South Korea’s electronics industry remains a cornerstone of the nation’s economic strength, powered by advanced production capabilities and a tech savvy domestic market. While the country maintains its position as a global innovation leader, the industry confronts mounting pressure from competitors, rising production costs and shifting global supply chains.

The nation’s semiconductor companies weathered significant challenges in 2023 amid a global chip industry slowdown. The downturn stemmed from weakening demand, falling prices and broader macroeconomic headwinds. The industry rebounded strongly in 2024, driven by renewed demand for high performance computing, AI and automotive chips.

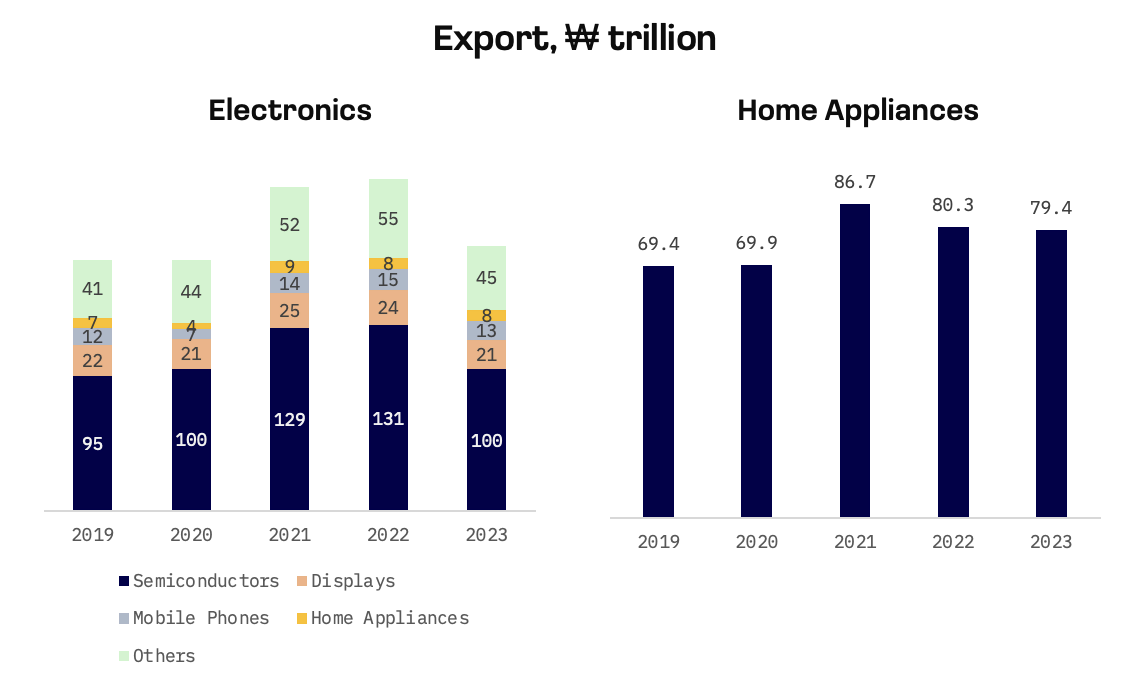

South Korean semiconductor giants Samsung Electronics and SK Hynix increased investments in advanced chip manufacturing, particularly in next generation DRAM and NAND flash memory. The country’s semiconductor exports jumped 43.9% to $141.9 billion in 2024 from $98.6 billion the previous year, according to the Ministry of Trade, Industry and Energy. This growth highlights South Korea’s dependence on international trade, as the country continues to be a major electronics exporter and importer.

