Japan’s cosmetic industry has earned a strong reputation for quality and innovation. The rise of “J-Beauty” reflects a blend of traditional practices, cutting edge technology and shifting consumer preferences, fuelling robust domestic and international demand for Japanese beauty products.

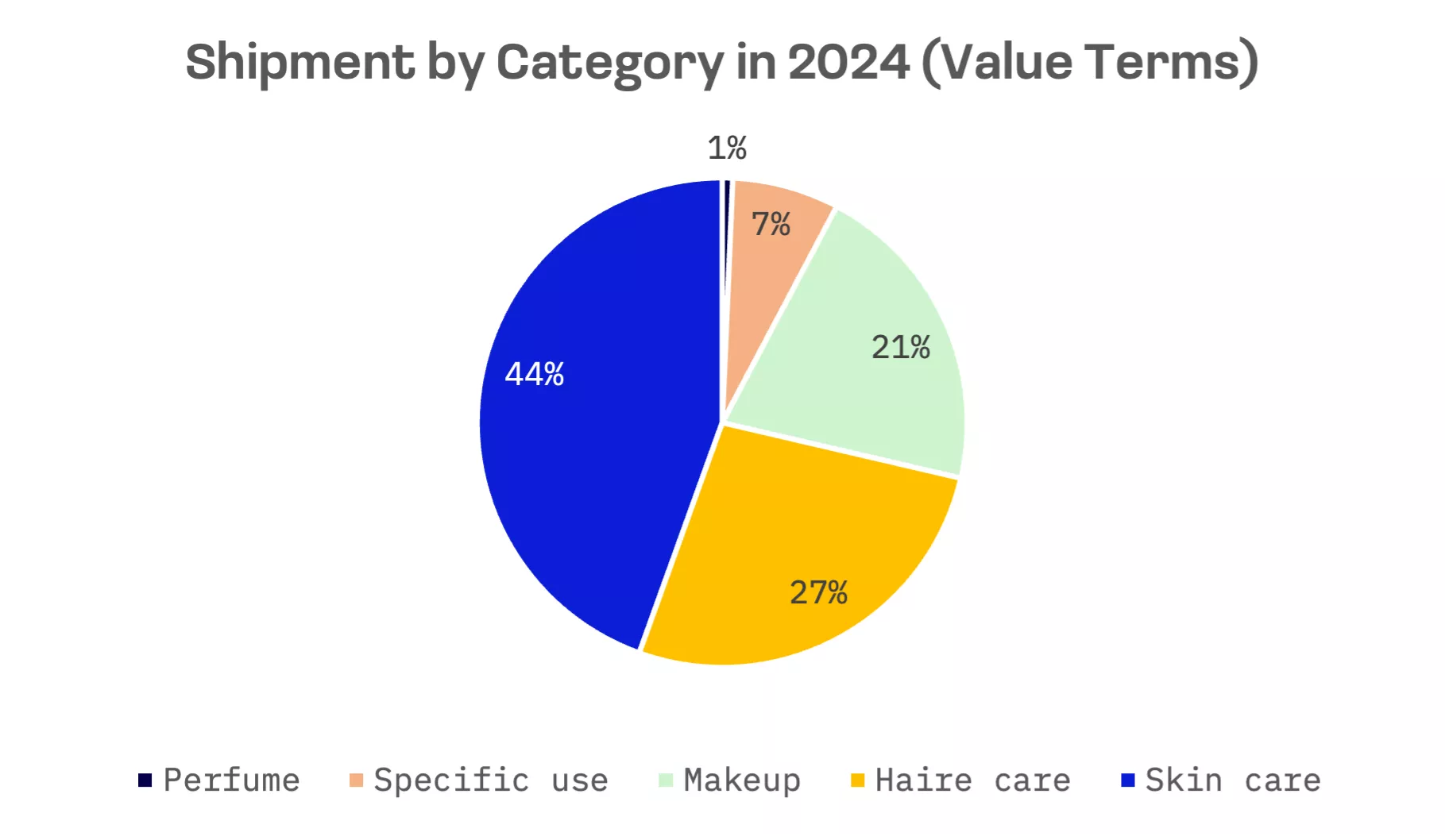

The Japanese approach to beauty emphasises skin care over makeup. Women view cosmetics primarily as products that enhance skin health and attractiveness rather than conceal imperfections. Compared with their Western counterparts, Japanese women typically use smaller amounts of makeup and fragrances, including perfumes and eau de cologne. Skin care dominates Japan’s cosmetics market as a result, accounting for 44% of domestic shipments by value, driven almost entirely by facial products. Despite premium price tags, demand has remained resilient. Japanese women consider skin care an essential part of their beauty routine.

