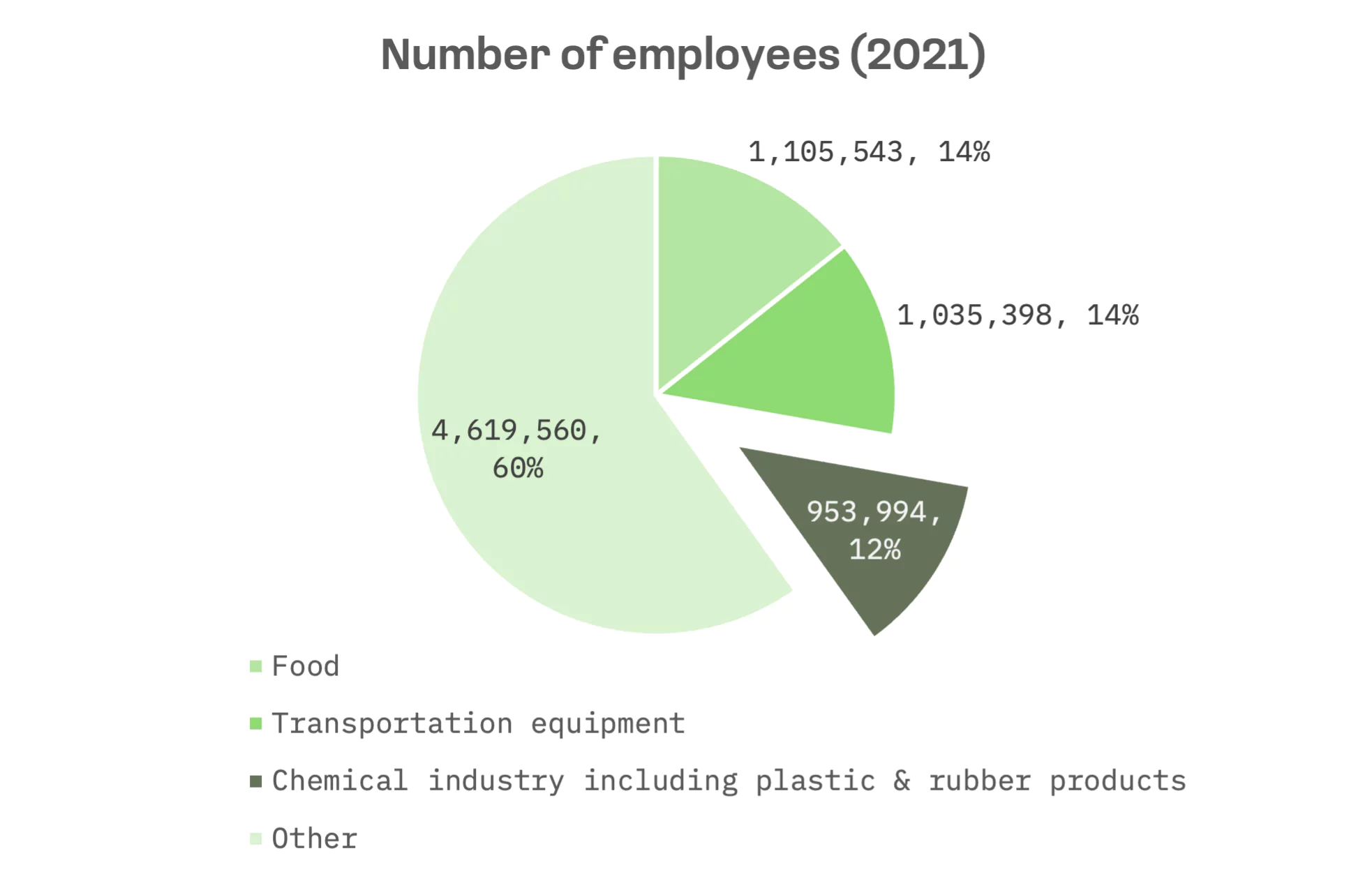

It is Japan’s second-largest manufacturing industry, boasting over 950,000 employees, which highlights its significant contribution to employment and economic activity.

