In recent developments, the Japanese Nikkei 225 and Taiwanese TAIEX stock indexes have ascended to unprecedented highs, with the Korean KOSPI reaching its pinnacle, surpassing its May 2022 record. Analysts point to foreign investment as a key driver behind this rally. Here, we delve into the dynamics at play.

Japan

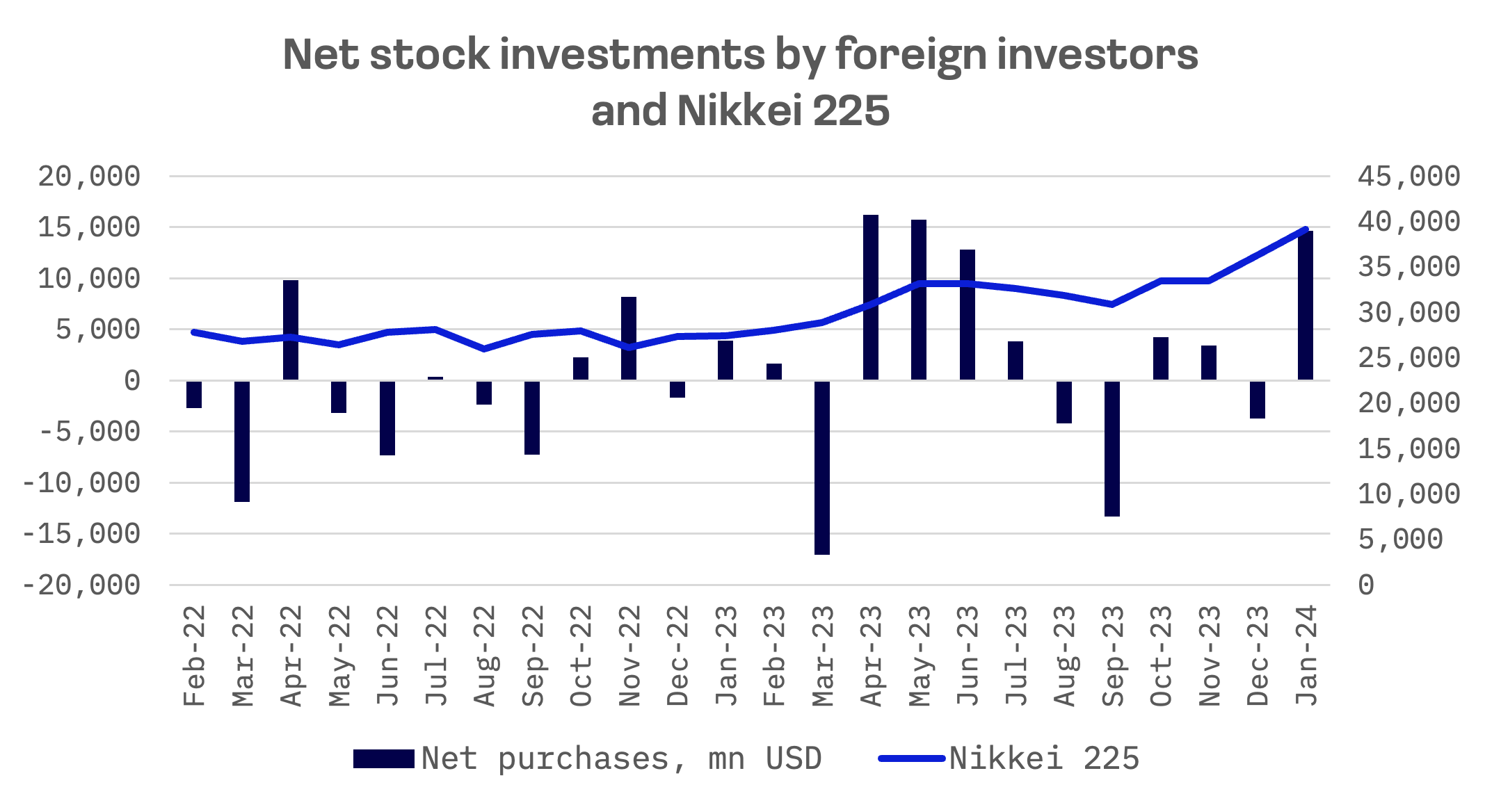

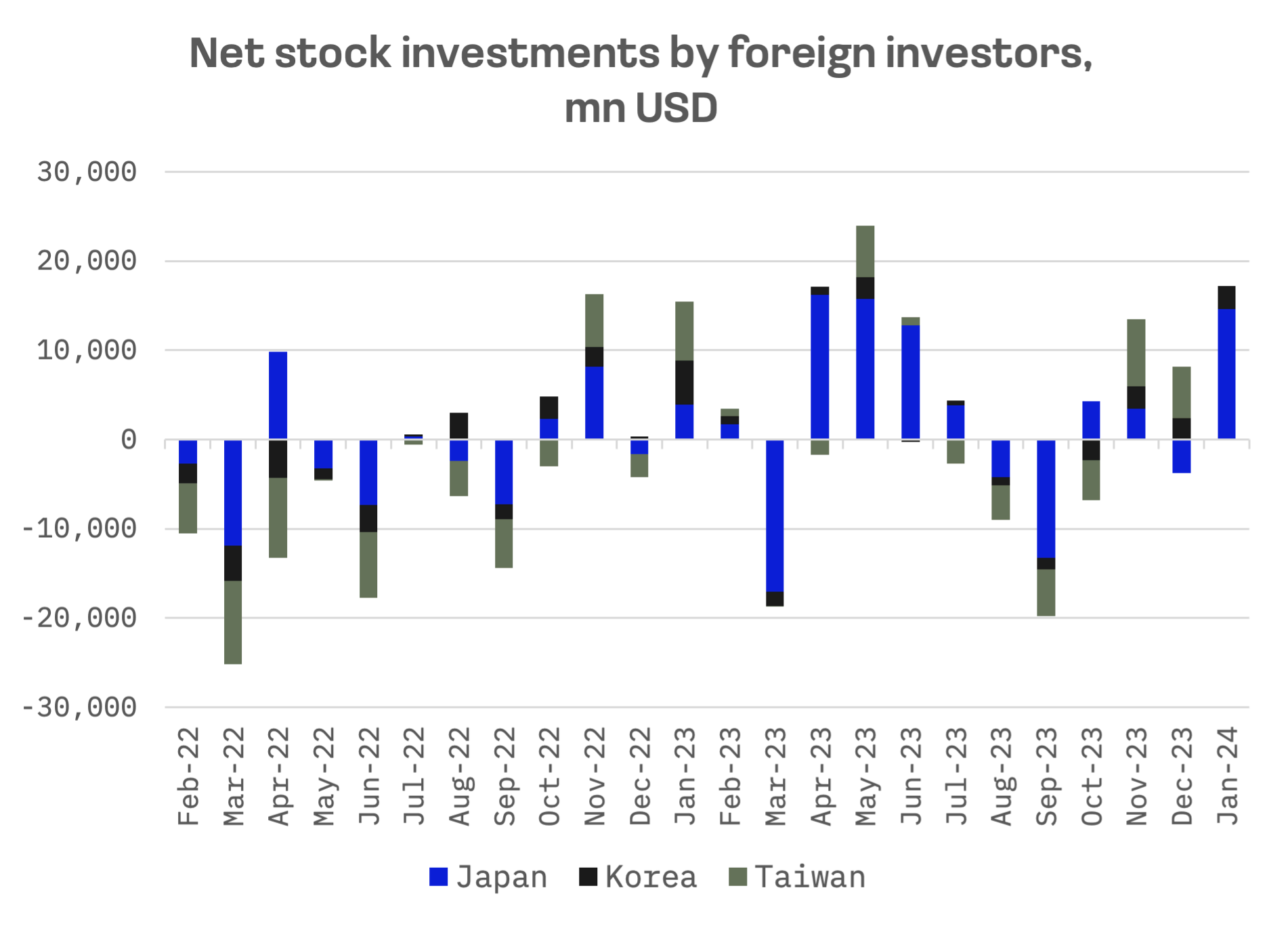

Over the past year, Japan has seen net foreign investment in its stock market exceed $34 billion — a stark contrast to the $12 billion net sales recorded in the preceding 12-month span.

