The aviation sector stands as a pillar of economic growth across Japan, South Korea and Taiwan. Their geographic positions as island and peninsular nations have made air travel essential to their economies, generating both direct and indirect jobs, underpinning international tourism and facilitating global trade.

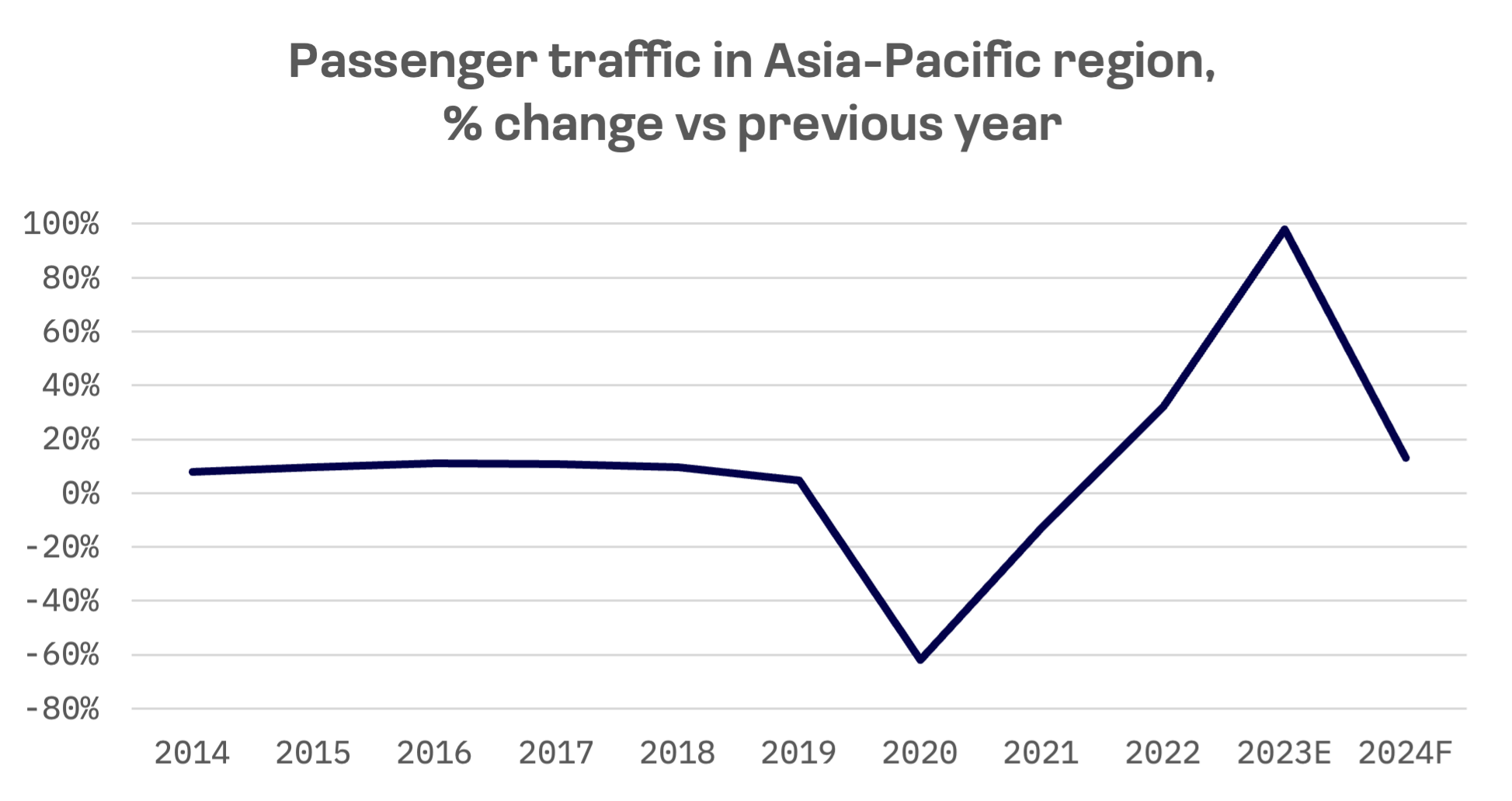

The Asia-Pacific (APAC) airline market showed robust growth before the pandemic, bolstered by economic expansion, a rising middle class, flourishing tourism and the emergence of low cost carriers (LCCs). Now, the industry is witnessing significant shifts as carriers adapt to new consumer preferences and heightened competition in the post-pandemic era.

