Japan’s consumer electronics sector, which powered the country’s postwar economic miracle of the 1950s and 1960s, emerged as the cornerstone of its export driven economy by the 1980s. The industry led global patent filings for innovative technologies, becoming a crucial contributor to Japan’s export value.

The 1990s digital revolution marked a pivotal shift. Japan, which had nearly monopolised analogue devices, struggled to adapt to solid state digital electronics. This transition exposed structural weaknesses as Japanese manufacturers and policymakers failed to embrace the software driven, cost efficient production models adopted by emerging competitors.

Despite its highly educated workforce and world leading R&D spending, Japan’s dominance has waned. Competitors from South Korea, Taiwan and China have surpassed Japanese firms, capturing market share in key categories including televisions, semiconductors and personal computers. The precision engineering prowess that drove Japan’s success became less critical in a digital era where production costs determined market leadership.

The 2008 global financial crisis hastened the decline. Industry leaders such as Sony, Panasonic and Toshiba recorded collective losses of $17 billion, revealing fundamental vulnerabilities. High production costs, yen strength and redundant product development among numerous Japanese firms undermined pricing power and economies of scale.

Supply chain globalisation further eroded Japan’s position. Digital components could be manufactured more economically across Asia and assembled in China, while U.S. firms provided crucial software. Japanese exports faced declining demand and prices, deepening economic challenges.

