Biotechnology firms like NKMAX Co. Ltd. (182400.KQ) often see their valuations pivot on advancements in clinical trials. Recently, NKMAX’s nod from U.S. regulators to begin Phase 1/2a trials for its Alzheimer’s drug, SNK01, sent shares soaring. The company’s stock, which opened at 14,000 KRW on October 27, has since leveled between 11,880 and 12,220 KRW.

Investors are keenly aware that early-stage trials, despite involving a limited cohort — specifically, 10 volunteers with minor signs of Alzheimer’s and about 90 individuals without evident symptoms of the disease — are less about efficacy and more about safety and dosage levels. For NKMAX, 90% of patients maintained or improved cognitive function, yet only 30% experienced significant drug impacts after three months. It’s a tentative step, not a leap, into further trials — notably in the high-stakes U.S. market.

NKMAX’s entry into the U.S. market occurred through a SPAC merger with Graf Acquisition Corp. IV, reflecting its American presence through NKGen Biotech, Inc. (NKGN). SNK01’s innovative approach, targeting neuroinflammation through immune system enhancement rather than protein increment, differentiates it in the Alzheimer’s treatment landscape. Concurrently, NKMAX is also venturing with SNK02, an experimental treatment for refractory solid tumors now in its initial clinical stages.

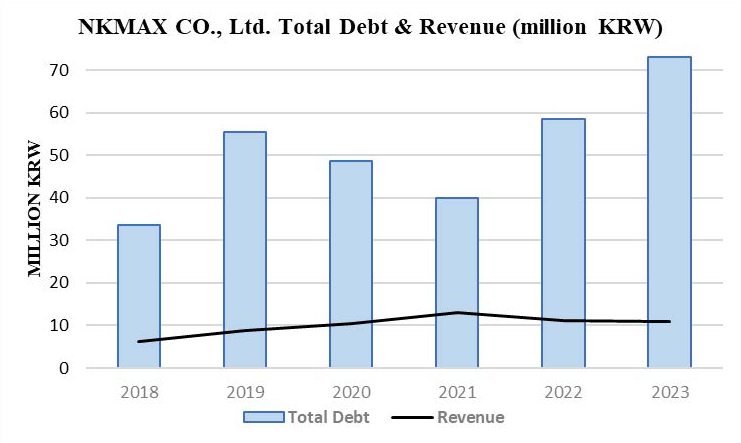

With its foray into products ranging from animal drugs to children’s vitamins and cancer diagnostics, NKMAX exemplifies the high-risk, high-reward nature of the small-cap biotech sector. Its finances, marked by negative net income, reflect a strategic thrust toward long-term, high-reward ventures. Peers like Voronoi, Inc. (310210.KQ), a JAKOTA Mid and Small Cap 2000 Index constituent with a focus on molecule kinase inhibitors, and Genexine, Inc. (095700.KQ), with its diverse therapeutic pipeline, share similar trajectories. Yet, NKMAX’s relatively high debt-to-industry ratio tempers its short-term appeal, despite its standing as a leading innovator in the South Korean biotech space.

| Company name | Symbol | Market cap, USD million | LTM Revenue, USD million | LTM EBITDA, USD million |

| Genexine Inc. | 095700.KQ | 241.9 | 5.4 | -29.6 |

| OptiPharm Co. Ltd. | 153710.KQ | 78.3 | 12.3 | -1.8 |

| Voronoi Co. Ltd. | 310210.KQ | 355.2 | 5.9 | -14.3 |

| Genome & Co. | 314130.KQ | 119.2 | 11.1 | -32.8 |

| Curacle Co. Ltd. | 365270.KQ | 85.4 | 6.4 | -6.2 |

| NKMAX Co. Ltd. | 182400.KQ | 365.2 | 8.2 | -31.7 |

Prospective gains for NKMAX hinge on the precarious nature of clinical trials. Successes could precipitate valuation spikes—historically, companies have seen an average 9.4% stock uptick post-trial triumphs, and a 4.5% dip with failures. But the reality is stark: Only 9.9% of drugs that clear Phase 1 trials in the U.S. ultimately reach the market. For NKMAX, completing Phase 1 is an imminent hurdle.

Investors eyeing NKMAX are committing to a long-term strategy, buoyed by recent developments, yet also factoring in the inherent optimism of favorable trial outcomes.