Each market shows distinct evolutionary patterns. In Japan, home to one of the world’s largest domestic air networks, budget carriers are gaining market share while premium airlines refine their services to meet post pandemic demand. South Korea’s aviation landscape mirrors these changes, with LCCs expanding aggressively as full service airlines fight to maintain their position. Meanwhile, Taiwan’s carriers are strategically positioning themselves as crucial links between East Asia and global destinations.

Japan

Japan maintains one of Asia’s most developed airline markets, holding the world’s sixth position in air passenger traffic. The country’s archipelago geography has fostered a vast domestic network, with Tokyo’s Haneda Airport ranking among the globe’s busiest hubs. Beyond domestic routes, Japan serves as a crucial nexus for both regional Asian flights and long haul connections to North America and Europe.

The market features a diverse mix of established players and emerging competitors:

- All Nippon Airways (ANA), a unit of ANA Holdings and Japan’s largest airline, operates both domestic and international routes. The carrier is also a member of the Star Alliance

- Japan Airlines, a Japanese flagship carrier, is a full service airline offering extensive international and domestic routes. JAL is part of the Oneworld alliance

- The LCC segment continues to expand, led by Peach Aviation (majority owned by ANA Holdings), Jetstar Japan (50% owned by Japan Airlines) and publicly traded Skymark Airlines (with ANA Holdings holding a minority stake). These carriers serve both domestic and regional routes

South Korea

South Korea’s aviation sector thrives on international travel, particularly routes connecting Korea with China and Southeast Asia. While domestic travel centers on the Seoul-Jeju route — the world’s busiest air corridor — the market’s scope remains limited by the country’s geography.

Key market participants include:

- Korean Air Lines, the nation’s flagship carrier and SkyTeam member, operates an extensive international network, with particular strength in routes to the U.S., Europe and Asian destinations

- Asiana Airlines, a Star Alliance member with comprehensive domestic and international operations, is working to complete its merger with Korean Air, announced in November 2020. The deal continues to face regulatory hurdles, leaving the consolidation incomplete

- The low cost segment has emerged as a significant force, featuring publicly traded carriers Jeju Air, T’way Air and Jin Air, along with Air Seoul, Asiana’s subsidiary. These airlines dominate regional routes to Japan, China and Southeast Asia, while maintaining strong domestic presence, particularly on the heavily trafficked Seoul-Jeju Island route

Taiwan

Despite its smaller market size, Taiwan holds strategic importance as a gateway linking East and Southeast Asia. While domestic travel remains limited, international routes to China, Japan, Southeast Asia and the U.S. drive traffic growth.

Taiwan’s airline market, while more compact than those of Japan and South Korea, holds strategic significance as a gateway between East and Southeast Asia. The country’s modest size naturally limits domestic air travel, but its international market thrives, with heavy traffic flows to China, Japan, Southeast Asia and the U.S.

Major carriers include:

- China Airlines, flag carrier of the Republic of China (Taiwan), maintains an extensive international network spanning Asia, North America and Europe

- EVA Air, operating under the Star Alliance banner, has built a reputation for premium service standards while developing a comprehensive global network, particularly strong on trans-Pacific routes

- The LCC segment, though less prominent than in Japan and South Korea, shows growth potential. Tigerair Taiwan, majority owned by China Airlines, leads this expansion with a focus on regional routes