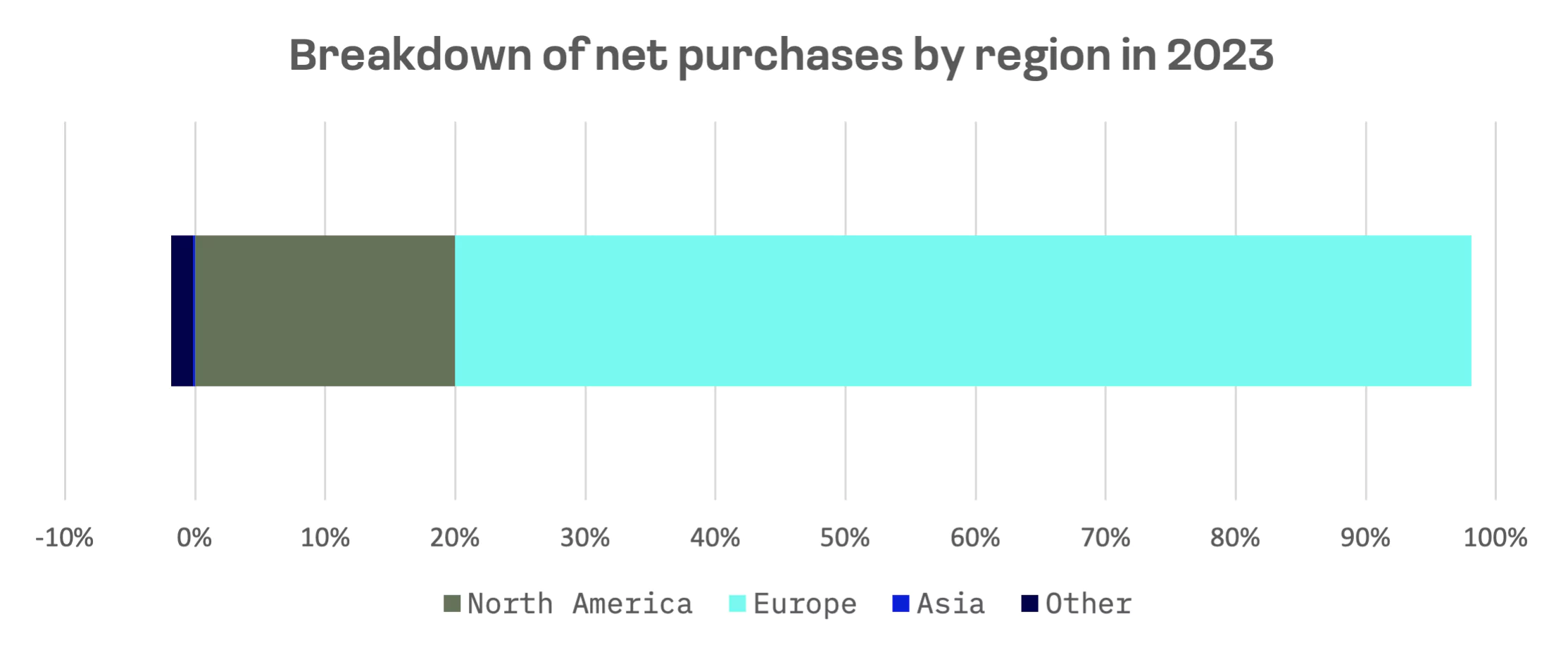

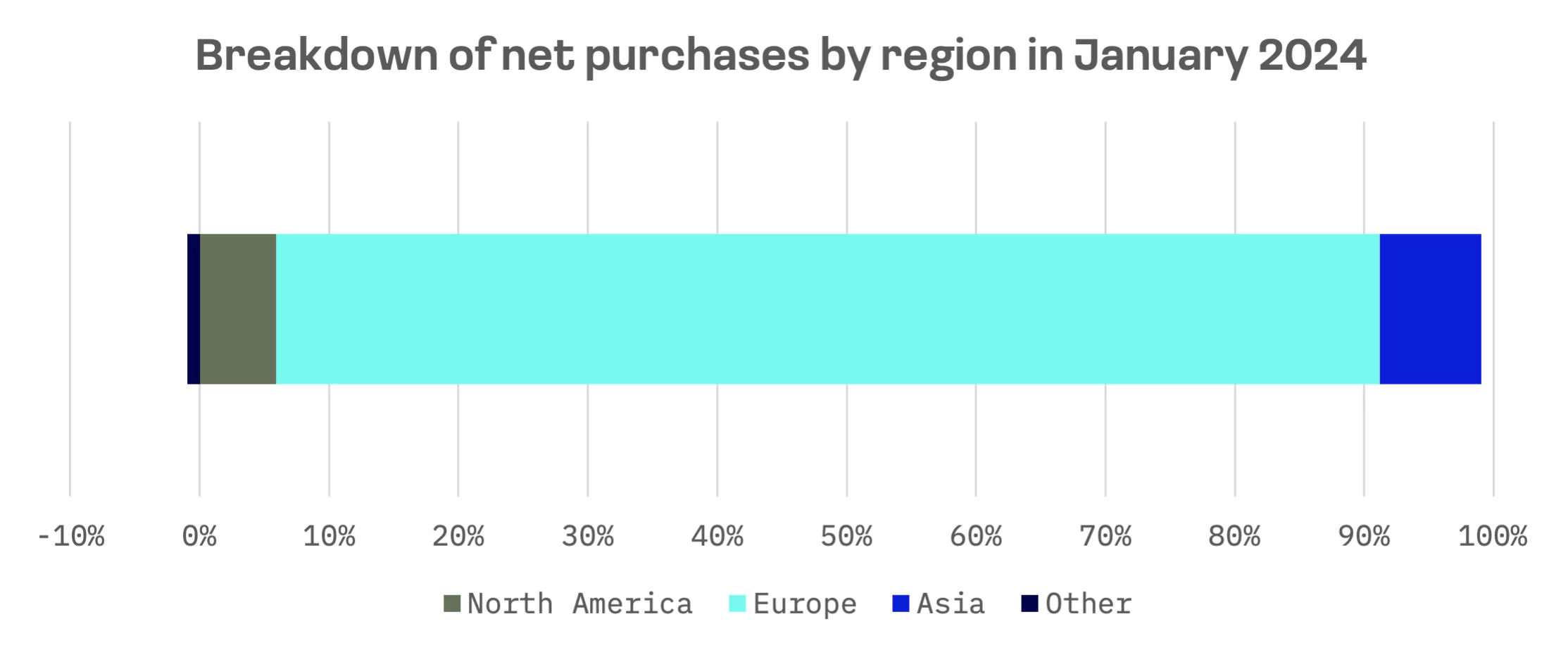