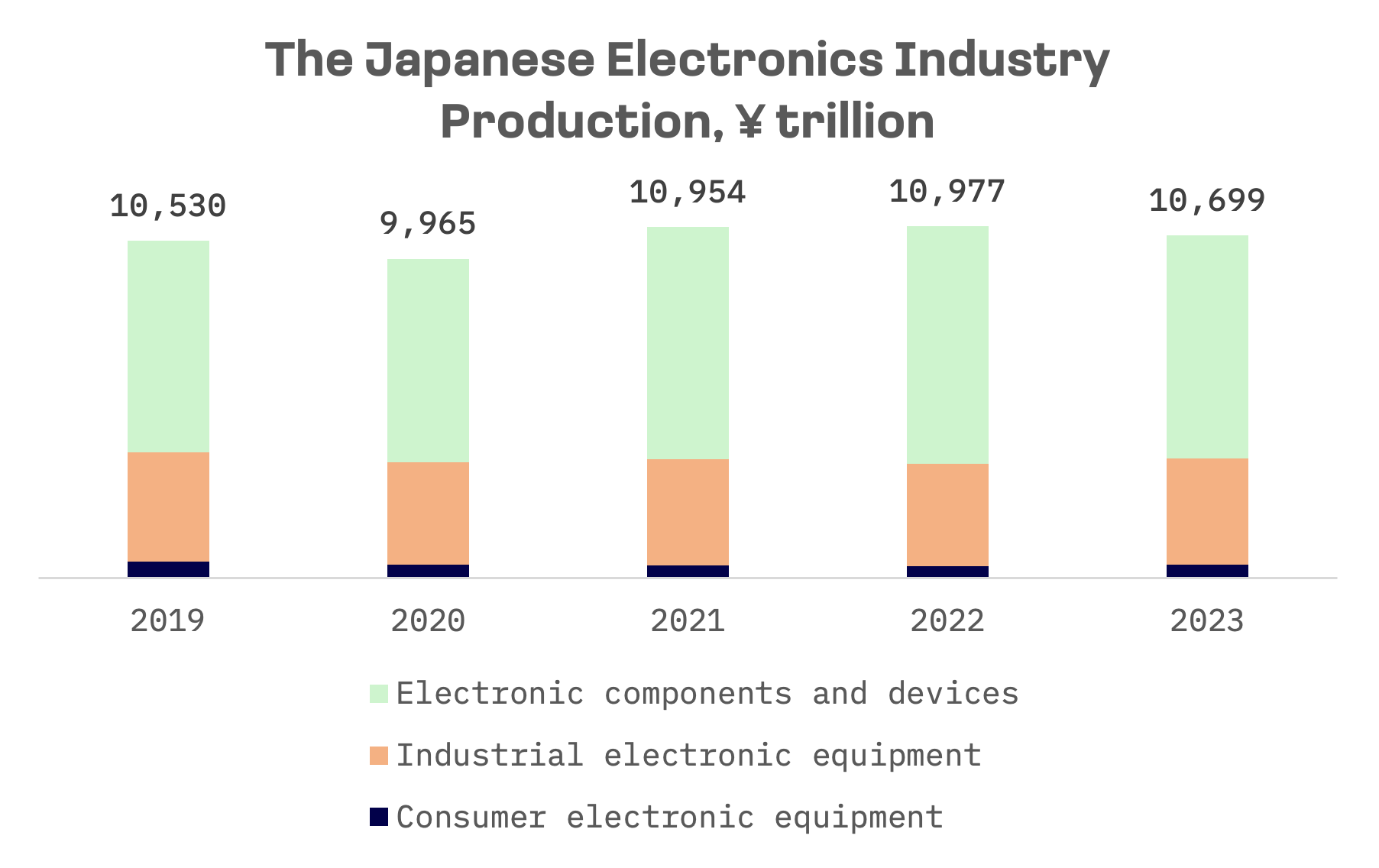

While total production in Japan’s electronics industry recovered after a 2020 downturn, 2023 saw a 2.5% decline from the previous year.