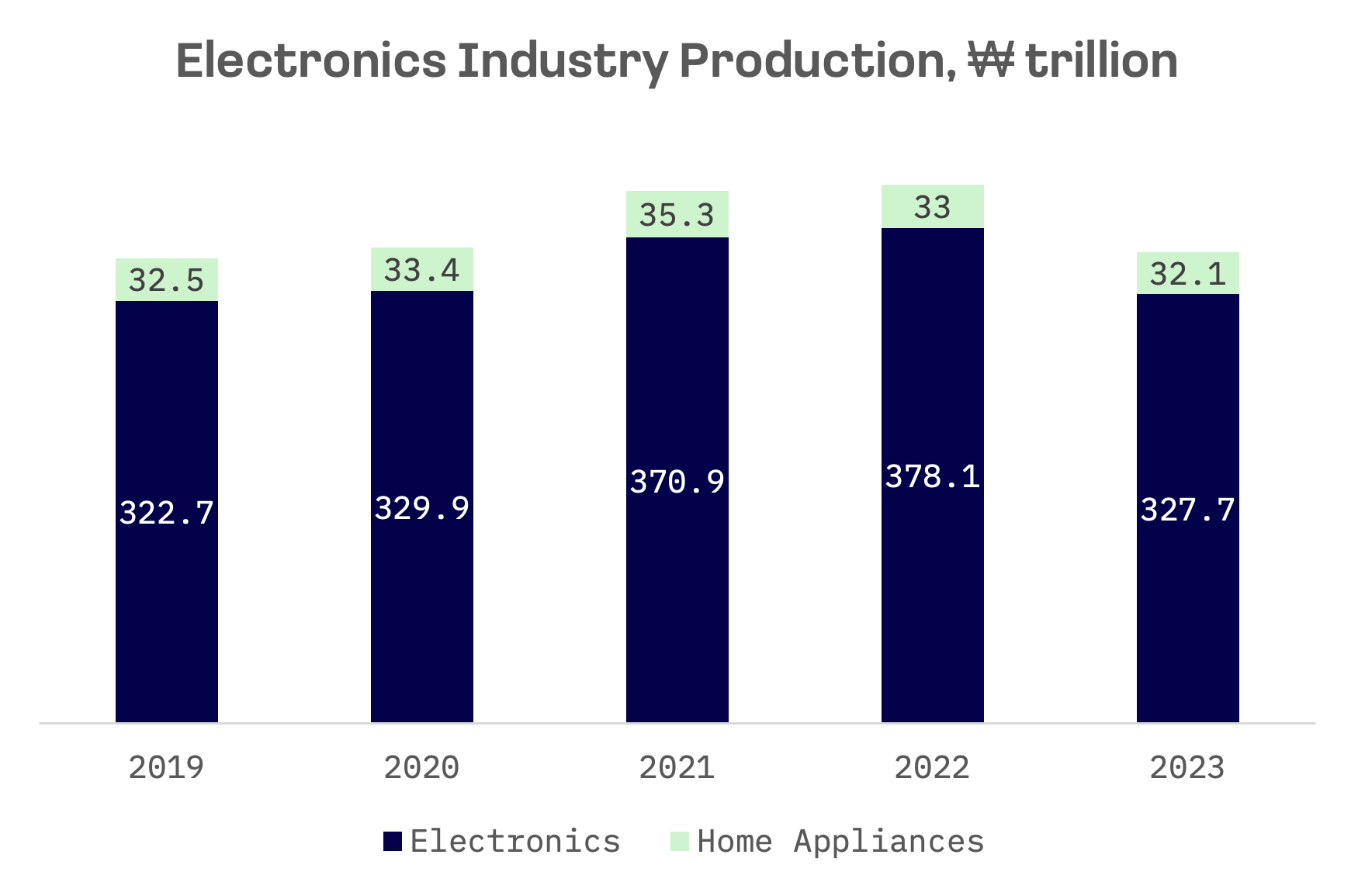

Unlike semiconductors, the home appliances export sector remained relatively stable in 2023, recording only a slight decline in export volumes.

China leads electronics export destinations at 31.2%, followed by Vietnam at 17.2%, the U.S. at 12%, Hong Kong at 10.7% and Taiwan at 6%. For home appliances, the U.S. dominates with 50.2%, followed by Japan at 6.5%, China at 5.5%, Vietnam at 4.7% and Mexico at 4.2%.