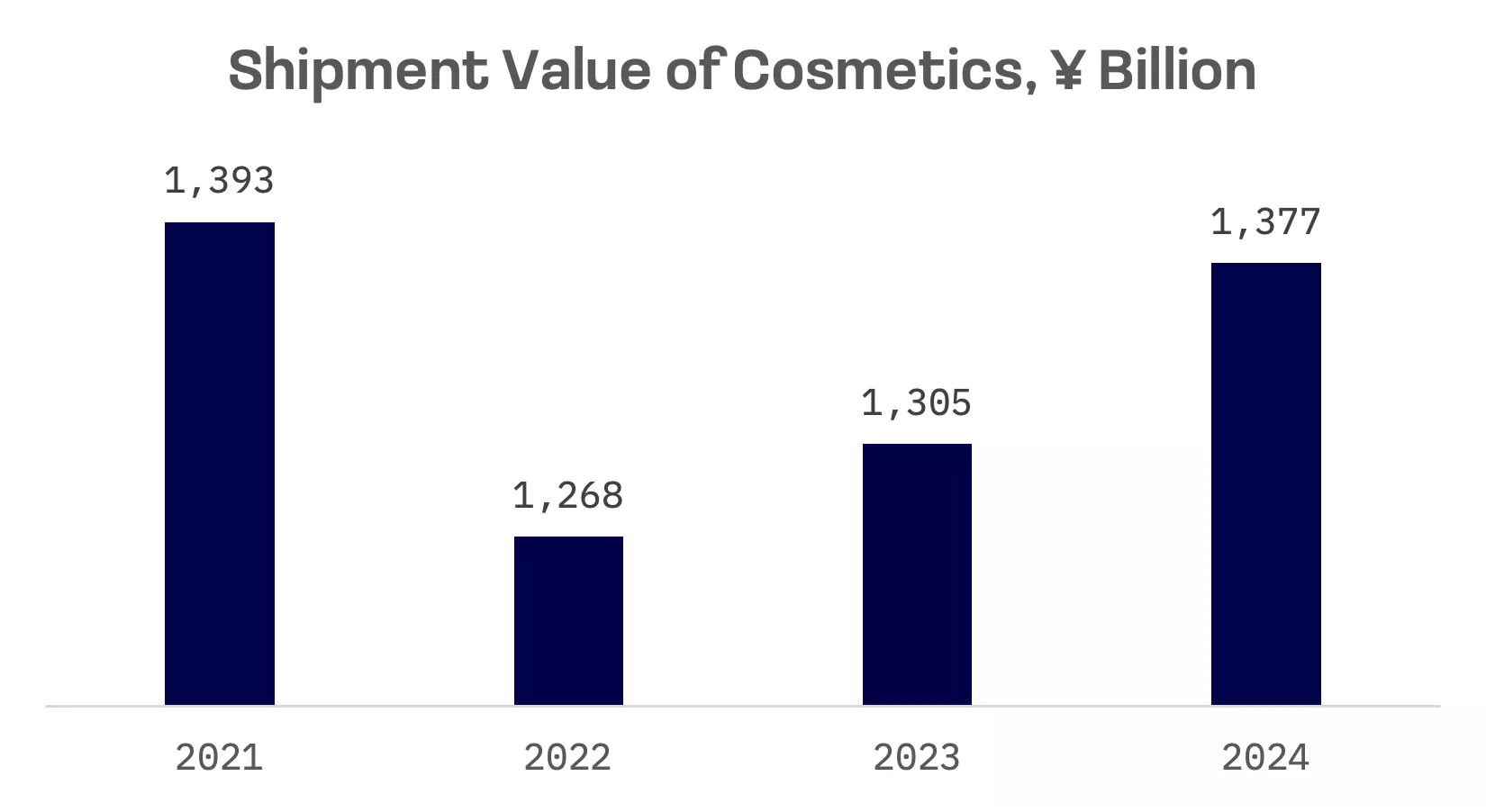

Japan’s cosmetics shipments reached ¥1.38 trillion in 2024, up 5.5% from a year earlier, according to Ministry of Economy, Trade and Industry (METI) data. The figures track domestic production and shipments, reflecting supply side trends. Broader market estimates, which include retail sales, imports and consumer spending, put the industry’s value at more than ¥3 trillion, making Japan the world’s third largest beauty market after the U.S. and China.