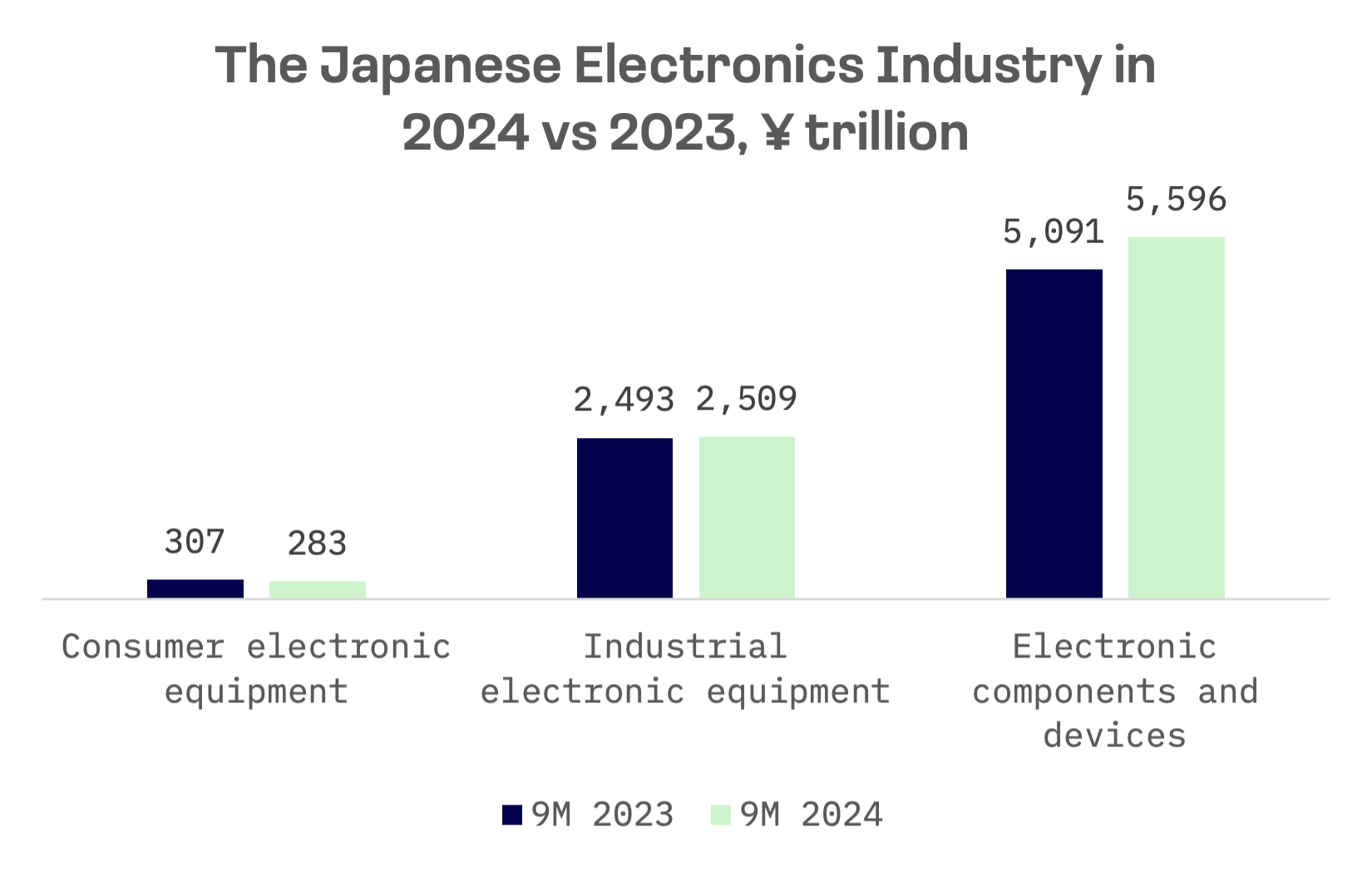

However, the sector’s production reached ¥8.388 trillion in 2024’s first nine months, up 6.3% from 2023. The Electronic Components and Devices segment led this growth, advancing nearly 10%.