All the key players mentioned above are either publicly listed companies or subsidiaries of publicly listed firms. The table below summarises the major players in the passenger airline industry across the Jakota markets, each with a market capitalisation exceeding $1 billion:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| ANA Holdings | 9202.TSE | Mid and Small Cap 2000 | 9.0B |

| Japan Airlines | 9201.TSE | Mid and Small Cap 2000 | 6.9B |

| Korean Air Lines | 003490.KO | Mid and Small Cap 2000 | 6.2B |

| China Airlines | 2610.TW | Mid and Small Cap 2000 | 4.1B |

| EVA Air | 2618.TW | Mid and Small Cap 2000 | 6.2B |

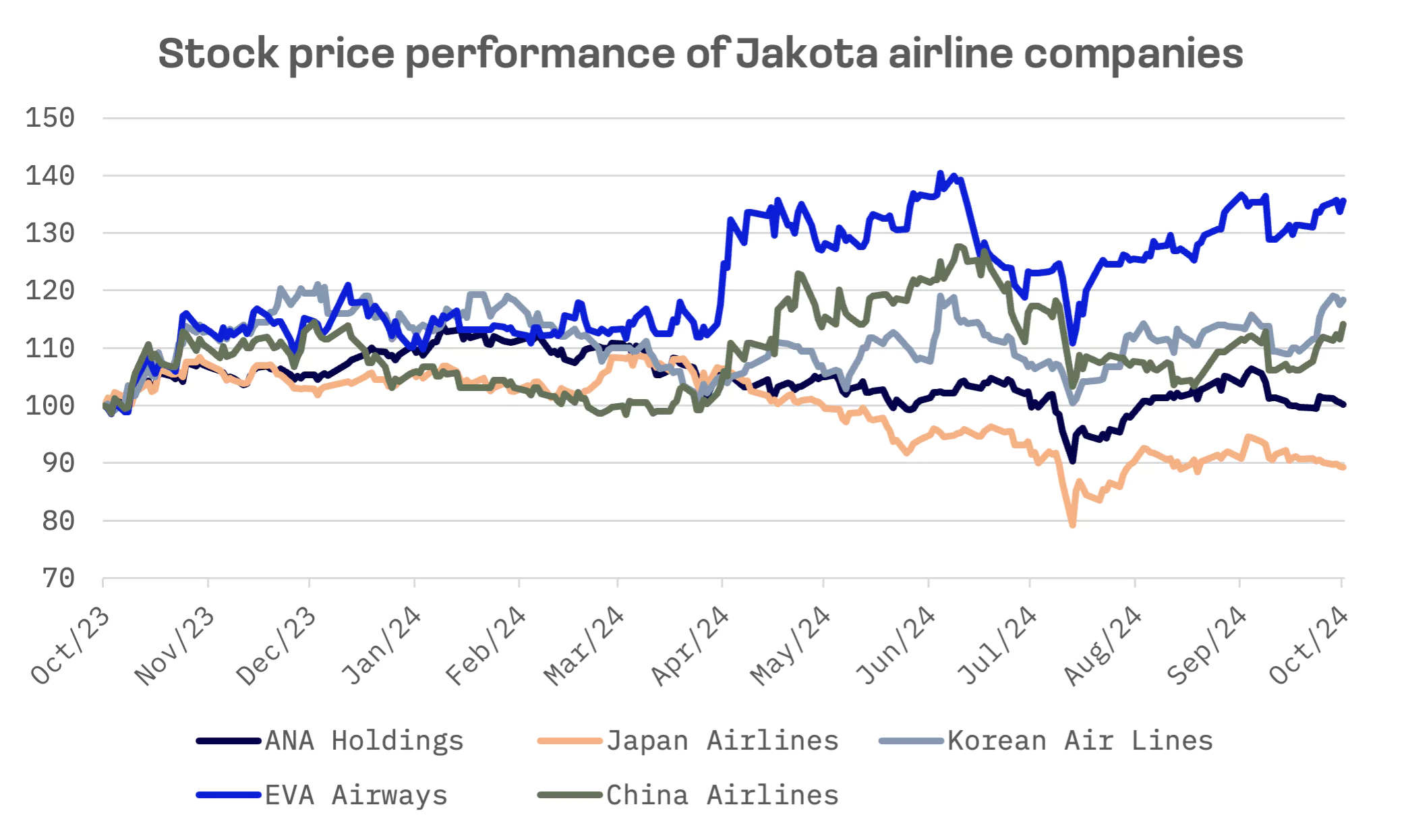

EVA Air emerged as the sector’s standout performer, posting a 36% share price gain while Japanese carriers struggled. Japan Airlines saw an 11% decline, while ANA Holdings remained flat.