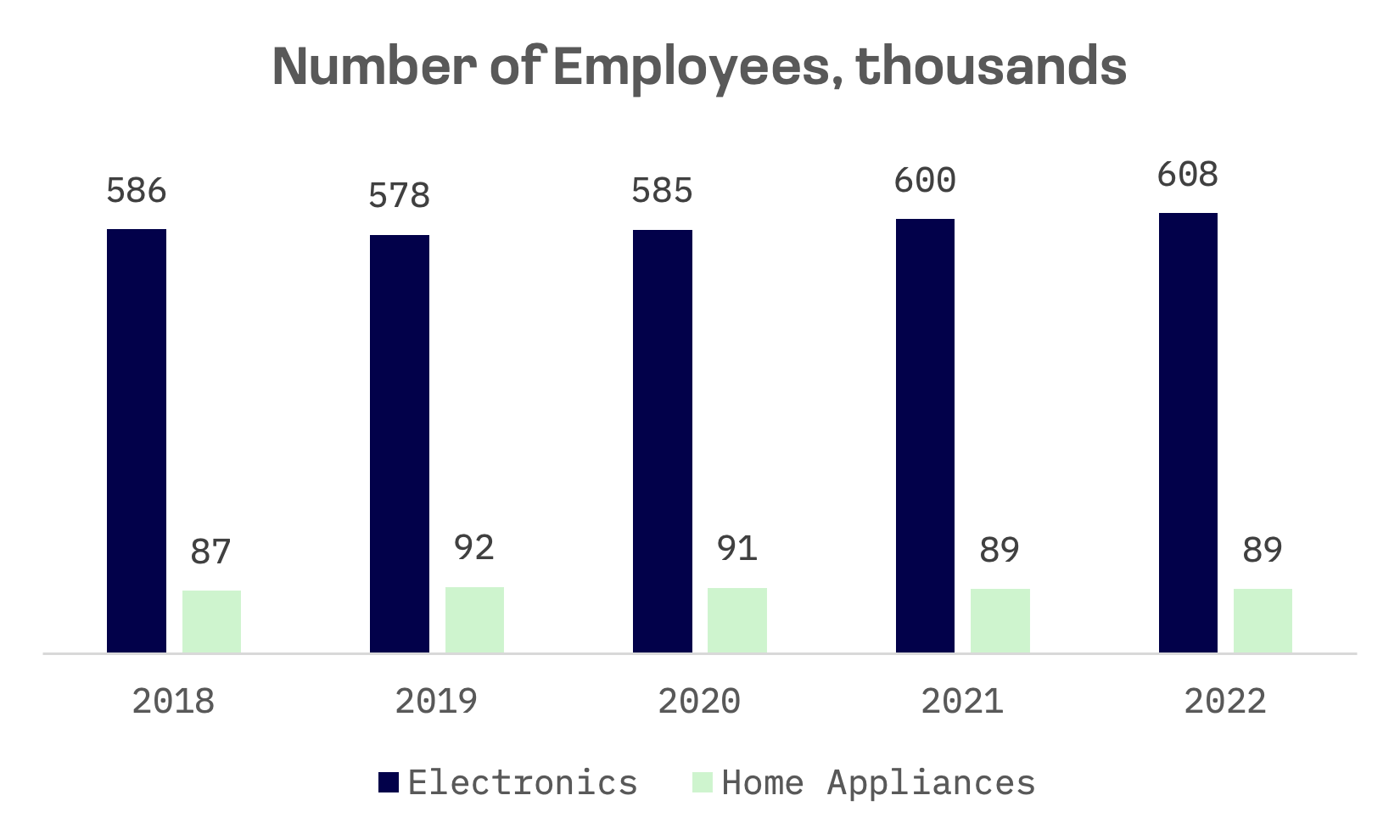

The electronics sector continues to be a crucial employer in South Korea. Employment growth in electronics has outpaced the home appliances industry over the past five years.

