South Korea is moving to integrate tokenised securities into its financial system as the country prepares to launch a new exchange for fractional investing. On September 4, the Financial Services Commission (FSC) said it would begin accepting applications in October from firms seeking approval to operate trading platforms.

The decision aligns with an international trend towards embracing digital assets. The U.S. Securities and Exchange Commission (SEC) said in September that it is reviewing regulatory changes to allow cryptocurrency trading on national securities exchanges and alternative trading systems. Days later, Nasdaq revealed it is working to introduce trading of tokenised securities – which, if approved, would mark the first time such assets could trade on a major U.S. stock exchange.

In South Korea, the FSC expects to finalise amendments to the Financial Investment Services and Capital Markets Act (FSCMA) and related regulations by the end of September. The move follows earlier regulatory changes: in June 2025, the regulator began reviewing applications from tokenised asset issuers after establishing the legal and technical infrastructure to support them. In February 2023, the FSC introduced guidelines for security token offerings, formally recognising digital tokens backed by traditional assets such as stocks, bonds and real estate.

In the initial phase, the FSC will grant only two licences – a strategy aimed at concentrating liquidity in an early stage fractional investing market with annual trading volume of ₩14.5 billion ($10 million). Applications will be evaluated by an external expert panel, with preference given to consortiums that combine fintech startups with established brokerages.

Roadmap and Timeline

| Phase | Key Activity | Estimated Date |

| Legal Foundation | FSCMA & Subordinate Rule Revision Complete | September 2025 |

| Applicant Briefing | FSC Explanatory Session | September 18, 2025 |

| Application Window | Preliminary Licence Applications Accepted | October 2025 |

| Evaluation | En Bloc Screening by External Expert Committee | Post October 2025 |

| Decision | Final Licence Grant by SFC/FSC | To Be Determined |

The foundation of South Korea’s fractional investment market is the Security Token Offering (STO), a process in which digital securities representing ownership of real world assets are issued on a blockchain. Fintech firms have been applying for licences to issue tokenised assets since June 2025. Applicants include FUNBLE and Kasa Korea, which run digital platforms for fractional investment in commercial real estate, as well as Galaxia Moneytree, a financial services provider that operates a token securities issuance platform for aviation finance.

Many of these firms have been operating under Korea’s regulatory sandbox for security tokens. Under the new framework, regulators expect the range of assets eligible for fractional investment to expand beyond real estate, artwork and music copyrights to include intellectual property and renewable energy projects.

Investor protection remains a cornerstone of the licensing framework. The rules require strict separation between issuers of fractional securities in the primary market and the secondary trading platforms, a measure designed to prevent conflicts of interest in lightly regulated digital asset markets. Licencees will also be bound by the FSCMA, including capital adequacy standards, disclosure requirements and bans on unfair trading practices, holding them to the same standards as traditional financial institutions.

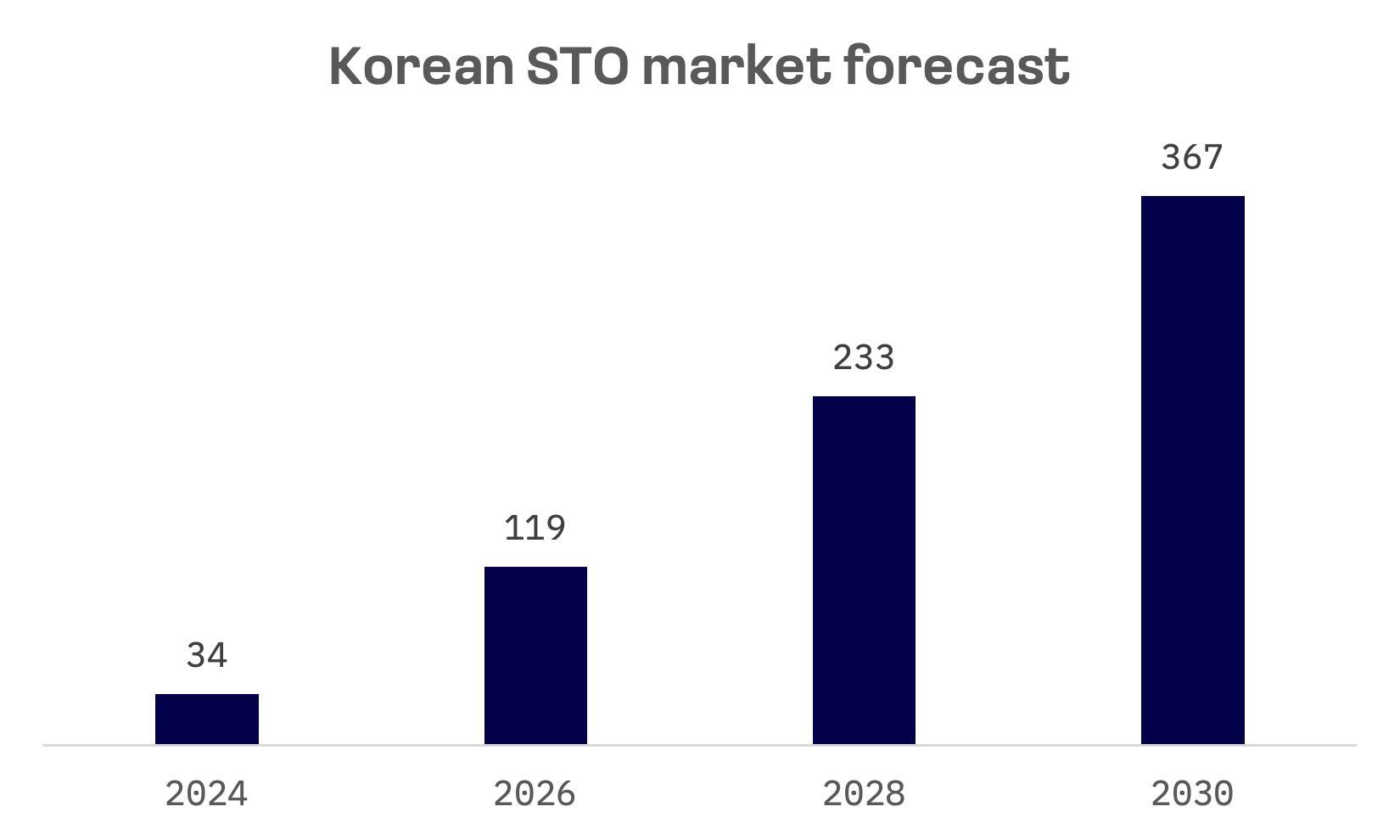

The FSC’s initiative marks a major milestone for South Korea’s digital asset industry, opening the door for the fractional investment sector’s evolution from an experimental sandbox into a fully established market. Institutionalised security token trading could accelerate the sector’s growth, attracting a broader range of participants and unlocking new investment opportunities.