Despite this strong performance, EVA Air’s shares still appear relatively undervalued based on EV/EBITDA and P/E multiples:

| Company Name | EV/Sales | EV/EBITDA | P/E |

| ANA Holdings | 0.76x | 6.76x | 9.72x |

| Japan Airlines | 0.71x | 4.10x | 12.21x |

| Korean Air Lines | 0.78x | 3.41x | N/A |

| China Airlines | 0.92x | 4.01x | 15.32x |

| Eva Air | 0.79x | 2.65x | 8.50x |

| AVERAGE | 0.79x | 4.19x | 11.44x |

| MEDIAN | 0.78x | 4.01x | 10.97x |

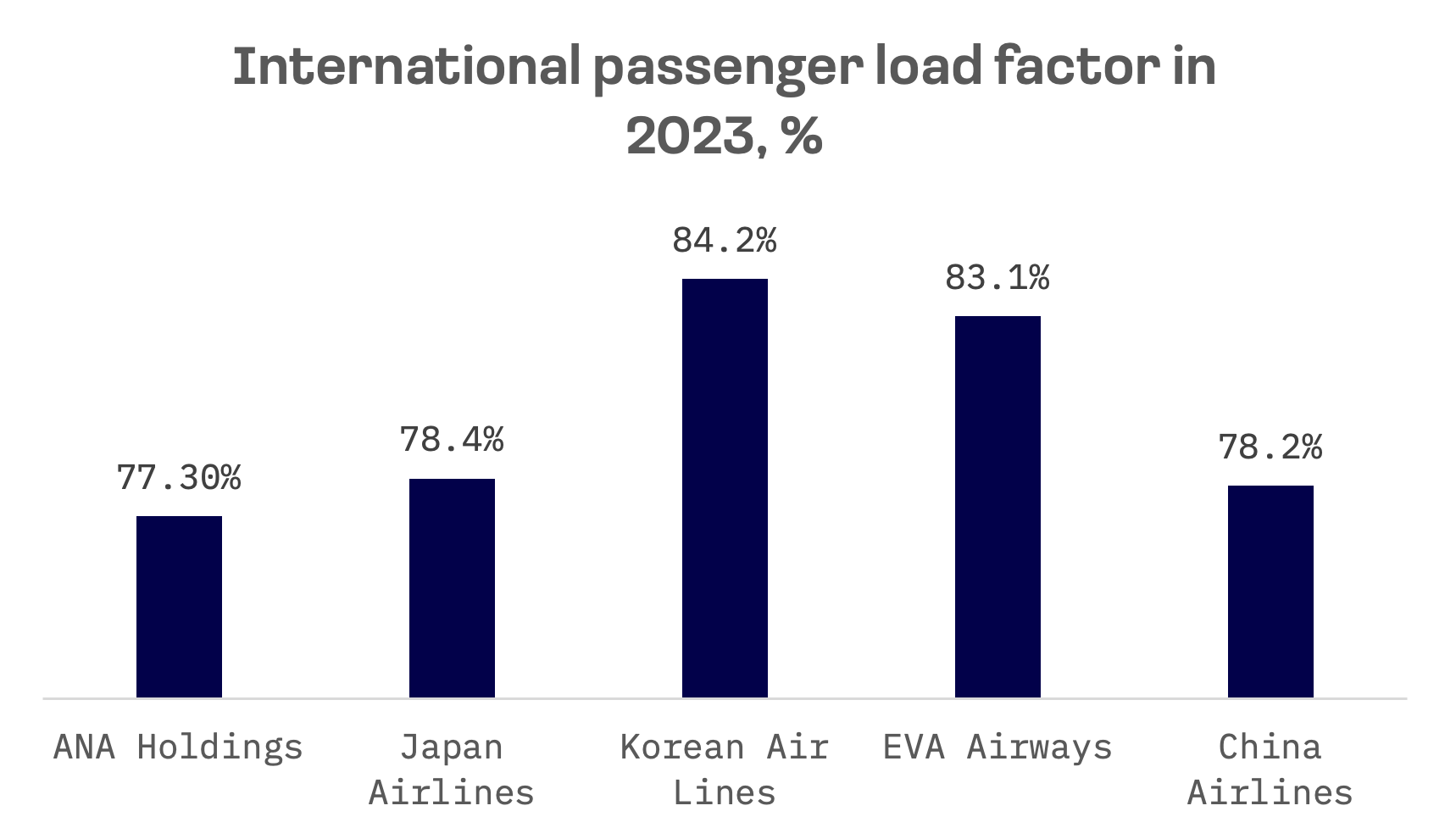

EVA Air, along with Korean Air Lines, boasts the highest international passenger load factor among its peer group, reflecting strong demand and efficient capacity utilisation on international routes.

EVA Air

The Taiwanese carrier reported robust quarterly results, with sales rising nearly 14% year-over-year and basic earnings per share (EPS) surging by 29.7%.

EVA Air: Key financial indicators, NT$ million

| As of 6/30/2023 | As of 6/30/2024 | Y/Y Change, % | |

| Total Revenue | 48,609 | 55,374 | 13.9% |

| EBITDA | 16,315 | 18,361 | 12.5% |

| Basic EPS | 1.11 | 1.44 | 29.7% |

EVA Air has been proactive in modernising its fleet, continuously investing in newer, more fuel efficient aircraft to enhance operational efficiency and meet sustainability goals. At the beginning of 2024, the company had finalised an order for 33 Airbus aircraft, following initial disclosure in November 2023. The deal, valued at up to $10.1 billion, includes 18 long range A350-1000s at up to $436 million each and 15 single aisle A321neos at up to $150 million each, though Airbus has not confirmed specific pricing.

Clay Sun, EVA Air’s president, highlighted the decision to choose “the most modern and fuel efficient types” in both categories, noting that the new aircraft will significantly reduce carbon emissions, aligning with the company’s sustainability goals.

Korean Air Lines

Korean Air Lines, delivering the second best share performance among its peer group, reported mixed financial results for the fourth quarter. Non consolidated revenue reached ₩3.98 trillion, up 10% year-over-year, powered by a 48% surge in passenger revenue to ₩2.46 trillion. This growth helped counterbalance a 29% decline in cargo revenue.