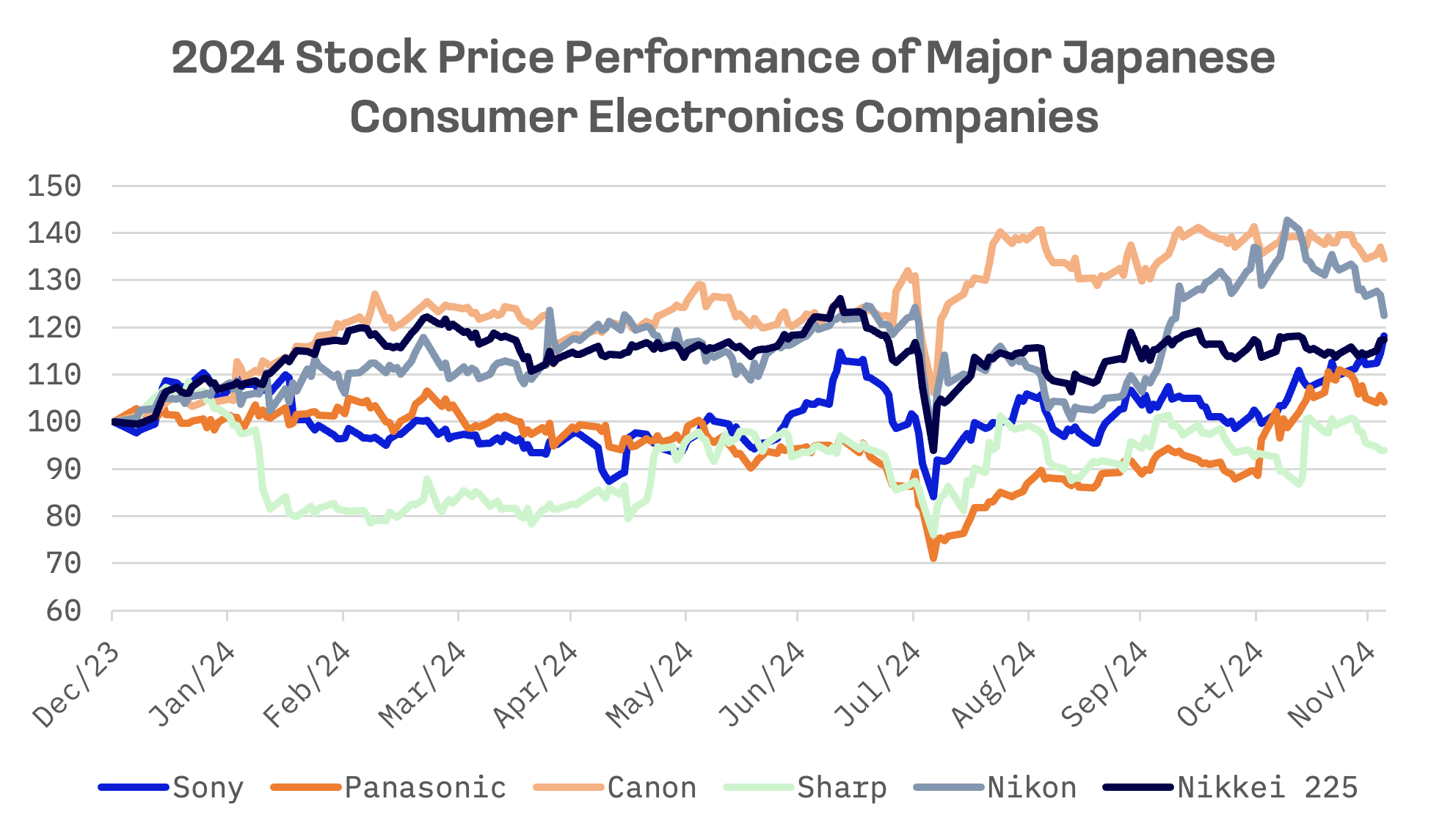

Japan’s consumer electronics landscape features major players Sony, Panasonic and Sharp. Additionally, the peer group can be expanded to global camera and imaging leaders Canon and Nikon.

| Company | Products | Market Position |

| Sony | Gaming consoles, televisions, cameras, audio devices and entertainment | Leader in gaming and entertainment sectors with strong presence in professional imaging and home entertainment |

| Panasonic | Televisions, home appliances, cameras, audio devices and automotive solutions (batteries, EV components) | Top player in energy storage solutions and sustainable technology innovation |

| Sharp | Televisions, smartphones, home appliances and displays | Advanced display technology and collaborations in IoT solutions |

| Canon | Cameras, printers, scanners and medical equipment | Global leader in imaging and printing technology |

| Nikon | Cameras, lenses, imaging products and medical equipment | Top player in camera and imaging industry |

Another notable player, Toshiba, once a leading manufacturer of personal computers, consumer electronics, home appliances and medical equipment, has shifted focus to infrastructure and energy. In December 2023, after 74 years on the Tokyo Stock Exchange, the company delisted following a decade of scandals and financial turbulence that diminished one of Japan’s iconic brands, culminating in a buyout.

Of the five public companies mentioned above, three are included in the JAKOTA Blue Chip 150 Index:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Sony | 6758.TSE | Blue Chip 150 | 126.6B |

| Canon | 7751.TSE | Blue Chip 150 | 30.5B |

| Panasonic | 6752.TSE | Blue Chip 150 | 22.5B |

| Sharp | 6753.TSE | Mid and Small Cap 2000 Index | 4.1B |

| Nikon | 7731.TSE | Mid and Small Cap 2000 Index | 3.9B |

In 2024, only Canon, Nikon and Sony have outpaced the Nikkei 225. Sony slightly edged ahead with a 19% rise versus the index’s 17% gain. Panasonic increased 4%, while Sharp declined 6%.

Sony commands the highest valuations in its peer group based on EV/Sales and EV/EBITDA multiples. In contrast, Sharp trades at 0.42 times sales and reports negative EBITDA and net profit, making EV/EBITDA and P/E multiples incalculable.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Sony | 1.52x | 7.43x | 17.05x |