Two major players, LG Electronics and Samsung Electronics, dominate South Korea’s consumer electronics landscape. Both companies have built strong global reputations for innovation and quality.

| Company Name | Products | Market Position |

| LG Electronics | Televisions, home appliances, air conditioners, audio devices, batteries, solar panels | A key player in home appliances and displays, strong in OLED TV technology and renewable energy solutions |

| Samsung Electronics | Smartphones, televisions, home appliances, semiconductors, display panels, automotive solutions | A global leader in smartphones, display technology and semiconductor manufacturing, strong in tech innovation |

Both Samsung and LG are publicly traded, with their shares listed on the Korea Exchange. Samsung Electronics, with a market capitalisation exceeding $224 billion, ranks as the third largest company by market value among Jakota countries:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Samsung Electronics | 005930.KO | Blue Chip 150 | 224.2B |

| LG Electronics | 066570.KO | Mid and Small Cap 2000 | 9.7B |

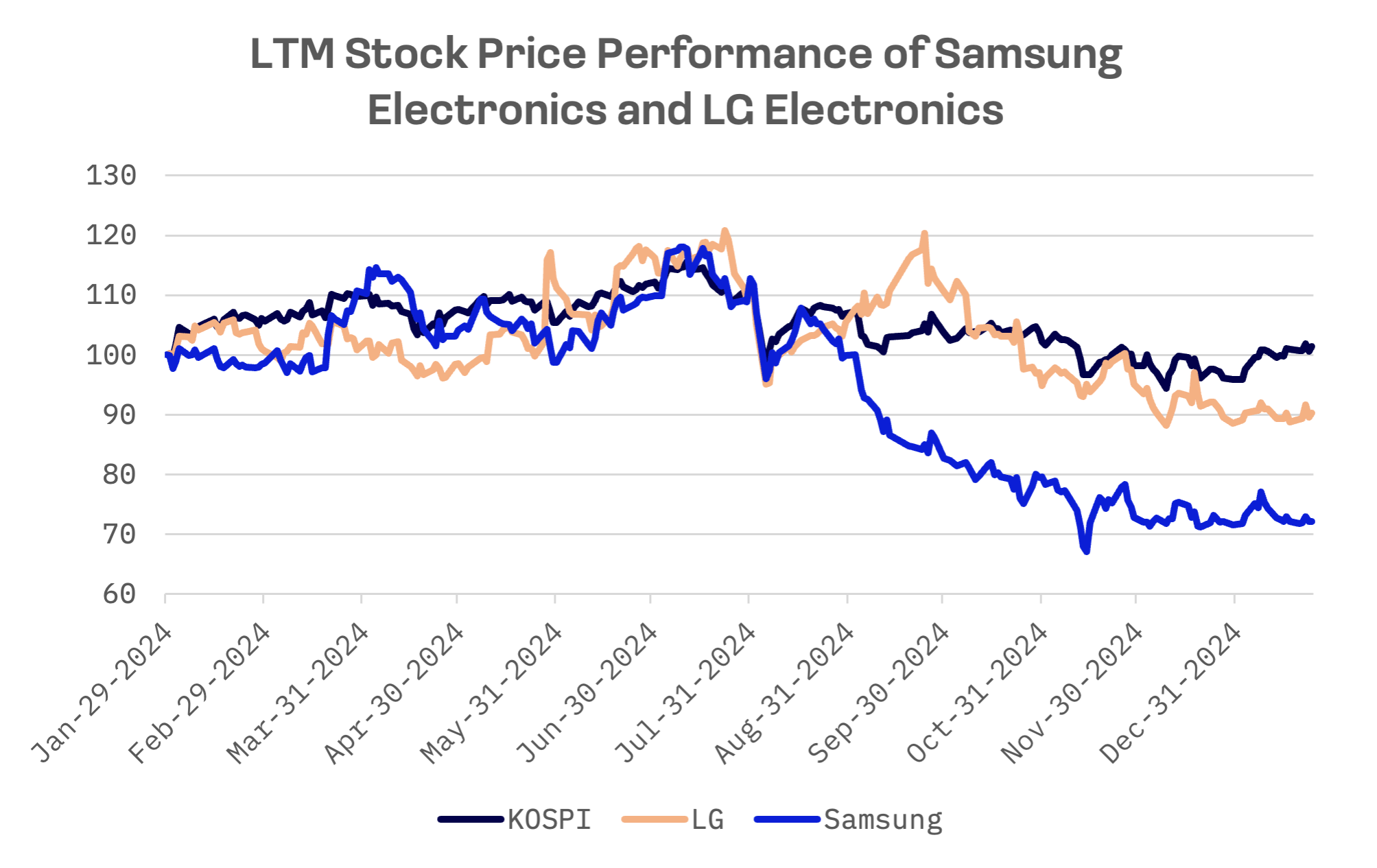

Both companies faced market pressure throughout 2024, with Samsung’s shares falling 28% and LG’s declining 10% over twelve months. The drops coincided with broader weakness in the Korean stock market, which struggled against macroeconomic headwinds and weak investor sentiment.