The carrier’s profitability fell short of expectations. Non consolidated operating profit came in at ₩183.6 billion, while consolidated operating profit reached ₩223.6 billion — significantly below the ₩411.4 billion consensus estimate. Higher than expected labour expenses, including bonus payments, weighed on the bottom line.

Meanwhile, Korean Air’s landmark $1.3 billion acquisition of Asiana Airlines approaches a crucial juncture. The carrier anticipates U.S. regulatory approval — one of the final major hurdles — by the end of October, nearly four years after announcing the deal. Regulatory scrutiny has centered on competition concerns, particularly regarding the combined airline’s potential dominance on key international routes.

Looking ahead, Korean Air plans to begin consolidating operations with Asiana in early 2025, pending final approvals. The merger would create one of Asia’s largest airline groups, integrating both carriers’ operations and resources.

Japan Airlines

Japan Airlines emerged as the only carrier among its regional peers to post negative performance, with financial results showing mounting pressures. While sales increased 11.2% to ¥424 billion in the last reported quarter, the carrier saw EBIT plunge 29.5% and net income drop 39.4%. The weaker performance stems from rising expenses, driven by increased capacity, global price inflation and a weakening yen.

The closure of Russian airspace has dealt another blow to Japan’s international airline network. Previously a crucial corridor for both European and North American routes, the closure has forced significant operational changes. Flights to major European airports now require detours adding two or more hours to flight times, substantially increasing direct operating costs. The situation is particularly challenging amid industry wide pilot shortages, as longer routes require “heavy” crews of four pilots in the cockpit, straining already limited crew resources.

As airlines in the Jakota countries adjust to the realities of a post pandemic environment, prioritising travel convenience, competitive pricing and trade facilitation will be crucial. With a strong commitment to sustainability and technological innovation, these airlines are well prepared to tackle the complexities of the aviation landscape.