| Canon | 1.12x | 7.41x | 16.00x |

| Panasonic | 0.44x | 4.32x | 10.01x |

| Sharp | 0.42x | N/A | N/A |

| Nikon | 0.81x | 7.20x | 23.24x |

| MEAN | 0.86x | 6.59x | 16.58x |

| MEDIAN | 0.81x | 7.31x | 16.53x |

Sony

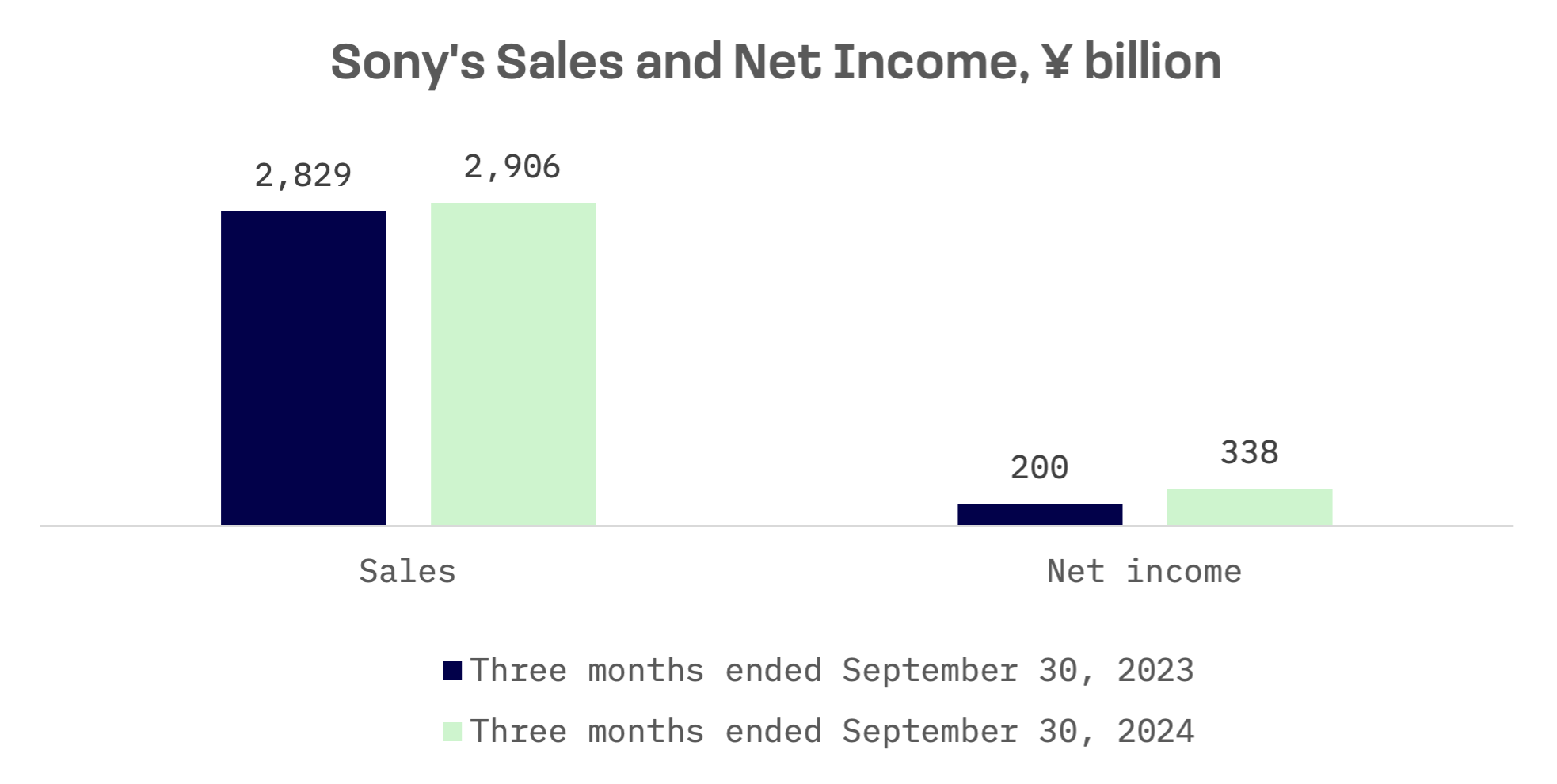

Sony raised its full year sales outlook on November 8 and reported better than expected operating profit, driven by gaming division strength. For the second quarter ending September 30, 2024, net income surged 69% while revenue rose 3%.

The Games and Networks segment’s robust performance offset weaker results from Sony Pictures Entertainment. Strong profit and gaming momentum signal positive prospects as the company enters the crucial holiday shopping season.

In November, Sony launched its upgraded PlayStation 5 Pro, featuring enhanced graphics processing for faster gameplay and advanced AI capabilities for improved image clarity. Analysts expect the launch to revive PS5 interest, positioning the console for the highly anticipated release of Grand Theft Auto VI, one of the decade’s most eagerly awaited titles.

Sharp

Sharp’s weak stock performance reflects persistent challenges. Revenue dropped from ¥2.55 trillion in fiscal 2022 to ¥2.32 trillion in fiscal 2023, amid continued losses. Its display panel business faces particular pressure from intense competition and global oversupply.