LG Electronics trades at a significant discount to Samsung Electronics based on revenue multiples, with an EV/Sales ratio of 0.25x compared to Samsung’s 0.92x, signalling a significantly lower market valuation on a top line basis. Despite this gap, both companies show similar EV/EBITDA and forward P/E ratios:

| Company Name | EV/Sales | EV/EBITDA | Forward P/E |

| Samsung Electronics | 0.92x | 3.61x | 10.06x |

| LG Electronics | 0.25x | 3.52x | 9.68x |

The industry faces several challenges despite its strong position. Chinese and global competitors are eroding market share, forcing domestic firms to accelerate innovation. Higher production costs – including labour expenses – are pressuring margins, while strict regulations on engineers’ working hours potentially hamper R&D efficiency. The dominance of Samsung and LG might limit opportunities for smaller players, potentially slowing industry innovation.

However, these challenges also create opportunities. A shift towards premium products allows South Korean firms to leverage their technological advantages and brand strength, enabling higher prices and margins. Increased investments in software and digital services could reduce hardware dependence and create new growth avenues.

The South Korean government supports the consumer electronics industry through targeted policies and investments:

- Strategic Tech Investment: Tax incentives promote R&D and facility expansion in key sectors like semiconductors

- Semiconductor Support Plan: A ₩26 trillion ($19 billion) package funds R&D, infrastructure and talent development, including expanded semiconductor parks

- Robotics Advancement: A $2.3 billion investment aims to strengthen the robotics industry, addressing labour shortages and enhancing automation

Samsung Electronics

Samsung Electronics strengthened its AI and connectivity focus in 2024, working to build a more integrated and intelligent technology ecosystem for consumers. Key initiatives included:

AI for All

The company introduced its “AI for All” vision, demonstrating AI applications across devices, from smartphones and laptops to home appliances and TVs.

New Product Innovations

Among its notable 2024 product launches, Samsung launched the Neo QLED 8K TV powered by the NQ8 AI Gen3 processor, promising enhanced picture quality and AI features. It also introduced The Premiere 8K, marketed as the world’s first wireless 8K projector.

Investment in Robotics

Samsung announced plans to become Rainbow Robotics’ largest shareholder, marking its expansion into robotics development across various sectors.