The industry is predominantly controlled by a cluster of major corporations, noted for their extensive diversification and a significant number of subsidiaries. The table below shows the five largest Japanese chemical companies by market capitalisation.

| Company Name | Ticker | JAKOTA Index | Market Cap as of Feb 21, 2024, USD | Total Assets as of Sep 30, 2023, USD |

| Shin-Etsu Chemical | TSE.4063 | Blue Chip 150 | 82.34B | 34.08B |

| Mitsubishi Chemical | TSE.4188 | Mid and Small Cap 2000 | 8.67B | 40.98B |

| Sekisui Chemical | TSE.4204 | Mid and Small Cap 2000 | 6.34B | 8.50B |

| Nissan Chemical | TSE.4021 | Mid and Small Cap 2000 | 5.90B | 1.96B |

| Mitsui Chemicals | TSE.4183 | Mid and Small Cap 2000 | 5.12B | 14.06B |

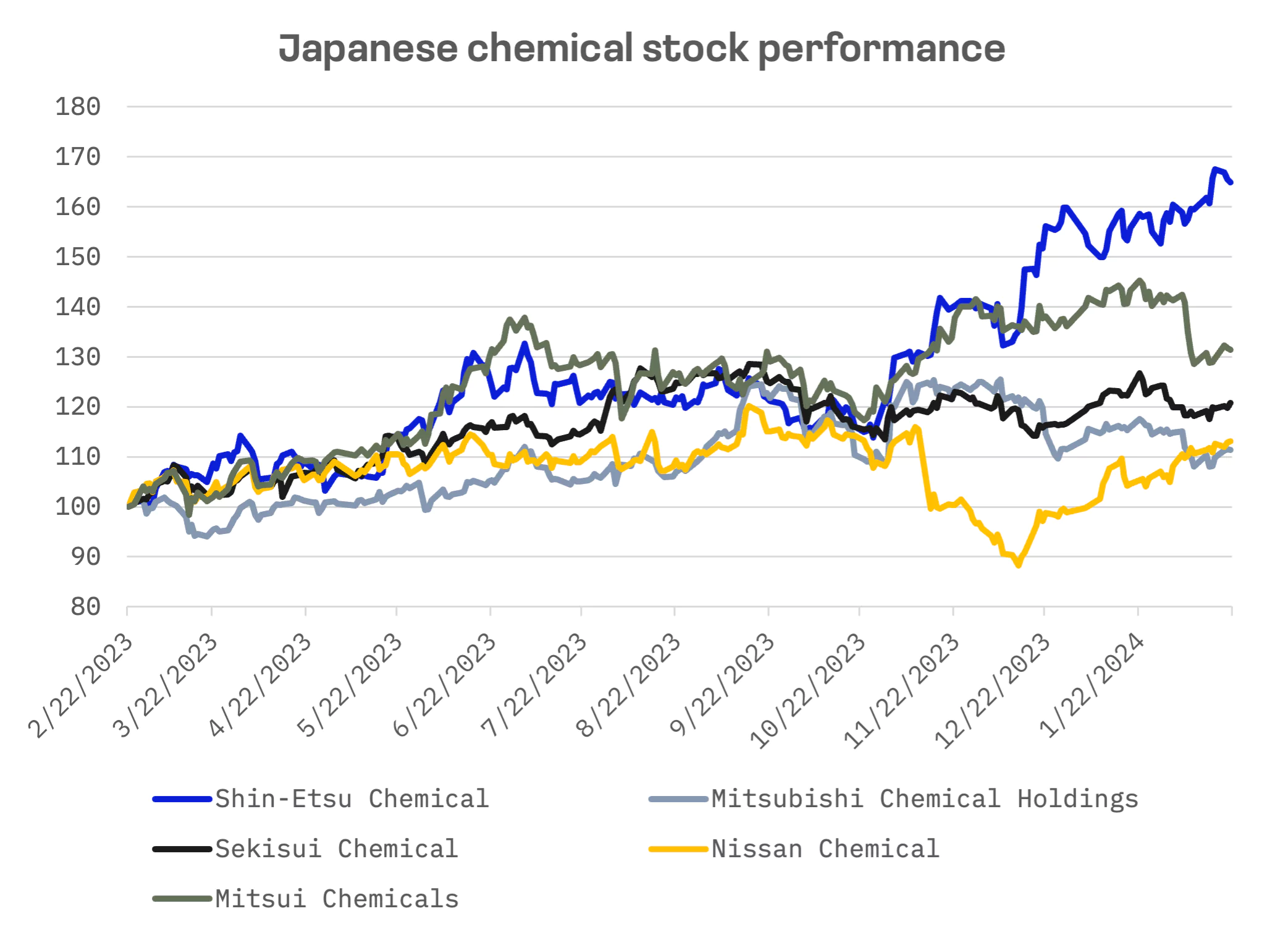

Despite growth among the top five companies over the last year, their performance lagged behind the Nikkei 225’s 39% surge in the same timeframe, with Shin-Etsu Chemical being the exception.