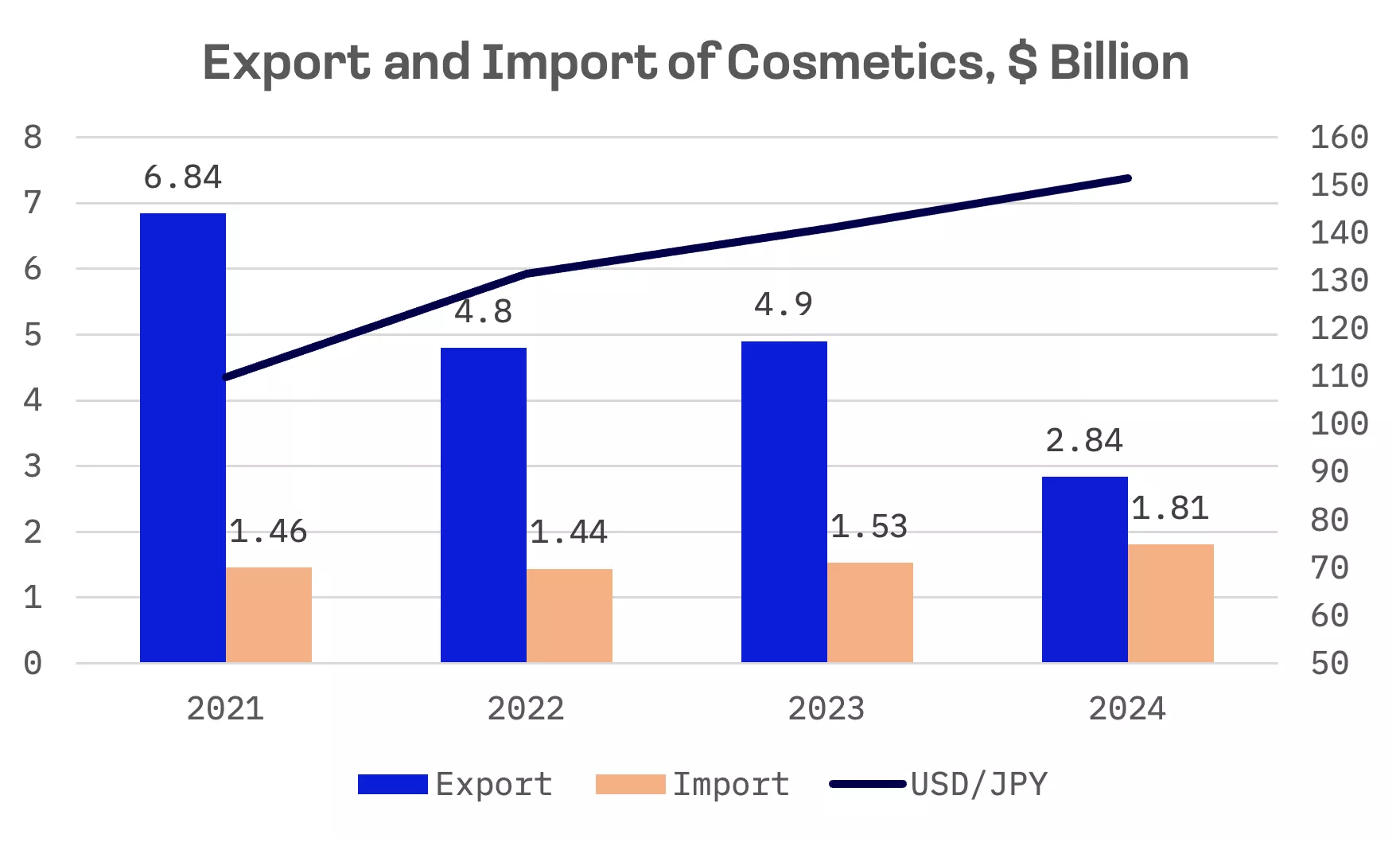

Japanese cosmetic exports fell consistently from 2021 through 2024, with the decline particularly pronounced in dollar terms amid sharp yen depreciation. China, Hong Kong, South Korea and Singapore remained the top destinations for Japanese cosmetics in recent years. Meanwhile, imports increased, especially in yen terms, with France and South Korea maintaining their positions as Japan’s leading suppliers.