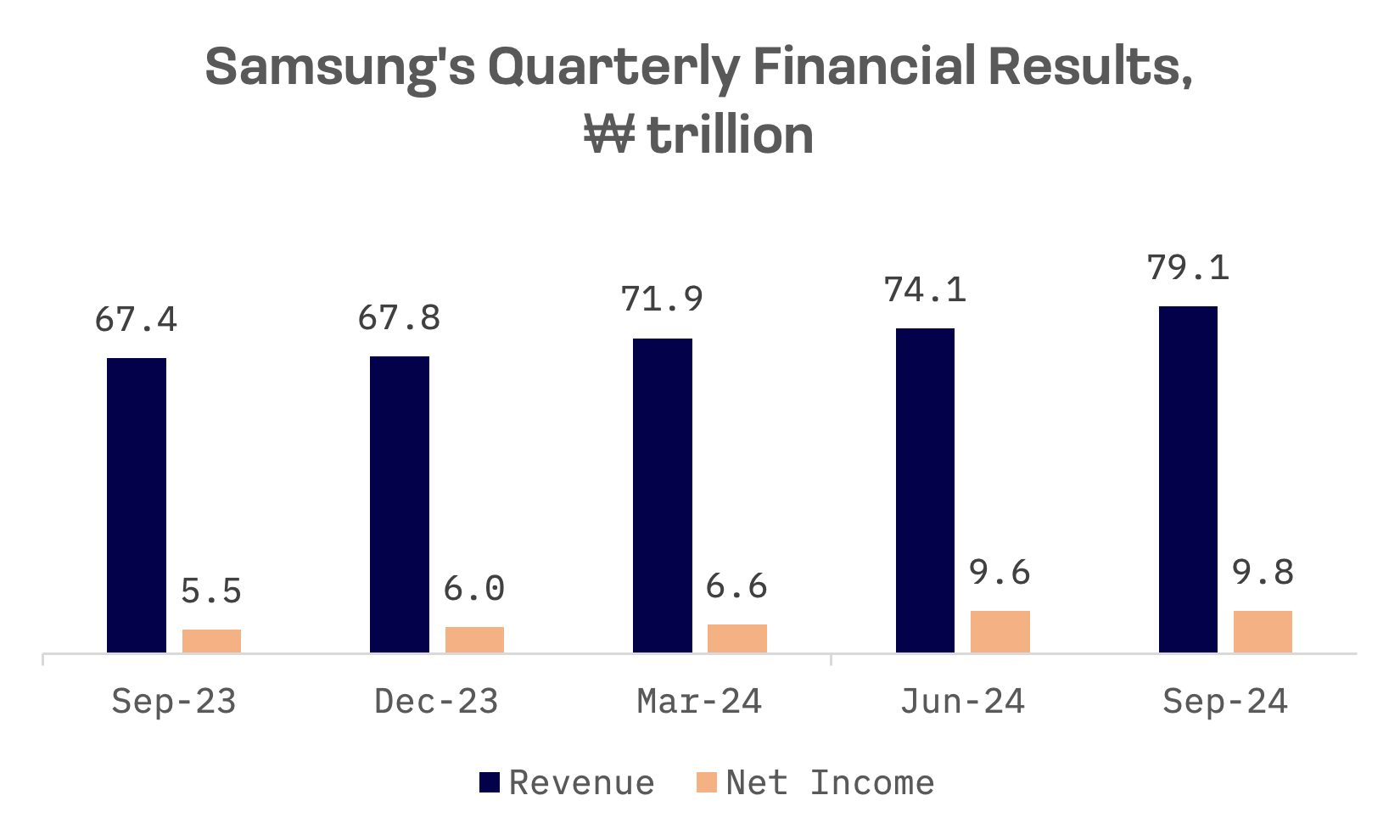

Samsung’s financial performance showed strength in 2024, with positive trends across key metrics.

Samsung Electronics: Key financial indicators, ₩ trillion

| Fiscal Q3 2024 ended on 9/30/24 | Y/Y change, % | |

| Revenue | 79.10 | 17.4% |

| EBITDA | 20.24 | 67.0% |

| Net income | 9.78 | 77.8% |

LG Electronics

LG Electronics reinforced its “Smart Life Solution Company” strategy in 2024 through AI innovations and business transformations.

AI Driven Home Solutions

At IFA 2024, LG showcased AI powered home technologies under its “Affectionate Intelligence (AI) Home” theme, illustrating its vision for future living. The company introduced an AI powered smart home system using sensors to track customer behaviours and deliver personalised solutions.

Expansion of webOS Ecosystem

LG committed over ₩1 trillion to expand its platform business, announced at the webOS Summit 2024. This investment signals the company’s push to lead the smart TV platform market.

Product Innovations

Among its 2024 product introductions, LG unveiled the SIGNATURE OLED T2, marketed as the world’s first transparent and wireless 4K OLED TV. The company also launched the G4 and M4 OLED TVs with new AI processors to enhance picture and sound quality.

Strategic Business Evolution

The company expanded into subscription services and Direct to Consumer (D2C) strategies in 2024, aiming to diversify revenue streams and strengthen customer relationships.

Acquisition of Bear Robotics

LG acquired a majority stake in Bear Robotics, a Silicon Valley based indoor service robotics startup, accelerating its robotics expansion plans across commercial, home and industrial sectors.