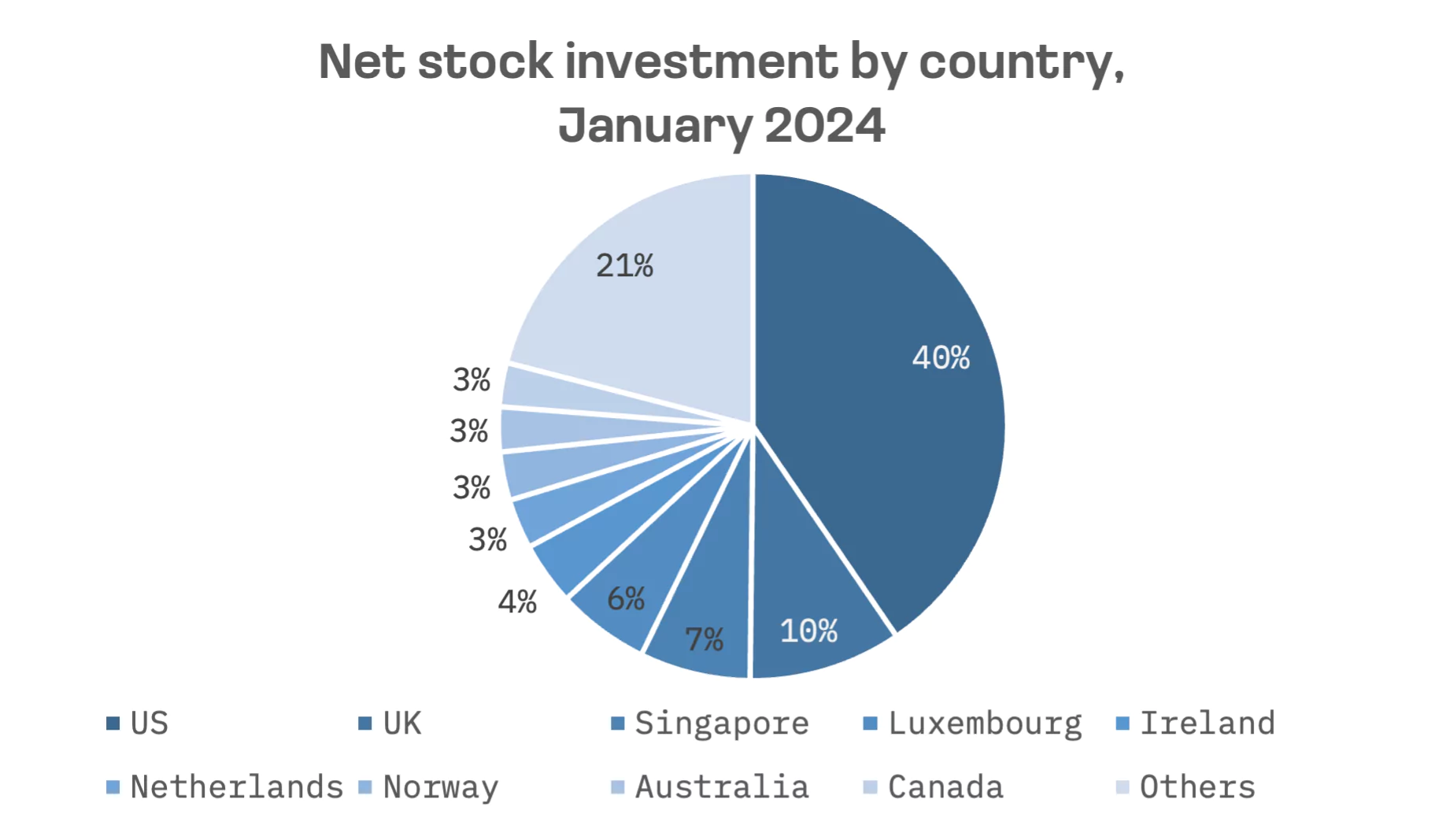

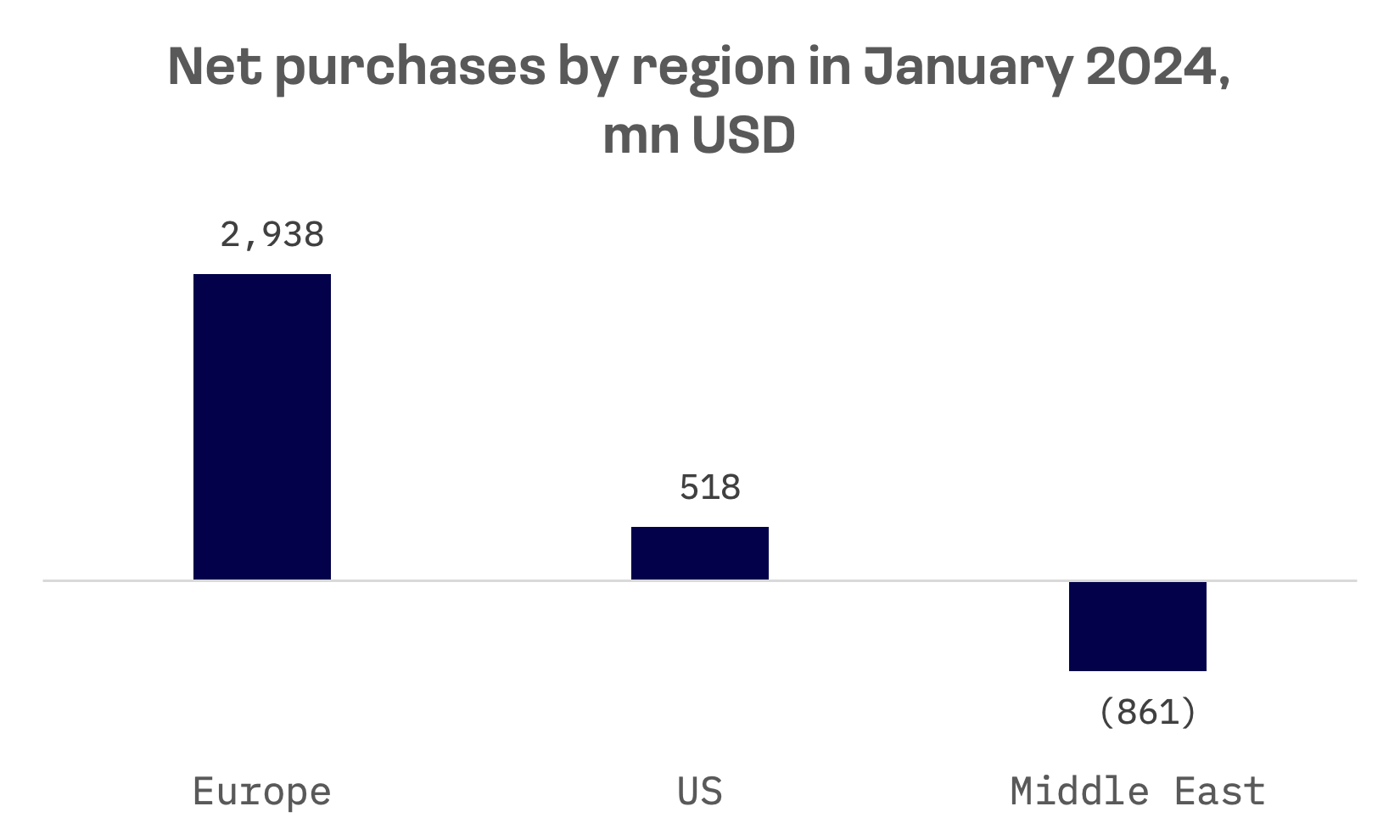

Notably, European investors have emerged as the most prolific buyers of Japanese stocks, intensifying their activity in January 2024.