Shin-Etsu Chemical, not only came out tops in Japan, but also secured ninth spot in the Forbes Global 2000 ranking for the chemical sector. Its dominance in the global market share for polyvinyl chloride, semiconductor silicon and photomask substrates, along with its pivotal role in supplying silicon wafers for integrated circuits, has driven its shares to outperform the Nikkei 225 index.

This outperformance has led investors to value Shin-Etsu’s shares at a premium, as evidenced by its significantly higher EV/Sales, EV/EBITDA, and P/E ratios compared to its peers.

| Company Name | TEV/Total Revenues LTM | TEV/EBITDA LTM | P/Diluted EPS LTM |

| Shin-Etsu Chemical | 4.14x | 12.58x | 22.30x |

| Mitsubishi Chemical | 0.68x | 4.78x | 6.80x |

| Sekisui Chemical | 0.70x | 5.23x | 11.66x |

| Nissan Chemical | 3.92x | 13.75x | 23.99x |

| Mitsui Chemicals | 0.73x | 6.77x | 13.62x |

| MEAN | 2.03x | 8.62x | 15.67x |

| MEDIAN | 0.73x | 6.77x | 13.62x |

However, the sector faces challenges, as the largest chemical companies in Japan have experienced a downturn in earnings, specifically within the basic chemical segment of their operations. The fiscal 2023 second quarter, which ended on September 30, saw a significant drop in profits across these companies, attributed in part to reduced petrochemical demand influenced by the slow recovery of the Chinese economy, which led to decreased sale prices.

| Company Name | Revenue Y/Y CHANGE, % | Net Profit Y/Y CHANGE, % |

| Shin-Etsu Chemical | -20.7% | -29.0% |

| Mitsubishi Chemical | -6.4% | -15.1% |

| Sekisui Chemical | 0.1% | -17.1% |

| Nissan Chemical | -1.0% | -26.0% |

| Mitsui Chemicals | -12.5% | -32.2% |

Shin-Etsu Chemical experienced significant declines in sales and profits, notably as the world’s leading PVC manufacturer — a material extensively used in the construction industry. The company’s PVC business segment was adversely affected by export pressures from Chinese manufacturers: a consequence of the sluggish construction and housing investment climate in China. Despite these challenges, Shin-Etsu managed to maintain stable price levels. This situation mirrored developments in the caustic soda market, where similar dynamics were observed.

Looking ahead, the company offers a mixed outlook for its semiconductor business, expecting the wafer market to show year-over-year improvement starting around January 2024. However, demand for EUV mask blanks remains subdued, despite increasing demand for artificial intelligence and high-end mobile chipsets.

Mitsubishi Chemical has countered the weaknesses in its petrochemical and carbon sectors with strong sales in industrial gases and Radicava, an amyotrophic lateral sclerosis (ALS) drug, achieving only a single-digit decline in earnings. CEO Jean-Marc Gilson announced a ramp-up in the company’s cost-cutting efforts, raising the initial cost reduction target for the 2021–2025 period from ¥100 billion to ¥135 billion.

This heightened focus on cost efficiency is part of Mitsubishi’s proactive strategy, which also included halting production at its methyl methacrylate plant in Billingham, England, in 2022, and closing its Canadian biotech subsidiary, Medicago, earlier this year. Gilson’s reaffirmation of the commitment to business rationalization underscores the priority placed on profitability across all sectors.

Likewise, Mitsui Chemicals experienced a decline in sales and profits during the first half of the fiscal year, primarily due to underperformance in its basic chemical division. In contrast, the mobility solutions division, which includes polypropylene compounds and lubricants, along with the life and healthcare solutions division, covering eyeglass lens monomers and agrochemicals, demonstrated resilience. However, the company encountered challenges in its materials and semiconductor products divisions.

Hajime Nakajima, Mitsui’s Chief Financial Officer, detailed plans to tackle the basic chemical division’s issues, particularly at the major site in Chiba, Japan. As part of Mitsui’s strategic adjustments, the company has decided to divest its phenol business in Singapore and announced the downsizing of its toluene diisocyanate facilities in Japan by 2025.

Sekisui Chemical stood out as the only company to register a modest increase in sales during the period, despite challenging conditions. The company managed to navigate through sluggish domestic demand for new housing, which led to a reduced number of houses sold, and as well as through stagnant demand for building materials and consumer goods in both Europe and the U.S. This growth can be attributed to a certain level of recovery in automobile production, along with the growth in sales of high-value-added products and the positive effects from foreign exchange rates.