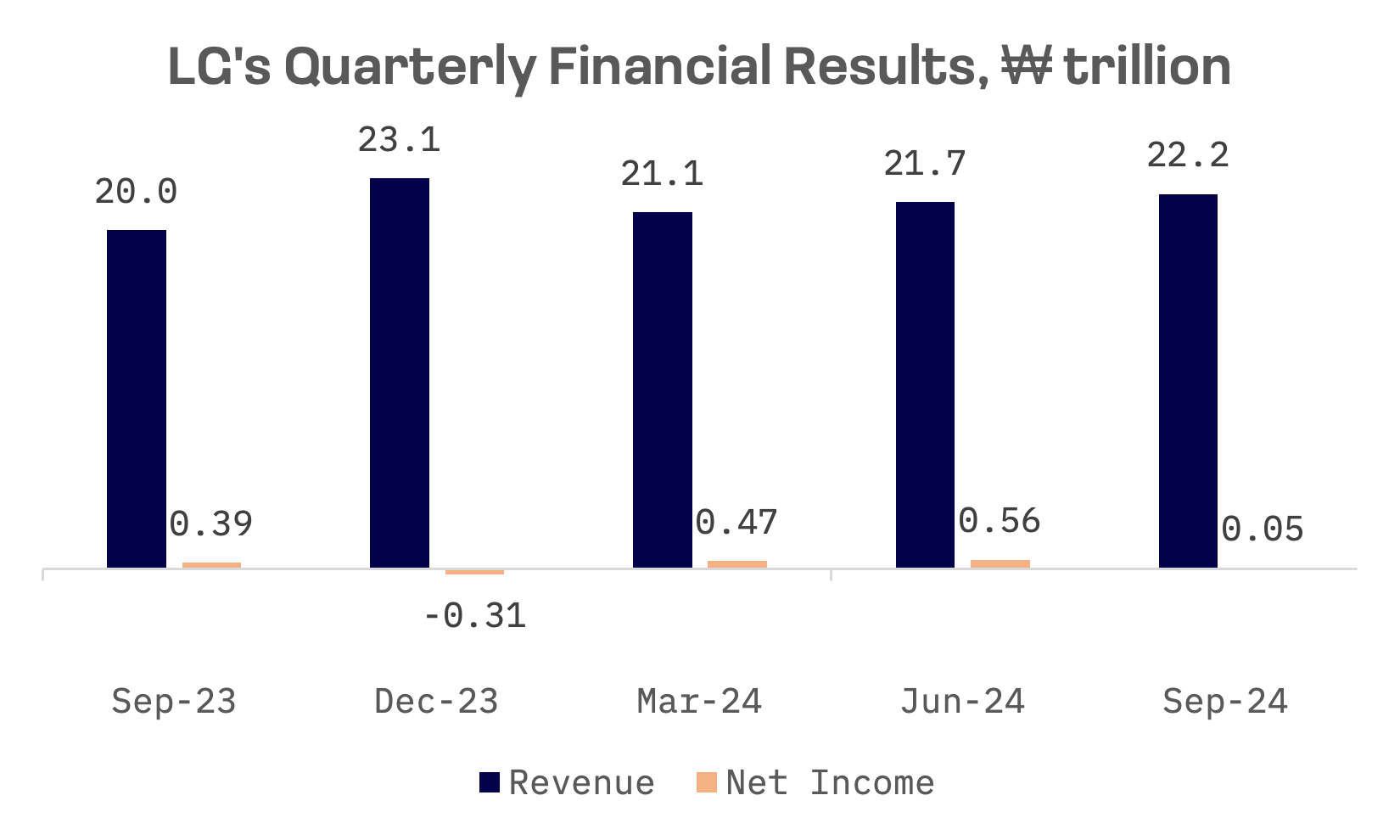

LG’s financial results were mixed in 2024. While achieving record annual revenue driven by home appliances and automotive electronics growth, the company faced challenges such as increased logistics and marketing expenses, which impacted profitability.

LG Electronics: Key financial indicators, ₩ trillion

| Fiscal Q3 2024 ended on 9/30/24 | Y/Y change, % | |

| Revenue | 22.18 | 10.67% |

| EBITDA | 1.69 | -3.12% |

| Net income | 0.05 | -87.4% |