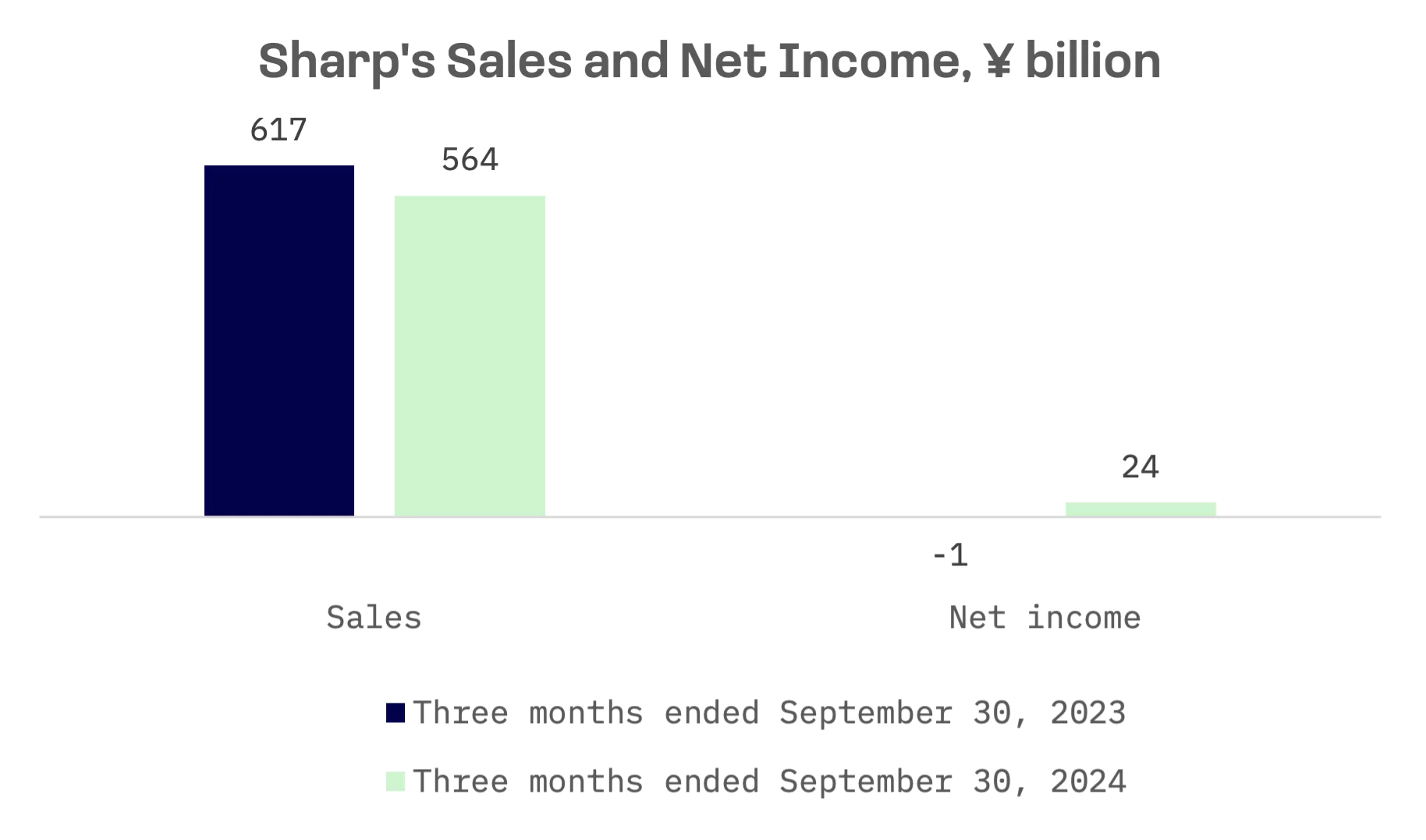

Addressing these challenges, Sharp is implementing its “Asset Light Initiative” restructuring plan. On November 12, the company reported second quarter and first half fiscal 2024 results. Sharp aims to return to profitability in fiscal 2024 after two years of operating and net losses. While modest, the reported profit marks a symbolic recovery, highlighting early restructuring benefits.

Sharp’s trajectory illustrates the broader challenges facing Japan’s formerly dominant consumer electronics industry. The sector must reinvent itself by adapting to global supply chain realities, emphasising software driven innovation and fostering deeper collaboration to eliminate redundancies and inefficiencies.