The Ministry of Health, Labour and Welfare (MHLW) reported that 4,222 companies held cosmetic manufacturing licenses in 2023, up steadily since 2011. Despite the increase, the market remains concentrated, with a handful of players holding dominant positions.

| Company Name | Segment | Products | Market Position |

| Kao | Consumer Products (Hygiene & Living Care, Health & Beauty Care, Cosmetics) and Chemical Business | Household products (e.g., laundry detergents), personal care products (e.g., shampoos), cosmetics (e.g., KATE, Curél, SENSAI, Molton Brown) and industrial chemicals | A global leader with a significant market share in Japan and a strong presence in Asia, the Americas and Europe. Known for its diversified portfolio |

| Shiseido | Cosmetics, Personal Care | Cosmetics, fragrances, toiletries and personal care products. Key brands include Shiseido, Clé de Peau Beauté, NARS and ELIXIR | One of the world’s largest and most well known cosmetics companies, with a strong focus on skin beauty |

| KOSÉ | Cosmetics, Personal Care | Cosmetics and personal care products with brands spanning a wide spectrum of price points, from mass affluent to luxury. Key brands include DECORTÉ, Sekkisei, ADDICTION TOKYO and Jill Stuart | The third largest cosmetics company in Japan with a wide portfolio of products |

| Pola Orbis | Cosmetics, Personal Care | Cosmetics and beauty care products, with a focus on anti aging care. Key brands are Pola and Orbis | Operates through a multi brand, multi channel strategy, with a strong focus on direct selling and in store consultations |

| Fancl | Cosmetics, Health (Nutritional Supplements) | Additive free skincare and cosmetics and dietary supplements. Brands include FANCL, Attenir and Boscia | Focus on preservative free, gentle formulations for sensitive skin |

Except for Fancl, which Kirin Holdings acquired in 2024, all above mentioned companies are listed on the Tokyo Stock Exchange:

| Company Name | Ticker | JAKOTA Index | Market Cap, USD |

| Kao | 4452.TSE | Blue Chip 150 | 20.2B |

| Shiseido | 4911.TSE | Mid and Small Cap 2000 | 6.8B |

| KOSÉ | 4922.TSE | Mid and Small Cap 2000 | 2.3B |

| Pola Orbis | 4927.TSE | Mid and Small Cap 2000 | 2.0B |

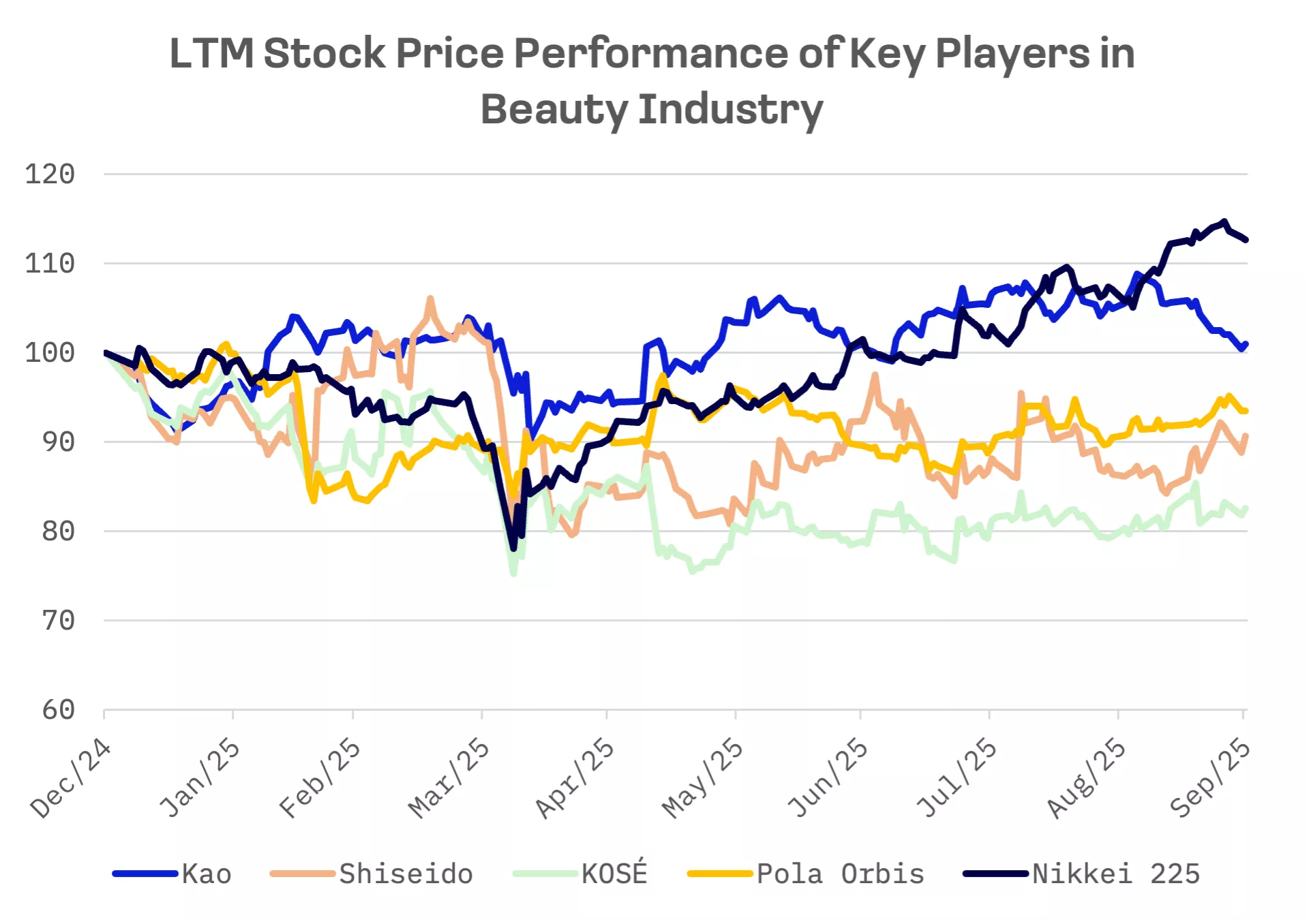

All four stocks have lagged the Nikkei 225 year to date, with Kao the only one posting gains. The sector faces pressure from global economic uncertainty and price competition, especially in the mass market. Swings in the China linked retail and tourism channel following an early 2024 surge remain a near term challenge. Ongoing corporate restructurings add execution risk and higher costs, weighing on margins.

Kao, whose operations extend beyond cosmetics into chemicals and broader consumer products, has a higher sales multiple. On an EV/EBITDA basis, the group trades in a relatively tight range of 11 to 13 times.

| Company Name | EV/Sales | EV/EBITDA | P/E |

| Kao | 1.76x | 11.75x | 26.35x |

| Shiseido | 1.30x | 13.13x | N/A |

| KOSÉ | 0.80x | 10.74x | 113.80x |

| Pola Orbis | 1.41x | 13.39x | 46.03x |

| AVERAGE | 1.32x | 12.25x | 62.06x |

| MEDIAN | 1.36x | 12.44x | 46.03x |

A more detailed look at the two largest companies by market capitalisation:

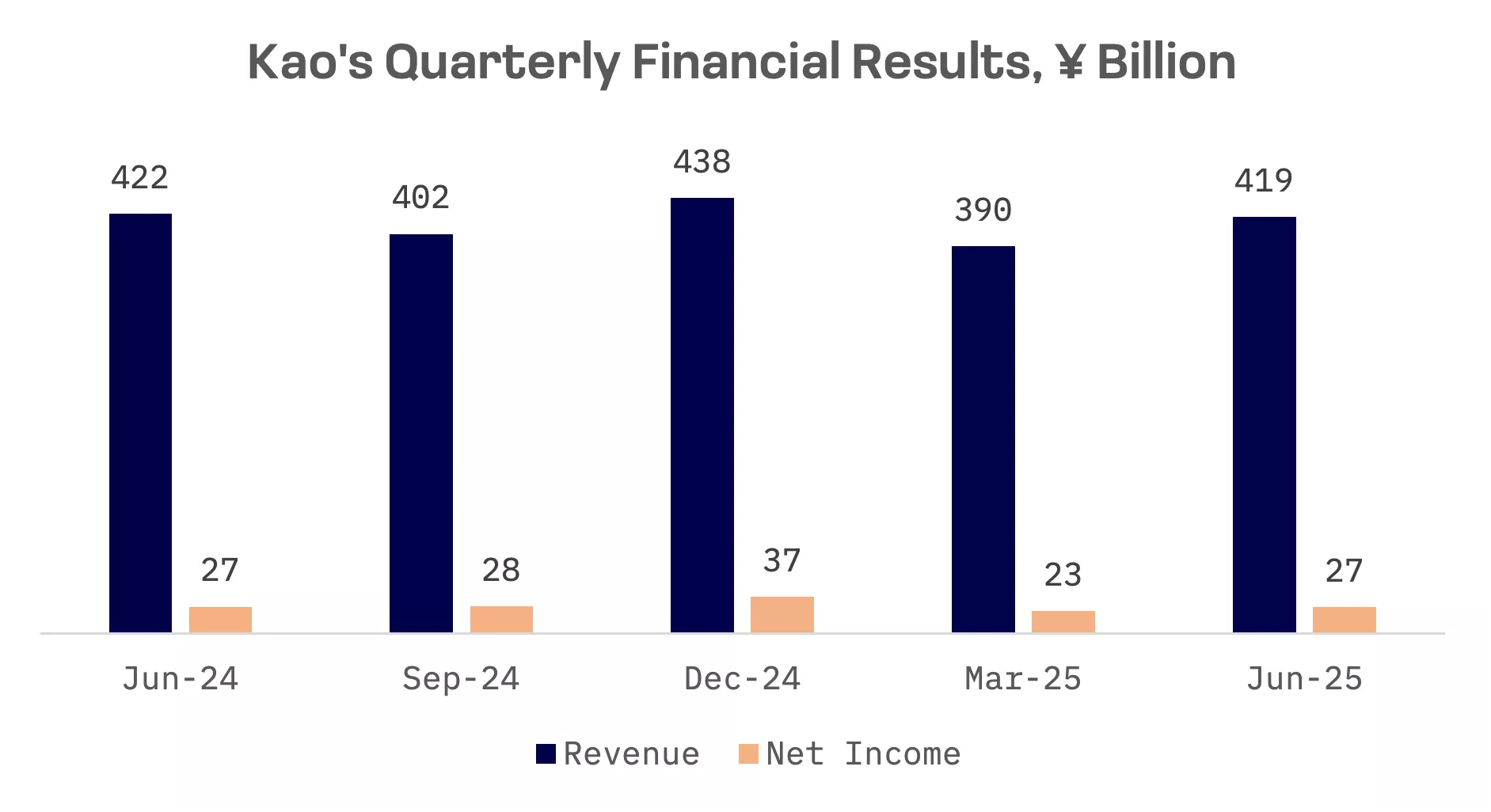

Kao

Kao, a diversified chemical and consumer goods company, is executing a major transformation under its K27 Mid Term Plan, focusing on reforming its cosmetics business. The company has set an ambitious target for cosmetics: ¥400 billion in sales and a 15% operating margin by 2027.

Key initiatives under K27 include:

- concentrating investment on six core brands,

- adopting a decentralised “scrum-style” operating model to boost agility,

- shifting from brand specific, borderless operations to a globally unified structure.

Kao plans to position SENSAI, Molton Brown, Kanebo, Sofina, Curél and Kate as its core global growth brands, accelerating overseas expansion in markets where they align with consumer demand and where the company can leverage its scale and expertise.

The cosmetics business generated ¥244.1 billion in sales in 2024. The latest second quarter 2025 results showed a modest 2.1% year-over-year increase, driven by strength in skin care and high end hair care in Japan. The ambitious goal of achieving a 15% operating margin, up from historical levels around 7-8%, entails considerable execution challenges and risk.