South Korea

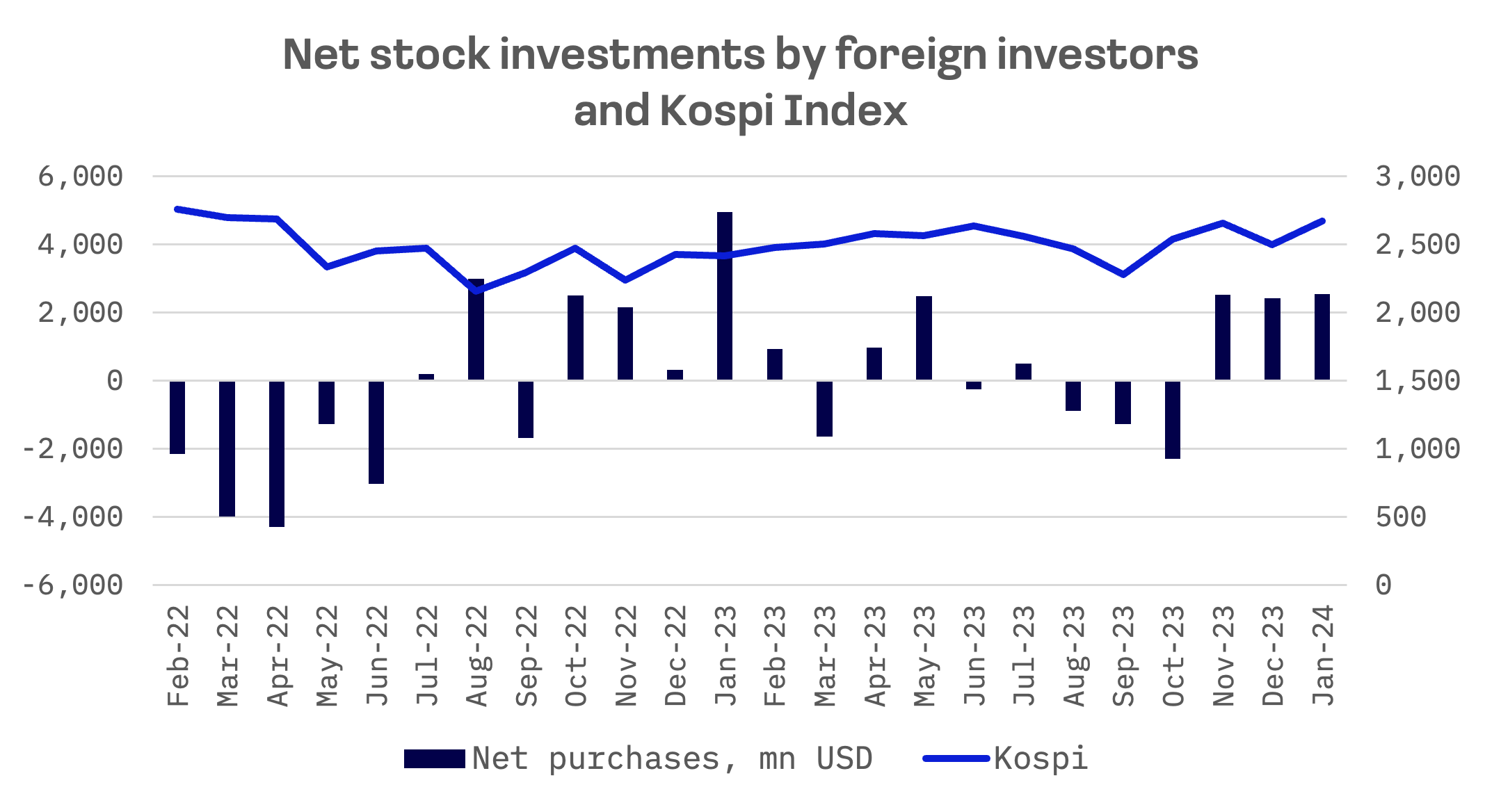

South Korea’s equity market has similarly benefitted from foreign interest, with almost $6 billion in net purchases over the last year, moving away from a net sale of $3.2 billion during the previous year.

While U.S. investors traditionally dominate the shareholder base, European investors took the lead in January 2024, demonstrating a keen interest in Korean equities.