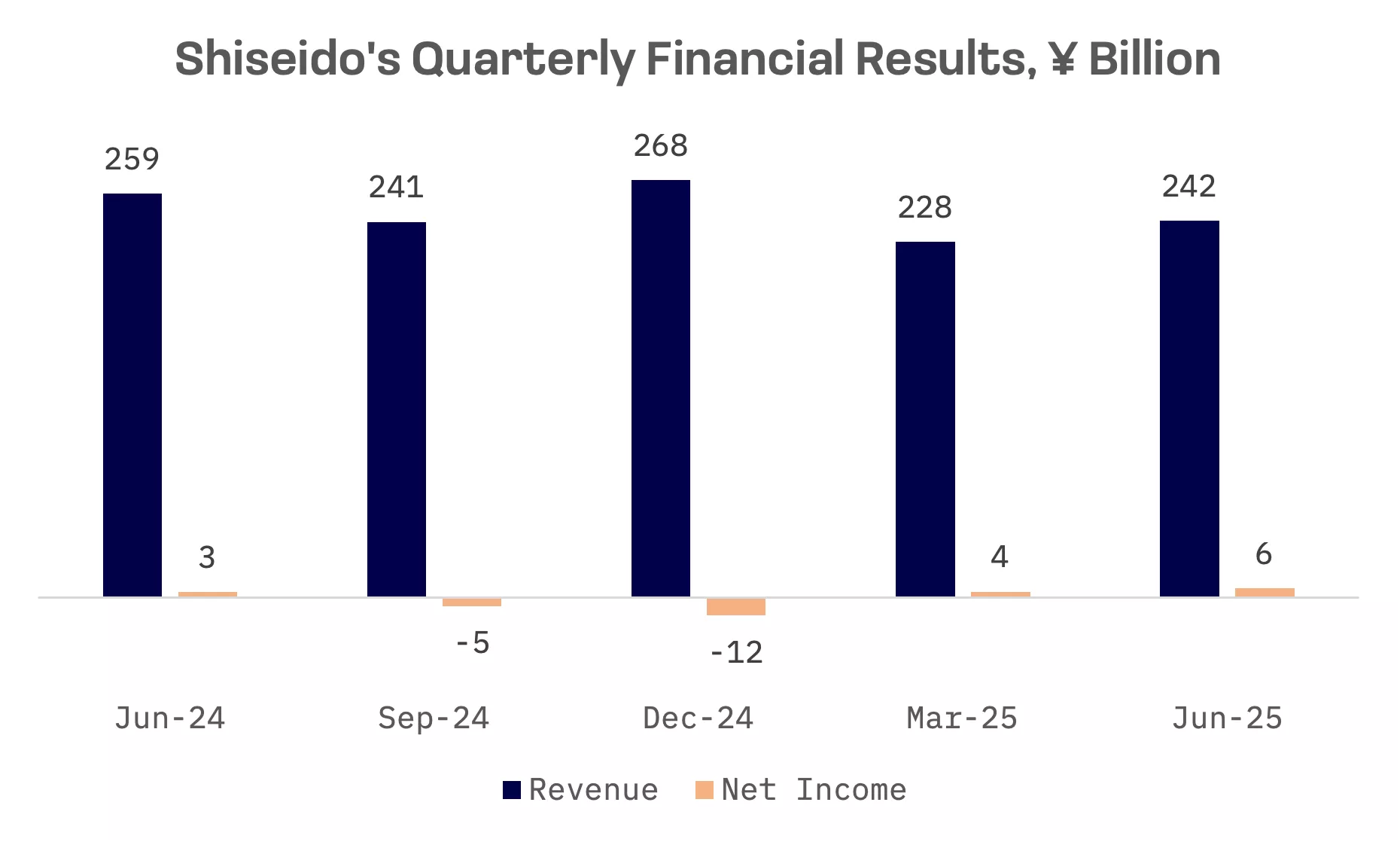

Shiseido

Unlike Kao, which spans multiple consumer segments, Shiseido focuses solely on beauty. The company is executing its “SHIFT 2025 and Beyond” strategy, aimed at accelerating a pivot to high end prestige brands such as Clé de Peau Beauté, Shiseido and ELIXIR, while pushing deeper into global markets, particularly fragrances and men’s grooming. To back the effort, the company has pledged ¥100 billion in additional marketing spending over three years.

In the second quarter of 2025, Shiseido posted consolidated net sales of ¥241.6 billion, down 7% from a year earlier. EBITDA rose 15% to ¥28.3 billion, driven primarily by disciplined cost management globally. The company is targeting ¥20 billion in cost reductions in 2025, a key factor in offsetting volatile overseas sales.

The Japanese beauty industry faces multiple challenges, prompting key players to undertake large scale structural reforms. The main driver for the foreseeable future, however, remains an irreversible demographic shift towards high value and anti aging products, supported by rising global recognition of Japanese cosmetics’ technological edge and minimalist philosophy.