Taiwan

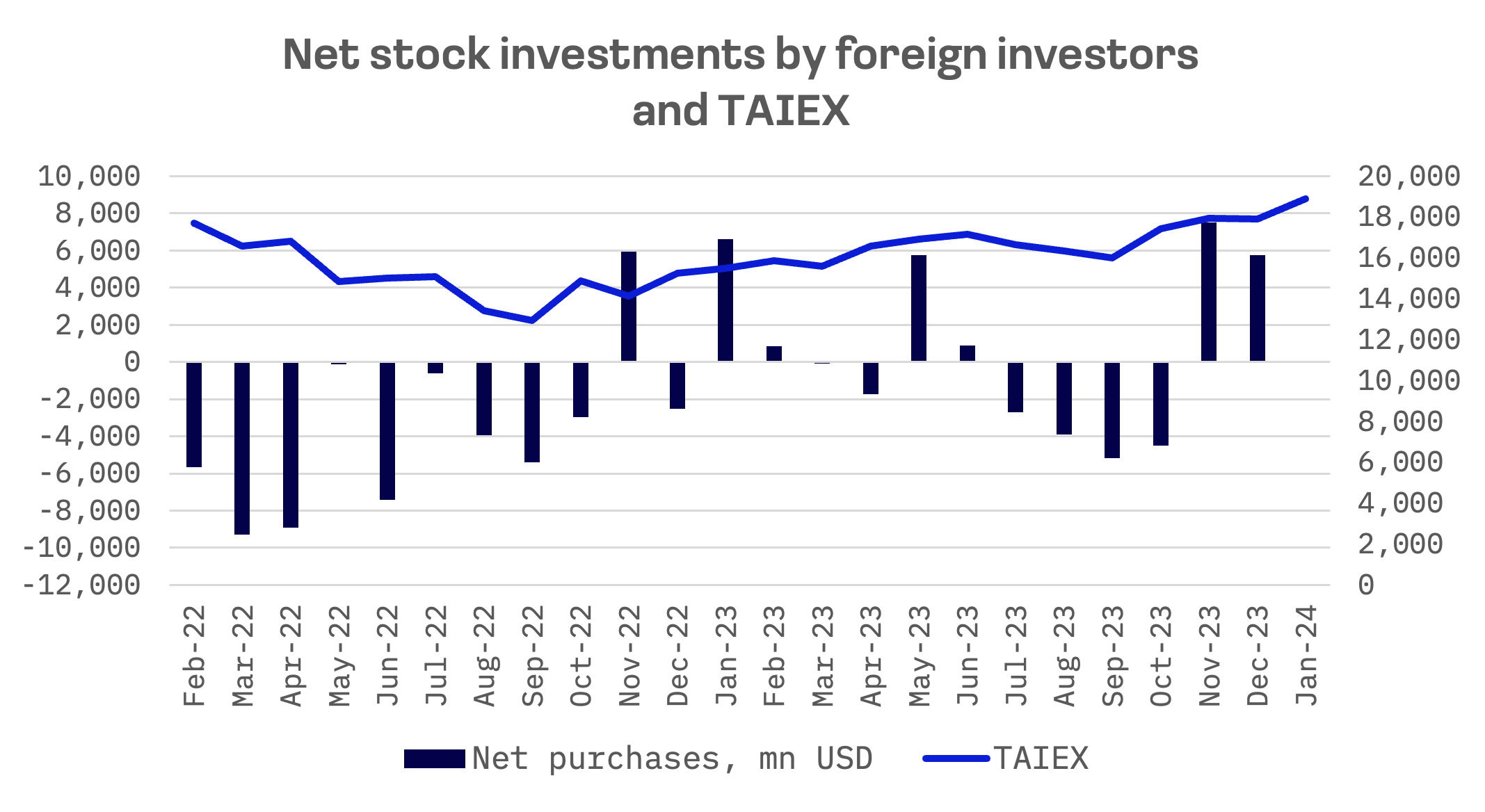

Taiwan’s market tells a remarkable turnaround story, with net purchases by foreign investors reaching $2.6 billion in the past year, reversing from net sales of $34.3 billion the year before.

This surge in foreign investment has been particularly pronounced in the JAKOTA markets, continuing its momentum into January 2024.

The performance of JAKOTA stocks, especially when evaluated in dollar terms, has been a critical factor in sustaining the trend of foreign investment. This dynamic, coupled with the potential for increased allocations from global investment funds, promises favourable conditions for further growth.

Highlighting this, Goldman Sachs points out that the holding ratio of Japanese stocks by actively managed funds that invest globally is 7 percentage points below their representation in the MSCI EAFE Index, a benchmark for developed markets outside the U.S. and Canada. The disparity suggests a substantial capacity for increased investment from global funds.